Crypto Tri-City Chronicles

TechFlow Selected TechFlow Selected

Crypto Tri-City Chronicles

Who will emerge victorious in this "tale of three cities"?

By TechFlow

Singapore, Hong Kong, Dubai.

On the global chessboard of the crypto industry, these three cities are vying for influence and talent in distinctly different ways.

Singapore’s tightening regulations have dimmed its once-utopian appeal; Hong Kong’s policy openness has triggered a wave of return migration; while Dubai, with its “zero taxation + open regulation” model, has emerged as a new oasis for crypto innovation.

These three crypto hubs—once dream destinations for blockchain pioneers—are now at a crossroads. Amid regulatory crackdowns, capital flows, and Web3 ambitions, who will prevail in this "tale of three cities"?

Singapore: The Glory of Bygone Days

Singapore, the so-called "Lion City," was once seen as a utopia for countless crypto dreamers.

Today, however, the city-state's crypto community is shrouded in a fog of compliance uncertainty.

In June 2025, the Monetary Authority of Singapore (MAS) issued final guidance requiring unlicensed Digital Token Service Providers (DTSPs) to cease offering services to overseas clients by June 30—even if core team members operate from Singapore. Overseas projects with key personnel based in Singapore must also undergo MAS scrutiny.

With policies still unclear, anxiety has spread across the ecosystem.

Since then, MAS has adopted a dual approach—offering reassurance while cracking down on offshore exchanges.

MAS clarified that its primary regulatory focus lies on digital payment tokens and capital market product tokens—essentially payment or equity-linked tokens. Providers dealing solely with utility and governance tokens remain unaffected and do not require licensing.

Moreover, according to Bloomberg, Singaporean regulators have issued a final warning, urging major cryptocurrency trading platforms operating in the country without local licenses to exit swiftly.

TechFlow has learned that numerous crypto exchanges headquartered in Singapore have already begun relocation plans, moving core staff to Hong Kong, Malaysia, and beyond.

Yet even before this regulatory pressure, a brain drain had already taken root.

"Too expensive—I can't afford it," says XIN, a seasoned crypto professional, echoing widespread sentiment about Singapore’s soaring cost of living.

"A decent apartment near Orchard Road costs around 5,000 SGD (~25,000 RMB). That alone is a huge burden. But more importantly, making money has become much harder this cycle."

For Adam, another industry veteran, Singapore initially attracted talent due to its safety, institutional stability, and profitability—projects, exchanges, and VCs alike could all profit during bull markets. But this cycle appears to belong only to Bitcoin. Most altcoin projects have failed post-launch, crypto VCs have suffered massive losses, and many now believe simply holding Bitcoin yields better returns than active participation. Staying in Singapore adds cost without value.

Qin, who has lived in Singapore for several years, has observed an increasing exodus over the past year. A telling sign: many once-active hiking groups for professionals have gone silent.

This latest policy shock will accelerate departures. Who remains?

First, employees of licensed crypto firms. According to MAS official records, 24 companies—including COBO, ANTALPHA, CEFFU, and MATRIXPORT—are on the exemption list, while 33—including BITGO, CIRCLE, COINBASE, GSR, Hashkey, and OKX SG—have obtained DTSP licenses.

Second, those not subject to licensing requirements—such as crypto VCs, KOLs, and teams behind non-security, non-payment utility tokens. However, these individuals are typically founders, executives, or permanent residents who have settled long-term in Singapore.

In summary, Singapore has executed its talent strategy precisely: attracting only highly compliant and high-net-worth individuals.

Hong Kong: A Surge of Renewal

Where do displaced crypto professionals go next?

Hong Kong and Dubai stand out as today’s top contenders.

Shortly after Singapore released its DTSP guidance, Hong Kong Legislative Council member Ng Kit-kwong took to social media with a bilingual message: "If you’re unable to continue operations in Singapore and are considering relocating to Hong Kong, feel free to contact me. We’re ready to assist. Welcome to develop here!"

The night view of Victoria Harbour remains dazzling—but Hong Kong’s financial narrative is entering a new chapter.

With Circle’s listing and Hong Kong advancing stablecoin regulation, global capital attention has returned to the Lion Rock.

On May 21, 2025, Hong Kong formally passed the *Stablecoin Issuers Bill*, mandating licensing for issuers and full backing of reserves with high-liquidity assets. The Hong Kong Monetary Authority (HKMA) even holds extraterritorial jurisdiction, allowing oversight of all HKD-pegged stablecoins globally.

On June 12, Bloomberg reported that Ant Group International is planning to apply for a stablecoin license in Hong Kong.

Beyond increasingly clear crypto policies, Hong Kong’s macro environment has improved dramatically compared to recent years, when it was mocked as a "financial ruin."

Glenn Ge from financial media outlet Gravitas shared several revealing data points:

1. Residential rents in Hong Kong have hit record highs;

2. The number of Americans in Hong Kong (a proxy for expatriates) has reached a new peak—over 85,000, surpassing pre-pandemic levels (down to 70,000 in 2023);

3. Application fees collected by the University of Hong Kong (not enrollment, just applications) have totaled HK$800 million.

Yi Lihua, founder of LD Capital, has lived and worked in both Singapore and Hong Kong. He admits his preference leans firmly toward Hong Kong, where he intends to stay long-term.

"Hong Kong offers many advantages—better food, climate, proximity to mainland China, and friendlier policies. Crucially, obtaining residency is easier than in Singapore—you qualify after meeting time requirements, whereas Singapore requires repeated renewals. I believe staying within Chinese cultural soil and ensuring future generations remain Chinese is the better choice."

An increasing number of crypto professionals are relocating from Singapore to Hong Kong. Insiders report that TRON founder Justin Sun relocated to Hong Kong well ahead of others.

A clear indicator of shifting momentum lies in rental trends.

According to Midland Realty, Hong Kong residential rents rose for three consecutive months in May 2024, reaching their highest level since 2019.

The Centaline City Rent Index (CRI) stood at 125.38 in May, surging 1.32% month-on-month—the largest increase in nine months—and just 2.05% below its historical peak.

In contrast, premium private residential rents in Singapore dropped 4.5% in the first half of 2024, the steepest decline among 30 global cities.

Dubai: The Middle East’s “Shenzhen”

Beyond East Asia’s Singapore and Hong Kong, Dubai—the “on-chain desert oasis”—is rapidly reshaping the global crypto landscape.

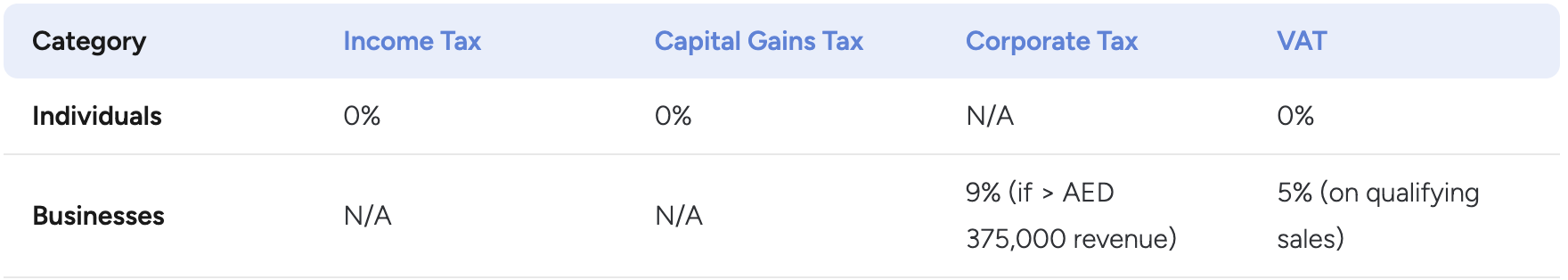

“Zero personal income tax, corporate tax ranging from 0–9%, relatively reasonable living costs, and greater international diversity,” says a professional who has worked in Dubai for two years. “More importantly, the regulators here truly understand and embrace crypto innovation.”

In 2025, Dubai’s Virtual Assets Regulatory Authority (VARA) further refined its framework, adopting a “sandbox-adapt-scale” model that provides clearer legal safeguards for Virtual Asset Service Providers (VASPs).

As early as 2024, Dubai had gathered over 1,400 blockchain startups, valued collectively at $24.5 billion, forming a complete ecosystem including more than 90 investment funds and 12 incubators.

Chainalysis data shows Dubai’s crypto sector contributes approximately 100 billion AED ($27.25 billion) in output, accounting for 4.3% of UAE GDP.

In May 2025, UAE state-backed investment firm MGX invested $2 billion into Binance, the world’s largest crypto exchange—an unmistakable signal of support.

Snow, a veteran crypto investor formerly based in Dubai, cites opportunity as her main reason for choosing the city. In her view, unlike Singapore or Hong Kong, the Middle East lacks mature institutions—legal frameworks, infrastructure, and systems are still developing. But the less complete a system is, the greater the opportunities.

Dubai resembles Shenzhen in the early 20th century—people from all over the world flock here chasing one simple dream: making money.

"Besides locals, most people in Dubai are Europeans, Russians, Indians, and Chinese—all here to do business and make money. Once they earn enough, they buy property either in Dubai or back home."

Nancy, a former real estate agent based in Dubai, has witnessed the city’s explosive property market firsthand. According to CBRE, Dubai’s residential prices rose 18% on average in 2024, accelerating to 20% in Q1 2025.

Crypto nouveaux riches have played a pivotal role in driving this surge.

"In recent years, numerous Chinese crypto millionaires have purchased large volumes of properties in Dubai," Nancy confirms.

Earlier, Damac Properties, Dubai’s largest private real estate developer, announced it would accept Bitcoin and other cryptocurrencies for property purchases.

Today, Dubai has become a leading testing ground for real-world asset (RWA) tokenization.

On May 1, MultiBank Group, real estate giant MAG, and blockchain provider Mavryk signed a $3 billion RWA agreement to bring MAG’s luxury real estate projects onto regulated blockchain markets.

On May 25, Dubai Land Department (DLD), Central Bank of the UAE, and Dubai Future Foundation launched a tokenized real estate initiative in the MENA region. These government bodies introduced a platform enabling investors to purchase tokenized shares of “ready-to-own” properties in Dubai.

Thanks to its favorable regulations, Dubai hosts numerous major exchanges—with Binance being the most prominent.

Binance enjoys a unique status across Dubai and the broader Middle East.

"Being associated with Binance is a powerful identity marker—former employee, portfolio company, or partner—all serve as strong credentials. Even those unaffiliated often claim connections to Binance executives," Nancy explains. This clustering effect has turned Dubai into a key hub for crypto information and project resources, where shell companies and market-making services are actively traded.

Beyond exchange staff, Dubai now attracts many top-tier crypto KOLs. For example, Coin Bureau, which boasts 2.68 million YouTube subscribers, operates its studio in Dubai.

Still, Dubai faces challenges of its own.

Extreme summer heat, cultural differences, limited banking access, and geopolitical uncertainties remain concerns. "Dubai is great, but it’s not ideal for everyone," Nancy admits. "Many come purely to earn money and leave once they’ve made enough. Dubai isn’t really suited for long-term living—Abu Dhabi offers a more livable atmosphere."

Additionally, cultural and timezone differences may hinder outreach to Asian markets. While Dubai bridges Europe, Asia, and Africa, Hong Kong serves as the gateway to Asia, especially the Chinese-speaking world.

As Singapore tightens regulation, Hong Kong revives its financial ambition, and Dubai ascends rapidly, a unique tri-polar structure is emerging: Hong Kong as the gateway to Asia—particularly Chinese markets, Dubai as the crossroads connecting Eurasia and Africa, and Singapore potentially repositioning itself as a highly compliant, institutional-grade center for crypto asset management.

Whether it’s the glittering skyline of Victoria Harbour, the majestic Burj Khalifa, or the modern silhouette of Marina Bay Sands, the skylines of these cities are bearing witness to the dawn of a new era in crypto finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News