Popular Science: How Do Venture Capitalists Make Money from Startup Investments?

TechFlow Selected TechFlow Selected

Popular Science: How Do Venture Capitalists Make Money from Startup Investments?

Investing is an art.

Author: Route 2 FI

Compilation: TechFlow

How can you become a venture capitalist? How do you start your own venture capital firm? And how can you become a successful VC?

What does it take to gain access to protocol-level investments and stay ahead of the market curve?

This is exactly what I want to explore today.

VC Game: Want to back startups too, my friend?

Introduction

Sometimes, you may feel dissatisfied with market returns—your portfolio takes a hit when markets decline.

Other times, you see everyone profiting in the market, yet your personal performance still falls short compared to large institutional teams. So who exactly are these top-tier players?

The crypto market hosts various participants: market makers, hedge funds, liquidity providers, and venture capital firms (VCs). The first three operate similarly—they primarily trade existing tokens on the market. VCs, however, differ fundamentally: they invest long before tokens even launch.

Venture capitalists support the teams behind the projects you love, often stepping in while the team is still building an MVP (Minimum Viable Product). These investors believe deeply in a team’s potential and are willing to commit significant capital well before product launch.

If the project succeeds, the investment can yield exponential returns. But if it fails, the losses can be substantial.

Venture capital carries high risk/reward ratios. But it's more than just capital—it involves actively supporting teams and working closely with them to ensure long-term success.

So, how do you become a VC? How do you build a VC firm? What does it take to become a successful one? And what capabilities are required to access early-stage protocol investments and lead at the market frontier?

To launch a VC fund, you must first understand its core structure—and especially the key roles involved

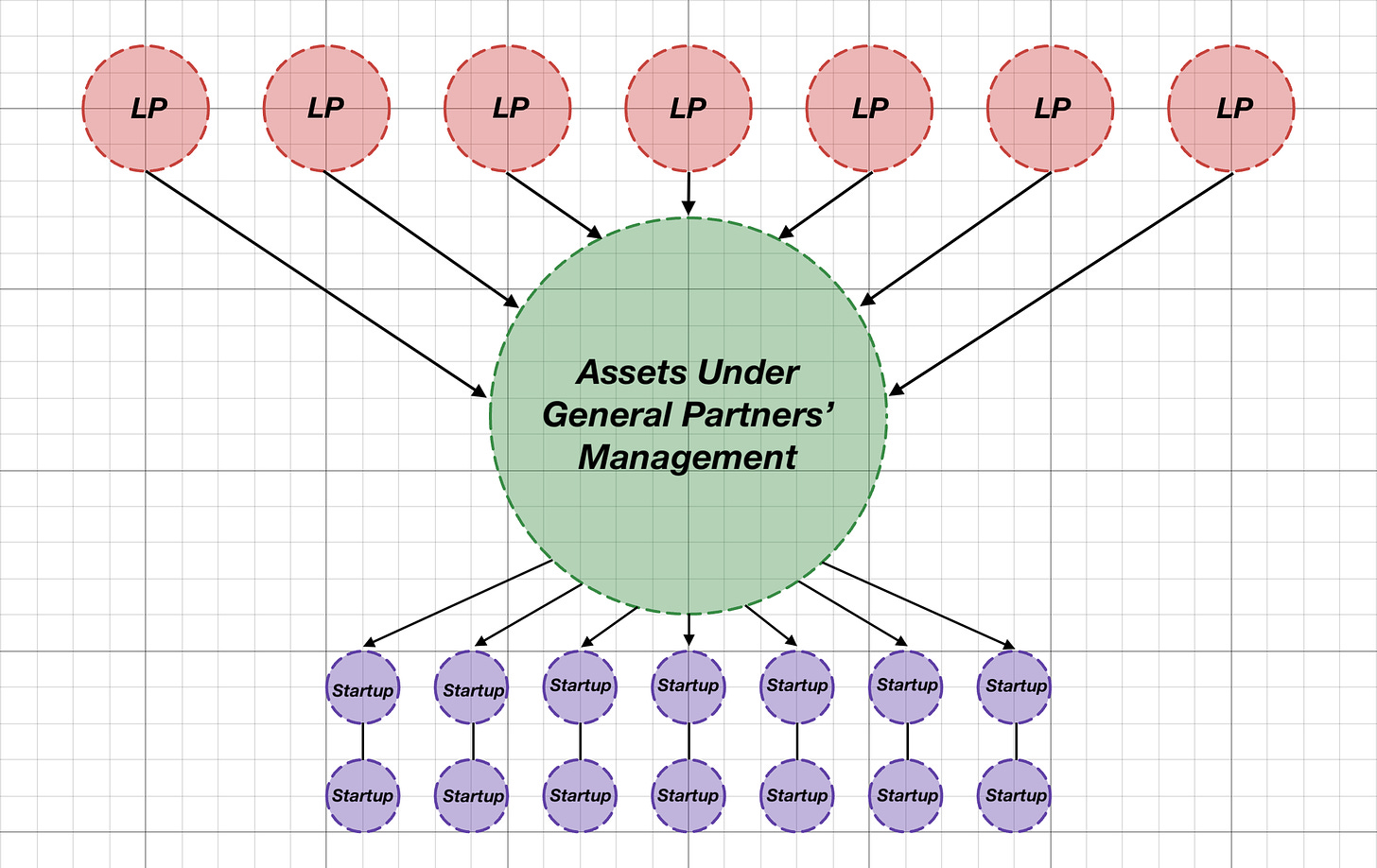

A typical VC fund consists of three main roles: Limited Partners (LPs), General Partners (GPs), and founders:

-

Limited Partners are individuals or institutions with substantial capital seeking to grow their wealth through venture investing.

-

General Partners are experienced professionals tasked with deploying LPs’ capital into promising deals, aiming to generate strong returns while earning management fees and carry.

-

Founders are innovators developing new products or services who need funding to bring their vision to market. If I were to illustrate the VC structure in one image, it would look like this:

The mandate given by LPs to GPs is clear: LPs provide capital and wait for returns. Their primary responsibility is selecting the right people to manage that capital—with the goal of achieving outsized returns.

Typically, LPs don’t participate directly in startup investment decisions; due diligence is handled by GPs. However, LPs can leverage their networks to surface potential opportunities for GPs to evaluate.

GPs usually report regularly—monthly, quarterly, or annually—to keep LPs informed about the fund’s status, including shifts in investment strategy, market sentiment, completed deals, and unrealized or realized returns.

Transparency is crucial because everyone acknowledges that venture investing is inherently risky—only about 1 in 100 startups becomes a unicorn (a company valued at over $1 billion).

A standard VC fund operates under the “2 and 20” model. This means GPs charge an annual fee of 2% of the total committed capital from LPs, used to cover operational costs such as salaries, partnership development, legal agreements, etc.

In addition, GPs earn 20% of the profits from successful exits—known as “carry.” For example, if a total return is $1 million, $800k goes to LPs and $200k to GPs as performance compensation.

It’s worth noting that most VC funds aren't particularly good and deliver modest returns. So why do LPs still invest?

VCs typically allocate capital into illiquid assets uncorrelated with traditional markets, serving as a hedge for a small portion of overall AUM (Assets Under Management). Large institutions and high-net-worth individuals often dedicate 5–10% of their portfolios to such alternative investments.

Yet, the right GP can generate exceptional returns. Over 3–5 years, LPs might achieve 3x to 10x returns—something hard to match in other asset classes.

So how can you stand out and convince LPs to choose you over other fund managers?

Sales is an art—one refined with every practice

You aim to invest in startups, but first, you must raise capital yourself—or else you won’t be able to invest at all.

Fundraising for your fund is a unique experience that puts you on the receiving end of pitching, which will later help you better assess pitches from others.

The process resembles traditional fundraising but has distinct nuances. First, if you're launching a crypto-focused fund, you should only invest in crypto-native companies (otherwise, the fund lacks focus).

LP backgrounds can be highly diverse. When raising for a crypto fund, you don’t necessarily need LPs from the crypto space.

The key is demonstrating your ability to generate strong returns. For instance, a friend of mine—a GP at a crypto fund—has LPs from e-commerce, real estate, oil production, and beyond.

This approach is known as a “fund thesis.” In reality, it's simply a set of optimized parameters guiding your investment focus.

Key elements include:

-

Investment Stage. There are generally six stages: Pre-seed, Seed, Series A, B, C, and D. Startups may also conduct "private rounds," often to obscure their actual stage. Focus on Pre-seed, Seed, and Private rounds—these offer the highest potential returns but come with elevated risks. Your success hinges largely on performance here.

-

Value-add Services. This may be the most critical factor. Founders increasingly seek “smart money” rather than passive capital. You must deliver value beyond funding. For example, a16z offers comprehensive support—from research and marketing to product development and hiring. Clearly define what you and your team bring beyond capital, and double down on it.

It’s no secret that many VCs offer little added value—that’s precisely how we distinguish top-tier from average funds. This difference becomes stark during bull and bear markets.

In bull markets, both projects and capital are abundant. Everyone—including retail investors—throws money around recklessly. Even low-quality tokens can return 10x. VCs compete fiercely for allocations in mediocre projects due to overwhelming demand. Risk and return management becomes difficult because everything appears to rise.

In bear markets, while many builders continue developing (thanks to the calm environment ideal for building), capital is scarce because little seems to grow.

Here, great VCs prove their worth. They rely on deeper evaluation metrics: team strength, sustainable token models, technical solutions, and coherent vision and go-to-market strategies. This demands greater skill, experience, and sometimes intuition!

Therefore, if you’re planning to build a VC from scratch, consider launching during a bear market or late in a bull cycle—competition is lower, and opportunity flows are richer.

Talent matters—whom should you hire?

Indeed, team is everything—as in any field. Human capital is the most important capital. So how do you build a strong team? Whom should you hire? The answer is simple, albeit cliché: hire people smarter than yourself. Build a team capable of outperforming the market.

VC teams are typically small; managing $50 million or more rarely requires more than 10 people. The process seems straightforward: find (or get found by) startups → identify the best ones → invest → support growth → exit (sell tokens) → realize returns.

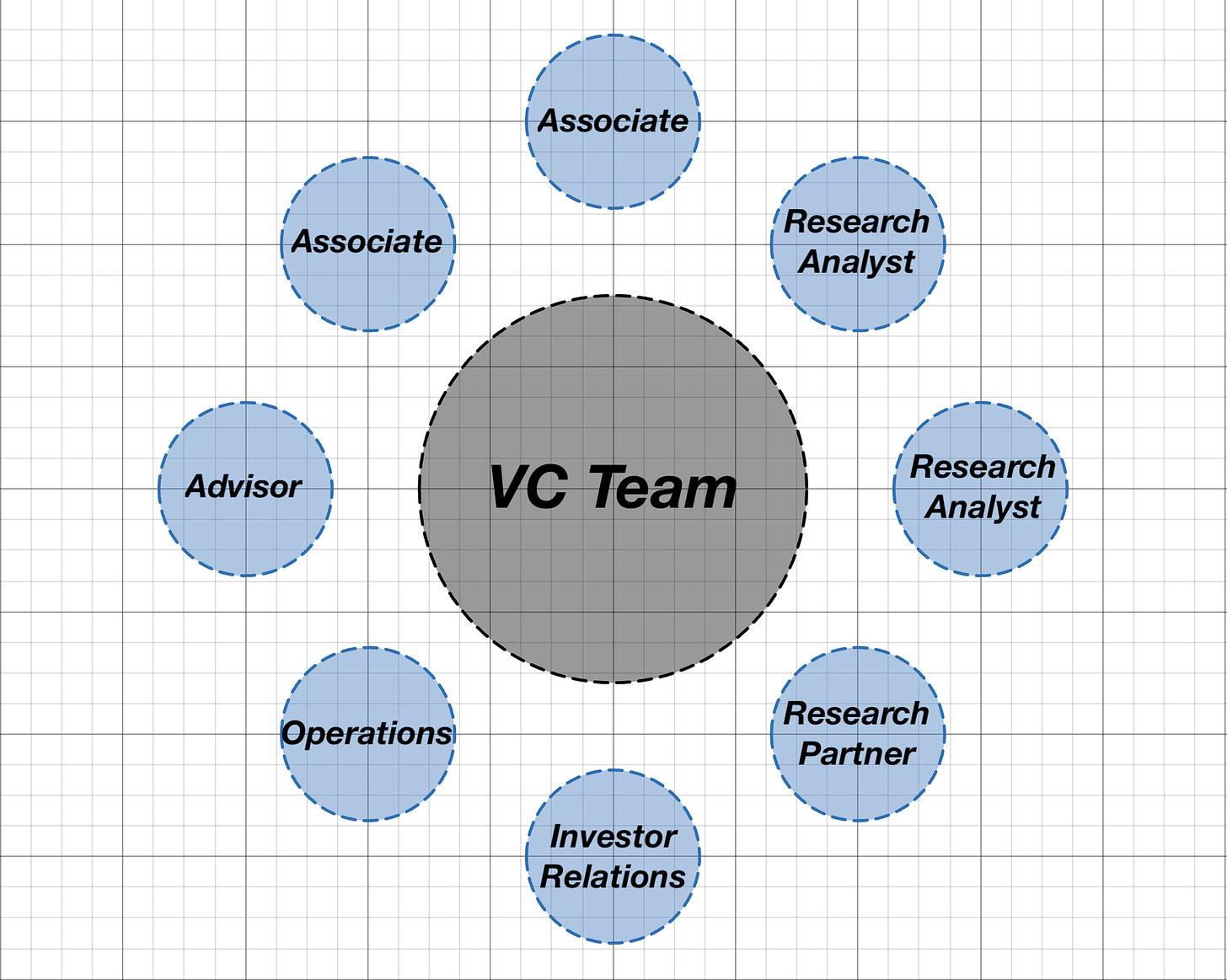

But doing each step well requires deep experience and knowledge. Obviously, you can't do it alone. An ideal team looks like this:

Associates handle most communication between the VC fund and startups. They conduct initial screening, provide feedback, and maintain contact throughout the investment lifecycle.

They source deals from various channels: Twitter, alpha groups, local meetups, conferences, demo days, hackathons, etc. Associates also establish deal-flow partnerships with other VC funds, enabling mutual sharing of opportunities and fostering collaboration.

Researchers focus on all analytical work—tokenomics, business models, technical solutions, and market analysis.

They monitor macro trends and forecast future directions. For example, researchers might track emerging projects with potential to join the portfolio.

This allows you to anticipate market movements 6–12 months ahead and identify which companies may create value. It provides holistic market context instead of narrow protocol focus.

Advisors offer specialized expertise and strategic guidance to the VC and its portfolio companies, usually on a part-time basis.

Their responsibilities include identifying investment opportunities, conducting due diligence, and advising portfolio teams. By sharing their networks, advisors help startups connect with key resources and partners.

Investor Relations (IR) specialists manage relationships with LPs—pitching, maintaining trust, creating investor materials, handling media inquiries, preparing meetings, and tracking sentiment.

Every team member plays a vital role. The GP’s core task is ensuring seamless collaboration, driving results, and overseeing the fund’s strategy and overall performance.

Building Deal Flow & Strategy

Investing is tough. Should you just follow the crowd? You could—but that’s too easy. To achieve superior performance, building a sustainable, evolving strategy is far better.

So how do you grow correctly over time?

-

Create detailed spreadsheets for every startup. Over time, compile competitor lists with performance and valuation data. Once you’ve built a database of 300+ startups, summarizing each project helps extract maximum insights.

-

Work closely with associates to refine sourcing strategies. Once you're established, startups will come to you. But during early growth, actively attend events—hackathons, demo days, early-stage incubators—to boost visibility.

-

Be precise but flexible. If a startup doesn’t fit after initial contact, move on quickly. But if you encounter a standout team closing their round, act swiftly and flexibly to secure the best terms.

-

Boost your online presence. Publish articles on topics aligned with your fund’s focus. For example, Paradigm conducted extensive research on MEV and eventually invested in Flashbots—an R&D group formed to mitigate MEV’s negative impacts.

What should you look for when investing?

Many indicators guide investment decisions. But when evaluating a protocol, several key parameters deserve attention:

-

Tokenomics. Analyze inflation rate, supply schedule, staking rewards, etc. The goal is to avoid sell pressure and ensure strong mechanisms incentivize ongoing demand.

-

Technical/Fundamental Analysis. This is often the hardest area. For complex projects, consult experts to identify key evaluation points. Assessing NFT collections is relatively straightforward, but understanding standalone L1 blockchains or developer SDKs is far more challenging.

-

Competitors. Study competing protocols. How are they performing? What’s their market share? What differentiates them—advantages or weaknesses? Comparative analysis deepens your understanding of the target project.

-

Ecosystem Fit. Most protocols are built on specific ecosystems—Ethereum, Solana, certain Layer 2s, or Cosmos. Evaluate whether a protocol aligns with its ecosystem. For example, someone built an agriculture protocol on Optimism, despite Optimism not being DeFi-focused—this weakens product-market fit (PMF). Watch for such misalignments.

-

Investor Track Record. If a project is in its second or third round, prior investors exist. Research them—they vary in caliber. Multicoin, for example, is a Tier-1 investor and among the best in crypto VC. Outlier Ventures ranks around Tier-4. Use reference tables to compare fund tiers.

-

Team. Ensure the team has relevant experience and a compelling vision. Do they deeply understand their domain? Are they intelligent? Do they fully grasp their proposal? Would you enjoy working with them?

Other important factors include sentiment analysis, on-chain data, partner ecosystem evaluation, and differences between primary and secondary markets. As a rule of thumb: unless there’s clear evidence an investment is good, assume it isn’t. Actively seek proof of value. If you can’t find it, it’s likely a bad bet.

Conclusion

Starting your own venture fund can be challenging—building operations and processes is always difficult. It’s like moving to a new city: tough at first, but it gets better over time.

The ultimate goal is generating strong fund returns. For example, with $100 million in total capital and average investments of $1 million (for 10% of a protocol), just one unicorn exit—where your stake reaches $100 million—can return the entire principal to LPs.

Remember: investing is an art, selling is an art, communication is an art, and research is an art. Keep practicing until you and your fund become one of the industry’s most recognized “artists.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News