Singapore, a crypto hub at the crossroads of innovation and regulation

TechFlow Selected TechFlow Selected

Singapore, a crypto hub at the crossroads of innovation and regulation

Singapore's position as a leading cryptocurrency hub in Asia is no accident.

Author: Rick Maeda

Compiled by: TechFlow

Executive Summary

-

While regulatory environments around Web3 remain uncertain across much of the globe, Singapore has long been recognized as a leader in providing clear frameworks for various businesses and asset managers within the industry.

-

In this edition of Presto Research’s Asia Focus series, we analyze the components of the regulatory environment to explore Singapore's appeal to crypto businesses.

-

We conclude our research with insights from Alex Svanevik and Hassen Naas, CEOs of Singapore-based Web3 companies Nansen and Laevitas, who share their perspectives on why Singapore continues to attract cryptocurrency firms.

Figure 1: MAS Headquarters

Source: Presto Research

1. Overview

As the digital asset landscape evolves, the city-state of Singapore has emerged as a beacon for crypto enterprises and projects seeking an Asian foothold. Singapore’s unique combination of regulatory clarity, technological infrastructure, and strategic location makes it a preferred destination for a wide range of Web3 entities—including cryptocurrency exchanges, token issuers, blockchain infrastructure providers, and decentralized finance (DeFi) protocols.

This report serves as a comprehensive guide for crypto entrepreneurs, investors, and established players considering Singapore as an operational base. Our analysis delves into key aspects of Singapore’s crypto ecosystem, examining both the regulatory environment and real-world experiences of businesses operating within it.

Singapore’s approach to crypto regulation is characterized by a careful balance between fostering innovation and mitigating risks. The Monetary Authority of Singapore (MAS), as the primary financial regulator, has established a clear regulatory framework while maintaining flexibility toward the rapidly evolving nature of blockchain technology and digital assets. This report outlines the roles of key institutions such as MAS and the Singapore FinTech Association, and their impact across different segments of the crypto industry.

We examine licensing requirements and regulatory considerations for a broad spectrum of crypto-related businesses, including exchanges, payment service providers, token issuers, crypto funds, custodians, over-the-counter (OTC) desks, blockchain infrastructure providers, DeFi protocols, NFT platforms, and stablecoin issuers. Our analysis highlights the nuanced approach taken by Singaporean regulators, illustrating how different types of digital assets and services are classified and regulated under existing frameworks such as the Payment Services Act (PSA) and the Securities and Futures Act (SFA).

To provide a holistic view of Singapore’s crypto ecosystem, this report incorporates perspectives and experiences from established crypto participants based in the city-state. Through interviews and case studies, we explore the practical realities of running a crypto business in Singapore—covering steps to obtain necessary licenses, navigating compliance obligations, accessing banking services, and leveraging Singapore as a gateway to broader Asian markets.

By combining regulatory analysis with on-the-ground insights, this report aims to equip readers with the knowledge and understanding needed to make informed decisions when establishing or expanding a crypto business in Singapore. As global crypto markets continue to evolve, grasping Singapore’s unique position as a nexus of innovation and regulation is essential for anyone looking to capitalize on the opportunities presented by this dynamic market.

2. Regulatory Bodies and Their Functions

Singapore’s robust and forward-looking regulatory framework has played a crucial role in attracting Web3 founders, protocols, hedge funds, and venture capital firms. The city-state’s approach to digital assets and blockchain technology emphasizes a balance between innovation and risk management. Two primary regulatory bodies oversee the crypto and blockchain sectors:

(1) Monetary Authority of Singapore (MAS)

The Monetary Authority of Singapore is Singapore’s central bank and integrated financial regulator. Its responsibilities include:

-

Licensing and regulating Digital Payment Token (DPT) services under the Payment Services Act (PSA).

-

Overseeing crypto derivatives trading on approved exchanges.

-

Supervising anti-money laundering and counter-terrorism financing (AML/CFT) compliance for crypto businesses.

-

Issuing guidelines on digital token offerings and digital payment token services.

MAS has actively engaged with the industry, regularly updating its regulatory framework to address emerging risks and opportunities in the Web3 space.

(2) Accounting and Corporate Regulatory Authority (ACRA)

While not specific to Web3, ACRA remains relevant for entity formation and corporate compliance:

-

Oversees the registration and regulation of business entities in Singapore.

-

Ensures adherence to corporate governance standards.

-

Maintains company registry information, including those operating in the Web3 sector.

(3) Other Relevant Organizations

-

Singapore FinTech Association: Though not a regulator, the Singapore FinTech Association plays a significant role in the ecosystem:

-

Serves as a bridge between the industry and regulators.

-

Promotes Singapore as a fintech hub and advocates for innovation.

-

Facilitates collaboration between traditional finance and Web3 companies.

-

Provides educational resources and networking events for blockchain and crypto startups.

-

The interaction among these entities creates a comprehensive ecosystem that supports Web3 innovation while preserving Singapore’s reputation for regulatory transparency and financial stability. This balanced approach positions Singapore as a preferred jurisdiction for Web3 founders and enterprises.

Figure 2: Presto Labs’ Singapore Office

Source: Presto Labs

3. Rules and License Types Required for Different Crypto Businesses

Various licensing requirements apply to entities involved in the Web3/crypto industry—we will now explore several business types and their corresponding license obligations.

(1) Payment Service Providers (including Digital Payment Token Exchanges):

-

These businesses are governed by the Payment Services Act (PSA) and must apply for a license from MAS. Two relevant licenses exist:

-

Standard Payment Institution licence (SPI): For smaller-scale operations.

-

Major Payment Institution licence (MPI): For larger operations handling higher transaction volumes. Currently, 28 entities in the digital payment token services category hold MPIs, including companies like Blockchain.com, Circle, and Coinbase.

-

Both licenses require compliance with anti-money laundering/counter-terrorism financing (AML/CFT) regulations, risk management measures, and customer protection safeguards.

(2) Token Issuers

-

The regulatory approach depends on the type of token:

-

Security Tokens: Regulated under the Securities and Futures Act (SFA), requiring a Capital Markets Services (CMS) license.

-

"Utility" Tokens: May not require a specific license, but issuers should assess other potential obligations—for example, if their tokens qualify as digital payment tokens, they may need to comply with relevant provisions under the PSA.

(3) Crypto Funds

-

Depending on their structure and activities, they may require a Capital Markets Services (CMS) license for fund management.

(4) Cryptocurrency Custodians

-

Custody services for digital payment tokens must be licensed under the Payment Services Act (PSA).

-

Must follow MAS guidelines on securing digital assets.

(5) Over-the-Counter (OTC) Desks

-

Depending on the products traded, they may require either a Capital Markets Services (CMS) license for dealing in capital markets products or a Payment Services Act (PSA) license for providing digital payment token services.

-

Must comply with AML/CFT regulations.

(6) Blockchain Infrastructure Providers

-

Typically do not require a specific license unless engaging in regulated activities.

-

Must comply with general commercial laws.

(7) DeFi Protocols

-

Currently operate in a regulatory gray area.

(8) NFT Platforms

-

Licensing may be required depending on the nature of the NFTs traded (e.g., if NFTs are considered securities) or whether the platform offers fiat-to-DPT on/off ramps.

-

If financial transactions are involved, AML/CFT regulations must be followed.

(9) Stablecoin Issuers

-

Subject to MAS’s stablecoin regulatory framework implemented in August 2023.

-

Single-currency stablecoins (SCS) pegged to the Singapore dollar or G10 currencies issued in Singapore will fall under MAS’s stablecoin regime. Other stablecoins will continue to be regulated under the existing Payment Services Act (PSA).

-

Under the MAS stablecoin regime, SCS issuers must meet specific reserve backing, redemption, and disclosure requirements.

Other Key Considerations

-

All entities must register with the Accounting and Corporate Regulatory Authority (ACRA) and comply with relevant corporate laws.

-

AML/CFT compliance is mandatory across all categories.

-

Foreign entities may need to establish a local presence to obtain licenses.

-

The regulatory environment is continuously evolving. MAS regularly updates guidelines and introduces new frameworks. This overview provides a snapshot of the current landscape but does not constitute legal advice. Given the fast pace of development in the crypto space, it is critical for businesses to engage directly with MAS and/or seek legal counsel to ensure compliance with the latest requirements.

4. Beyond Regulation: Why Singapore Remains Attractive in the Web3 Space

As discussed in previous sections, the relatively mature regulatory environment provides clear guidance for a wide array of crypto industry participants. However, Singapore’s advantages extend beyond regulation: its long-standing reputation as an expatriate hub, world-class education system, national safety, family-friendly infrastructure, and strategic location are non-crypto-specific factors that make the city-state an ideal base for founders. We now turn to two founders to hear about their decisions to establish their companies in Singapore.

Alex Svanevik, Nansen

Nansen is a leading on-chain analytics firm headquartered in Singapore. Co-founder and CEO Alex Svanevik shares his reasons for choosing Singapore:

Singapore is where East meets West, the private sector meets the public sector, and finance meets technology. It is one of the few countries in the world that was run for decades—until relatively recently—as a “founder-led” nation under Lee Kuan Yew. Today, it remains governed by one of the most capable administrations globally. For these reasons, I believe it is an ideal place to build a business.

This embrace of global talent has long been a cornerstone of Singapore’s economic strategy, significantly enhancing its appeal to entrepreneurs and businesses, including those in Web3.

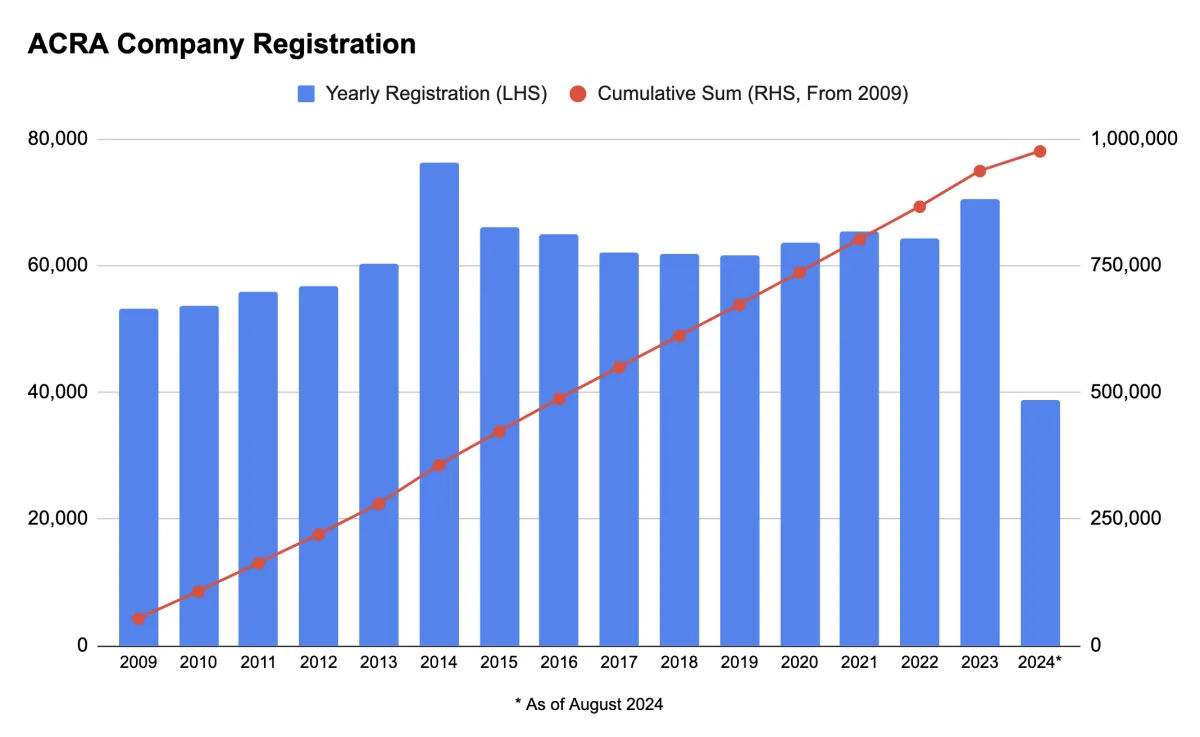

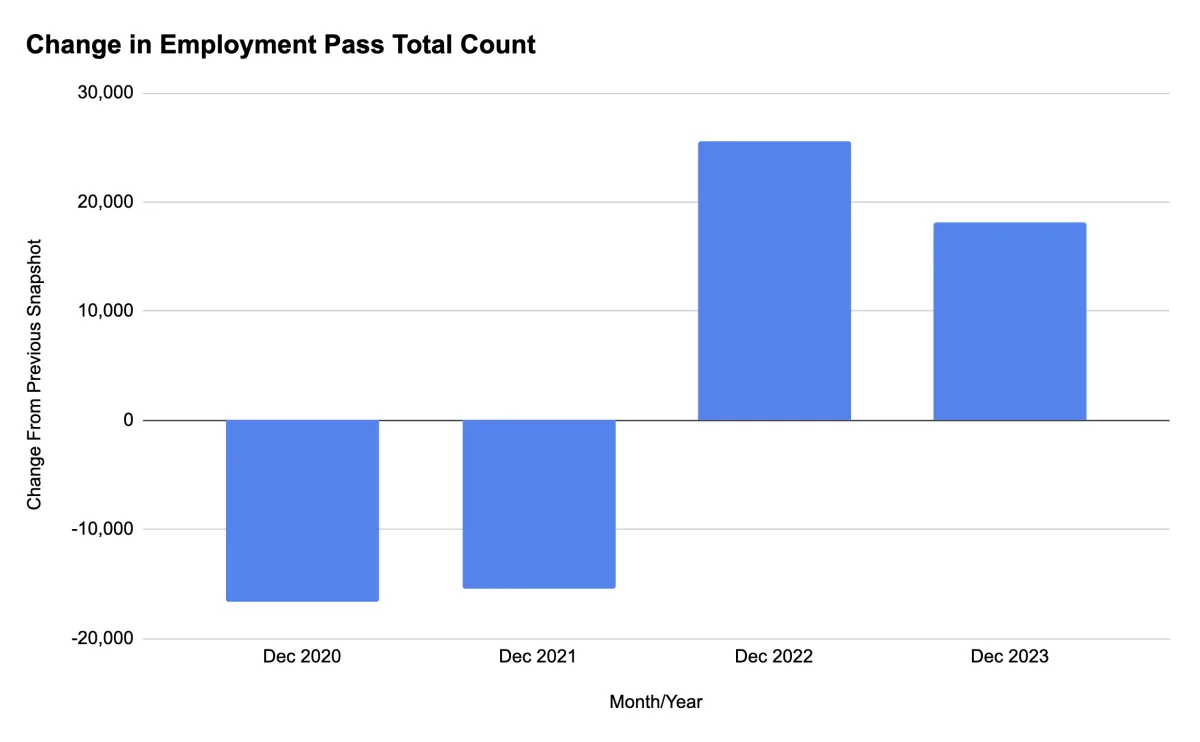

Singapore’s attractiveness as a business hub is not merely anecdotal. Data from the Accounting and Corporate Regulatory Authority (ACRA) shows steady growth in company registrations (Figure 3), while figures from the Ministry of Manpower (MOM) indicate a strong rebound in Employment Pass (EP) issuance post-pandemic (Figure 4):

Figure 3: Continued Growth in Number of Registered Companies in Singapore

Source: ACRA data from data.gov.sg

Figure 4: Strong Rebound in Employment Pass (EP) Numbers After Initial Pandemic Decline

Source: Ministry of Manpower (MoM)

Hassen Naas, Laevitas

Laevitas is a quantitative analytics firm specializing in crypto derivatives. As founder and CEO, Hassen offers unique insights, having relocated his company’s headquarters to Singapore.

The decision to move our company headquarters was not made lightly, especially for a Web3 company, given the skepticism the industry often faces in many jurisdictions. I believe this self-reinforcing dynamic strengthens Singapore’s position as a hub for tech startups—and now also for Web3: companies relocate here due to clear regulations, high quality of life, thriving financial and tech industries, access to skilled talent, and favorable tax policies. This encourages regulators and the government to provide even clearer rules and business frameworks, which in turn attracts more companies, prompting further improvements from regulators.

Singapore hosts a vast network of enterprises and funds, both crypto-native and traditional. Since relocating, we’ve experienced all the anticipated benefits—and more. With several new developments underway, such as market structure enhancements, order book imbalance detection, and time-weighted average price (TWAP) alert systems, we are proud to continue building in Singapore.

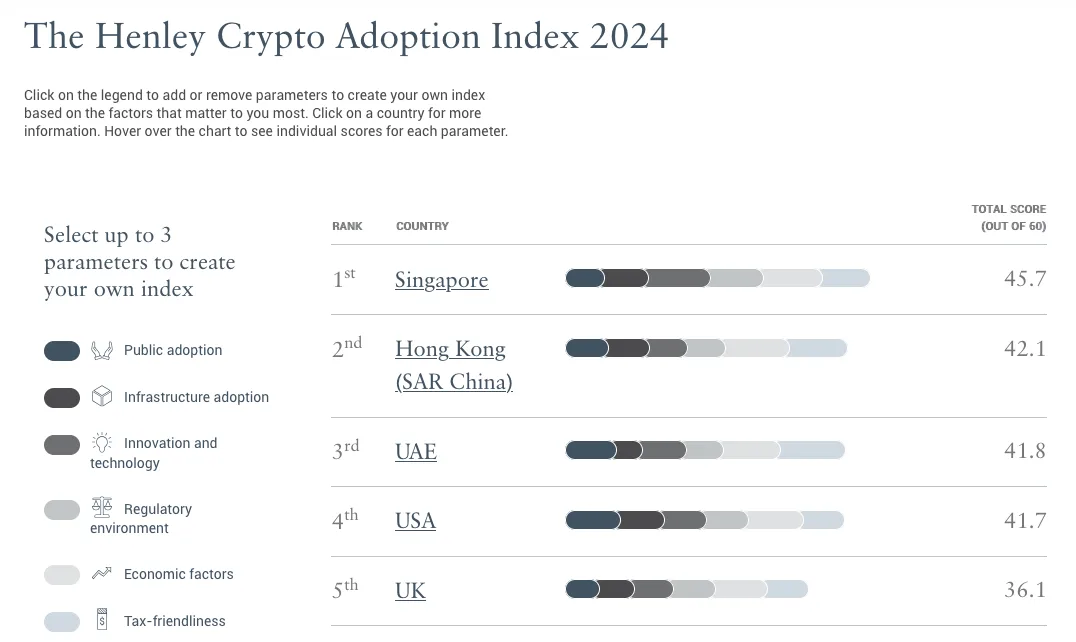

It’s no surprise then that Hassen points to a supportive regulatory environment driving high crypto adoption. According to a recent report by investment migration consultancy Henley & Partners, Singapore ranks first globally in overall cryptocurrency adoption (Figure 5). Henley highlighted strong regulatory frameworks, innovation and technology, and sound governance as key factors propelling the city-state to the top of the 2024 rankings.

Figure 5: Singapore Leads in Overall Cryptocurrency Adoption

Source: Henley & Partners

5. Conclusion

Singapore’s status as a leading cryptocurrency hub in Asia is no accident. The city-state has deliberately cultivated an environment where innovation and regulation coexist, creating fertile ground for Web3 businesses to thrive. The clear regulatory framework provided by the Monetary Authority of Singapore (MAS), combined with strategic location, world-class infrastructure, and pro-business policies, continues to draw founders and companies from around the globe.

As the crypto industry evolves, Singapore’s adaptive regulatory approach helps maintain its competitive edge. Testimonials from industry leaders like Alex Svanevik and Hassen Naas underscore the tangible benefits of operating within this ecosystem. While challenges remain, particularly in emerging areas like decentralized finance (DeFi), Singapore’s strong track record suggests it will continue refining its approach, balancing innovation with prudent risk management.

For entrepreneurs and established industry players alike, Singapore offers a unique blend of Eastern and Western influences, financial sophistication, and technological expertise. As the global cryptocurrency landscape continues to shift, Singapore’s role as a beacon of stability and innovation in the Web3 space appears set to grow even more prominent.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News