Is anyone still bullish on Ethereum now?

TechFlow Selected TechFlow Selected

Is anyone still bullish on Ethereum now?

Is everything over?

Author: Ignas | DeFi

Translation: TechFlow

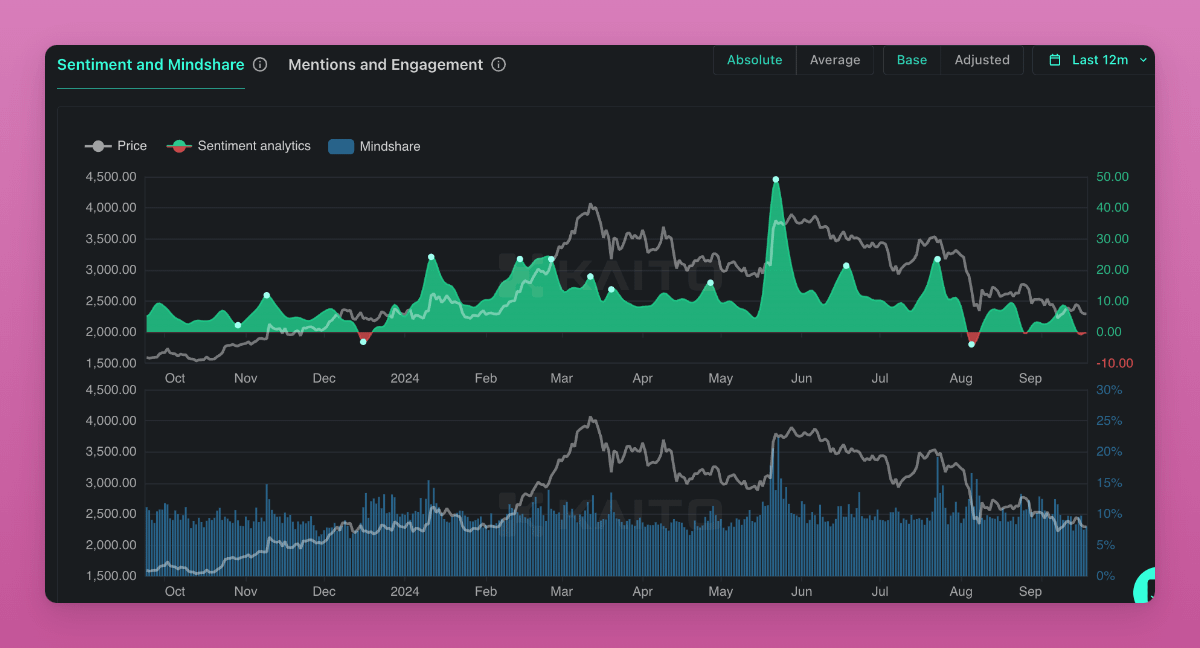

Ethereum's market sentiment has turned extremely bearish for the fourth time this year.

There is a growing realization that the concept of "ultrasound money" no longer applies, as Ethereum’s (ETH) revenue and burn rates are both declining.

While activity on L1 needs to grow, much of it has actually shifted to L2s—activity that the community sees as bringing little direct benefit to ETH.

@iamDCinvestor wants to refocus attention on Ethereum (ETH) as programmable money—the only narrative he believes truly matters.

This view treats ETH as high-quality collateral, making metrics like revenue and burning less relevant.

In contrast, @ChainLinkGod argues that stablecoins have already proven to be a more efficient and widely adopted form of programmable money than ETH.

The idea of ETH as “digital oil” is also weakening, as more Layer 2 solutions begin using their own native tokens to pay gas fees.

Even developers are becoming concerned.

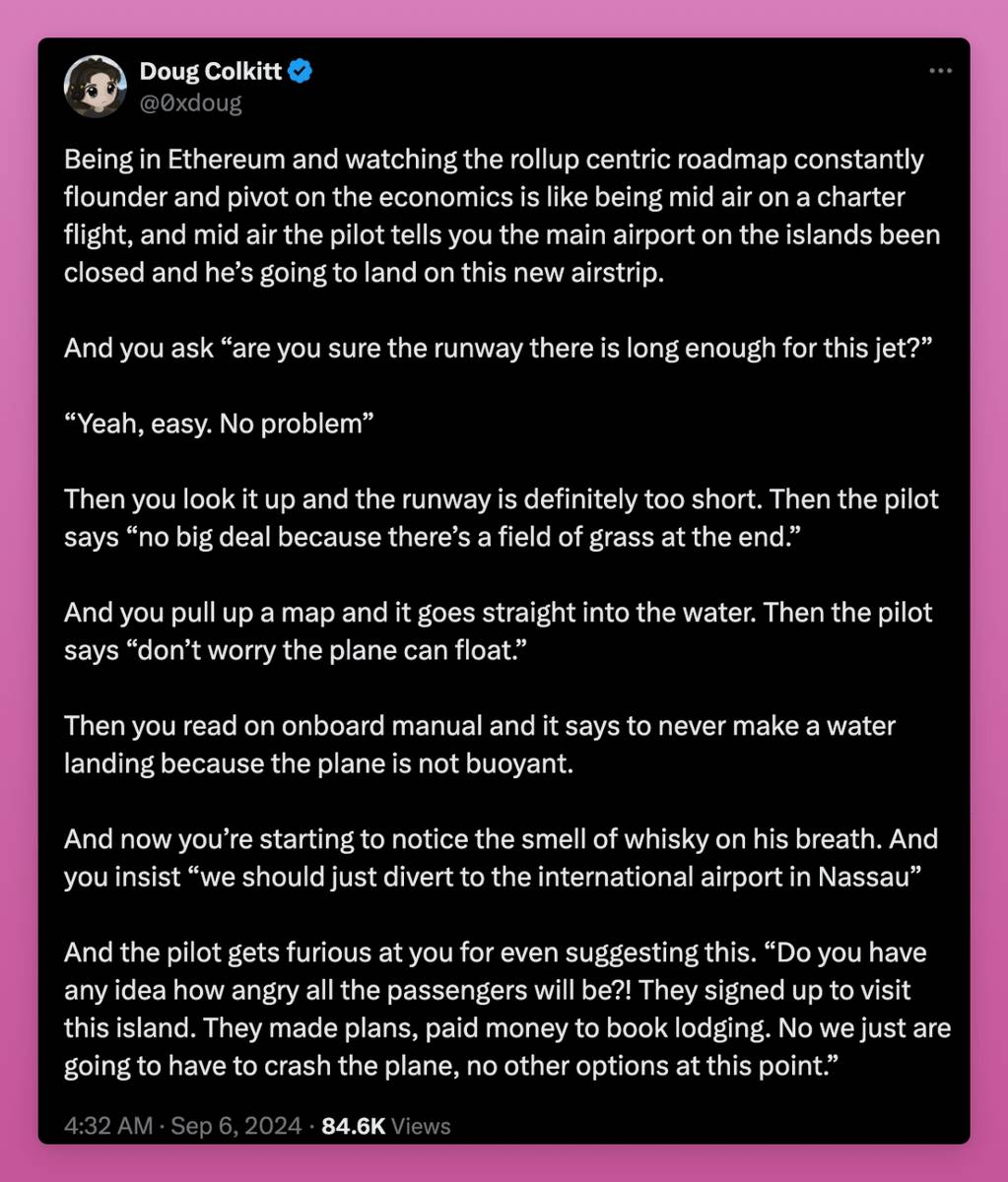

@ambient_finance founder @0xdoug humorously but accurately compared Ethereum’s rollup-centric roadmap to a pilot realizing mid-flight that the runway is too short, yet insisting everything will be fine—despite overwhelming evidence to the contrary.

Worse still, the pilot is drunk.

Watching Ethereum’s rollup-centric roadmap wobble economically feels like being on a chartered flight when the pilot suddenly announces mid-air that the main airport on your destination island has closed, and he plans to land on a newly built runway instead.

You ask, “Are you sure that runway is long enough?”

He replies, “Of course, no problem.”

But you check and realize the runway is indeed too short. The pilot says, “No worries, there’s grass at the end.”

Yet upon checking the map, you see the grass leads straight into water. The pilot reassures you: “Don’t worry, the plane can float.”

Then you flip through the in-flight manual and find a clear warning: never attempt water landings, as the aircraft cannot float.

Now you start smelling whiskey on the pilot’s breath. You insist: “We should divert to Nassau International Airport.”

The pilot reacts furiously: “Do you know how angry the passengers would be?! They signed up for that island. They’ve planned everything, paid for accommodations. Now we have no choice—we must crash the plane.”

Is it all over?

@llamaonthebrink believes that evaluating Ethereum’s (ETH) value requires social awareness, an understanding of the blockchain industry’s mission, appreciation for network effects, skepticism toward fiat currencies, and belief in innovative, internet-native societies.

ETH is fundamentally different from traditional assets, making it difficult to define using conventional narratives like “digital oil” or “tech stock.”

Its value lies in enabling an internet-native sovereign economy that operates without intermediaries or legacy systems.

This demands vision, an understanding of network effects, and the ability to see possibilities not yet realized.

Ethereum defines its own future beyond what existing frameworks can predict.

Some may argue this is hard for baby boomers and traditional institutions to grasp.

@mikeneuder offers a forward-looking example.

His optimism about Ethereum stems from its ability to provide a decentralized, self-custodial, permissionless system for global value transfer—one resistant to seizure and censorship.

This is the core of its long-term value proposition.

Decentralization isn't just a nice-to-have feature—it's essential.

In a world where governments and corporations control centralized systems, Ethereum’s neutral, censorship-resistant design makes it a unique system for digital property rights.

While Bitcoin (BTC) also resists censorship, as block rewards diminish over time, Bitcoin will rely on transaction fees to incentivize miners—a model that may not guarantee long-term security.

This is a point previously raised by well-known researchers at the Ethereum Foundation, such as @drakefjustin.

Ethereum

-

31 million ETH staked

-

Each ETH valued at $3,400

-> Total economic security: $105 billion

Bitcoin

-

Hash rate: 600 exahashes per second

-

Value per hash: $17.50

-> Total economic security: $10.5 billion

Moreover, compared to Bitcoin’s static development model, Ethereum’s flexible, scalable rollup roadmap allows it to adapt more readily to change.

@adamscochran points out that in the short term, Based Rollups—by fundamentally changing incentive structures—could directly impact ETH monetization.

This shift could increase long-term demand for ETH by up to 100x.

After successfully transitioning to PoS and introducing ETH burning, Ethereum once seemed firmly on track.

However, with ETH prices remaining depressed, the Ethereum narrative has stalled.

Personally, I find it fascinating to observe how the community discusses and attempts to redefine Ethereum’s narrative.

I agree with @llamaonthebrink that truly understanding Ethereum’s value requires greater social awareness and a deeper grasp of the industry’s mission.

Yet, when greed and speculation cloud our judgment, the entire industry often drifts from its original purpose. Only when times get tough do we return to first principles.

We’re also seeing more active discussions among the Ethereum Foundation and L2 developers, and even Vitalik increasing his engagement with the community.

This clearly signals a growing urgency to get back on the right track.

Still, as @0xdoug asked: “Are you sure this plane has a long enough runway?”

Even so, I remain optimistic about the future (call it holder bias if you like).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News