As the TON ecosystem becomes increasingly competitive, which type of application is more likely to succeed?

TechFlow Selected TechFlow Selected

As the TON ecosystem becomes increasingly competitive, which type of application is more likely to succeed?

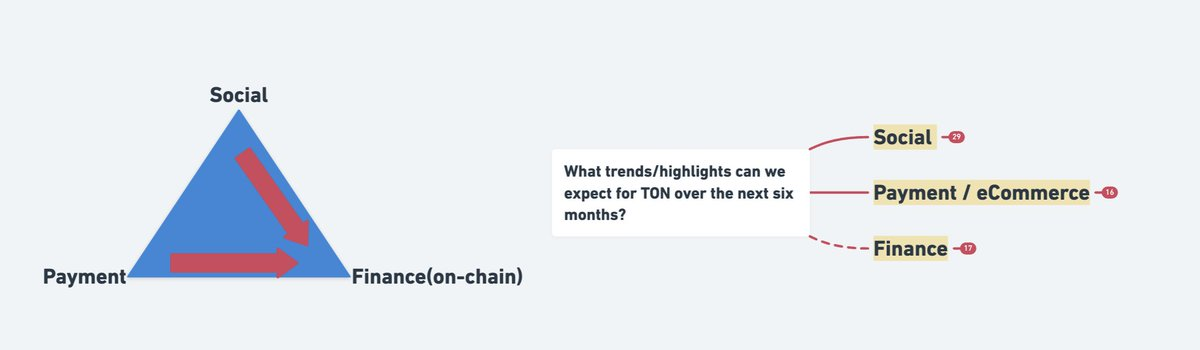

TON and Telegram should always revolve around three pillars: social, payments, and finance.

Author: Howard | Building on TON

Translation: TechFlow

In recent months, the ecosystem has flourished alongside an influx of new applications. While many projects follow similar paths—which is a positive sign—our goal remains maximizing your investment, whether in time or money, to achieve greater returns with less effort.

Leveraging the reliable 80/20 rule, attention in any field concentrates on the top 20% (or fewer) of projects, funneling traffic and capital toward the most exceptional ones.

Given your background and experience, selecting a niche market with less competition could significantly increase your chances of success. This article aims to help you reorient yourself and identify key milestones and themes, especially as numerous opportunities emerge within the @TON_Blockchain ecosystem.

1. Core Value of TON

You may have seen this diagram in my previous articles: "TON is just one part of the entire ecosystem." So if you encounter issues with your Telegram account, please consult here.

The wallet (t.me/wallet) handles financial matters, while Telegram (i.e., TApps — t.me/tapps) serves as the messaging layer that makes accessing content and webpages effortless. (@tappscenter / @wallet_tg)

The TON blockchain (t.me/toncoin, t.me/ton_blockchain) gives you full control over your assets. Together, these three modules form a powerful ecosystem with unique advantages.

Among Layer 1 blockchains, TON stands out for its unparalleled potential and creative possibilities. At its core, TON and Telegram should always revolve around three pillars: social, payments, and finance.

When planning your project, filter it through these three lenses and ask yourself: "What problem are you truly solving?"

Here’s how.

Social

Social interaction is Telegram's strength—the real-time, repeated exchange of valuable information. But imagine if that value could exist on the blockchain. Imagine expressing your uniqueness through on-chain assets or incentivizing friends to take action. That sounds exciting, right?

Take Calvin (@calchulus) as an example. He recently asked: "How much would you invest if I shared node sales with you?"

This is social; this is referral.

We encounter similar scenarios every day—from casual questions to heated discussions in Telegram groups. Undeniably, our trading behaviors are significantly influenced by those around us, and referrals drive most transactions.

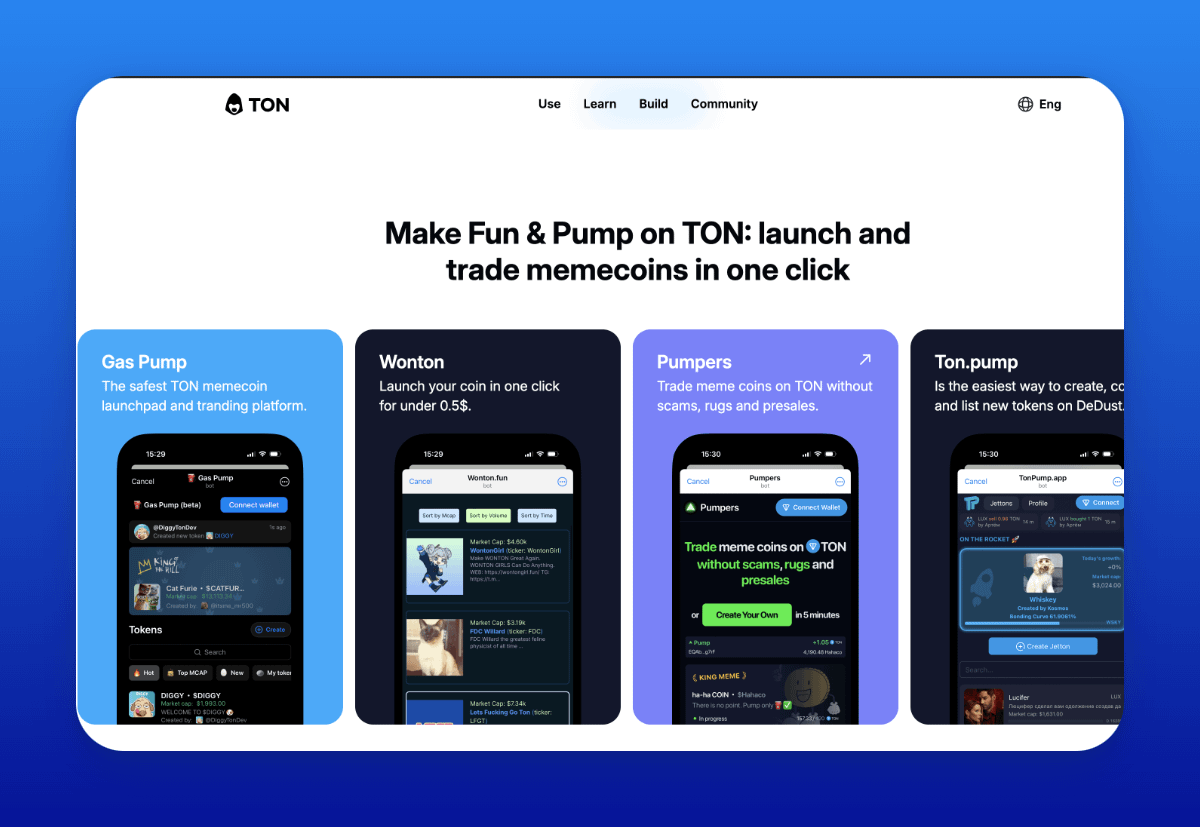

Of course, questions like Calvin’s might create pressure—no one wants to disappoint a friend by not responding. But this is exactly where prediction market products, Pump.fun, and other platforms allowing you to bet with friends should seamlessly integrate into social networks.

Experts can dive deeper when discussing the sociology of relationship management or how Telegram intertwines with “social.” These are fascinating topics worth exploring further.

Payments

When I talk about payments, I emphasize the disruptive business value brought by seamless transactions—such as e-commerce, online shopping, and widely adopted WeChat Pay via QR codes in China.

*Over 90% of financial transactions in China are now digital.

This digital transformation is reshaping every aspect. WeChat Pay didn’t just revolutionize offline transactions—it also spawned new business models, made payment processes more efficient, and revitalized the economy. It paved the way for e-commerce giants like Alibaba, Tmall/Temu, and JD.com.

And we mustn’t forget—we already have USDT on the TON blockchain.

-

How can you leverage this?

-

How can you help business owners solve more problems or improve payment conversion rates?

The goal is to deliver a smooth user experience for payments, benefiting both merchants and consumers. Around one million users have conducted cryptocurrency transactions on Ethereum’s mainnet, while TON’s potential market reaches one billion—a 1000x scale difference.

Serving billions globally is an exhilarating challenge.

Our payment research aims to make digital payments accessible to massive user bases, whether through custodial or non-custodial wallets. TON’s market potential is 1000x that of Ethereum, with remarkable network effects.

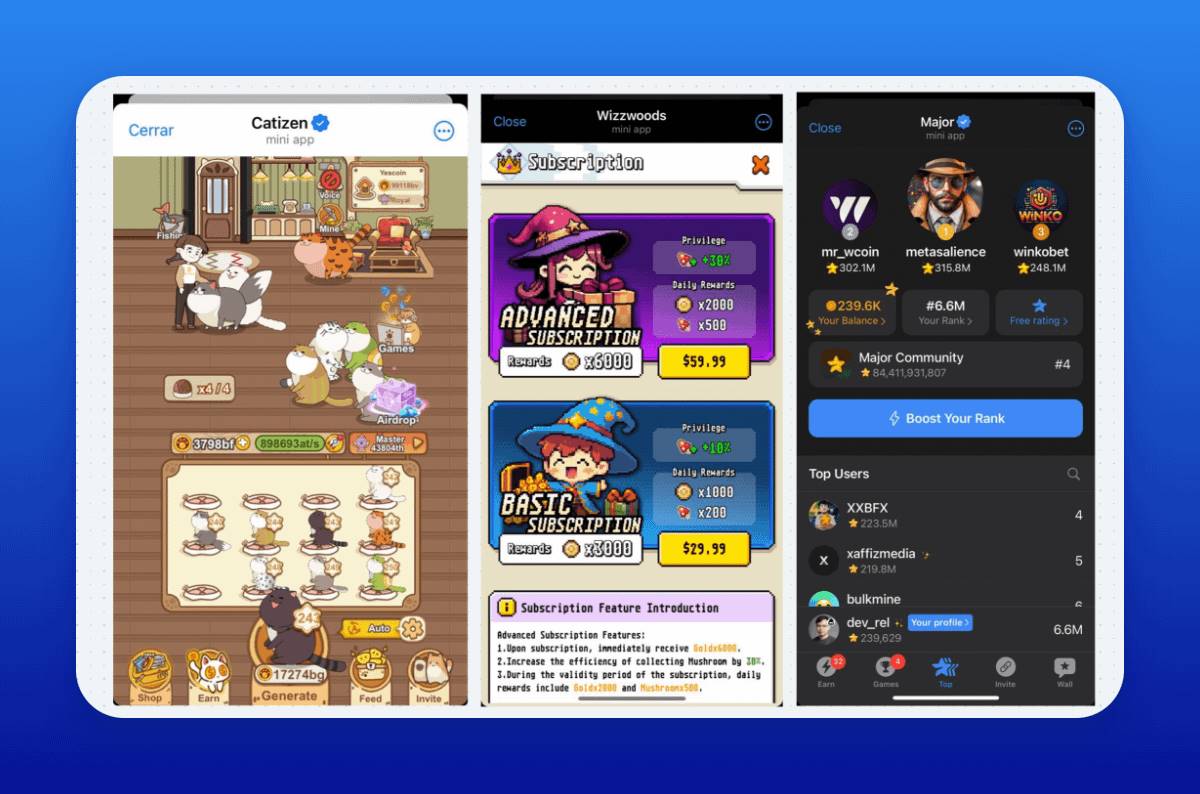

@CatizenAI / @Wizzwoods_game / @majoroftelegram

Huge opportunities lie in online shopping. Helping merchants migrate to TApps is a disruptive move, particularly in gaming and content. Here are some successful examples:

-

Catizen (@CatizenAI)

-

Major (@majoroftelegram)

-

Wizzwoods (@Wizzwoods_game)

Gaming platforms like Catizen have thrived thanks to streamlined payment systems, enabling rapid revenue generation—something early Web2 games couldn’t achieve.

Finance

When we discuss finance here, we refer to financial management and the "on-chain" aspects, such as bringing more assets on-chain and increasing TVL (Total Value Locked).

There is strong demand for decentralized finance (DeFi) in the short, medium, and long term. The reason is simple: We must acknowledge that the TON ecosystem currently lacks diverse DeFi products—such as yield-generating opportunities, profit avenues, and other financial management tools.

You might instinctively head in this direction, but you also need to consider the challenges of developing smart contracts on the TON blockchain. This constitutes part of the investment risk.

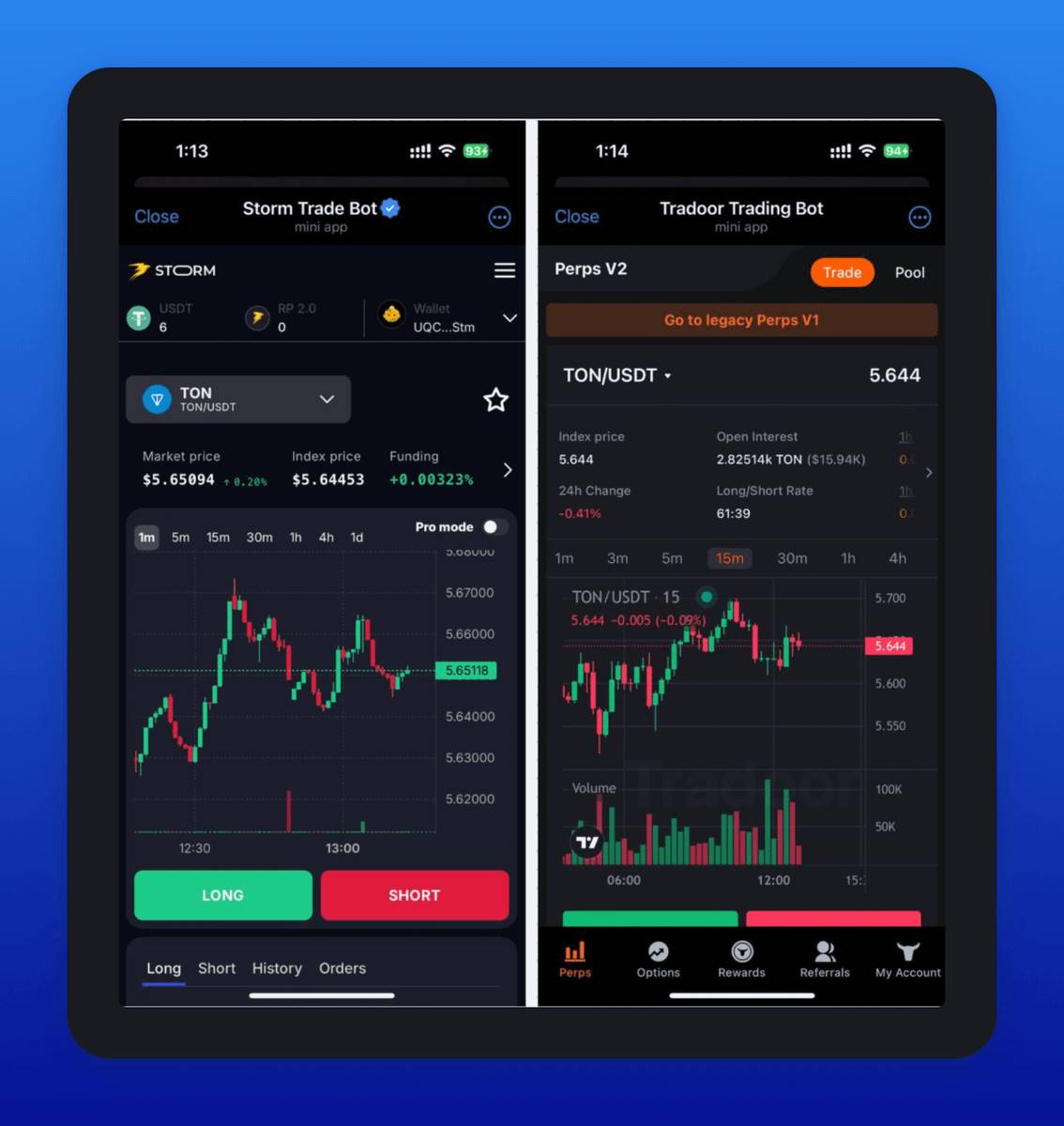

However, high-return opportunities also exist through "trading derivatives." For instance, LP (liquidity provider) returns on derivative platforms like StormTrade and Tradoor are promising. These are opportunities worth deep exploration.

-

StormTrade (@storm_trade_ton/ https://storm.tg)

-

Tradoor (@tradoor_io / https://tradoor.io)

2. Methodology

Our aim is to better categorize and discuss projects by elaborating on these three dimensions.

Currently, the financial sector faces a significant gap. TON lacks DeFi projects and needs stronger modules to drive on-chain yields and incentivize assets to remain on-chain. Bringing more assets on-chain—what we might call "on-chainification"—and increasing Total Value Locked (TVL) is the most direct solution.

But is following Ethereum’s development path the optimal strategy? Will focusing solely on DeFi enable TON to rapidly penetrate the market? After observing the market over the past few months, I am skeptical about the effectiveness of this approach.

Telegram’s robust user base suggests we should pivot toward finance to create more on-chain opportunities. I look forward to seeing more asset tokenization in the future. Moreover, I advocate for more multidimensional or bilingual concepts that combine “social and finance,” redefining traditional product ecosystems.

For example, decentralized exchanges (DEXs) are foundational to DeFi, often referred to as the “Lego” of the ecosystem. Let’s explore this independently.

Trading / Decentralized Exchange (DEX)

If we speak solely about DEXs, they belong to the financial domain but lack notable social elements!

The current issue with DEXs is primarily market penetration. Uniswap evolved from v2 to v3 and is now eyeing v4, but most updates are merely mathematical tweaks. What’s the real problem? They’re simply not engaging.

Can we view our friends’ portfolios? No.

Can we easily compare our PNL (profit and loss) with others? Yes, but only on niche platforms like DeBank or Zapper.

Can we send notifications to other traders on Uniswap? There’s no such opportunity.

Trading should be fun and interactive. Envision a platform that allows you to dive deep into trading and enjoy every moment. Take inspiration from products in our category, such as PumpFun.

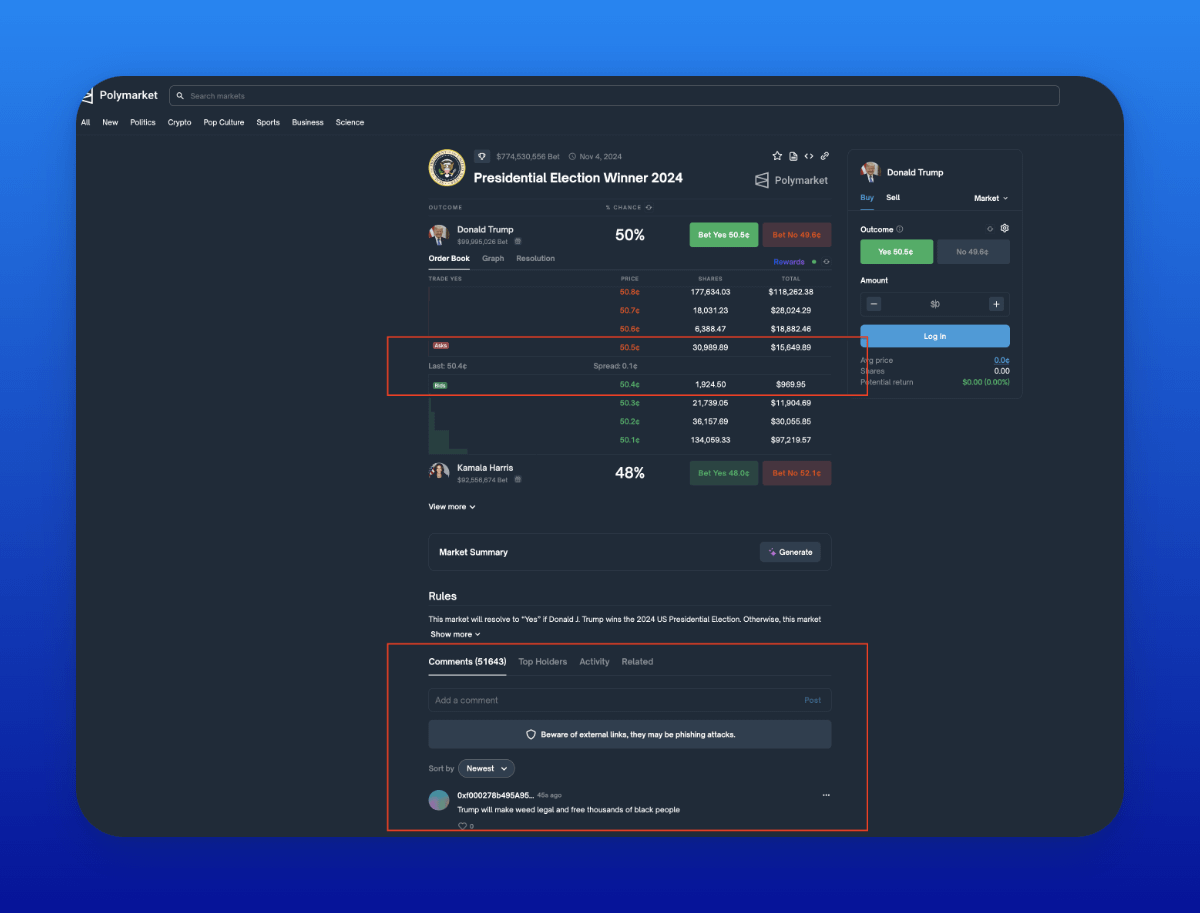

Trading / Prediction Markets

Even in seemingly simple areas like prediction markets, problems abound. They relate to social dynamics but fail to meaningfully engage users. Interactions are fragmented, lacking integration with popular platforms like Telegram group chats. Users connected via blockchain finance need more personal communication channels.

Polymarket also faces regulatory hurdles, stalling features like mobile apps. Poor user experience leads to missed convenience. Growth potential is suppressed—in 2024, who still uses web browsers? Mobile is the future, and its dominance will only grow stronger.

*Polymarket’s community engagement is limited to commenting on topics or markets, failing to foster active discussions.

*Financially, the platform isn’t attractive; AMM (Automated Market Maker) mechanisms are neither fair nor appealing when considering impermanent loss, yield, and capital exposure.

This is why I emphasize the close link between "prediction markets" and "social," despite my caution regarding its "financial" angle. We all hope for breakthrough functionalities in prediction markets driven by on-chain decentralized finance (DeFi). See how Blur.io reshaped the NFT marketplace and other innovative DeFi strategies.

Areas to Watch / Further Exploration

Focusing on social, payments, and finance within the TON ecosystem, we’ve identified early-stage opportunities ripe for exploration.

Are you curious why I classify Proof-of-Work (PoW) under payments? Bitcoin revolutionized energy efficiency, reduced electricity costs, and advanced power technologies. This exemplifies innovation driven by payments.

There’s much more to cover: DNS domains, MEME culture, credit cards, cross-chain bridges, etc.

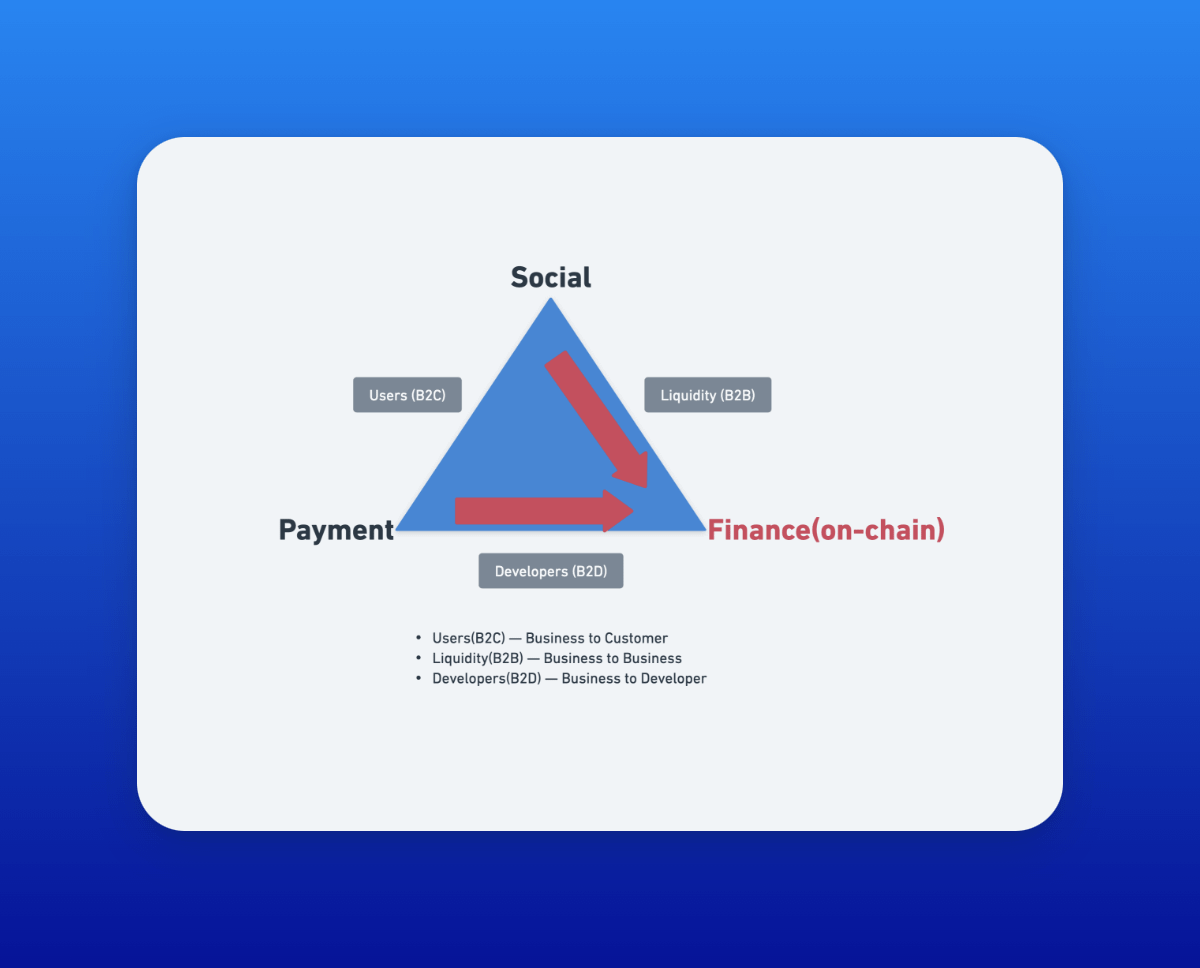

3. Vertical Expansion Discussion

Each category opens a field suitable for exploration. Want to spark ideas beyond this list? Of course, there are ways.

Users (B2C)

Think vertically to grow your business. Social and payments overlap because both rely on massive user bases. Companies like Amazon, which sell directly to shoppers, embody B2C transactions. Apps that facilitate social connections or sell digital goods fall into this category, leveraging user engagement for scalability.

-

Projects bridging social and payments excel here.

-

The gaming industry stands out, combining social interaction with payment demands, driving growth across two ecosystems. Take Catizen (@Catizen) mini-app as an example: it generated over $6 million in revenue through @Telegram Stars.

-

In my view, advertising also belongs in this category.

Developers (B2D)

In payments and finance, innovative developers drive growth and groundbreaking business models. Imagine APIs for blockchain payments or DeFi protocols tailored for developers—transforming ordinary yield-generating services into powerful profit engines.

-

Imagine integrating "existing payment channels" with on-chain transactions. This next leap—tokenizing Telegram Stars—could be game-changing.

-

Many projects struggle with the complexity of Telegram Stars, grappling with their strengths and limitations. While we can't elaborate fully here, this is a goldmine waiting to be tapped. Explore deeply to unlock new potential.

-

What’s the real highlight? Developers have enormous opportunities to solve these challenges, sparking a wave of new projects. This is a major pain point awaiting innovative solutions.

Liquidity (B2B)

Boost liquidity and drive growth through strategic B2B alliances. Collaborate with other businesses to build a powerful network that enhances liquidity and drives collective success. This strategy creates a robust ecosystem, crucial for both decentralized finance (DeFi) and social platforms like Telegram. Simply put, turn traffic into profit.

-

The potential here is undeniable; synergies among Launchpools, decentralized exchanges (DEXs), and social features are especially exciting.

-

Emerging "yield" products that combine financial tools with social functions are poised to transform the market. Innovative offerings like Alipay demonstrate the immense power of such combinations, particularly evident in China.

4. Final Thoughts

Although we’ve explored various categories in depth, certain areas still require more attention—revealing rich opportunities for innovative teams. Mini-app games have recently dominated, possibly due to fatigue from click-to-earn or invite-to-earn models, along with a highly competitive landscape.

Yet, it’s thrilling to think about untapped trending topics. These could evolve into billion-dollar ventures within Telegram mini-apps and the TON blockchain.

Promising areas include credit cards (cashback) and gift card businesses, real-world assets (RWAs), earn products, Launchpool-style initiatives, or companies focused on offline QR code payment solutions. These directions brim with potential and deserve deep exploration.

5. Postscript

A Layer 1 blockchain can be likened to a country. Though TON may not be perfect, it’s filled with potential and hope—much like the American Dream. In the 1980s, a new wave of immigrants came to America, bravely pursuing their dreams.

Today, consensus around the EVM ecosystem is unraveling. We see Solana pushing the boundaries of single-chain infrastructure, while Bitcoin’s Layer 2 solutions gain traction.

As someone who lived through the DeFi summer, my choice is clear—I see hope here.

-

Would I tell a young graduate to build on Ethereum? No.

-

Without millions of dollars, the chance of success is slim.

-

Would I recommend a Web2 gaming studio choose an EVM blockchain? No.

They lack users. Consider "Black Myth: Wukong"—would it have become a hit without Steam (@Steam)? Unlikely. Platform matters.

Our ecosystem is brimming with genuine growth potential. No matter what project you're working on, you still have a chance to succeed. This place feels like America’s Midwest in the 1980s or today’s Dubai—you can become whoever you want to be.

TON/Telegram, with its massive user base, seamless cross-platform functionality, and powerful value transfer capabilities, is the rocket that will launch your venture into orbit.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News