Binance Research: Blockchain Payments, A New Beginning

TechFlow Selected TechFlow Selected

Binance Research: Blockchain Payments, A New Beginning

Although the payments industry is one of the largest and fastest-growing sectors globally, it still primarily relies on outdated, 50-year-old banking infrastructure.

Author: Joshua Wong,Binance Research

Translation: Will Awang

Recently, Binance Research released a report on Web3 payments that provides a comprehensive overview of the current state of traditional and blockchain-based Web3 payments. By leveraging the advantages offered by blockchain technology, it also outlines the future potential of Web3 payments. The report is well-structured with solid arguments and offers valuable insights.

What inspired me most was how the author, Joshua Wong, drawing from his background as a macro analyst, uses data-driven analysis to place Web3 payments within the broader context of the massive traditional financial payment system—rather than getting lost in an obsessive pursuit of purely on-chain technical advancements.

Therefore, this article translates the Binance Research report and further analyzes its referenced sources. Only through cold, objective data comparisons can we clearly understand our current positioning, identify gaps, and determine the direction for future progress.

Enjoy:

1. Core Report Insights

Although the payment industry is one of the largest and fastest-growing globally, it still largely relies on outdated banking infrastructure that is over 50 years old. Modern fintech players such as Stripe, Mastercard, and Visa have improved end-user experiences for consumers and merchants. However, traditional costs remain due to up to six intermediaries involved in each transaction (e.g., card networks, issuers, processors, POS systems, payment aggregators, digital wallets). Blockchain technology offers a completely new global infrastructure track for payments—a fresh start.

Blockchain and its suite of supporting innovations have the potential to significantly reduce the cost and increase the efficiency of cross-border payments. This is already happening at the institutional level, where participants like Visa are running pilots to settle institutional-grade global payments on public blockchains. At the individual level, products like Binance Pay are being adopted for faster, cheaper peer-to-peer transfers and cross-border remittances, enabling direct crypto spending at merchants without gas fees, automatic currency conversion, and real-time settlement.

The sheer scale of the payment industry means adoption of revolutionary technologies like blockchain may be slow and cautious. This also gives the blockchain industry itself necessary time to mature and build essential payment tools and infrastructure.

2. Background

Cash-based face-to-face payments offer a unique sense of financial freedom. Unfortunately, modern digital payment systems fundamentally lack this ability for third-party-free, direct peer-to-peer transactions. This is because we rely on third parties to custody our funds—unlike blockchain technology, which enables self-custody.

Worse still, today’s global payment infrastructure stack still depends on banks and other intermediaries to process any transaction. Today’s payment tech stack urgently needs a reboot—and blockchain technology can deliver exactly that.

When the pseudonymous Satoshi Nakamoto launched Bitcoin in 2009, it was envisioned as a revolutionary form of peer-to-peer electronic cash. The goal was to create a decentralized currency that could offer the same freedom as physical cash transactions—but for digital payments. It achieved this by enabling direct transactions between individuals without financial intermediaries like banks. This vision promised a new era of financial freedom, transparency, and lower transaction costs.

Since its inception in 2009, the modern crypto industry has undergone significant changes. The emergence of stablecoins introduced a stable unit of value usable as a medium for exchange and payment, while leveraging blockchain's benefits and eliminating asset volatility issues. Additionally, Layer 1 and Layer 2 solutions have improved transaction speed and reduced costs, effectively overcoming previous bottlenecks that hindered the use of distributed ledgers for large-scale payment processing.

This report will outline the current landscape of traditional payments and their key challenges. Then, it will discuss how blockchain technology addresses these issues, the current state of blockchain-based payments, and how the payment industry can advance through blockchain integration.

3. Current State of Traditional Payments

When global payment systems like SWIFT were first created in the 1970s, enabling international money transfers was a groundbreaking achievement and a major milestone in finance.

However, today’s global payment infrastructure can only be described as outdated, analog, and fragmented. It is a costly and inefficient system operating within limited banking hours and relying on numerous intermediaries. The modern financial system depends on thousands of banks worldwide, each maintaining its own ledger. The lack of a unified global standard among these banks hinders seamless international transactions and complicates consistent cooperation.

Deficiencies in the modern payment system make interbank cross-border transactions expensive and inefficient, as a single transaction may pass through multiple intermediary banks before reaching its destination. Sometimes, it resembles a black box—neither sender nor receiver can track the flow of funds, left waiting in the dark.

According to the World Bank, cross-border remittances typically take up to five business days to settle, with average fees amounting to 6.25% of the transaction value. Despite these clear challenges, the business-to-business (B2B) cross-border payment market is massive and continues to grow. In 2023, the total B2B cross-border payment market size reached $39 trillion and is projected to grow 43% by 2030, reaching $53 trillion.

3.1 Current Landscape of the Traditional Payment Industry

The payment industry appears unaffected by inefficiencies and has grown into one of the largest industries globally. Estimated revenue reached $2.83 trillion in 2024 and is expected to reach $4.7 trillion by 2029, representing a compound annual growth rate (CAGR) of 10.8%. Global payment volume reached approximately $150 trillion in 2022, a 13% increase from 2021.

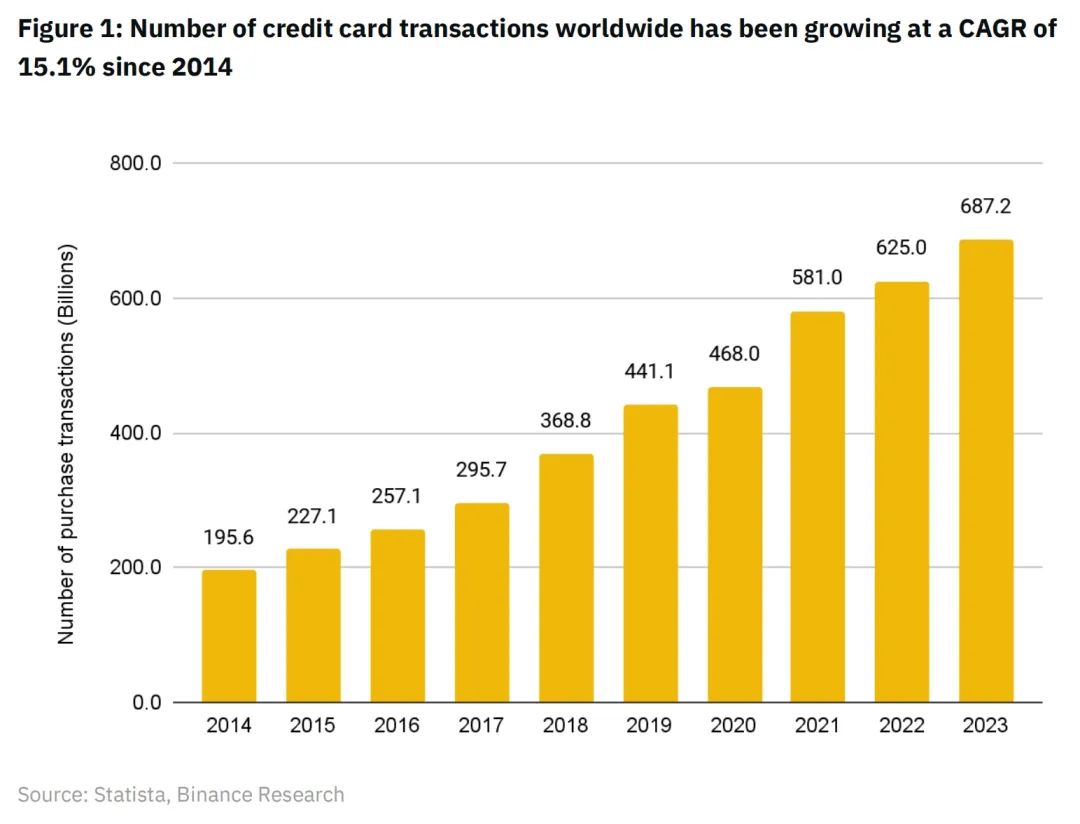

A similar trend is observed in the growth of purchase transactions across major global card networks (American Express, Discover, JCB, Mastercard, Visa, and UnionPay) over the past nine years. Since 2014, transaction volumes have steadily increased at a CAGR of about 15.1%.

Despite being one of the largest and fastest-growing industries globally, much of the payment sector still operates on 50-year-old technological rails. The global payments landscape has evolved into a rent-collecting intermediary ecosystem filled with middlemen who sit between merchants and consumers, extracting fees from every transaction.

Innovations in payment fintech over the past five years have worked wonders for merchant and consumer experience. Yet, they do not shield users from the high costs caused by the inefficiencies of legacy systems—even the most advanced fintech solutions still depend on these traditional payment infrastructures.

Broadly speaking, two types of payment systems exist in the modern payment industry: open-loop and closed-loop systems.

3.2 Open-Loop Payment Systems

Card networks like Visa and Mastercard support the global open payment infrastructure. They allow numerous acquiring and issuing banks worldwide to connect to the network, facilitating fund transfers between banks via clearing and settlement mechanisms.

Card networks represent invaluable innovation, enabling rapid communication between banks globally. They provide an extremely convenient system for consumers, allowing one Visa/Mastercard to be used for goods and services anywhere in the world. As such, they have become the dominant means of digital payments today. Visa and Mastercard rank as the 18th and 20th most valuable publicly traded companies globally, respectively.

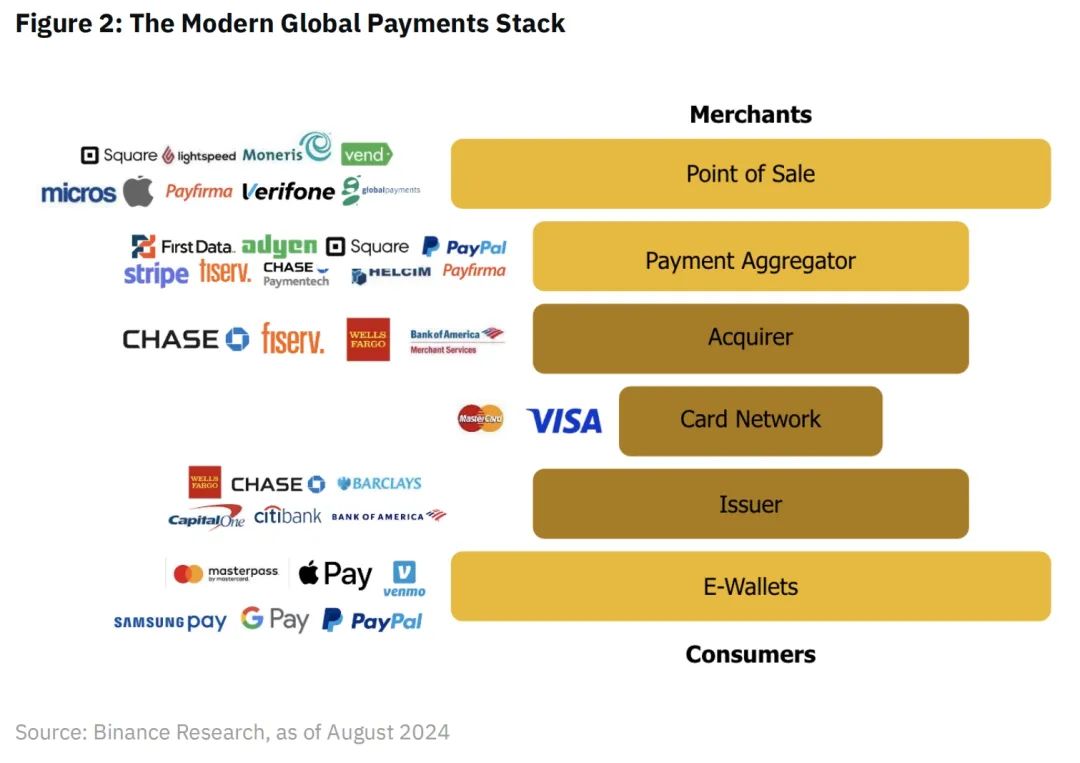

In a typical open-loop payment system supported by card networks like Visa and Mastercard, up to six intermediaries stand between merchants and consumers.

1. POS Services: Physical or digital terminals that initiate transactions by capturing payment details and sending them for processing. For example, Square—one of the leading POS providers—charges merchants 2.6% + $0.10 per transaction. This fee is then shared among the remaining four rent-collecting intermediaries in the payment stack (digital wallets like Apple Pay and Google Pay currently charge no per-transaction fees).

2. Payment Aggregators: Consolidate transactions from multiple merchants, simplifying the payment reception process. They offer a single integration point for various payment methods. Most aggregators (such as Stripe) also screen transactions for fraud to protect their merchant clients.

3. Acquiring Institutions: Financial institutions that process credit or debit card payments on behalf of merchants. They ensure transaction authorization and transfer funds from the issuing bank to the merchant’s account.

4. Card Networks: Facilitate the transmission of transaction information between acquirers and issuers. They establish rules and standards for card transactions.

5. Issuing Institutions: Banks or financial institutions that issue credit or debit cards to cardholders. They authorize transactions and debit funds from the cardholder’s account. Card networks like Visa and Mastercard also monitor transactions for fraud to protect their banking partners.

6. Digital Wallets (E-Wallets): Digital wallets that store payment information and facilitate online and in-store transactions. They offer users a convenient way to pay without directly using a credit card.

In short, blockchain can serve as an alternative, global, decentralized payment network—a new kind of open system unbound by today’s intermediary-heavy global payment architecture and the slow, costly legacy banking system.

3.3 Closed-Loop Payment Systems

Closed-loop payments are an emerging trend in the payment industry, popularized by companies like PayPal and Starbucks.

In a closed-loop system, consumers interact solely within the PayPal app, as various merchants are onboarded onto the PayPal network and accept payments via PayPal. In Starbucks’ case, customers can only spend funds stored in the Starbucks digital wallet at its stores. An increasing number of merchants are following suit, implementing their own closed-loop systems. The primary aim is to deepen customer loyalty through proprietary rewards programs and bypass the high fees imposed by existing open-loop payment stacks.

However, current closed-loop systems remain highly fragmented and tightly coupled with the slow, expensive traditional banking system. To move money into or out of the Starbucks loop, users still require a bank account. Moreover, many merchant-specific closed-loop systems (like Starbucks) do not allow peer-to-peer transfers and cannot be seamlessly used in many countries. Blockchain technology offers an alternative path forward for future payment fintech, enabling complete bypass of traditional, fragmented banking systems and ultimately reducing costs for merchants and consumers.

Binance Pay exemplifies this type of payment fintech. It supports instant, low-cost peer-to-peer transfers and direct merchant payments within a closed-loop framework. As a closed-loop model, next-generation fintech platforms like Binance Pay can deliver familiar, refined, and customizable fintech experiences for merchants and consumers, accelerating the transition from traditional banking rails to blockchain rails.

3.4 New Options for Cross-Border Payments

When it comes to cross-border transactions and remittances, costs multiply. According to the IMF, remittances refer to “migrants sending part of their income in cash or goods back home to support families.” This is a specific area of cross-border payments where blockchain technology can have a direct impact.

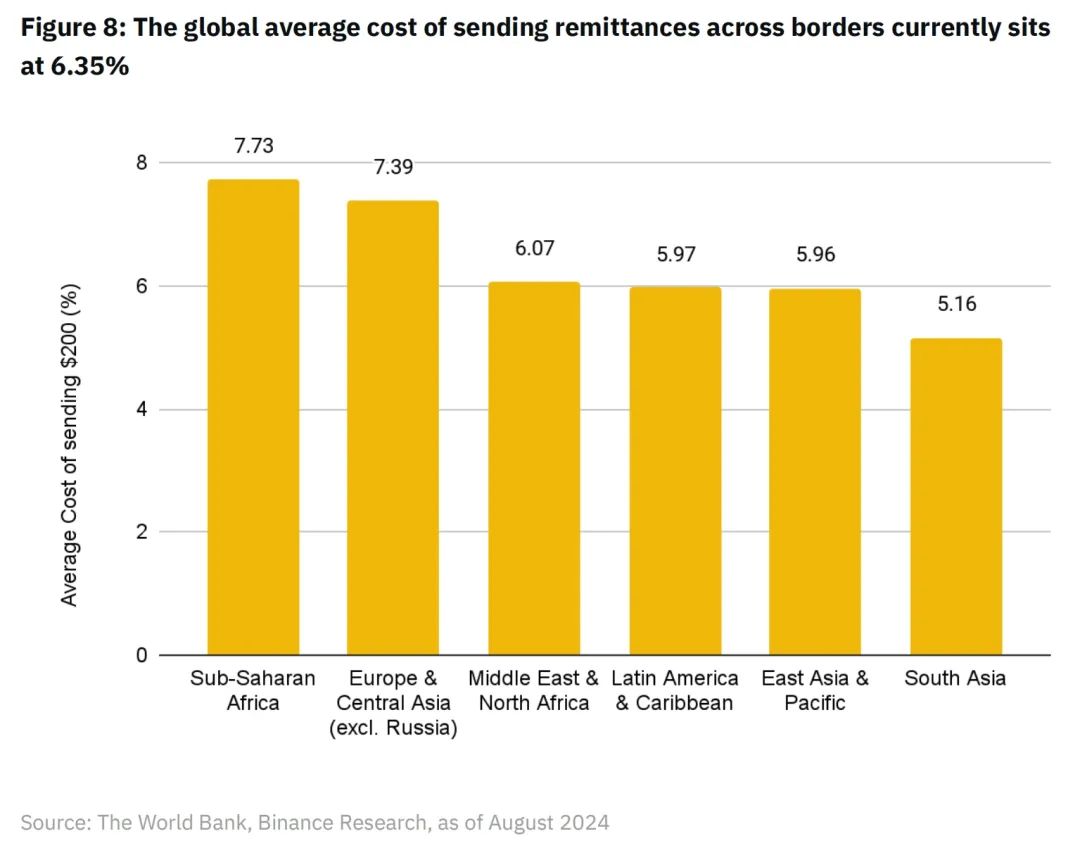

Global remittance flows are estimated to have increased from $843 billion in 2022 to $857 billion in 2023, a 1.6% rise. Growth is projected at 3% for 2024. In 2023, the top five low- and middle-income recipient countries (in current USD terms) were India ($120 billion), Mexico ($66 billion), China ($50 billion), the Philippines ($39 billion), and Pakistan ($27 billion). According to World Bank data as of Q1 2024, the global average cost to send $200 remains at 6.35% of the amount sent, totaling $54 billion in annual fees.

Due to these high costs, cross-border remittances represent a critical area in payments where blockchain can make a substantial difference.

Cross-border remittances involve transferring funds internationally through a series of banks in different countries, a process that can take several days—making it slow and expensive.

1) The process begins when a sender initiates a transfer at a local bank or remittance service, providing recipient details and the amount to be sent.

2) Since the sender’s and recipient’s banks may lack a direct relationship, intermediary banks (known as correspondent banks) facilitate the transaction. The sender’s bank sends funds to its correspondent bank, which may relay them through additional intermediaries, each charging a fee. The SWIFT network is typically used to transmit payment instructions.

3) If different currencies are involved, funds are usually exchanged at one of the intermediary banks, often at unfavorable exchange rates.

4) Each bank must comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, verifying identities and ensuring transaction legitimacy. Transactions are also screened against international sanctions lists.

5) After processing and compliance checks, funds are credited to the recipient’s bank account. The sender receives confirmation of completion.

The above-described traditional payment system is not only costly and inefficient but also fails to reach a significant portion of the global population.

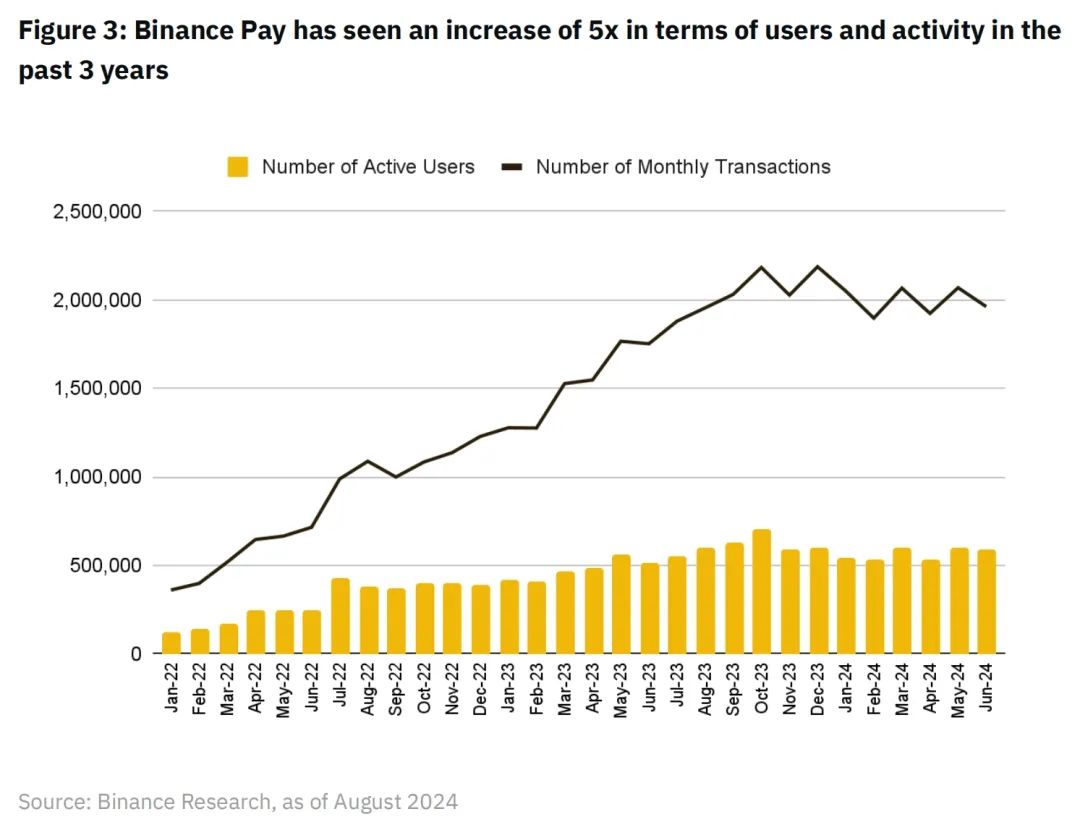

Today, as many as 1.4 billion adults worldwide remain unbanked. For these reasons, users around the world are increasingly turning to blockchain solutions like Binance Pay for cheaper, faster cross-border transfers. Since 2022, Binance Pay’s monthly active users and monthly transaction volume have both grown nearly fivefold, reaching approximately 13.5 million users and 1.96 million monthly transactions.

Blockchain and distributed ledger technology (DLT) have the potential to disrupt many existing players in the payments industry by offering a unified, global, transparent environment accessible with just a smartphone and internet connection. This means more direct communication between merchants and consumers, powered by distributed ledgers, eliminating the need for correspondent banks. Liberating future fintech from traditional banking systems may be the key to achieving cheaper, faster global payments. Jason Clinton, Head of European Institutional Sales at JPMorgan Chase, stated: "Ultimately, we want to enable instant settlement of any payment, anytime, anywhere, in any currency—and that may require blockchain technology."

4. Current State of Blockchain-Based Payments

Due to their high cash equivalence, stablecoins have become a key component of blockchain payments. In 2023, stablecoins processed over $10.8 trillion in transactions; excluding machine or automated activities, this figure stands at $2.3 trillion.

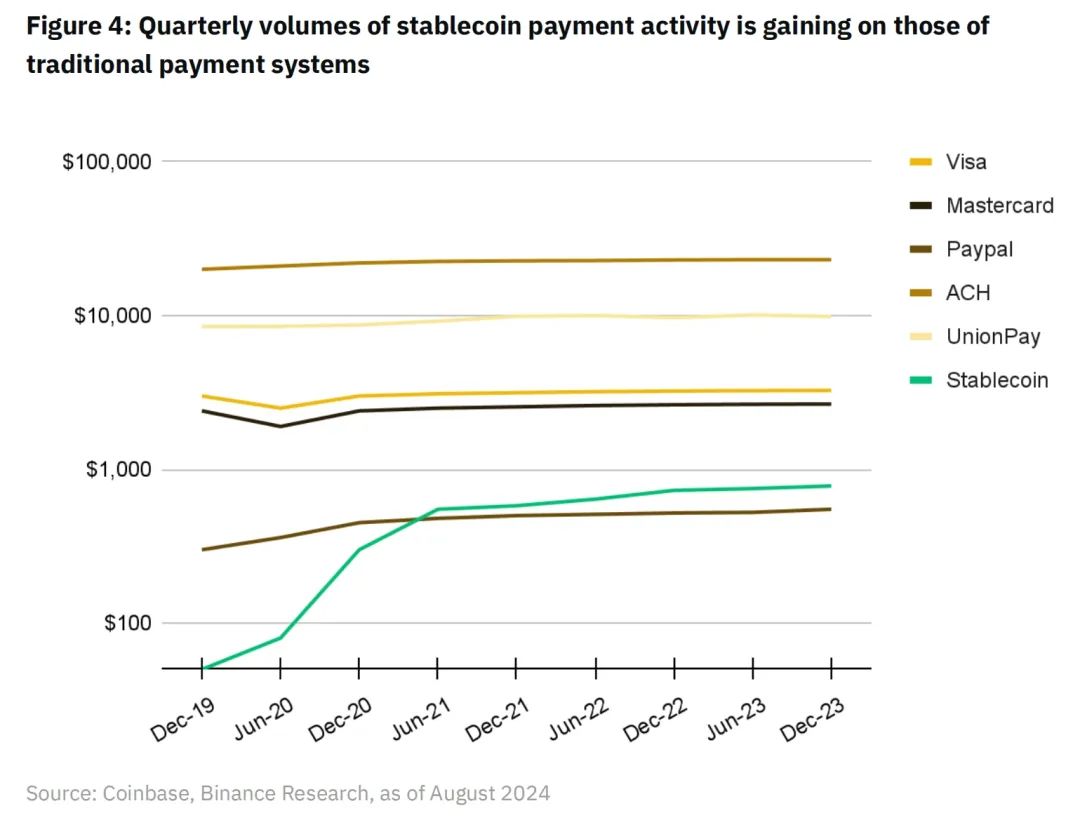

Comparing stablecoin payments with traditional payments reveals that, in terms of quarterly transaction volume, stablecoins are catching up with traditional systems.

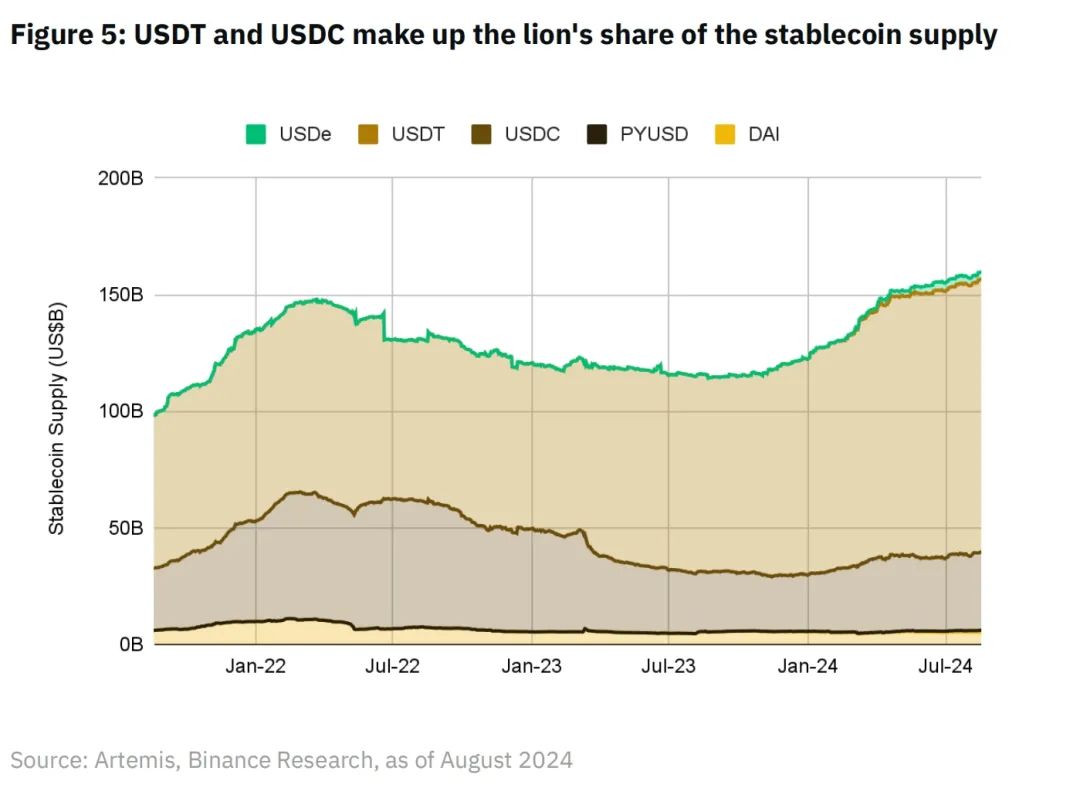

Since mid-2023, the total supply of stablecoins has also been increasing, indicating steady demand growth. The combined market capitalization of major stablecoins exceeds $160 billion, with USDT and USDC holding the largest shares at 73% and 21%, respectively.

Leveraging the low volatility provided by stablecoins, the blockchain payment ecosystem and its supporting infrastructure have made significant progress since 2009.

4.1 Blockchain-Based Payment Infrastructure

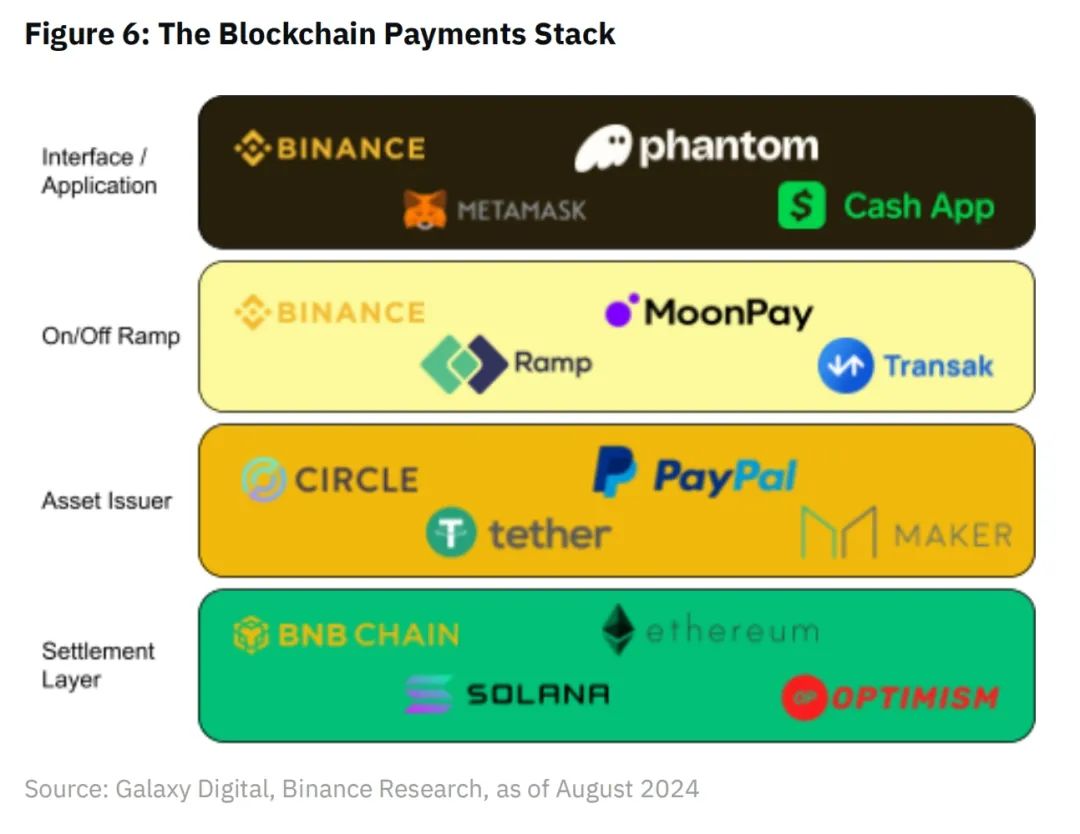

Settlement Layer

This refers to blockchain infrastructure responsible for transaction settlement. Examples include Layer 1 blockchains such as Bitcoin, Ethereum, and Solana, as well as multi-purpose Layer 2 solutions like Optimism and Arbitrum, which essentially sell block space.

These platforms compete across dimensions including speed, cost, scalability, security, and decentralization. Over time, payment use cases may become significant consumers of block space.

We can think of the settlement layer as analogous to the bank network underpinning today’s traditional payment systems. Instead of storing funds in centralized bank accounts, consumers and merchants can hold assets in on-chain externally owned accounts (EOAs) or smart contract wallets.

Notably, in modern payment stacks, authorization and settlement are handled separately. Card networks like Visa and Mastercard provide payment authorization; issuing and acquiring banks handle actual settlement. In contrast, on blockchain, authorization and settlement can theoretically occur simultaneously. A consumer can sign a transaction authorizing the direct transfer of 100 USDT from their EOA to a merchant’s EOA, with validators immutably processing and settling the transaction on-chain.

However, relying solely on blockchain for P2P payment authorization and settlement may mean bypassing the clearing, transaction monitoring, and fraud detection systems employed by payment aggregators like Stripe and card networks like Visa.

In recent years, Visa itself has been a pioneer in piloting blockchain for payment use cases. The company envisions a future where “Visa’s network involves not only multiple currencies and bank settlement channels but also multiple blockchain networks, stablecoins, and CBDCs or tokenized deposits.”

Asset Issuer Layer

Asset issuers are organizations responsible for creating, managing, and redeeming stablecoins—crypto assets designed to maintain stable value relative to a reference asset or basket of assets (most commonly the U.S. dollar). These issuers typically operate balance-sheet-driven business models similar to banks. They accept customer deposits, invest those funds in higher-yielding assets like U.S. Treasuries, and issue stablecoins as liabilities, profiting from the interest margin or net interest income.

Asset issuers represent a new type of “intermediary” within the crypto payment stack, with no direct equivalent in traditional payment stacks. Perhaps the closest parallel is governments issuing fiat currency for transactions.

Unlike traditional payment intermediaries, asset issuers do not charge fees on every transaction made using their stablecoins. Once issued on-chain, stablecoins can be self-custodied and transferred without paying additional fees to the issuer.

On/Off-Ramp Layer

On/off-ramps are crucial for enhancing the usability and adoption of stablecoins in financial transactions. Fundamentally, they act as technical bridges connecting on-chain stablecoins with fiat systems and bank accounts. Their business model is typically volume-driven, taking a small percentage of the total dollar volume flowing through their platform.

Currently, the on/off-ramp layer is often the most expensive part of the crypto payment stack. Service providers like Moonpay charge up to 1.5% to move assets from blockchain to bank accounts.

A transaction flowing from fiat in a consumer’s bank account → on-chain stablecoin → fiat in a merchant’s bank account could incur fees as high as 3%. In terms of cost, this remains the biggest barrier to widespread blockchain payment adoption, especially for merchants and consumers who still need fiat in bank accounts for daily transactions. To address this, products like Binance Pay are building their own merchant networks, allowing users to spend crypto directly and avoid these costs.

Interface/Application Layer

Front-end applications are customer-facing software in the crypto payment ecosystem, providing user interfaces for crypto-enabled transactions and leveraging other components of the stack to facilitate payments. Their business models typically include platform fees and transaction-based fees, earning revenue based on transaction volume processed through their interface.

4.2 Advantages of Blockchain-Based Payments

Near-Instant Settlement

With Visa or Mastercard transactions, consumers enjoy the convenience of near-instant payment authorization. However, the actual settlement—the movement of funds from the customer’s bank (issuing bank) to the merchant’s bank (acquiring bank)—typically takes at least a day. While card networks allow digital payments in seconds, merchants usually receive funds the next day or later. For cross-border transfers, settlement takes even longer due to interbank coordination across countries.

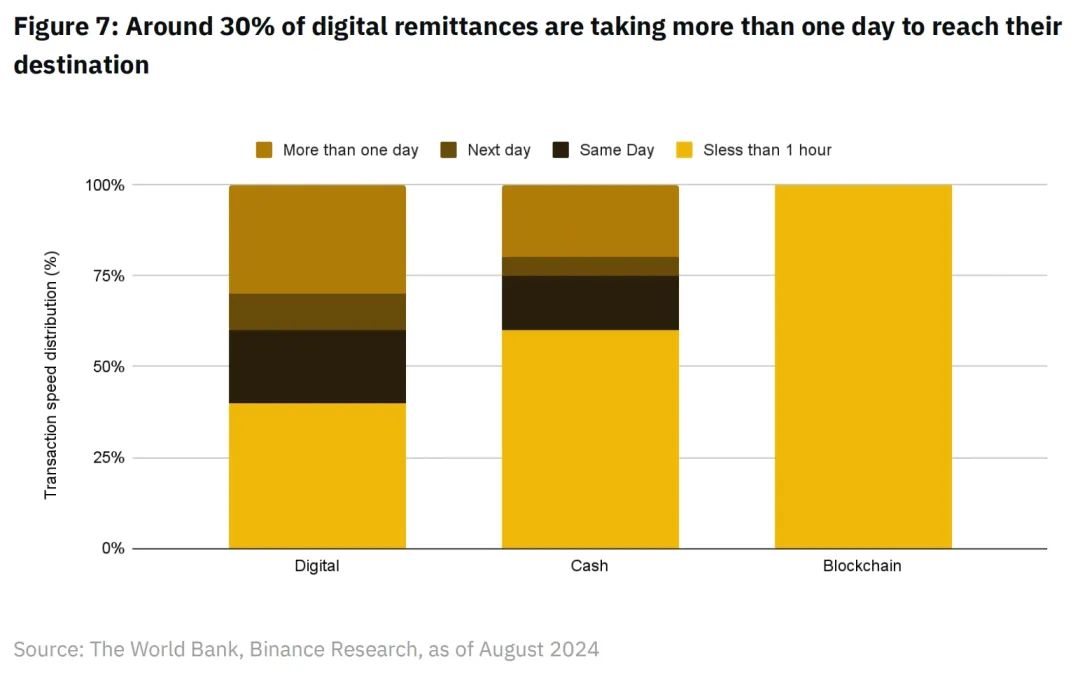

The inefficiency of cross-border interbank communication is evident in remittance times. Counterintuitively, about 30% of remittances take more than a day to arrive—higher than the 20% for cash-based remittances taking the same time.

The World Bank attributes this to two factors:

(1) Remittances include traditional bank services (account-to-account), which are slower.

(2) Most non-bank remittance providers pre-fund transactions, offering fast service to end-users using cash.

Among three payment mediums (digital, cash, and blockchain), blockchain leads clearly in speed—100% of transactions complete within an hour.

In 2021, Visa partnered with Crypto.com to pilot cross-border payments on Crypto.com’s Australian real-time card program using USDC and the Ethereum blockchain. Today, Crypto.com uses USDC to fulfill its Visa card settlement obligations in Australia and plans to expand this functionality to other markets.

Prior to this pilot, cross-border purchases with the Crypto.com Visa card involved lengthy currency conversions and costly international wire transfers.

Now, Crypto.com can directly send USDC cross-border via the Ethereum blockchain to a Circle-managed Visa financial account, drastically reducing time and complexity compared to international wires.

At the individual user level, services like Binance Pay enable instant cross-border crypto transfers.

Cost Reduction

According to the World Bank, the average cost of cross-border remittances declined from 6.39% in Q4 2023 to 6.35% in Q1 2024. Breaking down regional averages, Sub-Saharan Africa has the highest remittance costs at 7.73%.

For comparison, sending $200 worth of stablecoin via a high-performance blockchain like Solana costs approximately $0.00025 on average (or any amount, since most blockchains charge fixed gas fees unrelated to transfer value). Products like Binance Pay allow users to conduct borderless peer-to-peer stablecoin transfers at significantly lower fees—for transfers under 140,000 USDT. For larger amounts, a flat $1 fee applies.

It should be noted that currently, on/off-ramping represents the most expensive component of any transaction involving on-chain assets. In Q4 2023, Binance partnered with CryptoConvert to enable South African consumers to use digital assets for purchases. This eliminates the need for on/off-ramping and marks the beginning of integrating merchant networks into crypto-native closed-loop payment systems.

Transparent and Trustless Network

In an era where traditional payment systems like SWIFT are used for geopolitical purposes, blockchain technology offers a revolutionary alternative. With inherent transparency, every blockchain transaction is recorded on an immutable ledger visible to all network participants. This openness fosters trust and consensus while deterring fraud and manipulation.

Decentralization is another key advantage. Unlike centralized systems, blockchain distributes control across a vast network, reducing risks of single points of failure and power abuse. No single entity can impose sanctions or restrictions, ensuring a neutral and accessible global payment system. Blockchain’s decentralized nature enhances its security, making it highly resistant to attacks—compromising a blockchain would require immense computational power far exceeding that needed for traditional systems.

Additionally, blockchain simplifies transactions by enabling peer-to-peer payments, reducing intermediaries, and lowering fees. Cross-border payments that once took days can now be completed in minutes, facilitating real-time global trade. Blockchain provides a viable, unified global alternative to today’s fragmented banking systems for storing and transferring digital value.

5. Challenges Facing Blockchain-Based Payments

Scalability and Performance

A globally usable payment network must support cheap, fast transactions and operate 24/7. It must handle thousands of transactions per second, as even momentary delays can significantly impact global business operations. For example, Visa can process over 65,000 transactions per second (TPS).

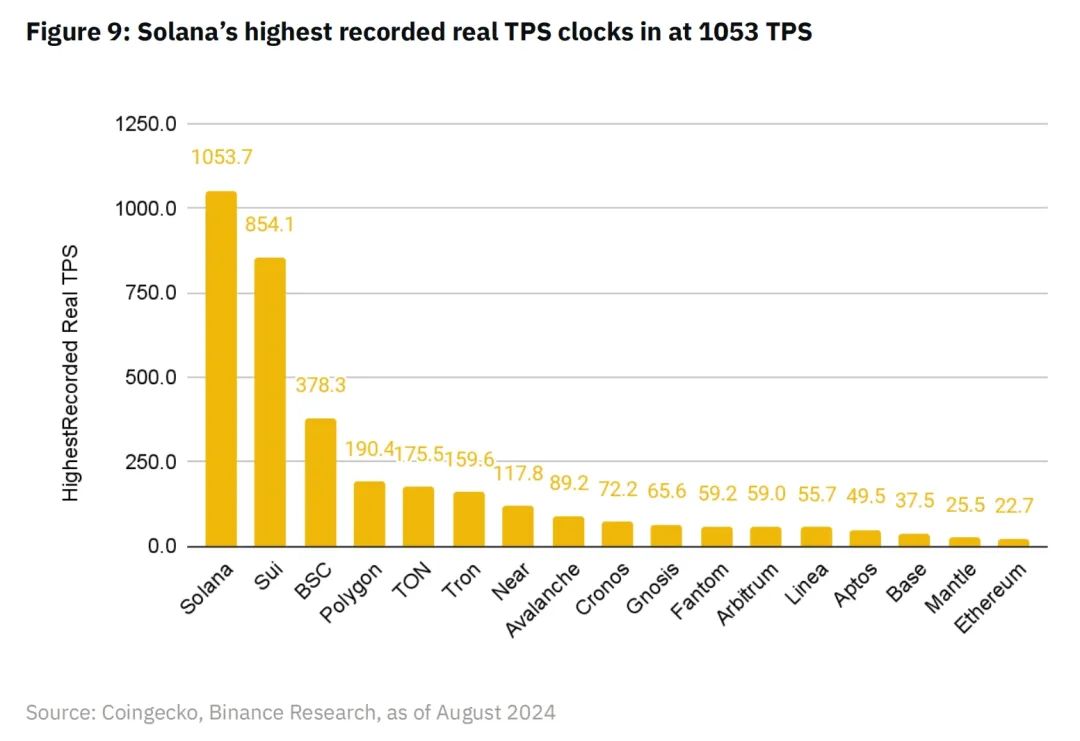

Solana is currently the blockchain with the highest recorded user-generated TPS, with a daily average peak slightly above 1,000. Sui follows closely, reportedly achieving over 850 peak TPS. BNB Chain ranks third with 378.3 TPS.

In 2023, Visa processed approximately 720 million transactions per day, equating to an average daily TPS of about 8,300.

This is nearly eight times Solana’s highest recorded user-generated TPS.

Beyond TPS limitations, Solana has exhibited performance issues. Since its mainnet launch in 2020, Solana has experienced seven major outages halting block production, most recently in February 2024. Such severe incidents make institutions cautious about relying on blockchains for critical operations like payments.

Nevertheless, despite these issues, Solana continues to be adopted by pioneering institutions. Due to its “proven high throughput levels,” Visa describes it as “a viable option for testing and piloting payment use cases.”

PayPal also chose Solana as the second chain (after Ethereum) to launch its PYUSD stablecoin. At the time of writing, despite launching nearly a year later, PYUSD supply on Solana ($377 million) has already surpassed that on Ethereum ($356 million).

On-Chain Complexity

Blockchain’s inherent complexity—largely due to its decentralized nature—makes it less convenient for consumers and merchants compared to centralized systems. End-user requirements such as private key management, gas fee payments, and lack of standardized front-ends present significant barriers to adoption for ordinary users and businesses.

Meanwhile, over the past five years, payment fintech companies like Square and Stripe have elevated the merchant and consumer payment experience to very high standards. They achieve this by abstracting away all underlying complexities—including intermediaries, correspondent banks, and third parties. Thus, from the perspective of consumers and merchants, today’s traditional global payment stack is a highly polished system—albeit one built on transaction fees as high as 3%.

Fortunately, with the emergence of faster, cheaper blockchain infrastructure, the UI/UX of blockchain applications has seen many improvements. Binance Pay offers users a familiar, centralized fintech experience while freeing them from the constraints of traditional banking systems. Users gain the freedom to send cryptocurrency globally at low cost, with the option to easily withdraw crypto assets into self-custody if desired.

Regulatory Uncertainty

The current regulatory environment for cryptocurrencies and blockchain technology remains fluid, creating uncertainty for businesses and consumers. Regulations vary widely across jurisdictions, complicating global operations and cross-border transactions.

Countries like Switzerland and Singapore are developing clear regulatory frameworks to guide and encourage innovation in the blockchain space. The EU’s Markets in Crypto-Assets (MiCA) regulation is another example aiming to create a harmonized regulatory environment. The blockchain industry is also developing compliance solutions to help enterprises navigate the regulatory landscape. Providing individuals and businesses with tools to monitor and ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is key to adoption.

6. The Future of Blockchain-Based Payments

Blockchain offers a unified technological infrastructure that simplifies the payment landscape beyond the fragmented nature of modern banking systems. As a globally distributed ledger, blockchain eliminates the inherent inefficiencies of traditional banks—which rely on maintaining and synchronizing multiple centralized ledgers. Thus, blockchain presents a new medium capable of reducing costs and accelerating global payments.

As mentioned earlier in this report, payment giant Visa is experimenting with blockchain as a cheaper, faster global settlement method for its institutional clients. Today, one of Visa’s clients, Crypto.com, can directly send USDC cross-border via the Ethereum blockchain to a Circle-managed financial account under Visa’s oversight. This reduces the time and complexity of international wire transfers, which previously took days. As companies grow more comfortable with blockchain technology, many may choose to transact using on-chain stablecoins rather than slower, costlier fiat banking systems.

At the smaller peer-to-peer level, blockchain could have a faster and more significant impact on the global payments industry—especially in cross-border remittances. Many remittance recipients are unbanked or underbanked. Blockchain offers the possibility to leapfrog traditional banking systems, enabling anyone with internet access and a smartphone to quickly begin receiving payments from anywhere in the world.

At its core, blockchain provides a new, decentralized medium through which payments can occur more seamlessly on a global scale. As the modern payment industry continues to experiment with this technology and integrate it into various parts of the global payment system, we must always keep in mind the ultimate goal: creating a world of free money that is cheaper, faster, and more efficient for everyone.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News