OKG Research: A Conversation with Bloomberg, from Data Aggregation to Value Creation

TechFlow Selected TechFlow Selected

OKG Research: A Conversation with Bloomberg, from Data Aggregation to Value Creation

In the future, obtaining data itself is not the ultimate goal, but a means to achieve innovation.

Produced by|OKG Research

Planning|Lola Wang

Author|Hedy Bi

In 1981, Bloomberg consisted of just four people and a coffee pot in a mere 10-square-meter office. Guided by founder Bloomberg’s enduring principle—“There is no new economy; doing business means providing what users need”—Bloomberg grew into a global giant in financial news and data analytics within fewer than 50 years.

Image source: Internet

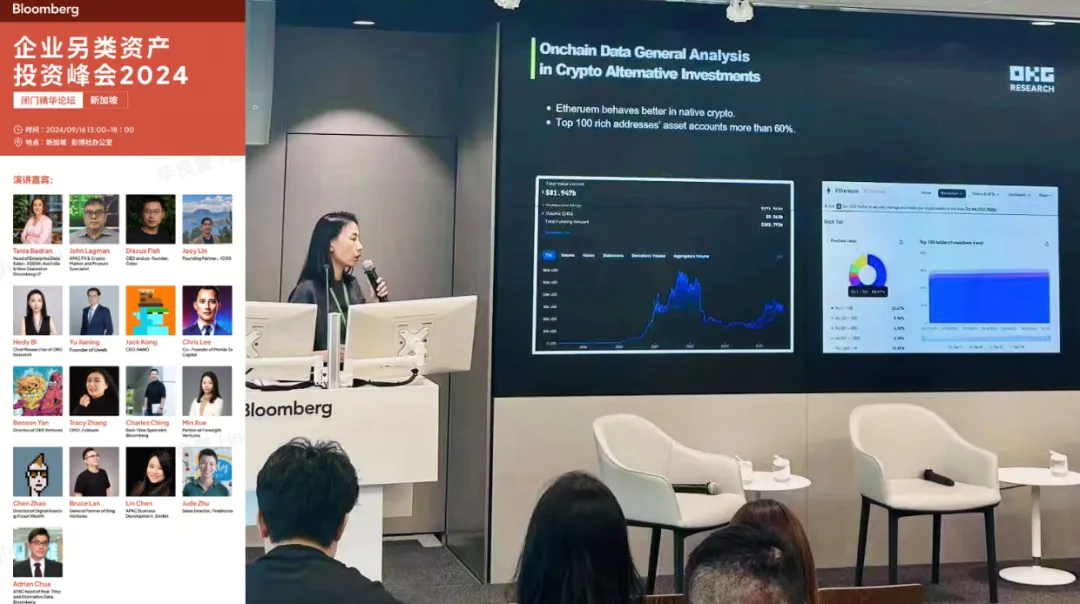

On September 16, 2024, TechFlow Research was invited as a keynote speaker at Bloomberg's 2024 Enterprise Alternative Asset Investment Summit, where it delivered a presentation on the topic of on-chain data. During the event, Hedy Bi, Chief Researcher at TechFlow Research, engaged in an in-depth discussion with Bloomberg product experts about the future of data forms and the evolution of on-chain data products. Bloomberg previously conducted a client survey on demand for on-chain data: 85% of respondents indicated they hoped data providers like Bloomberg would offer on-chain data products for crypto analysis. Moreover, we observe that technological advancement drives diversification in data formats, yet data product services across eras share striking similarities.

Image source: Bloomberg🇸🇬 Closed-door meeting – TechFlow Research (OKG Research) demonstrating real-time applications of on-chain data as keynote speaker

Demand Arises in Times of Chaos

In the early 1980s, Wall Street was in disarray. Brokerages were fragmented and information siloed, while traditional manual methods of information gathering were highly inefficient. At the same time, quantitative trading began to emerge, with only a few pioneers experimenting with computer-assisted trading. Technological constraints made data processing and transmission rudimentary. Bloomberg敏锐ly identified these industry pain points and launched its integrated data analysis terminal service. This not only simplified and accelerated data access for traders but also leveraged a news team of over 2,700 journalists producing more than 5,000 articles daily, quickly establishing itself as a dominant force in financial information. This powerful combination enabled Bloomberg to swiftly surpass Reuters, which had long dominated the financial media landscape.

Image source: Screenshot from "The Wolf of Wall Street"

This strategic approach allowed Bloomberg to reduce reliance on any single market: its terminals primarily serve institutional clients such as brokers and traders, while its news operations target the broader public. On one hand, Bloomberg attracted readers through its promise of news delivery “15 minutes faster than other media”; on the other, this rapid reporting fed timely data back into its terminals. This flexible and diversified strategy strengthened Bloomberg’s competitiveness in financial information, enhanced its visibility and brand influence among the general public, laid the foundation for sustained growth, and propelled its valuation from an initial $10 million startup capital to today’s $60 billion enterprise.

The cryptocurrency industry originated from a similar starting point: public blockchains based on decentralized technology provide the foundational layer for native crypto innovations. As public chain ecosystems continue to evolve, however, information silos between different chains have gradually surfaced. Furthermore, the deep integration of supply-demand dynamics and financial trading mechanisms has rendered the entire crypto market highly volatile and complex, filled with uncertainty and chaos. Therefore, enhancing cross-chain data interoperability and improving the integration capabilities of on-chain data have become critical challenges urgently needing resolution in the crypto industry.

Though separated by era and market, OKLink is emerging as a kindred spirit to Bloomberg on the journey of unlocking data value: backed by robust technical capabilities, it provides users with a multi-chain browser aggregating information, transforming complex and scattered blockchain data into clear, real-time insights, enabling easy access to cross-chain information and greatly enhancing data accessibility; on the other hand, by offering unified and rich API interfaces, OKLink empowers developers building innovative applications on public chains, lowering development barriers, increasing efficiency, accelerating product iteration, and allowing faster responses to market changes to launch competitive products and services. Different times, different markets—but both OKLink and Bloomberg rely on strong data and technological foundations, adopting this “one-two punch” business model to reduce dependence on any single market, meet diverse user needs, and navigate successfully through chaotic environments.

Image source: OKLink, Bloomberg

On-Chain Advancement: From Data Aggregation to Value Creation

Data itself does not create value—the value of data lies in its efficient and precise application to unlock utility. As Bloomberg puts it, “For us, the substance conveyed by information matters more than anything else—including the channel.” This philosophy was precisely why Bloomberg surpassed Reuters: by delivering financial data via terminals and analyzing it to aid investment decisions, Bloomberg transformed data from mere aggregation to value discovery.

Thus, the core value of current on-chain data platforms lies not merely in aggregating information for users, but more importantly in leveraging behind-the-scenes parsing and fusion of data across different public chains to enable value discovery. In the crypto space, public chain ecosystems have flourished into a vibrant “hundred schools contending” landscape. According to incomplete statistics from TechFlow Research, there are now over 1,000 public chains in existence, leading to market fragmentation. Particularly non-EVM chains such as Solana and TON, built on distinct technical architectures, suffer from low interoperability and lack standardized data formats, leaving users confused and challenged when choosing the right chain for trading or development—further constraining industry-wide innovation and convergence.

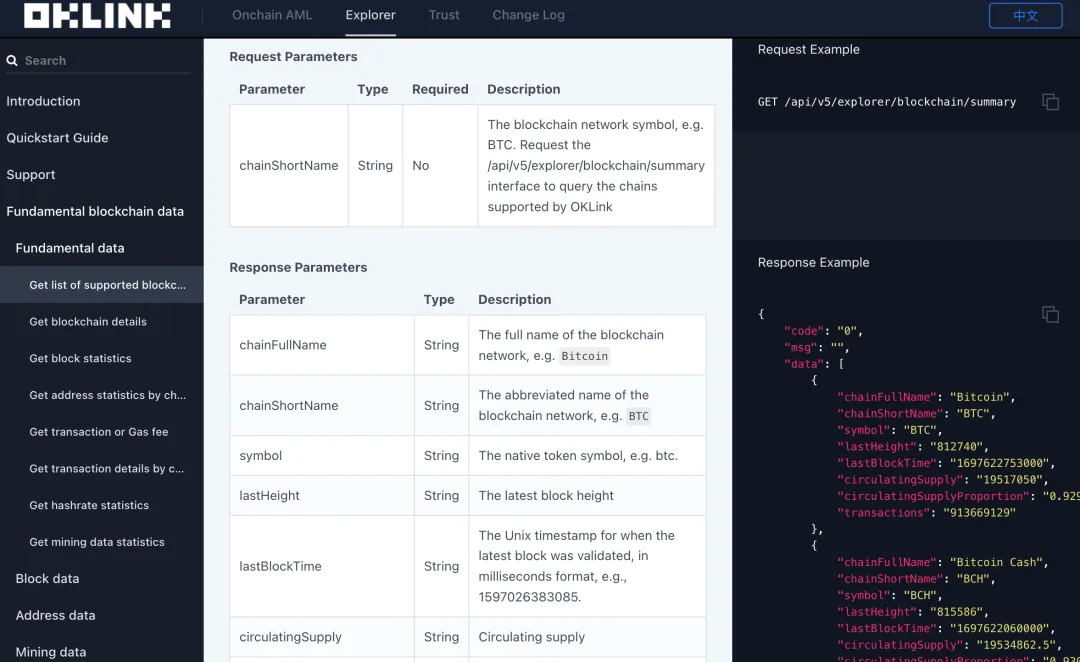

Much like Bloomberg’s role in standardizing financial data: the openness of on-chain data simplifies access, but each public chain’s unique protocols, data formats, and interfaces make cross-chain integration complex and raise usage barriers. Standardized data packaging into APIs can dramatically improve efficiency. As early as two years ago, OKLink’s OPEN API enabled developers to simultaneously and frequently query data from dozens of major public chains via a single API integration. This allows users to easily access various on-chain data without needing to master the intricacies or programming languages of individual chains.

Image source: OKLink

By eliminating the need to “reinvent the wheel,” this greatly accelerates the release of innovative value on-chain. Moreover, data can be reused endlessly without depletion, thereby generating greater returns. Beyond that, standardizing data products bridges disparate public chain ecosystems, creating network effects across on-chain data. Combined with developer tools—just as Bloomberg equips investors with analytical instruments—it ultimately enables value creation rooted in on-chain data.

Looking back at Bloomberg’s evolution, it exemplifies the extraordinary transformation of data—from aggregation to value discovery. Today, as blockchain technology sees widespread adoption, we believe the era of on-chain UGC has arrived. Accessing data itself is no longer the ultimate goal, but rather a means to drive innovation. Users—especially developers—will increasingly leverage diverse on-chain data products to unlock new possibilities and foster groundbreaking innovation on the blockchain! Let's BUIDL!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News