Another Token2049: Cultural Shifts Behind the Crypto Frenzy

TechFlow Selected TechFlow Selected

Another Token2049: Cultural Shifts Behind the Crypto Frenzy

In Singapore, the crypto industry is rekindling hope, with young investors looking ahead optimistically.

Author: Teo Kai Xiang

Translation: TechFlow

In 2024, Singapore hosted Token2049, the world's largest crypto conference, attracting a large number of participants.

Photo source: Token2049

Key Takeaways

In 2022, the cryptocurrency industry experienced multiple collapses, including FTX and Three Arrows Capital, but the subculture surrounding crypto is now reviving.

Crypto culture blends idealism with opportunism, attracting young, tech-savvy individuals, yet it remains rife with fraud and scams.

With increasing regulation and growing institutional interest, cryptocurrencies are gradually gaining legitimacy, drawing talent from traditional finance and technology sectors. However, some insiders worry this may cause the industry to lose its original core spirit.

Singapore—if you ask anyone working in or investing in crypto about the industry outlook in 2022, they might purse their lips and fall silent for a moment.

That year, the crypto industry faced a series of headline-shaking collapses. At the time, one of the world’s largest cryptocurrency exchanges, FTX, filed for bankruptcy; Singapore-based crypto hedge fund Three Arrows Capital collapsed, owing creditors over $3 billion (about S$3.85 billion). The value of cryptocurrencies TerraUSD and Luna plummeted, wiping out $45 billion in market capitalization.

Cryptocurrency prices plunged, layoffs swept across the sector, and many observers predicted a long crypto winter was coming.

Three years later, the industry mood has shifted.

Spurred by U.S. President Trump’s favorable crypto policies and gradual adoption of digital assets by major financial institutions such as Goldman Sachs, BlackRock, and DBS Bank of Singapore, Bitcoin surged to record highs, breaking the $100,000 mark and peaking at $140,000 in January this year.

The world’s largest crypto event, Token2049, is expected to draw 25,000 attendees to Singapore in October.

In 2022, when Token2049 was first held in Singapore, it attracted around 7,000 attendees and occupied just one level of the Marina Bay Sands Expo and Convention Centre.

By 2025, the conference will expand to five levels, reflecting the rapid growth and rising influence of the crypto industry.

The crypto community is making a strong comeback. Among 15 people interviewed by ST, the overall sentiment was optimistic, even celebratory.

"After Trump’s election, the crypto industry has been on a roll," said 29-year-old Kaushik Swaminathan, strategy lead at Web3 security firm Zellic. Web3 is the industry term for describing the next generation of the internet powered by blockchain technology.

"When prices go up, people feel rich. And when people feel rich, they do extravagant things," said the Yale-NUS College graduate. "While the broader tech market may be contracting or slowing hiring, the crypto industry seems to be doing the opposite."

He referenced EthCC, a recent crypto conference in Cannes that drew 6,400 attendees. The southern French city, known for attracting the wealthy and celebrities, was effectively “taken over” by “crypto people” in June, with events held on yachts, in castles, and at Michelin-starred restaurants.

"If you’re attending a 'business meeting' on France’s Côte d’Azur in summer, things probably aren’t too bad," he remarked. "Crypto confidence never really disappeared, and when Bitcoin trades above $100,000, people are more willing to engage in these lavish activities."

In 2024, Token2049’s event in Singapore attracted over 20,000 participants.

Photo source: TOKEN2049

Crypto bro culture—born from internet memes mocking central banks and idealistic anti-establishment visions of decentralized finance—is increasingly permeating the mainstream.

Despite enduring constant scandals, it is now winning support from fresh graduates who once aspired to work in traditional finance or big tech.

Anti-Establishment Wave

The crypto industry mixes idealism with opportunism, giving rise to a unique “anti-establishment” culture distinct from traditional tech and finance.

Imran Mohamad, a 41-year-old Singaporean crypto enthusiast, recalled that in 2010, an enthusiastic entrepreneur gave him a USB drive containing Bitcoin. At the time, Bitcoin was an obscure technology discussed only in niche online forums, valued at just a few cents.

"I don’t know where that USB ended up," said Imran, now head of marketing for Asia-Pacific at blockchain company Move Industries. "If I had foresight back then, maybe I wouldn't need to be interviewed by you today."

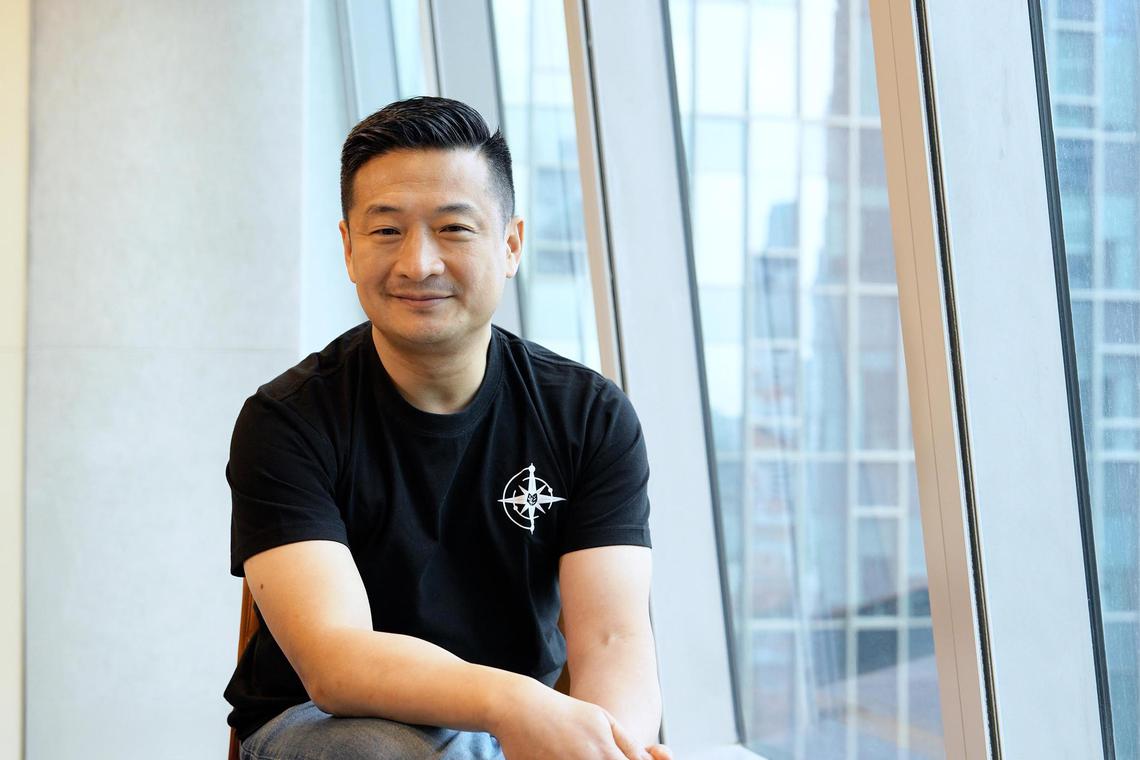

Imran Mohamad’s crypto career has witnessed multiple boom-and-bust cycles in the industry.

Photo source: Provided by Imran Mohamad

His intermittent relationship with crypto since then reflects the industry’s recurring cycles of boom and bust. During the 2017 initial coin offering (ICO) frenzy, he ran a marketing firm serving crypto clients.

"For most of these companies, nothing ever truly materialized," said the National University of Singapore (NUS) Business School graduate. "The real winners were those minting tokens—who then vanished without a trace."

These public online sales were driven by social media hype and centered on whitepapers explaining how proceeds would develop a “hot new token,” along with projected returns for early investors.

After having to threaten legal action against some crypto clients for non-payment of fees, he grew disillusioned with the industry. He returned to crypto in 2022 as head of marketing at exchange Kyber Network—until it was hacked, losing over $50 million in assets. Although Kyber eventually repaid creditors, he noted these investors still missed out on potential gains.

Such experiences are common in crypto, where professionals often harbor complex “fear of missing out” (FOMO) emotions, remaining deeply optimistic despite accepting malicious behavior as normal.

Unlike traditional industries, crypto professionals typically don’t introduce themselves via LinkedIn or business cards. Instead, they prefer communicating through Telegram and X (formerly Twitter), or building connections at events that blur work and leisure.

Mr. Aneirin Flynn (pictured left, taken at startup competition Meet The Drapers) chose to skip university and enter the workforce directly.

Photo source: Failsafe

Young Singaporeans like 31-year-old Aneirin Flynn exemplify this subculture’s freewheeling style. As CEO and founder of a crypto cybersecurity startup, he hired an engineer who previously hacked his company by discovering a code vulnerability.

In crypto, many operate anonymously, avoiding real names or photos due to fears of doxxing or hacking.

"He didn’t want to reveal his real name or where he was from at the time," Flynn recalled, later learning the hacker was from Egypt. After months of collaboration and trust-building, the hacker proved to be a "good guy."

He added: "Now, he’s a pillar of our team—a burly man with a thick beard, a father, and one of the friendliest people I’ve ever met."

Still, he admitted: "But there’s always a chance he could’ve been a bad guy."

Flynn’s own company, FailSafe, was inspired by a hack in 2022 when he lost about $20,000—likely because he trusted the wrong developer. After earning A-level certificates at Victoria Junior College, he dropped out of university to join a startup.

He noted that while Web3 advocates an idealistic, “trustless” future internet without central authority, the reality is “it means you’re on your own.”

Given widespread fraud, face-to-face interactions have become increasingly important for crypto workers like Flynn.

While others prefer networking at events around the annual Token2049 conference, he favors activities that involve “sweating together and seeing how we operate under pressure” to build relationships.

Token2049’s multicultural vibe features meme-filled, casual atmospheres.

Photo source: Token2049

Token2049 embodies the crypto industry’s multiculturalism. This Singapore-hosted event has drawn speakers from diverse fields, including Vitalik Buterin, co-founder of Ethereum from Canada; British Formula 1 driver Lando Norris; American whistleblower Edward Snowden; and Australian rapper Iggy Azalea.

Industry insiders say the real action doesn’t happen on conference stages, but at peripheral events like exclusive social gatherings and parties. On the exhibition floor, attendees can experience ice baths or ride mechanical bulls, just meters away from panel discussions.

Resistance Money

Meme culture dominates the annual Token2049 conference. 'Hodl' (hold onto coins) is a slogan encouraging crypto investors to hold their assets during turbulent times.

Photo source: TOKEN2049

The roots of crypto’s countercultural energy lie at the intersection of fringe internet communities, technology, and finance.

"Cryptocurrency is fundamentally a rejection of financial institutions and central banks," said Dr. Andrew Bailey, a philosophy professor at the National University of Singapore and author of *Resistance Money* (2024). "People drawn to this idea often also distrust other types of institutions and norms."

Modern cryptocurrency concepts emerged after the 2008 financial crisis, when libertarians, anarchists, and some criminals sought decentralized alternatives to a financial system they believed no longer served them.

Different generations enter crypto in different ways. Early adopters were often computer programmers exposed via fringe internet communities or online black markets. Later adopters, like Gen Z and younger millennials, often encounter crypto through viral internet memes or influencers promoting new paths to success.

Dr. Bailey says disillusionment is a shared bond.

Many embracing this subculture believe they’ve discovered a domain where they can get ahead and achieve short-term windfalls.

"I don’t want to downplay people’s desire to succeed in a world they perceive as unfair," he said. "The 18- to 24-year-olds I’ve spoken with have a strong sense of this. I’d say they feel it more intensely now than their peers did five to ten years ago."

The result is a subculture dominated by young, male, tech-savvy individuals dissatisfied with or disenfranchised by financial institutions.

Like the tech industry, crypto remains male-dominated.

Photo source: TOKEN2049

Mr. Jeremy Tan, 34, exemplifies shifting public attitudes toward crypto. A Nanyang Technological University business graduate, he ran as an independent candidate in Mountbatten SMC during the 2025 elections, advocating government adoption of Bitcoin as a reserve currency.

Mr. Tan said the post-2008 financial crisis spawned a new counterculture, with movements like “Eat the Rich” and “Occupy Wall Street” sparking his interest in Bitcoin—driven by his impoverished upbringing and desire for assets that don’t depreciate over time.

"Now, we’re seeing similar movements," he said, noting comparable economic discontent is fueling Singaporeans’ interest in crypto. "Our generation’s 'Occupy Wall Street' will be AI and youth unemployment."

This view is echoed by other crypto enthusiasts and advocates. Some complain about being excluded from the “high-net-worth club,” call the current financial system “unfair,” and praise crypto’s potential to level the playing field by creating a space without established experts.

Yet, Web3’s decentralization ideals don’t mean the crypto subculture can self-regulate or share a consistent ideology.

Although crypto was initially envisioned as a “superior” alternative to centralized finance, most interviewees see growing interest from regulators and banks as a positive sign.

Mr. Tan also weighs in on this ideological tension: "The original ideology was that money is being devalued, and we need 'resistance money' to fight governments."

"I think the original ideology is now meeting its evolved form, because stablecoins and Bitcoin enable a revolution—ultimately relying on technology and math instead of flawed fiscal planning."

No Different From 'The Wolf Of Wall Street'

Celebration party at Token2049 Singapore 2024.

Photo source: TOKEN2049

This anti-establishment atmosphere is exactly what many in the crypto industry are eager to move beyond.

Nearly all industry insiders interviewed by ST tried to downplay links between the industry and lavish lifestyles or global travel, instead emphasizing the sector’s “maturation” since 2017.

Joash Lee, a 22-year-old Columbia University student, invests in Web3 and AI startups through Iron Key Capital, a funding pool focused on startup investments.

He said while it’s not uncommon for crypto firms or conferences to rent yachts and nightclubs, such displays are relatively restrained compared to the “free money” era before 2022, when slapping “Web3” on a business plan would trigger a flood of venture capital for seed rounds.

Others say crypto’s “immaturity” lends itself to such lifestyles—splurging on models and influencers joining teams, and designing clothes and hosting parties based on obscure internet memes.

Dr. Loretta Chen (pictured at Token2049 event) believes crypto excesses signal the industry’s immaturity.

Photo source: SMOBLER

Dr. Loretta Chen, 48, founder and CEO of local Web3 startup Smobler, said: "When the concept of cryptocurrency was introduced, it was embraced by the younger generation and digital natives."

"When you're young and suddenly have so much money, you say, 'Wow, let's throw a party,' right?"

Current conditions are often compared to the excesses of Wall Street in the 1980s—as depicted in the 2013 film *The Wolf of Wall Street*—before regulations imposed discipline.

In 2024, Ms. Soh Wan Wei (right) posed with Hide the Pain Harold (a popular internet meme) at an ARC Community gathering. ARC members bought Memeland tokens early.

Photo source: SOH WAN WEI provided

Another prominent example of the industry embracing party culture is the private members’ club ARC Community, known for its lavish annual parties hosted by its Singaporean co-founders, including singer JJ Lin and influencer Elroy Cheo.

Membership requires owning its non-fungible token (NFT), a digital asset currently listed for sale at $4,000 and above on OpenSea.

Members could pre-purchase Memecoin, a cryptocurrency created by internet culture site 9GAG, whose founder is also an ARC member. In 2024, they gathered for a meme-filled celebration featuring guests like Memecoin ambassador Hide the Pain Harold. Since then, Memecoin’s value has sharply declined.

Jaclyn Lee, brand lead at ARC Community, declined to discuss the club’s parties or members’ lifestyles and social habits.

She said: "We try to avoid these angles because they further reinforce the perception that Web3 isn’t formal or legitimate enough."

This sensitivity to external perceptions explains why the crypto industry increasingly avoids discussing lavish parties and founders’ high-end lifestyles, preferring magazine profiles about founders’ stories and their love for the technology to rebrand itself.

Chasing the 'Rug Pull'

Crypto insiders are trying to downplay associations with lavish parties and global travel.

Photo source: TOKEN2049

Dr. Li Xiaofan, assistant professor at the National University of Singapore researching cryptocurrency and cybersecurity, noted that the underlying technology remains in early stages—meaning excessive speculation persists despite some practical applications.

Dr. Li recalled past students inspired to intern or pursue careers in crypto, only to end up disappointed.

He said: "They thought they’d be doing system design or technical improvements in certain areas, but found it was more like sales work. Acquiring clients and funds mattered far more than developing technology."

The lack of crypto regulation in many regions means the allure of short-term gains—often exploiting information asymmetry among investors—is hard to resist.

The 2017 ICO bubble resulted from public influx into crypto, many acting out of fear of missing early investment opportunities like Apple or Google. Unlike IPOs, crypto asset investments aren’t mitigated by financial reporting and audits, leaving investors operating in a fog of war.

This includes scams and other activities such as insiders profiting at others’ expense, exaggerating actual blockchain ties of products, and building ecosystems to promote more crypto activity.

"People drawn to this industry do have certain traits," observed Dr. Li. "In my view, this may delay the industry’s development for long-term benefit."

Experts say hype and speculation drive the industry’s focus on quick profits rather than long-term value creation.

Photo source: TOKEN2049

"The way to make money in crypto is to imagine it as a waterfall made of shit," summarized Dr. Bailey, capturing a worldview widely held in crypto circles. "Either the shit falls on you, or you’re standing higher up, safe, dumping shit on others."

This normalization of malicious behavior resonates with many in the industry.

For instance, one marketing professional sees the “extremely high failure rate” as no different from that of tech startups. Another, when asked about feelings following the high-profile 2022 market crash, said: "It’s normal to go through such things," and the joy of being in a nascent industry outweighs these regrets.

The “zero-sum game” notion—that one’s gain means another’s loss—is common industry parlance.

"It’s PvP (player versus player), not PvE (player versus environment)," added Dr. Bailey, borrowing gaming terms to describe competitive rather than cooperative behavior among crypto users. "If you’re taking something out, someone else is putting that money in."

Kaushik Swaminathan, a Yale-NUS College graduate, said his mindset has become more transactional since entering the crypto industry in 2021.

Photo source: Provided by Kaushik Swaminathan

As Mr. Swaminathan observed: "When people lose money in crypto, they’re upset; when they profit, they’re excited. No one really cares about scandals—only that scandals lead to losses. To survive in crypto, you need thick skin, and those with thick skin tend to be numb to outside noise."

What unsettles him is how, since entering crypto in 2021, his thinking has gradually become more “transactional.”

"It’s not something I like," he said. "Once you fall into the crypto black hole, money becomes the currency or language of all interactions."

This also means that when someone pitches him an idea at a conference, his default mindset is suspicion about being exploited. He explained: "People often say, 'I don’t want to be your exit liquidity,' meaning 'I don’t want to be the one you dump your assets on.'"

'Cult'

Ms. Soh Wan Wei, 37, who has worked and invested in crypto since 2017, holds a harsher view, saying she dislikes the prevalent “do whatever I want” culture in the space.

Ms. Soh Wan Wei (pictured speaking at a fintech event) says money is distorting ethical values among crypto professionals.

Photo source: SIBOS

She said: "People from Binance went to jail, and came out worshipped like gods." She referred to Changpeng Zhao, former CEO of cryptocurrency exchange Binance, sentenced to four months in prison in 2024 for money laundering.

She added: "If someone’s net worth suddenly grows 1,000-fold, they’re treated like a deity. This phenomenon is very cult-like."

She noted that wealth seems equated with morality in crypto. She recalled crypto figures boasting photos of themselves in castles and helicopters. To network, she would “clap and say, ‘Great, happy for you.’”

Nonetheless, she admits the volatility of crypto carries an addictive quality. Despite risks of “rug pulls” (founders fleeing with investor funds) and sharp asset declines, the adrenaline rush from a successful bet remains compelling.

"It feels like buying Labubus (a popular blind box toy series by Pop Mart)."

Today, she prefers staying away from crypto conferences. "The barrier to entry is too low," she added. "Anyone can get rich just by buying Bitcoin."

This volatility further intensifies ideological fervor within the crypto subculture while weeding out those lacking resilience or conviction after high-profile collapses.

Mr. Brian Chan joined Web3 software firm Animoca Brands in 2022, weeks before witnessing the fallout from the collapse of crypto Luna and the subsequent spiral of FTX, marking the onset of a bear market.

Mr. Chan said: "Crypto’s volatility is a feature, not a bug." As deputy CEO at Animoca Brands, shuttling between Hong Kong and Singapore, he oversees development of Anichess, a blockchain chess game in partnership with chess.com.

Mr. Chan observed that this volatility eliminates people not just within Animoca Brands but across the industry

Industry uncertainty also affects how hiring managers screen candidates.

"When hiring, we really look at culture and values," said Mr. Chan. "When I recruit for my team, I care less about their résumés and more about what they’ve actually done in crypto. That tells you whether they’ll stick with the industry long-term, whether they’re true believers or just chasing profits."

This emphasis on unconventional metrics is part of what attracts young, ambitious talent to crypto, especially compared to traditional finance, which prioritizes elite university credentials.

Still, Mr. Chan noted the current wave of interest in crypto differs. Past growth cycles were driven by “hype and sell-off frenzies,” while 2025 sees more professionals in suits bringing new legitimacy to the field.

Is Singapore Becoming the Crypto Capital?

OKX’s Singapore office is located at Marina Bay Financial Centre. The company has over 900 employees in Singapore.

Photo: OKX Singapore

While the global crypto bro culture is resurgent, industry insiders are divided on whether Singapore can become the center of the crypto world. Local regulatory policies present a complex picture.

In June this year, the Monetary Authority of Singapore (MAS) tightened rules, requiring crypto service providers serving overseas clients to obtain licenses. Previously, only providers serving Singaporean clients needed licensing.

Other restrictions include banning crypto firms from advertising services in Singapore and requiring providers to conduct customer due diligence and report suspicious transactions.

Experts told ST that several issues hinder effective crypto regulation: lack of audit tools to ensure smart contracts (computer programs running on blockchains) function securely, rampant cybercrime, anonymity, ease of market manipulation, and in many cases, absence of accountable governing bodies.

"Despite the immense potential of blockchain and cryptocurrency, regulators must confront these complex challenges," said Dr. Daniel Rabetti, assistant professor at NUS Business School.

He added that asset tokenization remains a promising application of the technology—representing real-world assets as digital tokens, thus opening traditionally illiquid markets and promoting greater financial inclusion.

Industry insiders say the recent trend toward institutionalization in crypto has driven some people away—those inclined to operate in gray areas or who reject compliance and monitoring requirements.

On August 1, Singapore police and MAS announced that local crypto exchange Tokenize Xchange is under investigation. A director of its parent company has also been charged with fraudulent trading. Previously, the company said it had ceased operations in Singapore and planned to relocate to Malaysia.

In June, Bloomberg reported unlicensed exchanges like Bitget and Bybit are planning to shift their existing Singapore operations to Dubai and Hong Kong.

Meanwhile, due to the highly remote nature of the crypto industry, many employees working for unlicensed exchanges like Binance still choose to live and work in Singapore, even though these platforms cannot serve Singaporean customers.

Regulation isn’t the only factor affecting crypto’s development. Some argue that crypto’s emphasis on decentralization and breaking traditions clashes with Singapore’s focus on centralization and stability.

Some privately note that crypto professionals often embrace unconventional lifestyles difficult to sustain in relatively conservative Singapore—such as the leadership’s “communal living” and “polyamory” (having multiple partners), which gained attention during the FTX collapse.

In fact, the size and density of Singapore’s crypto scene mean almost everyone knows each other, creating an atmosphere more like a “village” or “secondary school” than a growing hub—especially outside conference seasons. This also means gossip spreads fast, and people easily form “closed-loop” relationships.

Dr. Loretta Chen (right) believes Singapore’s crypto regulations allow local firms to promote compliance as a competitive advantage.

Photo source: SMOBLER

Despite challenges, crypto enthusiasts like Dr. Chen remain optimistic about Singapore’s future. She believes Singapore’s reputation for safety and strong regulatory frameworks naturally makes it an ideal hub for “exceptionally smart talent” and high-net-worth individuals.

She specifically mentioned that whenever Ethereum co-founder Vitalik Buterin visits Singapore, he needs no security detail and can use public transport—a rarity among other crypto hubs.

Unable to display this content outside Feishu Docs

Dr. Chen said founding companies in Singapore fosters different business models. She noted Smobler resists temptations of “sh**coins and memecoins” for short-term gains, diversifying into AI and virtual reality.

"The technology genuinely supports these areas, and many are rushing in, but we won’t," she added, noting that close cooperation with financial institutions and regulators demands a long-term orientation.

"Regulation is like training wheels and guardrails," said Mr. Swaminathan. "We can’t stay unruly 'cowboys' forever."

Putting On Suits

As regulators and financial institutions worldwide increasingly engage with crypto professionals, the sector is gaining stronger legitimacy. This trend is attracting more talent who might otherwise have entered traditional finance or consulting.

Crypto enthusiasts like Mr. Tan point out that as banks and family offices increasingly discuss crypto and host related events, this shift is pushing the industry away from its original crypto bro Twitter culture.

Mr. Hassan Ahmed (top right, with Coinbase Singapore team) says the company is seeing a surge in job applicants.

Photo source: Coinbase

Hassan Ahmed, head of Coinbase Singapore, said regulatory uncertainty prior to 2025 deterred not only businesses and capital allocators but also job seekers. He noted: "Maybe I wouldn’t plan my career in an industry that might be forced overseas."

Currently, Coinbase has about 100 employees in Singapore, and Mr. Ahmed said the company is experiencing record job applications.

Likewise, Gracie Lin, CEO of crypto exchange OKX Singapore and 43 years old, said interest from job seekers has surged at her 900-employee company. Applications in the first half of 2025 were triple those in the same period of 2024.

This interest comes not only from “Web3 natives” but also seasoned professionals from traditional tech and finance, as well as fresh graduates.

Ms. Lin said: "The entire industry seems to have entered a more confident 'post-winter' phase, and regulatory clarity in Singapore and other key markets has undoubtedly fueled this momentum."

This shift is also evident at events like Token2049.

Mr. Chua Ee Chien, business director of Token2049, says the conference is attracting increasing institutional attention from outside the crypto space.

Photo source: TOKEN2049

Mr. Chua Ee Chien, 37, business director of Token2049, said four years ago all speakers were from crypto, but now the event draws speakers from BlackRock and Goldman Sachs.

Attendees say this sometimes creates a puzzling cultural mix: suited bankers and regulators holding roundtable discussions on one side, while men in T-shirts and shorts pass women in revealing costumes or jump into ice baths on the other.

"I sit here thinking, this is exactly why crypto hasn’t gained broader institutional adoption," said Mr. Flynn. "But this contradiction is also attractive—it’s what draws people like me to the industry."

Mr. Eddie Hui, 50, is one such person who transitioned from traditional finance to crypto. After 23 years at Société Générale in France, he moved to Singapore in 2022 to join MetaComp.

MetaComp is a digital payment solutions provider, offering cross-border payment infrastructure powered by stablecoins—cryptocurrencies typically pegged to existing currencies like the U.S. dollar.

"Until recently, if you mentioned digital assets, people might not even know what you meant," he said. "If you mentioned crypto, they’d say it was a scam. But with the Genius Act, it’s brought significant legitimacy to the space."

The Genius Act is a U.S. federal law aimed at establishing a comprehensive regulatory framework for stablecoins, signed into law by President Trump in July.

Dr. Emiliano Pagnotta, associate professor of finance at Singapore Management University, noted that stablecoins have become a primary application of crypto. In 2024, on-chain stablecoin settlement volume exceeded $15 trillion, surpassing Visa and Mastercard transaction volumes.

"Despite this growth, regulatory ambiguity remains a barrier to wider adoption. That changed recently with the U.S. passing the Genius Act," he said.

Dr. Pagnotta added that Bitcoin has also become a household name, with a market cap second only to gold and the top six U.S. companies (Nvidia, Microsoft, Apple, Amazon, Alphabet/Google, and Meta). Since the launch of U.S. spot Bitcoin exchange-traded products in 2024, integration with traditional finance has accelerated, attracting over $54 billion in inflows.

"In 2025, a notable trend has emerged: corporations are acquiring Bitcoin as treasury reserves," he said. "Overall, given ongoing global concerns about fiat depreciation, geopolitical instability, and erosion of property rights, this momentum is unlikely to fade."

Meanwhile, Dr. Christian Hofmann, associate professor at NUS Faculty of Law, said even central banks are now exploring similar technologies.

"Particularly noteworthy is the concept of wholesale central bank digital currencies (CBDCs)—a tokenized form of central bank money," said Dr. Hofmann. "Especially in cross-border transactions, such CBDCs could facilitate payments across jurisdictions and reduce reliance on existing private-sector intermediaries, particularly correspondent banking networks."

Mr. Eddie Hui’s move from banking to crypto exemplifies the industry’s growing institutionalization.

Photo source: MetaComp

For Mr. Eddie Hui, a lifelong banker, transitioning to crypto wasn’t painless. One challenge was the constant need to educate and explain products when dealing with traditional financial institutions.

"I never thought my field of work would be questioned," he said. "You have to do a lot of education to help people understand what you’re trying to do."

He added: "It’s very different from banking, where anyone entering the field has studied finance at some point. In crypto or digital finance, you can’t just say, 'Find me a candidate with over 10 years of experience'—while such professionals exist, they’re harder to find."

Still, Mr. Hui acknowledged many senior staff at his company come from traditional finance backgrounds. "All the experience and knowledge we accumulated in traditional finance—we’re trying to apply it to digital assets."

Some industry insiders told ST this institutionalization marks crypto gradually moving beyond its wilder, more informal subcultural origins—roots based on distrust of centralized finance.

"Traditional markers of prestige, like the ones you usually look for in investing, banking, or traditional tech roles, are now entering crypto," said Mr. Swaminathan.

"People care about your Ivy League education, your big-tech résumé," he said. "These are things people absolutely wouldn’t have cared about five to eight years ago. Now, frankly, it’s almost no different from applying for a job at Google."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News