Banana Gun ($BANANA) Deep Dive: A Rising Star Among DeFi Trading Bots

TechFlow Selected TechFlow Selected

Banana Gun ($BANANA) Deep Dive: A Rising Star Among DeFi Trading Bots

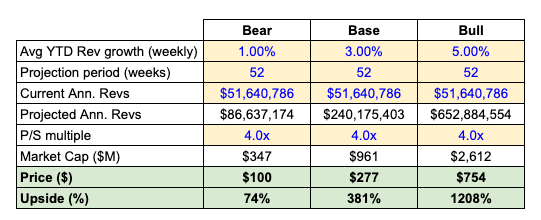

Despite significant growth momentum and structural tailwinds, $BANANA has a price-to-sales ratio (P/S) of only 4x, reflecting a relatively conservative valuation.

Author: ML

Compiled by: TechFlow

Executive Summary

-

Based on a 4-week rolling average, Banana Gun (BG) generates approximately $52 million in annualized revenue, with around $21 million flowing to token holders (a 17% annual yield)

-

Despite strong growth momentum and structural tailwinds, $BANANA trades at a conservative price-to-sales (P/S) ratio of just 4x

-

Full-dilution concerns are minimal: it is unlikely that $BANANA will face supply shocks from team or treasury allocations in the foreseeable future

-

Vertical integration offers significant upside potential—annual revenue and profits could triple

-

Upcoming product launches will further strengthen BG’s competitive advantage and improve its market positioning

-

Although market, competition, and regulatory risks exist, they are well managed

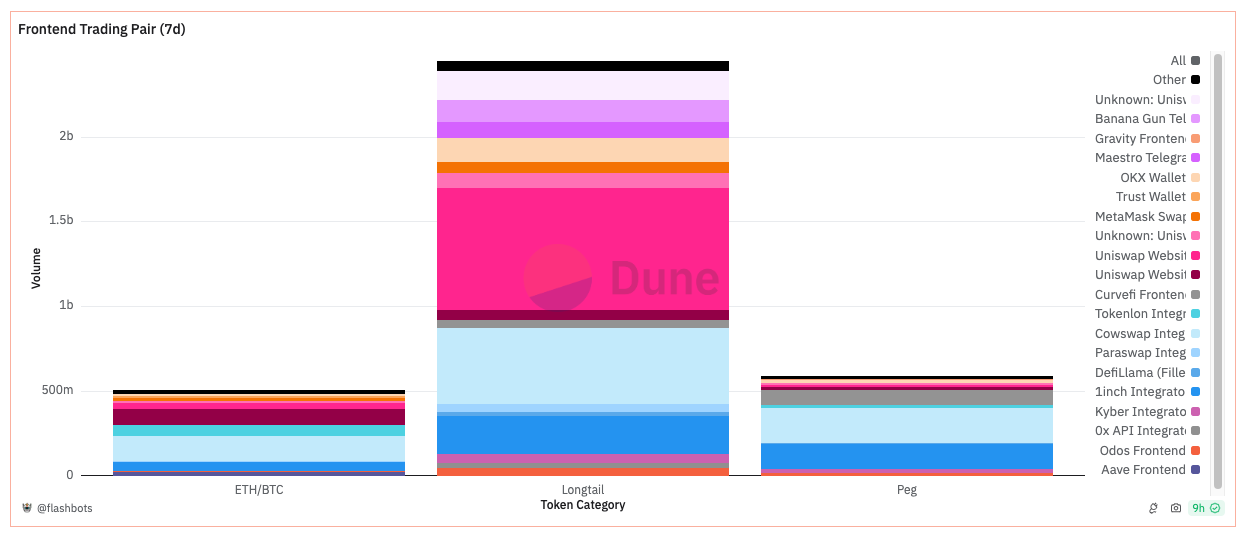

The Frontend Battle

Source: Flashbots

In the past 7 days, frontend trading platforms on Ethereum generated about $36 billion in trading volume (annualized at $185 billion). Long-tail assets (non-ETH/BTC or non-pegged assets) accounted for 69% of this volume (~$24.5 billion). Leading frontend platforms include familiar names such as Uniswap (despite its frontend fees), Cowswap, and 1inch. However, BG also generated approximately $129 million in volume, capturing about 5% of long-tail asset trading.

I recently read an article by Mason discussing the privatization of order flow and how the surge in altcoins has driven the rise of Telegram (TG) trading bots. As this asset class expands, traders are becoming more sophisticated, actively seeking faster execution and MEV protection. Users of these bots are typically less price-sensitive and prioritize speed and convenience. Despite charging high fees ranging from 0.5% to 1%, we observe a significant increase in TG bot usage.

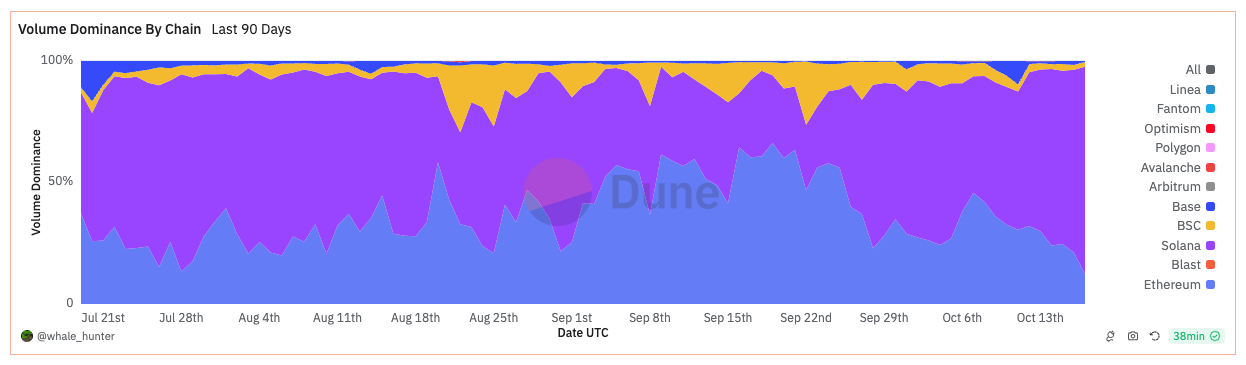

Source: whale_hunter

Analyzing the dynamics of the TG bot market, we find that 98% of trading volume is concentrated on Ethereum and Solana. Over the past 7 days, Trojan led in volume ($325 million), primarily due to its dominance on Solana, while BG and Maestro recorded $167 million and $142 million respectively.

Although BG launched on Solana around the same time as Trojan, I believe Trojan's edge comes from a more effective referral program (tiered rewards system) and airdrop campaigns. BG has deep roots and an established community within the Ethereum ecosystem, tied closely to its origins. Notably, Maestro, once dominant on Ethereum, is gradually losing market share, partly due to the existence of the $BANANA token and BG’s higher success rate in sniping operations (explained later).

Four key conclusions emerge:

-

The importance of building direct relationships with end users is increasing;

-

As users mature, faster execution and improved trade efficiency become trends;

-

Using TG bots for altcoin trading has become mainstream;

-

TG bot users are often incentivized (via token ownership, referral programs, cashback, and airdrops).

BG’s Revenue Model and User Acquisition Strategy

BG earns revenue by charging 0.5% on manual buys/limit orders (Ethereum only) and 1% on all snipes or trades across other supported chains. Based on a 4-week average, BG generates approximately $993,000 in weekly revenue ($52 million annualized). Forty percent of this revenue is distributed to token holders, excluding treasury holdings, CEX balances, and half of the team tokens. Out of the 3.4 million circulating tokens, only 2.9 million are eligible to receive income, resulting in a current annual yield of about 17%.

To enhance user loyalty, the team introduced a cashback program rewarding users with $BANANA for trading on the bot. The actual $BANANA rebate is calculated based on the dollar value of fees paid and a discretionary multiplier. This program is partially funded by treasury buybacks, reducing reliance on token emissions.

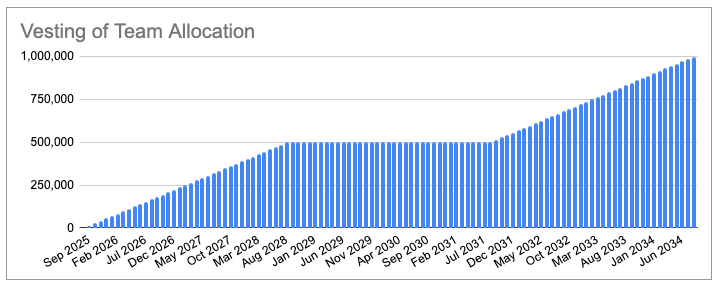

Understanding $BANANA Tokenomics

The team holds 10% of the total supply, with the first tranche unlocking on September 14, 2025, and the remainder on September 14, 2031. Both tranches will vest linearly over three years from their respective unlock dates. The team’s willingness to accept such a long vesting schedule stems from the fact that half of their tokens are eligible for revenue sharing—a fair arrangement given their incentive structure. This reflects strong conviction, as they benefit only when BG is profitable, eliminating the need to sell tokens for personal gain.

Conclusion: The team’s incentives are aligned with token holders.

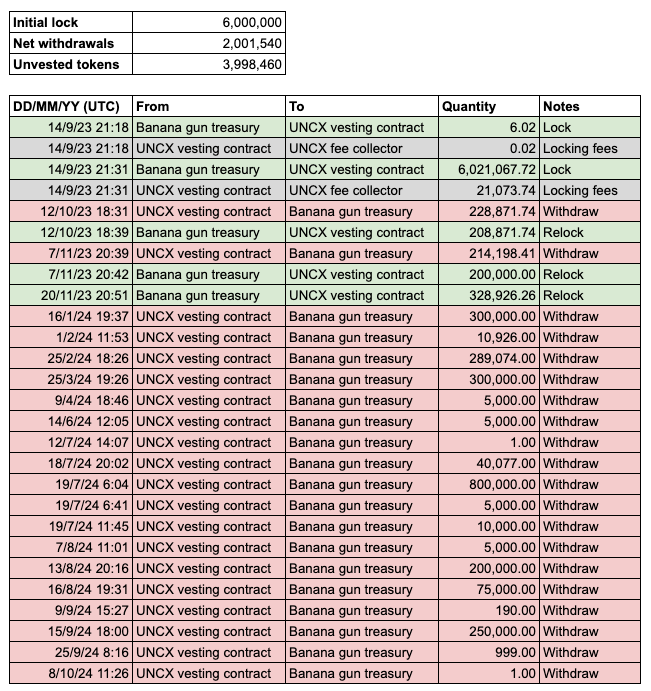

It should be noted that the initial treasury allocation was 60% of the total supply (lock transaction here), but after burning approximately 15%, the documentation was revised to reflect 45%. Originally, 250,000 tokens were scheduled to unlock monthly for two years. Although the treasury unlocks should have reached 3.25 million tokens by October 2024, only 2 million net tokens have been withdrawn from the contract so far.

Clearly, given BG’s substantial revenue, continued product adoption does not depend on token emissions.

Insights

BG’s order flow represents massive untapped revenue potential.

Source: whale_hunter

As previously mentioned, BG benefits from the growing preference for private execution and fast listing. According to Felipe’s research, BG wins about 88% of snipes, establishing a natural monopoly in this niche. Part of this is due to the "high-bribe culture" surrounding highly anticipated project launches (see query above).

Source: Arkham (Banana Gun’s top counterparties ranked by outflows)

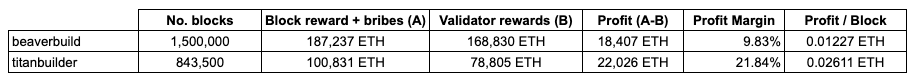

From BG’s Arkham profile, we see users paid nearly $100 million in priority fees (bribes) for snipes, most of which went to titan. This is somewhat surprising, as titan is a relatively new player (joined April 2023) in block building and lacks the historical track record of established builders like beaverbuild.

Digging deeper, despite producing half as many blocks as beaverbuild, titan generates higher profits. This suggests a possible "exclusive order flow arrangement" between BG and titan—which isn’t necessarily negative.

Source: libMEV (data since The Merge)

The key question… what if BG keeps its own order flow? If it chooses to become a block builder, BG’s annual revenue could easily triple overnight (assuming $ETH at $2.6K).

Imagine a world where $BANANA holders earn approximately 51% annualized yield from both frontend and block-building revenues.

Supply shock is unlikely

We are familiar with team strategies around major unlock events and supply overhangs. In the case of $BANANA, locked supply won’t enter the market until September 2025 (when treasury and team allocations begin linear vesting).

I have strong reasons to believe selling pressure from the treasury and team will be minimal:

-

BG is highly profitable, and if it becomes a block builder, it can significantly boost revenue

-

Strong revenue enables funding growth and operations without selling unvested treasury tokens

-

Underutilized treasury tokens further support this view

-

BG’s community culture is built around the vision of BG being a self-sustaining cash cow (e.g., long team lockups, shared revenue model)

-

The team understands that dumping unlocked tokens would undermine cultural alignment and belief in the long-term vision, severely impacting sustained growth and adoption. I wouldn’t be surprised if the team relocks their treasury and team tokens upon unlocking.

If this happens, I expect the relocked team tokens to be included in the revenue-sharing pool (after all, they’re entitled to it).

Strong Narrative and Fundamentals

Source: Brent

BG is a unique platform combining short-term catalysts with strong fundamentals. Recently, there’s been discussion about whether funds might include meme coins in core portfolios. Here’s my take:

-

If funds invest directly in meme coins, they’ll likely focus on blue-chip ones due to scale and liquidity constraints

-

While they probably won’t use tools like BG, this benefits the broader meme coin market (driving prices and sentiment upward)

-

This will spur more micro and small-cap meme coins, increasing user activity on tools like BG to capture these opportunities

-

If funds avoid direct meme coin exposure but still want exposure, buying projects like $BANANA as proxies makes sense—a “picks and shovels” approach suitable for theory- and fundamentals-driven funds.

On fundamentals, $BANANA attracts investors who favor reasonably valued quality assets. Using a 4-week rolling average to smooth data, BG achieves $52 million in annualized revenue ($21 million in earnings), with P/S and P/E ratios of 4x and 8x respectively. This is below the average for comparable projects (decentralized exchanges being the closest category).

Year-to-date, BG’s annualized revenue and earnings show ~4.5% weekly growth. Interestingly, since January 2024, P/S and P/E multiples have compressed from 12.5x and 26.5x respectively. Part of this compression stems from reduced growth expectations for ETH and SOL, but I believe $BANANA will re-rate higher because:

-

Investors will increasingly favor large applications that “own the full stack” (e.g., Aave, Uniswap, Ethena)

-

Upcoming growth catalysts (discussed next) haven’t yet been priced into valuations despite their potential impact on revenue and earnings

New Growth Drivers

Several exciting catalysts are expected:

-

Webapp (expected Q3 2024): A browser-based trading terminal optimized for professionals, offering a centralized-exchange-like on-chain trading experience

-

White-label products: BG will integrate with dextools (and potentially other platforms) to increase order flow (more frontends mean better distribution)

-

Others: App store (e.g., moonshot), additional blockchain support, expanded use cases for Banana Points, etc.

I believe the future of TG trading bots is cross-platform, and a sophisticated, user-friendly webapp will lower the barrier to entry. Additionally, white-label solutions will effectively expand order flow and may convert users into loyal BG platform participants.

These initiatives create strong differentiation in a relatively homogeneous market, and I believe BG is on the right path to sustainably grow its market share.

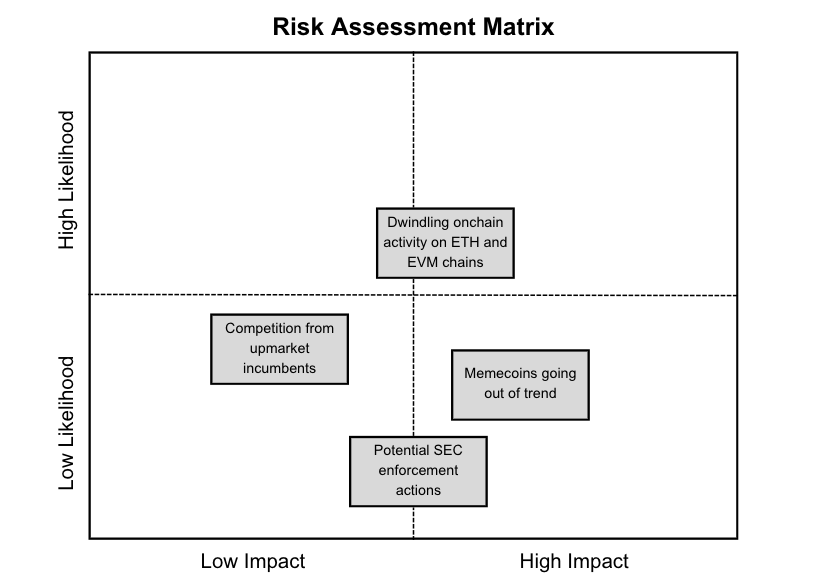

Risks

Declining On-Chain Activity on ETH and EVM Chains

Since early 2024, on-chain activity on SOL has surpassed ETH. If this trend continues, it could negatively impact BG. While BG has some presence on SOL, it faces intense competition from photon, bonkbot, and trojan. However, I believe the upcoming webapp and app store will offer unique advantages and help mitigate this risk.

Competition from Established Players in Premium Markets

While projects like Uniswap Labs focus on increasing volume in premium markets (intent-driven execution for large orders), we cannot rule out competitive threats if BG grows too quickly. However, given that micro-asset trading represents a small fraction of overall on-chain volume, this scenario seems unlikely.

Meme Coins May Lose Market Appeal

Source: DefiSquared

Each bull cycle has its themes—we’ve seen speculative cycles in DeFi, L1s, NFTs, etc. So far, this cycle’s theme has been meme coins, which greatly benefits BG. But nothing lasts forever—if the market finds a new speculative narrative, meme coins may lose appeal. That said, I don’t expect this to happen in the near term.

Regulatory Risk: Potential SEC Enforcement Action

Since 2023, the SEC has sued over 40 crypto companies for alleged securities law violations. However, the SEC typically targets larger platforms and exchanges with significant token trading volumes and securities-like characteristics, such as Crypto.com, Robinhood, Consensys, Uniswap, Kraken, and Binance. While this risk cannot be ignored, given BG’s relatively small operational scale, the likelihood is low.

Simple Valuation Analysis

I outline bear, base, and bull scenarios based on the following assumptions:

Bear Case: New entrants from established players (e.g., Uniswap) in premium markets, declining on-chain activity on ETH, and Trojan maintaining dominance on SOL lead to sharply reduced growth.

Base Case: Growth slightly below the YTD 4.5%, maintaining current market share on ETH and SOL, with no shitcoin rallies on supported chains (excluding ETH/SOL).

Bull Case: BG becomes a block builder, growth initiatives succeed, BG becomes the market leader across all chains, and sees some shitcoin rallies on supported chains (excluding ETH/SOL).

Note: To avoid excessive speculation, I did not assume expansion in P/S multiples.

Conclusion

Banana Gun ($BANANA) presents a compelling opportunity in the rapidly evolving trading bot market. With strengths in private order flow, execution speed, solid fundamentals, limited supply overhang, and attractive valuation, BG demonstrates strong growth potential at current prices. Furthermore, a series of upcoming catalysts will differentiate BG within the trading bot landscape. While regulatory and competitive risks exist, they are manageable and mitigated given BG’s current scale. Despite market challenges, BG’s innovative strategy and robust fundamentals suggest strong performance in the foreseeable future.

Disclaimer: Information in this research report is for informational purposes only and should not be considered financial advice. The author may hold or trade assets discussed in this article and may benefit from price increases. Accuracy, completeness, or timeliness of the report are not guaranteed. Investing involves risk, including possible loss of principal. Readers should independently verify all information before making investment decisions. The author, publisher, and related parties assume no responsibility for any losses, damages, or expenses arising from the use of this information. This report does not meet specific regulatory requirements, may contain third-party information of unknown reliability, and includes forward-looking statements based on assumptions that may not materialize. It does not constitute an offer to buy or sell securities. By accessing this report, you agree to these terms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News