How to Manage Airdrop Expectations: The Right Way for Projects to Demonstrate "Big Picture" Thinking

TechFlow Selected TechFlow Selected

How to Manage Airdrop Expectations: The Right Way for Projects to Demonstrate "Big Picture" Thinking

Don't waste money, don't be a fool.

By Icefrog

Foreword:

Jesse Livermore, the legendary stock trader, once said, "Money is made by sitting and waiting." Regardless of its profound implications in trading, this statement certainly holds true in the realm of blockchain airdrops. However, four years after Uniswap launched its large-scale airdrop, the airdrop landscape has undergone a complete transformation. While money is still made by waiting, you no longer know whether what you're waiting for is a humble pork chop rice meal, a Michelin-starred feast—or perhaps, just loneliness.

No airdrop farmer would be satisfied with mere pork chop rice handouts, yet few would turn hostile over it. What truly becomes unacceptable is: "You called me your sweetheart, but behind my back you ran a pump-and-dump scheme; you claimed to be a wealthy elite, but all you wanted was to scam me into Myanmar; you failed to deliver on your promises, yet blamed me as the fool."

"You betrayed me, then expected me to laugh it off"—when lyrics mirror reality, it cuts especially deep in the context of airdrop expectations. Ironically, every party involved genuinely feels this sentiment reflects their own truth. The root cause lies in expectation gaps—driven primarily by how projects manage (or mismanage) community expectations around airdrops.

To prevent users from pulling the ladder away after such disillusionment—and avoid turning projects into ghost towns—properly managing airdrop expectations with genuine vision ("big picture" thinking) must become the next essential discipline for every project team. Before that, however, we must first clarify how airdrops have evolved and how communities perceive them, laying the foundation on "abandoning PUA tactics, and simply building real products." After all, the blockchain world has proven countless times: community support is the bedrock of any project’s long-term survival. Without it, a project may not die today—but it will surely perish tomorrow.

1. Evolution and Current State of Airdrops

1. Origins and Essence:

Value Created by Contribution vs. Traffic-Buying Mentality—Stance Determines Direction

Since Uniswap successfully executed the crypto industry's first major airdrop in 2020, airdrops have become one of the most effective strategies for launching new blockchain projects. Within less than four years, fueled by repeated waves of massive wealth creation, airdrop farming has evolved into a highly specialized niche industry.

Meanwhile, the relationship between farmers and project teams has shifted from mutual dependence to open confrontation. Projects continuously inflate user expectations through manipulative tactics (PUA), securing massive funding rounds; users, in turn, adopt a "suffer now, exit fast" mindset—rushing to cash out immediately post-airdrop, pulling the ladder behind them.

This deteriorating dynamic begins with the very origin of airdrops.

-

In the early ICO-era airdrop days: blockchain was still frontier territory. Back then, airdrops required no interaction—just having an address was enough to receive tokens.

-

Later, during the rise of liquidity mining, rewards were replaced by liquidity incentives. As TVL grew, so did the maturity of “mine-and-dump” behaviors.

-

Uniswap’s landmark airdrop ushered in the Age of Airdrop Exploration, setting a gold standard for subsequent project launches. From then on, airdrops officially became a critical tool for user acquisition, fundraising, and exchange listings—giving birth to the professional airdrop farmer.

When different participants interpret the same event under identical rules from entirely different perspectives, chaos begins. The state of blockchain airdrops today is no exception.

-

From the project’s perspective, viewed through a business model lens: one side sees it as promotional traffic buying—once traffic scales up, monetization follows naturally, whether via liquidity or fundraising. The other side aims at achieving decentralization in governance structure, completing the project’s foundational architecture.

-

From the user’s perspective: contribution creates value—since I contributed, I deserve a fair return.

-

While interests may align superficially, a key divergence exists: recognition of contributions and the power to define value rest solely with the project team. Once abused, conflict becomes inevitable. More critically, with power comes responsibility—but there are no strong enforcement mechanisms holding project teams accountable.

-

This forces users to constantly guess and adapt to the project’s shifting criteria. Project teams, driven by changing priorities across development stages, retain full authority to alter these standards at will. As blockchain market caps surge and institutional capital floods in, complex利益 entanglements emerge—project teams must navigate between competing stakeholder interests, balancing various agendas.

Things always move along the path of least resistance.

-

For projects, capital is king; exchanges are the kings’ overlords.

-

Users start as gods, then become partners, and eventually degrade into mere numbers.

For unchecked project teams, choosing who to sacrifice when necessary becomes an easy decision—especially after the rise of organized farming studios.

-

Some projects build massive datasets from farming studios to secure huge funding rounds.

-

Yet simultaneously ramp up Sybil detection tools, preparing to precisely target and disqualify those same contributors when the airdrop arrives.

-

Hypocrisy abounds—the root cause being absolute control over airdrop allocation held by project teams.

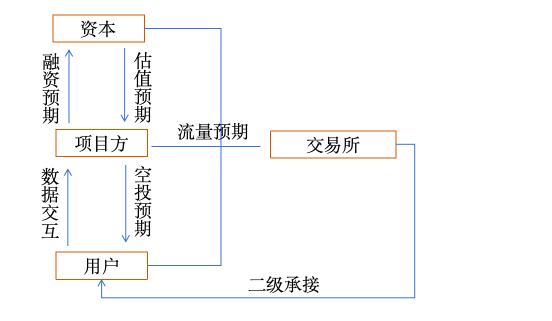

The chart above shows how within the ecosystem of users, projects, capital, and exchanges—all expectations—airdrop anticipation, fundraising targets, valuation goals, exchange traffic demands—ultimately rely on user data interactions.

In practice, to meet regulatory requirements, projects theoretically allocate over 50% of tokens to the community. Yet often only up to 10% goes toward airdrops. After accounting for team allocations and VC shares, what remains is extremely limited—making practices like inflating valuations via fake activity, insider trading (rat warehouses), and dumping during lock-up periods understandable, if unethical.

Faced with利益, unregulated power becomes a series of scalpels wielded against users.

2. Development and Evolution:

From Tokens to Points: Traffic Value and利益 Conflicts, PUA vs Anti-PUA

User adaptation, project tacit approval, and capital encouragement have made airdrop farming an integral part of project growth.

The wealth effect from high valuations satisfies capital demands, while also creating fertile ground for the rise of farming studios. Massive bot farms create love-hate dynamics for projects—when stakes get high enough, love fades completely.

How to minimize sybil attacks while maintaining user growth? Farmers evolve—so do projects.

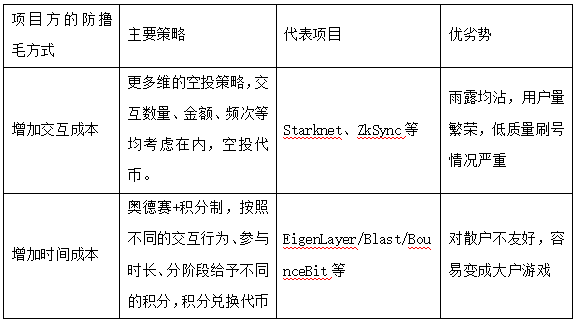

The most direct method is increasing farming costs. But to retain participation, projects must amplify reward expectations—creating expectation gaps and indirectly fueling high-valuation VC coins. Notably, nearly all projects capable of implementing point systems boast top-tier investor backing.

In outcome, point systems—with increased time investment and阶段性 hurdles—effectively reduce low-quality sybil behavior. However, they also drive away retail users, turning farming into a game dominated by whales and studios. This further leads to mutual non-support between farmers and projects upon launch.

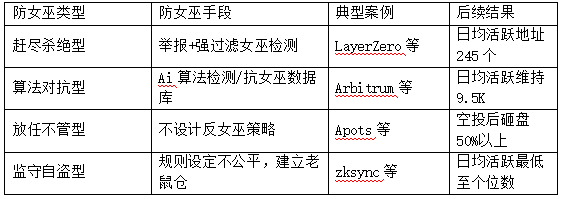

Prior to TGE or even before airdrop distribution, various projects deploy different anti-Sybil measures—yielding vastly different outcomes.

The table clearly illustrates: an industry that becomes too "pure" loses vitality. Confusing means with ends rarely yields good results. Point systems and Sybil detection are tools to filter fake users—not end goals themselves.

-

Attempting to eradicate all Sybils through extreme psychological tests is unreasonable;

-

Complete laissez-faire is equally unacceptable;

-

But insider theft via rat warehouses is outright criminal.

-

Even with point systems filtering some low-quality bots, opaque point distribution, lack of rule transparency, and frequent shifts—from encouraging volume to punishing farmers—continuously erode trust. It’s no surprise when both user confidence and project metrics plummet.

Project-side PUA tactics may be sophisticated, but where there’s profit, anti-PUA countermeasures grow stronger: from basic accounts to premium setups, from script automation to organized studio operations, to large-scale human farming armies—even launching script attacks on GitHub repositories.

Though people declared “airdrops are dead” as early as 2023, professional farmers persist—fundamentally because rapid expansion in the crypto space still makes farming a highly profitable endeavor.

From the project side, they can’t live without farmers either. In bear markets, farmers are often the only source of liquidity. As the saying goes: no winter is too harsh for airdrop farmers to overcome.

3. Dilemma and Stagnation:

From Traffic to Retention: Everyone Wants to Rewrite Destiny, Yet No One Keeps Their Original Intent

For projects navigating the rapidly changing blockchain landscape, user attention is scarce. Capturing it has become a core challenge.

Nothing beats the wealth effect generated by airdrops. But what follows—user retention—becomes the Achilles’ heel. Blockchain ghost towns are both cause and consequence of poor retention.

-

After token distribution, most projects see participants refusing to support each other, causing sharp price drops. Anti-VC sentiment一度 became market consensus—the primary reason being overall market downturns and cyclical shifts.

-

A token valued highly in bull markets inevitably finds no buyers when launched in a bear market.

-

Even during market recovery, external liquidity flows first to blue-chips like Bitcoin and Ethereum—new VC-backed tokens fight only for scraps among existing capital.

Losing the wealth-generation narrative is crypto’s greatest original sin. Every surfer entering this digital frontier dreams of rewriting their fate.

With mainstream capital pouring in, booming financial engineering clashes with stagnant organic user growth—the central contradiction of today’s ecosystem:

-

Backed by massive capital, projects view farmers as digital beggars—yet remain dependent on their activity;

-

Farmers tirelessly reverse-engineer project rules, industrializing artificial prosperity, yet complain about oppressive Sybil restrictions.

The surface conflict appears to be about PUA-style point systems or Sybil policies, or bot farming. But at its core lies growing uncertainty among users regarding airdrop value and point allocation expectations. Meanwhile, projects grow frustrated by the steep traffic decline post-airdrop. It’s a tangled mess—but not beyond untangling.

Power only answers to its source.

As previously stated, project teams hold absolute power over airdrop rules and distribution. But in an environment where this power faces no checks, the cost of abuse is minimal. What many fail to realize is that their current authority stems from cumulative user contributions. Users occupy the weakest position in the ecosystem hierarchy—but they are precisely the source of that power.

Therefore, understanding how users view airdrop expectations—and why some projects still maintain strong followings post-airdrop—is essential.

2. How Communities View Airdrop Expectations

1. Demand Benefits, But Also Fairness and Transparency

For community members, the primary goal of farming is to receive expected or better-than-expected rewards. Studios use scripts or manpower to execute point campaigns; projects respond with technical defenses, plugging loopholes to prevent mass Sybil infiltration—this arms race is understandable and acceptable, as seen with Arbitrum.

While perfect rules and anti-Sybil tech are unattainable, relatively fair frameworks allow majority satisfaction, laying a solid foundation for project reputation and sustained engagement.

However, inherent unfairness—whether in point systems or token distributions—triggers backlash. Examples include:

-

Zksync’s infamous rat warehouse controversy;

-

Starknet’s developer-biased rules;

-

Taiko’s refusal to disclose rules;

-

IO project’s failure to reveal points, engaging in classic PUA behavior.

At the heart of public outrage and community revolt is always injustice—opaque, unfair systems. Large-scale user exodus naturally follows.

2. Want Short-Term Co-Creation of Traffic, But Even More Want Long-Term Value Connection

If a project is strong, with a thriving ecosystem and excellent user experience, farmers and builders can become mutually beneficial success stories.

For instance, Base maintains massive user engagement despite not issuing a token—thanks to friend.tech’s profit-driven ecosystem. Arbitrum and Optimism foster positive flywheels by consistently incentivizing ecosystem projects with token rewards.

As long as a project delivers long-term value, possesses sustainable revenue generation and strong operational capabilities—rather than relying solely on short-term airdrop hype to extract value—even if some Sybil actors slip through, it will stand firm in the market over time. Both farmers and genuine users ultimately become pillars of the ecosystem.

3. How Projects Should Manage Airdrop Expectations

1. Formation of Expectation Gaps: Asymmetric Hopes and Unpredictable Information

All expectation gaps stem from mismatched hopes and information asymmetry. Failed airdrop cases abound with such examples.

The psychological evolution of failing project teams typically unfolds in four stages:

-

Stage One:暗示 airdrop potential to attract users to burn GAS and deposit funds.

-

Stage Two: Data looks good, funding secured, valuation stable, exchange listing imminent—multi-account farmers now seem inconvenient. Time to discard the millstone.

-

Stage Three: Realize community expectations are sky-high. Any drastic move risks backlash—so join the grind, build your own rat warehouse quietly.

-

Stage Four: I know you’ll dump—I’ll dump first. Lock-up period? Doesn’t exist.

In reality, this mental shift is common in anti-farmer airdrop cases. The fundamental issue?

-

When you need them—you call them users, gods;

-

When you don’t—they’re digital beggars, tumors.

The cycle of inflated hopes followed by betrayal stems from unchecked project power. When you dangle ambiguous signals to raise user expectations, you cannot blame greed when they react strongly. As stated earlier: you claimed to be a rich prince, but only wanted to lure people to Myanmar.

Information opacity and divergent expectations create cognitive misalignment between projects and farmers—the most direct cause of expectation gaps.

2. Core Secrets of Expectation Management: Don’t Overpromise, Don’t Flip-Flop, Deliver on Promises

In actual operations, many projects deliberately keep airdrop/point valuations vague, leaving interpretation space for users to sustain motivation. This can be effective.

But vagueness must not cross into底线lessness or inconsistency.

The best-tested example of expectation management on Earth is the Federal Reserve. Effective expectation management rests on three pillars: don’t overpromise, don’t flip-flop, deliver reliably.

-

Don’t Overpromise: Allow room for user interpretation in future direction, but establish clear, unwavering baseline rules. Guide the community with consistency and correction—not let rumors spiral out of control, as Starknet experienced.

-

Don’t Flip-Flop: Many projects change rules capriciously, openly diluting airdrop value—a shameless act deeply harming users, e.g., Scroll recently. Others make unnecessary odd moves—like Blast, which, without prior notice, forced users to watch founder videos during final airdrop claim, awkwardness rivaling Gree phone splash screens. Its market cap has since plunged relentlessly.

-

Deliver on Promises: This reflects a project’s true vision. Small-minded teams are everywhere—manifested in zero airdrops, or distributing low-value tokens/NFTs.

In fact, reverse-engineering outcomes reveals a pattern: the bigger the vision, the higher the market cap tends to climb. When users say “this project lacks格局,” it’s effectively shouting: “Don’t buy this on二级markets.”

3. Some Recommendations: Balance Interests, Prioritize Community, Build Real Products

As mentioned at the outset, conflicting expectations exist among projects, users, capital, and exchanges. These expectations reflect underlying利益 claims. Proper expectation management thus requires skillful利益 balancing.

The current reality: 99% of high-valuation token projects suffer immediate post-launch dumps. Only a rare few listed on Binance survive with breathing room. To break the vicious cycle of VC coins and airdrop failures—beyond macro bull/bear cycles—project teams must recognize that beyond farmers’ self-exploitation, the crypto market has entered a phase of natural selection. With insufficient liquidity, crude management won’t win community support—it invites backlash.

In today’s environment, airdrops remain effective for user acquisition and promotion. But fairness and transparency in design must come first—otherwise, better not issue a token at all. Furthermore, projects should understand that airdrop costs are marketing expenses—traffic acquisition fees, one-time incentives—not investments in users. Like any marketing campaign, conversion rates vary. The real challenge lies in converting initial interest into sustained building, driving long-term revenue.

Community building matters. Projects must acknowledge that successful meme projects have already set the precedent. Sustainable growth requires broad user bases built through community engagement, KOL collaboration, and authentic outreach.

-

Use technology to combat bots—not corrupt yourself in the process;

-

Communicate with sincerity, not manipulation;

-

Earn user respect through fairness and transparency—not scorn through deceit and pettiness.

4. Conclusion

The era of easy big gains for airdrop farmers is ending—it’s an inevitable result of industry maturation.

Likewise, the time for project teams to manipulate communities with PUA tactics is also running out—equally inevitable amid shifting industry narratives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News