HK SFC's new circular sends positive signal: exchanges may share order books, market depth could see a leap

TechFlow Selected TechFlow Selected

HK SFC's new circular sends positive signal: exchanges may share order books, market depth could see a leap

This article will explore the significance of the new circular's release in the regulatory governance of the crypto economy, against the backdrop of the path outlined in SFC's ASPIRe roadmap.

Author: Fintax

1. Introduction

On November 3, 2025, coinciding with the grand launch of Hong Kong FinTech Week, the Securities and Futures Commission of Hong Kong (SFC) simultaneously released two landmark regulatory circulars—the "Circular on Sharing Liquidity for Crypto Asset Trading Platforms" and the "Circular on Expanding Products and Services Offered by Crypto Asset Trading Platforms." The circulars state that, subject to regulatory requirements and prior written approval, licensed crypto asset exchanges may share order books with overseas compliant platforms to consolidate liquidity, while also expanding their product and service offerings, including providing short-term virtual assets to professional investors. The strategic intent behind announcing this policy during a major event drawing tens of thousands of global fintech elites is clear: Hong Kong is determined to position crypto assets as a key lever in solidifying its status as an international financial center. This article will examine the significance of these new circulars within the context of crypto-economic regulatory governance, using the path outlined in SFC's ASPIRe roadmap, and discuss their potential implications for platforms, investors, and market structure.

2. Interpretation of the Circulars

2.1 "Circular on Sharing Liquidity for Crypto Asset Trading Platforms"

The "Circular on Sharing Liquidity for Crypto Asset Trading Platforms" focuses on enhancing market liquidity under compliance conditions, primarily allowing licensed virtual asset trading platforms (VATPs) to share order books with their overseas affiliated platforms, thereby merging into a larger, deeper global liquidity pool to improve price discovery, enhance trading efficiency, and reduce cross-jurisdictional price spreads.

The circular emphasizes strict settlement risk management, including the adoption of DVP (Delivery-versus-Payment) mechanisms, daily settlements, establishment of compensation mechanisms, and ensuring secure custody of client crypto assets. It also requires platforms to establish legally binding rules for shared order books, set up cross-border collaborative market surveillance mechanisms, and fully disclose associated risks before offering such services to clients—especially retail investors—and obtain explicit opt-in consent from them.

In addition, platforms must apply in advance for SFC approval and include corresponding terms and conditions in their licenses. At its core, this circular allows licensed virtual asset platform operators to integrate order books with qualified overseas platform operators, forming a shared liquidity pool enabling cross-platform matching and trade execution. The mechanism mandates the use of DVP settlement, intraday settlement monitoring, and limits on unsettled transactions, requiring platforms to maintain reserve funds and insurance or compensation arrangements in Hong Kong at levels not lower than the maximum exposure to cover settlement risks. Market surveillance must be unified and capable of providing real-time transaction and customer data to the SFC, with full risk disclosure and client opt-in confirmation required before offering services to retail investors.

2.2 "Circular on Expanding Products and Services Offered by Crypto Asset Trading Platforms"

The "Circular on Expanding Products and Services Offered by Crypto Asset Trading Platforms" focuses on broadening the range of products and services available on platforms. It explicitly defines "digital assets" to include crypto assets, stablecoins, and tokenized securities, relaxes asset inclusion criteria—for example, removing the 12-month track record requirement for crypto assets offered to professional investors (PI)—and permits licensed stablecoin issuers to directly offer stablecoins to retail investors.

The circular also proposes revising platform licensing conditions to allow VATPs to distribute investment products related to digital assets and tokenized securities, and to provide custody services for digital assets not traded on the platform—including tokenized securities—as long as they meet relevant technical, security, monitoring, and anti-money laundering requirements. This circular emphasizes "product diversification," eliminating the 12-month performance history requirement for crypto assets (including stablecoins) offered to professional investors, while allowing stablecoins issued by licensed stablecoin issuers to be sold directly to retail investors. Additionally, platforms may distribute tokenized securities and digital asset-related investment products in compliance with existing regulations, and may provide custody services for non-listed digital assets through affiliated entities.

3. Why Issue the Circulars: Strategic Continuity and Market Response

3.1 Strategic Continuation of the ASPIRe Roadmap

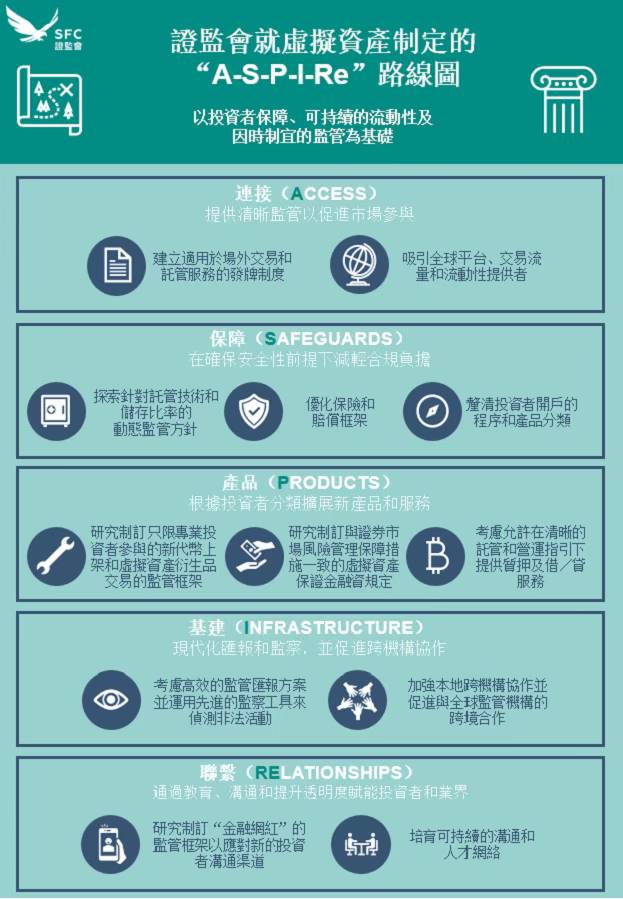

The release of the two circulars is not an isolated policy move but rather a concrete institutional implementation of the SFC’s "ASPIRe" roadmap published on February 19, 2025. The roadmap is structured around five pillars: Access (market access), Safeguards (investor protection), Products (product development), Infrastructure (infrastructure), and Relationships (industry collaboration), outlining the long-term regulatory direction for Hong Kong’s crypto asset market.

In specific terms, the "Circular on Sharing Liquidity for Crypto Asset Trading Platforms" responds primarily to the Access pillar of the ASPIRe roadmap—aiming to strengthen Hong Kong’s connectivity with global liquidity, enhance market efficiency, and provide Hong Kong investors with broader and deeper global liquidity. Meanwhile, the "Circular on Expanding Products and Services Offered by Crypto Asset Trading Platforms" aligns with the Products pillar, aiming to meet the diverse needs of different investor groups while maintaining risk control and investor protection.

Lilian Lui, Chief Executive Officer of the SFC, stated during a forum at FinTech Week that Hong Kong’s initially closed-loop ecosystem—centered on licensed crypto asset trading platforms and focused on investor protection—is now evolving into a critical phase of "connecting local markets with global liquidity." This arrangement allows licensed platforms to share order books with affiliated overseas platforms, enabling Hong Kong investors to access global liquidity while attracting that liquidity into Hong Kong’s virtual asset market.

Illustration of the ASPIRe Roadmap (Source: Hong Kong Securities and Futures Commission)

3.2 Responding to Market Liquidity Challenges

A second reason for the SFC issuing the two circulars is to address the liquidity challenges facing Hong Kong’s crypto market.

According to Fu Rao, Executive Director of the Hong Kong International Institute of New Economics, Hong Kong’s crypto asset market has long faced two persistent realities: first, low trading volumes and thin order books on local platforms, where many tokens have visible prices but fail to find counterparties; second, frequent price discrepancies between domestic and international markets, with significant spreads and slippage for the same asset across Hong Kong and major overseas platforms. These issues harm investor experience and undermine Hong Kong’s credibility as a pricing hub. The shared liquidity mechanism introduced in the circulars is a direct institutional response to this pain point—bringing overseas compliant liquidity into Hong Kong selectively, using a regulatory framework rather than relying solely on market forces to address insufficient liquidity and price divergence. For the Hong Kong market, price discovery will no longer be confined to a small local pool but will connect, under regulated mechanisms, to mainstream global liquidity pools, naturally narrowing price gaps and bringing trading volumes closer to global benchmarks.

At a deeper level, the issuance of these dual circulars marks a shift in Hong Kong’s crypto asset regulation—from “gatekeeping” to “empowerment.” The new rules do more than impose restrictions; they actively create compliant pathways for institutions to engage in crypto activities. Rather than merely blocking risks, they aim to channel innovation by bringing gray areas into the regulatory fold. As Fu Rao observes, Hong Kong regulation has never been about simple liberalization but about opening the floodgates conditionally under controlled risk. Clear red lines are evident in the design of the shared order book mechanism: cooperation only with licensed entities, data sharing only within supervisable frameworks, and synchronized asset transfers only under the core settlement principle of Delivery-versus-Payment (DvP). This locks legal, technical, and counterparty risks arising from cross-border collaboration into a verifiable, accountable regulatory loop.

4. Impact on Hong Kong’s Crypto Market

4.1 Rebuilding Trust in the Digital Asset Hub

From a regulatory perspective, the issuance of the dual circulars reflects Hong Kong’s core principle of “same business, same risk, same rules.” Dr. Ye Zhiheng, Executive Director of Intermediaries Supervision at the SFC, emphasized that the new roadmap adheres to core principles of investor protection, sustainable liquidity, and flexible regulation, precisely addressing the challenges of the emerging crypto asset market.

Notably, while promoting market development, the SFC also stresses stringent risk controls in both circulars. The shared liquidity mechanism requires overseas affiliated platforms to operate under regulatory frameworks aligned with FATF recommendations and IOSCO’s crypto asset policy guidance, and to remain under continuous supervision by local regulators. Settlement mechanisms must include full pre-funding, DvP, and intraday settlement. For investor protection, platforms must establish client compensation reserve funds and insurance arrangements.

Meanwhile, the SFC continues to strengthen anti-money laundering oversight. On November 17, 2025, it issued a key circular urging licensed corporations and crypto asset platforms to remain vigilant against suspicious fund transfers showing signs of tiered trading activity to prevent money laundering. It has also established a “24/7 stop-payment” mechanism in coordination with law enforcement, significantly enhancing detection and prevention capabilities against virtual asset crimes.

4.2 Shaping an Investment Landscape of Opportunities and Challenges

For platforms and industry participants, the primary benefit of the dual circulars is a significant expansion of business opportunities. The product expansion circular enables platforms to rapidly list emerging tokens and stablecoins, distribute tokenized securities and digital asset products, and expand into custody services. The shared liquidity circular helps deepen trading and improve efficiency, enhancing user experience.

However, increased compliance costs present a non-negligible challenge. Participating in shared liquidity requires building complex cross-border settlement systems, unified market surveillance programs, and reserve fund mechanisms—placing higher demands on platforms’ technological capabilities, capital strength, and compliance standards.

From an industry ecosystem perspective, Hong Kong’s cryptocurrency sector in 2025 shows a clear trend of convergence. Traditional financial institutions are actively embracing crypto businesses, with over 40 securities firms, 35 fund companies, and 10 major banks now involved in crypto asset operations. The tension and integration among crypto-native culture, internet finance culture, and traditional finance culture are shaping a unique ecosystem for Hong Kong’s crypto industry.

5. Conclusion and Outlook

The release of the SFC’s dual circulars marks a new stage in Hong Kong’s crypto asset regulation. This is not only an institutional response to the local market’s liquidity challenges but also a strategic move for Hong Kong to seize regulatory leadership in the global digital asset competition.

On one hand, the SFC and the Hong Kong Monetary Authority (HKMA) are driving deeper integration between traditional finance and blockchain technology. The HKMA’s "Fintech 2030" vision promotes financial tokenization and leads by example in asset tokenization initiatives. The e-HKD pilot program continues to progress, focusing on three key application scenarios: settlement of tokenized assets, programmable payments, and offline payments. On the other hand, from a global perspective, regulatory frameworks in Hong Kong, Singapore, and the UAE are becoming increasingly aligned. Core principles in the EU’s MiCA regulation, Dubai’s VARA regime, and Hong Kong’s VASP licensing system are converging, all emphasizing investor protection, AML compliance, and market integrity. By aligning with international standards, Hong Kong is well-positioned to play a more significant bridging role in global digital asset regulatory coordination.

Looking ahead, as product offerings continue to expand, the stablecoin ecosystem accelerates, and traditional finance integrates deeply with Web3, Hong Kong is poised to become a true global digital asset hub connecting East and West. As Dr. Ye Zhiheng of the SFC noted: “Hong Kong evolved from a small fishing village into one of the world’s leading financial centers. We have the capability to achieve similar success in the virtual asset market.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News