Galaxy Digital (GLXY) Research: A Hybrid of Web3 Institutional Service Providers and AI Data Centers

TechFlow Selected TechFlow Selected

Galaxy Digital (GLXY) Research: A Hybrid of Web3 Institutional Service Providers and AI Data Centers

Galaxy Digital's market valuation is significantly lower than the sum of its segment values.

Author: Lawrence Lee

1. Research Summary

Galaxy Digital (GLXY) is a hybrid platform spanning crypto finance and AI computing power, with a business structure covering three core modules: ① Global Markets (trading, market making, and crypto investment banking); ② Asset Management & Infrastructure Solutions (fund management, staking, custody, and proprietary investments); ③ AI Data Centers & Computing Infrastructure (the Helios campus).

Over the past three years, Galaxy has risen from the lows of the crypto winter to multi-business synergistic growth. In Q3 2025, driven by the surge in Digital Asset Treasury Company (DAT) activity and the sale of 80,000 BTC, it achieved over $730 million in adjusted gross profit, a record high; its asset under management (AUM) for asset management and staking reached $9 billion, with staking scale exceeding $6.6 billion, generating over $40 million in annual management fees; meanwhile, the Helios mining site fully transitioned into an AI computing campus, signing a 15-year long-term contract with CoreWeave, locking in all 800MW of available power capacity across three phases, projecting annual revenue exceeding $1 billion upon full delivery.

GLXY's financial performance is highly volatile and significantly influenced by the crypto market: it lost nearly $1 billion in 2022, turned profitable in 2023, and achieved a net profit of $365 million in 2024. Although performance dipped slightly in the first half of 2025, Q3 single-quarter profits hit a record $505 million amid overall market volatility, with adjusted EBITDA turning strongly positive, demonstrating enhanced resilience in core operations.

In terms of valuation, we apply a SOTP (sum-of-the-parts) framework: valuing Galaxy’s digital asset financial services segment at $7.7 billion; valuing its AI computing infrastructure business at $8.1 billion, totaling $15.8 billion, plus net assets resulting in an estimated equity value of approximately $19.4 billion. Currently, Galaxy's market cap stands at $10.1 billion, representing a 48% discount to our calculated sum-of-the-parts valuation. This may be due to investor conservatism toward companies facing both industry cycle fluctuations (with current crypto cycles possibly peaking) and business transformation challenges (computing operations beginning deliveries only in 2026).

PS: This article reflects my interim views as of publication, which may change in the future. The opinions are highly subjective and may contain factual, data, or logical errors. All views expressed herein are not investment advice. Feedback and further discussion from peers and readers are welcome.

2. Business & Product Lines

Galaxy Digital was founded in 2018 by former Wall Street star investor Michael Novogratz. Novogratz was previously a partner and macro fund manager at the renowned hedge fund Fortress. Today, Galaxy Digital’s business landscape has evolved into "three core segments": ① Global Markets (Global Markets, including trading, derivatives market making, investment banking, and lending services), ② Asset Management & Infrastructure Solutions (Asset Management & Infrastructure Solutions, including fund management, staking services, proprietary investments, etc.), and ③ Data Centers & Computing Power (Data Centers, including previous Bitcoin mining and ongoing AI/HPC high-performance computing infrastructure). Below, we break down each major product line’s business model, latest developments, and revenue contribution.

2.1 Global Markets (Global Markets)

Business Overview & Definition

The Global Markets division encompasses Galaxy Digital’s digital asset trading and related financial services offered to institutional clients, serving as its primary revenue source. This module includes two main components: Franchise Trading and Investment Banking. The franchise trading team acts as a market maker and liquidity provider in the crypto market, offering OTC spot and derivatives trading services to over 1,500 counterparties, supporting more than 100 mainstream crypto assets. Simultaneously, Galaxy leverages regulated entities to conduct digital asset collateralized lending, OTC block brokerage, and structured yield products, providing leverage, hedging, and instant liquidity solutions for institutions such as miners and funds. The investment banking team serves blockchain and crypto industry enterprises, offering specialized financial advisory services including M&A advisory, equity and debt financing arrangements, and private placements, helping digital asset companies access traditional capital markets. These services enable Galaxy to deliver comprehensive financial solutions comparable to Wall Street investment banks, meeting evolving demands within the crypto-financial ecosystem.

Key Development Milestones

-

2018–2019: Galaxy Digital was established in 2018 with the goal of “bringing crypto to Wall Street and bringing Wall Street to crypto.” It quickly began building a full-service platform covering trading, asset management, and investments, rapidly accumulating an institutional client base.

-

2020: Galaxy achieved significant expansion through acquisitions: in November 2020, it acquired DrawBridge Lending, a digital asset lending and structured products firm, and Blue Fire Capital, a professional market maker, enhancing its capabilities in OTC lending, futures derivatives, and bilateral market making. This expanded Galaxy’s trading portfolio into advanced products such as leveraged loans, OTC options, and structured notes, increasing its annual OTC trading volume to over $4 billion and growing active counterparties to nearly 200.

-

2021: The company appointed senior executives like Damien Vanderwilt, formerly of Goldman Sachs, to launch a dedicated investment banking division focused on the crypto sector, offering M&A and financing advisory services. That year, Galaxy continued expanding its product offerings by acquiring Vision Hill Group (a digital asset investment advisor and crypto fund index provider), strengthening its fund products and data analytics capabilities. On the trading side, the Galaxy Digital Trading team developed the integrated GalaxyOne trading platform (combining trading, lending, and custody), completing key technical frameworks during the year, laying the foundation for a unified institutional service portal.

-

2022: Despite entering a crypto winter, Galaxy’s Global Markets business steadily expanded. By Q4 2022, the franchise trading desk had increased its number of counterparties to over 930, providing continuous market making and liquidity support for over 100 digital assets. On the investment banking front, the team capitalized on industry consolidation, participating in multiple major transactions—for example, advising Amberdata on its acquisition of Genesis Volatility and assisting CoreWeave in securing strategic investment from Magnetar Capital. Notably, when Galaxy itself acquired the Helios mining facility (see Data Center section below) at the end of 2022, its investment banking team provided transaction advisory support, demonstrating internal synergy.

-

2023: As the market gradually recovered, Galaxy’s Global Markets business rebounded strongly. The company expanded its presence in Asia, the Middle East, and other regions, establishing teams in Hong Kong, Singapore, and elsewhere to serve local institutional clients (e.g., family offices, funds). The investment banking team remained active in the first half of 2023, involved in several industry M&As and financings—for instance, acting as advisor on Galaxy’s acquisition of custodian GK8 (on the buy-side) and various mining company restructurings. Despite ongoing volatility in the crypto sector, Galaxy’s Global Markets segment already displayed a more stable revenue curve compared to traditional crypto exchanges, thanks to its diversified business model (including interest income, market-making spreads, and advisory fees).

-

2024: This year saw a clear recovery in digital asset markets, with Galaxy’s Global Markets recording record-breaking performance. Full-year 2024 counterparty trading and advisory revenue reached $215 million, surpassing the combined total of the prior two years. Q4 alone generated $68.1 million in revenue (up 26% quarter-on-quarter). Growth was primarily driven by heightened derivatives trading activity and strong demand for institutional lending—OTC derivatives and credit businesses surged that quarter, with counterparty trading volumes up 56% sequentially and average loan book size reaching $861 million, a new high. By year-end 2024, Galaxy had 1,328 trading counterparties, a significant increase from the previous year. On the investment banking side, Galaxy completed nine advisory deals in 2024, finalizing three in Q4 alone—including serving as exclusive financial advisor on Bitwise’s acquisition of Ethereum staking provider Attestant and assisting Thunder Bridge Capital’s SPAC merger with Coincheck. These transactions generated substantial fee income, solidifying Galaxy’s reputation in the crypto investment banking space.

-

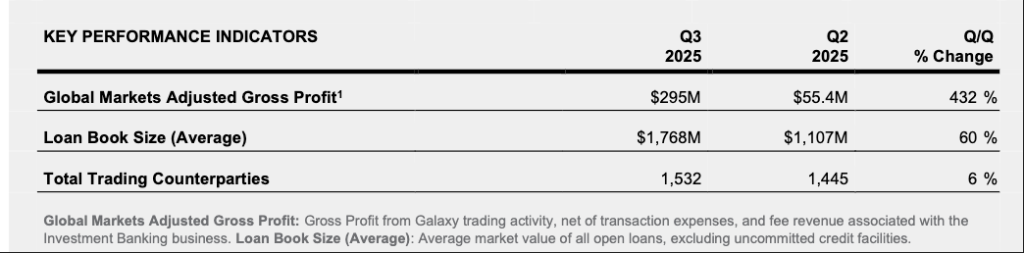

2025: Entering 2025, buoyed by favorable expectations around ETF approvals, digital asset markets rallied sharply, pushing Galaxy’s Global Markets to new heights. In Q3 2025, Galaxy’s Global Markets segment achieved $295 million in adjusted gross profit for the quarter, surging 432% from the previous quarter and setting a new record. Total trading volume for the quarter grew 140% sequentially, reaching an all-time high and far outpacing average market growth. A standout transaction was Galaxy facilitating the sale of 80,000 BTC (nominal value ~$9 billion) on behalf of a large institution, significantly boosting quarterly spot trading volume. Both BMNR and SBET, leading ETH stock companies, also conducted their ETH acquisitions via Galaxy. Meanwhile, Galaxy’s institutional lending business expanded rapidly, with average loan balances reaching $1.78 billion in Q3, up 60% from Q2, indicating growing institutional demand for crypto credit financing through Galaxy. On the investment banking front, Galaxy capitalized on the fundraising window in Q3, co-managing Forward Industries’ $1.65 billion PIPE private placement and serving as exclusive financial advisor on Talos’ acquisition of Coin Metrics. These high-profile deals further cemented Galaxy’s leadership position in digital asset investment banking. Looking ahead to full-year 2025, amid the DAT company boom, market expectations are for Galaxy’s Global Markets to achieve revenue and profitability levels far exceeding historical norms.

Financial Reports & Public Disclosures Summary (2023–2025)

Revenue & Profit: In 2023, due to the bear market environment, Galaxy recorded an overall loss, but the Global Markets segment showed improvement in the second half. In 2024, Global Markets became the main driver of corporate performance: full-year counterparty trading and advisory revenue reached $215 million, a sharp increase from 2022 (~$100 million due to market downturns). Derivatives and quantitative trading profitability rose, while interest income grew alongside expanding lending volumes. The Global Markets segment achieved over $100 million in adjusted EBITDA in 2024, demonstrating operating leverage. Q4 2024 alone generated $68.1 million in Global Markets revenue, directly turning the company’s quarterly net profit positive. By Q3 2025, Galaxy reported $250 million in adjusted EBITDA for its digital asset business (encompassing Global Markets and Asset Management), with Global Markets being the primary contributor. That quarter, Global Markets achieved $295 million in adjusted gross profit, highlighting strong earnings elasticity in bull markets. Notably, although the company’s overall net profit in the first nine months of 2025 was affected by volatility in proprietary investments (e.g., losses in Q1 due to falling digital asset prices), the underlying trend in core operations remained robust. Management indicated in the Q3 2025 earnings report that with the full rollout of the GalaxyOne platform and increasing institutional client adoption, trading-related revenues could grow further. Additionally, the cost-to-income ratio for Global Markets improved (indicating higher operational efficiency), delivering significant operating leverage benefits.

GLXY Q3 2025 Global Markets profit, loan size, and counterparty data

2.2 Asset Management & Infrastructure Solutions (Asset Management & Infrastructure Solutions)

Business Overview & Definition

The Asset Management & Infrastructure Solutions segment integrates Galaxy Digital’s expertise in digital asset investment management and blockchain infrastructure technology services, complementing its Global Markets operations.

In asset management, Galaxy offers diversified crypto investment products to institutional and qualified investors through its subsidiary Galaxy Asset Management (GAM). Product formats include: 1) public market products: ETFs/ETPs (exchange-traded products) co-launched with traditional institutions, covering single-asset ETFs (Bitcoin, Ethereum), blockchain-themed ETFs, etc.; 2) private fund products: actively managed hedge funds (alpha strategies), venture capital funds (investing in blockchain startups such as Galaxy Interactive), crypto index funds, and fund-of-funds, providing diversified risk-return profiles. Galaxy also offers customized crypto investment services for institutions, such as digital asset index construction, treasury management, and co-investment (SPV) opportunities. As of Q3 2025, Galaxy manages nearly $9 billion in AUM, spanning over 15 ETFs and alternative investment strategies, placing it among the world’s largest crypto asset managers.

In infrastructure solutions, Galaxy leverages its technical and operational experience to provide institutions with foundational blockchain network services and custody solutions. Key offerings include custody and staking. The GK8 platform, acquired by Galaxy in 2023, provides enterprise-grade self-custody technology, allowing clients to securely manage their crypto assets using cold wallets and MPC (multi-party computation). GK8 supports rich functionalities including DeFi protocol participation, tokenization issuance, and NFT custody, enabling Galaxy to offer a “one-stop” digital asset infrastructure solution (e.g., token issuance platforms). For staking, Galaxy has established a dedicated blockchain infrastructure team offering node management and “staking-as-a-service.” This team operates a global network of validator nodes, supporting major PoS blockchains such as Ethereum and Solana, helping clients earn staking rewards by delegating their holdings. Galaxy’s staking service features institutional-grade security and flexibility: integration with compliant custodians like Anchorage, BitGo, and Zodia allows seamless staking of custodied assets; additionally, Galaxy offers innovative features such as staked-asset collateralized lending, improving capital efficiency. Furthermore, Galaxy engages in proprietary investments through divisions like Galaxy Ventures, backing promising blockchain startups and protocols. As of end-2022, the company had invested in over 100 companies (145 investments). These strategic investments yield potential financial returns and expand Galaxy’s industry influence and partnership networks (e.g., early investments in Block.one, BitGo, Candy Digital). Overall, the Asset Management & Infrastructure Solutions segment enables Galaxy to vertically integrate the value chain, driving client service through dual engines: managing assets and managing underlying technology.

Key Development Milestones

-

2019–2020: Galaxy began developing its asset management business, collaborating with traditional financial institutions to launch crypto investment products. In 2019, Galaxy partnered with Canada’s CI Financial to launch the CI Galaxy Bitcoin Fund (a closed-end Bitcoin fund listed on the Toronto Stock Exchange), one of North America’s earliest publicly raised Bitcoin investment products. Subsequently, in 2020, they jointly launched the CI Galaxy Bitcoin ETF, one of the world’s lowest-fee Bitcoin ETFs at the time. These collaborations established Galaxy as a pioneer in the public crypto product space.

-

2021: In May, Galaxy acquired Vision Hill Group (a New York-based digital asset investment advisor and asset manager), integrating its team and products (including crypto hedge fund indices, the VisionTrack data platform, and fund-of-funds) into Galaxy. Following the acquisition, the Galaxy Fund Management platform could offer institutions richer data-driven investment decision support and a broader fund lineup. During the year, Galaxy Asset Management expanded its active management offerings, launching funds such as Galaxy Liquid Alpha, ending the year with ~$2.7 billion in AUM (a significant increase from $407 million at the start of the year).

-

2022: In Q4, Galaxy announced a strategic partnership with Itaú Asset Management, one of Brazil’s largest private banks, to co-develop a series of digital asset ETFs for the Brazilian market. They launched their first joint product, the “IT Now Bloomberg Galaxy Bitcoin ETF,” in late 2022, giving Brazilian investors exposure to physically backed Bitcoin via local exchanges. That year, despite market headwinds affecting Galaxy’s AUM (dropping to $1.7 billion at year-end, down 14% YoY), the company strategically focused on “scaling active strategies”: for example, the Galaxy Interactive fund successfully completed multiple game/metaverse startup investments, and the Liquid Alpha hedge fund achieved net inflows even in difficult market conditions.

-

2023: In February, Galaxy successfully acquired the GK8 digital asset custody platform from bankrupt Celsius Network for ~$44 million (well below Celsius’s original purchase price of $115 million). Nearly 40 members of the GK8 team, including top crypto security experts, officially joined Galaxy, establishing a new R&D center in Tel Aviv. GK8’s patented technologies include offline cold vault transactions and MPC hot wallets, enabling institutions to sign on-chain transactions without internet connectivity and perform automated, multi-signature custody operations. This acquisition significantly strengthened Galaxy’s capabilities in secure custody, staking, and DeFi access, which CEO Novogratz called “a critical step toward offering a full financial platform.” GK8 was subsequently integrated into the GalaxyOne platform, becoming a key tool for Galaxy to empower institutional clients with self-managed assets. Galaxy’s asset management business also had highlights in 2023: it was hired as an advisor to the FTX bankruptcy team, helping liquidate FTX’s portfolio, generating additional management fees and reputational gains; simultaneously, as the market rebounded, Galaxy’s AUM bottomed out and recovered, reaching ~$3 billion by Q4. At year-end, Galaxy announced the upgraded brand “Galaxy Asset Management & Infrastructure Solutions,” integrating traditional asset management with blockchain technology services, emphasizing its differentiated positioning.

-

2024: This year marked rapid growth for Galaxy’s asset management and blockchain infrastructure businesses. In July, Galaxy announced the acquisition of most assets from CryptoManufaktur (CMF), a blockchain node operator founded by Ethereum veteran Thorsten Behrens. CMF specializes in automated Ethereum node deployment and oracle infrastructure operations. This move immediately added ~$1 billion worth of Ethereum staking assets to Galaxy (increasing total staking scale to $3.3 billion). The core team of three joined Galaxy, accelerating its technical accumulation in Ethereum staking and Oracle data services. Staking became one of Galaxy’s biggest highlights in 2024: fueled by Ethereum’s Shanghai upgrade enabling withdrawals and increased institutional participation, Galaxy’s staked assets surged from just $240 million at the start of the year to $4.235 billion by year-end—an almost 17-fold increase (with $1 billion from acquisitions and the rest organic growth). Responding to market demand, Galaxy formed partnerships with multiple major custodians: in February, it became an integrated staking provider for BitGo, allowing BitGo’s custodial clients to use Galaxy’s nodes for staking and collateralize staked assets for third-party loans; in August, Galaxy partnered with Zodia Custody (a bank-backed institutional custodian) to offer compliant staking solutions for European clients; it also expanded technical integrations with Fireblocks and Anchorage Digital. These initiatives greatly broadened Galaxy’s staking distribution channels.

-

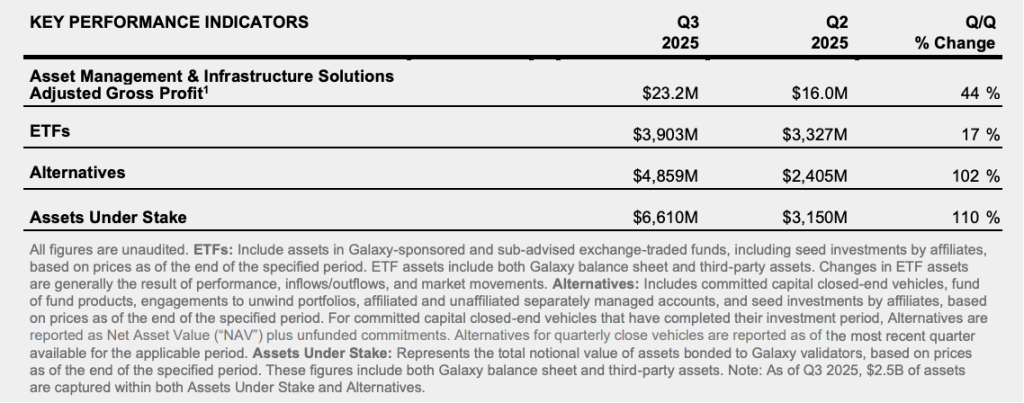

2025: In 2025, with clearer market and regulatory conditions, Galaxy’s Asset Management & Infrastructure segment continued advancing. In Q3 2025, Galaxy reported $23.2 million in adjusted gross profit for the segment, up 44% from Q2, reflecting scale expansion. Growth was driven by over $2 billion in net new inflows during the quarter, sourced from long-term mandates by large digital asset holders (e.g., crypto project foundations, corporate treasuries). These institutions entrusted their assets to Galaxy for management and staking, contributing over $4.5 billion in disclosed assets by Q3, generating over $40 million annually in recurring management fees. Galaxy refers to this service as “digital asset treasury outsourcing”—helping projects or corporations manage their crypto reserves for steady appreciation. As a result, Galaxy’s AUM rose to nearly $9 billion, with staked assets reaching $6.61 billion, both record highs. On October 29, Galaxy announced integration with Coinbase Prime, becoming one of Coinbase’s select staking providers. Through this collaboration, Coinbase’s institutional clients can seamlessly access Galaxy’s high-performance validator network, marking Galaxy’s entry into top-tier custodial ecosystems. Overall, in 2025, Galaxy achieved simultaneous progress in product innovation, scale growth, and ecosystem deepening within its asset management and infrastructure segment.

Financial Reports & Public Disclosures Summary (2023–2025)

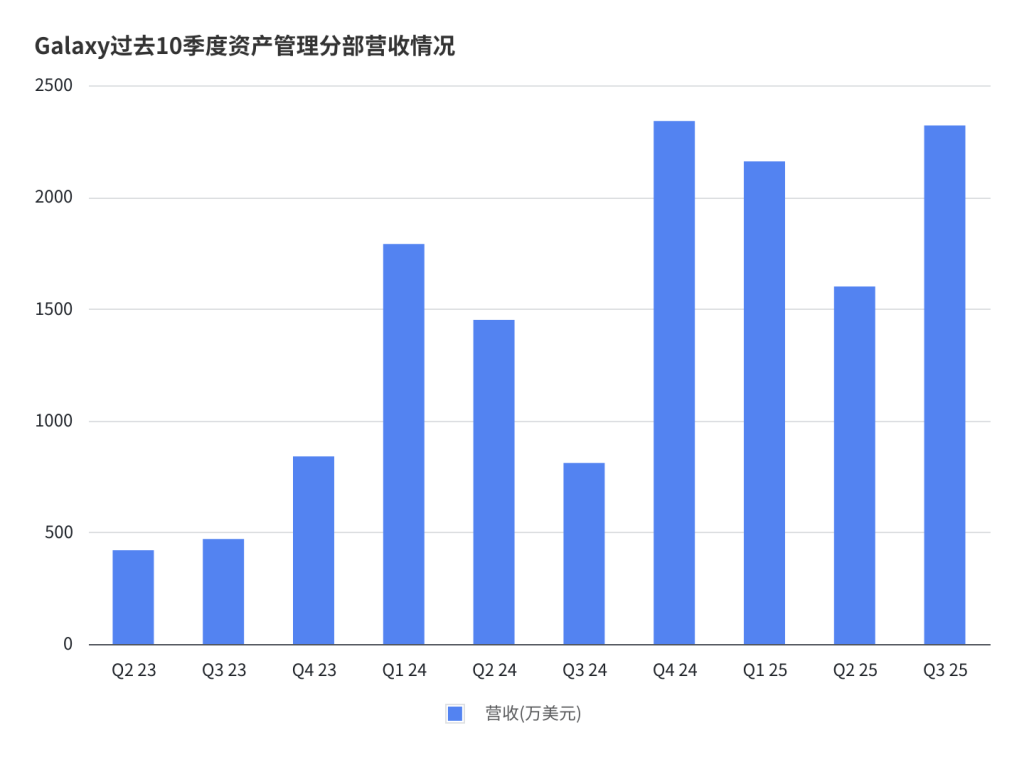

Asset Management Performance: In 2023, amid market downturns, Galaxy’s asset management revenue declined, but began recovering in Q4 as market sentiment improved. 2024 was a bumper year: full-year revenue reached $49 million, a record high (significantly up from ~$28 million in 2022). Drivers included organic inflows and market appreciation boosting AUM and fee-based income, along with commissions earned from executing FTX bankruptcy asset sales for creditors. By end-2024, Galaxy’s AUM reached $5.66 billion, up from ~$4.6 billion in 2023. Of this, ETF/ETP products accounted for $3.482 billion, and alternative investment products for $2.178 billion (e.g., venture funds). Asset management operating margins also improved in 2024, with full-year adjusted EBITDA exceeding $20 million, indicating emerging economies of scale.

In the first nine months of 2025, Galaxy’s asset management segment continued growing in a strong market environment. Especially in the most recent quarter:

-

Galaxy’s AUM reached nearly $9 billion, with alternative investment products up 102% quarter-on-quarter to $4.86 billion, and ETFs rising to $3.8 billion;

-

Staking assets increased 110% quarter-on-quarter to $6.6 billion.

-

Driven by these factors, the adjusted gross profit (GAAP basis) for the Asset Management & Infrastructure Solutions segment reached $23.2 million, up 44% sequentially, with quarterly revenue approaching half of 2024’s full-year total.

Galaxy Q3 2025 adjusted gross profit, AUM (including ETFs and alternative products), and staking assets

Overall, from 2023 to 2025, Galaxy’s digital asset segment—including Global Markets and Asset Management—rode favorable trends such as the crypto bull market, regulatory tailwinds, and ETF launches, rising from troughs to peaks, achieving record highs in both revenue and profit.

2.3 Data Centers & Computing Power (Data Centers & Computing Power)

Business Overview & Definition

The Data Centers & Computing Power segment represents Galaxy Digital’s second major strategic domain beyond digital assets, focusing on investment, construction, and operation of foundational computing infrastructure. Its core mission is converting abundant energy and data center resources into computing power usable for blockchain mining and high-performance computing (HPC), creating value for itself and its clients. Galaxy initially entered this field through Bitcoin mining: deploying specialized mining rigs to earn Bitcoin block rewards using its own or hosted data center capacity. Simultaneously, the company provided hosting services and financial support (e.g., equipment maintenance, power procurement consulting, mining rig financing) to other miners, building a mining ecosystem. With the explosive demand for computing power driven by the AI and big data era, Galaxy began a strategic shift in 2023, gradually expanding its data center resources for AI model training, cloud rendering, and other HPC workloads. Specifically, Galaxy partners with AI infrastructure firms to transform its large campuses into AI computing supply hubs, generating stable rental and service income by leasing power and server racks—a model equivalent to providing “Computing Infrastructure as a Service (IaaS).”

Currently, Galaxy’s most critical data center asset is the Helios Data Center campus located in Dickens County, Texas. Originally developed by Argo Blockchain, Helios aimed to leverage low-cost renewable energy (wind and solar) in West Texas for Bitcoin mining. However, in late 2022, soaring natural gas prices drove up electricity costs, and Argo lacked fixed-price power purchase agreements, leaving it fully exposed to extreme price volatility. Under liquidity pressure, Argo sold the Helios facility to Galaxy Digital in December 2022 for $65 million (plus a $35 million loan).

For Galaxy, this deal included not just physical assets but crucially, 800 MW of approved grid connection capacity. Currently in Texas, interconnection approval queues for large loads have stretched to over four years, making Helios’s existing grid permits one of the most valuable intangible assets on its balance sheet. In sheer scale, 800 MW places Helios among the world’s top-tier computing campuses—by comparison, Google’s new AI data center in Arizona plans ~1,200 MW, and Microsoft’s expansions in Iowa range between 300–600 MW. Thus, Helios is already highly significant. If its long-term vision of 3.5 GW is realized (with an additional 2,700 MW still pending approval), it would nearly double the capacity of today’s largest data center clusters.

In practice, Galaxy does not directly operate AI cloud services but signed a 15-year long-term hosting agreement with CoreWeave. CoreWeave, an NVIDIA-backed top-tier cloud provider, faces insatiable demand for computing infrastructure. The series of long-term leases effectively convert Galaxy’s power resources into bond-like stable cash flows. CoreWeave has now exercised all available options, locking in all 800 MW of Helios’s currently approved power capacity. The partnership uses a Triple-Net (triple-net) lease structure: Galaxy is primarily responsible for providing the physical shell and power connectivity, while CoreWeave bears electricity costs (including price volatility risks), equipment maintenance, insurance, and taxes. In this model, Galaxy functions more like a digital real estate landlord than an operator, resulting in exceptionally high cash flow stability. For Galaxy, revenue is almost equivalent to net profit, with projected EBITDA margins reaching as high as 90%.

Galaxy has divided the development of the Helios campus into multiple phases: Phase I plans to deploy 133 MW by mid-2026, Phase II will deploy 260 MW in 2027, and Phase III will deploy another 133 MW in 2027, providing a total of 526 MW of “critical IT load” available for servers (corresponding to the full 800 MW power capacity). To meet CoreWeave’s needs, Helios is accelerating its transformation from a “mining farm” to an “HPC data center,” including upgrades to cooling systems, redundancy architecture, and structural reinforcement.

Key Development Milestones

-

2018–2020: Driven by the digital asset bull market, Galaxy recognized the upstream value of computing power and began venturing into Bitcoin mining. Initially adopting a co-hosting model, it entrusted mining rigs to professional facilities while offering complementary financial services such as mining rig financing and OTC hedging, accumulating experience and resources. During this period, Galaxy quietly invested in several mining infrastructure projects and assembled a team skilled in power and mining hardware, preparing for future in-house data center construction.

-

2021: Galaxy formally announced the establishment of its “Galaxy Mining” division, elevating mining to a core strategic priority. That year, Galaxy expanded partnerships with multiple major North American mining farms and actively sought suitable locations in Texas and elsewhere to build its own data centers.

-

2022: This year marked a milestone for Galaxy’s data center business. On December 28, 2022, Galaxy announced the acquisition of Argo Blockchain’s Helios Bitcoin mine in Dickens County, Texas (including full operational assets) for $65 million, along with a $35 million loan to help Argo navigate its liquidity crisis. The Helios facility, recently operational, featured 180 MW of built-out power capacity with vast room for expansion. Galaxy took immediate operational control, establishing it as a core mining base. The company planned to ramp up Helios’s online power to 200 MW by end-2023, allocating part of the capacity to third-party hosted miners and part to Galaxy’s proprietary mining. This acquisition dramatically expanded Galaxy’s mining footprint and was seen as “Galaxy owning its own Bitcoin mining factory.”

-

2023: This year marked Galaxy’s transition from a “mining-only” to a “dual-track” model combining mining and computing power leasing. In the first half, Helios steadily expanded: by mid-2023, it deployed about 3 EH/s of computing power, split evenly between proprietary and hosted operations. Rising Bitcoin prices in the first half also restored profitability to mining operations. In Q2 2023, Galaxy disclosed in its earnings report that its mining division’s Hashrate Under Management (HUM) reached ~3.5 EH/s, with proprietary mining maintaining low unit BTC production costs. In the second half, while continuing to boost Helios’s Bitcoin hash rate, Galaxy proactively engaged CoreWeave to explore leasing parts of Helios’s power and space for GPU server deployment. In September 2023, Galaxy and CoreWeave reached a preliminary agreement: Galaxy would provide land and power infrastructure at Helios, and CoreWeave would progressively deploy AI equipment. This marked the beginning of Galaxy’s strategic pivot in data center operations. By Q4 2023, Galaxy’s mining HUM rose to 6.1 EH/s, mining 977 BTC for the year; however, the company clearly stated it would reduce proprietary mining operations after the agreement took effect, focusing instead on Helios’s redevelopment.

-

2024: This year marked a complete shift toward HPC. On March 28, 2024, Galaxy announced a formal Phase I lease agreement with CoreWeave: Galaxy would provide 133 MW of “critical IT load” at Helios for CoreWeave to deploy AI/HPC infrastructure, with a 15-year term. Under the terms, CoreWeave would pay Galaxy lease fees similar to data center hosting, expected to generate ~$4.5 billion in total revenue for Galaxy over 15 years. Galaxy planned to deliver the full Phase I capacity to CoreWeave by mid-2026. Shortly afterward, in April 2024, CoreWeave exercised its first option (Phase II), adding another 260 MW of IT load, bringing cumulative commitments to 393 MW. Galaxy stated this Phase II contract would follow economic terms similar to Phase I (i.e., long-term leases), with Phase II capacity expected to be delivered in 2027. Meanwhile, Galaxy began drastically reducing Bitcoin mining investments: selling some mining rigs in the first half of 2024 and halting expansion of proprietary mining operations, freeing up power and space at Helios for retrofitting to accommodate high-density GPU servers. On November 7, 2024, Galaxy announced it had reached term sheets for project financing of the Helios initiative with a major financial institution. Final financing closed in 2025 (see below). By end-2024, Galaxy’s mining HUM dropped to 6.1 EH/s, with some rigs idle and awaiting sale; proprietary mining profits declined as a share of overall corporate earnings, while capital expenditures in the data center segment surged, entering an investment phase. Nevertheless, Galaxy successfully completed its strategic transformation—from a pure Bitcoin mining operator to an AI data center developer with long-term contracts from major clients.

-

2025: Galaxy’s data center business entered a full-scale construction and financing phase. On August 15, 2025, Galaxy announced the successful closing of $1.4 billion in project financing (debt) to accelerate the development of the Helios AI data center. The loan was led by a major institution, issued at 80% Loan-to-Cost, with a three-year term and secured by Phase I Helios assets. Galaxy contributed $350 million in equity, fully funding the $1.7 billion Phase I project. This ensured adequate financial support for Helios Phase I construction (including substation upgrades, cooling systems, structural reinforcements), enhancing delivery certainty. In August 2025, Galaxy disclosed that CoreWeave had exercised its final option (Phase III), locking in an additional 133 MW, bringing its total leased capacity at Helios to the full 800 MW. Thus, all of Helios’s approved power capacity now has lease coverage—100% occupied. The company expects, based on contractual terms and full utilization of 526 MW of IT load, that the Helios project will generate over $1 billion in annual revenue over the next 15 years, becoming a major long-term cash flow source for Galaxy. For longer-term planning, in 2025 Galaxy acquired additional land adjacent to Helios, expanding the campus to over 1,500 acres, capable of supporting up to 3.5 GW of potential power load (nearly triple the current 800 MW). These capacity expansions are currently under review with grid operator ERCOT, and if approved, will be implemented in phases. In October 2025, Galaxy secured a $460 million equity investment from a top-tier global asset manager to support Helios construction and other corporate purposes. Market rumors suggest the investor is BlackRock (not yet officially confirmed). This staged investment grants the investor a certain equity stake and symbolizes recognition and support from traditional mainstream institutions for Galaxy’s computing strategy. By end-2025, Galaxy stated that Helios Phase I construction is progressing as planned, with 133 MW scheduled for delivery to CoreWeave in the first half of 2026; site preparation and foundational construction for Phase II are underway, targeting delivery in 2027; Phase III is planned to begin deliveries in 2028.

Financial Reports & Public Disclosures Summary (2023–2025)

Mining Business Performance: In 2023, Galaxy’s mining business was in an investment phase following the Helios acquisition, and due to depressed Bitcoin prices, recorded an overall loss for the year. However, in 2024, with price recovery and operational optimization, the mining segment turned profitable and contributed steady cash flow. In 2024, Galaxy’s mining division generated $94.9 million in revenue, directly mining 977 BTC; after deducting power and other operating costs, average gross margins were around 50%. However, Galaxy noted in its financial reports that due to strategic shifts, mining revenues would decline noticeably in 2025. In 2025, as mining rigs were gradually sold and decommissioned, mining revenues fell sharply. In Q3 2025, the data center segment (primarily mining) generated only $2.7 million in adjusted gross profit. Galaxy expects minimal mining profits in the second half of 2025 as Helios continues its transformation, until partial legacy rigs restart or strategies adjust based on market conditions in 2026.

AI/HPC Hosting Business Outlook: Since Helios’s contracts with CoreWeave won’t begin execution until 2026, there was no recurring revenue from this segment in 2023–2025. Galaxy capitalized construction costs, so short-term income statements were not significantly impacted. In its Q3 2025 financial report, Galaxy explicitly stated: “Galaxy expects contributions from the data center segment in terms of adjusted gross profit and EBITDA to be immaterial before the first half of 2026” (i.e., still in preparation phase). However, the company has already provided future earnings guidance: once Helios is officially delivered and operational, the data center segment will become a new cash cow. Based on signed contracts, Galaxy expects to recognize substantial rental income starting in H1 2026, with high projected margins due to the tenant bearing operations (similar to a REIT model). In its August 2025 announcement, Galaxy disclosed that full contract execution would generate over $1 billion in annual revenue, totaling over $15 billion over 15 years—many times its current asset size. Even accounting for operating costs and loan interest, net profit contributions would be substantial. This outlook attracted attention in capital markets in 2025: Galaxy’s stock surged ~60% after announcing full occupancy and financing news, reflecting investor reassessment of its “computing segment” value. In summary, the data center business remains in a “planting” phase financially from 2023 to 2025, but its future “harvest” potential has been repeatedly emphasized in financial reports and management discussions, forming an indispensable part of Galaxy’s narrative.

Summary

In conclusion, Galaxy Digital’s three core business segments—Global Markets, Asset Management & Infrastructure Solutions, and Data Center Computing—each cover different value chain segments within the digital asset ecosystem, yet form complementary and synergistic relationships under the company’s strategy. The Global Markets segment generates revenue from trading and investment banking, leading market innovation; the Asset Management & Infrastructure segment secures long-term management fees and technological advantages, binding high-quality clients; the Data Center Computing segment promises sizable, stable cash flows, serving as a “safety net” for corporate performance. Through clear strategic planning and a series of bold acquisitions and partnerships, Galaxy’s management has transformed the company into a unique player bridging finance and technology. Amid the fast-changing digital asset industry, Galaxy’s diverse growth potential and mutual support across segments make it uniquely resilient and comprehensive in investors’ eyes. This explains why increasing numbers of institutional investors show interest and confidence in Galaxy. Looking ahead, Galaxy’s three pillars are poised to advance together, continuously achieving new milestones and creating shared value for shareholders and clients.

3. Industry Analysis

Based on the above analysis, Galaxy’s operations span two industries: the crypto industry and the AI computing infrastructure industry. We now analyze the current state and development trends of these two industries.

3.1 Crypto Industry

Industry Status: Market Size, Participants & Structure

Market Size & Key Players: The cryptocurrency market regained momentum in 2024–2025, with North American trading activity accounting for roughly one-quarter of global volume. As of mid-2025, North America received approximately $2.3 trillion in crypto transaction value over the past year, with monthly peaks in December 2024. The global market cap approached $4 trillion by end-2024, and trading volumes also hit record highs. In terms of participants, centralized exchanges (CEXs) still dominate most spot and derivatives trading: in 2024, the top 10 CEXs recorded $17.4 trillion in annual spot trading volume, doubling the previous year. Decentralized exchanges (DEXs) have rapidly gained market share in recent years, with DEX trading volume accounting for ~7.6% of global volume in the first five months of 2025, up significantly from 3% in 2023. Additionally, major market makers and OTC institutions provide off-exchange liquidity, forming a “third pillar of liquidity” behind CEXs and DEXs. Particularly for large-scale funds exceeding hundreds of millions of dollars, OTC trades avoid market impact by matching large orders behind the scenes. Leading market makers and brokers (such as Galaxy Digital, Jump Trading, Wintermute, Cumberland, etc.) play a key role in providing exchange liquidity and matching large OTC trades. Traditional institutional investors (hedge funds, asset managers, etc.) are increasingly participating, accessing digital asset markets through premium exchange accounts or OTC channels, resulting in “large” ($>10 million) trades accounting for 45% of total trading volume in North America—far higher than in other regions.

Market Structure Changes & Liquidity: Recent trends show convergence between on-exchange and off-exchange markets. On one hand, centralized exchanges have undergone consolidation—after events like FTX, compliant North American platforms (e.g., Coinbase, Kraken) strengthened their positions, while some trading volume shifted to OTC and on-chain DEXs. OTC market trading surged since 2024: monthly OTC volumes exceeded year-ago levels throughout 2024, with Q4 OTC volume up 106% YoY, and H1 2025 up 112.6% YoY. Institutions prefer using “dark pool” OTC venues to establish or close positions, minimizing price impact on public markets. This makes OTC an invisible liquidity pool, playing a greater role in smoothing market volatility. On the other hand, improvements in decentralized trading technologies (e.g., on-chain order books, Layer 2 scaling) enabled DEXs to break through in long-tail assets and perpetual contracts. For example, by 2025, decentralized perpetual platforms (like Hyperliquid) saw noticeable increases in trading share. While CEXs still account for about 70–80% of total trading volume, DEXs, with their transparency and trustless nature, are becoming important venues for swapping emerging tokens and stablecoins. Overall, after hitting a low in 2022, market liquidity significantly improved in 2024–25, with daily trading volumes for major coins (BTC, ETH, etc.) returning to tens of billions of dollars. Stablecoins played a crucial role in enhancing liquidity and transparency: USD stablecoins widely serve as pricing units, and by end-2024, on-chain stablecoin transfer volumes in North America hit record highs. Because stablecoin transactions are transparent and traceable on-chain, tracking on- and off-exchange fund flows became easier, improving market transparency. Some institutions even use on-chain analytics tools to monitor capital movements, raising information transparency compared to a few years ago. Overall, the North American crypto trading market is evolving toward a more institutionalized, multi-layered structure: CEXs provide foundational liquidity and fiat gateways, DEXs offer long-tail assets and trustless trading, and OTC handles large-scale fund matchmaking—forming a mature market system together.

Regulatory Developments: North America (mainly the U.S.) has experienced major regulatory changes in recent years, directly impacting market structure and participant behavior. The divide between the SEC and CFTC over digital asset classification once created regulatory uncertainty: the SEC treated most tokens as securities and intensified enforcement, taking legal action against exchanges like Coinbase and Binance in 2023, using “enforcement instead of regulation” to clean up non-compliant issuances and trading. Meanwhile, the CFTC classified Bitcoin and Ethereum as commodities, authorizing regulated futures and options trading through venues like CME. This SEC/CFTC jurisdictional overlap led to fragmented regulation—some instruments could only trade on CFTC-regulated futures markets (e.g., Bitcoin futures ETFs), while spot exchanges faced SEC pressure, forcing them to delist certain tokens or restrict U.S. user choices.

Late 2024 brought a regulatory shift amid political changes in the U.S.: the new administration adopted a more open stance, with agencies like the SEC and OCC retracting previous strict guidelines that hindered banks from engaging in crypto, instead developing clearer frameworks to encourage traditional institutions to participate. In early 2025, the U.S. regulator halted several high-profile investigations, signaling an end to the “enforcement-first” model, and even the presidential task force proposed a policy vision to make the U.S. a “global crypto capital.” This deregulation directly boosted market confidence and institutional participation. Alongside regulatory clarity, compliance requirements also rose: exchanges must adhere to stricter KYC/AML and asset transparency standards, and licensed custodians are increasingly stepping in to provide compliant custody and settlement services. Notably, the approval of crypto spot ETFs marked a milestone in U.S. regulatory dynamics. In early 2024, the U.S. approved its first Bitcoin spot ETFs, triggering a boom in crypto investment products. By July 2025, global Bitcoin ETF AUM reached ~$179.5 billion, with U.S.-listed products accounting for ~$120 billion. Accessing crypto assets via spot ETFs opened compliant investment pathways through traditional broker channels, making it easier for institutional portfolios to allocate to Bitcoin and other assets. These regulatory shifts moved the North American market environment from suppression to support, driving sharp increases in trading volume and asset prices by late 2024. Overall, regulatory uncertainty is decreasing, and compliant market frameworks are maturing, clearing obstacles for large financial institutions and corporations to enter digital asset trading.

Trends: Institutionalization, Derivatives & New Products

Institutionalization & Strengthened Compliance: The North American crypto market is undergoing rapid institutionalization, expanding its participant base from early retail and crypto-native funds to hedge funds, asset managers, and even traditional banks. From 2024 to 2025, multiple signs indicate rising institutional participation: increased share of large on-chain transactions, traditional investment banks applying for trading licenses, and renowned asset managers (e.g., BlackRock) launching crypto trusts and even spot ETFs. This pushes demand beyond simple trading toward compliant custody, auditing, and risk control services. Rising compliance demands are standardizing the industry: exchanges add internal compliance departments, adopt on-chain analytics and monitoring tools, and OTC firms proactively register or obtain licenses (e.g., in Hong Kong, Singapore) to attract institutional trading. The U.S.’s fragmented regulatory model also prompts trading firms to restructure: some platforms choose to register as ATS (Alternative Trading Systems) or brokers, accepting SEC oversight to offer security token trading; others focus on commodity-type assets under CFTC regulation. Overall, “institutional capital entering” makes the market prioritize compliance, transparency, and risk management, driving industry consolidation, where well-capitalized, compliance-capable firms (e.g., Coinbase, Fidelity Digital Assets) gain dominant positions. Companies like Galaxy Digital, with Wall Street roots and diversified operations, can offer one-stop compliant services and expertise, making them preferred partners for many institutions. For example, Galaxy, as a crypto investment bank, leverages its founders’ Wall Street experience and public company governance to build trust among institutional clients, enabling large traditional capital inflows into crypto via its OTC and asset management platforms. Going forward, institutional share and trading scale are expected to keep rising, making the market more mature, stable, and less volatile.

Derivatives Market Expansion: Derivatives have become one of the fastest-growing areas in the crypto market. As early as 2023, global crypto derivatives volume already dwarfed spot trading, and the trend accelerated post-2024. In North America, regulated platforms lead derivatives trading: CME’s Bitcoin and Ethereum futures and options volumes hit new highs, with Bitcoin futures daily volumes rising significantly by end-2024. Off-exchange derivatives demand is also strong, with institutions frequently using forwards, swaps, and other instruments to hedge risks or generate returns. Traders like Galaxy offer a suite of customized derivative services, including options and swaps, providing miners, crypto funds, and other clients with channels to hedge price volatility or amplify returns. Notably, innovative products like perpetual contracts are rising in decentralized domains—decentralized perpetual exchanges accounted for ~4–5% of all futures volume in 2024, rising further in 2025. This indicates derivatives trading is expanding from centralized to decentralized platforms. Looking ahead, as regulators gradually allow more types of crypto derivatives (e.g., options based on spot ETFs, volatility indices), derivatives market capacity could expand, attracting more professional trading firms, deepening liquidity, and improving pricing efficiency. Risk management and clearing will evolve accordingly, possibly introducing central clearing parties (CCPs) or blockchain smart contract clearing models to enhance derivatives market stability.

Custody Integration & New Product Innovation: With institutionalization advancing, the “trade-custody-clearing” integration trend is evident. Compliant custodians have become essential for institutional participation in digital asset trading: custodians connect seamlessly with trading platforms via API, enabling rapid transfers between cold storage custody accounts and exchanges, thus ensuring safety without missing trading opportunities. This integration spawned the “crypto prime brokerage” model, offering custody, margin financing, and on/off-exchange execution as bundled services. For example, Coinbase and Fidelity have launched institutional-focused integrated platforms. Galaxy Digital, by acquiring custody technology (e.g., its GK8 self-custody platform) and integrating its OTC and brokerage operations, is building a similar comprehensive service system to meet institutions’ “one-stop” needs. On the other hand, new trading products continue emerging, reshaping market structures. Stablecoins remain one of the most impactful innovations: USD stablecoins have become base currencies for many trading pairs, reducing friction in fiat on/off-ramps and enabling 24/7 trading. Stablecoin usage surged in late 2024, with monthly on-chain transfer volumes setting records. Widespread stablecoin adoption improves international consistency in market liquidity, ensuring ample USD liquidity for trading at any time globally. Moreover, physically backed ETFs (e.g., Bitcoin spot ETFs) in North America have bridged traditional capital into crypto. After the launch of the first batch of physically backed Bitcoin ETFs in 2024, their scale soared to hundreds of billions within a year. The combination of stablecoins and ETFs allows investors to access crypto exposure through either on-chain or securities accounts—potentially shifting some trading volume from native crypto exchanges to ETF products on traditional exchanges (especially for long-term allocation funds)—while stablecoins continue handling on-chain and OTC clearing roles. Overall, new products in the crypto trading market keep emerging, enriching investment strategies and prompting market restructuring, requiring industry players to continuously adapt to the opportunities and challenges posed by innovation.

North American Market Characteristics & Galaxy Digital’s Role

Regulatory Fragmentation & Regional Traits: A defining feature of the North American (U.S.) market is its complex, fragmented regulatory system, with overlapping federal and state jurisdictions. This regulatory fragmentation is especially pronounced in crypto: the SEC and CFTC compete over classification authority, federal regulations remain ununified, and individual states (e.g., New York’s BitLicense, new OTC exemptions) impose their own rules, requiring market participants to carefully navigate compliance. This environment previously caused uncertainty for exchanges and investors—for example, some U.S. exchanges reduced token listings for compliance reasons, and institutions slowed investment due to regulatory concerns. Conversely, North America’s advanced financial infrastructure and rule-of-law environment position it at the forefront of compliant innovation. The U.S. pioneered futures-based crypto ETFs, and Canada approved Bitcoin spot ETFs first, reflecting North America’s willingness to embrace new assets through traditional frameworks. Investors in the U.S. and Canada also prefer regulated investment channels, favoring monitored platforms for digital asset trading. This makes compliant custodians and regulated trading platforms critically important in North America. For example, Bakkt, founded by NYSE parent ICE, though it underwent multiple strategic shifts, initially attracted considerable traditional institutional attention as a regulated digital asset custodian and futures exchange. Coinbase, as the largest compliant crypto exchange in the U.S., holds significant shares in both retail and institutional markets, and its listing made it more inclined to cooperate with regulators, earning it status as an industry “whitelist” member. In contrast, many global exchanges (e.g., Binance) face strict restrictions or have exited the North American market. This makes the North American trading landscape more localized, dominated by a few compliant giants (Coinbase, Kraken, etc.) and specialized institutional service providers. North American investors also emphasize transparency and audits, requiring platforms to regularly disclose reserve holdings and undergo independent audits—standards higher than some overseas markets. Overall, the North American market is known for high compliance and institutional participation, and while regulatory fragmentation once fragmented its structure, legislation in 2025 (e.g., congressional push for market structure bills) may unify it, laying institutional groundwork for long-term industry development.

Coinbase/Bakkt Roles: Coinbase, the undisputed leader in North America, plays a dual role as “retail gateway + institutional portal.” Its retail trading volume is massive, and its institutional arm (Coinbase Prime) serves hedge funds, corporate treasuries, etc., offering custody and bulk matching. Post-listing, Coinbase enjoys strong capital, actively developing derivatives (gaining regulatory approval to offer crypto futures to U.S. users since 2023) and, while solidifying its spot market share, becoming one of the main liquidity providers in the U.S. market. Bakkt started with physically settled Bitcoin futures, gaining attention but limited volume. Later, Bakkt pivoted to a digital asset custody and settlement network for institutions and businesses, entering securities brokerage crypto services via acquisitions (e.g., Apex Crypto). Though quiet in retail, Bakkt, backed by a traditional exchange group, accumulated resources in compliant custody and payments. Platforms like Bakkt in North America provide safe, compliant infrastructure for institutions, complementing services from emerging crypto firms. In essence, Coinbase exemplifies a crypto-native firm successfully embracing regulation and scaling up, while Bakkt represents traditional finance’s exploration into digital assets. Both strengthen North America’s appeal to mainstream institutions. Besides these, U.S.-licensed exchanges like Kraken and Gemini each have distinct traits (e.g., Gemini emphasizes compliance and conservative token listings, Kraken offers diverse derivatives), forming a North American trading platform matrix. Their existence ensures U.S. institutions have “safe” trading channels, eliminating reliance on offshore markets and fostering a healthier, more transparent North American trading ecosystem.

Galaxy Digital’s Position & Competitive Landscape: As detailed in the business analysis above, in the crypto trading space, Galaxy’s core positioning includes market maker/OTC broker, institutional broker & advisor, investment banking, asset management, and infrastructure. Through diversified operations, Galaxy has built a degree of business synergy: its proprietary GalaxyOne trading platform, deep institutional networks, and diversified revenue streams differentiate it competitively. In contrast, other North American competitors have specific focuses: Coinbase leans toward exchanges and custody, Fidelity focuses on custody and trading, dedicated market makers include Cumberland, Jump, etc., and traditional investment banks like Goldman Sachs and Citigroup also offer partial brokerage or liquidity services. Yet Galaxy stands out with its “full-stack” model of “trading + asset management + infrastructure,” relatively unique in the industry. Its main competition comes from integrated platforms like Coinbase and emerging crypto financial firms (e.g., Fidelity Digital Assets, Anchorage, FalconX as prime brokers). Galaxy’s advantage lies in breadth and flexibility: it can act as a market maker providing deep liquidity (Galaxy emphasizes deep liquidity, a factor institutions value most) and simultaneously serve high-end clients as an investment banker. Recently, Galaxy further enhanced its brand and transparency by going public on Nasdaq (May 2025), raising capital and gaining U.S. listing status.

Overall, in the North American institutional crypto market landscape, Galaxy Digital occupies a leading second tier: smaller in scale than Coinbase but having built a strong reputation in institutional services, forming competitive-cooperative relationships with traditional giants and specialized market makers. Looking ahead, as the crypto market becomes further institutionalized, Galaxy is poised to secure a place in North American digital asset investment banking/brokerage through comprehensive positioning and compliant operations, shaping the industry landscape alongside other top players.

3.2 AI Computing Infrastructure Industry

Industry Status: AI Computing Demand & Bottlenecks

AI Computing Demand Explosion: In recent years, the demand for computing power in AI model training and inference has grown exponentially. Especially for large-scale pre-trained models (e.g., GPT-4, PaLM), with parameters in the hundreds of billions, their training processes require massive parallel computing. From 2023 to 2025, major tech companies and AI startups raced to train larger models for natural language processing, image generation, etc., directly fueling explosive demand for GPU clusters. Industry observations show that training cutting-edge AI models often requires hundreds or thousands of high-end GPUs running continuously for weeks or even months—a computing demand far exceeding traditional applications. Even during model deployment, supporting AI inference services for millions of users requires substantial computing power. This trend makes computing power a key “production material” in the AI era, with supply shortages becoming increasingly apparent. North America, as the core region for AI R&D, hosts major computing consumers like Google, OpenAI, and Meta, experiencing particularly intense demand for high-performance computing (HPC) infrastructure. Some forecasts suggest that by 2025, global AI training compute demand will grow several times over 2022 levels, urgently requiring massive data center expansions to support it. Overall, AI computing power has become a bottleneck constraining AI advancement, leading to what the industry calls an “arms race for computing,” with companies investing heavily to hoard GPUs and build computing clusters to gain an edge in the next wave of AI competition.

Shift from “Chip Shortage” to “Power Shortage”: The core bottleneck facing North America’s data center industry is fundamentally shifting. If the focus over the past two years was GPU chip supply shortages, the coming five years’ primary conflict will be power access and grid capacity constraints. According to Goldman Sachs research, driven by demand for generative AI model training and inference, U.S. data center power demand will grow at a 15% CAGR from 2023 to 2030, reaching an estimated 45GW by 2030. However, real-world grid infrastructure development lags far behind this demand.

Power shortages stem not just from generation capacity but more from transmission and distribution bottlenecks. In major North American data center clusters (e.g., Northern Virginia), grid interconnection and substation construction timelines have significantly lengthened, with some project wait times extending from 1–2 years to 2–4 years or more. Additionally, supply chains for critical electrical equipment like transformers are severely congested, prolonging delivery cycles. This physical infrastructure lag has led to a repricing of electricity assets with “immediate access” capabilities.

In this context, the “power shells” held by Bitcoin miners—that is, already-approved large-scale power capacity, ready land reserves, water rights, and existing high-voltage substation infrastructure—have become strategically valuable scarce assets. Traditional data center operators and hyperscale cloud providers urgently need these sites to rapidly deploy GPU clusters and seize AI development windows.

Indeed, CoreWeave’s willingness to sign a lease with Galaxy on seemingly very favorable terms stems precisely from Helios’s 800MW grid connection permit. According to the Q3 2025 financial report, CoreWeave’s revenue backlog reached $55.6 billion, indicating extreme hunger for computing infrastructure, with market concerns mainly about its ability to fulfill commitments.

Representative Companies & Strategies: The North American AI computing infrastructure sector features diverse players, including cloud giants, specialized computing providers, and traditional data center firms, collectively meeting market demand.

First, large cloud providers remain dominant forces: Amazon AWS owns the most data centers globally, continuously investing in GPUs/AI chips (developing its own Inferentia/Trainium chips) to meet customer AI needs. AWS is building or retrofitting HPC-ready availability zones across the U.S. and launched products like P4d instances (featuring NVIDIA GPUs) to serve enterprises. Microsoft Azure, backed by deep collaboration with OpenAI, is aggressively expanding supercomputing clusters, constructing dedicated AI supercomputers in Iowa for OpenAI. Reports indicate Microsoft invested billions. Google Cloud holds TPU cluster advantages, continuously expanding U.S. data centers and offering AI platform services externally. These giants, with strong capital and comprehensive technology, leverage their owned data center networks to provide IaaS/PaaS services, capturing large shares of the high-end market.

Second, emerging specialized cloud computing firms are rapidly rising, with CoreWeave as the representative. Originating from crypto mining, CoreWeave pivoted to AI cloud and gained immense investor enthusiasm, raising over $1.1 billion in equity and $2.3 billion in debt financing from 2023–24. It focuses on providing GPU computing-as-a-service, optimizing infrastructure for AI training, and constantly expanding its data center footprint. CoreWeave’s strategy involves establishing regional computing centers across North America to serve local AI firms, while partnering with real estate and power providers to rapidly scale power capacity. Its soaring post-listing stock price and a $6.3 billion investment agreement with NVDA reflect market excitement.

Third, traditional data center and colocation providers are joining the fray: Equinix, a neutral colocation provider, primarily handles network nodes and enterprise hosting but sees the high-power demands from the AI wave. It has begun retrofitting some data centers for GPU deployment and collaborates with cloud providers to offer “edge computing” services. Switch (a major U.S. data center operator renowned for high-density design), after going private, continues expanding campuses in Nevada, with its advanced cooling technology highly attractive to HPC customers.

Capital markets view this sector extremely positively: AI computing infrastructure is seen as the “next-generation infrastructure” opportunity, with related firms frequently securing massive funding and high valuations. For example, CoreWeave raised over $2.5 billion in total financing, including funds from renowned institutions like Blackstone and Coatue; its post-listing valuation surged, briefly nearing $100 billion in June and still around $40 billion today. TeraWulf successfully attracted Google as a strategic investor; even traditional data center REITs like Equinix saw stock prices lifted by AI demand expectations. In short, capital markets liken AI infrastructure to early cloud computing infrastructure, assigning high-growth expectations. Listed or soon-to-be-listed computing firms are pursued by investors, with valuations skyrocketing, reflecting market confidence in the sustainability of AI computing demand. Of course, some rational voices caution about profitability (high-interest burdens from massive borrowing) and uncertainties stemming from chip supply bottlenecks. But overall, AI computing infrastructure is viewed as one of the most strategically valuable assets in the current tech cycle, with capital markets adopting a generally positive outlook.

Trends: IaaS Model, Mining Transition & Regional Competition

Divergence Between IaaS Leasing vs. In-House Building: In AI computing supply models, the industry is seeing a split between two approaches. One is the Infrastructure-as-a-Service (IaaS)/leasing model, where specialized computing providers or cloud vendors centrally build large GPU clusters, and enterprise users rent capacity on-demand. This model’s advantage is eliminating upfront capital expenditure and operational overhead for users, enabling elastic access to computing power to handle peak demand. CoreWeave, AWS, etc., represent this approach, capitalizing on computing investments shared among numerous clients. Among AI startups and SMEs, the leasing model is predominant because building in-house clusters is prohibitively expensive and technically complex. However, as top AI labs and large tech firms see escalating computing demands, an alternative in-house building model is gaining traction: sufficiently large organizations, for cost and control reasons, prefer direct investment in dedicated data centers. For example, OpenAI, backed by Microsoft, still plans proprietary computing facilities; Tesla built its Dojo supercomputer for autonomous driving training; some companies with extreme computing needs even buy land and power plants to build entire campuses. In-house models allow optimization of hardware architecture for specific workloads and lock in long-term supply but test capital strength and management capability. Thus, the industry currently shows polarization: mega-computing demanders lean toward vertical integration of proprietary infrastructure, while most small-to-medium AI projects rely on third-party computing clouds. In the coming years, a trajectory similar to cloud computing may emerge—hybrid models becoming mainstream: leading tech firms own core in-house computing while renting external capacity for elasticity; mid-sized enterprises primarily lease, supplemented by minor local or edge deployments. For computing providers, this means opportunities for customization: offering dedicated hosting (entire data centers to single clients) or cross-region dedicated connections, giving large clients both the security of in-house setups and the elasticity of the cloud. IaaS providers will also lock in large clients via long-term contracts (e.g., CoreWeave signing multi-year leases with numerous AI labs), resembling traditional IT outsourcing. In short, leasing and in-house building will coexist—the choice depending entirely on user scale and needs—industry finding balance between standardized services and custom delivery.

Transition from Mining Infrastructure to HPC: A notable trend

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News