Sui Ecosystem by the Numbers: Transactions Briefly Surpass 100 Million—Behind the DeFi Surge, Are Social and Gaming the True Foundation?

TechFlow Selected TechFlow Selected

Sui Ecosystem by the Numbers: Transactions Briefly Surpass 100 Million—Behind the DeFi Surge, Are Social and Gaming the True Foundation?

Judging from Sui's official updates, its recent focus has been primarily on stablecoin and cross-chain bridge development.

Author: Frank, PANews

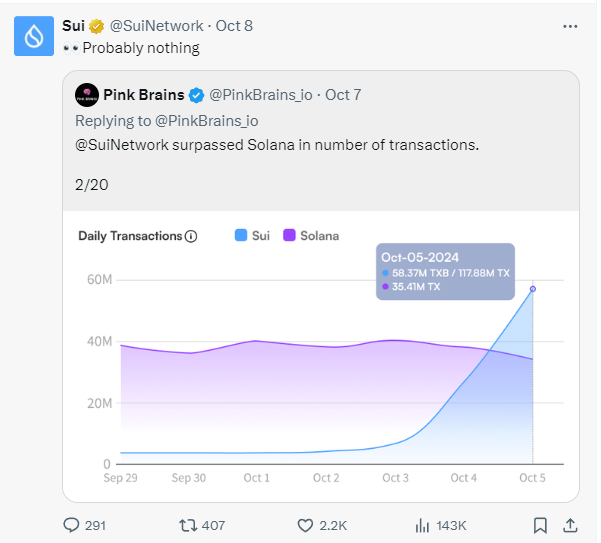

Recently, Sui's data has surged again. From October 5 to October 7, the number of daily transactions on the Sui blockchain exceeded 100 million for three consecutive days. On October 5 alone, it reached 117 million transactions—setting a new record for the Sui network and surpassing Solana’s previous non-voting transaction high of 77 million per day in May. Meanwhile, the price of SUI has also been rising steadily, approaching its earlier peak of $2.18.

What underlying changes have recently occurred on Sui? Is this surge in transaction volume another case of artificial spam inflating metrics, or does it signal genuine ecosystem growth? PANews examines on-chain data to find out.

Another yield farming project driving high transaction volume

Sui leading the industry in transaction volume isn’t unprecedented. In May, a spam project called SPAM on the Sui ecosystem generated 46 million daily transactions by incentivizing users to send transactions, briefly outpacing other public blockchains and attracting significant attention from the crypto community.

At that time, Sui urgently needed such high traffic to gain visibility, and the Sui team actively engaged with SPAM on social media. But this time around, despite surpassing one billion daily transactions, the Sui team appears to be downplaying the achievement—responding to user comments about exceeding Solana’s transaction numbers with a casual “probably not much.”

This should have been another great opportunity to showcase strength—why is Sui being so low-key?

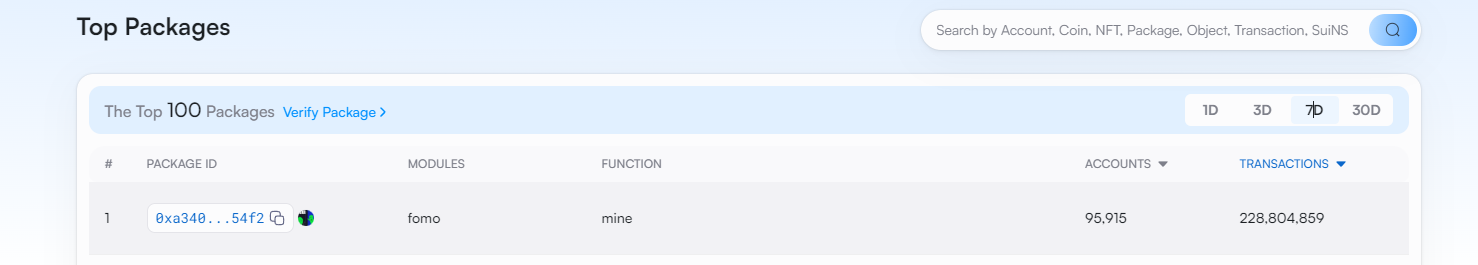

PANews found that the recent spike in transaction volume likely stems from FomoSUI, another mining project on Sui. Data shows that within the past seven days, the FomoSUI contract generated 228 million transactions—accounting for over half of all transactions on the Sui network—with approximately 95,000 participating addresses.

FomoSUI is a Bitcoin-style Proof-of-Work (PoW) token launched by Foundation3DAO on the Sui blockchain. With a total supply of 21 quadrillion tokens, it went live on October 4 and had already mined 49% of its total supply by October 11. However, its GitHub repository has since been disabled. Additionally, Foundation3DAO remains anonymous. In September, the same group launched another PoW project called META on Sui, which currently has a market cap of just $481,000 and a liquidity pool of only $111. Now, FomoSUI seems caught in the same mining-and-dump cycle: between October 9 and 11, its price dropped more than 75%, prompting miners in community chats to complain they were "not making money." As of October 11, FomoSUI’s market cap was about $730,000, with $70,000 in liquidity. Many early participants noted that heavy selling by miners, combined with minimal financial backing from the team, made it difficult for the token’s price to recover.

It appears that the surge driven by FomoSUI represents yet another anomaly. Perhaps learning from the SPAM incident, the Sui team chose not to engage with this project.

DeFi data doubles monthly, fueled by Ethereum inflows

Nonetheless, discussions about Sui remain active on social media, especially regarding meme coin development. A closer look at DeFi metrics offers a more objective view of what’s happening on Sui. Transaction value on the Sui blockchain has significantly increased—from an average of around $50 million daily to roughly $200 million. On October 9, transaction volume hit $207 million. Pure DeFi transaction counts also rose sharply, reaching 2.32 million on October 9—nearly double the level from a month earlier. Active accounts have similarly grown: prior to September 21, Sui’s DeFi user base hovered around 10,000; by October 9, it had jumped to 111,000—an increase of over tenfold in about 20 days.

This growth closely correlates with the rise of meme coins. According to official data, on October 9, the number of newly created tokens on Sui surpassed 10,000. At the end of September, daily new token creation was under 1,000. Today, Sui’s rate is comparable to Solana’s, where about 18,000 new tokens are created daily—far exceeding Solana’s pre-Pump.fun era, when daily new token creation ranged between 2,000 and 3,000.

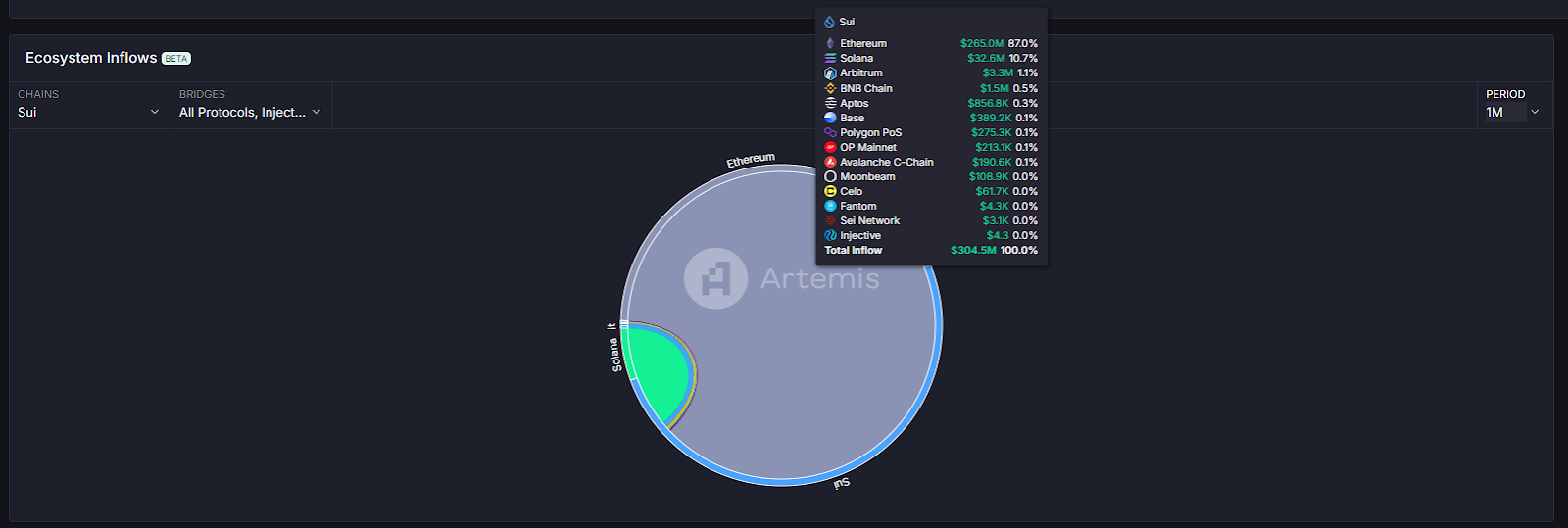

As reported by Cointelegraph, nearly 27% of funds flowing out of SOL last month moved into SUI. According to Artemis data, among major blockchains over the past three months, Sui ranks second in net capital inflow at $284 million, behind only Solana’s $1.07 billion. Looking at sources of capital, however, Ethereum remains the primary contributor to Sui: over the past month, 87% of incoming funds to Sui originated from Ethereum.

Social and gaming may be Sui’s real strengths?

Sui, born from Facebook, shows a clear preference for social applications in its ecosystem development. In terms of active user metrics, a social app called RECRD leads with 869,000 daily active users and 872,000 daily transactions—second only to FomoSUI. RECRD is a TikTok-like short video platform where creators can earn up to 100% of ad revenue and receive instant payouts based on views rather than follower count. In July, the platform secured a $4 million investment led by the Sui Foundation.

Besides RECRD, another SocialFi project, FanTV, ranks fourth in Sui’s activity rankings with 92,000 active users on October 11. Originally Polygon’s largest social application, FanTV migrated to Sui in May and brought over one million new users to the Sui network within a week.

Beyond social apps, gaming is another key segment on Sui. The Telegram-based pet-raising game Birds has over 190,000 daily active users. Another GameFi project, Aylab, is also among the top ten applications. The most popular wallet app, Wave Wallet, is itself a Telegram-integrated gaming-related application. Officially, Wave Wallet reports over 600,000 daily active users and more than 3 million total users. Interestingly, most of Sui’s popular GameFi apps are built on Telegram.

In terms of on-chain activity, DeFi has yet to become dominant on Sui. The largest DEX, Cetus, currently ranks sixth. Meme launchpad Movepump doesn’t even make the top ten. On October 11, DeFi accounted for only 1.92 million transactions—less than 5% of Sui’s total 41 million transactions. DeFi active users numbered around 84,000 out of 1.67 million total active users—also about 5%. In contrast, two SocialFi projects together account for 65.9% of active users, while three GameFi-related apps make up 24.7%. Combined, these five social and gaming apps represent 90% of active users. Clearly, Sui’s true momentum comes from social and gaming applications.

From a user experience standpoint, Sui still has a long way to go in DeFi infrastructure. Most cross-chain bridges only support connections with Ethereum, and native stablecoin adoption remains low. However, judging from recent official developments, Sui’s priorities are now focused on stablecoins and bridge construction. On October 8, native USDC officially launched on Sui. On October 1, the official Sui Bridge announced mainnet launch—though currently only supports ETH and WETH transfers. Additionally, Grayscale has recently published multiple reports and analyses on Sui, and with continued high social media buzz, Sui’s ecosystem potential appears to be gaining traction.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News