DeFi's New Frontier: The Rise of On-Chain Dark Pools, Merging Privacy, Efficiency, and Decentralization

TechFlow Selected TechFlow Selected

DeFi's New Frontier: The Rise of On-Chain Dark Pools, Merging Privacy, Efficiency, and Decentralization

On-chain dark pools provide traders with privacy protection while eliminating the need for centralized intermediaries.

Author: Tiger Research Reports

Translation: TechFlow

Key Takeaways

-

In traditional financial markets, large-scale trades by institutional investors can significantly impact market prices, potentially causing losses for other participants. To mitigate these effects, dark pools have been introduced as alternative trading systems where trade details remain confidential until execution.

-

Although dark pools have continued to grow since their inception, trust has been undermined by information leaks and misuse by operators. In response, regulators in multiple countries have taken steps to strengthen oversight of these platforms. Given this context, blockchain-based dark pools have emerged as a potential solution.

-

On-chain dark pools offer traders privacy while eliminating the need for centralized intermediaries, addressing several issues faced by traditional financial systems. Additionally, growing demand for private trading is expected to drive the development of on-chain dark pool markets in the near future.

TechFlow Note: In traditional financial markets, a dark pool is a private trading venue that allows institutional investors to conduct large-volume securities transactions without publicly disclosing trade information. Trades executed in dark pools are not displayed in real time on public markets; trade data is often delayed or only partially disclosed.

1. Introduction

Volatility in traditional financial markets continues to rise, primarily driven by technological advancements and various market factors. Large-scale institutional trading, particularly the evolution of block trading and high-frequency trading (HFT), is a major contributor to this volatility.

This heightened market volatility poses significant risks to retail investors. As a result, institutional investors are seeking alternative solutions that allow them to execute large trades while minimizing market disruption. One increasingly prominent solution is the dark pool—an alternative trading system designed for private trading.

Dark pools differ from traditional exchanges in several key ways. First, trade details such as order prices and volumes are not publicly disclosed prior to execution. Second, dark pools primarily support large orders, with some platforms setting minimum order sizes to filter out smaller trades. Finally, they employ unique execution mechanisms, including centralized matching of large orders and execution at mid-point pricing within the bid-ask spread. These features enable institutional investors to execute large-scale trades at favorable prices without revealing strategic information to competitors, thereby reducing price impact.

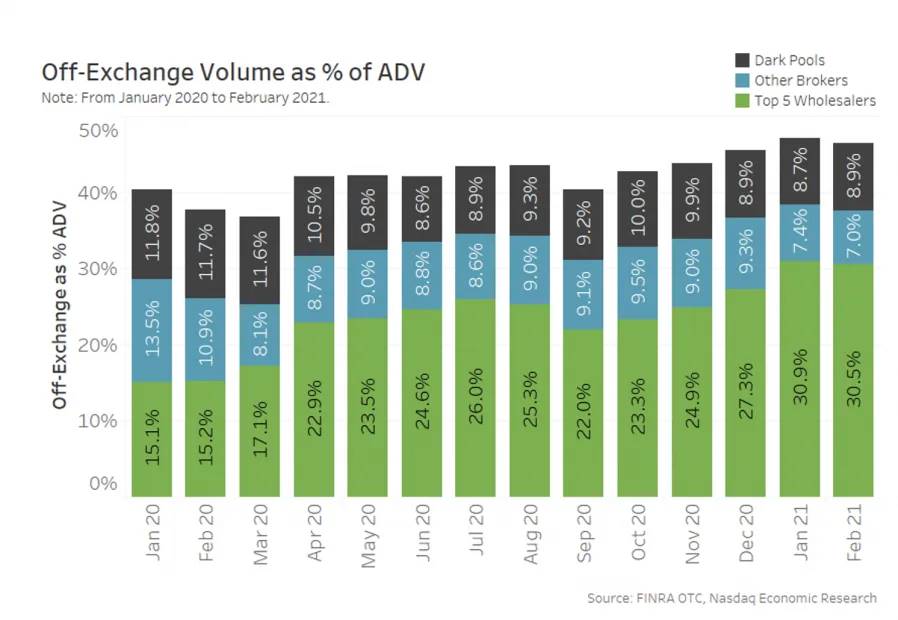

Source: Nasdaq

Dark pools have primarily developed in the United States and Europe. In the U.S., dark pools once accounted for approximately 15% of total trading volume, peaking at up to 40% of daily volume. Currently, over 50 dark pools are registered with the Securities and Exchange Commission (SEC), and the number continues to grow. In Europe, the introduction of the Markets in Financial Instruments Directive (MiFID) in 2007 accelerated the growth of dark pools.

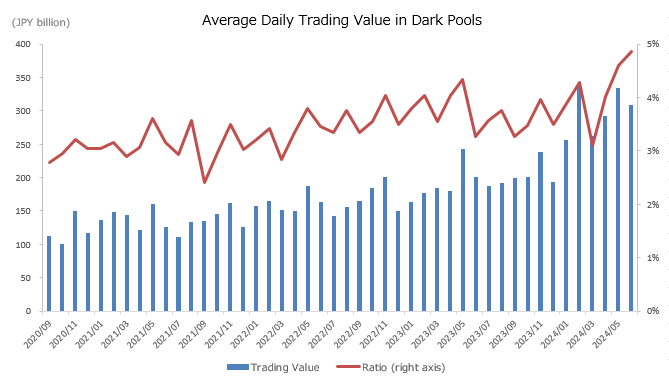

This trend is also expanding into Asia. Since 2010, Hong Kong and Singapore have adopted dark pool systems, while Japan and South Korea have introduced such platforms within their respective regulatory frameworks.

Japan Dark Pool Trading Trends, Source: JPX

While dark pools were initially designed for institutional investors handling large block trades, recent data shows a shift toward smaller transactions. According to FINRA (Financial Industry Regulatory Authority), the average trade size in the top five U.S. dark pools is only 187 shares. This shift stems from two factors: first, the emergence of platforms targeting retail investors has diversified the types of trades occurring within dark pools; second, institutions are increasingly splitting large orders into smaller ones to reduce market impact, thus altering trading patterns within these platforms.

2. Challenges Facing Traditional Financial Market Dark Pools

Dark pools offer clear advantages by reducing market impact and lowering the cost of large trades through confidentiality before execution. However, criticism persists, leading some countries to either avoid adopting or restrict the use of dark pools. This stems largely from several key concerns.

First, while dark pools enable cost-efficient large-scale trading, this comes at the expense of transparency. Trade information within dark pools remains hidden from public markets until after execution. This lack of transparency makes monitoring and regulation more difficult, raising concerns about potential negative impacts on financial markets. Second, liquidity concentration in dark pools reduces available liquidity on public exchanges, increasing transaction costs for retail investors and potentially undermining market efficiency.

Third, although dark pool trades are meant to be confidential, there have been known cases of platform operators intentionally leaking information. Documented incidents show that such leaks cause harmful effects, deepening skepticism toward dark pools.

3. The Inevitability of On-Chain Dark Pools

Some argue that decentralized finance (DeFi) systems offer solutions to the problems facing traditional dark pools. As previously noted, the operation of dark pools relies heavily on the assumption that operators will not exploit client information—a critical factor in maintaining trade confidentiality. However, in the traditional dark pool space, numerous cases exist where operators have leaked information for profit.

Consider a scenario involving a dark pool named "BlackTiger" and a stock called "Tiger." Suppose Institution A intends to purchase 5 million shares of Tiger from Institution B. The operator of BlackTiger leaks this information to Investor C in exchange for compensation. Since dark pool trade execution may take time, Investor C waits for the price of Tiger to drop, then purchases a large quantity of shares. After the dark pool trade is publicly disclosed and the stock price rises, Investor C sells the shares at a profit—exploiting informational asymmetry.

This practice undermines trust in centralized dark pools within traditional finance. One reason this issue persists is that operators can gain substantial profits from exploiting such information asymmetry, which often outweighs the risk of penalties. Although some countries have attempted to address these issues through stricter regulations, skepticism toward dark pool operators remains strong.

4. Implementation of On-Chain Dark Pools

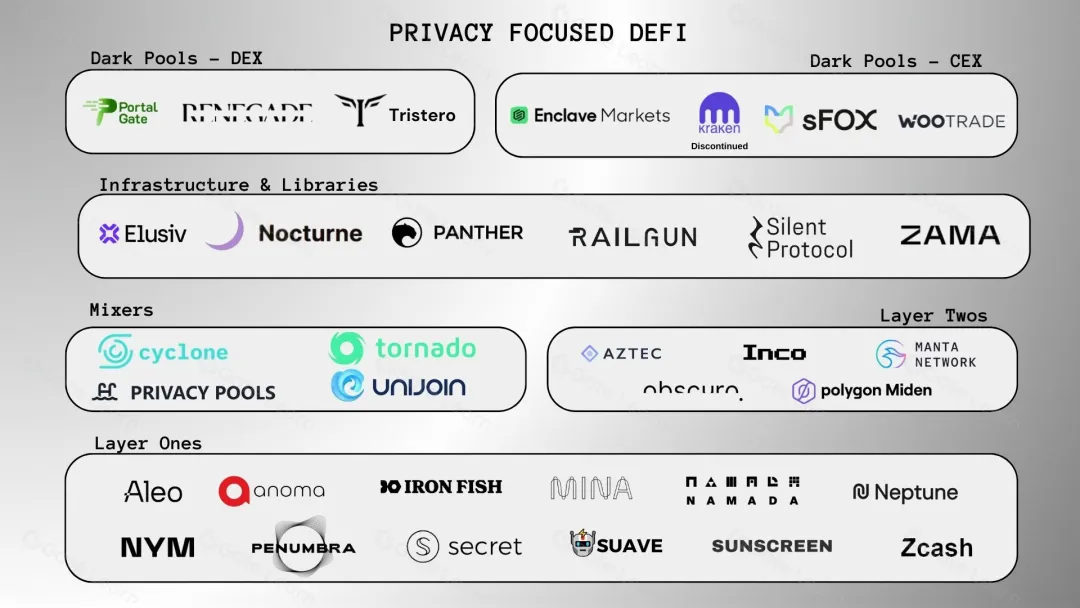

Source: Delphi Digital

In the decentralized finance (DeFi) space, several platforms have partially implemented dark pool functionality. Decentralized exchanges (DEXs), such as Uniswap, provide traders with a degree of anonymity by using automated market makers (AMMs) to match token trades without revealing participant identities. DEXs operate via blockchain networks and smart contracts, eliminating the need for intermediaries or centralized control. This effectively addresses the trust issues prevalent in traditional dark pools, where operators might abuse customer information.

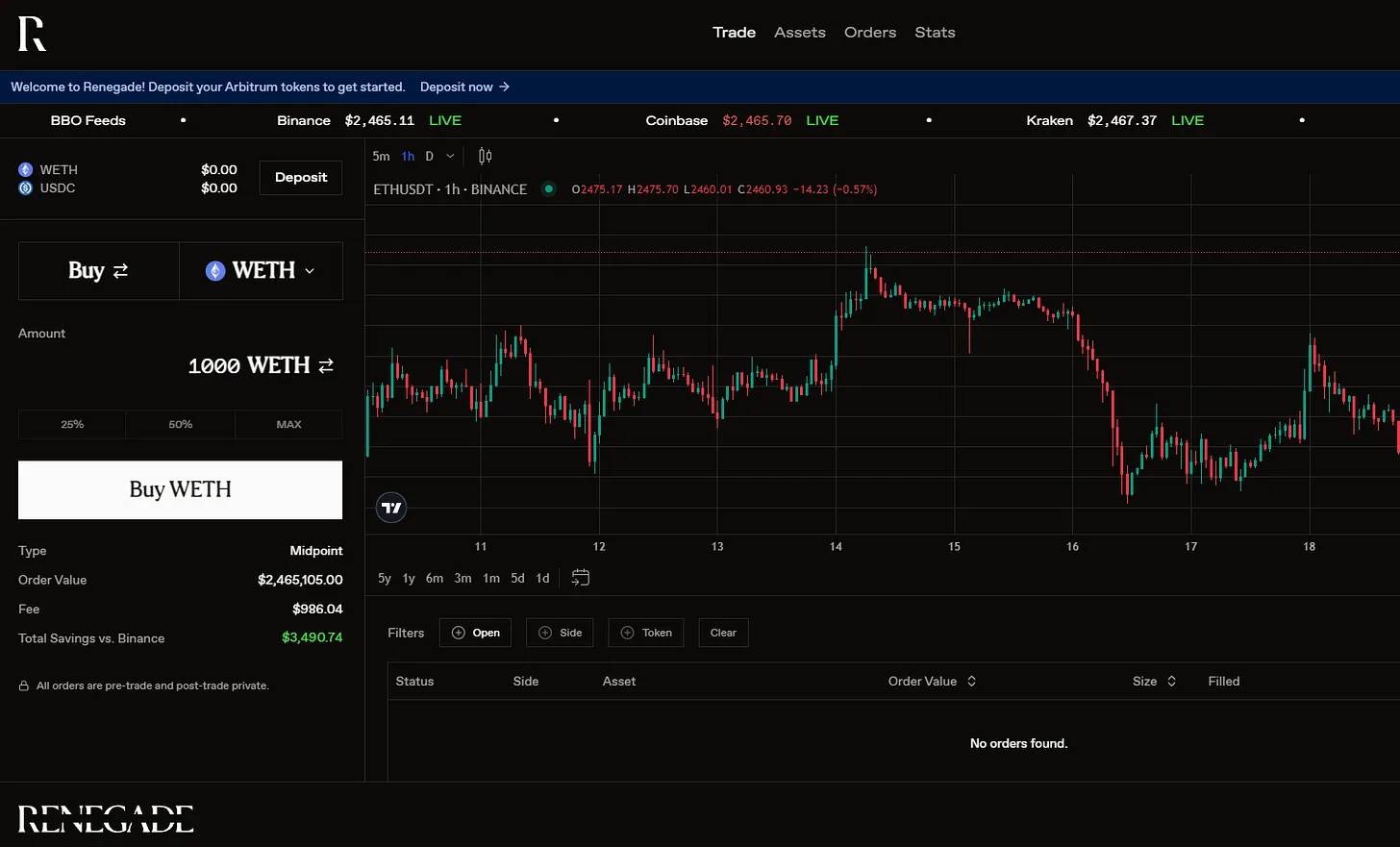

Source: Renegade

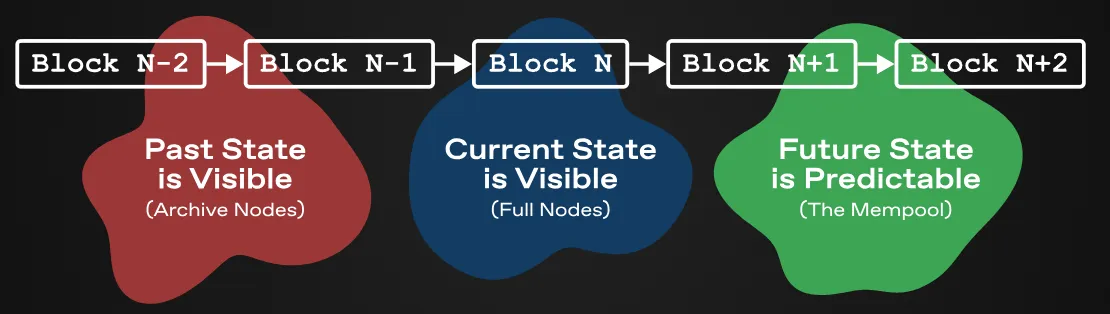

However, due to the inherent transparency of blockchain technology, decentralized exchanges (DEXs) struggle to fully replicate the confidentiality offered by traditional dark pools. Wallet addresses associated with certain institutions or large traders are often identifiable and traceable, and transaction details are visible to all participants on the blockchain. Services like block explorers and trackers make both completed and pending transactions easily accessible. Traders and platforms frequently leverage this transparency, which can lead to increased market instability, front-running, back-running, and maximum extractable value (MEV) attacks—creating a less favorable environment.

To address these challenges, on-chain dark pools introduce technologies such as zero-knowledge proofs (ZKPs), multi-party computation (MPC), and fully homomorphic encryption (FHE) to enable private trading mechanisms. ZKPs ensure that participants can prove the validity of a transaction without revealing actual inputs, preserving confidentiality. For example, a trader can prove they hold sufficient token balance to complete a trade without disclosing their full balance.

Source: Renegade

A notable on-chain dark pool is Renegade, which uses multi-party computation (MPC) for order matching and zero-knowledge proofs (ZKPs) to execute matched trades. This ensures that no information about orders or balances is revealed before trade completion. Even after execution, only the traded tokens are visible. Smart contracts verify ZKPs, reducing the risk of malicious behavior by block producers or sequencers. Other protocols, such as Panther, also utilize ZKPs and encryption techniques to facilitate private on-chain trading.

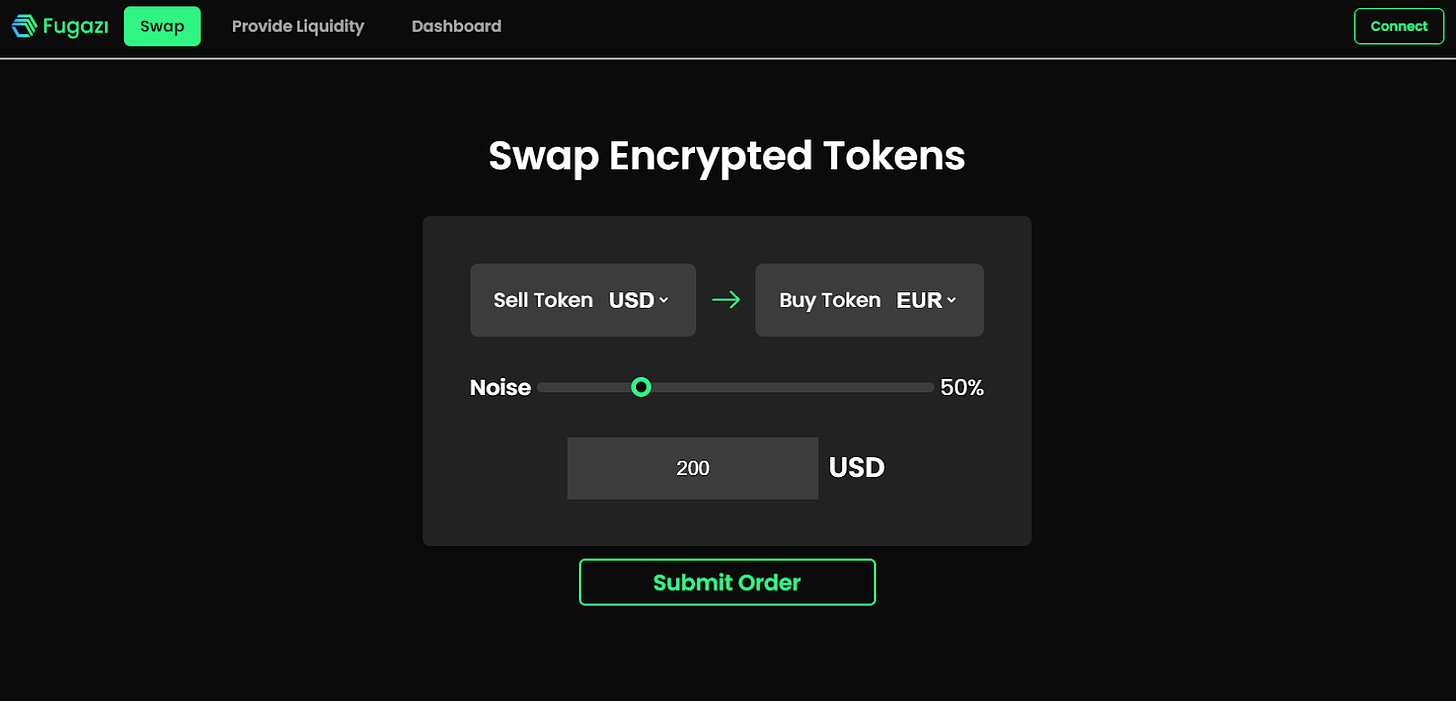

Source: ETH Online 2024

Meanwhile, automated market maker (AMM)-based decentralized exchanges (DEXs) like Uniswap and Curve are vulnerable to front-running and back-running attacks. These occur when third parties monitor the mempool and copy or manipulate transactions, resulting in unfavorable price outcomes for the original trader.

To counter this, projects like Fugazi, recognized at ETH Online, have introduced mechanisms such as batched transaction processing and noise orders to prevent MEV attacks. Fugazi bundles user transactions with random noise orders and applies fully homomorphic encryption (FHE). This prevents third parties from identifying specific transaction details and executing front-running attacks. While many on-chain dark pools adopt peer-to-peer (P2P) systems to reduce slippage, Fugazi’s combination of AMM mechanics with MEV mitigation represents a promising advancement in protecting participants.

5. The Dilemma of On-Chain Dark Pools: Transparency

One major concern surrounding on-chain dark pools is whether they could undermine the transparency of blockchain networks. Since the inception of blockchain technology, it has faced challenges such as the "blockchain trilemma"—balancing scalability, decentralization, and security. Similarly, the transparency issues introduced by on-chain dark pools represent another challenge requiring extensive research and experimentation to resolve.

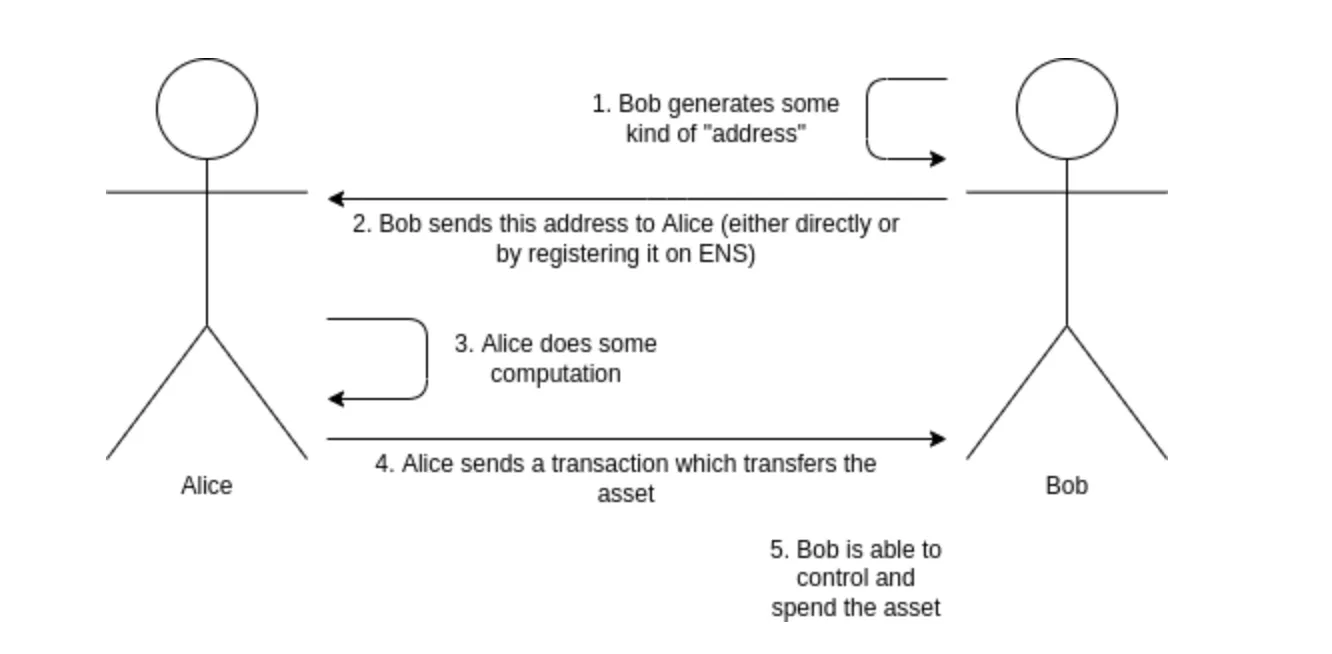

Source: vitalik buterin’s blog

Essentially, there may be a trade-off between transparency and security within blockchain systems. The development of on-chain dark pools aims to minimize security risks and market impact, serving as a response to the inherent transparency of blockchains. Even Ethereum co-founder Vitalik Buterin has proposed the concept of stealth addresses to alleviate privacy concerns arising from publicly available information such as wallet addresses and Ethereum Name Service (ENS) records. This suggests that while transparency is a major advantage of blockchains, achieving broad adoption may require balancing transparency with user privacy—without compromising user experience.

6. The Future of On-Chain Dark Pools

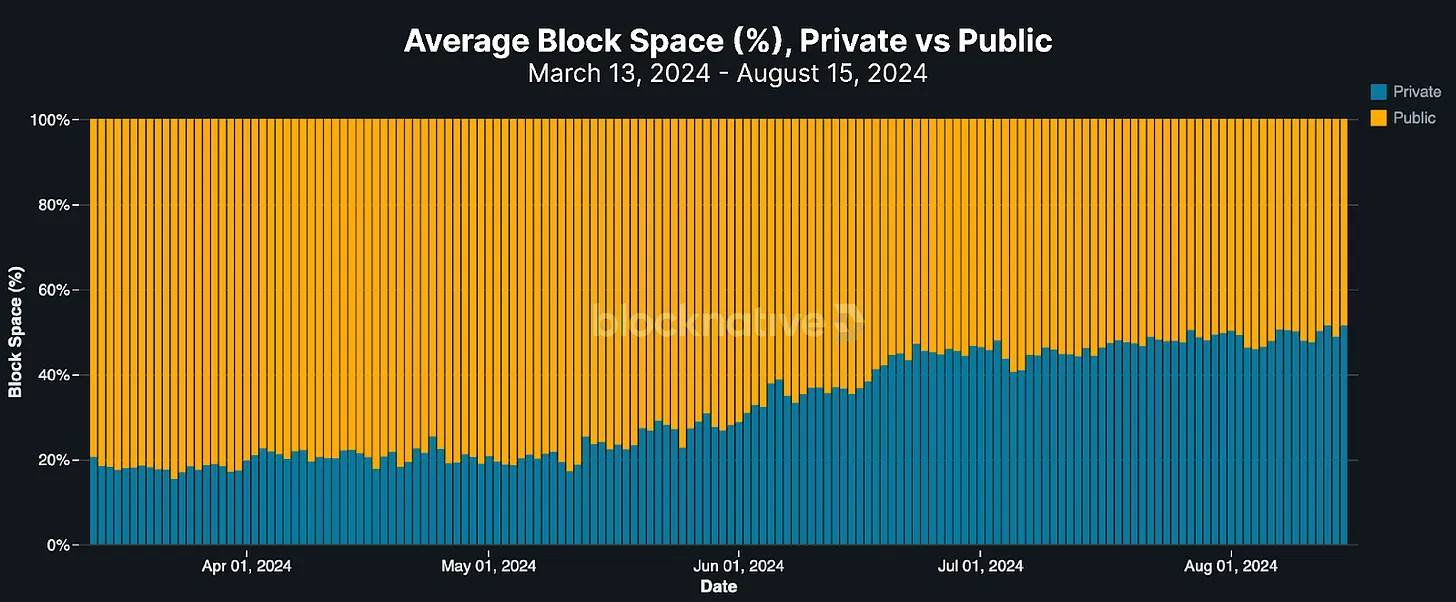

Source: blocknative

The growth potential of on-chain dark pools is expected to be substantial. This is evidenced by the rapid increase in private transactions on the Ethereum network. While private transactions accounted for only 4.5% of total Ethereum transactions in 2022, they have recently surged to account for over 50% of total gas fees—indicating a strong effort by users to avoid bots that influence transaction outcomes.

Users can leverage private mempools for private transactions, but this still relies on trusting a small group of operators who control these mempools. Although private mempools offer greater censorship resistance compared to public ones, a fundamental issue remains: block producers can still monitor and potentially exploit transaction data. Given these challenges, the market for on-chain dark pools—where trades can be securely concealed while maintaining auditable accessibility—is poised for sustained growth.

7. Can On-Chain Dark Pools Revolutionize Financial Markets?

Traditional financial market dark pools face a serious crisis of trust due to incidents involving money laundering, hacking, and information leaks. As a result, regions like the United States and Europe, once leaders in dark pool adoption, have introduced regulations to enhance transparency and set clear conditions under which non-public trading can occur. In contrast, markets like Hong Kong impose restrictions on dark pool usage, limit participation, and prohibit retail investors from engaging in dark pool trading.

Despite these challenges, on-chain dark pools—with strong anti-censorship capabilities and enhanced security—may bring transformative change to the financial industry. However, two key issues must be addressed to achieve widespread adoption. First, the platforms and entities operating these pools must undergo thorough scrutiny to ensure stability and reliability, as they depend on blockchain networks and smart contracts. Second, on-chain dark pools currently lack a clear regulatory framework. Institutional investors must participate cautiously and ensure compliance with all relevant regulatory requirements before entering such markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News