Bull Market Not So Bullish? DeFi Veteran Takes You Through the Market Reality with Data

TechFlow Selected TechFlow Selected

Bull Market Not So Bullish? DeFi Veteran Takes You Through the Market Reality with Data

We are in a phase of volatile market sentiment—stay focused, pay attention to the data, and don't be swayed by market noise.

Author: Ignas | DeFi Research

Translation: TechFlow

To be honest, I've remained bullish since mid-2023, but recently my confidence has started to waver. Ironically, this is actually a good sign—it suggests the market is healing. I'm also receiving more and more private messages from seasoned crypto veterans expressing concern about the market, especially given ETH's recent underperformance. Another comically contrarian signal. Back in March, the consensus was to follow the classic four-year cycle. That seemed too straightforward—and indeed, it was! But just how bad is the situation now? I wanted to step outside the Twitter bubble and look at the data myself. So here’s a snapshot of several data points to help us understand where we currently stand and prepare for what comes next.

U.S. ISM Manufacturing Index

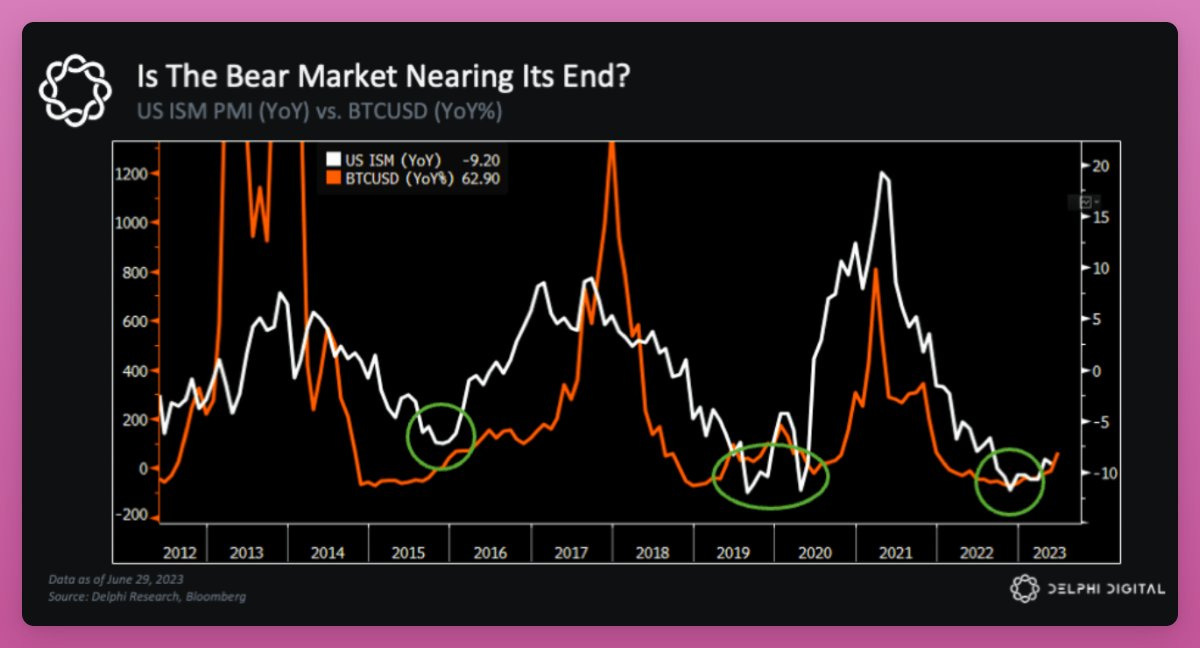

This might seem like an odd starting point, but let me explain. A year ago, I shared a post highlighting Delphi Digital's analysis on catalysts for the upcoming bull run. It's worthwhile revisiting past predictions to extract key lessons.

In their analysis, Delphi detailed the "heavyweight" and "lightweight" narratives expected to dominate the cycle.

Heavyweight narratives included the Fed's liquidity cycle, wars, and new government policies. Delphi accurately predicted Grayscale's legal victory would pave the way for BTC ETFs, though they (like others) didn't foresee ETH ETFs following so closely behind.

They also correctly called SOL's surge, the rise of AI tokens, and memecoins' dominance. Major respect for that.

But there was one thing they seemed to get better than most. Check the chart below.

They wrote: “The U.S. ISM is one of the best indicators for predicting asset price trends and appears to be nearing the bottom of its two-year downtrend. Financial markets have already begun reacting…”

“Surprisingly, ISM precisely tracks prior cycle trajectories, including timing of peaks and troughs. Every 3.5 years, it repeats like clockwork.”

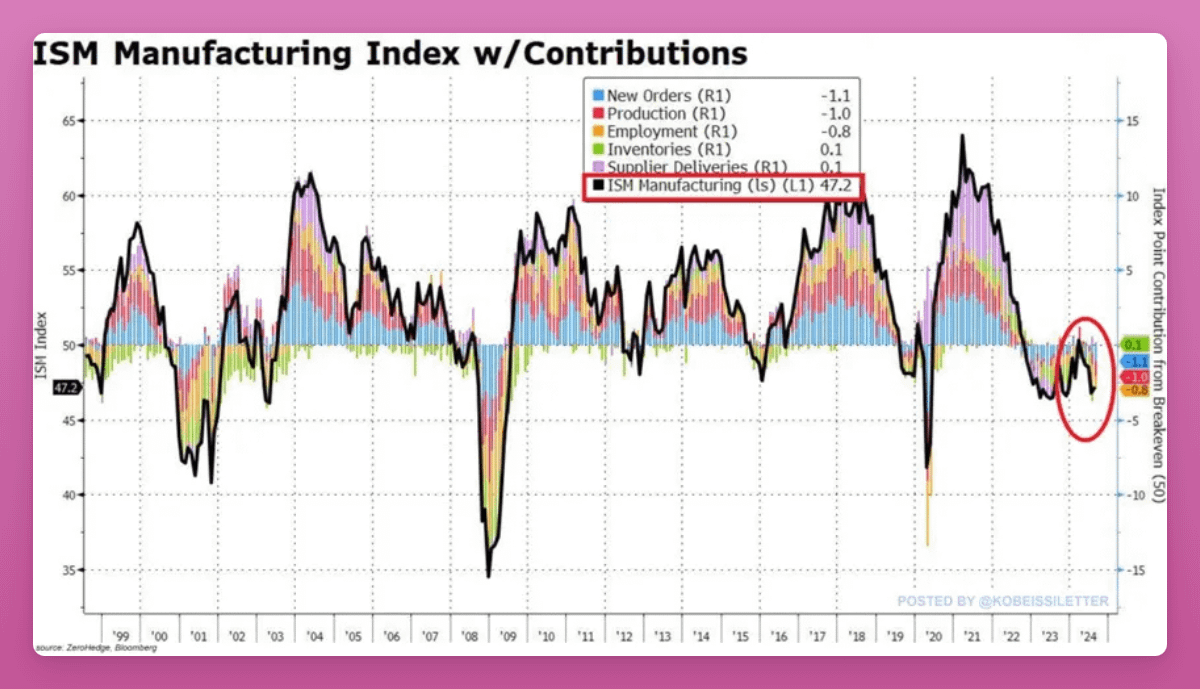

They were right that ISM can predict BTC prices. However, the big issue now is that the U.S. ISM Manufacturing Index reversed its prior bullish trend in 2024 and has started declining again.

U.S. manufacturing has contracted for five consecutive months, dropping to 47.2. The ISM Manufacturing PMI missed last month's expected 47.5. Source: The Kobeissi Letter.

The U.S. ISM index affects crypto by influencing economic sentiment, risk appetite, and the strength of the U.S. dollar. A weak reading may lead to reduced risk-taking and sell-offs, while a strong reading boosts market confidence.

Additionally, it impacts inflation and monetary policy expectations—typically, rising interest rates or a stronger dollar negatively affect crypto.

If the U.S. ISM is truly one of the best indicators for predicting asset prices, we must closely monitor its trend to catch potential bullish reversals.

Crypto ETFs

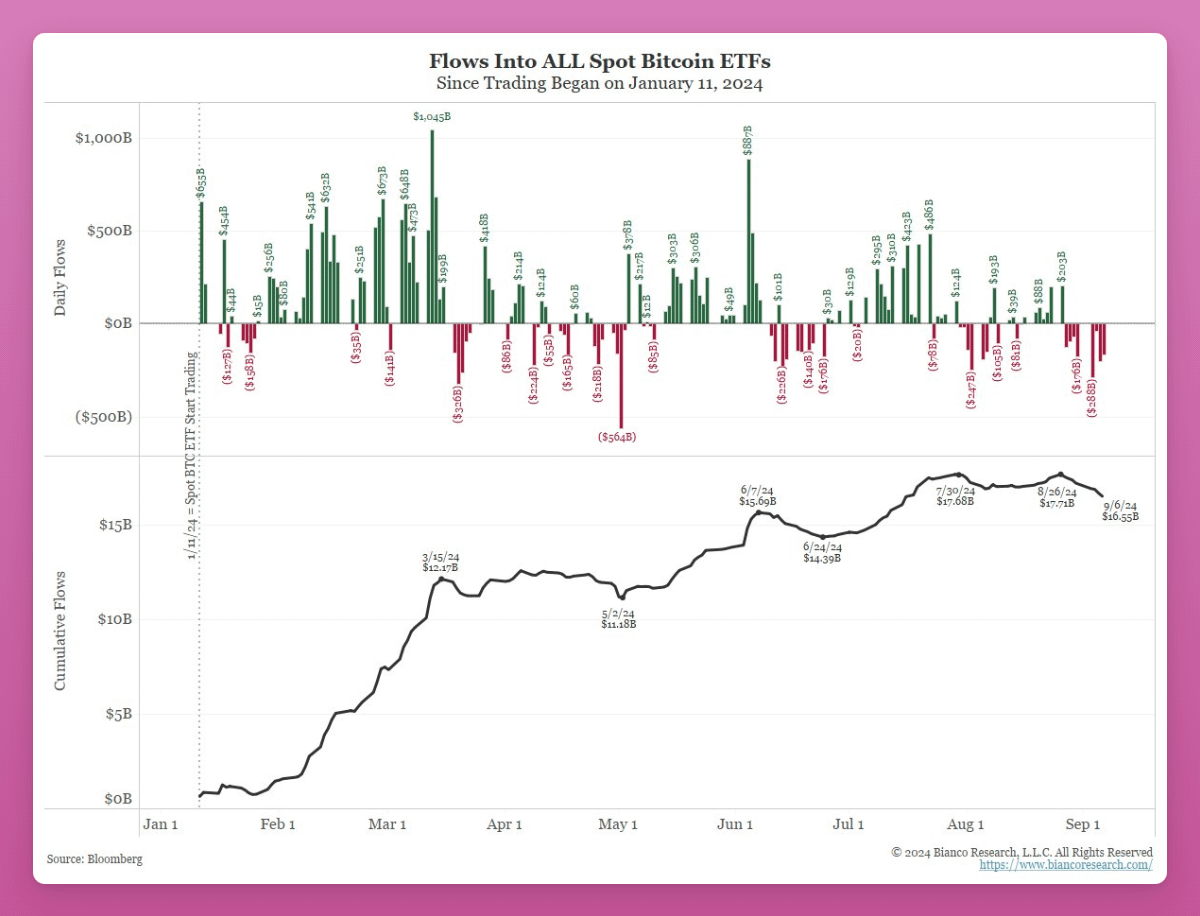

Our new generation of ETFs is going through a rough patch.

Over the past nine days, BTC ETFs saw outflows totaling $1 billion across eight days—the longest sustained period of negative flows since their launch.

Things got worse.

On Friday, spot BTC closed at $52,900, leaving ETF holders with a record $2.2 billion in unrealized losses—equivalent to a 16% loss, according to Jim Bianco. Conditions have improved slightly as of writing.

He also pointed out that ETF buyers aren’t institutions or baby boomers, but small retail “tourists” with average transaction sizes of around $12,000.

According to on-chain analytics, most inflows into spot BTC ETFs come from existing holders moving assets back into TradFi accounts, meaning very little “new” capital is entering crypto.

The main institutional participants are hedge funds focused on basis trades (profiting from funding rates), not directional bets. Wealth advisors remain largely uninterested.

Hence, baby boomers haven’t entered the market yet.

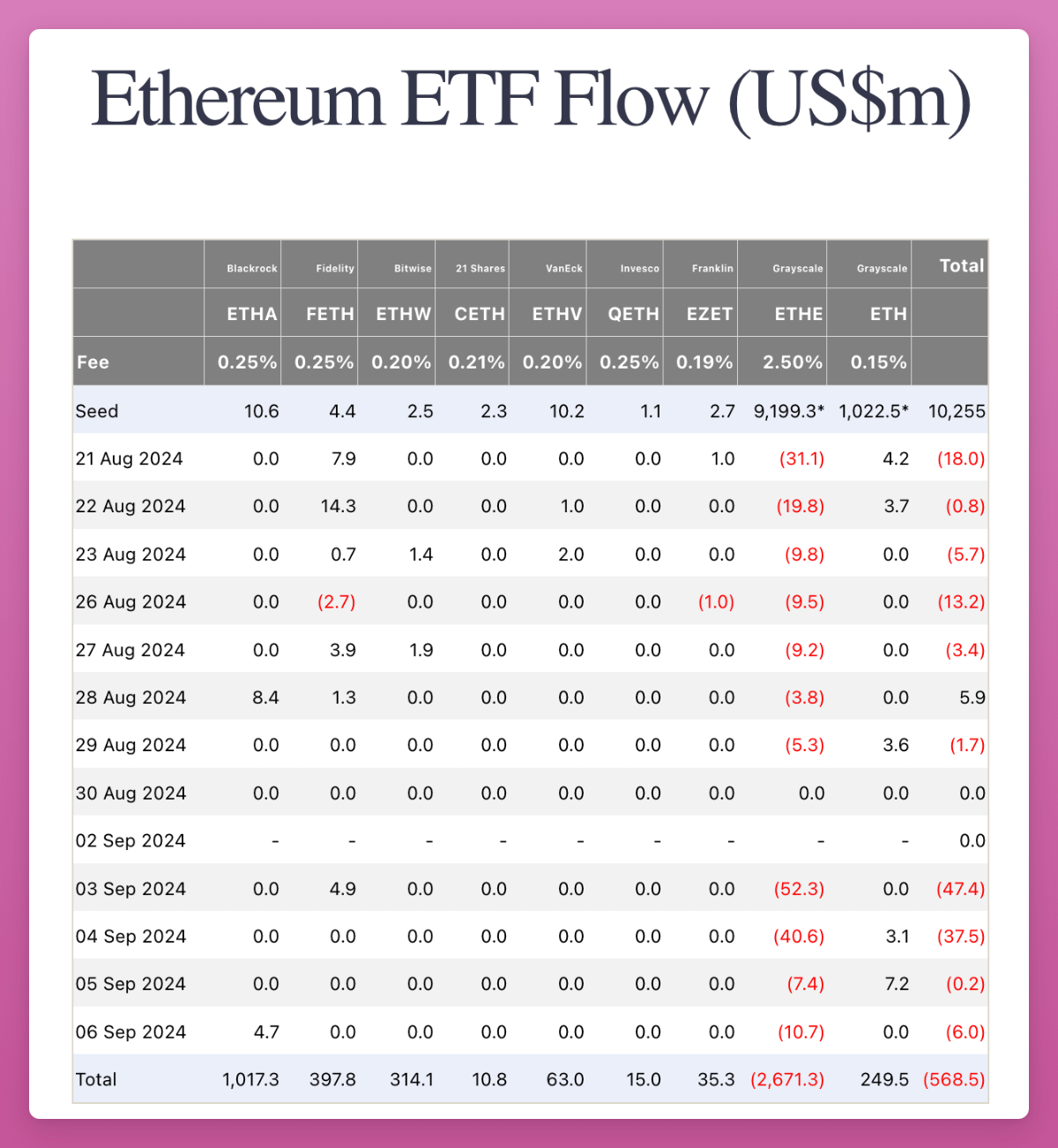

And it gets worse. Just look at ETH ETF flows.

See those zeros?

ETH ETFs haven’t even attracted retail interest. Even Blackrock’s ETHA saw inflows on only two of the past 13 days. All issuers combined show net negative flows.

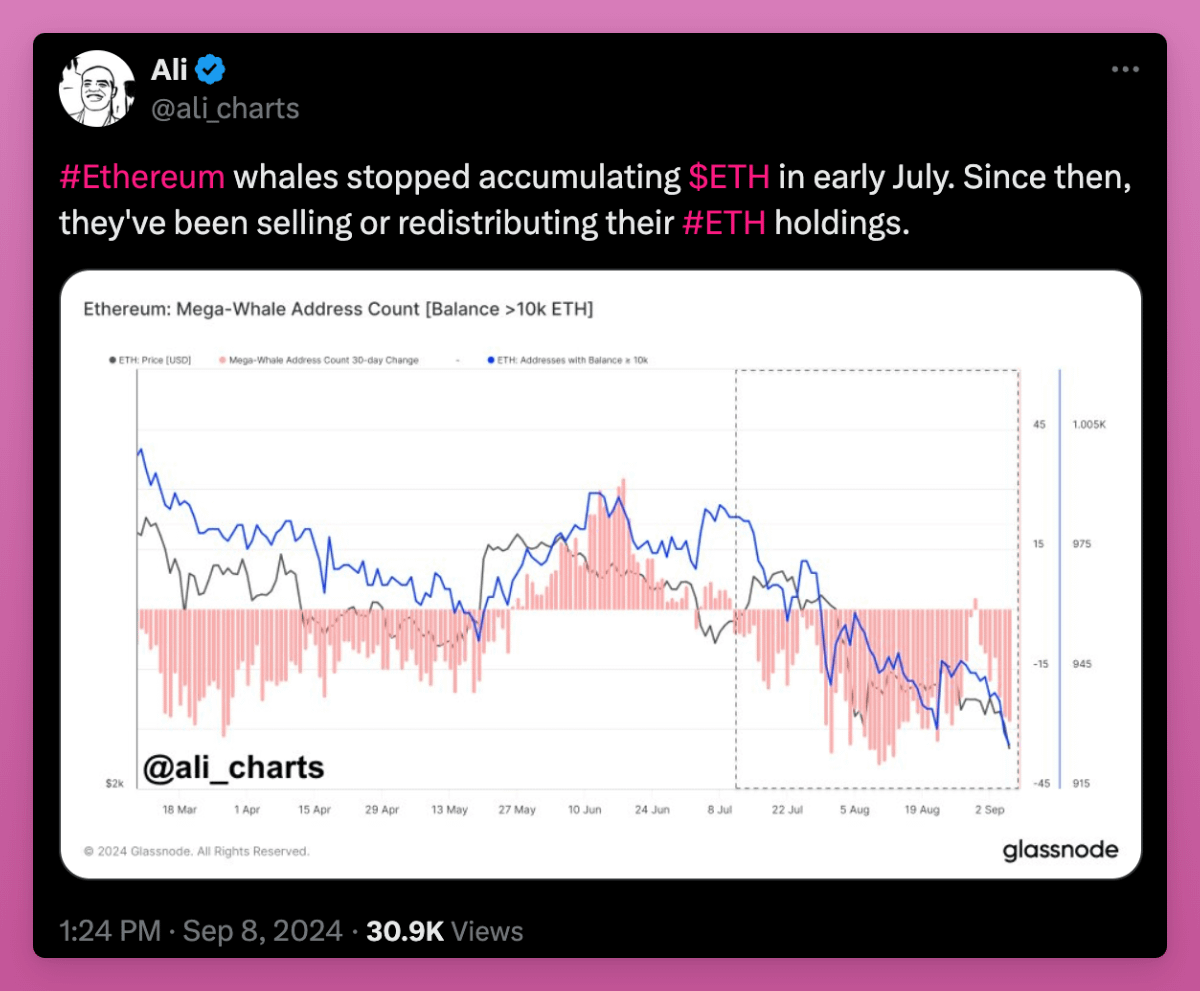

Since July, large-scale selling by ETH whales has dealt another blow to the market.

The only silver lining is that Grayscale ETHE hasn’t dumped ETH en masse. Grayscale still holds $5 billion worth of ETH, but with daily inflows under $10 million, ETF demand isn’t enough to absorb these outflows.

Despite the bearish data, I’ve shared below why I remain optimistic about ETH. Since then, discussions around ETH’s roadmap and L2-driven value accrual to L1 have intensified. I’m hopeful the community can finally start focusing on L1 value accumulation.

What Are VCs Actually Doing?

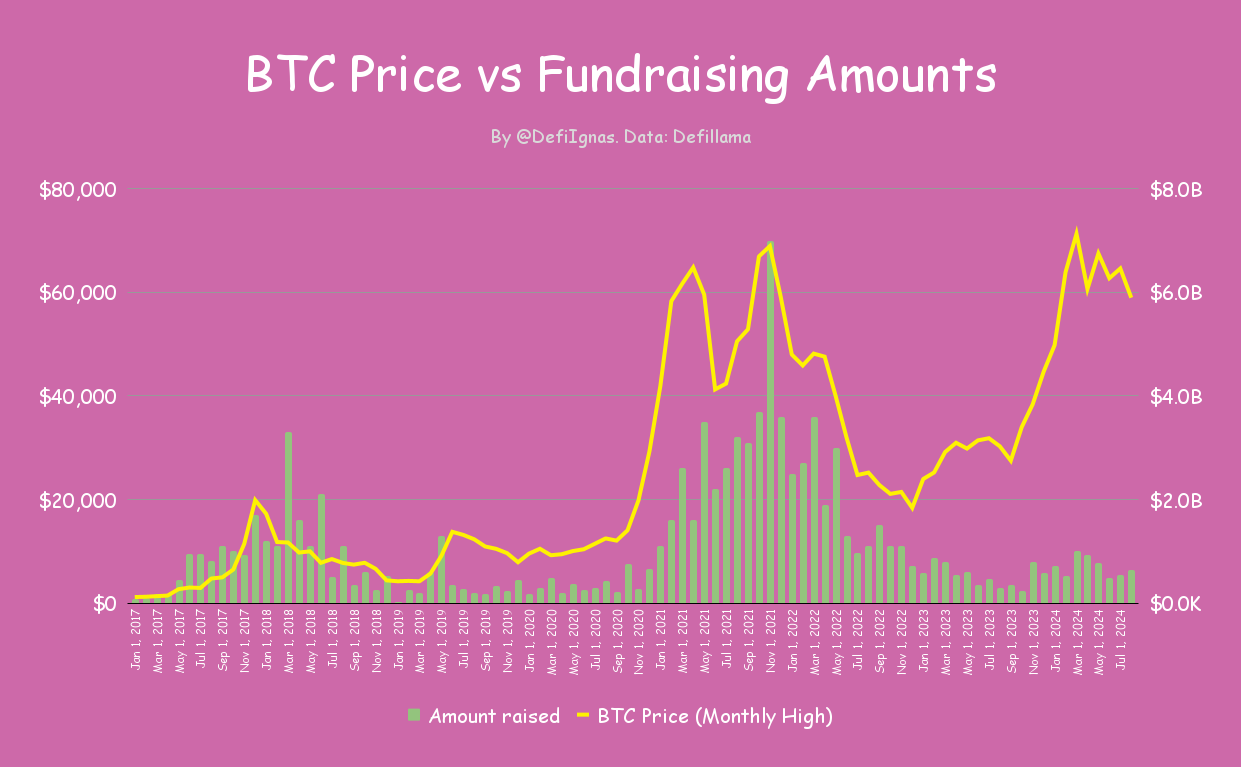

One of the most puzzling aspects of this cycle is the low fundraising volume. While BTC has rebounded, fundraising remains sluggish. I’ve been continuously updating the chart below to reflect this.

Either VCs know something we don’t and are bearish on the industry, or they’re chasing tops just like retail. Conversations with some VCs suggest crypto-focused venture firms behave like retail investors—just with deeper pockets.

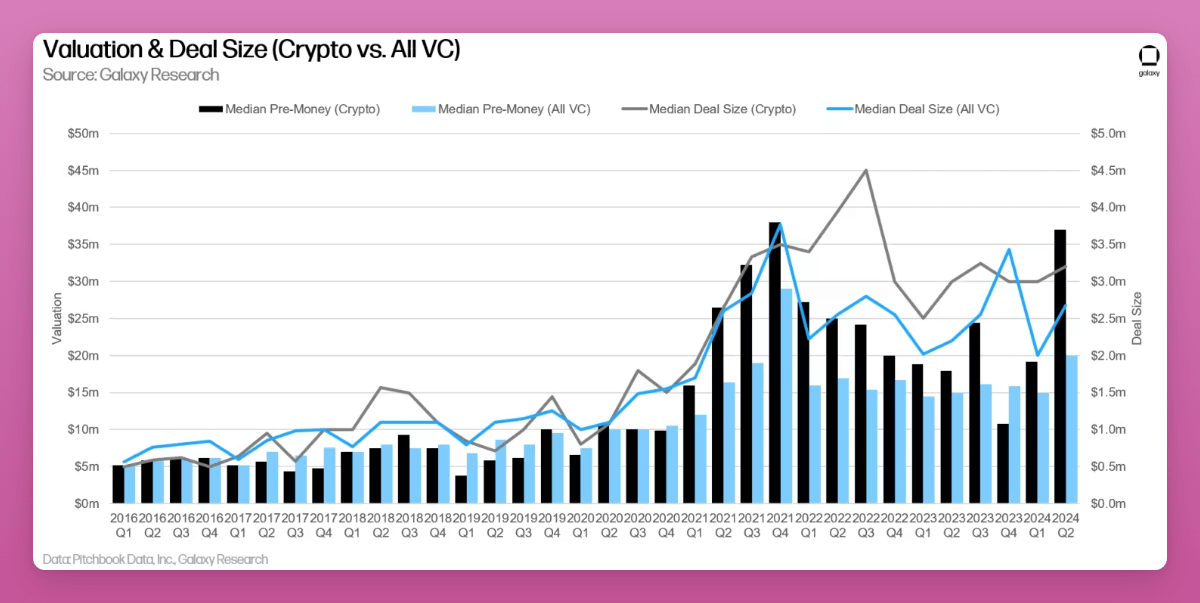

While total fundraising is far below 2021 levels, median pre-money valuations have nearly doubled—from $19 million in Q1 to $37 million in Q2, close to historical highs.

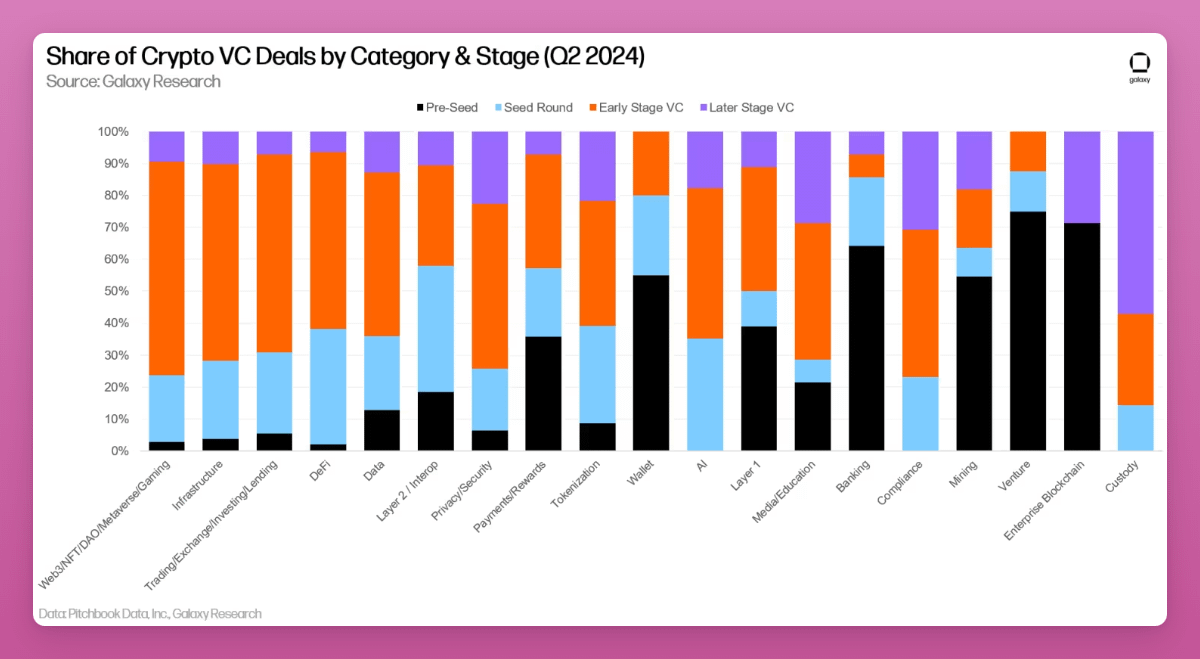

According to Galaxy’s Q2 2024 VC report, despite limited available capital, competition and FOMO have driven up valuations, especially among early-stage startups.

This makes sense. As crypto prices rebound, VCs rush to invest in a limited pool of high-quality protocols. For example, Paradigm, having missed Eigenlayer, backed its competitor Symbiotic instead.

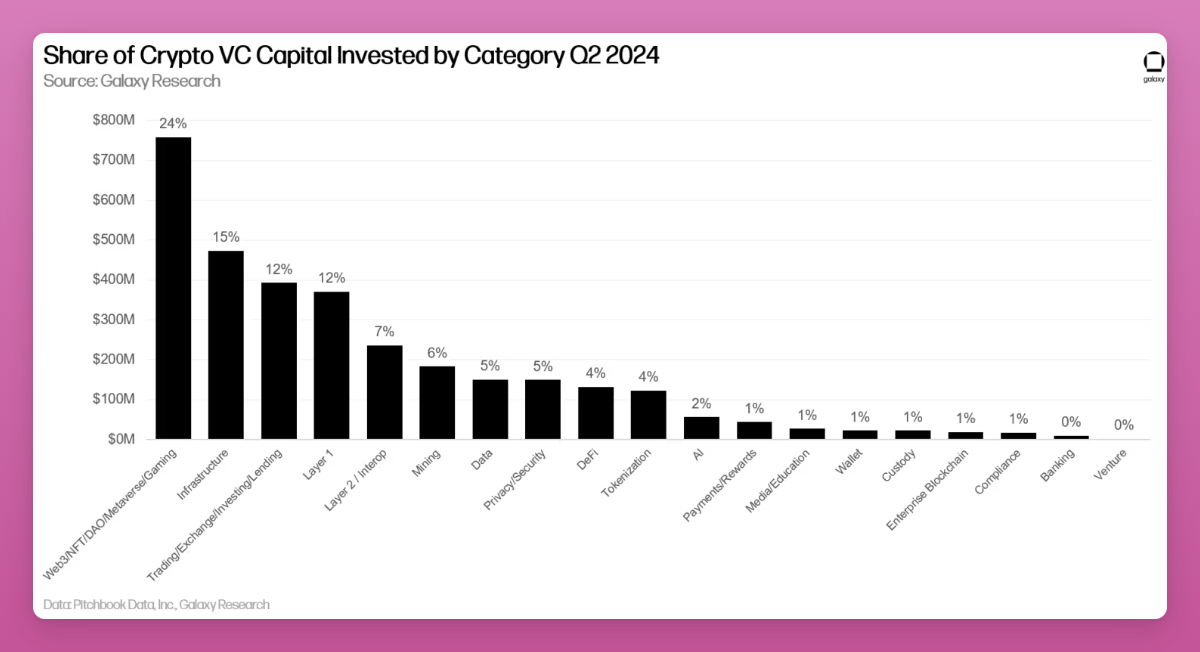

An interesting trend: despite lower retail interest, Web3, NFTs, DAOs, metaverse, and gaming projects led fundraising, raising $758 million in Q2—24% of total VC capital.

The two largest deals were Farcaster ($150M) and Zentry ($140M). Infrastructure, Layer 1, and trading platforms followed. Notably, AI-crypto hybrids still attract only marginal capital.

I personally feel demand for gaming and metaverse projects is low. At my DeFi creative agency Pink Brains, we hired someone dedicated to GameFi and metaverse research and community building, but had to pause due to lack of interest.

Interestingly, Bitcoin L2s raised $94.6 million this quarter—a 174% YoY increase—indicating growing VC interest in the BTCFi ecosystem.

Investors remain optimistic about the Bitcoin ecosystem, expecting more composable blockspace that could bring DeFi and NFT models back to Bitcoin. — From Galaxy’s Q2 2024 VC Report.

Moreover, Galaxy notes that early-stage deals accounted for nearly 80% of invested capital in Q1, with pre-seed rounds making up 13%. This signals optimism about crypto’s long-term outlook.

Despite challenges facing late-stage companies, innovative ideas continue to attract VC attention.

I personally sense fundraising has slowed—I rarely get DMs inviting me to KOL rounds anymore.

Still, I usually avoid participating in KOL rounds, as I don’t believe I have a special edge in private markets. I prefer more liquid investments and want to maintain editorial independence.

State of L2s—Base Shines, Others Lag

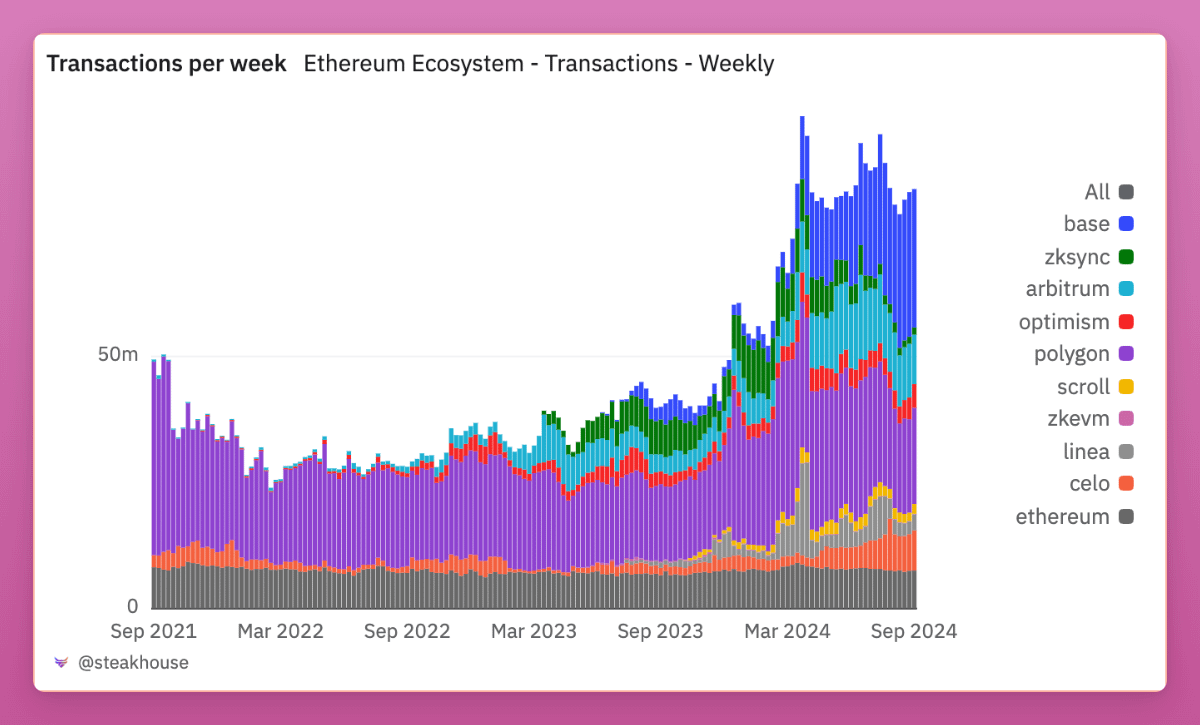

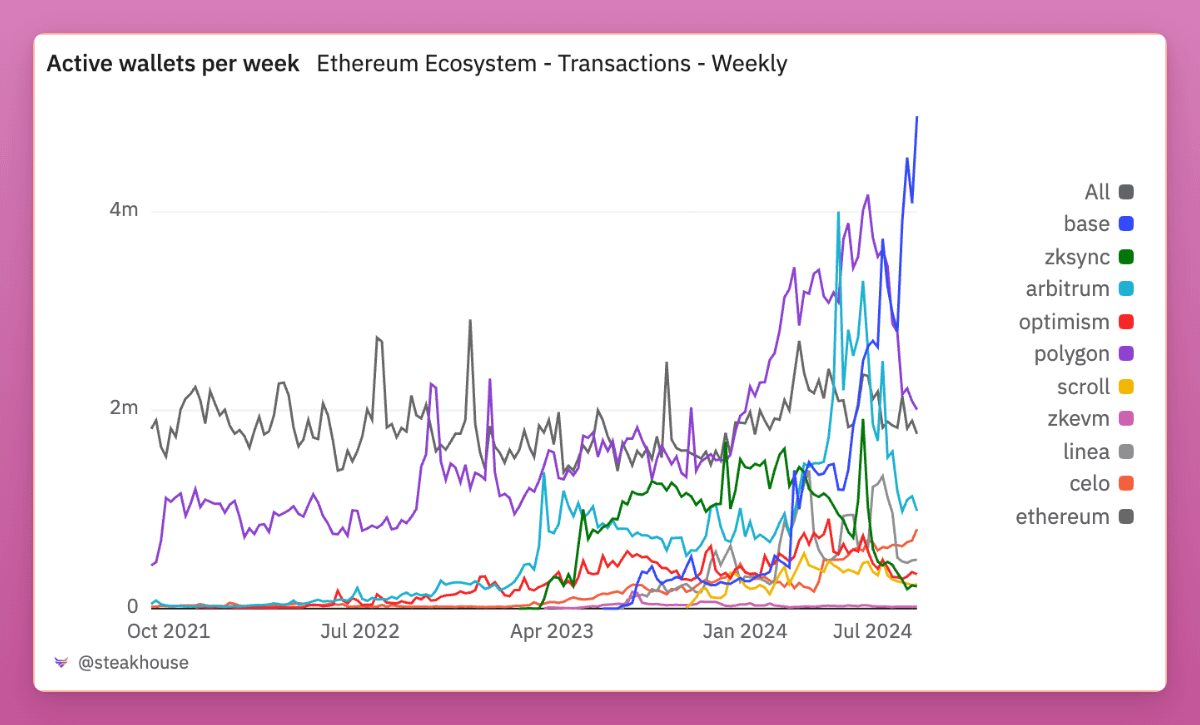

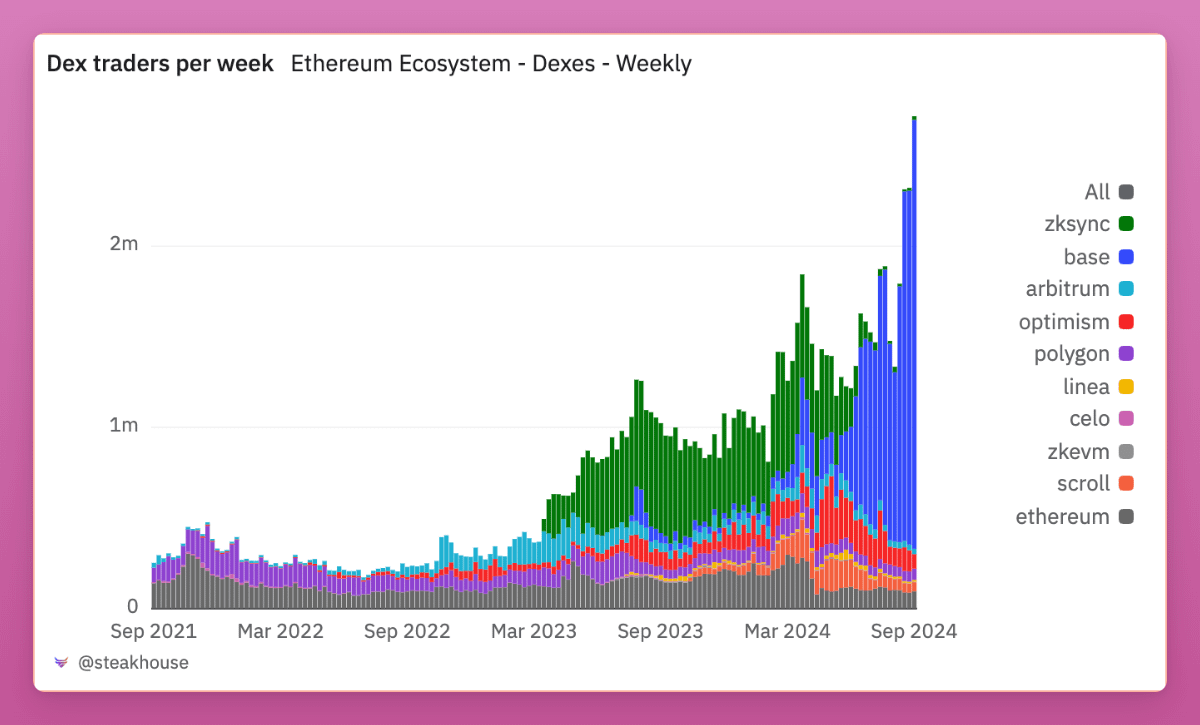

The good news: activity on L2s is growing rapidly. Active wallet counts and weekly transactions are rising, and DEX volumes have been climbing for over a year.

However, Base is growing much faster than the rest. Check the blue line representing weekly active wallets.

Base continues to attract new users, while other L2s are losing them. This growing dominance is especially clear in DEX trader share—Base captured a staggering 87%!

So what’s driving this?

Base launched smart wallets during Onchain Summer. While Passkey-based wallet creation is novel, I mostly used the app to mint a few NFTs just to try it out.

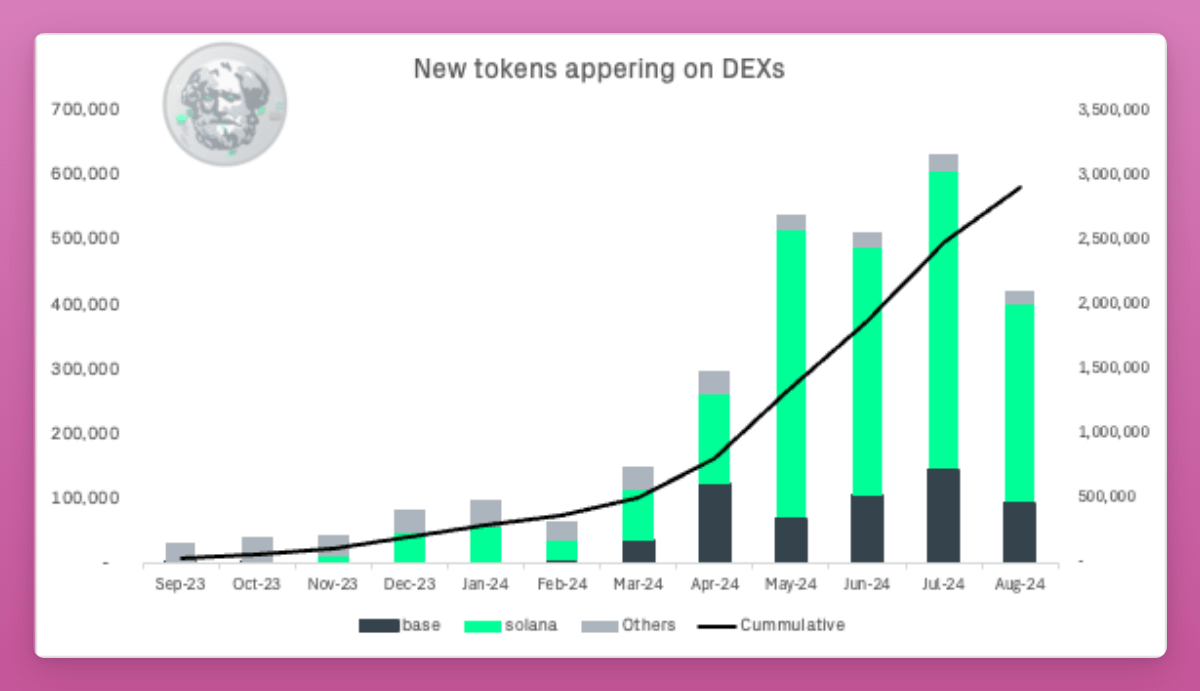

But Base’s real summer highlight was meme coin speculation, which pushed transaction volume and wallet growth to record highs. As shown, Base and Solana were the primary drivers behind most new token launches on DEXs.

Source: Archimed Capital

Surprisingly, even after the meme coin hype faded and summer ended, volumes have stayed elevated.

This may also relate to airdrop farming: multiple insiders I met at KBW speculated a Base token launch is likely. So make sure to create your smart wallet and try out a few apps. Farcaster might be a solid choice :)

About SocialFi

Despite frustrations with Racer and Friend Tech, SocialFi is another area seeing strong user growth.

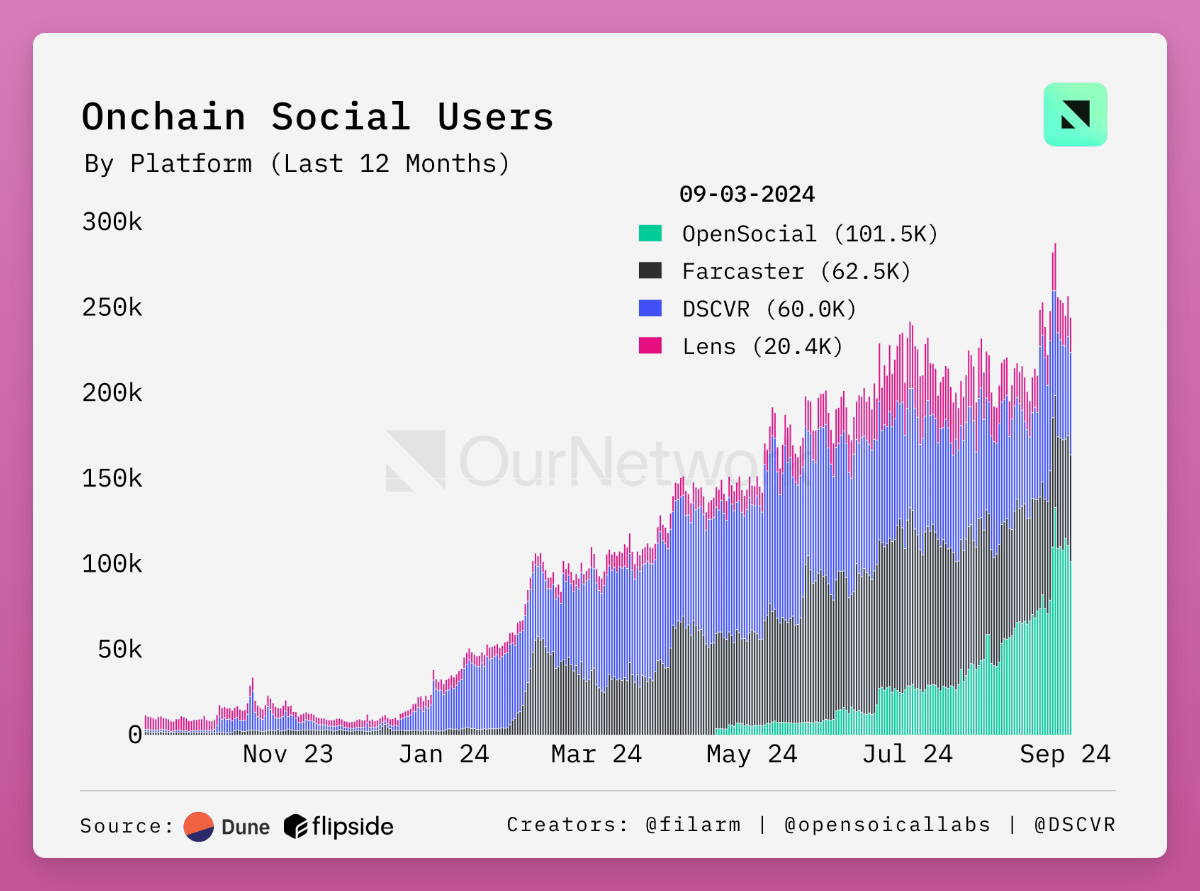

Farcaster and Lens may dominate attention on X, but APAC’s OpenSocial Protocol recently hit 100K daily active users—surpassing Farcaster’s 65K and Lens’ 25K combined. Yet, few on X seem aware of OpenSocial’s actual features. DSCVR, built on Solana, quietly reached 60K DAUs with almost no buzz.

Despite losing money on Friend.tech, I remain bullish on SocialFi. It’s one of the few crypto sectors that goes beyond pure speculation. Vitalik Buterin mentioned in an AMA that he’s most excited about decentralized social media.

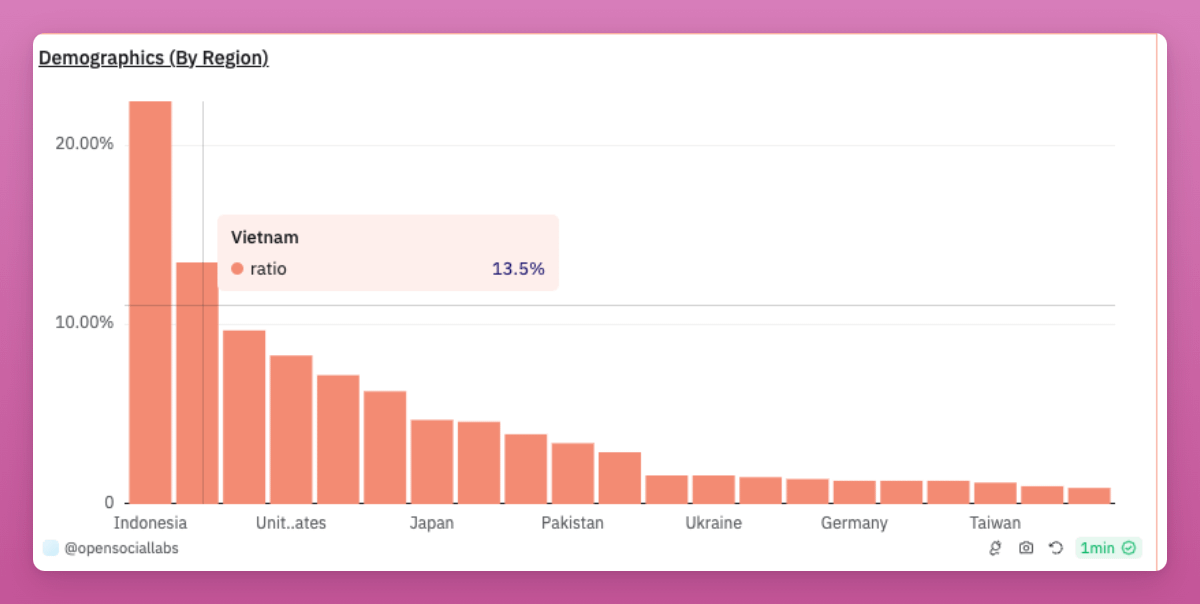

Yano noted that OpenSocial is overlooked because crypto media and X are Western-dominated, while OpenSocial originates in Asia: Indonesia, Vietnam, and India are its top user sources, with the U.S. ranking fourth.

OpenSocial aims to build a decentralized social platform where creators and communities fully own their networks and data. Users can independently build and manage social apps, communities, and assets without relying on giants like Facebook or Twitter. This offers greater control, ownership, and monetization opportunities, making social media more open and fair.

Like Lens and Farcaster, OpenSocial is a platform hosting multiple apps and interfaces. Among them, Social Monster (SoMon) leads in DAUs. You can try it here, though the experience still has many kinks…

The key takeaway: crypto narratives are often shaped by Western audiences, but real global users may be engaging with crypto in ways quite different from what crypto OGs on X describe.

Quick Charts to Understand Current Market Conditions

I’d like to share a few data points to help illustrate our current market state.

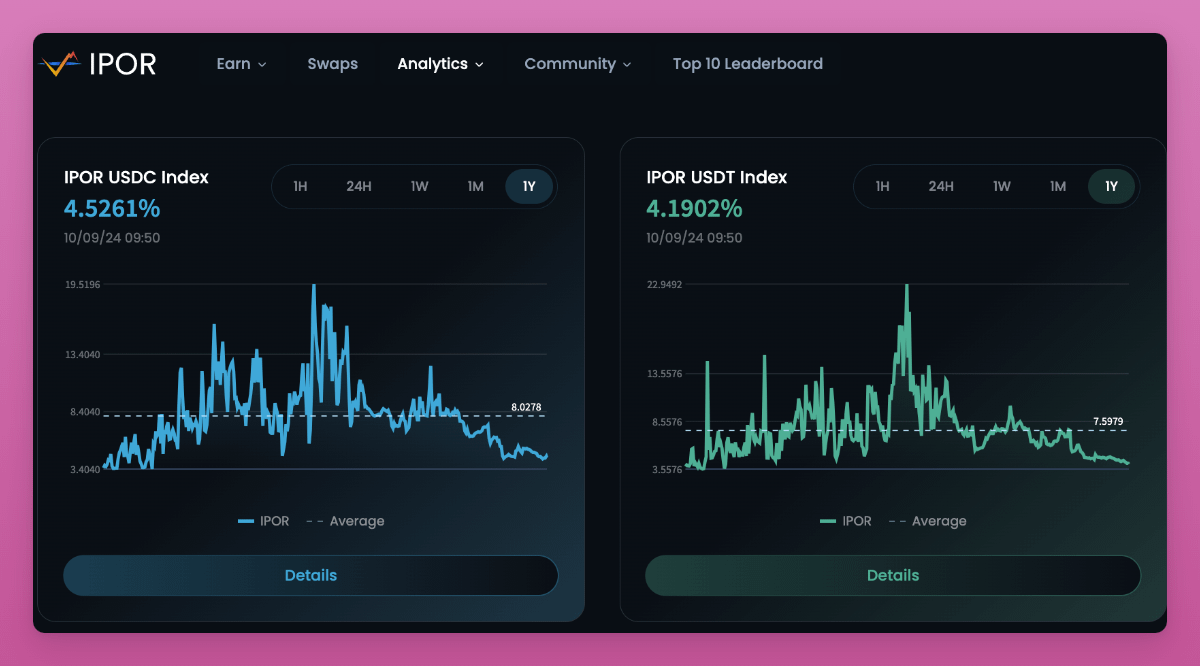

According to the IPOR Stablecoin Index, on-chain leverage has cooled, as borrowing rates have returned to pre-2023 rally levels. During peak airdrop farming periods, borrowing rates spiked, but with poor airdrop outcomes, many investors closed their leveraged positions.

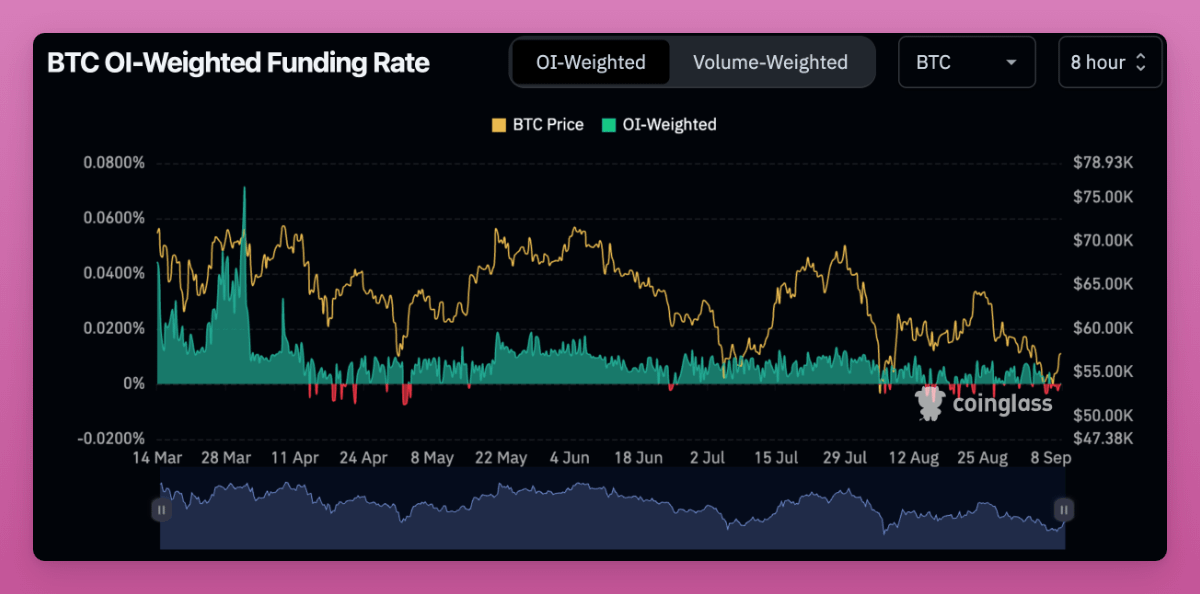

We can also clearly see a reset in Bitcoin’s open interest funding rates.

Note the high funding rates in March, turning negative in April, and dipping negative again in July and August. Negative rates mean shorts pay longs, typically indicating bearish sentiment. Yet, open interest (OI) is now back in positive territory.

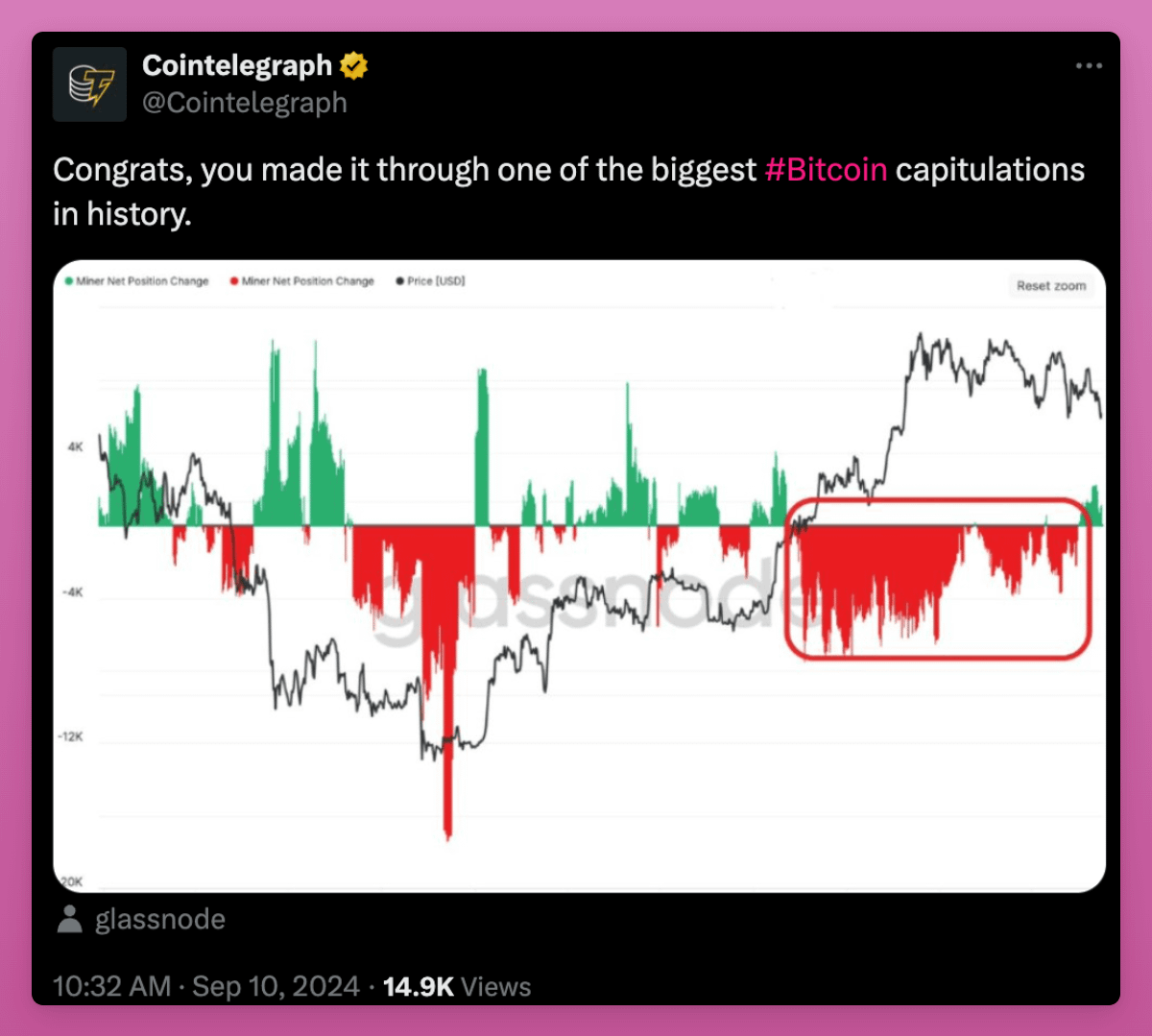

Another bullish signal: miner selling behavior. Miners appear to have stopped selling and are accumulating BTC again.

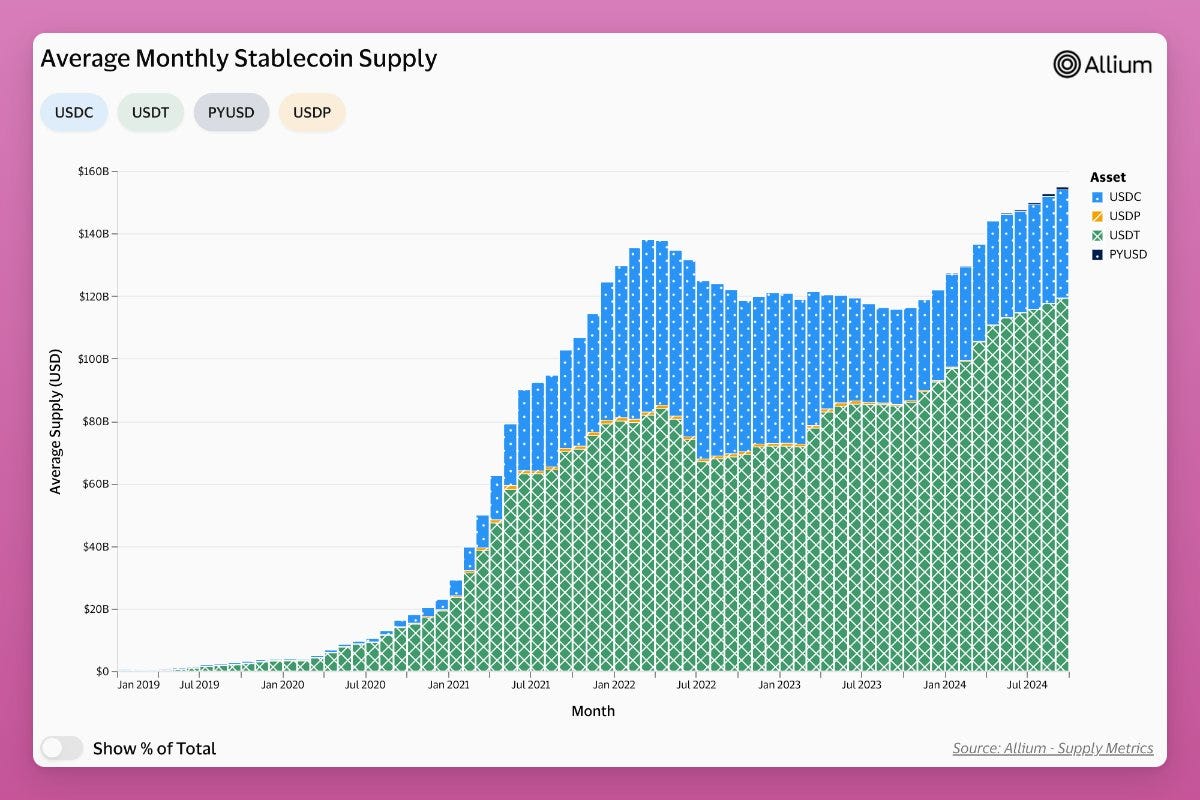

Possibly an even more bullish chart is stablecoin supply, which continues to grow steadily.

However, the biggest shift is USDT supply rising while USDC dropped from $55B to $34B. Why?

First, Silicon Valley’s collapse caused USDC depegging, marking the peak of its supply. Nic Carter offered another explanation: U.S. policy is pushing investors toward less-regulated offshore stablecoins, stalling USDC growth while USDT expands.

If so, pro-crypto regulation in the U.S. could become a tailwind for USDC.

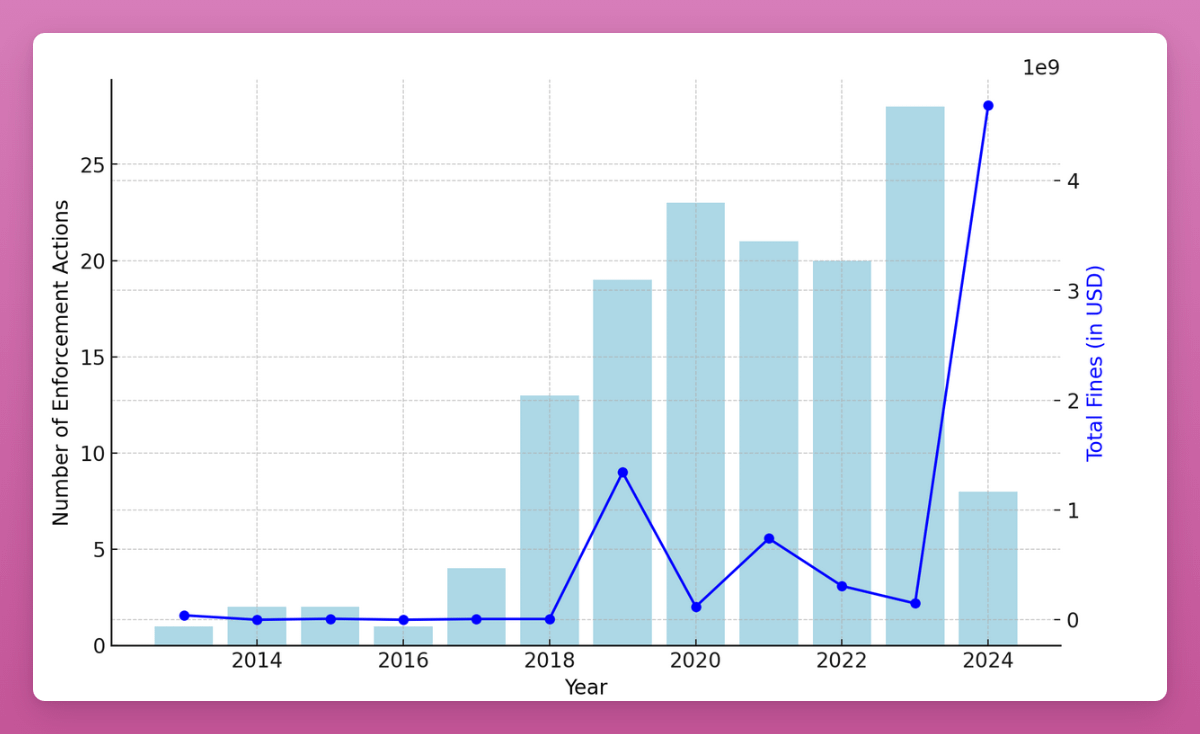

On regulation, the SEC collected $4.7 billion from crypto firms in 2024—30 times more than in 2023.

This capital could have gone into crypto innovation, but instead went to government officials rather than real victims in the space.

Of course, most of that was the $4.47B Terra settlement. The good news is, according to Social Capital, “The SEC is reducing the number of fines but increasing their size, focusing on high-impact enforcement actions to set industry-wide precedents.”

Not ideal. We need either a shift in the current administration’s negative stance on crypto or new leadership to reverse this.

Conclusion: Up or Down?

The current picture looks bleak.

A declining ISM index, weak ETH ETF demand, cautious VCs—none of this paints an ideal market environment. Yet, this is exactly how markets heal. In fact, when everyone is fearful, we’re often closer to a bottom than we think.

While there are plenty of bearish indicators, there are also strong bullish signals. L2s are thriving (especially Base), social platforms like Farcaster and OpenSocial are growing, and market leverage has been cleared. Despite cooling hype, key areas remain active.

The regulatory landscape remains messy. The SEC continues pressuring the crypto space. We need either regulatory reform or leadership change to stop this. Pro-crypto policies could become a major catalyst. Until then, pressure remains. Still, even if Democrats take power, they may need to expand money supply to fulfill promises. In such an environment, Bitcoin stands as the strongest asset.

Ultimately, markets don’t move in straight lines. We’re in a phase of volatile sentiment—but that’s okay. Stay focused, watch the data, and don’t let noise distract you.

Bullish trends are rarely obvious before they happen. Overall, I remain optimistic about the market.

Of course, I could be wrong.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News