Worldcoin's rebranding fails to save itself, WLD empowerment unclear, new chain ultimately becomes a meme spectacle

TechFlow Selected TechFlow Selected

Worldcoin's rebranding fails to save itself, WLD empowerment unclear, new chain ultimately becomes a meme spectacle

Worldcoin rebrands to World—drifting away from crypto?

Author: Tuoluo Finance

On October 18, the long-silent Worldcoin finally stirred market attention.

The two founders, Alex Blania and Sam Altman, announced during a live-streamed launch event that Worldcoin would undergo a major upgrade. Worldcoin was officially rebranded as World Network, with the mainnet of World Chain going live and other components updated in tandem—ORB 2.0, World ID 3.0, and World App 3.0 all included.

The ambition for brand transformation is evident. However, just three months prior, Worldcoin faced intense backlash over WLD token inflation and wash-trading fraud allegations. This update can be seen as a self-rescue effort, especially since Sam Altman, the often-absent co-founder of OpenAI, finally stepped back into the spotlight to promote the project.

Despite high-profile advocacy, the market response has been lukewarm at best. Following the launch of World Chain, WLD dropped by 10% instead of rising, while World Chain itself quickly devolved into a new playground for meme tokens.

During the October 18 presentation, the founding team unveiled the latest strategic direction for Worldcoin. While previously focused on World ID, WLD, and World App, this update introduces World Chain, slightly deprioritizing the app while downplaying earlier talk of Universal Basic Income (UBI). Instead, the project returns to its core identity: human authentication. The future will center on three pillars—World Chain, World ID, and WLD—aiming to build a network composed of real, verified humans.

The most significant highlight of the update is undoubtedly World Chain. After nearly six months of anticipation, World Chain officially launched as an OP Stack-based Layer 2 network integrating World ID. Its distinguishing features stand out compared to other public chains. First is gas-free transactions: users who complete iris scanning via Orb are exempt from gas fees, which will instead be covered by the foundation. Second is a priority block space design aimed at reducing MEV attack risks—an innovative feature drawing considerable attention.

The long-criticized Orb iris-scanning device has been upgraded to version 2.0, with new Orbs expected to roll out in spring 2025. The redesigned device reduces components by 30%, lowering costs significantly, and uses NVIDIA’s Jetson chipsets, making it three times faster than the previous version. Notably, this marks a renewed push toward global expansion and the ambitious goal of reaching one billion users. A partnership with Rappi, Latin America's leading delivery service, will enable home-visit Orb verification appointments, greatly expanding access channels.

Changes within the app are even more pronounced. Beyond its original wallet functionality, World App now introduces Mini Apps—third-party applications that run inside World App and deeply integrate, in an anonymous manner, with users’ World ID, wallet, and contacts. New features include social interaction, light consumer services, and casual gaming. This move clearly takes inspiration from the popular Telegram mini-programs. Compared to the flood of bots on Telegram, World App’s emphasis on authentic human identities may offer a distinct advantage.

All these functions can integrate World ID. In this 3.0 update, aiming to accelerate adoption, World ID now supports "World ID Credentials," allowing verification using physical hardware or NFC-enabled documents such as passports. Verification data will be stored locally on devices to ensure privacy. Previously, World ID only supported iris scans, and unverified users could not claim WLD. Additionally, World ID 3.0 introduces World ID Deep Face, compatible with video and chat, designed to counter deepfake threats.

Overall, this update represents a clear strategic realignment and reshuffling. It reaffirms the project’s primary vision—authentic human identity—and returns to its original mission of countering AI threats. Updates across components also emphasize growth and viral distribution mechanisms. The introduction of a new chain may also aim to empower the WLD token. In this sense, Worldcoin’s business model appears to be gradually maturing.

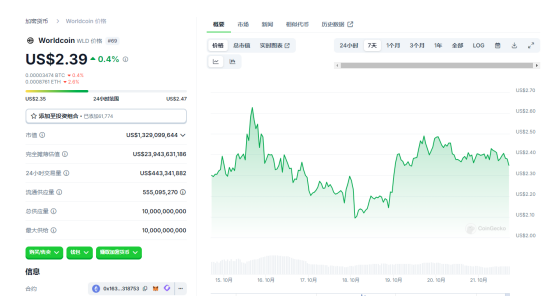

Despite numerous positive updates and the rare public appearance of prominent founders, market reactions have been disappointing.

WLD prices fluctuated noticeably around the event, rising from $2.08 on October 17 to $2.53 on October 19. However, immediately after the mainnet launch, the price reversed course and fell by 10%. In contrast, Uniswap saw UNI surge 15% intraday following the announcement of Unichain, despite both projects launching Layer 2 chains.

The root cause lies in the lack of tangible utility or value accrual for WLD. As early as September 30, when Worldcoin released a teaser titled “Building AI on human terms takes all of us,” the mention of AI led markets to speculate about potential collaboration between Worldcoin and OpenAI. The emergence of World Chain seemed poised to provide practical use cases for WLD. According to the team’s official blog, as of October 17, 2024, 15 million World ID holders and World App users had already migrated or were in the process of migrating to World Chain. Clearly, both internal momentum and external expectations placed high hopes on WLD.

Yet throughout the entire presentation, no concrete details were provided regarding WLD’s actual utility. It was only briefly mentioned that verified users on World Chain would receive WLD airdrops. No emphasis was placed on WLD’s role within the ecosystem. Even the possibility for users verified via physical documents like passports to claim WLD before full Orb-based World ID verification was glossed over. These measures fall far short of market expectations—such as direct protocol revenue sharing for token holders—and even lag behind the indirect incentive models common among typical public chains.

Under these circumstances, the market remains largely skeptical toward WLD. Once the hype faded, immediate sell-offs became standard practice, particularly among market makers. According to Coinwire’s on-chain analysis, multiple market makers engaged in short-term profit-taking. GSR Markets deposited $3 million worth of WLD into Binance and quickly sold during the price spike. On the day of the livestream, Binance transferred $16 million worth of WLD to cold storage wallets, while Amber withdrew over $5 million in WLD from Binance and split it into two sub-wallets to avoid tracking. These actions reignited accusations of price manipulation.

In fact, this isn’t the first time WLD has been embroiled in controversy over pricing. Back in July, DeFi Squared published a detailed post on X accusing the WLD team of manipulating prices through changes in supply, market maker contracts, and pre-unlock announcements. They alleged that insiders—including team members or VCs—regularly traded ahead of利好 announcements based on non-public information. On-chain investigator ZachXBT echoed similar sentiments.

With such a troubled track record, sustained price appreciation becomes nearly impossible. And so, World Chain—with its claimed base of 15 million users—inevitably turned into yet another meme token playground, unique to crypto culture.

ORB, named after the iconic iris-scanning device, is the first token on this chain and carries quasi-official status. Users who complete Orb verification can claim 1,000 ORB tokens via the World App. However, trading for ORB has not yet been enabled.

Beyond official tokens, memes abound. On the day of World Chain’s launch, cats, dogs, rabbits, and frogs rushed onto the scene one after another, reviving the familiar “zoo market.” Among them, the frog-themed meme token FROGE surged 16x in 24 hours on launch day, topping performance charts. This meme frenzy fueled transaction volume: disclosed data shows that World Chain achieved over $70 million in daily trading volume on the event day.

Overall, as a nascent chain lacking robust applications, the rise of memes is almost inevitable—and not necessarily negative. Meme-driven activity has repeatedly proven beneficial for ecosystem growth, with Solana serving as a prime example. Yet in the long term, World Chain cannot rely solely on memes. Compared to other Layer 2 solutions, it lacks any significant technical breakthroughs and holds no decisive advantage in user experience, placing it at a disadvantage when attracting developers.

Of course, viewed holistically, the chain exists primarily as an extension of the broader World ecosystem, currently emphasizing integration with World ID. Its creation was strategically motivated by the fact that Worldcoin-related transactions accounted for 44% of activity on OP Mainnet—a foresight-driven decision. Nevertheless, it's undeniable that the new chain’s appeal heavily depends on the development of the World ecosystem. External capital remains cautious and exploratory at this stage.

Looking at the World ecosystem overall, official figures show that World ID now spans 160 countries and regions, with over 7.01 million verified users, 848 active Orb devices, and daily wallet transaction volumes exceeding 290,000. Though still far from the founders’ envisioned scale, these numbers are somewhat acceptable for a project in the identity verification space.

However, growth metrics tell a less impressive story. For instance, in the past three months, fewer than one million new verifications were added—about 333,300 per month. At this rate, achieving the newly restated goal of one billion users would take at least 248 years—let alone growing concerns over Orb’s regulatory compliance. Orbs have already been banned in Spain and Portugal, and are under review in Argentina and the UK.

Considering all this, the significance of this major update leans heavily toward self-preservation. Since its launch in July 2023, Worldcoin’s initial momentum quickly fizzled. Despite raising hundreds of millions, the project has struggled with poor token performance, ongoing compliance issues, and stagnant growth. Under these pressures, the founding team must seek new paths for expansion. Thus, we see a clear shift toward growth-centric strategies in this update: relaxing reliance on Orb verification by accepting physical documents; enhancing user retention via richer social features in the app; cutting Orb production costs and improving efficiency; and adopting on-demand delivery models for aggressive user acquisition—all pointing toward global expansion as the primary strategy.

Yet if the intent is to rescue the project from crisis, market reactions suggest formidable challenges remain. To date, the entire World ecosystem lacks a core business model. Whether it’s the foundation, market makers, or outside investors, all depend on WLD for monetization. Yet once again, the update fails to meaningfully empower WLD. Until this fundamental issue is addressed, the trajectory of the token—and the project—is easy to predict.

For now, WLD remains subordinate to the crypto-AI narrative and to Sam Altman’s marketing storytelling, rising and falling with trends. Ironically, as Worldcoin transitions to World, the word “Coin” has been dropped. While the official explanation states that the old name no longer fits the mission of accelerating humanity’s role in an AI-driven future, does this coincidentally mirror WLD’s own fate? Perhaps the answer will become clear soon enough.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News