Messari Researcher: Competitors Emerge in Stablecoin Market – Reviewing Each Project and Their Features

TechFlow Selected TechFlow Selected

Messari Researcher: Competitors Emerge in Stablecoin Market – Reviewing Each Project and Their Features

The landscape of the stablecoin sector is shifting as new entrants join every week.

Author: Addy

Translation: TechFlow

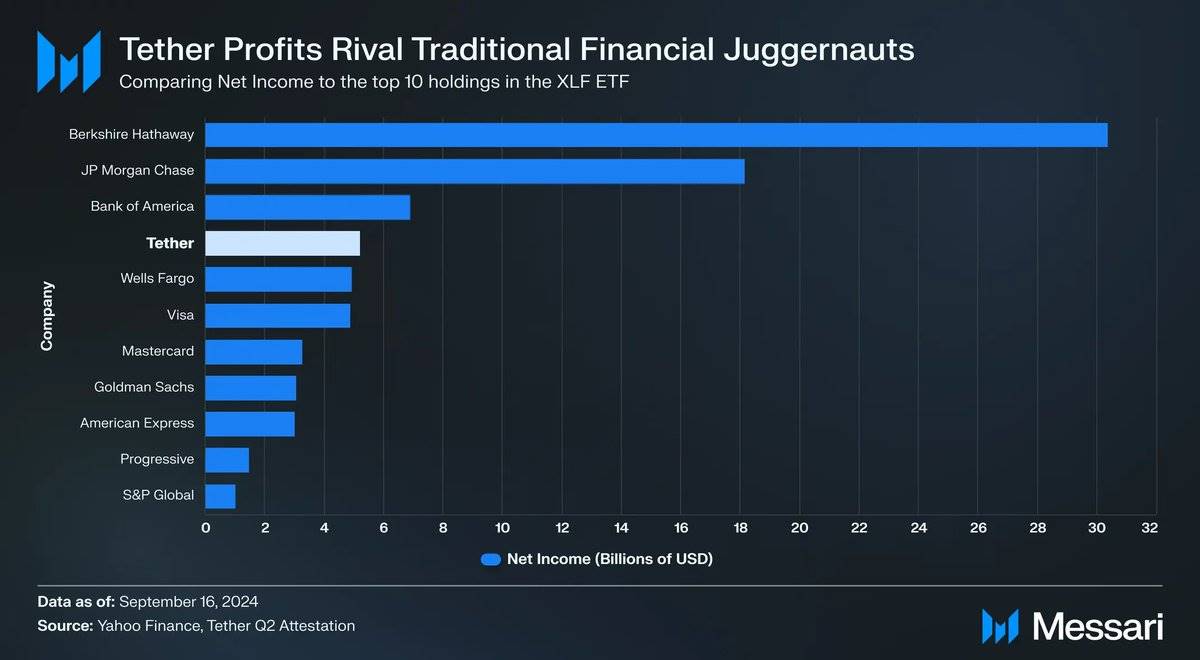

Tether achieved record profits last quarter, placing it among traditional financial giants. However, that $5.2 billion profit figure has also made it a target for new competitors aiming to capture a share of this market:

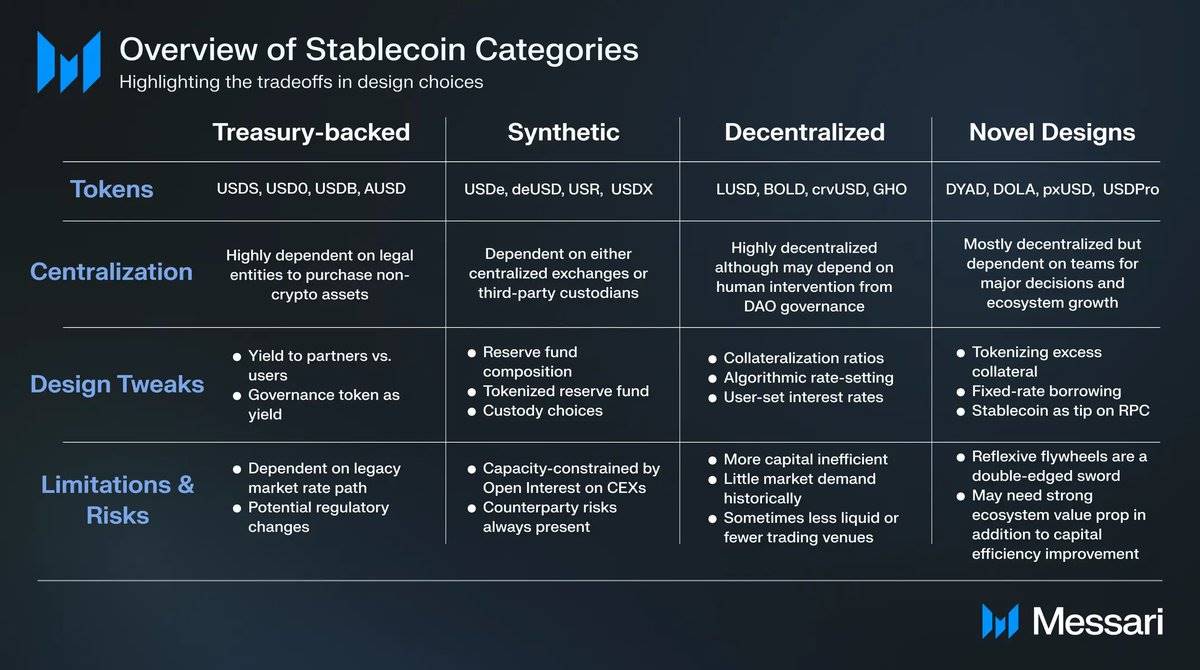

My latest article dives deep into the rapidly evolving stablecoin landscape, covering both centralized and decentralized solutions. We break this space down into several major categories:

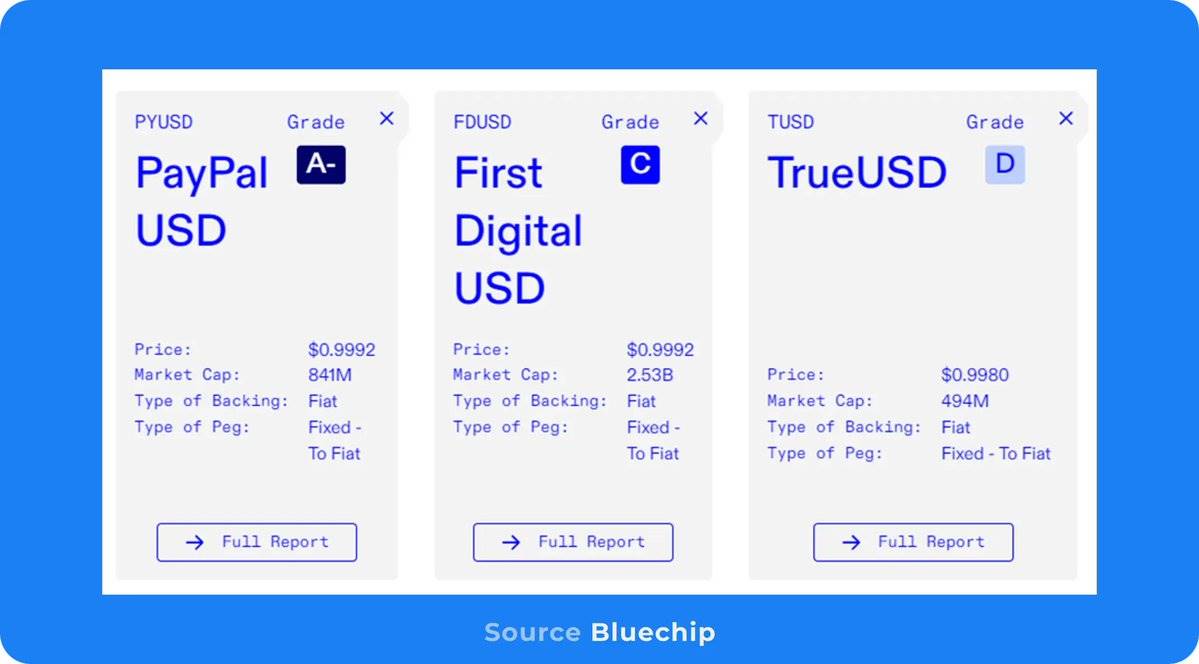

Centralized alternatives often lack transparency and typically see high volumes only when explicit incentives are in place. PYUSD is one of the few stablecoins to gain trust and achieve a billion-dollar market cap:

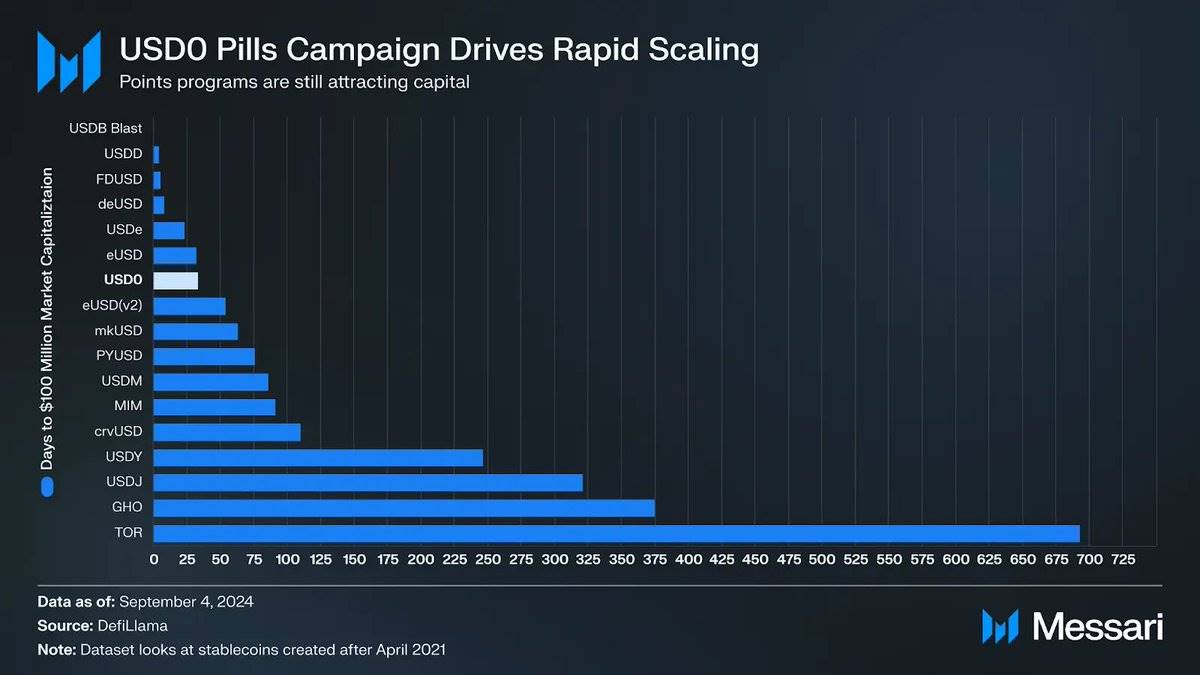

More decentralized, yield-backed stablecoins like USD0 have grown rapidly through airdrop incentives and integrations with DeFi platforms such as Morpho. USD0 has reached a market cap of around $250 million—and quickly at that:

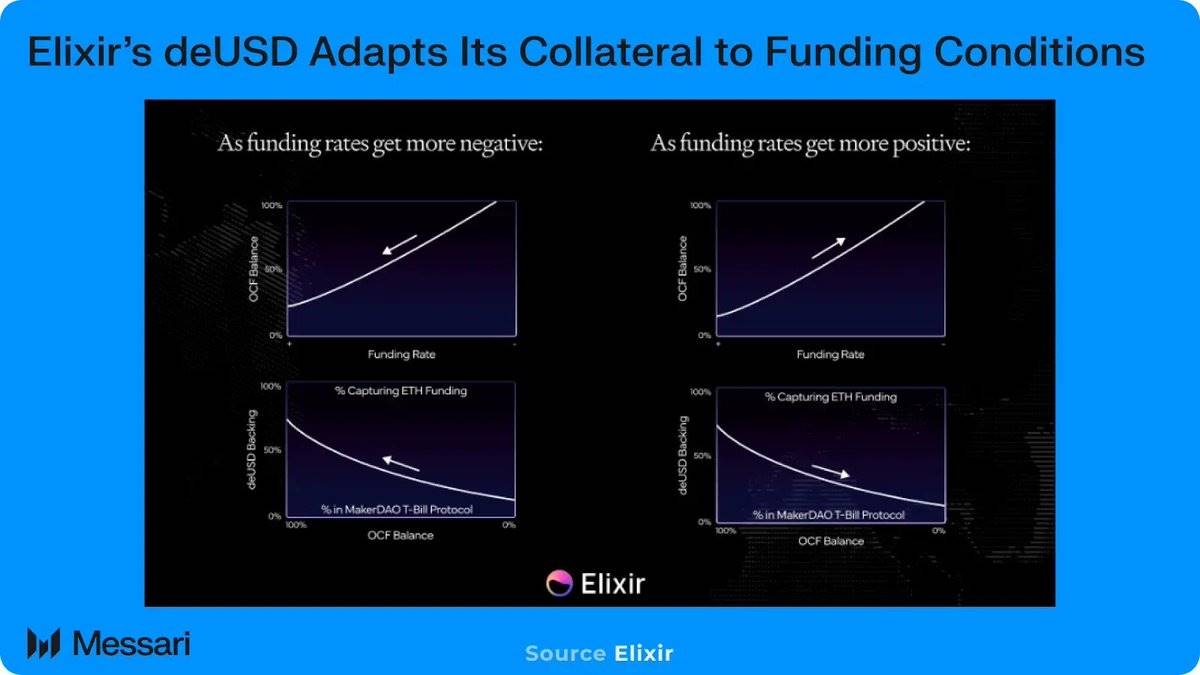

Synthetic stablecoins like USDe maintain their peg by simultaneously holding long spot and short futures positions. As basis narrowed, USDe lost market share. But new protocols like Elixir aim to improve upon Ethena’s model by adjusting its collateral backing:

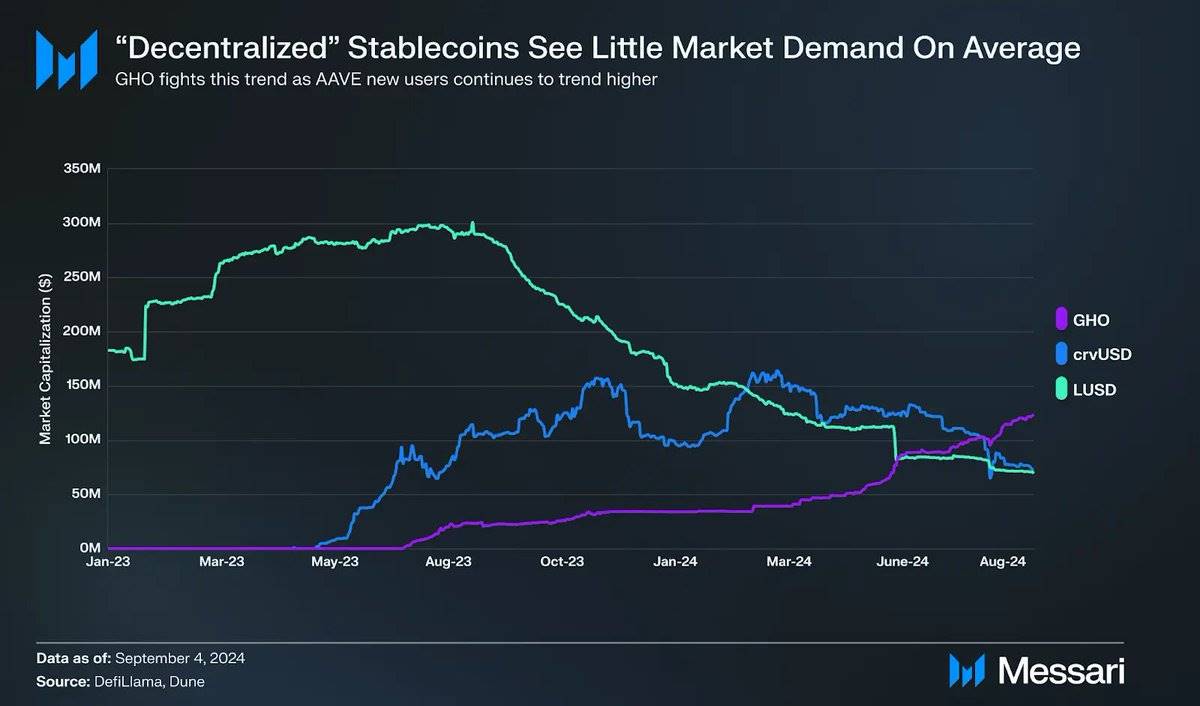

Historically, demand for stablecoins focused on maximizing decentralization and minimizing human intervention has been low. GHO might be an exception, benefiting from AAVE’s already-growing active user base:

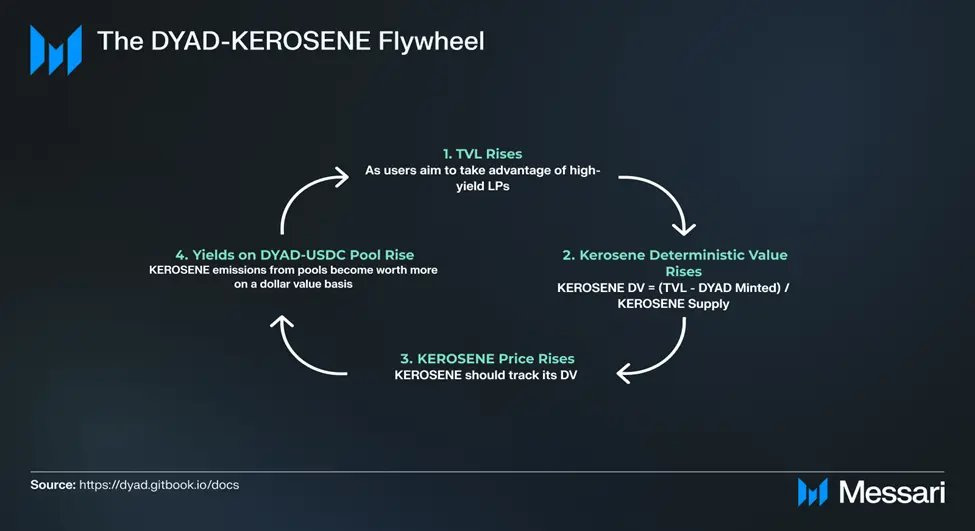

Innovative designs often attempt to introduce mechanisms that improve upon the traditional collateralized debt position (CDP) model. DYAD is one such stablecoin aiming to leverage excess collateral within the system via a second-generation token called KEROSENE. KEROSENE allows users to mint more DYAD based on their external capital. The more KEROSENE a user holds on their NOTE NFT, the greater the yield they earn from liquidity pools:

DYAD-KEROSENE Flywheel

-> 1. TVL Rises - As users seek opportunities to capitalize on high-yield liquidity providers (LPs), total value locked (TVL) increases.

-> 2. KEROSENE Deterministic Value Rises - KEROSENE's Deterministic Value (DV) is calculated as: KEROSENE DV = (TVL - Minted DYAD) / KEROSENE Supply.

-> 3. KEROSENE Price Rises - The price of KEROSENE should align with its Deterministic Value (DV).

-> 4. Yield in the DYAD-USDC Pool Increases - KEROSENE emissions from the pool become more valuable in dollar terms.

New stablecoins across these categories compete on yield, accessibility, liquidity, stability, and capital efficiency. New designs—or modifications of old ones—involve different trade-offs:

Original image source: Messari, translation by TechFlow

With new entrants emerging every week, the stablecoin landscape is rapidly shifting.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News