DeFi Flexible Layout + Token Yield Combos: Unpacking Tranchess's Chessboard Wisdom

TechFlow Selected TechFlow Selected

DeFi Flexible Layout + Token Yield Combos: Unpacking Tranchess's Chessboard Wisdom

A deep dive into Tranchess's multiple innovations, analyzing how Tranchess leverages its inherent advantages and mechanism design to carve out a unique yield-generating path for investors in the current market environment.

Author: TechFlow

Introduction

The crypto market never rests, and DeFi continues to evolve amid the turbulence. Global economic expectations of interest rate cuts are quietly reshaping investors' risk appetite and return demands.

In an environment where market narratives are increasingly drying up, discussions around DeFi have resurged. Having gone through a full bull-and-bear cycle, DeFi projects are no longer content with simply replicating traditional financial models—they're now focusing on how best to meet real market needs.

From MakerDAO’s rebranding to the emergence of innovative yield strategies, the entire ecosystem is undergoing a profound transformation. At the same time, industry giant Binance is also actively evolving. The meme boom on BNB Chain and the high-frequency listing of ecosystem projects send positive signals to the market.

Amid this turbulent wave of change, Tranchess, a pioneering DeFi protocol within the BSC ecosystem, stands out with its unique structured fund architecture. By ingeniously combining the concept of structured funds with DeFi innovation, it offers investors a distinctive DeFi experience. As market conditions shift, Tranchess continuously iterates its products and partners with various projects to align with demand.

This article will explore Tranchess’ multiple innovations, analyzing how it leverages both inherent strengths and mechanism design to carve out a unique yield path for investors in today’s market. Whether you’re a seasoned DeFi veteran or just stepping into the space, this piece aims to offer fresh insights.

Why DeFi?

Faced with the ever-expanding array of crypto innovations, not only new users but even experienced crypto natives may ask: with so many new ideas emerging constantly, why should DeFi still command attention?

Andre Cronje offered some relevant insights in his recent article "Why DeFi Is Key to the Future?".

He pointed out that DeFi is essentially a liquidity hub and carrier of trading demand. In every blockchain ecosystem, DeFi plays an indispensable role by providing necessary liquidity support and fulfilling diverse financial needs—from simple token swaps to complex derivatives trading.

AC noted: “Anyone willing to participate can join in—this is a crucial foundation for economic growth.” DeFi’s openness and composability make it an ideal testing ground for financial innovation. Whether in bull or bear markets, DeFi remains the core engine sustaining ecosystem vitality.

Tranchess: A Winning Move Across Market Cycles

Tranchess emerged during the 2021 DeFi surge, at the peak of the crypto bull market. Yet it has not only demonstrated strong resilience across long cycles but also injected new vitality through continuous iteration and innovative mechanisms—showcasing the deep strength of a true "OG."

According to the latest data from DeFiLlama, as of September 2024, Tranchess achieved a TVL of $183 million on BNB Chain, representing nearly a 500% increase year-to-date.

Professional Team

Tranchess’ ability to remain vibrant even through severe bear markets is closely tied to its professional team. Composed of individuals with extensive backgrounds in blockchain and finance, the core members bring rich experience from investment banking, asset management, and hedge funds.

Danny Chong, Co-Founder, graduated from Nanyang Technological University and brings over a decade of banking experience, including roles in trading, sales, and management across the Asia-Pacific region.

The technical team also boasts solid expertise in cybersecurity for centralized exchanges and DeFi protocols, with members hailing from tech giants such as Google, Meta, and Microsoft.

A DeFi Protocol Inspired by "Tranches"

Tranchess was inspired by the traditional finance concept of "Tranches" (slices), innovatively offering tiered, multi-structured investment solutions tailored to investors with different risk appetites.

Tranchess provides two core services:

-

Liquid staking: Tranchess’ liquid staking service primarily features nQUNEE, the staked token on BNB Chain, and qETH on Ethereum. Taking qETH as an example, users on Ethereum can stake ETH to receive qETH. They earn staking rewards within the protocol while also using qETH as collateral in external DeFi protocols, improving capital efficiency.

-

Structured return products: Tranchess offers diversified risk-return solutions based on its flagship fund QUEEN, splitting QUEEN into two derivative tokens—BISHOP and ROOK—based on differing risk-reward profiles to serve various investor preferences. Today, Tranchess has further optimized its product structure, upgrading it into a more flexible Turbo & Stable framework.

No Fixed Strategy: From Structured Funds to Turbo & Stable

From its original tranching model to the current Turbo & Stable framework, Tranchess’ evolution resembles a masterful chess game—each move precisely responding to market shifts.

Opening Move: Structured Response via Tiered Funds

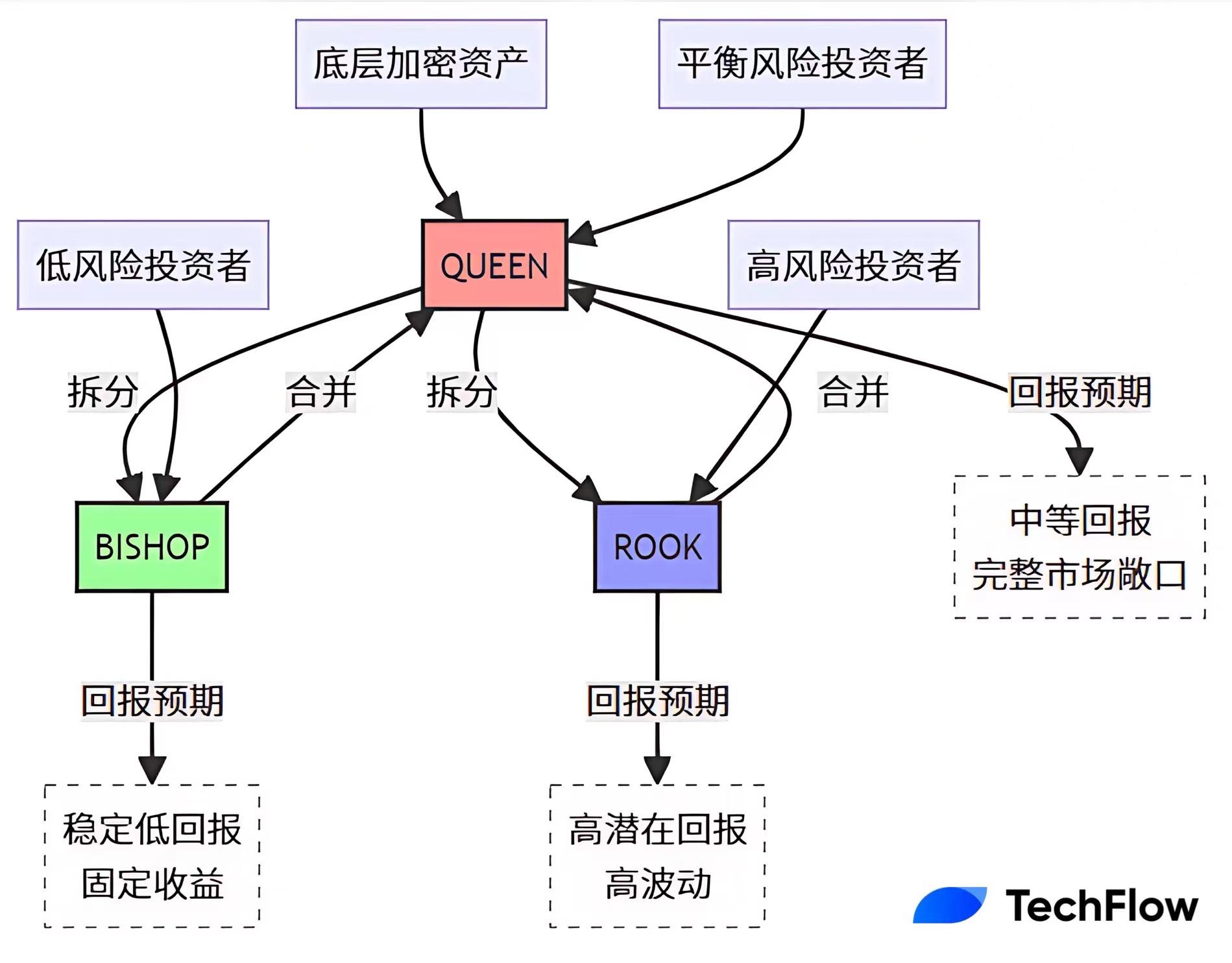

Structural design lies at the heart of Tranchess’ innovation—dividing a single asset into derivatives with varying risk levels. This allows investors to choose strategies aligned with their individual risk tolerance. Specifically, Tranchess divides assets into three tiers:

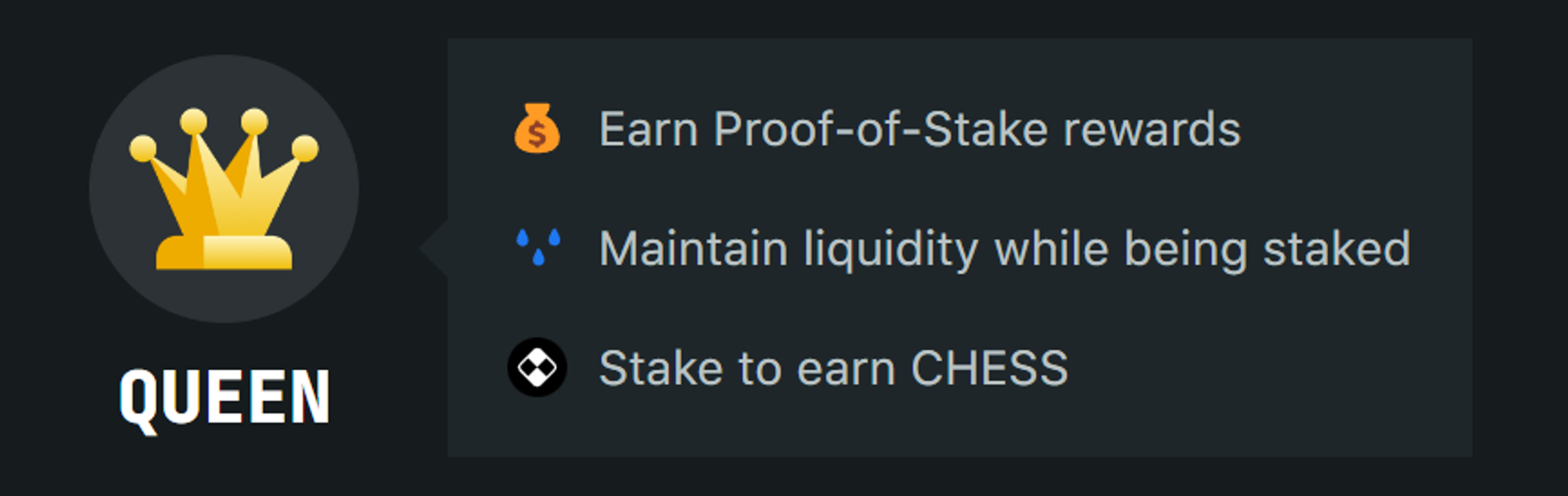

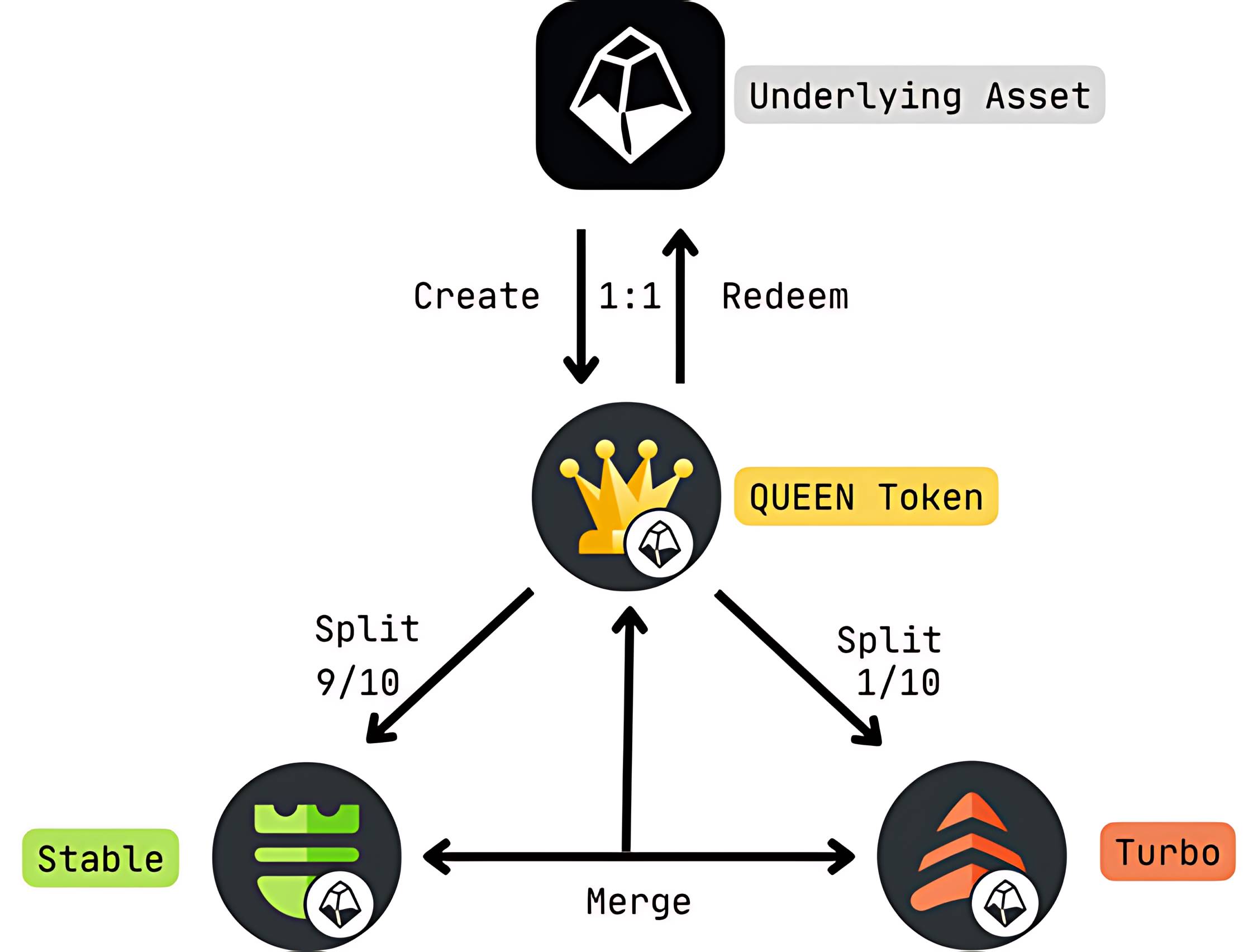

Flagship Fund Token: QUEEN

QUEEN represents the base asset, pegged 1:1 to the underlying cryptocurrency. It serves as the primary fund unit, allowing direct exposure to the underlying asset. QUEEN can be minted, redeemed, or split into BISHOP and ROOK. Its returns come from price movements of the underlying asset, staking rewards (if applicable), and protocol revenue distribution.

Taking BTC as an example, QUEEN holders benefit not only from Bitcoin's price appreciation but also earn additional CHESS governance tokens through staking. Investors can exchange BTC directly for QUEEN or purchase QUEEN with USDC via Tranchess Swap.

Derivative Tokens: BISHOP and ROOK

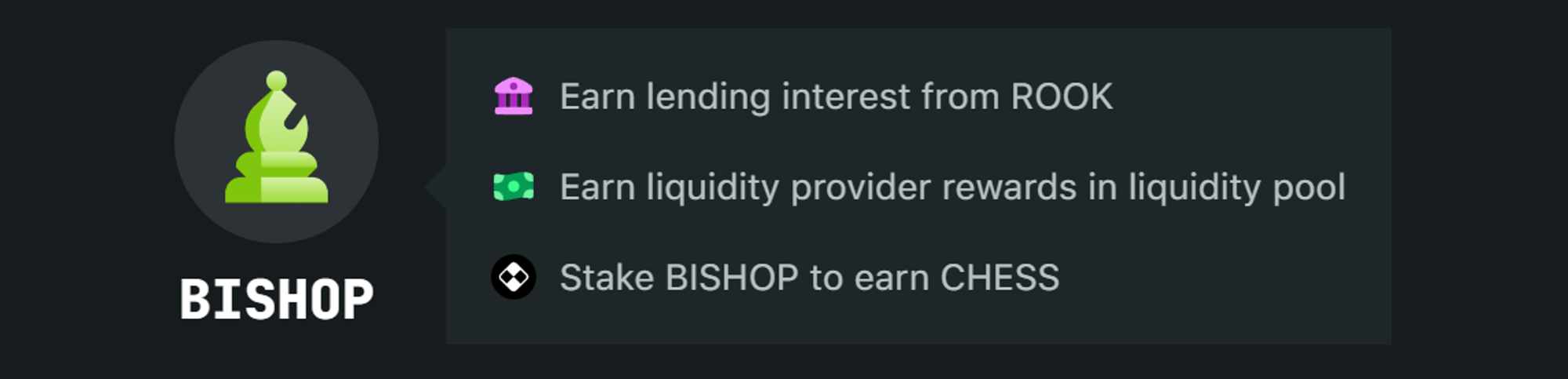

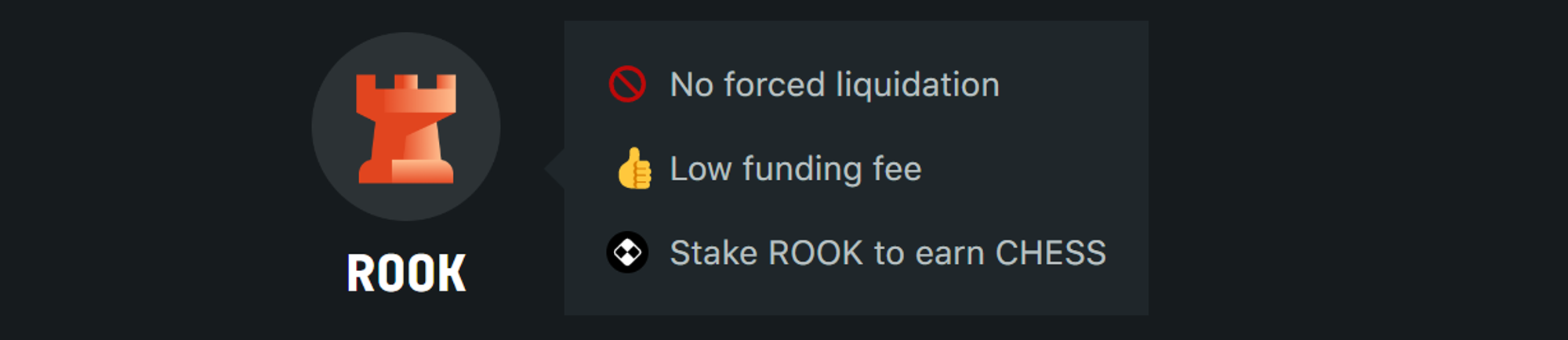

BISHOP and ROOK, derived from QUEEN, represent distinct risk and return characteristics.

BISHOP is a fixed-income token, lower in risk, offering stable returns akin to fixed-income instruments. Its yield comes from a fixed percentage of QUEEN’s returns, periodically adjusted by the protocol. BISHOP delivers relatively stable returns during market volatility, making it suitable for risk-averse investors.

ROOK is a leveraged token, higher in risk, offering amplified returns and greater sensitivity to the underlying asset’s price movement. ROOK captures all residual returns from QUEEN (total returns minus payments to BISHOP). During market rallies, ROOK generates outsized gains—but also faces greater downside risk.

The structured fund design enables investors to flexibly adjust holdings based on risk appetite. Users can freely convert between QUEEN, BISHOP, and ROOK, implementing personalized risk management. For instance, when anticipating a market rise, one might increase ROOK exposure; during downturns, increasing BISHOP positions offers stability.

This flexible tiered architecture allows Tranchess to expand into more crypto assets in the future, broadening market participation. Whether BTC, ETH, or BNB, Tranchess has the potential to create corresponding structured products to meet diverse investor needs.

Turbo & Stable: Tactical Innovation on the Chessboard

With the launch of Tranchess’ liquid staking product qETH on the Ethereum mainnet, the concept of «Turbo & Stable» was introduced into its product ecosystem.

The Turbo & Stable model is essentially a refined upgrade of the structured fund—Turbo and Stable can be understood as enhanced versions of ROOK and BISHOP, respectively.

-

Turbo (Enhanced ROOK): A high-leverage, high-return offensive weapon

Like a rook charging forward in chess, the Turbo product offers higher leverage and potential returns, ideal for investors comfortable with elevated risk. It represents a bold offensive play in the game—potentially delivering significant gains, but also exposing users to greater risk.

-

Stable (Enhanced BISHOP): A defensive fortress for stable returns

Similar to the bishop (BISHOP) in chess, the Stable product offers more predictable income, serving as a defensive anchor in an investment portfolio. It caters to investors seeking low-risk, steady returns—akin to building a solid defense in a chess match.

Deep Dive into Turbo & Stable: The STONE Fund Case Study

Concepts alone can feel abstract. Let’s examine how this architecture works in practice using the STONE Fund, a Turbo & Stable product developed through Tranchess’ collaboration with StakeStone.

Simplifying Complexity: Flexible Token Splitting

The core of the STONE Fund lies in its Turbo & Stable-based token splitting mechanism. Users can exchange STONE 1:1 for stoneQUEEN, and each stoneQUEEN can be split into 0.1 turPSTONE (Turbo Point STONE) and 0.9 staYSTONE (Stable Yield STONE). The process is reversible—users can merge 0.1 turPSTONE and 0.9 staYSTONE back into one stoneQUEEN.

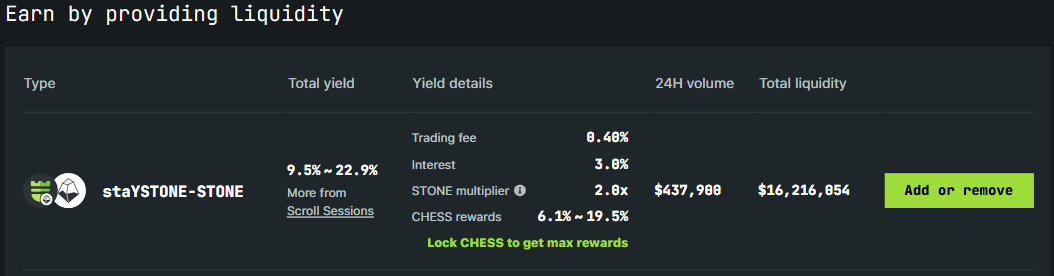

staYSTONE-STONE LP: Diversified Yields

Tranchess also introduced the staYSTONE-STONE LP token, creating additional yield opportunities for ecosystem participants.

Holders of these LP tokens earn CHESS tokens and 0.05% of trading fees, along with a portion of staYSTONE’s interest and a 2x multiplier on StakeStone points (applied to the STONE portion in the LP). Additionally, Tranchess offers a weekly bonus of 150,000 CHESS tokens specifically for STONE Fund LPs.

Different Reward Structures and Yield Profiles

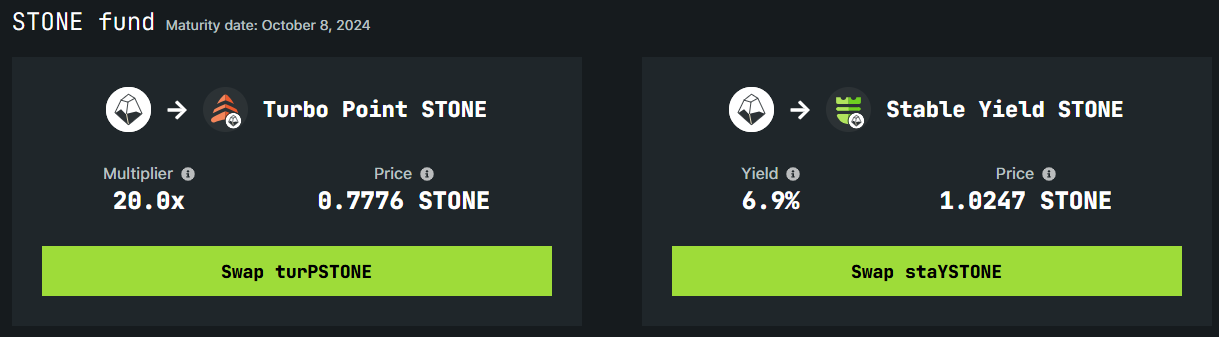

The Tranchess STONE Fund has a total staking period of six months, ending on October 8, 2024. At maturity, each token type can be redeemed back to STONE based on fair value. Tranchess also allows Scroll-based STONE holders to earn both StakeStone Points and Scroll Marks simultaneously.

-

stoneQUEEN can be exchanged 1:1 with STONE. Holding stoneQUEEN earns the same multiplier of StakeStone Points as holding an equivalent amount of STONE. However, splitting stoneQUEEN into staYSTONE and turPSTONE and holding both yields a 2x multiplier on StakeStone Points—plus eligibility for Scroll Marks based on holding value.

-

turPSTONE offers a fixed 10x leverage and a 2x StakeStone Points multiplier, resulting in a total 20x multiplier. After deducting the fixed-rate cost paid to staYSTONE, turPSTONE will redeem for less than 1 STONE at maturity (turPSTONE : STONE < 1).

-

staYSTONE offers risk-averse investors a fixed 6% annualized yield but does not earn StakeStone Points. However, holders do earn Scroll Marks based on value. At maturity, staYSTONE will redeem for more than 1 STONE (staYSTONE : STONE > 1).

Additionally, Tranchess takes a 3% fee from the points earned by Turbo & Stable fund products, distributing 100% of this revenue to veCHESS holders, thereby enhancing returns for long-term stakeholders.

PS: The conversion ratios shown for turPSTONE, staYSTONE, and STONE are approximate estimates. Final ratios will be determined based on fair value and announced closer to the fund’s end date.

Fast and Flexible: A Replicable, Precision Architecture

Beyond the STONE Fund, other launched Turbo & Stable products include the weETH Fund (with eth.fi), Staked ETH Fund (with LIDO), SolvBTC (with SOLV), slisBNB (with Lista DAO), and the recently launched SolvBTC.BBN Fund.

Not only do these offerings provide diverse yield strategies, but the Turbo & Stable framework also enables rapid deployment for any new LST narrative across chains. It can also dynamically adapt to changes in underlying asset yields. For instance, SolvBTC.BBN—the largest BTC staker in the early Babylon ecosystem—currently offers the highest LRT points yield in Babylon. This advantage is preserved within the Turbo & Stable structure, highlighting the architecture’s “fast and flexible” nature.

Tranchess’ Master Move: CHESS & veCHESS

Recently, CHESS’ listing on Binance Futures drew renewed attention. As Tranchess’ governance token, CHESS—and its locked form veCHESS—not only serves as the key link binding the entire system but also grows in value alongside the project itself.

Governance Token: CHESS

CHESS has a total supply of 300 million. Besides direct purchases, users can earn CHESS through various methods, primarily by participating in liquidity mining or staking QUEEN, BISHOP, and ROOK tokens.

Once locked into veCHESS, CHESS unlocks multiple ecosystem use cases: veCHESS grants voting rights, weekly protocol dividends, and entitlement to 3% of Turbo & Stable points revenue.

Beyond liquidity and governance, CHESS currently supports cross-chain functionality across BNB Chain, Ethereum, and Scroll.

Lock to Transform: veCHESS Activated!

Lock CHESS to Receive veCHESS

Users can lock CHESS for periods ranging from 1 week to 4 years. The conversion ratio increases linearly with lock duration. The formula for calculating veCHESS is: (number of CHESS) × (lock duration in years) / 4.

For example, locking 100 CHESS for 4 years yields 100 veCHESS, while locking 100 CHESS for 2 years yields 50 veCHESS. The veCHESS balance decreases linearly over time, but users can increase it by extending the lock duration or adding more CHESS.

Tranchess also supports batch locking—each lock creates a separate position. For easier management, users can merge multiple lock positions into one.

Layered Additional Yields

In addition to receiving 3% of Turbo & Stable fund points revenue, veCHESS holders also receive 50% of Tranchess’ weekly platform revenue as extra staking rewards—the other 50% goes to the Treasury.

Expanding Governance Rights

veCHESS holders gain proportional voting power in major platform decisions, ensuring long-term stakeholders have greater influence. Recently, the community passed Governance Proposal 9, which extends veCHESS voting rights to decisions regarding the launch of all new Turbo & Stable projects. This expands veCHESS utility and underscores the scalable potential of the Turbo & Stable framework.

Undervalued Amid the Hype?

As exploration of the Tranchess ecosystem deepens, it becomes clear that CHESS is far more than a simple governance token—it is the core value carrier within the Tranchess ecosystem.

Converting CHESS into veCHESS not only unlocks substantial revenue sharing but also grants decision-making power in platform governance. This dual utility makes CHESS a highly attractive tool for value storage and appreciation.

With growing platform TVL, the official launch of perpetual contracts, and several Turbo & Stable funds nearing maturity, CHESS may currently sit at a value inflection point. The earning potential of veCHESS could already justify—or even exceed—current market pricing. The true underlying value of CHESS extends beyond short-term hype or speculative “lottery” expectations about exchange listings—it lies in sustainable, product-driven returns with long-term fundamentals.

Innovation Wins the Game

From structured funds to the Turbo & Stable architecture, veteran player Tranchess maintains excellence and agility in the fiercely competitive DeFi landscape. While delivering diverse returns for users, it also offers broader solutions for various ecosystems—embodying true DeFi-native principles.

Tranchess’ development path proves one thing: only through constant innovation and maintaining a critical half-step advantage can one stay unbeaten in the grand game of crypto.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News