Recap of Recent ETH Airdrop Opportunities and On-Chain Alpha

TechFlow Selected TechFlow Selected

Recap of Recent ETH Airdrop Opportunities and On-Chain Alpha

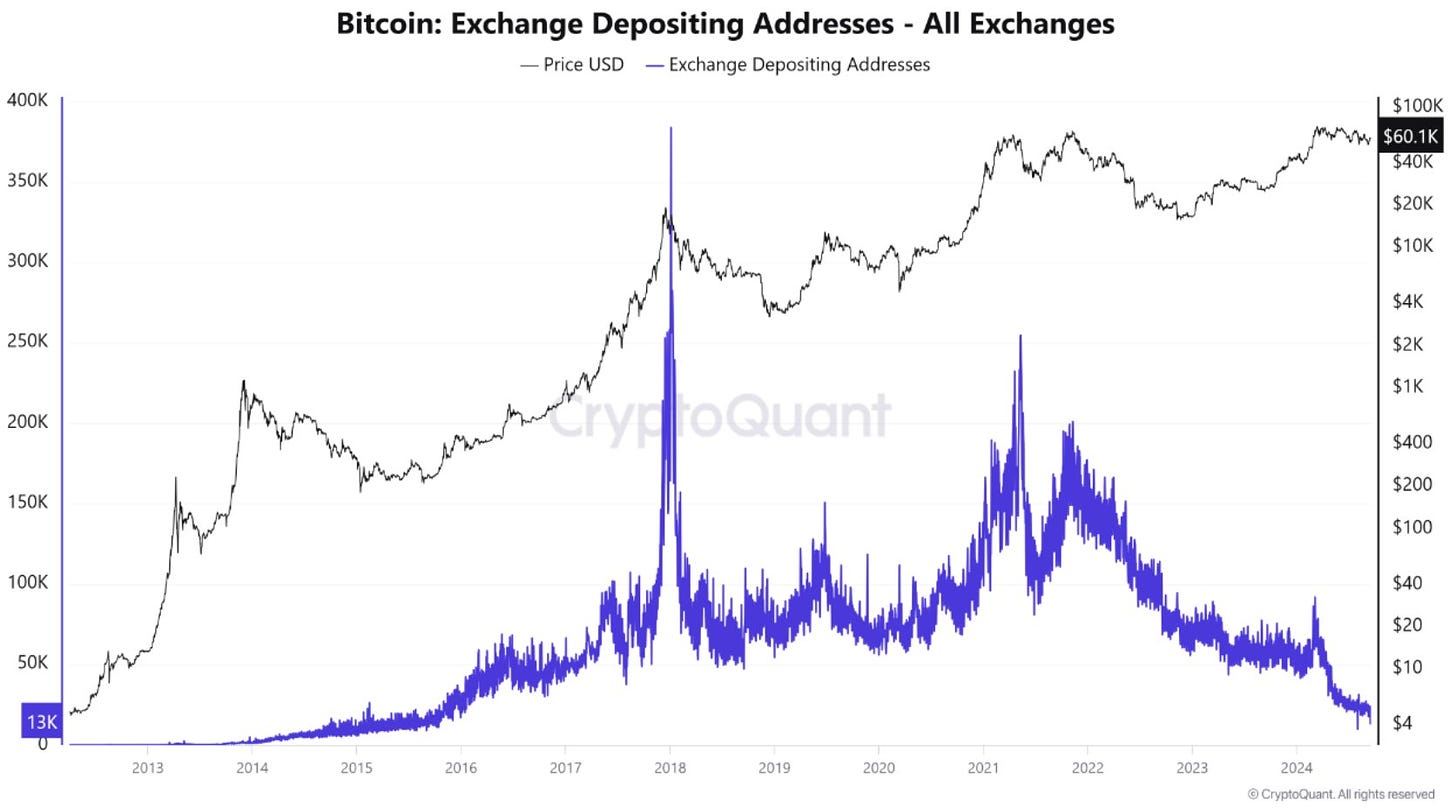

Currently, the number of deposit addresses for Bitcoin (BTC) exchanges has dropped to its lowest level since 2016.

Author: The DeFi Investor

Translation: TechFlow

3 ETH Airdrop Strategies

If you hold ETH, consider putting it to work in DeFi.

Currently, there are several high-quality ETH airdrop opportunities that could yield substantial returns.

Although the days of depositing $100 in a dApp and receiving a $1,000 airdrop are gone, it's still possible to achieve high double-digit annualized yields with ETH.

Today, I’ll share what I believe are the three most promising ETH airdrop strategies.

Let’s dive in.

1. Mantle + Karak

Mantle is one of the best-funded projects in the Ethereum Layer 2 ecosystem and the developer of mETH Protocol, a fast-growing liquid restaking protocol for ETH.

It has been confirmed that holders of mETH will receive an airdrop from the mETH Protocol.

Here’s my strategy to capture this airdrop:

-

Visit Mantle’s Methamorphosis airdrop campaign page, connect your wallet, and join the points program

-

Click the "Gather mETH" button to stake ETH and bridge it to Mantle

-

Deposit the mETH received into Karak. Karak is the third-largest restaking protocol. By depositing mETH on Karak within Mantle L2, you can also qualify for a Karak airdrop.

Here’s why I like this strategy:

-

This approach lets you earn airdrops from both mETH Protocol and Karak

-

Users who stake and bridge ETH to Mantle between September 4 and October 2 will share an additional 1,800,000 $COOK tokens

-

Karak offers a 2x bonus on Karak points for deposits in the mETH pool. Additionally, I appreciate that Mantle clearly stated upfront that their first airdrop campaign will last exactly 100 days.

2. Fluid + EtherFi

Fluid is an innovative DeFi protocol developed by Instadapp, while Symbiotic is the second-largest restaking protocol.

Using Fluid, you can leverage up to 11x to accumulate Symbiotic points.

The strategy is as follows:

-

Restake wETH on EtherFi to receive weETHs—this is the liquidity restaking token EtherFi provides for Symbiotic

-

Deposit weETHs into the weETHs/wstETH vault on Fluid

-

(Optional) Borrow wstETH on Fluid and swap it for more weETHs to increase leverage—boosting your points accumulation up to 11x

Here’s why I like this strategy:

-

By depositing weETHs on Fluid, you simultaneously earn 3.5x EtherFi points, 1x Symbiotic points, 3x Veda points, and 1x Zircuit points

-

Fluid offers one of the highest collateral thresholds in the industry. If you borrow wstETH using weETHs as collateral, be cautious not to get liquidated. However, one advantage of Fluid is its very low liquidation penalty. Even simply depositing weETHs into Fluid is valuable, as it allows you to earn four different airdrop points simultaneously.

3. Kelp DAO + Pendle

Kelp DAO is one of the largest tokenless ETH liquid restaking protocols, while Pendle is the most popular yield-trading protocol.

Recently, Kelp DAO launched the Airdrop Gain Vault—a product that automatically farms airdrops across various L2s and DeFi protocols.

The strategy is as follows:

-

Visit the official Kelp DAO website

-

Click “Restake Now,” then select “Gain” in the top-left corner

-

Deposit ETH or rsETH into Kelp’s Gain Vault to receive agETH

-

(Optional) Supply agETH to the agETH pool on Pendle to earn additional yield

After depositing ETH, Kelp’s Gain Vault automatically allocates your assets across multiple tokenless Ethereum L2s and other protocols.

Here’s why I like this strategy:

-

The Gain Vault charges relatively low fees—only 2% per year

-

Depositing into Kelp’s Gain Vault gives you agETH, a receipt token usable in DeFi. While agETH currently has limited use cases, the Kelp team expects to announce several new DeFi integrations soon.

I hope these airdrop opportunities interest you! As I mentioned at the beginning of this edition, airdrops are no longer a quick path to riches, as participation has grown significantly. But in my view, participating in airdrops remains a solid way to generate extra yield.

On-Chain Alpha

Currently, the number of Bitcoin (BTC) exchange deposit addresses has dropped to its lowest level since 2016.

Source: cryptoquant.com

This indicates that very few people are currently willing to transfer Bitcoin (BTC) to exchanges for selling.

As a result, BTC holdings on centralized exchanges have been consistently declining, which I view as a positive signal.

As shown in the chart above, during the peak of the 2021 bull market, the number of active BTC exchange deposit addresses was nearly 20 times higher than it is today!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News