Sei Network: A Layer 1 Blockchain Breaking DEX Scalability

TechFlow Selected TechFlow Selected

Sei Network: A Layer 1 Blockchain Breaking DEX Scalability

Sei provides the best infrastructure for applications and exchanges.

Author: Will

Sei: The Fastest L1 for Trading

Sei Labs has a core thesis: the ability to exchange digital assets is the foundational use case of crypto. Solving how to scale trading applications and exchanges will unlock the next phase of growth in Web3 adoption. Sei is a general-purpose Layer 1 blockchain built for trading, optimized at every layer of the stack to provide the best infrastructure for trading applications and exchanges.

Asset Exchange Forms the Foundation of Crypto

Trading extends beyond the conventional understanding of candlestick charts, technical analysis, and derivatives. It encompasses a broad range of assets and activities, including trading tokens, NFTs, real-world assets, virtual world assets, risk, social similarity, and more.

The success of the most prominent Web3 applications is rooted in trading and asset exchange. For example, Bitcoin's value comes from its exchangeability. MetaMask users ultimately use trading applications like Uniswap or OpenSea to swap assets. It is this exchange functionality that drives their wallet usage. Similarly, people use Aave to gain liquidity to purchase things. These and other successful Web3 applications derive traffic and value from trading and asset exchange. In this sense, trading as a defining feature of cryptocurrency goes far beyond what many might expect.

Notably, many successful Web3 applications are functionally exchanges, regardless of whether they market themselves as such. Obvious examples include Uniswap, OpenSea, and Sushi. However, not all trading applications are so explicit. Axie Infinity and StepN are both games, but in-game asset trading is crucial to the user experience, making them trading applications as well. This is why both gaming projects have built their own NFT markets and DEXs.

Trading Is Poised for Exponential Growth

As Web3 continues to evolve, the importance of trading will only increase. The surge in digital assets drives greater demand to exchange them, making trading an indispensable part of the industry. Moreover, increased regulatory pressure on centralized exchanges (CEXs) could push more trading volume and activity on-chain. This will require trading applications to scale and adapt to massive waves of usage. Trading will not only remain relevant in Web3—it will grow exponentially alongside the industry.

The Challenge

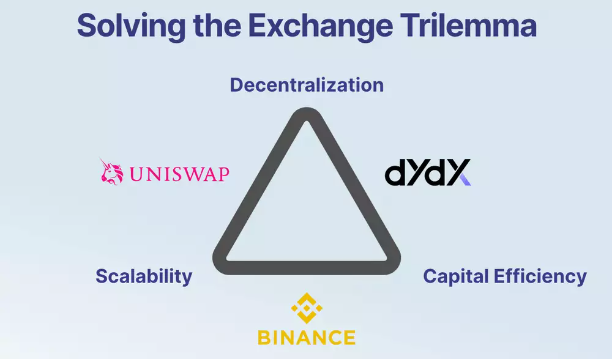

Over the past few years, it has become clear that on-chain asset trading has achieved deep product-market fit. The natural next step is to scale applications to meet rising demand. The problem is that trading applications face major scalability barriers on existing Layer 1 and Layer 2 infrastructures. This challenge is known as the "trilemma of trading," where trading apps cannot simultaneously achieve decentralization, scalability, and capital efficiency.

Given the unique requirements of trading applications—speed, throughput, reliability, and MEV resistance—specially designed infrastructure is needed to address these issues. This is exactly what Sei aims to deliver: a solution to DEX scalability challenges that enables trading applications to scale effectively while maintaining decentralization and capital efficiency.

If Sei succeeds, trading applications will no longer need to compromise on decentralization. They will be able to offer a user experience on par with any Web2 application while preserving the non-negotiable benefits of decentralization: trustlessness, permissionless trading, and the ability to prove ownership without risk of censorship.

Sei Solves the Problem

Sei is an open-source Layer 1 blockchain designed to solve the scalability problem for trading. As the fastest Layer 1 for trading, Sei optimizes every layer of the stack to provide the best possible infrastructure for trading applications. Sei’s unique value proposition lies in its singular focus on trading functionality. By optimizing infrastructure specifically for trading applications, any game economy, NFT marketplace, or DeFi DEX will perform better on Sei than on any other Layer 1.

Sei boasts the industry’s fastest finality—with sub-300ms finality—and built-in parallelization, making its infrastructure ideal for trading functions. Leveraging two recent advances in consensus research, Sei features Twin-Turbo Consensus, achieving performance levels unreachable by other Layer 1 blockchains. Additionally, Sei’s built-in matching engine and frontrunning protection provide valuable out-of-the-box advantages for trading applications. Finally, Sei’s automatic order batching functionality increases application throughput and improves the user experience across all trading applications built on Sei.

Why Build Sei as a Layer 1?

Sei Labs, the development team behind Sei, initially explored building Sei as a Layer 2 on Ethereum. However, Layer 2 rollups come with two key drawbacks:

-

Decentralization. Every Layer 2 currently uses centralized sequencers, meaning a single entity is responsible for validating and executing user transactions. This leads to serious concerns around security, censorship resistance, and liveness.

-

Throughput. The maximum throughput of a Layer 2 is limited by the block space of the underlying Layer 1 it writes to. This creates significant scaling bottlenecks.

By focusing on trading, Sei creates a compelling product for developers who want to build on a general-purpose Layer 1. Trading is critically important for all types of Web3 applications, including gaming, social, and NFTs. By fulfilling this fundamental need, Sei generates gravitational pull, encouraging users to explore any type of application built on Sei, since trading is universal. Hundreds of promising teams are building on the Sei ecosystem, including some from the largest Layer 1s and Layer 2s such as Ethereum, Solana, zkSync, Polygon, and Sui.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News