Uniquid Layer: Aggregating fragmented Babylon ecosystems to build WBTC for the Restaking era

TechFlow Selected TechFlow Selected

Uniquid Layer: Aggregating fragmented Babylon ecosystems to build WBTC for the Restaking era

As a rising latecomer in liquidity aggregation, Uniquid Layer has the potential to consolidate the currently fragmented BTC liquidity, much like WBTC—the leading force in the BTC DeFi ecosystem—offering users a smoother, cross-chain liquidity interoperability experience.

1. Bitcoin DeFi Ecosystem: From WBTC to BTC Restaking

1.1 WBTC Pioneers the BTC DeFi Ecosystem

Bitcoin is like a sleeping dragon—once awakened, it will shake the world.

As the earliest and most widely recognized blockchain project, Bitcoin holds an undisputed position in value storage and exchange. However, due to its lack of Turing completeness, it has long struggled to participate in the thriving DeFi ecosystem. Compared to Ethereum’s flourishing ecosystem, the total market capitalization of Bitcoin's ecosystem accounts for less than 1% of Bitcoin's own market cap.

Prior to this current wave of mainnet ecosystem growth driven by upgrades in asset issuance protocols, the BTC ecosystem primarily relied on external consensus, using pegged tokens to join DeFi ecosystems across various chains. Pegged tokens map BTC onto other blockchains with a 1:1 rigid redemption mechanism against the mainnet. This mechanism unlocks BTC’s financial value, enabling participation in DeFi scenarios such as collateralized lending and liquidity mining, while also supporting use cases across different chain ecosystems. For long-term BTC holders, using BTC-pegged tokens represents the optimal strategy to earn yield from various DeFi ecosystems while still holding Bitcoin.

The mapping mechanisms for BTC pegged tokens fall into two categories:

-

Centralized pegging relies on trusted third-party custodians who manage the mainnet BTC assets and mint the pegged tokens. This model depends on off-chain social trust and carries inherent risks related to trust and security.

-

Decentralized pegging uses MPC and BFT algorithms to hold BTC in multi-signature addresses, reducing single points of failure and enabling permissionless minting, though the minting and redemption processes are more complex.

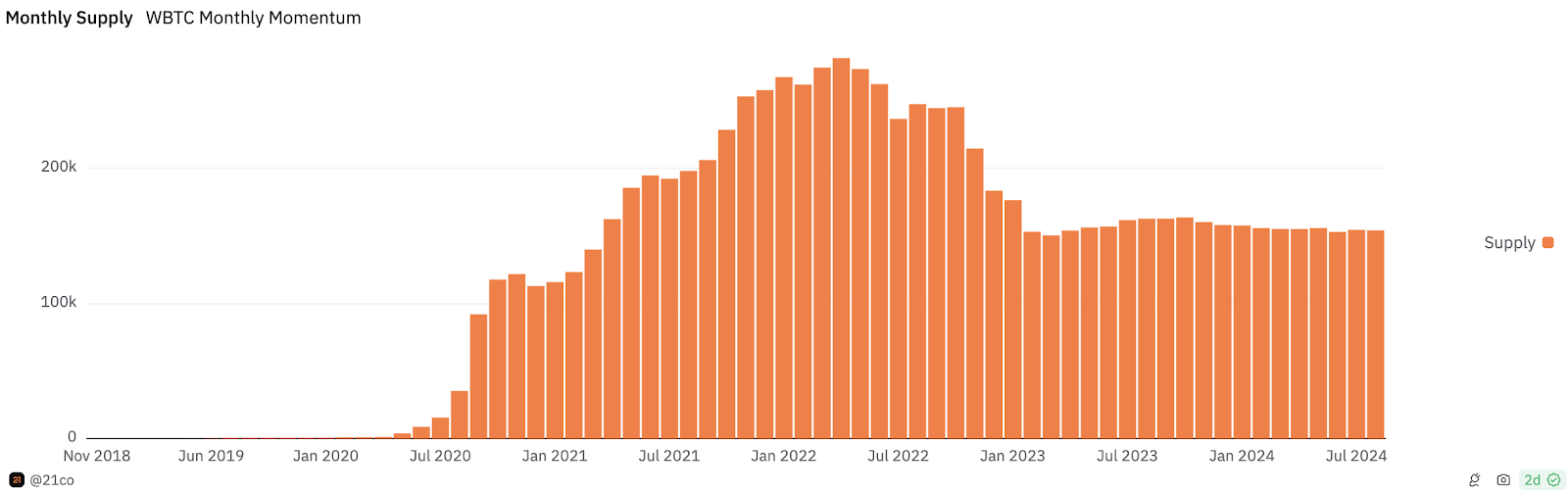

WBTC is currently the most widely used BTC pegged token, launched in 2018 by BitGo and several other institutions. After being accepted as collateral by MakerDAO, WBTC rapidly dominated the market, increasing its supply tenfold within three months. During the 2020 DeFi Summer, demand for WBTC on Ethereum peaked, reaching a supply of 281,000 BTC. Today, supply has stabilized at around 154,000 BTC, primarily used in lending (40%) and other DeFi applications.

WBTC experienced rapid growth starting in 2022 and has since stabilized after late 2022

Despite numerous subsequent alternatives—such as decentralized pegging projects like RenBTC and tBTC, or chain-specific BTC variants like BTCB—WBTC has maintained market dominance due to first-mover advantage, network effects, and user trust, capturing 94.6% market share on the Ethereum mainnet.

This reflects users’ prioritization of liquidity aggregation over pure security. WBTC’s seamless integration across DeFi protocols remains unmatched by newer entrants.

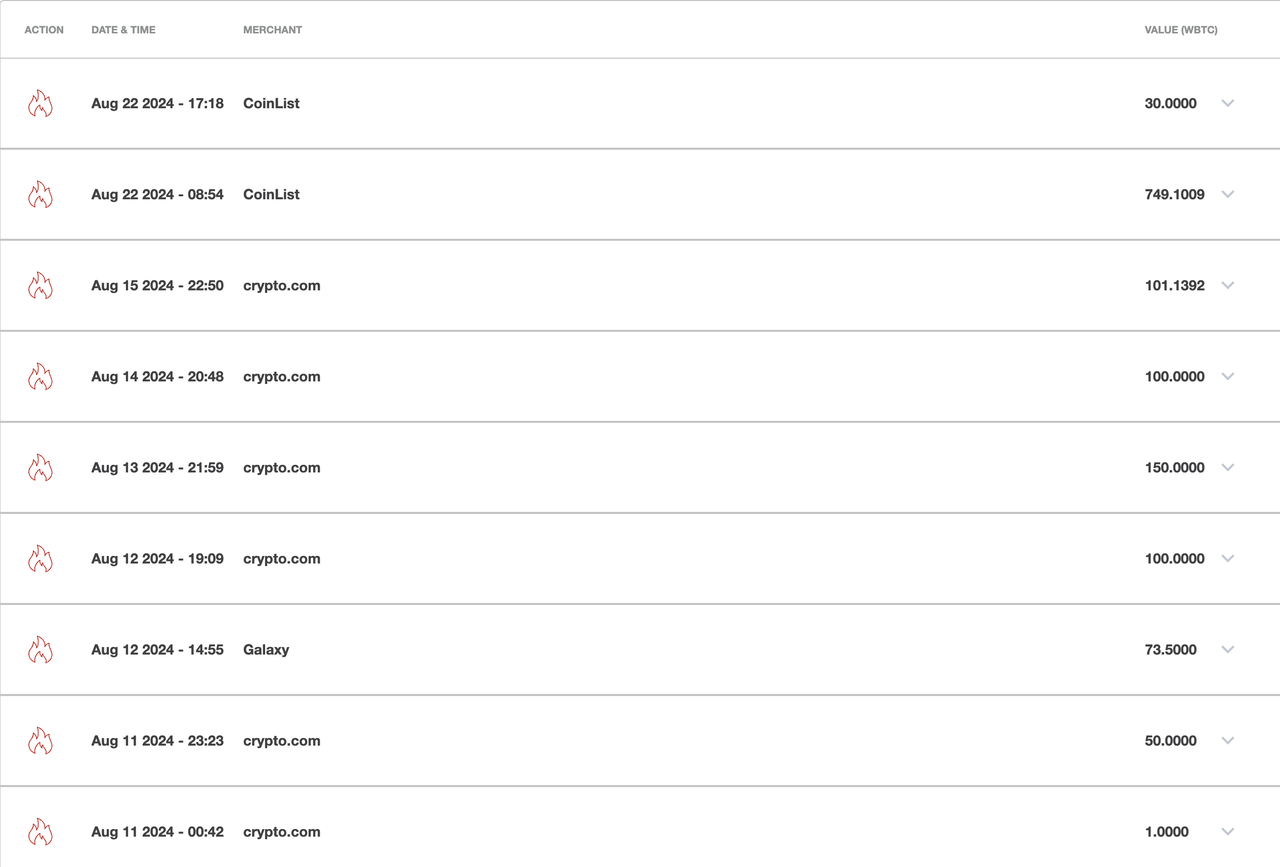

However, WBTC’s high market share cannot hide its centralization risks. In August 2024, BitGo formed a joint venture with BiTGlobal, with Justin Sun becoming the de facto controller. This raised concerns about WBTC’s centralization, triggering massive redemptions from institutions like Crypto.com.

Following BitGo’s announcement, nearly 1,380 BTC were redeemed across channels, with no new WBTC minted

In addition, WBTC’s fees and lack of yield limit its appeal. Each time BTC is deposited with a custodian to mint WBTC, or WBTC is burned to redeem BTC, a 0.2% fee is charged. If users receive neither stable high returns nor compensation for taking on centralized counterparty risk, they lack incentive to bridge more mainnet BTC into on-chain financial applications.

Despite nearly six years of development, WBTC’s market cap still only represents 1% of Bitcoin’s total market cap, and growth has plateaued.

How to bring secure and stable yield to BTC has become a key challenge for the evolution of the BTC DeFi ecosystem.

1.2 Babylon Fires the First Shot at Native BTC Yield

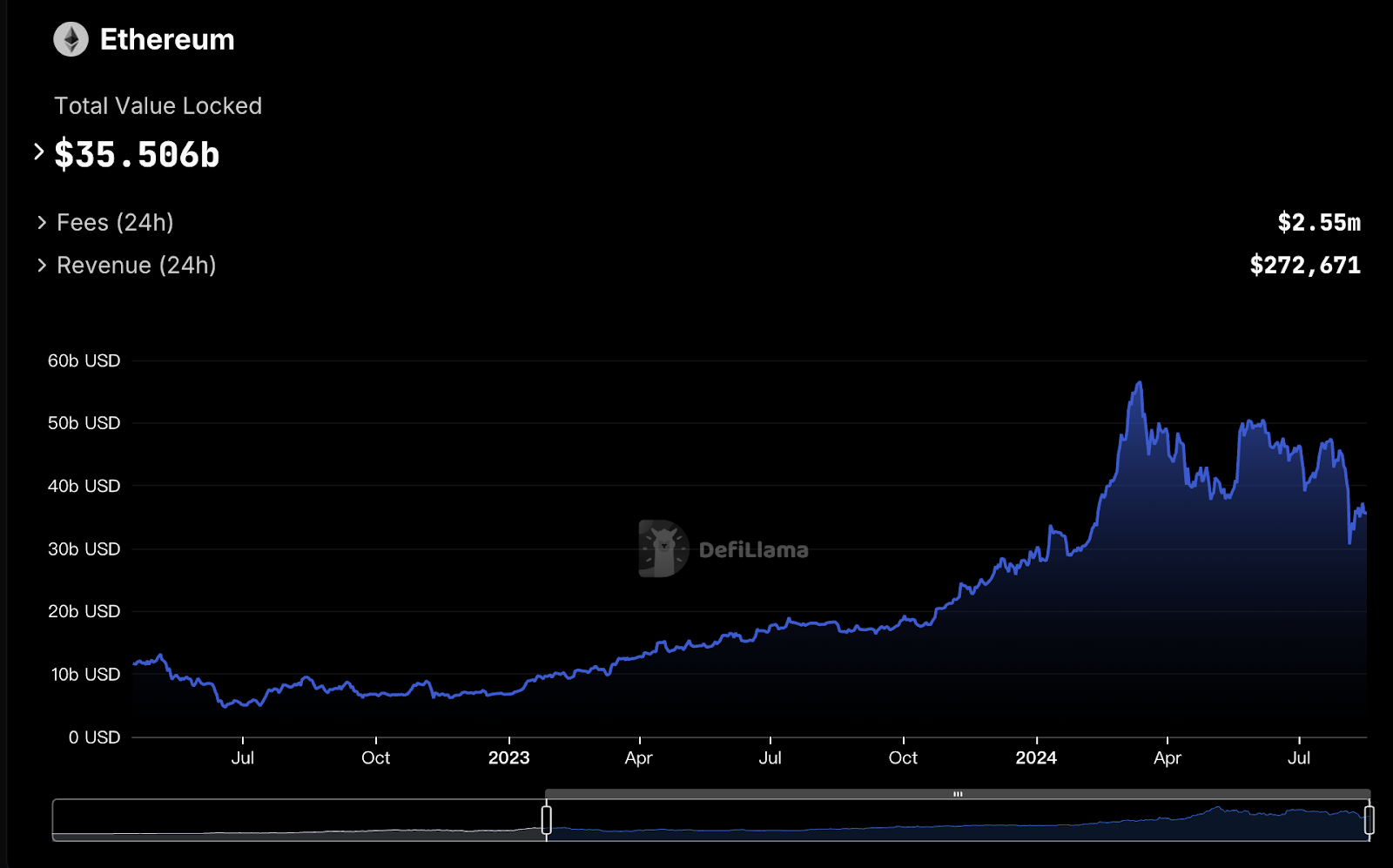

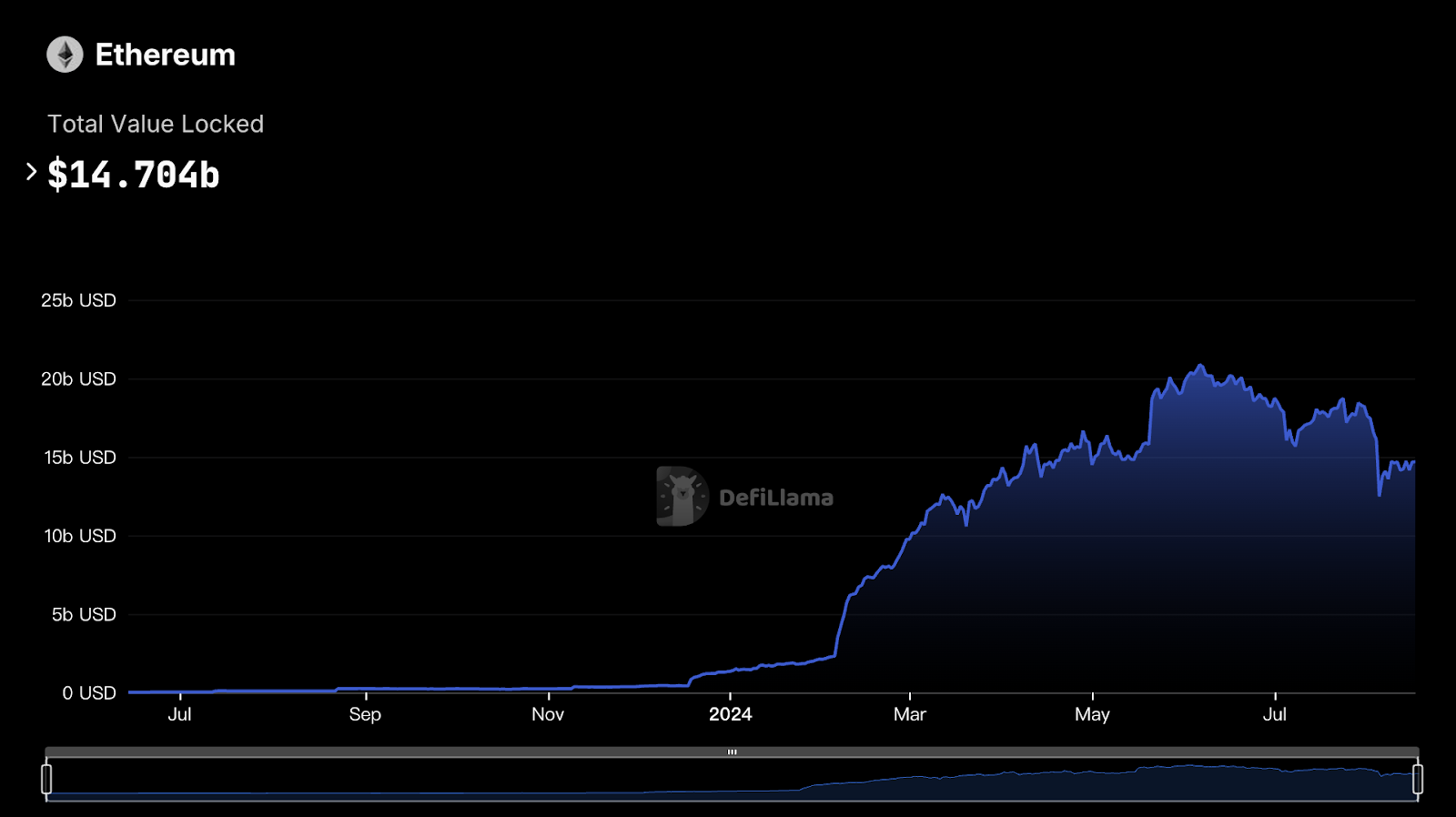

While the total market cap of the Bitcoin ecosystem has stagnated, Ethereum completed The Merge at the end of 2022, successfully transitioning to proof-of-stake (PoS) and introducing native risk-free yield. This catalyzed explosive growth in the ETH staking ecosystem. As of August 28, 28.11% of ETH has been staked, giving rise to a $35.5 billion staking market and a $14.7 billion restaking market. DeFi products based on liquid staking tokens (LSTs) now dominate Ethereum’s financial ecosystem and continue to grow rapidly.

Left: Staking market; Right: Restaking market

Compared to Ether, Bitcoin—the largest cryptocurrency by market cap—is known for decentralization, resistance to price manipulation, and price stability, making it arguably even more suitable for staking and restaking markets. The security of PoS systems heavily depends on capital stability, a characteristic that aligns naturally with Bitcoin’s strengths.

With the approval of Bitcoin ETFs, compliant avenues for institutional investment in Bitcoin have opened up. Long-term investors such as family offices, private banks, and pension funds are increasingly including Bitcoin ETFs in their portfolios, further reinforcing Bitcoin’s price stability and its status as digital gold.

Babylon emerged as the chosen protocol to deliver much-needed native yield to the token best suited for AVS (Actively Validated Services).

Babylon aims to awaken Bitcoin’s dormant ecosystem by introducing permissionless PoS risk-free yield (with an initial hard cap of 1,000 BTC TVL), all while maximizing asset security. Using Bitcoin’s existing scripting language, Babylon implements staking and slashing mechanisms through staking contracts that allow users to self-custody their assets while securing PoS consumer chains economically.

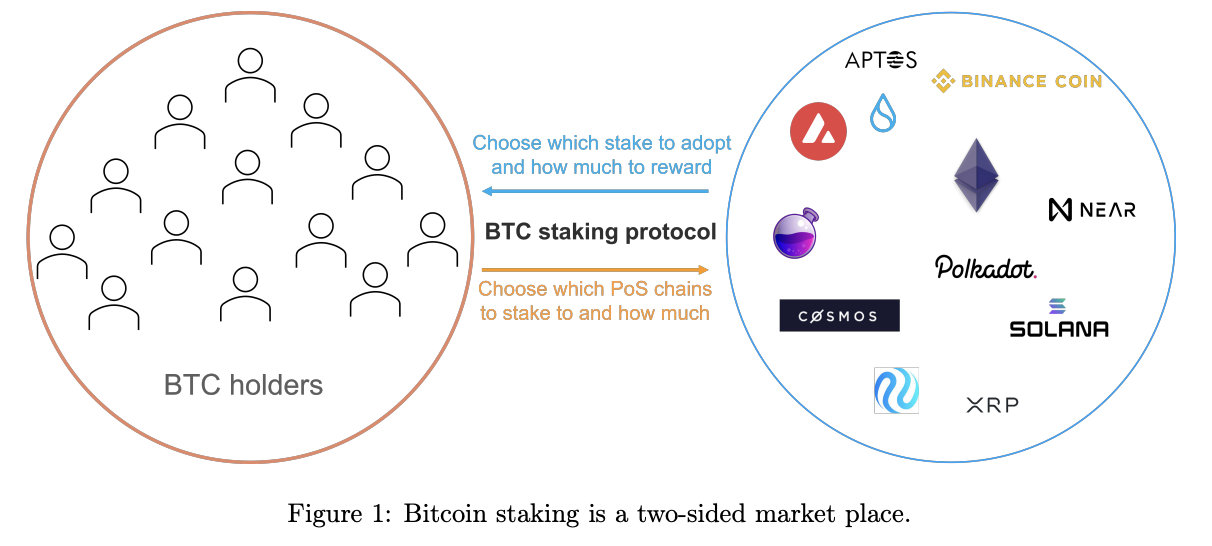

Bitcoin staking is a two-sided market, connecting yield-seeking demand with economic security needs of PoS chains

Babylon eliminates reliance on third-party custodians through its self-custody protocol and unlocks restaking potential via remote staking. Projects in the Bitcoin ecosystem can build upon Babylon’s PoS yield as a foundational layer, combining it with CeDeFi yields to maximize economic incentives.

Babylon marks the beginning of native yield for BTC, ushering the BTC DeFi ecosystem into a new phase and resolving core bottlenecks that have constrained its development over the past two years.

1.3 Fragmented BTC Layer2 Landscape

Beyond native yield, the rapid rise of Bitcoin’s programmable ecosystem has introduced safer sources of DeFi yield.

It took Ethereum nine years—from Fabian Vogelsteller proposing the ERC-20 standard in November 2015 to EigenLayer launching on the Ethereum mainnet in April 2024. In contrast, the Bitcoin ecosystem achieved comparable progress in just one and a half years.

At the end of 2022, Casey Rodarmor introduced the Inscriptions protocol, enabling asset issuance on the Bitcoin mainnet. In March 2023, Domo launched the experimental BRC-20 standard, allowing token deployment, transfers, and minting on Bitcoin. By the end of 2023, the Ordinals ecosystem surged, revealing strong demand for asset issuance on Bitcoin and highlighting the importance of DeFi applications. However, due to limited block space on the Bitcoin mainnet, development of complex financial applications was constrained, leading to rising user costs and deteriorating experience. Especially when the halving reached block height 840,000, the activation of the Runes protocol triggered market FOMO, causing mainnet transaction fees to spike to 2,000 satoshis per byte.

The launch of the Runes protocol on April 20, 2024 caused a sharp spike in Bitcoin mainnet fees

Some researchers proposed Bitcoin Improvement Proposals (BIPs) to enhance mainnet smart contract capabilities by reintroducing the OP_CAT opcode. Others explored scalability solutions without altering Bitcoin’s original technical framework, accelerating the development of Bitcoin Layer2s.

Bitcoin Layer2s such as Botanix and BitLayer treat Bitcoin Finality as a foundational principle. They compress and bundle transactions onto the Bitcoin mainnet, building trustless bridges that ensure security equivalent to the Bitcoin mainnet.

Compared to bridging to Ethereum, which faces various challenges, bridging to Bitcoin Layer2s offers higher security and legitimacy, gaining broad consensus and support within the Bitcoin community. This has activated vast amounts of dormant Bitcoin liquidity, injecting it into the Bitcoin ecosystem in search of high-yield financial opportunities. Since most Bitcoin Layer2s are fully EVM-compatible, many Ethereum-based DeFi applications are now being deployed on them, gradually forming a rich DeFi ecosystem.

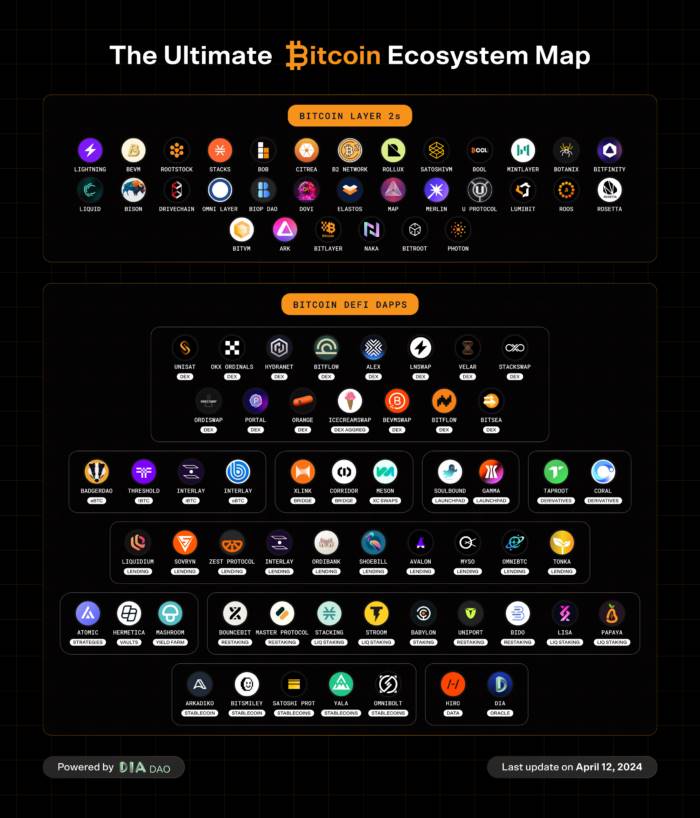

Bitcoin ecosystem landscape as of April 2024

1.4 Competitive BTC Restaking Landscape

The emergence of native yield solutions, combined with enhanced programmability in the Bitcoin ecosystem, has made restaking a major DeFi use case. Similar to Ethereum’s EigenLayer restaking ecosystem, a nascent restaking ecosystem has begun to form around the Babylon staking protocol. Users can choose to self-custody and stake BTC directly on the Bitcoin mainnet to earn Babylon’s shared security yield; deposit BTC into an LRT protocol to receive liquid staking tokens (LSTs) and participate in DeFi on Bitcoin L2s for additional yield; or during Merlin Seal and other Layer2 staking events, stake M-BTC into Solv Protocol to obtain SolvBTC—a liquid yield-bearing token—for liquidity mining or arbitrage in CeFi funding rate markets.

Restaking projects collaborate with Babylon to provide underlying yield for BTC pegged tokens, while the growth of these projects strengthens Babylon’s PoS AVS security in return.

However, the development of the BTC restaking sector brings new challenges:

-

Unsustainable underlying yields: Many protocols rely on high-inflation tokens as rewards, unable to maintain high yields long-term. If these protocols fail to achieve sustainability, users may face declining valuations post-token generation event (TGE).

-

Liquidity and user experience fragmentation: Competition among restaking projects fragments liquidity across the BTC ecosystem, reducing overall utility. Increased complexity in switching between different Layer2s and wrapped tokens raises the barrier to entry, limiting large-scale financial operations and cross-chain integration. Over time, this could lead back to a situation where smaller players fight while larger ones benefit, recreating WBTC’s monopoly.

-

High educational barriers: The fast-paced and competitive nature of the Bitcoin ecosystem makes it difficult for users to keep up with new protocols and understand various yield strategies to select optimal ones.

-

Security not guaranteed: Many projects launch hastily without sufficient security validation, increasing risks to user assets.

These new issues require new solutions. The restaking era needs a new aggregated liquidity token—like WBTC once was—to seamlessly connect diverse DeFi protocols.

Uniquid Layer emerges precisely for this purpose.

2. Uniquid Layer — A Liquidity Layer Designed for the Broader Community

2.1 What is Uniquid Layer?

Uniquid Layer’s full name is Unified Liquidity Layer, literally meaning “Unified Liquidity Layer.” Its function is straightforward: comparable to chain-abstraction-based universal liquidity aggregation networks like Cycle Network or AggLayer, it aims to efficiently and seamlessly interconnect the fragmented Bitcoin ecosystem.

Uniquid focuses on unified liquidity management, helping users avoid tedious yield calculations and comparisons, thereby maximizing Bitcoin investment returns. To illustrate, traditional BTC restaking protocols are like smartphone manufacturers, offering pre-built devices with slight performance advantages under specific parameters, striving to lock users into their ecosystems. Uniquid, by contrast, is like a PC assembly expert. It selects the best components according to user needs and integrates them. If any component fails or becomes outdated, the expert can quickly respond and replace it.

As the “People’s Liquidity Layer,” Uniquid Layer addresses the aforementioned problems from a user experience perspective.

-

Provides security assurance. Uniquid Layer employs ADV technology to maximize the security of liquidity aggregation. Additionally, it conducts thorough risk assessments of underlying restaking protocols to select the safest and most sustainable projects for users.

-

Maximizes Bitcoin yield. By integrating various restaking projects and analyzing their real underlying yields, Uniquid Layer maximizes liquidity returns.

-

Offers a unified and user-friendly liquidity management platform for Bitcoin holders. Users’ cross-chain BTC liquidity is centrally managed and intelligently allocated via Uniquid Layer, ensuring seamless interoperability across Layer1s and Layer2s.

-

Serves as an entry point to the Bitcoin DeFi ecosystem, lowering the barrier to entry. Users no longer need to learn how each restaking protocol works—simply stake assets into Uniquid Layer to automatically receive optimized composite yields and a liquid token for broader DeFi participation.

2.2 Lowering BTC Restaking Entry Barriers, Unifying BTC Pegged Token Liquidity

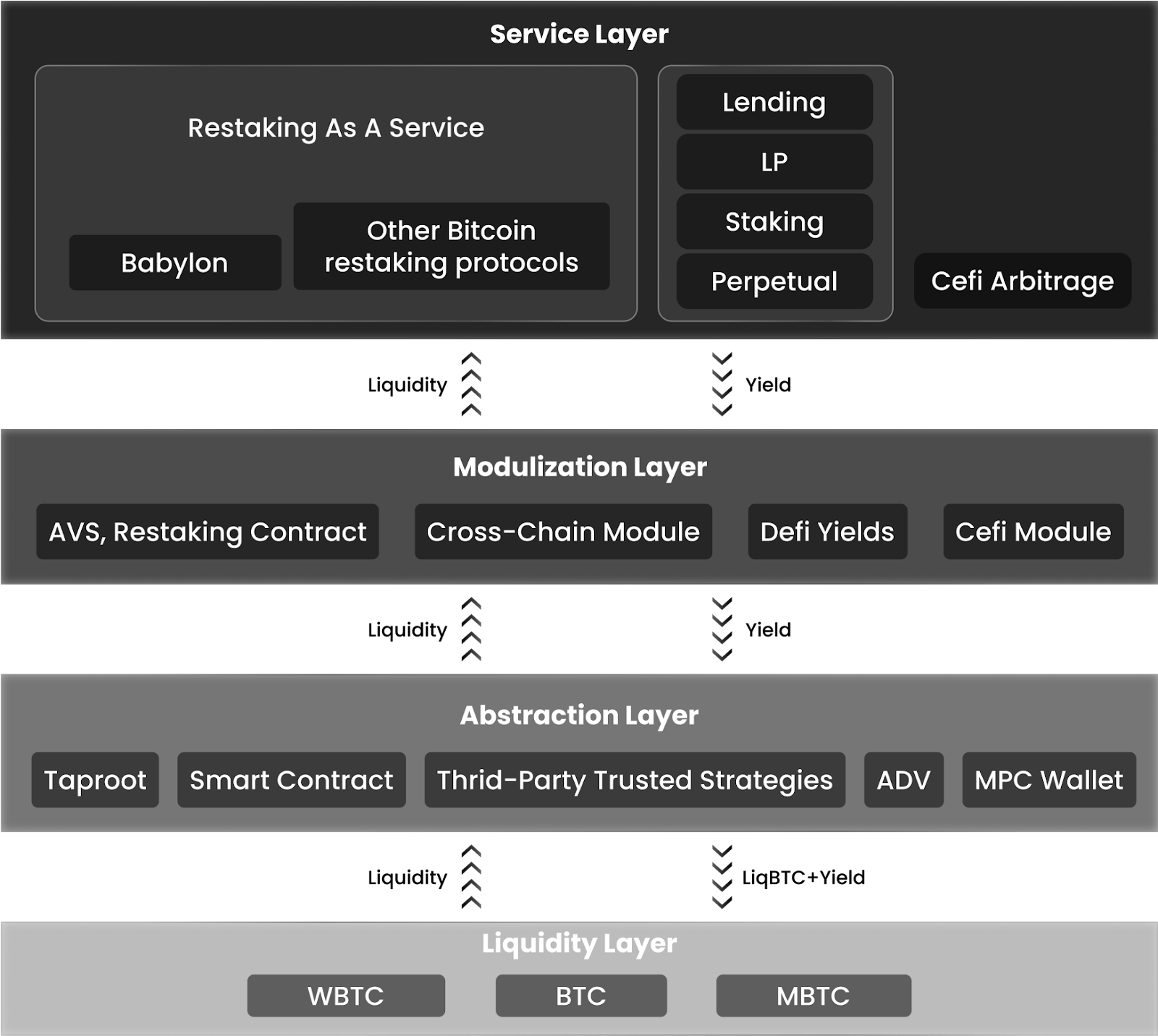

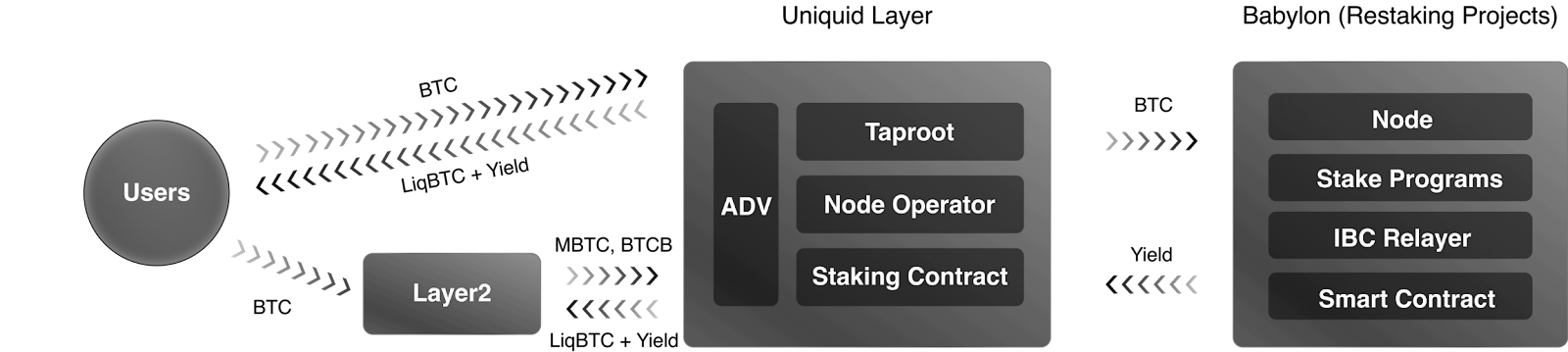

Uniquid Layer provides a unified framework to aggregate and manage Bitcoin liquidity across different blockchains and centralized exchanges. It abstracts the entire restaking ecosystem into four layers: service layer, modular layer, abstraction layer, and liquidity layer. The first three layers are encapsulated within the underlying protocol. Users simply deposit their BTC pegged tokens from any chain or format into the liquidity layer to earn the best annualized yield managed by Uniquid Layer.

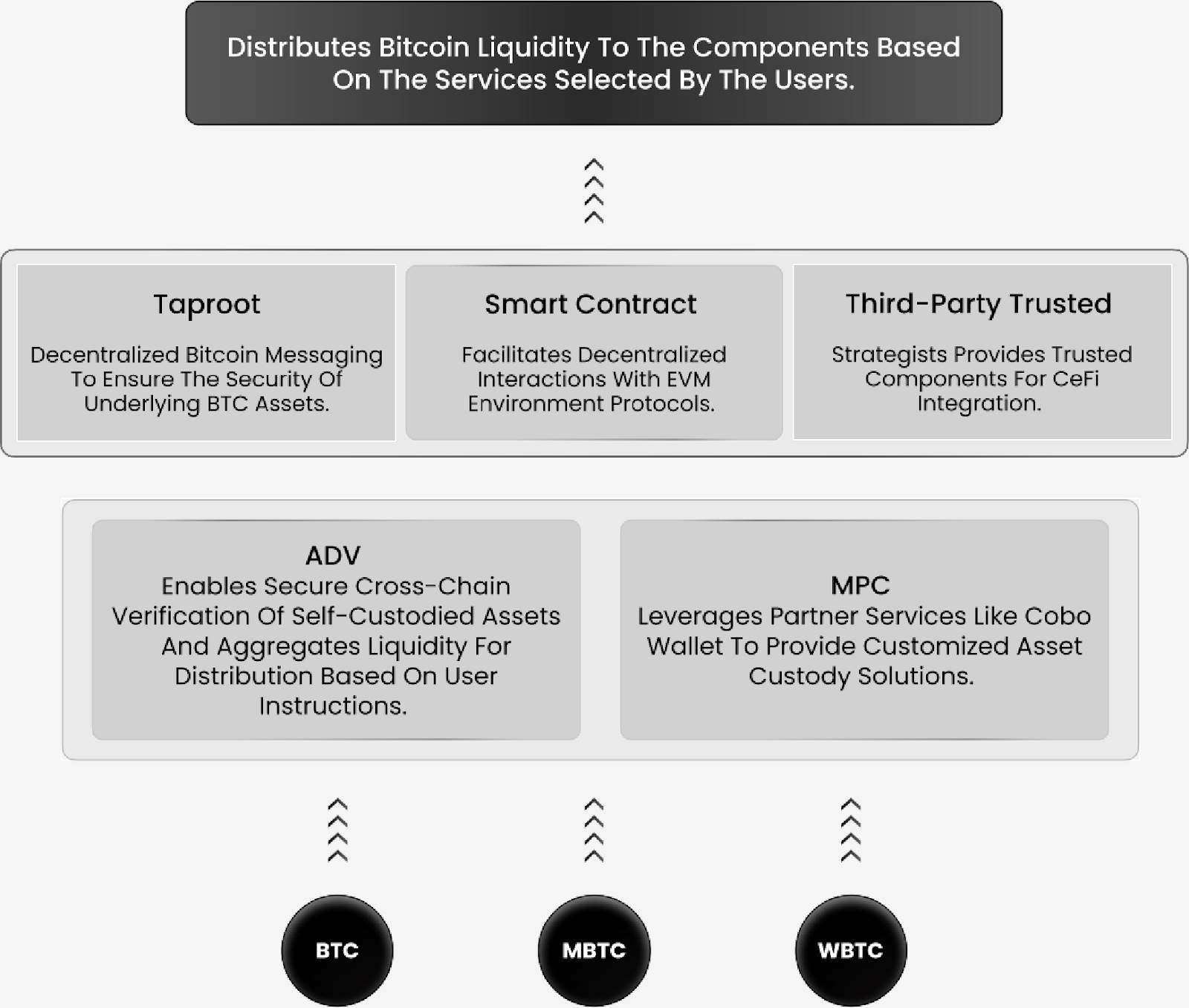

For Bitcoin ecosystem projects, asset security should always outweigh economic incentives. For a liquidity aggregation platform, aggregating Bitcoin spread across chains and protocols in a minimally-trusted manner is Uniquid Layer’s core technological pillar. Uniquid Layer uses Anonymous Decentralized Verification (ADV) technology to pool cross-chain BTC liquidity. It designs targeted decentralized privacy technologies for different BTC use cases to secure the aggregation process and enable safe yield access:

-

For the Bitcoin mainnet, Taproot is used to effectively obscure script information;

-

For EVM environments, decentralized signatures interact with smart contracts;

-

For centralized exchanges, trusted third-party strategies are integrated;

-

Collaborates with MPC custody providers to offer customized asset custody solutions.

ADV

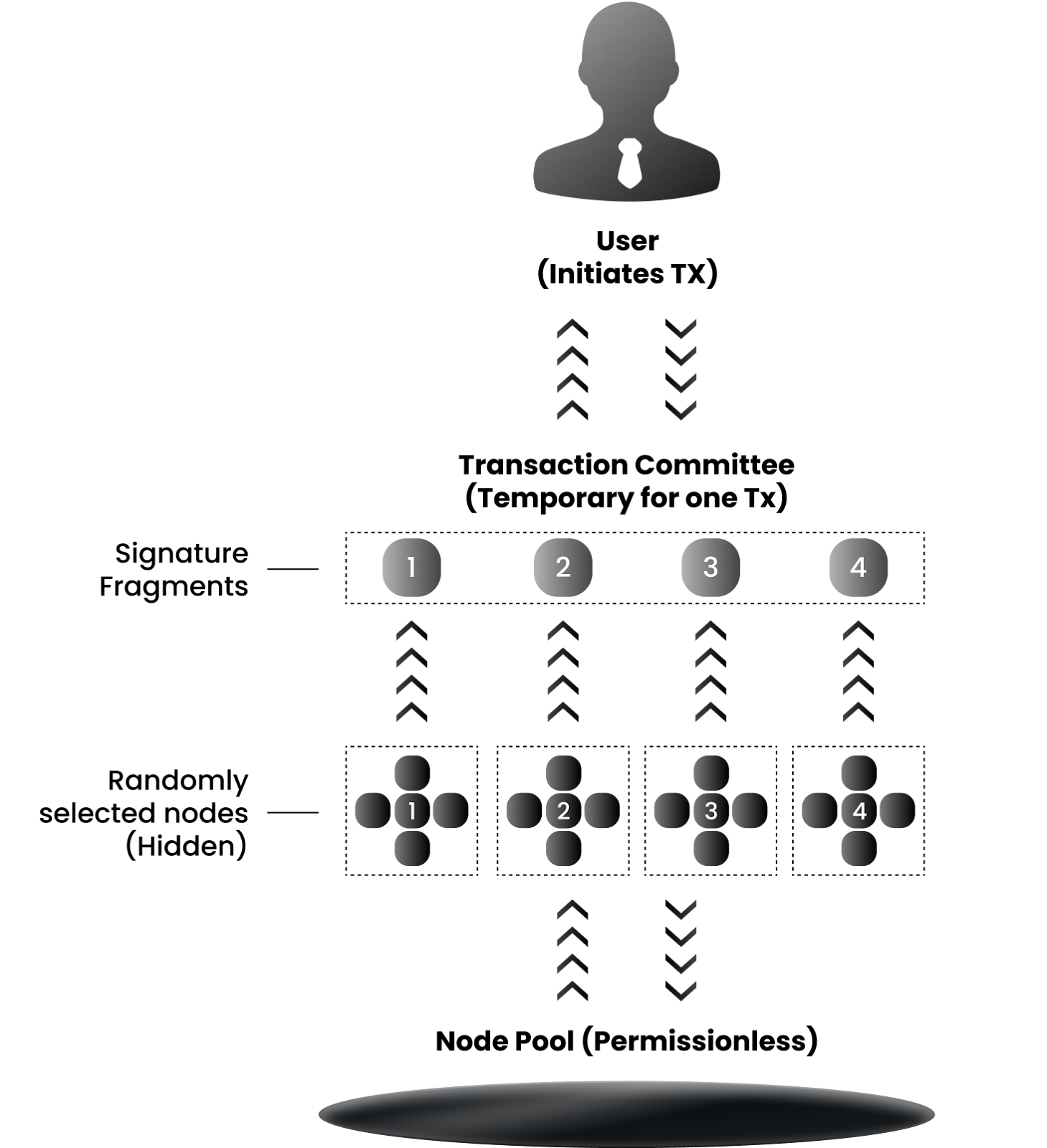

Uniquid Layer uses ADV technology to protect and abstract liquidity, securely aggregating it into the restaking protocols offering the highest current annualized yield. Similar to threshold signature schemes, the private key for cross-chain transaction signing is no longer controlled by a single node. Instead, signing authority is split among a permissionless pool of anonymous nodes. When a user initiates a cross-chain transaction, the protocol randomly selects a group of nodes from the pool. Only by aggregating their partial signatures can the full signature be generated.

Since signers are randomly selected from a permissionless, anonymous node pool, the ADV mechanism effectively prevents single-point failures, significantly increases the cost of attacks by malicious nodes, and ensures flexibility, anonymity, and scalability in the cross-chain ecosystem.

2.3 Modularizing Restaking Components, Integrating Protocol Providers

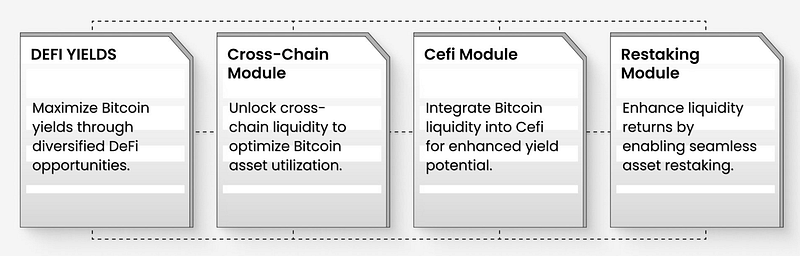

Uniquid Layer unifies existing restaking ecosystem projects under a powerful and adaptive modular framework, linking their yields and enhancing liquidity management. The modular framework consists of four modules: AVS & Restaking Module, Cross-chain Liquidity Module, DeFi Yield Module, and CeFi Yield Module. All restaking providers are abstracted and integrated into this layer for easy selection and orchestration.

-

AVS & Restaking Module: AVS yield is the foundation of restaking. Uniquid Layer actively integrates advanced validation systems to maximize liquidity returns through seamless restaking protocol integration, while maintaining high standards of asset security.

-

Cross-chain Module: Facilitates free and secure movement of liquidity across blockchains, optimizing Bitcoin asset utilization and enabling users to explore diversified yield sources across multiple ecosystems.

-

DeFi Yield Module: Aims to increase yield from both decentralized and centralized finance by integrating Bitcoin liquidity into various DeFi platforms, maximizing return potential through diversified opportunities.

-

CeFi Module: Integrates Bitcoin liquidity into centralized financial systems, offering users additional arbitrage-driven yield opportunities.

2.4 Restaking-as-a-Service, Maximizing User Returns

By participating in Uniquid Layer’s restaking service, users achieve optimal returns on their staked assets. Uniquid Layer aggregates all liquidity yield sources into the restaking service layer, where dynamic algorithms and analysts calculate expected returns from various sources to maximize investment returns. Additionally, staking assets into Uniquid Layer’s liquidity layer earns users Uniquid Points rewards.

2.5 LiqBTC: The WBTC of the Restaking Era

By staking assets into Uniquid Layer, users not only maximize returns but also receive a liquid staking token called LiqBTC. LiqBTC is designed not just as a liquid staking token (LST), but as a new standard for cross-chain yield-bearing BTC pegged tokens. Integrated with DeFi ecosystems across more than 10 chains, LiqBTC will, like WBTC, connect the vast BTC financial ecosystem beyond the Bitcoin mainnet—while avoiding centralization risks and delivering the highest underlying yield in the restaking era.

2.6 Roadmap and Future Plans

In 2024, Uniquid Layer will complete the foundational protocol framework. In Q3, it will integrate restaking-as-a-service functionality and launch an early supporter incentive program. In Q4, it will integrate liquidity modules and develop the liquidity abstraction layer protocol. The testnet is scheduled to launch in Q1 2025, with validator nodes deployed. The mainnet will roll out between Q2 and Q4, gradually integrating LiqBTC into DeFi protocols across multiple chains to build a universal cross-chain liquidity market.

2.7 Funding Status

Uniquid Layer boasts a prestigious investor lineup, having secured funding from top-tier global and domestic investment firms including Amber Group, DWF Labs, and ArkStream Capital.

3. Conclusion

Babylon’s introduction of native yield has ushered the BTC financial ecosystem into a new age of exploration. In this blue-ocean market worth billions, whoever delivers higher security, better real yields, and lower user friction will claim the throne of BTC liquidity finance. In this race, Uniquid Layer—emerging as a latecomer in liquidity aggregation—has the potential to consolidate today’s fragmented BTC liquidity and, like WBTC before it, become a leader in the BTC DeFi ecosystem by offering users a smoother, fully interoperable cross-chain liquidity experience.

References

-

https://www.odaily.news/post/5150988

-

https://foresightnews.pro/article/detail/66576

-

https://blog.bitgo.com/bitgo-to-move-wbtc-to-multi-jurisdictional-custody-to-accelerate-global-expansion-plan-2ea0623fa2c8

-

https://www.btcstudy.org/2021/12/13/schnorr-applications-blind-signatures/

-

https://dune.com/21co/wbtc

-

https://wbtc.network/dashboard/order-book

-

https://dune.com/sankin/bitcoin-on-ethereum

-

https://www.diadata.org/blog/post/bitcoin-ecosystem-map/

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News