How will the MiCA bill reshape Europe's stablecoin market?

TechFlow Selected TechFlow Selected

How will the MiCA bill reshape Europe's stablecoin market?

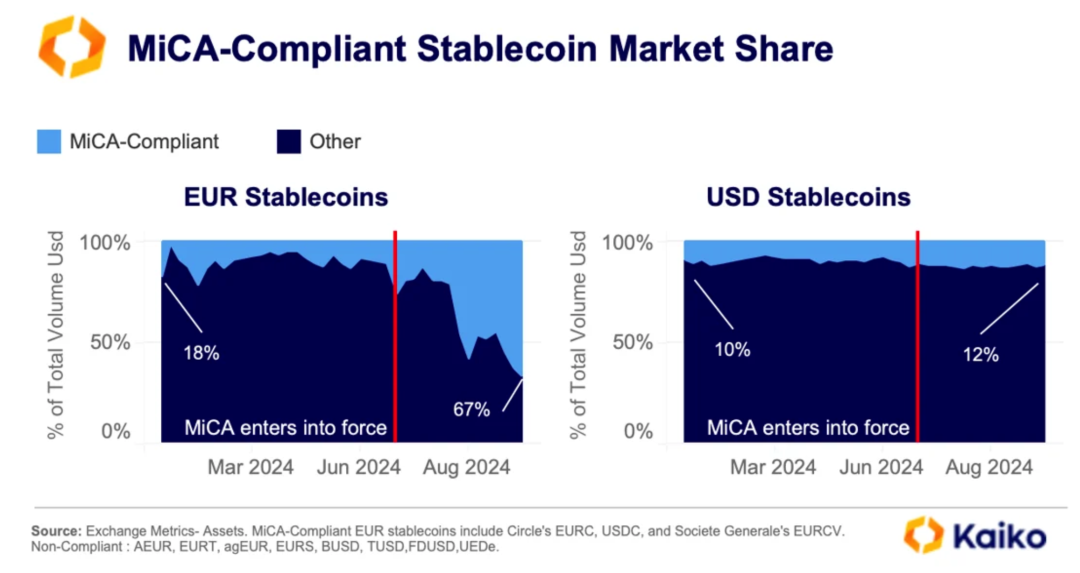

The implementation of MiCA has not only had a profound impact on the market landscape of euro stablecoins, but is also gradually affecting the market share of dollar stablecoins.

Author: Kaiko

Translation: Aiying, AY Team

The European Union’s Markets in Crypto-Assets regulation (MiCA), effective since the end of June, is profoundly reshaping the euro stablecoin market landscape. The implementation of this regulation has prompted a series of major cryptocurrency exchanges to adjust their product offerings, including delisting certain stablecoins. In early October, Coinbase announced it would phase out USDT for European users by year-end—a move mirrored across several other major centralized exchanges.

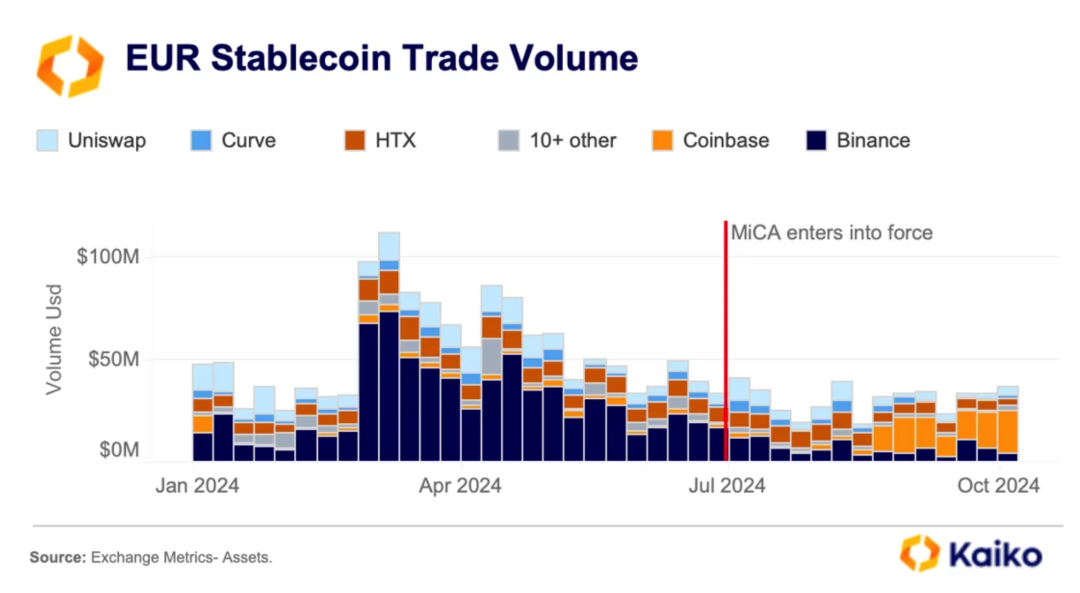

Three months after MiCA's enforcement, the European stablecoin market has visibly shifted, especially in the euro stablecoin segment. Currently, MiCA-compliant euro stablecoins—such as Circle’s EURC and Société Générale’s EURCV—reached a record-high market share of 67% last week. This shift has been driven largely by Coinbase, which surpassed Binance in August to become the leading marketplace for euro stablecoin trading. Meanwhile, Binance continues promoting non-MiCA-compliant euro stablecoins through zero-fee models, primarily targeting non-European users.

In the U.S. dollar stablecoin space, USDC remains the largest MiCA-compliant dollar stablecoin and has seen its market share increase moderately from 10% to 12%.

Overall, since MiCA’s implementation, weekly trading volume for euro stablecoins has remained around $30 million, significantly below the $100 million level seen in March this year. This indicates that despite regulatory changes, demand for euro stablecoins has not meaningfully increased; the shift in market share has primarily resulted from exchange delistings mandated by MiCA.

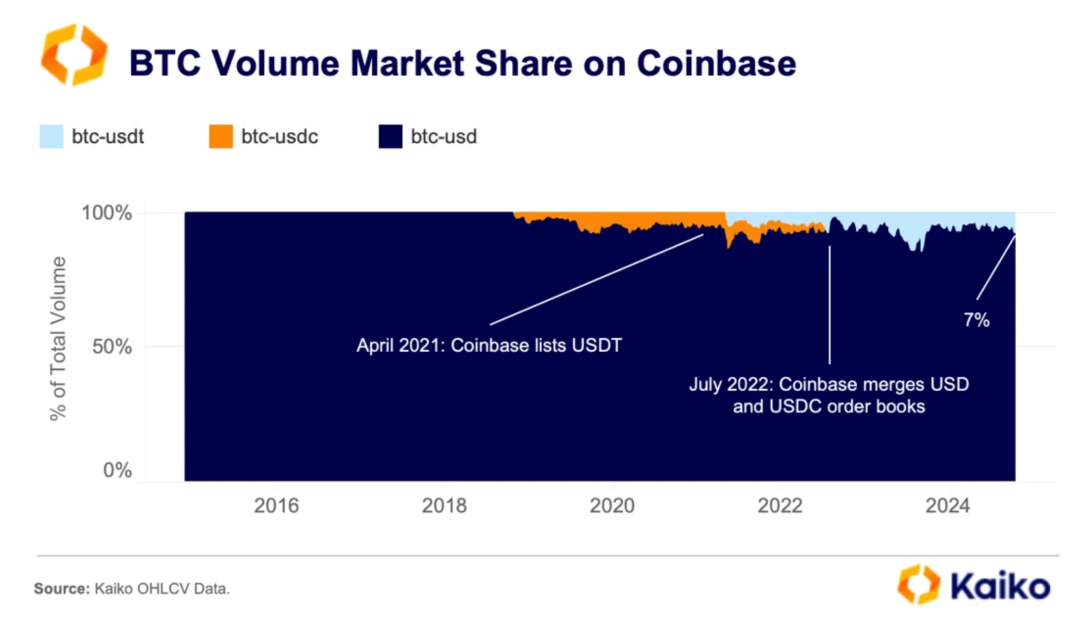

It remains to be seen whether similar shifts will occur in the U.S. dollar stablecoin market. Coinbase’s upcoming delisting of USDT for European users may provide some upside for regulated dollar stablecoins. Historically, despite lacking MiCA compliance, USDT achieved rapid global adoption. Since its launch on Coinbase in 2021, the share of BTC-USDT trading pairs surged from 1% to over 5%, surpassing BTC-USDC by the end of that year. Although Coinbase merged the USD and USDC order books in July 2022 to improve liquidity, USDT maintained a market share of around 10% by Q2 2023.

MiCA could also influence stablecoin competition on decentralized exchanges (DEXs). Since DEXs are not subject to MiCA regulations, they continue to support USDT trading, potentially attracting traders seeking liquidity—after all, USDT remains the most liquid stablecoin in the market today. This trend became particularly evident following the U.S. banking crisis, during which USDT usage grew steadily on Uniswap, Ethereum’s largest DEX.

In contrast, USDC’s dominance on Uniswap has significantly declined. After Circle’s key banking partner Silicon Valley Bank (SVB) collapsed—triggering a severe depeg of USDC—its market share on Uniswap dropped from nearly 90% in 2022 to around 55% last week.

In summary, MiCA’s implementation has not only deeply reshaped the euro stablecoin market but is also gradually affecting the competitive dynamics among dollar stablecoins, particularly within decentralized finance (DeFi), where USDT is increasingly consolidating its dominant position.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News