Arthur Hayes' full speech at Token2049: Markets may crash after rate cuts, but Ethereum could perform well

TechFlow Selected TechFlow Selected

Arthur Hayes' full speech at Token2049: Markets may crash after rate cuts, but Ethereum could perform well

Focus on the dollar-yen exchange rate; that's the only thing that matters.

Compiled by: Weilin, PANews

"It's fucking fed day," Arthur Hayes, CIO of Maelstrom Fund, opened his keynote speech on macroeconomic conditions at Token 2049 in Singapore on September 18, instantly triggering screams from the audience. At around 00:00 Beijing time on September 19, the Federal Reserve was about to hold its monetary policy meeting—the most important decision of the year—whose stance on rate cuts would directly shape future market directions.

Hayes said there’s roughly a 60% to 70% chance the Fed will opt for a 75 or 50 basis point rate cut. He offered an intriguing outlook on ETH, suggesting that declining U.S. Treasury yields could indeed make high-yield tokens more attractive. He likened Ethereum to an "internet bond" and further analyzed its potential. He repeatedly emphasized the Japanese yen and urged the audience to watch the USD/JPY exchange rate: "That is the only thing that matters."

Below is PANews' live compilation of the speech (AI-assisted translation):

I think there’s about a 60% to 70% probability the Fed will cut rates by 75 or 50 basis points. Before talking about crypto, let me share my view: I believe it’s a massive mistake for the Fed to cut rates under current circumstances, especially as the U.S. government increases intervention. I expect the market to collapse within days after a Fed rate cut, because it will narrow the interest rate differential between the dollar and the yen. A few weeks ago, we saw the yen jump from 162 to 142 in about 14 trading days—an event that nearly triggered a mini financial collapse. Now, with markets expecting the Fed to rapidly continue cutting rates, we may see similar financial stress again.

Back to crypto. This is one of my favorite trades outside of crypto. I hold short-term Treasuries and collect interest. This is the yield on one-month T-bills. Ever since the Fed stopped hiking rates over a year ago, it has hovered around 5.5%.

When you have enough capital earning 5.5%, you don’t need to do much else. Why take risks? Why try to grow your capital when preserving it is already profitable? When people hold substantial assets, they become reluctant to act because they can easily earn money just by holding short-term Treasuries. This mindset creates ripple effects across financial markets, including crypto. Let me ask you: who are the losers when the interest rate environment changes? When T-bill yields fall, the income generated from holding the safest, risk-free assets becomes a critical consideration.

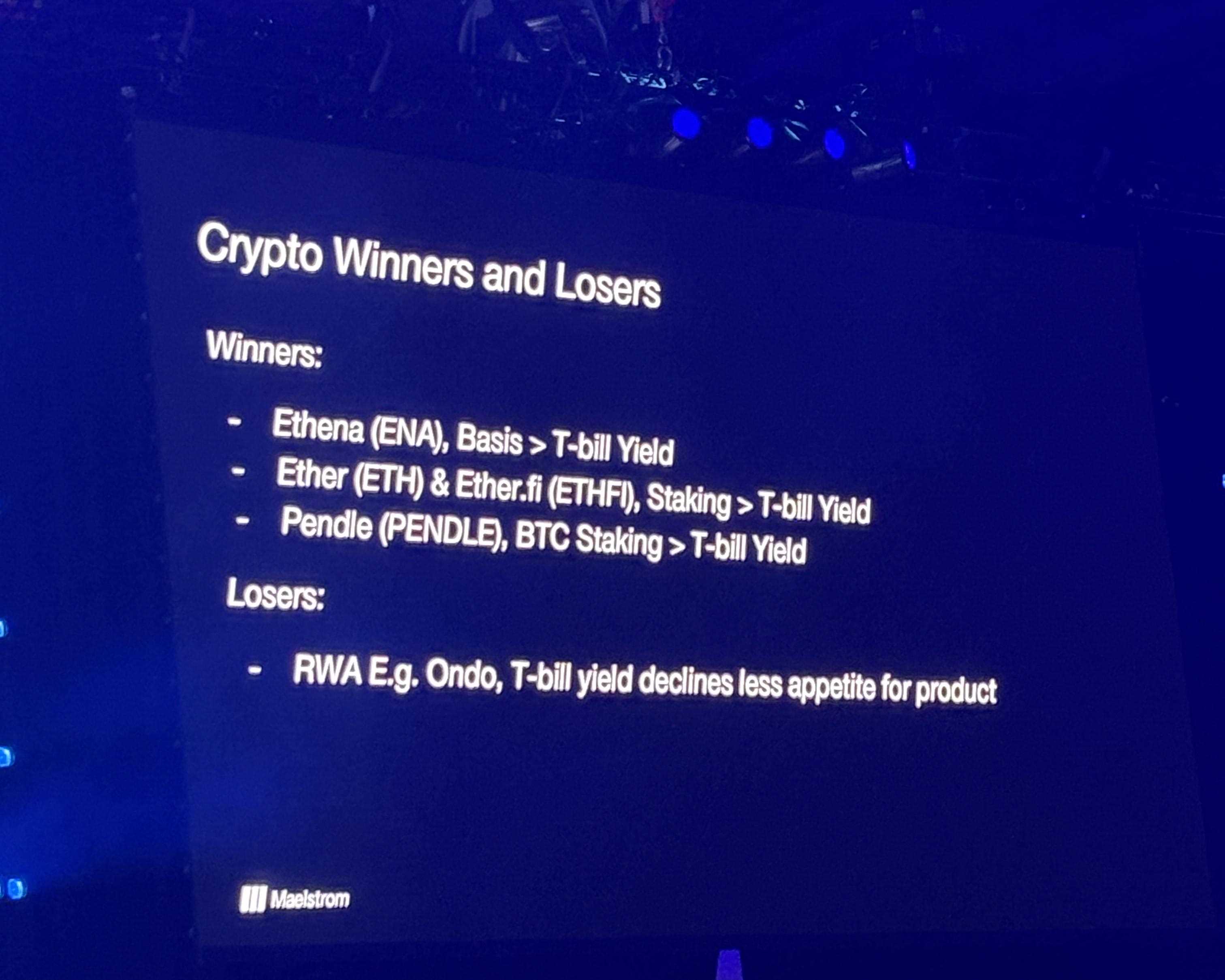

First reaction: comparing five Ethereum-based assets—I should disclose I hold large positions in these. Fortunately, I haven’t invested in any apartments, but ultimately, this portfolio is well-suited for a falling interest rate environment. Essentially, I’ve invested heavily in projects that deliver interest income to users in various forms.

Currently, their yields are either slightly above or below those of short-term T-bills, which puts downward pressure on price performance. After all, why invest in riskier DeFi applications when you can simply call your broker, park your money in T-bills, and earn 5.5%?

Some projects performed exceptionally well in a high-rate environment. I’ll use Ondo as an example here, though there are many other real-world asset (RWA) projects. Their basic model goes like this: “You need to buy Treasuries—we’ll purchase them, place them into a legal structure, and issue you an interest-paying instrument.” These projects were essentially one-way bets on rising and sustained high interest rates. But when rates fall, such products lose their purpose.

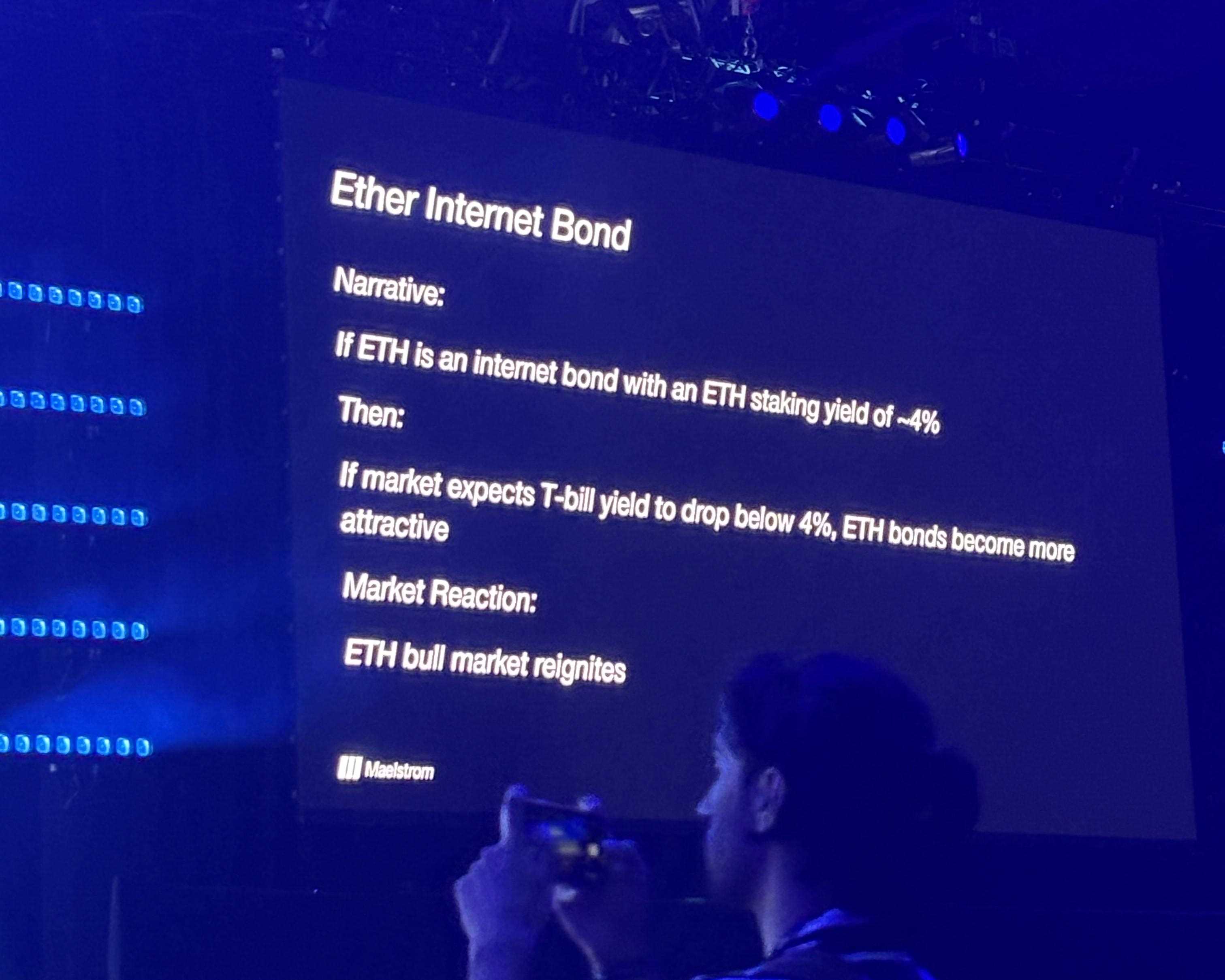

First, Ethereum. Many people hear “Ethereum” and think it hasn’t changed much. The main narrative around ETH is that it’s seen as an “internet bond.” If it offers a 4% annual yield while short-term T-bills offer higher returns, investors will naturally prefer T-bills. But if T-bill yields drop sharply—as I believe they will—then Ethereum becomes more attractive, and the return I get from holding ETH could exceed what I’d earn holding dollars.

As you can see, rates are dropping quickly as the Fed prepares to cut, and markets are falling. Then they’ll say: “Let’s keep doing this—it’s the solution.” Right now, yields are basically flatlining, while Ethereum yields hover between 3% and 4%, which isn’t sufficient for holders. That’s why I’m not holding it.

As evident, during the current bull run, Ethereum has significantly underperformed Bitcoin. With ETH staking (ETHfi), you can stake your Ether, but clearly this strategy has taken a hit. Post-fee staking yields are only around 3%, making returns unappealing. We need Treasury yields to fall faster so that Ethereum’s yield becomes more competitive.

Why is this a problem? Because traders use leverage, and they pay fees for that leverage. This has been going on for years. It’s actually how I got started in crypto—building foundational trades and applying such strategies. It’s relatively simple: put in capital and earn yield. Again, this is risky lending and cannot be compared to the safety of U.S. Treasuries. If you’re a yield-seeking investor and Ethereum doesn’t offer a compelling yield relative to Treasuries, you likely won’t allocate your assets to such protocols.

Here’s a chart comparing Ethena’s yield against Treasuries, using data from earlier this year. It was extremely attractive—yields of 30%, 40%, 50%, even 60% versus 5.5%. I would’ve put my money into that product. But now, actual yields are around 4.5%. As a result, prices have been suppressed because people are asking: why would I put my money into a protocol offering lower yields than Treasuries?

Another topic is interest rate derivatives protocols that allow trading between fixed and floating rates. There’s a newly launched product enabling you to stake crypto and earn fixed income via loan buyer agreements. While the yield is appealing, it comes with certain risks. I don’t think the yield is high enough yet to lure large numbers of investors away from 5.5% T-bill returns. Similarly, if yields fall further, fewer people may be willing to take on this interest rate risk.

Again, you can now earn up to 9% through such strategies. This product launched just weeks ago. That yield is very attractive compared to 4.5%. Even though there are risks—including smart contract risk—many rate-sensitive investors might still find it insufficient. But if I can earn 5.5%, I might consider Pendle. Clearly, it has given back 50% to 60% of its gains, but if yields rise significantly above Treasury levels, it could become highly attractive.

I’ve said before that many crypto projects are actually quite poor. The main reason? Interest rates. I can achieve similar outcomes in simpler, cheaper ways rather than paying premium prices for illiquid tokens. Ultimately, however, these protocols provide valuable services for those without U.S. brokerage accounts or access to traditional investments. In this room, there are many very wealthy individuals. If you go to your private banker, they might recommend something other than Treasuries—because they can’t make much money off Treasuries. Holding Treasuries is extremely low-cost.

These protocols are highly appealing to certain types of investors, especially those seeking easy 5.5% returns. But if we anticipate central banks aggressively cutting rates amid worsening economic conditions or financial crises, then the rationale for putting money into RWA (real-world asset) protocols disappears. Why take on smart contract risk for just 1% or 2% extra yield? Therefore, I believe many TVL (total value locked) projects reliant on high-yield Treasuries will suffer when rates decline. I’ll use Ondo as an example. I pulled its data from the website last night. It has a market cap of $6 million and a very low FDV (fully diluted valuation). You can earn 5.35% in their stablecoin. We expect yields to drop by 25 to 50 basis points now, with further declines likely ahead.

In relative terms, if you examine other charts they’ve published, you’ll notice their tokens are trading below prices seen at launch earlier this year—and I believe this is due to the high-interest-rate environment. Their product makes sense, but as I briefly mentioned, we now have about five minutes left. I want to dive deeper into why I think the more the Fed cuts rates, the more dissatisfied markets will become with what follows next. If there’s one thing I hope you remember tonight, it’s this: when you're drunk at a party, pull out your phone and check the USD/JPY exchange rate. That is the only thing that matters. Because if the Fed suddenly cuts 50 or 75 basis points, you’ll see a very negative reaction in the dollar.

Again, with the Bank of Japan hiking rates while the U.S. Fed cuts, theoretically, exchange rates should reflect this interest rate divergence. Thus, the USD/JPY rate should rise, meaning the nominal price you see on screen should fall. If I expect the central bank to surprise with a sharp rate cut—or if their dot plot (a tool where each official’s future rate expectations are plotted) shows aggressive easing sentiment—we’ll see a strong appreciation in the yen.

What does this mean? The yen carry trade has likely been one of the most widely used strategies over the past three decades. As individual investors, corporations, or central banks, we borrow yen at nearly zero cost—sometimes even free of charge—and invest those borrowed funds into higher-yielding assets.

These assets may include U.S. equities, Nasdaq, S&P 500, real estate, or even U.S. Treasuries. This strategy is estimated to involve up to $20 trillion in global exposure—all from people borrowing yen to invest elsewhere.

If interest rates shift rapidly, your profits can vanish overnight. So your risk manager will tell you to “cover your position.” That means selling assets—liquidating stocks (highly liquid), selling Treasuries (also highly liquid). Japan is the world’s largest creditor nation, so U.S. officials like Powell and Yellen must pay attention. With about 40 to 50 days left until the U.S. election, the last thing they want is Trump gaining momentum while the S&P drops 20%. That’s why I believe they’ll cut rates aggressively. They’ll see the yen appreciating and respond with more monetary supply, which should fuel all the trades I’ve discussed today. So even though I’ve talked a lot about crypto, the key takeaway I want you to remember is: watch the USD/JPY exchange rate. That is the only thing that matters.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News