TON hype fades but major moves continue: Is the bubble bursting, or is a super gateway taking shape?

TechFlow Selected TechFlow Selected

TON hype fades but major moves continue: Is the bubble bursting, or is a super gateway taking shape?

TON does not offer a "get-rich-quick myth," but rather a Web3 imagination closer to real-world usage scenarios.

Author: Wayne_Zhang

Introduction

In Q3 2024, the TON blockchain rapidly attracted hundreds of millions of users through Telegram's traffic gateway and Tap-to-Earn mini games, creating a miracle of on-chain growth. At the same time, multiple TGEs (token generation events) by TON ecosystem projects generated strong wealth effects, making "TON / Telegram" the hottest narrative center in Web3.

However, after the hype, TON is entering a cooling phase worth watching. Similar to past Web3 narratives, will there be consolidation after the bubble bursts—or total collapse? Is this merely a pause in traffic, or has value conversion simply not yet arrived?

At this juncture, we aim to reassess whether TON possesses long-term potential to become a 'super on-chain gateway', using detailed data, ecosystem evolution paths, and technical stack deployment as entry points.

1. After the Tap-to-Earn Boom: Cooling Enthusiasm and Declining Data on TON

According to TON's official website, TON (The Open Network) is a decentralized open internet designed to bring 500 million people on-chain, built by the community using technology developed by Telegram. Backed by Telegram—a Web2 social platform with nearly 1 billion users—TON indeed has the potential to achieve its goal of bringing 500 million people into the on-chain world, and it achieved tremendous success in 2024:

-

Toncoin (TON Token) reached a peak market cap exceeding $25B, ranking among the top 10 in crypto asset market capitalization [1];

-

The Tap-to-earn mini game Hamster Kombat officially disclosed attracting over 300 million users [2];

-

TON Blockchain achieved a daily new address peak of over 700k, with more than 1.657M daily active addresses [3];

-

Several Telegram mini-game assets surpassed $500M in market cap, and DeFi TVL surged up to 5,500% in 2024…

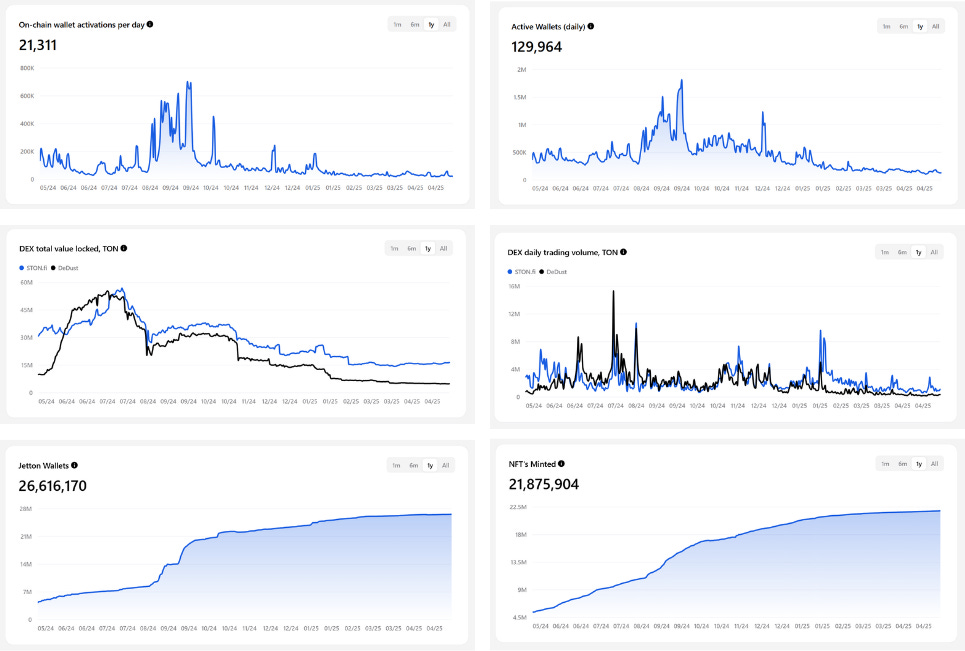

This dual miracle of traffic and wealth made TON one of the absolute focal points of Web3 narratives in 2024. However, similar to previous Web3 booms, short-term explosions are often followed by data retractions. The TON ecosystem is currently experiencing a phased “narrative cooling period”: as shown in Chart 1, metrics such as daily new wallets, active addresses, and TVL and trading volume on core DEXs (Stone.fi and Dedust) have all declined significantly from their peaks. Although some short-term spikes occurred intermittently, these were mostly temporary rebounds driven by specific projects; overall trends show that multiple indicators have returned to pre-narrative levels.

Still, not all signals are negative. Jetton Wallet (non-zero balance wallets) continue to rise steadily, indicating ongoing base user accumulation—albeit at a much slower pace. Meanwhile, NFT minting numbers remain on an upward trend, suggesting continued advancement of the on-chain application ecosystem.

Chart 1: TON Ecosystem Data, Source: Ton Stat, 2025.05.20

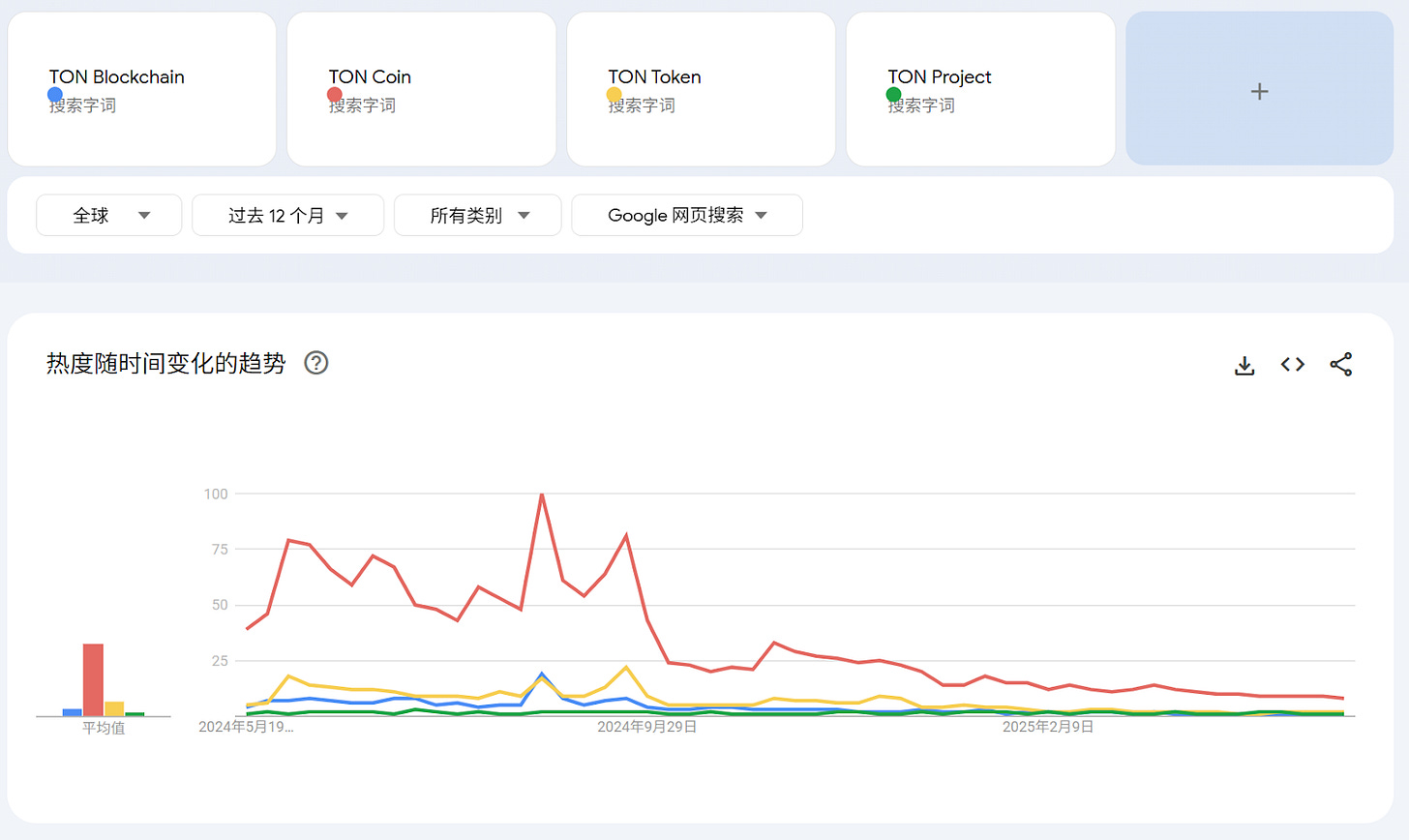

On another front, Google Trends keyword data shows that overall search interest in TON is gradually declining, especially regarding the ecosystem itself. In contrast, market attention to token price remains relatively stronger.

Chart 2: Browser Search Interest for TON Keywords, Source: Google Trends, 2025.05.21

That said, declining data does not necessarily mean narrative termination. Precedents abound: Bitcoin once suffered network overload due to inscription mania but eventually stabilized; Solana and Base both experienced halved metrics before rebounding with technical optimization and ecosystem progress, ultimately achieving new highs.

Chart 3: On-chain Data Trends for Solana and Base, Source: Artemis, 2025.05.22

Can TON also transform traffic into deep, lasting value once the hype fades? Is it merely lying low temporarily, or destined to become a “narrative relic”? Ultimately, actions will determine the answer. The following sections will analyze the quiet changes taking place within TON’s organizational strategy, ecosystem development, technological upgrades, and narrative transformation during this “low tide” period.

2. Major Moves: Leadership Changes, Compliance & New Markets, Infrastructure Expansion

Since its Binance listing in August 2024, TON’s narrative has entered a new stage. While surface-level enthusiasm cooled, strategic deployment accelerated—encompassing team restructuring, regulatory compliance exploration, deeper integration with Telegram, technical scalability enhancements, and global developer incentives and capital injections.

2.1 Leadership Transition and Compliance Push: Accelerating Mainstream Adoption

In early 2025, personnel adjustments at the TON Foundation sent a clear signal: globalization and compliance would become core strategic directions for the coming years.

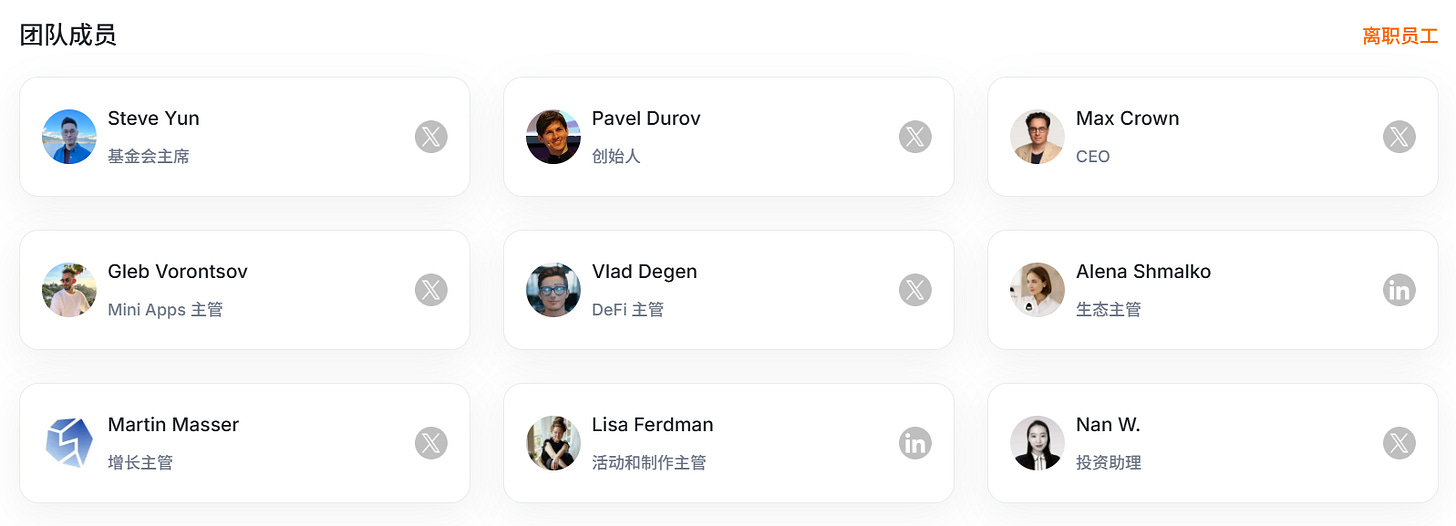

On January 15, Manuel Stotz, former board member and founder of Kingsway Capital, was appointed as the new President of the TON Foundation. Kingsway is a veteran investment firm managing billions in assets for U.S. investors. Stotz’s background brings a strong “traditional capital markets” signal to TON. According to official announcements, he will work alongside former president and current board member Steve Yun to drive TON’s international expansion, with a particular focus on the U.S. market—a highly regulated yet vibrant region considered essential in TON’s strategic roadmap.

On April 24, the TON Foundation further appointed Maximilian Crown, co-founder of MoonPay, as CEO. MoonPay is a leading global crypto payment infrastructure provider, holding compliance licenses across jurisdictions including the U.S., Australia, and the Netherlands. Crown brings extensive global operational experience and regulatory expertise. His appointment is widely seen as a landmark step signaling TON’s formal embrace of regulation and move toward mainstream global adoption [4].

Chart 4: Current Core Team Members of TON, Source: RootData

Notably, Pavel Durov, founder of Telegram and early advocate of the TON blockchain, was detained in August 2024 over allegations of Telegram violating regulations and only re-emerged publicly in March 2025. While no final verdict has been reached, the timing closely aligns with TON Foundation’s strategic shift, possibly prompting the team to prioritize regulatory issues and preemptively clear obstacles for global rollout.

Recently, the TON Foundation has been actively engaging with U.S. regulators. According to the TON ecosystem report, self-custody TON wallets are scheduled to launch in the U.S. in Q2 2025 [5]. In March 2025, the TON Foundation disclosed that U.S.-based venture capital firms—including Sequoia Capital, Ribbit, and Benchmark—hold over $400 million worth of Toncoin [6], serving as significant evidence of TON’s shift toward compliance and globalization.

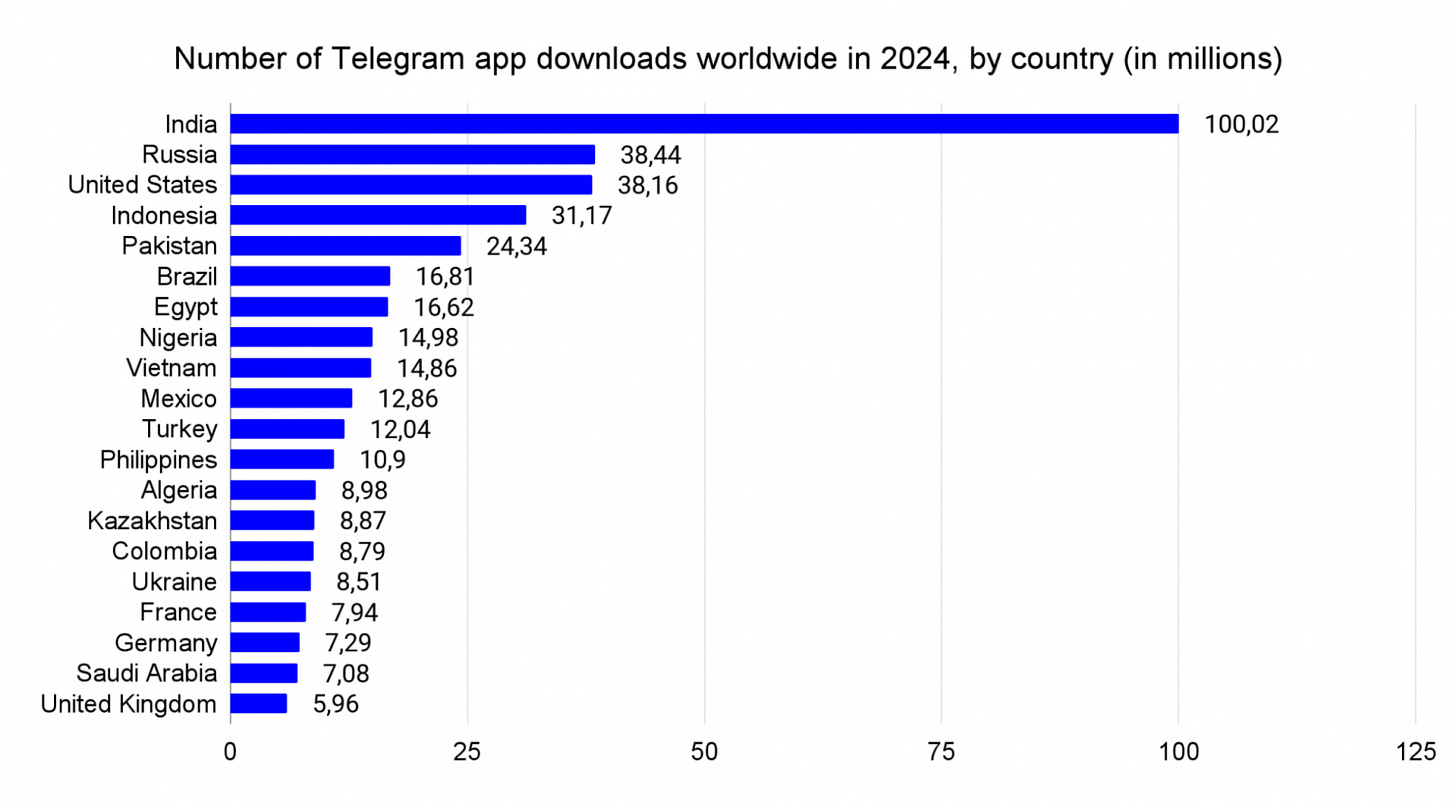

Looking at Telegram’s global user distribution (Chart 5), if TON hopes to convert these users into Web3 participants, it must meet regulatory requirements across different jurisdictions. Otherwise, not only will it struggle to deploy applications in key markets, but it may also pose legal and business risks to Telegram itself.

In fact, TON wallet’s global expansion has already begun. Starting November 2023, TON initiated phased rollouts in select African countries, later expanding into the Middle East, Europe, and various Asia-Pacific markets—laying the groundwork for future global compliance.

Chart 5: Telegram Downloads by Country in 2024, Source: CPA.RIP

2.2 TON × Telegram: Deep Integration, Binding the Ecosystem Gateway

In January 2025, Telegram officially designated TON as the sole blockchain infrastructure for its growing mini-app ecosystem. The centerpiece is the TON Connect protocol, which seamlessly links Telegram mini-apps with blockchain wallets, simplifying user interaction with decentralized apps within the messaging platform. This exclusive protocol establishes TON as the de facto blockchain layer for Telegram’s nearly 1 billion users, positioning it as a potential carrier for a “Web3 version of WeChat Pay,” fully leveraging Telegram’s massive network effect.

In terms of payments, Telegram committed to exclusively accepting Toncoin as non-fiat currency across its ecosystem—including use cases like Telegram Stars, Premium subscriptions, advertising systems (Telegram Ads), and payment gateway services (Telegram Gateway). Developers and channel operators can directly receive income in Toncoin, establishing an initial internal payment and revenue distribution system based on Toncoin.

Meanwhile, payment provider RedotPay now supports Toncoin and USDt (the USDT variant on the TON chain) and integrates major payment methods like Apple Pay, Google Pay, and Alipay, usable across over 130 million offline merchants globally—further expanding TON’s real-world payment capabilities.

The TON Space wallet recently introduced fee payments via Telegram Stars, effectively an “abstraction” solution that allows users to complete transactions without understanding complex on-chain operations. Unlike traditional chain abstraction models, this approach leverages massive entry-point traffic while simultaneously advancing on-chain applications toward “everyday life” and “normalization.” Per official plans, U.S. users will gain direct access to TON wallet services within Telegram starting Q2 2025, further bridging Web2 consumption scenarios with on-chain asset management [7].

2.3 Ecosystem: From Mini-Game Frenzy to Diversified Expansion

TON’s first wave of ecosystem growth was primarily driven by mini-games. Fueled by “airdrop incentives + easy onboarding,” users flooded in quickly. For example, *Hamster Kombat*, which airdropped in September 2024, peaked at 300 million monthly active users in July—but by November, only 52 million remained, losing over 86% of its user base in just a few months [8]. Simple, replicable game mechanics may create short-term “growth illusions,” but fail to sustain long-term user retention, exposing early-stage homogeneity in the ecosystem.

Facing this situation, TON is expanding builder ecosystems while accelerating infrastructure deployment. In April 2025, TON announced a strategic partnership with Chinese gaming giant KingNet (with over 100 million users) and hosted its first major game developer conference in Asia, attracting dozens of studios from the WeChat ecosystem to explore building Web3 applications on Telegram and TON.

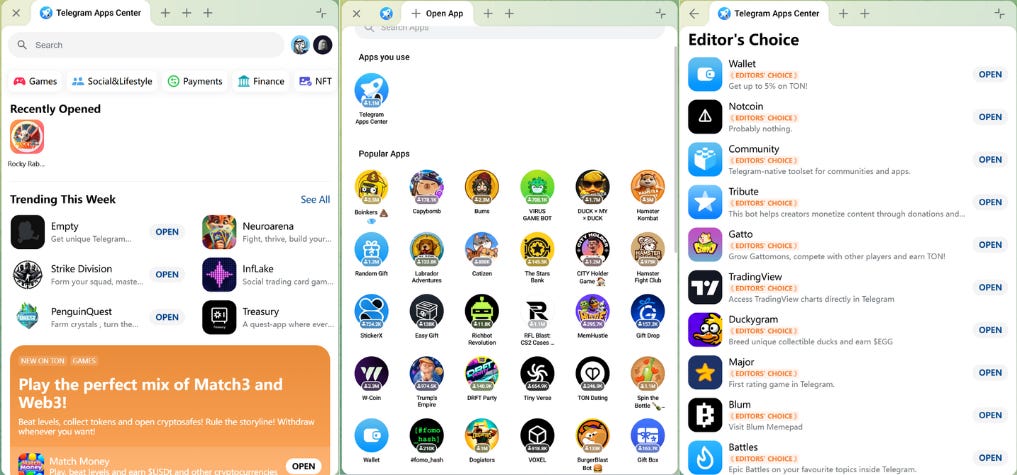

With the launch of Telegram App Center, users can now directly discover integrated third-party apps within the platform. An increasing number of TON ecosystem apps appear on recommendation lists—not limited to games anymore, but spanning social, payments, DeFi, and NFTs—marking the initial diversification of its application ecosystem.

Chart 6: Screenshot of Telegram App Center Interface, Source: Telegram Product Page

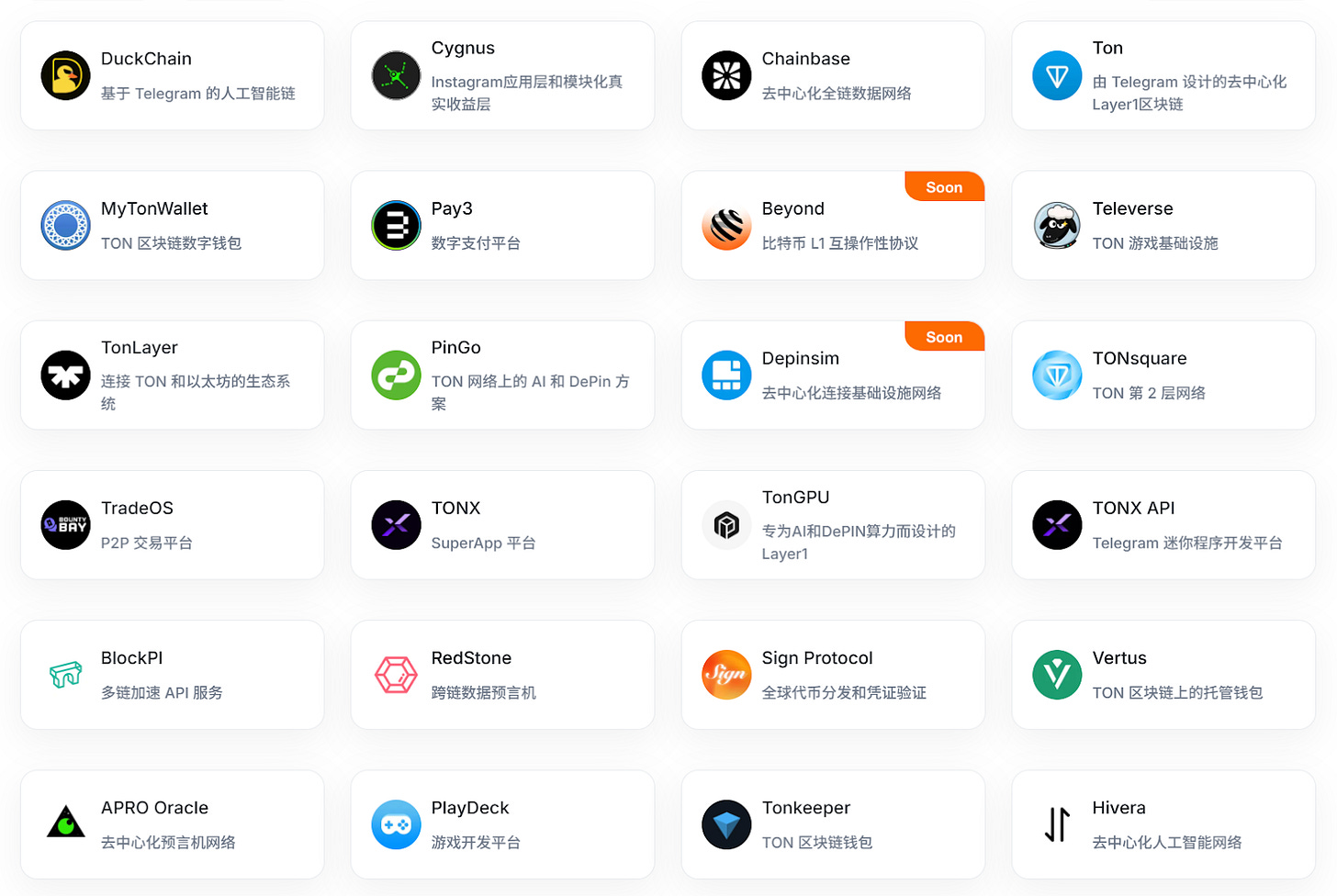

According to RootData, among the 187 recorded TON projects, about 14% focus on infrastructure. Beyond oracle and wallet services, platforms like TONXAPI and Play Deck serve as developer support tools, lowering technical barriers for new builders and accelerating sustainable ecosystem growth.

Chart 7: TON Ecosystem Infrastructure Projects (Partial), Source: RootData

Beyond gaming, the TON ecosystem is expanding into several new narrative tracks: PayFi, RWA (detailed below), AI, perpetual contracts (Perp DEX), and DePIN. Examples include:

-

Joint incentive campaign with GMX for a TON-based perpetual DEX;

-

Bounty program launched with AI Agent OS ElizaOS;

-

Collaboration with aggregator protocol Jupiter to promote TON ecosystem aggregators…

Ecosystem potential has drawn strong institutional investment. In September 2024, Foresight Ventures and Bitget invested $30 million into TON; the following month, Gate.io announced another $10 million investment to boost Telegram app development [9]. In early 2025, former TON Foundation president Steve Yun launched a VC fund, TVM Ventures, with an initial size of $100 million focused on supporting DeFi, PayFi, and foundational infrastructure projects—further strengthening TON’s appeal to developers and deepening its ecosystem moat.

2.4 Technical Upgrades: Advancing Performance and Scalability

According to TON’s published H1 2025 roadmap, the core goal of its technical iteration is to alleviate congestion and enhance scalability and stability. This update spans four key areas, reflecting TON’s evolution toward a “high-load, high-frequency application blockchain”:

1. Accelerator Mainnet Upgrade

This is TON’s most significant architectural upgrade since inception, aiming to implement an “infinite sharding” mechanism and significantly improve network stability and scalability. Key improvements include:

-

Optimized shard chain tracking: nodes will only need to track the main chain and their associated specific shards, rather than all shards—significantly reducing resource consumption and improving node processing performance.

-

Validator role separation: TON splits the previously unified validator role into “Collators” and “Validators,” boosting overall validation efficiency through parallel task processing.

These upgrades will help the TON network maintain stable block production and transaction throughput under high load while reducing hardware dependency.

2. Layer 2 Payment Network

TON plans to launch a Layer 2 payment network similar to Bitcoin’s Lightning Network, offering instant transactions and ultra-low fees for asset exchange. Currently in testing, this network will eventually support various token assets including Jettons, ideal for high-frequency transactions and mini-game payments. Its implementation could significantly increase actual usage rates of TON in everyday payments and gaming ecosystems.

3. BTC Teleport Cross-chain Bridge (Live)

BTC Teleport enables asset transfers between the TON and Bitcoin networks. Using peer-to-peer bridging, it simplifies cross-chain interactions, dramatically lowering user thresholds and costs. This enhances interoperability between TON and major public chains, paving the way for expanded DeFi and asset management use cases.

4. Optimization and Enhancement of Technical Tools

To improve validator efficiency and system security, TON has rolled out features such as MyTonCtrl backup and recovery, Telegram notification bots for validators, and web dashboards. It also plans to strengthen validator incentives and penalties—for example, nodes failing to produce blocks in designated rounds will face harsher penalties. Additionally, a new version of TON Proxy is in development, aimed at enhancing DDoS attack protection to ensure network stability and security. TON’s official API will also add functions like operation simulation, querying pending transactions, and domain management [10].

The DOGS airdrop event in August 2024 served as a “stress test” for TON’s tech stack. The network halted for three hours due to overload and validator consensus failure, exposing architectural bottlenecks under extreme concurrency. The ongoing 2025 roadmap is a direct technical response to that incident. With mainnet architecture refactoring (Accelerator), Layer 2 network testing, and cross-chain bridge deployment, TON is transitioning from a “high-TPS showcase chain” to a truly scalable and resilient general-purpose Layer 1.

TON’s technical direction isn’t about chasing “lowest fees” or “peak single-transaction speed,” but about modular design enabling diverse scenarios—especially high-frequency interactions around payments, gaming, socializing, and lightweight financial apps. In the future, beyond the payment-focused Layer 2, TON may introduce multiple specialized Layer 2 solutions tailored to different applications, enabling highly adaptable on-chain architecture scaling.

3. Restructuring Financial Narratives: From DeFi to PayFi and RWA

3.1 From Trading Hype to Asset Depth: Catching Up on DeFi in TON

Despite ranking among top-tier public chains in on-chain active addresses and transaction frequency, TON’s DeFi ecosystem depth still lags far behind its traffic volume. According to DeFiLlama, TON’s TVL is currently around $115 million, ranking 36th among major public chains. This “high activity, low locked value” discrepancy has raised market skepticism: “Is TON just another gathering ground for ‘farmers’?”

There are objective reasons: TON’s ecosystem grew extremely fast, while DeFi—being a type of “slow and meticulous” infrastructure—is difficult to rapidly mature in product completeness and operational cycles. On one hand, developers need time to build high-quality contracts and protocols; on the other, early TON DeFi apps largely followed traditional web interface logic, failing to integrate efficiently with Telegram’s mini-app ecosystem. As a result, centralized exchanges (CEXs) benefited most during the initial boom, drawing in large volumes of new registrations and trades.

To address this gap, the TON team has begun systematically improving the DeFi ecosystem, showcasing its full DeFi module layout at the Hong Kong Web3 event in April 2025.

Chart 8: Current State of TON DeFi Ecosystem, Source: Youtube

At Tier 1 are core DeFi functions: cross-chain bridges, collateralized stablecoin CDPs, AMM protocols, lending, and liquid staking derivatives (LSD). These form the foundation for more complex financial products. Building on this, TON is promoting advanced applications such as yield farming, derivatives, options, yield tokenization, vaults, and launchpads:

-

STON.fi launched Omniston, a decentralized liquidity aggregation protocol designed to simplify liquidity management across the ecosystem;

-

Decentralized perpetual contract platform Storm Trade continues to grow, reaching peak TVL in February 2025;

-

Yield tokenization protocol FIVA achieved $1 million TVL and $28 million in trading volume within days of launch…

Beyond these core DeFi apps, TON continues integrating key DeFi partners—the most notable being two major stablecoin issuers: Tether and Ethena.

Tether’s USDT was officially deployed on the TON chain in April 2024 and experienced rapid growth. Within five months of launch, circulating supply exceeded $1 billion. Integrated directly into Telegram apps, USDT supports direct transfers and is widely used in Telegram mini-apps and Web3 services—including creator tips, digital service settlements, and content monetization—further enriching TON’s payment ecosystem.

Simultaneously, TON is collaborating with Ethena to integrate USDe, its synthetic dollar asset with over $6 billion in TVL. Through this integration, TON aims to provide Telegram’s vast user base with stable dollar-denominated savings and yield opportunities—particularly benefiting users in regions where accessing dollar assets is otherwise difficult. This move strengthens TON’s strategic position in the stablecoin ecosystem and injects longer-term financial infrastructure into its DeFi system.

3.2 PayFi and RWA: Bridging On-chain Yields to Real-World Value

At the TON Day event, officials formally introduced a “dual-engine” financial application framework, revealing their on-chain financial design built around Telegram mini-apps. The structure consists of three layers:

-

Core DeFi Layer: Includes continuously improved DeFi infrastructure and protocols, emphasizing technical performance and compliance frameworks;

-

Real Yield Layer: Provides sustainable yield support to upper-layer applications through stablecoins, RWA yields, and staking pools;

-

Retail TMA Layer: Leverages Telegram mini-apps to build user-facing products such as PayFi wallets, on-chain savings, yield games, and swap aggregators—key to activating mass Web2 users.

Chart 9: Telegram Mini-App Application Layer, Source: Youtube

Within this architecture, PayFi and RWA have emerged as TON’s two most strategically valuable new narrative pillars. Around them, TON is gradually building a multi-layered yield network connecting on-chain and off-chain realms:

-

Base Layer: Integrates real-world financial assets via mechanisms like the Telegram Bond Fund (a $500 million RWA pool), providing verifiable, quantifiable real-world yield sources. This layer represents TON’s pivotal effort to “blockchain-transform” traditional finance logic.

-

Middle Layer: Uses protocols like Ethena’s USDe synthetic dollars and yield tokenization to disaggregate, repackage, and redistribute underlying yields into programmable interest-rate anchoring tools. This mechanism enhances asset liquidity and makes “yield” itself composable and cross-protocol usable—becoming the “interest rate bedrock” of TON’s financial ecosystem.

-

Top Layer: Builds frontend products atop Telegram’s high-frequency interaction scenarios, presenting on-chain financial capabilities in familiar ways to end users. Through interfaces like Wallet Earn and Banking mini-apps, users can claim USDT rewards, participate in savings, or configure financial portfolios without needing to understand concepts like synthetic stablecoins, staking pools, or RWA assets—enabling a natural transition from Web2 to on-chain financial users.

Take PayFi, for instance: it’s not just a functional extension of the Telegram wallet, but an interactive hub linking “daily payments + on-chain wealth management.” Users can use USDt for real-time payments at over 100 million retailers worldwide via Oobit’s Tap & Pay feature. Simultaneously, they can earn USDT rewards and manage yields through Wallet Earn—all without understanding terms like smart contracts, asset pegging, or off-chain mapping. This “lightweight experience + high financial utility” design is naturally converting Telegram users into Web3 financial participants.

On the RWA front, TON is attempting to build foundational infrastructure for “on-chain brokerages” and “on-chain savings banks.” For example, Libre, in collaboration with the TON Foundation, launched the Telegram Bond Fund, allowing users to invest in fixed-income products like dollar-denominated bonds via blockchain. Future plans include supporting low-value, fractionalized asset tokenization. Meanwhile, Ethena’s synthetic stablecoin USDe is expected to integrate with debit cards and offline spending, opening new consumer finance scenarios for RWA applications.

In essence, what TON is building is not a set of isolated financial protocols, but a “yield network on-chain” centered on Telegram: Telegram provides user access and traffic distribution; PayFi sits at the front-end interaction layer, linking on-chain finance with daily payment scenarios; RWA assets serve as the underlying value anchor, injecting real yields into the financial system; while stablecoins like USDe and yield tokenization protocols handle on-chain yield capture and distribution. Through this closed-loop pathway, TON aims to naturally guide Web2 users into the on-chain financial ecosystem, completing the entire journey—from asset onboarding to yield realization—without raising cognitive barriers.

4. TON’s Road Ahead: A Super Gateway in Maturation, or a Castle in the Air?

TON’s “traffic miracle” stemmed from Telegram’s ecosystem nesting and the viral spread mechanism of Tap-to-Earn. Yet, as the frenzy subsides, user stickiness declines, and on-chain data retreats, a critical question arises: Can the TON ecosystem establish a sustainable “traffic-to-value” model?

The answer may already be unfolding through TON’s own strategy.

In terms of development rhythm, TON is not rushing to repeat the high-frequency stimulation of Tap-to-Earn, but has instead entered a deeper phase of infrastructure maturation. This resembles Solana’s engineering recovery phase post-meme coin craze, or Base’s deepening period after Friend.tech faded. TON’s current strategy reflects a similar mindset: shifting from “breakout narratives” to a value path rooted in “high-frequency essentials + long-term consolidation.”

At the heart of all this remains Telegram—one of the Web2 platforms closest to the “super gateway” ideal:

-

Entry advantage: Nearly 1 billion-user social gateway + all-in-one wallet (TON Space) + Telegram App Center;

-

Dual engine of payments and finance: PayFi connects offline payments, RWA builds a new paradigm for “on-chain wealth management”;

-

Protocol-level nesting: TON Connect and Stars fee mechanisms effectively establish chain abstraction infrastructure;

-

Technical stack execution: Accelerator mainnet upgrade + Layer 2 payment network + BTC cross-chain bridge—all enhancing TON’s infrastructure capacity.

From this perspective, TON’s path forward looks less like a “castle in the air” and more like the construction of a new digital economic hub. But this hub isn’t built for DeFi enthusiasts—it’s built for the next wave of Web2 users.

Nevertheless, TON still faces three major challenges:

1. Gap between user quality and financial depth: Despite hundreds of millions in monthly active users and frequent mini-games, it remains unclear whether users truly understand DeFi, engage in on-chain activities, or use Toncoin beyond “airdrop farming.”

2. Difficulty closing the application value loop on-chain: Lightweight, embedded applications (e.g., mini-games, transfers, ads, payments) enjoy inherent traffic advantages, but this “use-and-leave” pattern poses a challenge: user behavior rarely translates into on-chain assets, identity, data, or long-term retention. Unlike Ethereum’s ecosystem—where wallets, DeFi participation, and NFT ownership form rich on-chain profiles—most current TON users are merely “lightweight on-chain avatars” of Telegram users, exhibiting low on-chain asset activity and interaction depth.

3. Uncertainty of compliance path: Despite TON’s proactive regulatory engagement—such as appointing MoonPay’s co-founder as CEO—the sustainability of the Telegram+TON combination in high-pressure regulatory environments like the U.S. and EU remains to be seen.

In other words, TON stands at a tipping point between “attention” and “value consolidation.” Whether it evolves like WeChat mini-programs—gradually turning high-frequency interactions into financial and service gateways—or becomes another fleeting traffic illusion, depends heavily on team execution, ecosystem self-evolution, and regulatory adaptability. One advantage TON and Telegram hold over WeChat is that they can “cross the river by feeling the stones” of WeChat’s experience. The next 6–12 months will likely be a critical window for TON’s ecosystem to shift from “narrative-driven” to “fundamentally value-supported.”

5. Conclusion

TON’s story is an experiment in “converting platform traffic into on-chain value.” It doesn’t resemble Ethereum’s developer-led financial universe, nor Solana’s tech-driven, meme-fueled path. Instead, it’s a Web3 mass adoption testbed centered on users, anchored by entry points, and armed with lightweight experiences.

From Tap-to-Earn to PayFi, from explosive popularity to infrastructure consolidation, TON’s evolutionary path sends a crucial signal: the next wave of Web3 mass adoption may not unfold within crypto communities, but quietly emerge in the daily lives of hundreds of millions of Web2 users.

Whether TON can truly seize this opportunity—to evolve from an “on-chain super gateway” into an “on-chain super application platform”—remains to be proven. But regardless of outcome, it offers a valuable case study: one that doesn’t rely on “DeFi yields” to lure users, but instead uses familiar interfaces, lightweight payments, mini-games, and social experiences to gently guide them onto and within the chain.

This is both an experiment and a high-stakes bet. But in a prolonged bear market, TON doesn’t offer a “get-rich-quick myth.” Instead, it presents a Web3 vision grounded in real-world usage. It may not deliver immediate results, but through a series of small entry points and genuine user needs, it might just be nurturing the possibility of the next true large-scale Web3 adoption.

Disclosure: The author holds Toncoin and related assets; this report contains subjective elements

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News