L2 in Data: Growth Suddenly Stops, Elimination Round Begins

TechFlow Selected TechFlow Selected

L2 in Data: Growth Suddenly Stops, Elimination Round Begins

A comprehensive overview of the Layer2 sector's fundamental landscape, development models, market data, and future breakthrough strategies.

Author: Ice Frog

It has been proven that Layer2 has not been falsified, but L2s relying on airdrop expectations to PUA (psychologically manipulate) users have indeed been debunked.

Amid the overall underperformance of the Ethereum ecosystem and the imbalance between Infrastructure (Infra) and Applications (App), L2s are now facing a brutal market elimination round. The long-standing concern over liquidity fragmentation will naturally dissipate during this process. Looking ahead, once interoperability is resolved and application-layer breakthroughs occur on Ethereum, L2s may yet regain their former glory.

1. Overview of L2: From Scaling and Cost Reduction to PUAing Users

L2 as Infrastructure: Low Barriers, Proliferation; Homogenization, Weak Narratives

After Ethereum's transition to POS, Layer2 (L2) became one of the most anticipated domains in the Ethereum and broader blockchain space. At its core, L2 solutions aim to reduce transaction costs and increase throughput by sacrificing a small degree of security—a critical step toward Ethereum’s ultimate sharding roadmap.

Following Optimism's open-sourcing of OP Stack, launching an L2 chain became nearly instantaneous. The technical barrier for L2s has dropped to an all-time low, resulting in an explosion of projects. There are now over 60 active L2 chains, underscoring Ethereum's enduring appeal. However, it also raises questions about necessity—especially given the severe liquidity fragmentation caused by high homogenization among L2s. This helps explain why, despite EIP-4844 introduced during Ethereum’s 2024 Cancun upgrade drastically lowering L2 transaction fees, neither Ethereum nor its L2 ecosystem experienced the anticipated boom. Market criticism continues to grow around issues like homogenization, weak narratives, and infrastructure overcapacity.

L2 Development Models: Ecosystem Building vs. PUAing Users

At the peak of market enthusiasm, four flagship projects—Arbitrum, Optimism, ZkSync, and StarkWare—were widely watched as leaders of the L2 race, backed by massive funding rounds, sky-high valuations, extensive ecosystems, and strong technical capabilities. Yet today, amid a chaotic landscape, some have fallen from "kings" to "doomed," while others maintain leadership and widen the gap with competitors. These divergent outcomes stem from differing development strategies.

The business model for L2s is relatively straightforward: act as middlemen profiting from the gas price difference between L2 and L1. Under this model, L2s must serve two groups—developers and users—requiring continuous developer engagement and user activity. This tests each project's operational capability and leads to strategic divergence: some lower barriers for developers and expand ecosystem partnerships; others focus on nurturing native applications and strengthening core advantages; still others rely on airdrop farming incentives to lure user interactions and inflate TVL.

Despite sharing the same revenue model, different growth paths have led to starkly different results. Market data clearly shows that projects genuinely committed to ecosystem development exhibit higher activity and stronger resilience, whereas those relying solely on airdrop-driven user manipulation have become obsolete, fading into obscurity.

2. Market Data: From King to Doom – Just One Airdrop Away

Market Data: Some Daily Active Users in Single Digits, Others Steady and Strong

In the blockchain world, token launches often signal the harvest season. But post-launch user retention remains a crucial test of a project’s quality.

By launch timeline:

Established launched projects: Arbitrum, Optimism;

Recently launched: Zksync, Starknet, Blast;

Expected to launch soon: Linea, Scroll.

Data performance breakdown:

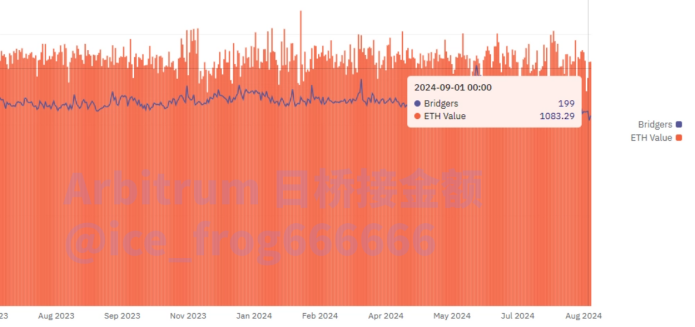

Arbitrum

As the leading L2, Arbitrum boasts a massive $1.3B TVL. Its daily metrics remain stable, with ETH bridging averaging 1,000 ETH per day. It maintains high activity, large transaction volume, and strong protocol revenue.

Despite aggressive attempts by other L2s to siphon off TVL, Arbitrum’s activity remains unaffected—truly demonstrating its龙头 (dragon head) status.

Arbitrum average daily bridged funds,data source.

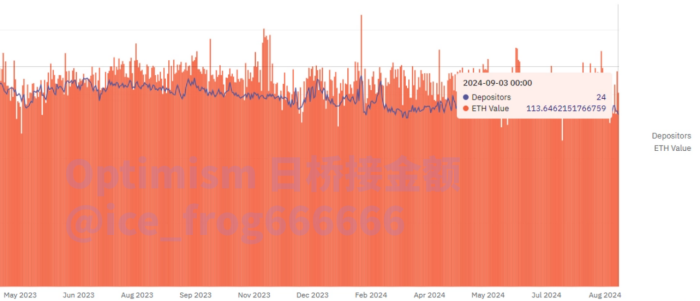

Optimism

As a veteran L2, Optimism lags behind Arbitrum in absolute numbers, but maintains solid stability and consistent activity levels.

Chart: Optimism average daily bridged funds

Data links:

https://dune.com/queries/3626332/6108345

https://dune.com/queries/784244/1399124

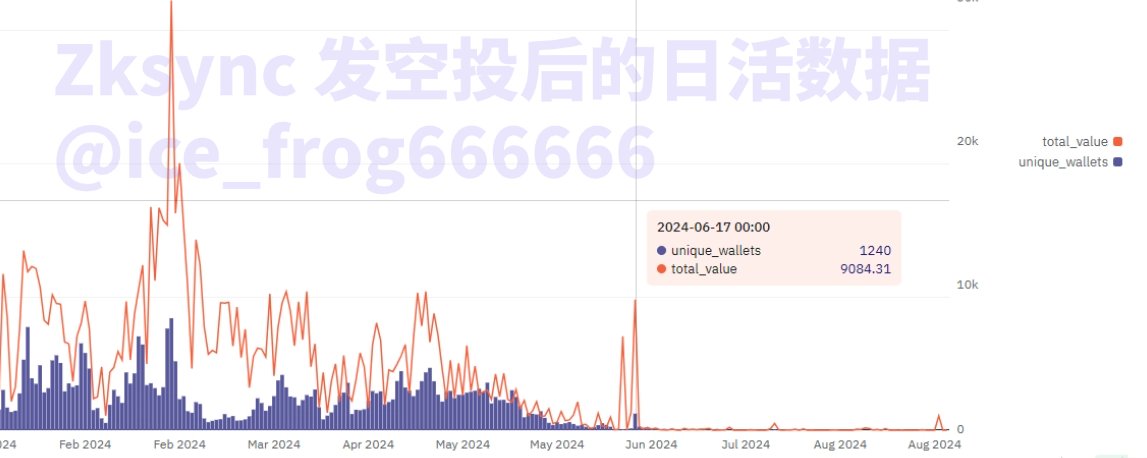

ZKsync

Once hailed as a top-tier zero-knowledge leader, ZKsync fell from “king” to “doom” almost overnight—after just one airdrop. Despite V God and industry experts praising ZK technology’s foresight, ZKsync’s controversial airdrop execution and poor market performance have marred its reputation.

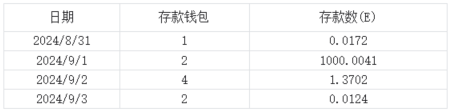

ZKsync’s overall activity is extremely low. After its TGE and airdrop distribution on June 7, on-chain activity collapsed. It frequently sees less than 1 ETH in daily deposits, fewer than 10 depositors per day, and generates only around 1 ETH in daily protocol revenue—barely enough to cover operating costs, effectively running at a loss.

ZKsync protocol revenue and daily active users post-airdrop

Data links:

https://dune.com/peyha/sequencer-profit-on-l2s

https://dune.com/queries/3813897/6414359

Recent data reveals near-zero activity: single-digit depositors, depositing mere tens of dollars. For a project with a $2B FDV and over $100M in funding, these figures are devastatingly bleak.

Starknet

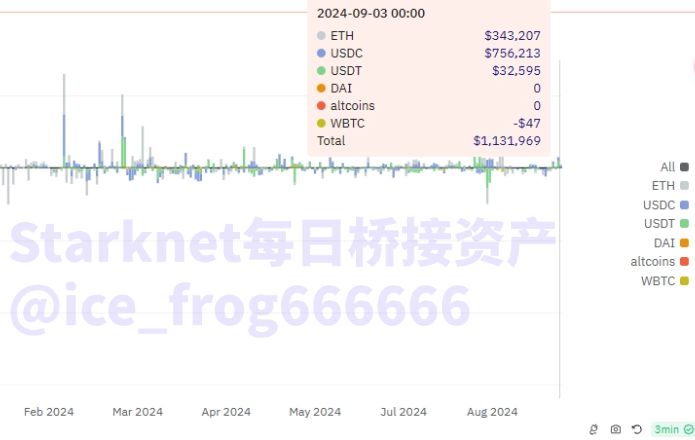

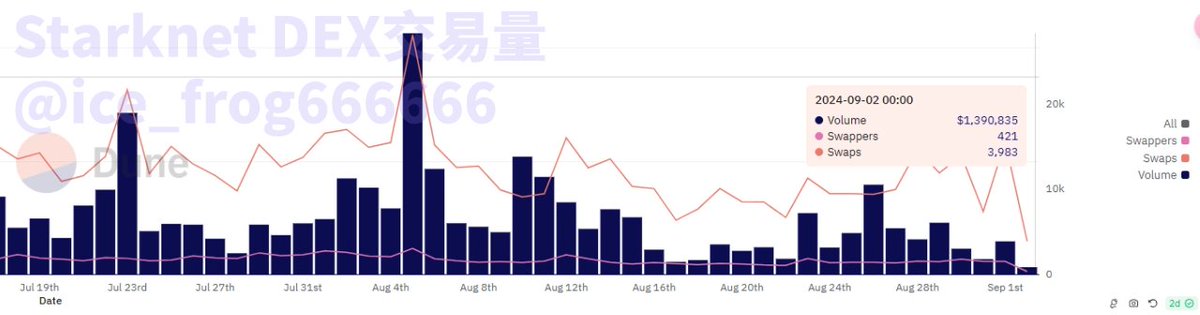

Also using zero-knowledge proofs, Starknet performs slightly better than ZKsync, with average daily bridge deposits in the hundreds of thousands of dollars. However, overall user activity remains low. Since early 2024, daily transactions have dropped to around 70,000, and DEX daily trading volume stays below $5M. For a blockchain with a $4B FDV, this level of activity is still unimpressive.

Starknet average daily bridged funds, daily depositors, and DEX trading volume

Data links:

https://dune.com/queries/831568/1453718

https://dune.com/tk-research/starknet

Blast

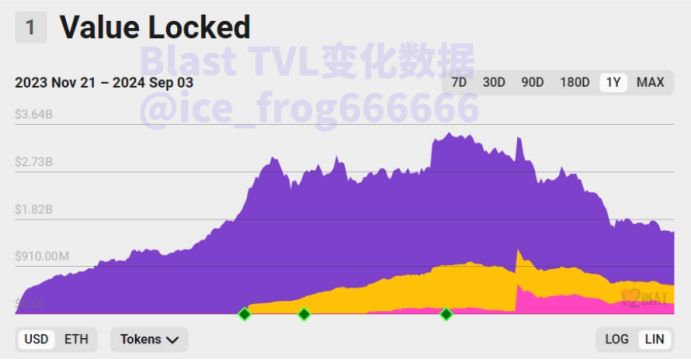

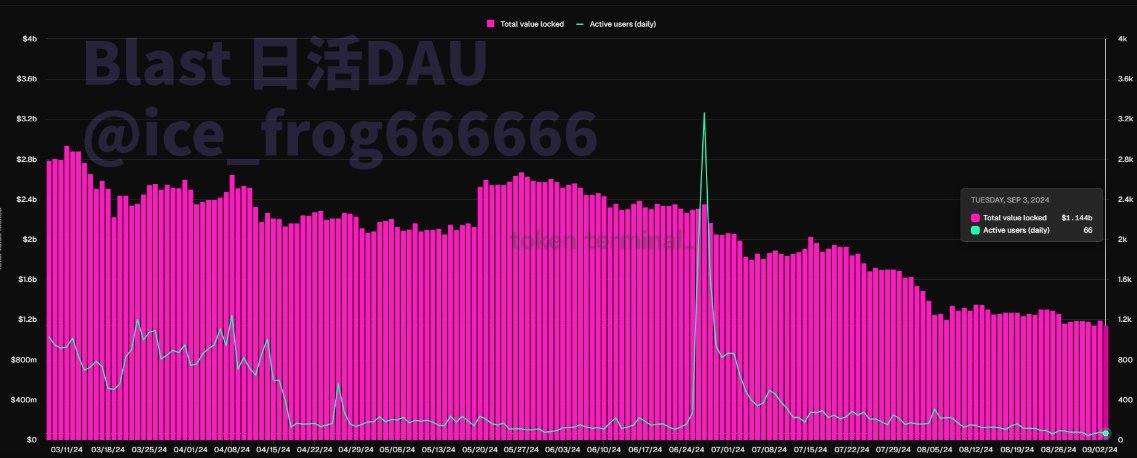

Blast has very low daily active users. Its TVL plummeted from a peak of $3.5B at the beginning of the year to $1.5B—a 60% drop—indicating severe capital outflows. Data clearly shows that daily active users spiked above 3,000 only on the day of its airdrop. Three months after the airdrop claim period ended, average DAU now falls below 100.

Charts: Blast TVL and DAU data

Data links:

https://dune.com/alec/blast-the-new-eth-l2

https://tokenterminal.com/terminal/projects/blastbridge?v=NDhjMTQ3YzUwYzg4ZGU5MjI5MzNmYWVh

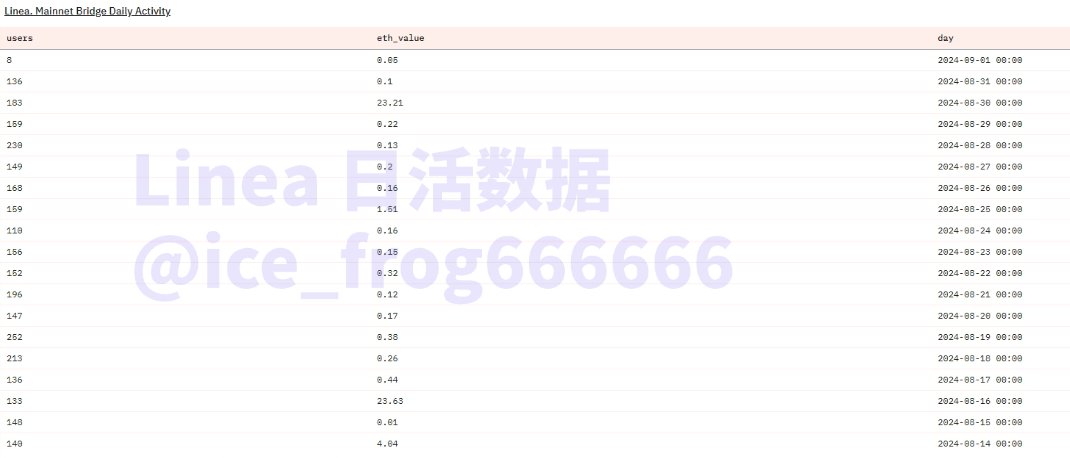

Linea

Linea showed strong initial performance, but due to lack of clear token launch plans or airdrop expectations, user activity has significantly declined. Daily bridged funds sometimes fall below 1 ETH, though the number of users remains relatively high, averaging around 150 daily bridgers. This contrast suggests that yield farmers contribute many small transactions. Overall, without visible airdrop anticipation, DAU has dropped sharply—current daily new users number just over a thousand, far below earlier highs of 100,000 per day.

Charts: Linea DAU and daily new users

Data links:

https://dune.com/linea/linea-overview

https://dune.com/queries/2733739/4549682

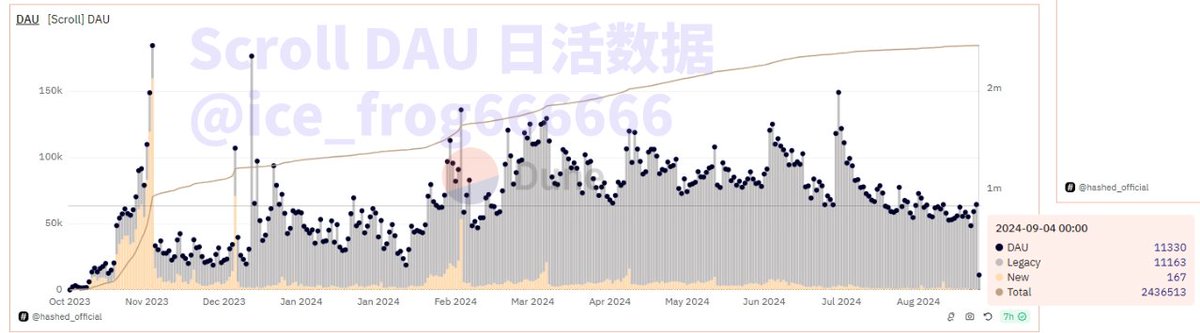

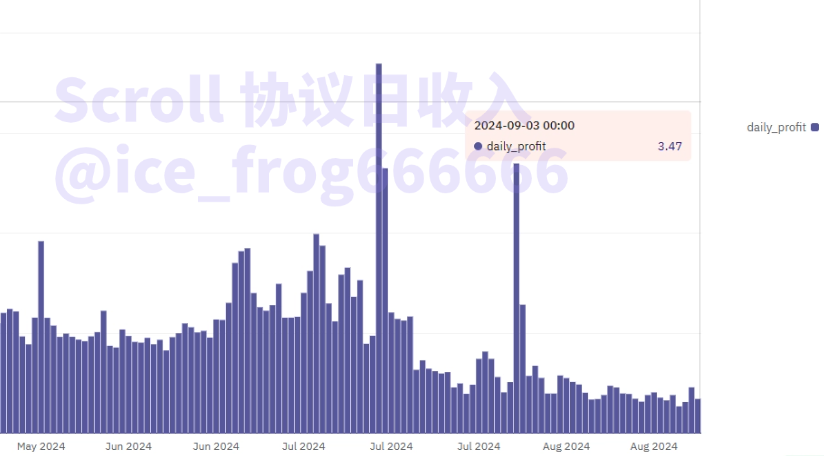

Scroll

Scroll’s DAU has been declining since early 2024, with only about 100 new users per day. However, due to strong airdrop anticipation, historical retention remains high, with ongoing interactions from legacy wallets. Protocol revenue is modest but compares favorably against other recently launched L2s.

Scroll DAU and average daily protocol revenue

Data links:

https://dune.com/queries/3626340/6108370

Underlying Causes: Fierce L2 Competition, Airdrop Hype as a Double-Edged Sword

The data clearly shows that intense competition among numerous L2s has intensified. Established players like Arbitrum and Optimism continue to dominate, while newer entrants like ZkSync, Starknet, and Blast are rapidly falling behind. Upcoming launches like Linea and Scroll cling to survival through lingering airdrop speculation. The reasons behind these trends warrant deeper analysis—particularly airdrop expectation management.

Airdrop-fueled wealth stories have raised user expectations to unprecedented levels, giving projects powerful leverage. However, as shown above, while airdrops can temporarily boost TVL and valuation, enabling big fundraising rounds, failure to invest continuously in user experience, ecosystem building, and fair airdrop design inevitably backfires. Artificially inflating expectations only to deliver underwhelming or unfair outcomes triggers swift market backlash.

ZKsync is a textbook case: farmers built up a billion-dollar valuation, but after a four-year wait, the community was met with accusations of insider allocations (“rat warehouses”), destroying trust. The resulting reputational collapse dragged key metrics down irreversibly—its former glory unlikely to return.

In contrast, Arbitrum and Optimism may not have reached new price highs, but they’ve consistently invested in ecosystem growth and executed relatively fair, inclusive airdrops—maintaining stable data and ensuring sustainable operations. Perhaps learning from ZKsync’s downfall, Scroll and Linea have avoided giving clear signals about token launches, buying time and space to survive until more favorable conditions emerge.

3. Breaking the Deadlock: Consolidation or Elimination – Hope Lies with Applications

This year, pessimism toward Ethereum has grown steadily—not only due to failed L2 growth expectations but also increasing external pressure from chains like Solana, compounded by poor macro market conditions. The anticipated boom and sharp price rallies never materialized. From an L2 perspective, core revenue comes from gas fee spreads. When mainnet gas drops to single digits, even Ethereum itself lacks compelling narratives—leading to predictable declines in protocol income.

From a purely technical standpoint, L2s have undeniably succeeded in solving Ethereum’s congestion and high gas issues—at least temporarily. But as mentioned at the outset, improved performance brought fragmented liquidity. Intensifying competition among rollups worsened fragmentation, with interoperability standing as the first major hurdle. Vitalik clearly recognizes this—announcing on social media in August that solutions are imminent. Inevitably, this journey will involve either consolidation or elimination of weaker L2s. Given current activity levels, there’s simply no need for over 60 L2s.

Looking further ahead, the most critical factor in the L2 business model is gas fees—which depend heavily on end-user adoption. Ironically, most well-funded, highly anticipated L2s continue stacking B2B infrastructure upon infrastructure—RAAS, DAAS, AVS-as-a-service—generating new buzzwords. It’s like every project building highways or road construction tools, while the entrances remain overgrown and abandoned. Infrastructure dominates, while applications remain scarce. The former is faster and easier to fund; the latter slower and less glamorous. This imbalance explains Ethereum’s current developmental stagnation.

In July, at the Ethereum Developer Conference, Vitalik’s keynote titled *“Ethereum’s Next Decade”* highlighted a pivotal shift: the next decade’s central theme will be applications. If interoperability is solved, enabling consolidation or elimination of redundant L2s, combined with the emergence of the next killer app, the L2 sector could be reborn. Which L2s will survive this great filter remains to be seen.

4. Conclusion

A comprehensive review of the L2 landscape—covering basic structure, development models, market data, and future breakout paths—reveals clear patterns:

Some projects relied on airdrop hype to PUA users—once tokens were issued, activity vanished overnight, becoming irrelevant—e.g., ZkSync and Blast;

Others leveraged early ecosystem advantages and user bases, sustaining innovation and strong operations to stay competitive—e.g., Arbitrum and Optimism;

Still others, despite elite backing and record funding, survive only on fragile airdrop anticipation—e.g., Linea and Scroll.

The data proves: Layer2 itself has not been falsified—but L2s that manipulate users via airdrop hype have been thoroughly debunked.

Further analysis shows that amid Ethereum’s overall underperformance and Infra–Application imbalance, L2s face a harsh market elimination process. Liquidity fragmentation concerns will fade during this purge. Looking forward, once interoperability is addressed and application-layer breakthroughs occur, L2s may yet reclaim their former brilliance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News