Ethereum's Scaling Economics: Is It Worth Letting L2s Take Most of the Sequencing Revenue?

TechFlow Selected TechFlow Selected

Ethereum's Scaling Economics: Is It Worth Letting L2s Take Most of the Sequencing Revenue?

If you believe ETH's long-term value lies in network equity within a widely adopted protocol, then mechanisms for value accrual must be realized.

Author: Doug Colkitt

Translation: TechFlow

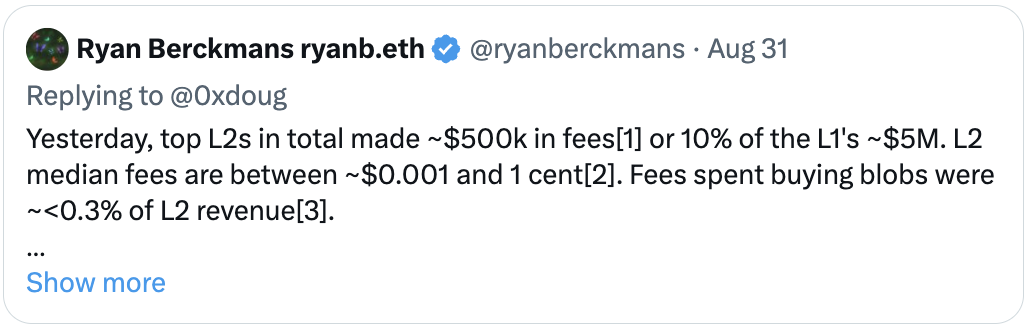

This is an excellent analysis of data availability (DA), and perhaps the most reasonable bull case for DA. However, I believe it's impossible for DA to capture anywhere near 50% of L2 fees. Structurally, sequencing will always accumulate far more value than DA.

The core business of blockchains is selling block space. Since block space isn't easily interchangeable across chains, each chain effectively operates as a monopoly.

However, not all monopolies generate excess profits. The key lies in the ability to price-discriminate among consumers.

Without price discrimination, monopoly profits are barely higher than those of ordinary goods. Consider how airlines distinguish between price-insensitive business travelers and cost-conscious leisure travelers, or how the same SUV platform is sold under Volkswagen, Audi, and Lamborghini at vastly different price points.

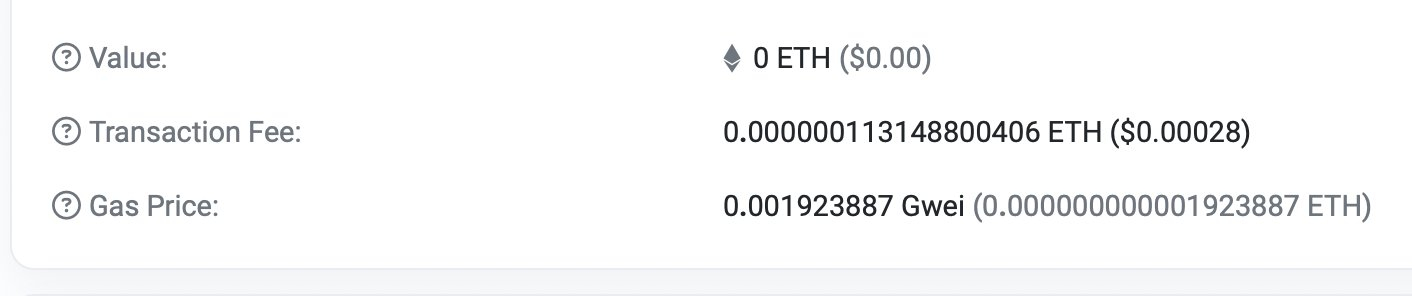

Priority fees are an extremely effective price discrimination mechanism in blockchains. Highest-priority transactions pay fees orders of magnitude above median levels.

L2s and Solana achieve high throughput and high revenue by leveraging sequencer-based priority pricing. Marginal transactions pay very low fees, enabling high TPS, while price-insensitive transactions contribute the majority of network income.

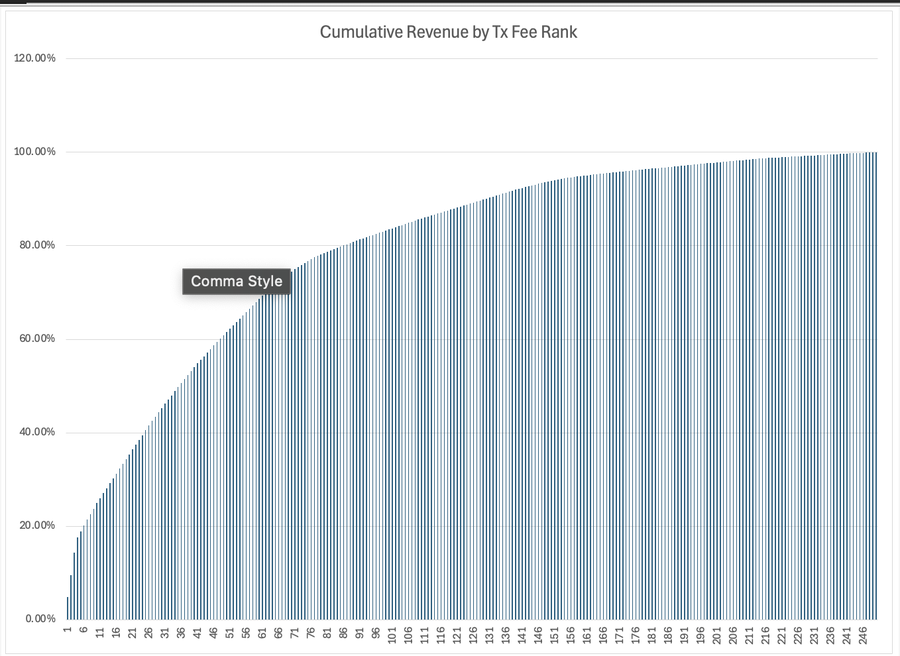

Below is the transaction distribution from five randomly sampled blocks on Base L2. It clearly follows a Pareto distribution, making price discrimination highly effective. The top 10% of transactions pay 30% of revenue, while the bottom 10% pay less than 1%.

The problem is that while sequencers can profit from this, DA layers cannot participate—they lack any ability to price-discriminate. Whether it’s a high-value arbitrage or a 1 wei spam transaction, both pay the same fee on Ethereum's DA layer because they settle in the same batch.

Since marginal transactions have very low value, high TPS is only possible when median transactions can be included at nearly zero cost. But on the DA layer, every transaction pays roughly the same fee. A DA layer can have either high throughput or high revenue—but not both.

This makes it nearly impossible for rollups to scale without undermining Ethereum’s network revenue. The rollup-centric roadmap is fundamentally flawed because it gives up the valuable part of the stack (sequencing), mistakenly believing it can be compensated through the less valuable part (DA).

I was initially optimistic about the rollup-centric roadmap, assuming rational actors would recognize the economics of price discrimination and allow L1 scaling to proceed in parallel.

High-value, price-insensitive users could remain on L1 for its durability, security, and finality, while L2s serve marginal, low-value users excluded by high L1 fees. In this scenario, Ethereum would still capture substantial sequencer rents.

Yet Ethereum's leadership has repeatedly stated that the L1 application layer is effectively obsolete and will not scale. Users and developers responded rationally—leading to a gradual decline in the L1 application ecosystem and a reduction in Ethereum’s network revenue.

If you believe ETH’s long-term value lies in being a monetary asset, this might still work. By enabling broader ETH ownership, it could become a durable form of money. Subsidizing L2s while failing to accrue value to the base layer might even help that outcome.

But if you believe ETH’s long-term value lies in being equity in a widely used protocol—and I find this more plausible than ETH as pure money—then value accrual is essential. Clearly, we’ve failed here due to incorrect economic assumptions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News