Counting Sony's 8-Year Web3 Strategy: Why You Shouldn't Overestimate the Layer2 "Soneium" Just Yet

TechFlow Selected TechFlow Selected

Counting Sony's 8-Year Web3 Strategy: Why You Shouldn't Overestimate the Layer2 "Soneium" Just Yet

Should the crypto market lower its 'big player expectations'?

Author: flowie, ChainCatcher

Editor: Marco, ChainCatcher

Recently, Sony Group made a high-profile announcement of launching its Layer2 network "Soneium" on Ethereum, aiming to drive mass adoption of Web3 and opening up new possibilities for the ecosystem.

This Japanese conglomerate, with a market capitalization exceeding $100 billion and nearly 80 years of history, operates across consumer electronics, gaming, film, music, finance, and other sectors, with subsidiaries or manufacturing facilities in over 140 countries worldwide.

According to Sony’s 2023 financial report, its net profit for the year reached 970.6 billion JPY (approximately $6.619 billion USD).

Whether in terms of bringing massive Web2 user bases into Web3 or potential financial investment, this move appears to be a positive signal for the Web3 industry.

In fact, this isn’t Sony’s first foray into Web3. Since announcing R&D investments in blockchain back in 2016, Sony has explored various Web3 subfields including hardware wallets, metaverse/blockchain games, NFTs, stablecoins, and crypto exchanges.

However, facing the long innovation cycles typical of Web3, Sony may still struggle with the “big company disease.” On one hand, despite broad explorations, it often rushes into projects without sustained follow-through, leaving many initiatives unfinished. On the other hand, it tends to selectively apply blockchain technologies where marketing appeal outweighs real-world implementation.

For the Web3 industry, amid this innovation-driven wave, perhaps excessive expectations should not be placed on traditional tech giants entering the space.

Broad but Shallow Web3 Moves, Often Half-Hearted

"Before getting too excited about Sony and its new L2, remember its last crypto project was an NFT marketplace called SNFT that nobody actually used." @beaniemaxi, a crypto KOL with 200K followers on X, expressed skepticism toward Sony's high-profile Layer2 strategy announcement.

In @beaniemaxi’s view, Sony might follow in Google’s footsteps—launching 100 products and quickly abandoning 95 of them once they fail to gain traction.

Looking back at Sony’s eight-year journey into Web3, it has indeed been adept at chasing trends but often stops short. Many Web3-related initiatives were announced but never materialized, remaining only on paper or in research phases without large-scale deployment.

Sony’s earliest Web3 efforts date back to 2016, when Ethereum and ICOs had yet to take off and Japan hadn’t established regulatory frameworks for crypto assets.

At the time, Sony primarily experimented with blockchain to build shared databases for secure data transmission and sharing.

In early 2016, Sony Global Education introduced blockchain technology into K12 education to enable encrypted student data transfer.

Later, Sony conducted similar experiments in real estate and mobility. For example, in 2019, Sony partnered with commercial banks to establish a lab aiming to enhance transparency in real estate transactions using blockchain and create a more efficient transaction environment.

In 2020, Sony announced plans to develop a public database platform (BCDB) to record and share anonymized travel history data, facilitate revenue distribution, and improve efficiency and transparency in mobility services.

These initiatives resemble today’s popular concepts like RWA and DePIN, but due to compliance and technical challenges, few tangible results have emerged.

Beyond software, Sony also attempted to enter the crypto hardware wallet space.

In early 2018, riding the hype wave, Sony announced development of a contactless cryptocurrency hardware wallet based on its Felica smart card technology.

According to the Nikkei Review, Felica chips shipped over 1 billion units globally in 2016. Had Sony successfully integrated Bitcoin payments, it could have significantly boosted crypto adoption.

Yet, Sony never revealed any plans to deploy this hardware wallet commercially.

The same year, Sony, with its extensive gaming business, also announced support for blockchain gaming.

At the end of 2018, Sony said it would launch a blockchain game, *Plague Hunters*, in Q1 2019. It described the game as an Ethereum-based RPG and claimed it would be the first game to use blockchain technology. However, no release information or player data surfaced in 2019.

In 2020 and 2021, as blockchain gaming, metaverse, and NFTs surged in popularity—especially within gaming and IP rights—Sony deepened its Web3 exploration. Beyond simple collaborations, it began establishing subsidiaries to advance these initiatives.

In the NFT space, Sony initially took straightforward approaches, such as issuing movie ticket NFTs through partners or co-developing NFTs via strategic partnerships with NFT platforms.

For instance, Sony Music Entertainment (SME) partnered with Snowcrash, an NFT platform on Solana, to launch celebrity artist series NFTs. However, the platform has been largely silent since January 2023.

On April 13, 2022, Sony Network Communications established an NFT-focused joint venture in Singapore with software developer Sun Asterisk, holding a 70% stake.

The company offers services including “NFT business strategy planning support,” “NFT issuance support,” “unique token issuance support,” “NFT game development support,” and “NFT promotion support.” It operated an NFT marketplace called SNFT, which gained little visibility in the market.

This summer, Sony Bank launched a Web3 mobile app called “Sony Bank CONNECT,” aiming to provide digital services for its bank’s NFT users and digital securities holders.

Additionally, Sony filed multiple NFT-related patents. In early 2023, Sony Interactive Entertainment filed a patent allowing consumers to use NFTs within the Sony ecosystem, while also supporting third-party game developers like Nintendo and Microsoft.

In the metaverse and blockchain gaming space, Sony formed strategic partnerships with infrastructure developer Hadean and digital avatar technology firm Didimo.

In March 2022, Manchester City Football Club, Premier League champions, entered a three-year partnership with Sony to build a football stadium in the metaverse. In October 2023, Roblox, a leading metaverse platform, launched PS4 and PS5 experiences on its service.

As the hype around metaverse and NFTs faded in 2022 and attention shifted toward foundational infrastructure like public chains, Sony pivoted toward deeper infrastructure and financial services.

The recently announced Layer2 public chain initiative was actually initiated as early as 2023.

In September 2023, Startale Labs announced receiving a $3.5 million investment from Sony Network Communications and forming a joint subsidiary to develop Sony Chain, claiming the chain could surpass Coinbase’s previously launched Layer2 network Base.

On April 5, 2024, Sony Bank officially began pilot experiments for issuing fiat-backed stablecoins. The goal is to reduce transaction fees for individuals during payments and transfers, while exploring applications in intellectual property businesses related to gaming and sports.

Over $1 Billion Invested in Web3, Heavy Bet on Metaverse Gaming

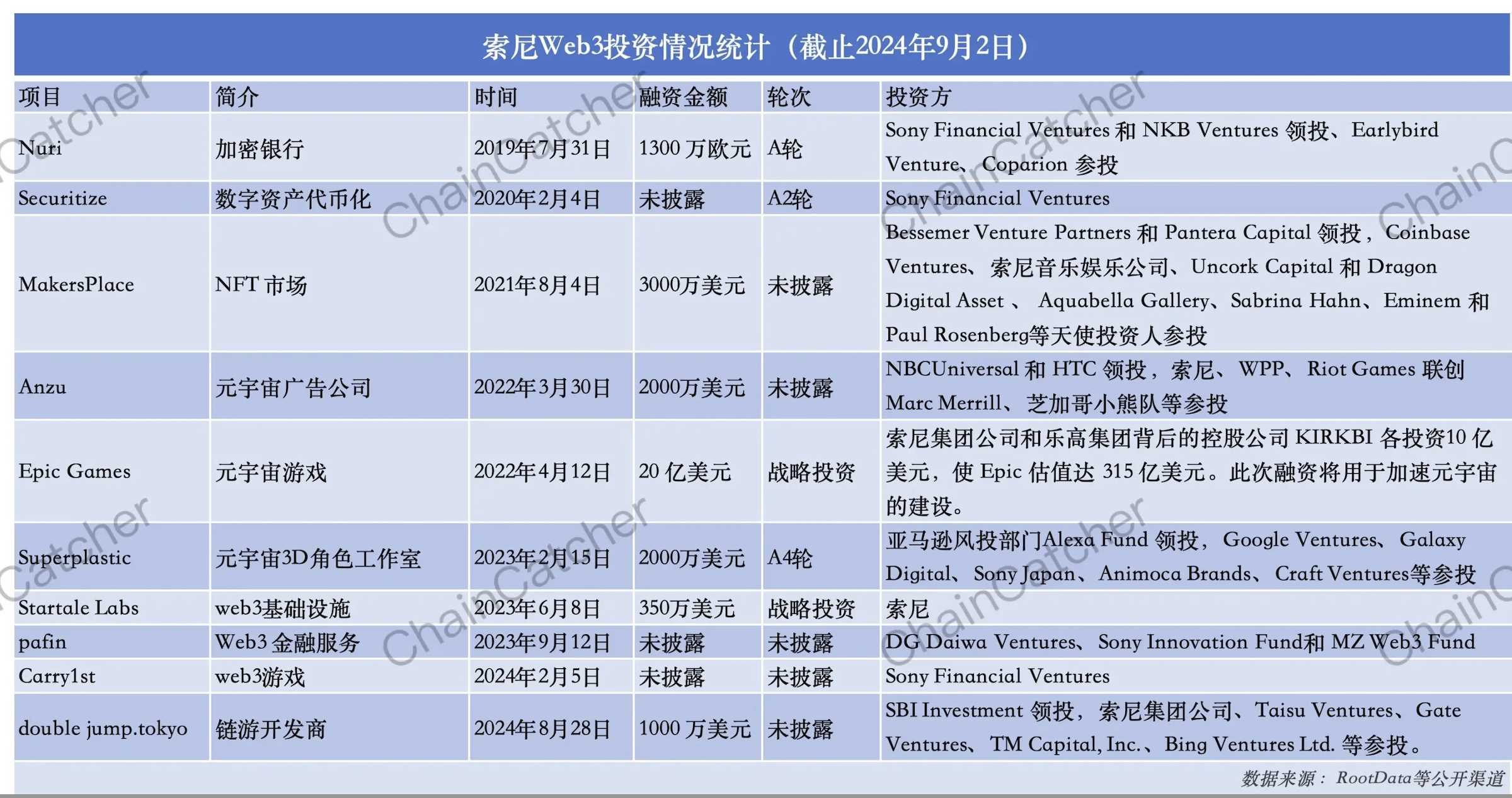

Besides direct business expansion, Sony has also positioned itself in Web3 through investments.

However, Sony hasn’t established a dedicated Web3 investment fund.

Instead, it leverages Sony Financial Ventures along with funds like the Sony Innovation Fund and Innovation Growth Fund I L.P., which target emerging technologies in AI, robotics, and fintech. The Sony Innovation Fund and Innovation Growth Fund are valued at 10 billion JPY (~$68 million) and 20 billion JPY (~$136 million), respectively.

From 2019 to now, over five years, Sony has made around 10 Web3 investments, with the largest bets placed on metaverse gaming—accounting for five of those deals.

In April 2022, Sony invested $1 billion in Epic Games to accelerate the development of its metaverse ecosystem. Post-investment, Epic Games was valued at $31.5 billion.

Epic Games is the developer of *Fortnite*, one of the world’s most profitable games, and creator of Unreal Engine—the dominant engine used by major AAA game studios.

Prior to the metaverse boom, Sony had already invested $250 million in 2020 and $200 million in 2021 in Epic Games.

Although the metaverse hype has cooled, Epic remains a top player. In early 2024, according to GamesIndustry.biz, Disney invested another $1.5 billion in Epic to build a new entertainment universe.

Anzu, a company focused on in-game advertising within metaverse games, secured $20 million in funding in 2022 with Sony’s participation, and in 2023 raised a $48 million Series B round led by Emmis Corporation, with PayPal Ventures among the participants.

In 2024, both of Sony’s Web3 investments were again in gaming. One involved investing in double jump.tokyo, the developer behind the Japanese legacy gaming blockchain Oasys, to promote development on Sony’s own blockchain “Soneium.”

Among Sony’s earlier Web3 startup investments, Securitize—the asset tokenization platform—has shown the most steady growth. After RWA gained momentum in 2023, Securitize became a key infrastructure provider for numerous institutions entering the RWA space. Following Sony’s investment, Securitize raised nearly $100 million across two additional funding rounds.

In May of this year, BlackRock led Securitize’s $47 million funding round. Earlier in March, BlackRock had partnered with Securitize to launch a new fund—the BlackRock USD Institutional Digital Liquidity Fund.

Recently, Securitize also provided tokenized securities issuance support for Sony’s new film. Sony Bank and Sumitomo Mitsui Trust Bank are using the Securitize platform to offer digital securities to customers.

Conversely, Sony’s early investments in crypto banking and NFT marketplaces have underperformed.

Nuri, the crypto bank Sony invested in 2019, declared bankruptcy in August 2020 after failing to secure a buyer or further external funding.

MakersPlace, which Sony backed in 2021, was once among the top five NFT trading platforms by volume.

MakersPlace partnered with Christie’s to auction Beeple’s digital artwork *Everydays: The First 5000 Days* for $69 million, drawing significant user attention.

However, as of September 2, 2024, NFTscan data shows MakersPlace has recorded almost zero trading volume over the past week and month.

Beyond traditional investments, in May 2023, Sony’s subsidiary Sony Network Communications partnered with Polkadot parachain Astar Network to launch a Web3 incubation program, identifying early-stage Web3 projects through “Demo Day” events.

Sony’s High-Profile Web3 Push Amid Growth Stagnation

In 2024, Sony’s Web3 activities and announcements have become increasingly prominent.

In the past, Sony’s Web3 efforts were mostly limited to blockchain technology or loosely defined Web3 concepts.

But in July this year, Sony first acquired Amber Japan (now S.BLOX), entering the cryptocurrency exchange sector; recently, it announced a collaboration with Startale Labs to launch Layer2 “Soneium” on Ethereum, building a general-purpose blockchain.

In Japan’s traditionally closed, conservative, heavily regulated, and slow-moving crypto market, Sony’s recent moves have drawn considerable attention.

From Sony’s own business trajectory, it is clearly seeking new growth avenues beyond the PS5.

In February, after Sony disclosed its third-quarter 2023 earnings (ending December 2023), its total market capitalization dropped by approximately $10 billion.

According to Wall Street analysts, prior to Q1 2022 (January–March), Sony’s gaming division maintained an operating margin of around 12%-13% over the previous four years. That quarter marked the lowest operating margin for Sony’s gaming business in nearly a decade.

Facing slowing growth in its core gaming segment, following the release of its 2023 fiscal year results in May, Sony President Hiroki Totoki outlined a new growth strategy: “maximizing synergies across content IPs in gaming, music, and film” to build sustainable monetization models from its existing content. He also announced a 1.8 trillion JPY ($12.3 billion) M&A and growth investment plan over the next three years.

Crypto exchanges and public blockchains are among the most lucrative areas in the crypto space. Sony’s high-profile moves this year may reflect its attempt to counteract stagnating growth.

General-purpose blockchains like Soneium also align well with Sony’s goal of maximizing content IP synergy. Recently, Startale Labs CEO Sota Watanabe revealed on social media that Soneium is focusing on building a platform for mass creation centered around creative IPs—directly aligning with Sony’s stated growth strategy.

Additionally, regulatory easing may have created favorable conditions. In April 2023, Japan’s ruling Liberal Democratic Party released the *Japan 2023 Web3 White Paper*, signaling intent to loosen regulations. Senior officials, including the Prime Minister, have publicly endorsed Web3 conferences to demonstrate support.

With Sony’s high-profile entry into crypto creating a demonstration effect, more major Japanese corporations are expected to announce their own crypto initiatives soon.

Nonetheless, skepticism remains around Sony and other traditional Japanese giants’ crypto ambitions.

As reviewed earlier, Sony’s Web3 engagements have mostly taken the form of strategic partnerships or minority investments. This includes the recent crypto exchange acquisition and the upcoming Sony Chain—neither of which is led by Sony’s core internal teams.

Given Sony’s vast range of operations, questions remain about how much commitment and long-term investment it can dedicate to these ventures.

Secondly, there are limitations rooted in traditional Web2 thinking. Crypto KOL @Lorrainelooloo warned that if the final product of the “Sony Web3 ecosystem” ends up being just a selective, partial application of blockchain for marketing purposes—retaining a top-down, traditional operational model—it may fail to deliver meaningful innovation and could even stifle creativity within Japan’s nascent crypto industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News