RWA: The Rise of Real-World Assets

TechFlow Selected TechFlow Selected

RWA: The Rise of Real-World Assets

This article explores the trend and development prospects of tokenizing real-world assets (such as real estate, bonds, stocks, etc.) through blockchain technology and integrating them into the decentralized finance (DeFi) ecosystem.

Author: Trustless Labs

1. Origins of RWA

RWA—Real World Assets

RWA, short for Real World Assets, literally means "real-world assets." It refers to the representation and trading of real-world assets within blockchain or Web3 ecosystems through digitization and tokenization. These assets include, but are not limited to, real estate, commodities, bonds, stocks, art, precious metals, and intellectual property. The core idea behind RWA is to bring traditional financial assets into decentralized finance (DeFi) via blockchain technology, enabling more efficient, transparent, and secure asset management and transactions.

The significance of RWA lies in its ability to unlock liquidity for traditionally illiquid real-world assets through blockchain, allowing them to participate in DeFi activities such as lending, staking, and trading. This bridge between physical assets and the blockchain world is becoming a key development direction within the Web3 ecosystem.

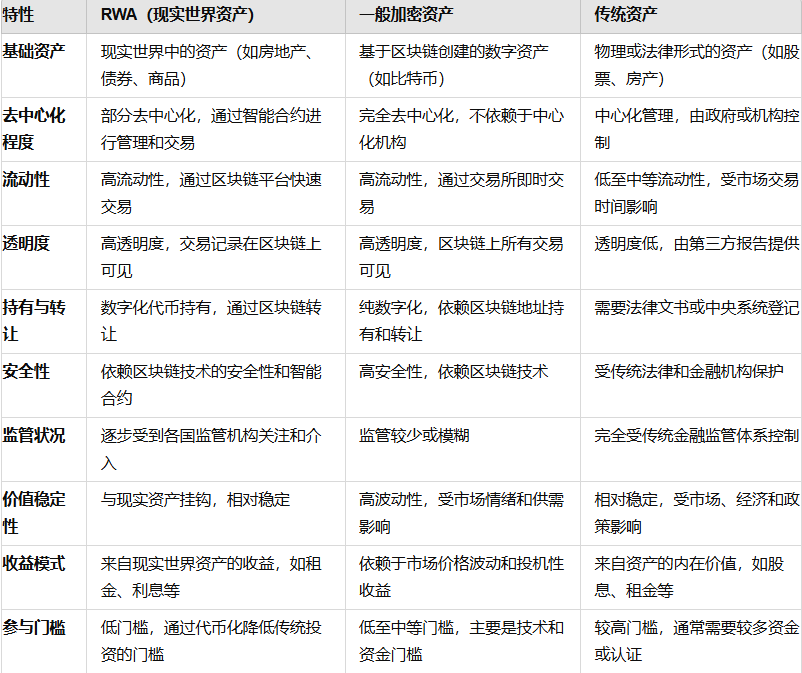

RWA—A Unique Asset Class

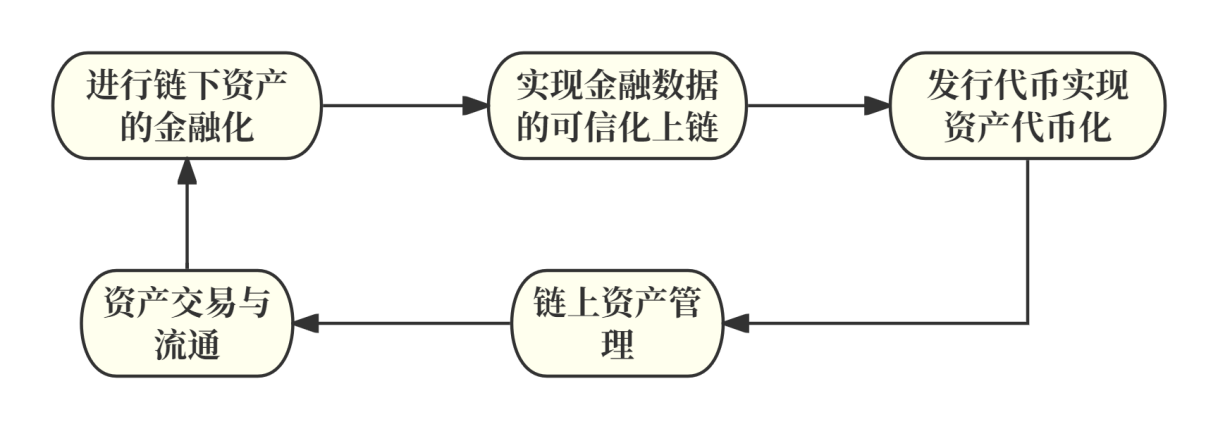

RWA bridges native crypto assets and traditional financial assets by tokenizing real-world assets into digital assets that can generate utility on-chain. Native crypto assets are typically governed entirely by smart contracts on-chain, adhering to the principle of "Code is Law." In contrast, traditional assets like bonds, stocks, and real estate operate under existing legal frameworks and are protected by governmental regulations. RWA introduces a set of tokenization rules that require both on-chain technical support from smart contracts and off-chain legal protection for underlying assets such as equities and real estate.

In practice, tokenization under the RWA framework goes beyond simply issuing a token on a blockchain. It involves a complex process integrating real-world asset relationships. This includes acquiring and custodizing the underlying asset, establishing a legal framework linking tokens to these assets, and finally issuing the tokens. Through this process, legal rights over the underlying assets are conferred upon token holders, combining on-chain mechanisms with off-chain laws and operational procedures.

Figure 1

Figure 2

RWA—Historical Evolution

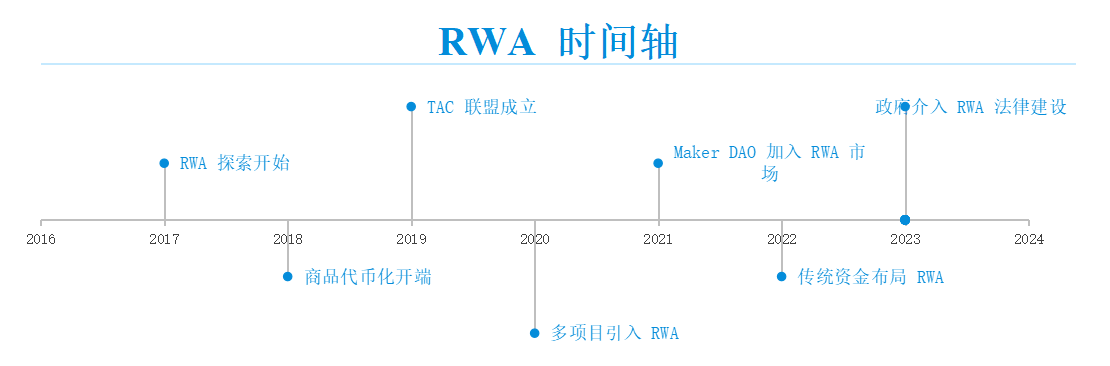

The development of RWA can be divided into three phases: early exploration, initial growth, and rapid expansion.

Early Exploration Phase (2017–2019)

-

2017: Initial RWA Exploration Begins

As the concept of decentralized finance (DeFi) matured, the idea of RWA began to take shape. Pioneer projects such as Polymath and Harbor started exploring the feasibility of security tokenization. Polymath focused on building a platform for issuing security tokens with an emphasis on regulatory compliance, while Harbor aimed to provide a compliant framework enabling securities to become liquid on blockchains.

-

2018: Commodity Tokenization Emerges

Pilot projects in real estate and commodity tokenization began appearing. For example, RealT experimented with tokenizing U.S. real estate, allowing global investors to gain partial ownership and rental income by purchasing tokens.

-

2019: Formation of the TAC Alliance

The Tokenized Asset Collaboration (TAC) Alliance was established to promote standardization and cross-platform interoperability in the RWA space, fostering collaboration among various projects. Platforms such as Securitize and OpenFinance also launched during this period, offering compliant solutions for enterprise-level asset tokenization.

Initial Growth Phase (2020–2022)

-

2020: Multiple Projects Adopt RWA

The Centrifuge project gained significant attention by tokenizing real-world accounts receivable and invoices, enabling small and medium-sized enterprises (SMEs) to access financing on blockchain. Meanwhile, major DeFi protocols such as Aave and Compound began experimenting with using RWA as collateral to expand their lending offerings.

-

2021: MakerDAO Enters the RWA Market

Centrifuge integrated RWA as collateral into MakerDAO’s lending platform, allowing users to mint the stablecoin DAI by holding RWA-backed assets.

-

2022: Traditional Financial Institutions Enter RWA

Major financial institutions such as JPMorgan and Goldman Sachs began researching and piloting RWA initiatives to explore how traditional assets could be digitized via blockchain. The Real World Asset Alliance (RWA Alliance) was also founded to drive standardization and global adoption of RWA.

Rapid Expansion Phase (2023 – Present)

-

2023: Government Involvement in RWA Regulation

Large asset managers including BlackRock and Fidelity began testing tokenized asset management to improve liquidity and transparency. Regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) and the European Securities and Markets Authority (ESMA) started engaging in developing regulatory frameworks for RWA.

Figure 3

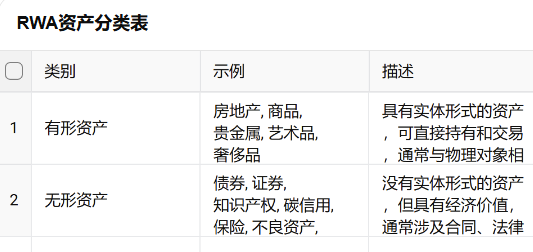

2. RWA Sector Directions

Given the diversity of traditional assets, the RWA sector has shown strong potential across multiple domains. From tangible assets such as real estate, commodities, precious metals, art, and luxury goods, to intangible assets such as bonds, securities, intellectual property, carbon credits, insurance, distressed assets, and fiat currency, RWA demonstrates broad applicability.

Figure 4

Real Estate

In traditional finance, real estate is considered a relatively stable long-term investment with strong capital appreciation potential. However, its low liquidity and high leverage characteristics increase transaction barriers and investment risks, especially for individual investors. RWA-based real estate projects enhance liquidity and reduce individual risk exposure through tokenization.

-

Tangible: Focuses on tokenizing physical assets such as real estate and precious metals, enabling traditionally illiquid assets to become tradable on blockchain.

-

Landshare: Enables small investors to access real estate markets through tokenization, particularly via blockchain-based real estate funds.

-

PropChain: Offers a blockchain-based global real estate investment platform, allowing investors to gain exposure to international real estate markets without directly purchasing properties.

-

RealT, RealtyX: Allow investors to purchase tokens representing partial ownership in U.S. real estate and receive rental income.

Fiat to Stablecoins

In the stablecoin space, assets such as USDT (Tether), FDUSD, USDC, and USDE are prominent. These stablecoins offer low volatility in the crypto market by pegging their value to fiat currencies. Among them, USDT (Tether) is the most well-known and holds the largest market share, maintaining a 1:1 peg to the U.S. dollar—each USDT is backed by one USD.

Fiat currency itself is a real-world asset (RWA), whose value is maintained through reserves and regulatory oversight. When fiat enters the blockchain as a stablecoin, it becomes a programmable digital asset capable of participating directly in DeFi operations such as lending, payments, and cross-border transfers. By anchoring USDT’s value to real-world dollar-denominated assets, Tether enhances stability and creates a relatively secure environment for RWA integration.

-

USDT's Operational Mechanism

Tether maintains a reserve portfolio to back USDT, consisting of cash, cash equivalents, short-term government bonds, commercial paper, secured loans, and a small amount of precious metals. When users deposit fiat currency (e.g., USD) into Tether’s account, Tether issues an equivalent amount of USDT, maintaining the 1:1 peg.

-

USDT Stability and Risks

-

Systemic Risk: Since USDT is pegged to the U.S. dollar, users are exposed to systemic risks associated with the dollar. A significant depreciation of the dollar would reduce USDT’s purchasing power.

-

Regulatory Risk: If regulators challenge or restrict Tether’s operations, it could impact USDT issuance and usage.

-

Collateral Risk: Although Tether claims full backing, concerns remain about the transparency and quality of its reserves. Insufficient or deteriorating reserves could lead to de-pegging, breaking the 1:1 parity with the dollar.

-

Liquidity Risk: Under extreme market conditions, Tether may face liquidity shortages. If many users simultaneously request redemptions, Tether might struggle to meet demand, triggering panic and price volatility.

The challenges faced by Tether are not unique to stablecoins but reflect broader issues in the RWA market. RWA security is inherently tied to the quality of underlying assets and remains highly sensitive to regional and national regulations.

Lending Markets

Integrating RWA with credit lending expands collateral options and increases loan capacity. In DeFi protocols like Maker and Aave, borrowers must over-collateralize with crypto assets. By incorporating traditional assets such as real estate and accounts receivable as collateral, RWA broadens the range of acceptable assets, enabling real-world economic assets to participate in the system. This provides SMEs with greater access to public funding, offers large enterprises additional financing channels, and allows ordinary investors to invest in businesses and share in future growth.

Bonds and Securities

In traditional finance, bonds and securities are among the most widely adopted investment vehicles, supported by robust regulatory frameworks. Therefore, aligning with real-world laws and regulations is crucial for RWA projects involving bonds and securities.

-

Maple Finance: Provides a platform for creating and managing on-chain loan pools, making bond issuance and trading more efficient and transparent.

-

Securitize: Offers services for issuing, managing, and trading tokenized securities. The platform enables companies to issue bonds, stocks, and other securities on blockchain, equipped with compliance tools to meet jurisdictional regulatory requirements.

-

Ondo Finance: Offers tokenized short-term U.S. Treasury funds providing stable yields, further blurring the line between DeFi and traditional finance.

3. RWA Market Size

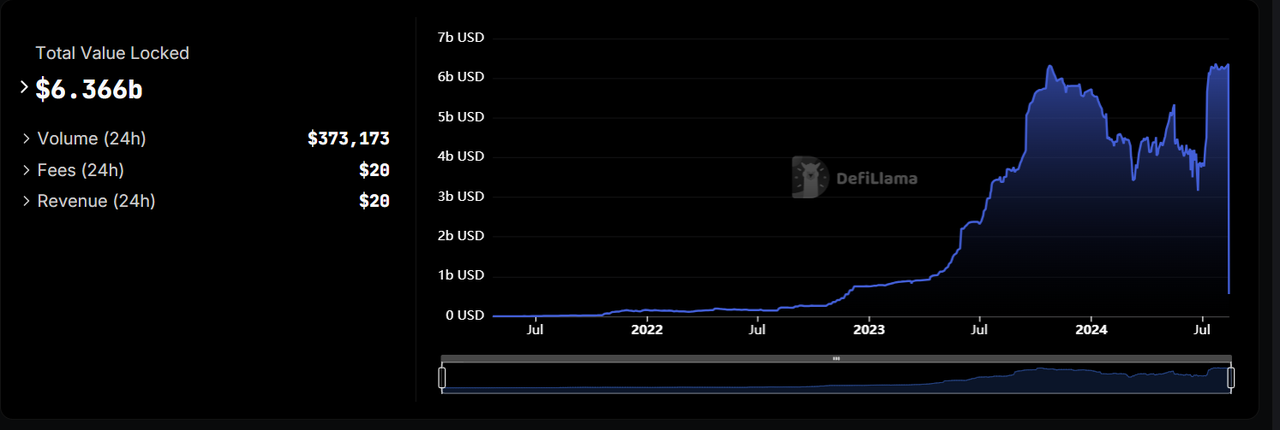

RWA experienced explosive growth starting May 2023. As of the time of writing, according to DefiLlama, RWA-related total value locked (TVL) stands at $6.3 billion, a year-over-year increase of 6000%.

Figure 5

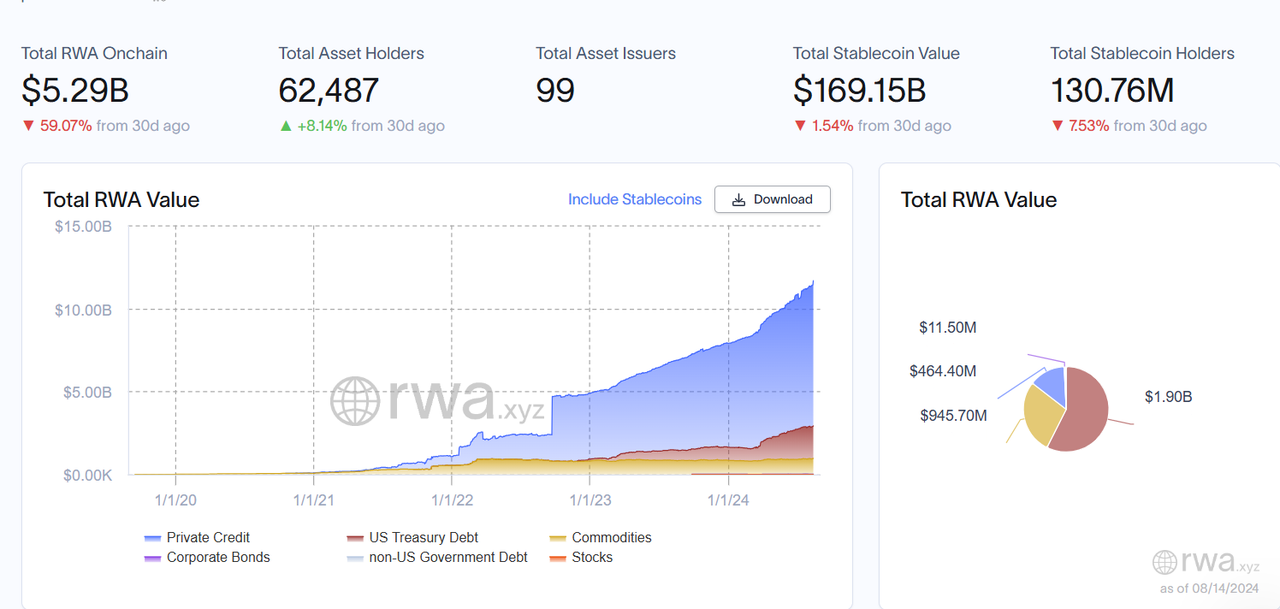

According to data from RWA.xyz, there are currently 62,487 RWA asset holders, 99 issuers, and a total stablecoin value of $169 billion.

Figure 6

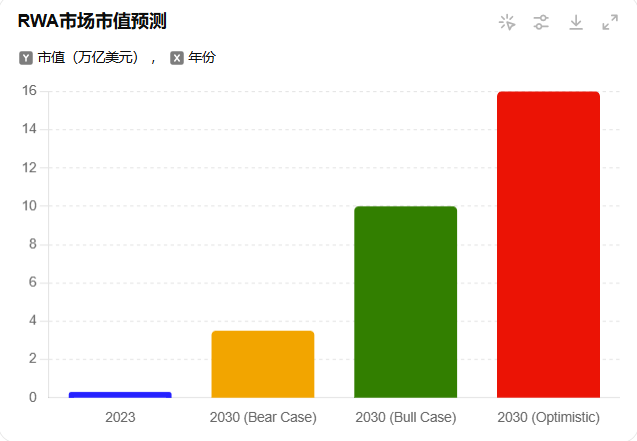

Major Web3 players such as Binance hold optimistic projections for RWA’s future market cap, with some estimating it could reach $16 trillion by 2030.

Figure 7

As an emerging sector, RWA is reshaping the DeFi landscape with unprecedented momentum, and its vast potential warrants investor attention. However, due to its close ties with the real economy, varying legal and regulatory environments across jurisdictions may constrain its development.

4. RWA Ecosystem Development

With traditional capital firms like Goldman Sachs and SoftBank, alongside major Web3 platforms such as Binance and OKX entering the space, leading RWA projects are emerging. Established and new players alike—including Centrifuge, Maple Finance, Ondo Finance, and MakerDAO—are positioning themselves as leaders in technology and ecosystem development.

Centrifuge: Real-World Asset Onboarding Protocol

Concept

Centrifuge is a platform for tokenizing real-world assets on-chain, providing a decentralized asset financing protocol. It connects prominent DeFi lending protocols such as MakerDAO and Aave with real-world borrowers (typically startups) who have pledgeable assets, enabling the flow of value between DeFi and traditional assets.

Funding and Growth

Since its inception, Centrifuge has attracted strong investor interest, raising $30.8 million across five funding rounds from 2018 to 2024. Notable backers include ParaFi Capital and IOSG Ventures. The project has achieved impressive results, having tokenized 1,514 assets with total financing reaching $636 million and a 23% year-on-year TVL growth.

Figure 8

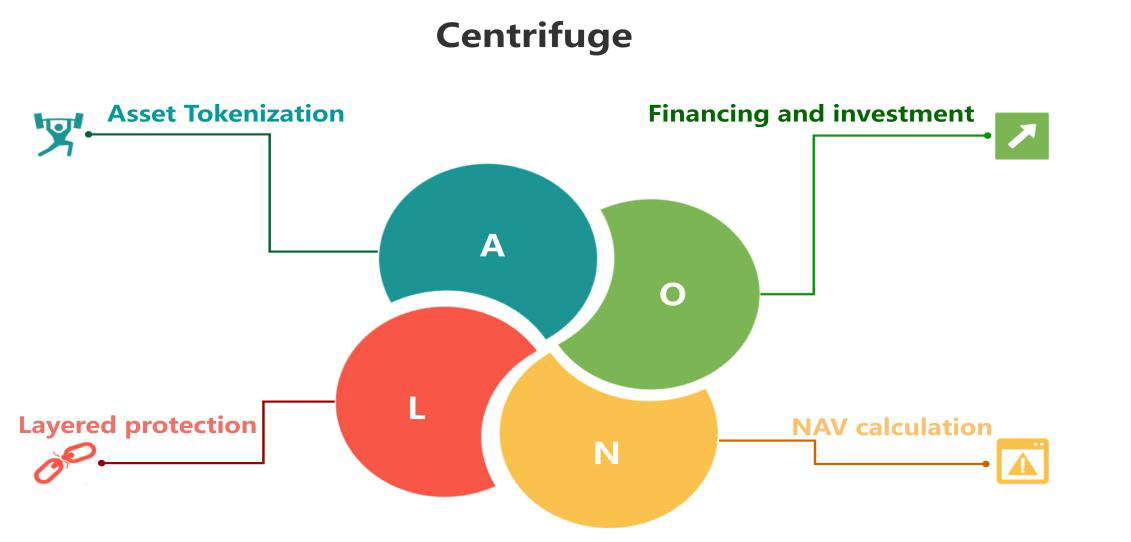

Technical Architecture

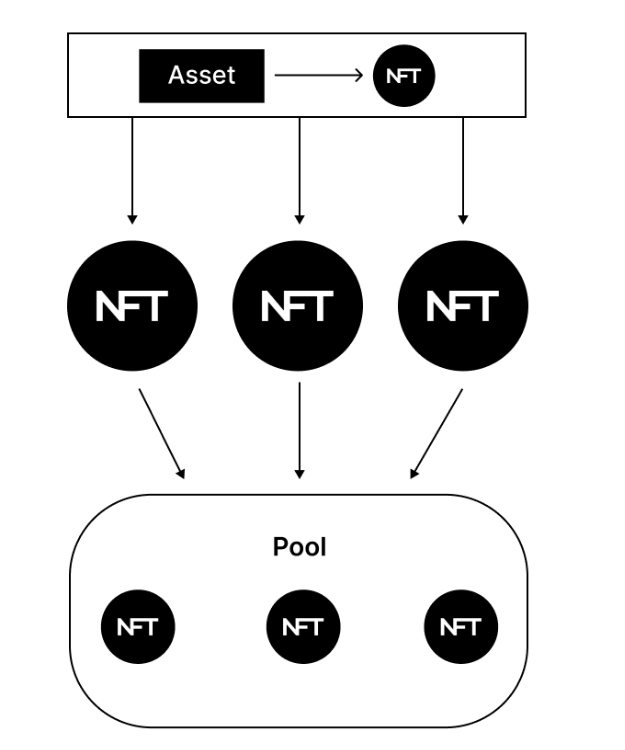

Centrifuge’s core architecture consists of Centrifuge Chain, Tinlake, on-chain net asset value (NAV) calculation, and a tiered investment structure. Centrifuge Chain is a standalone blockchain built on Substrate (part of the Polkadot parachain network), designed specifically for asset tokenization and privacy protection. Tinlake is a decentralized asset financing protocol that allows issuers to tokenize assets as NFTs and use them as collateral to obtain liquidity.

Figure 9

In a complete lending cycle, real-world assets are tokenized into NFTs via Tinlake, which serve as collateral. Issuers receive liquidity from the pool while investors contribute funds. The on-chain NAV model ensures transparent pricing and status tracking for both investors and issuers. The tiered investment structure supports three levels: junior (high risk, high return), mezzanine, and senior tranches (low risk, low return).

Figure 10

Development Challenges

Despite ranking first in RWA project popularity on RootData, Centrifuge has seen a steady decline in key metrics such as TVL, influenced by the 2022 bear market and unmet project expectations in 2024. Its current TVL stands at only $497,944.

Figure 11

Ondo Finance: Leader in U.S. Treasury Tokenization

Concept

Unlike Centrifuge, which focuses on connecting DeFi capital with real-world assets, Ondo Finance is a decentralized institutional-grade finance protocol aiming to build an open, permissionless, and decentralized investment bank. Ondo focuses on expanding beyond stablecoins by bringing low-risk, scalable yield-generating products—such as U.S. Treasuries and money market funds—onto blockchain, allowing holders to earn returns from underlying assets while maintaining capital stability.

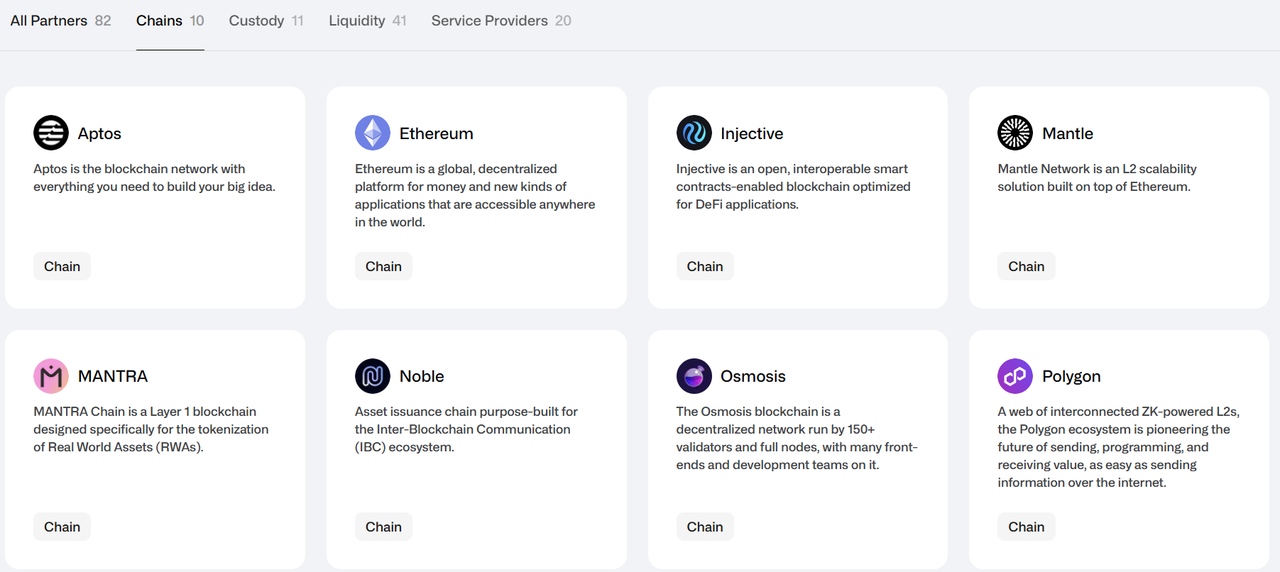

Funding and Growth

Ondo Finance has raised $34 million across three funding rounds from top-tier investors including Pantera Capital, Coinbase Ventures, Tiger Global, and Wintermute. Additionally, it has 82 partners across four areas: chain support, asset custody, liquidity provision, and service infrastructure.

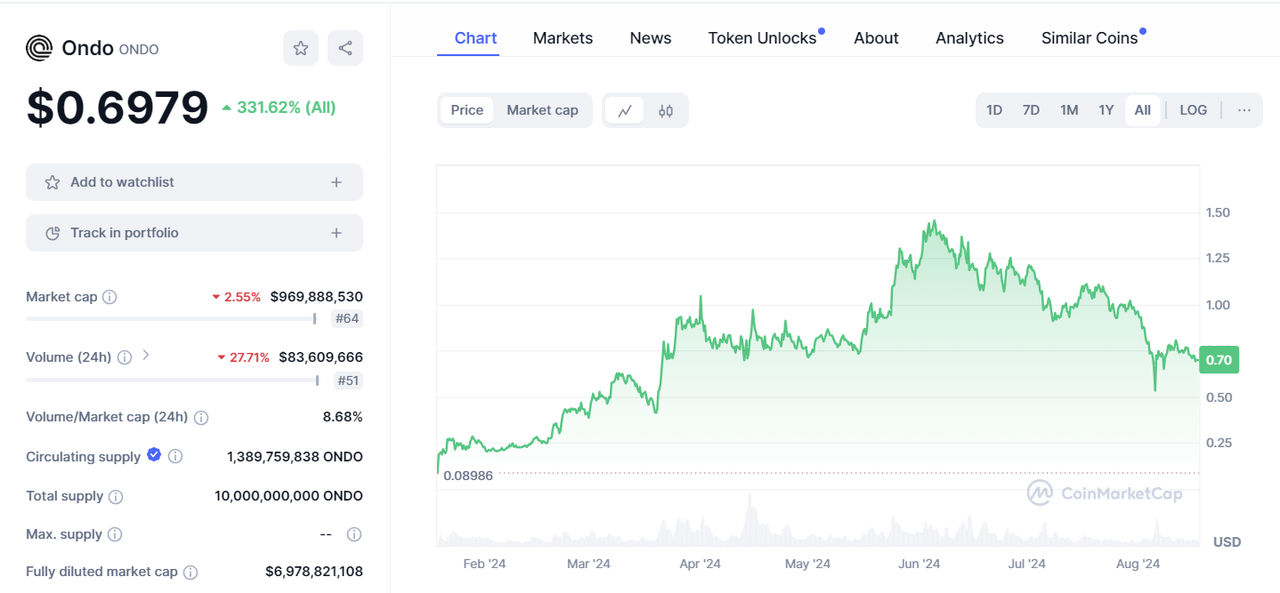

Figure 12

Ondo Finance has demonstrated strong market performance. The ONDO token currently trades at $0.6979, up 2448% from its Series A price of $0.0285, 1270% from its ICO price of $0.055, and 784% from its listing price of $0.089—reflecting strong market confidence.

Figure 13

Key metrics such as TVL have grown significantly since April, reaching $538.97 million—ranking third in the RWA sector.

Figure 14

Product Architecture

Ondo Finance’s main products are USDY and OUSG.

USDY (U.S. Dollar Yield Token) is a novel financial instrument issued by Ondo USDY LLC, combining the accessibility of stablecoins with the yield benefits of U.S. Treasuries. Structured to comply with U.S. regulations, USDY is backed by short-term U.S. Treasuries and bank demand deposits.

USDY comes in two forms: USDY (accrual type), whose price increases with accrued earnings—ideal for long-term holders and cash management; and rUSDY (rebase type), which maintains a fixed price of $1.00, with earnings distributed via token supply adjustments—suitable for settlement and exchange purposes.

OUSG (Ondo Short-Term U.S. Government Bond) is a tokenized investment vehicle offering liquid exposure to ultra-low-risk U.S. government debt. OUSG is linked to short-term U.S. Treasuries, allowing holders to earn liquidity premiums through instant minting and redemption.

-

Tokenization Structure: OUSG’s underlying assets are primarily held in BlackRock’s BUIDL (Digital Liquidity Fund), with additional allocations in BlackRock’s TFDXX fund, bank deposits, and USDC to ensure liquidity. Blockchain enables 24/7 transferability and trading of OUSG shares.

-

Minting and Redemption: Investors can instantly mint OUSG using USDC or redeem OUSG for USDC.

-

Token Variants: Similar to USDY, OUSG has two versions: OUSG (accrual) and rOUSG (rebase).

Both USDY and OUSG require KYC verification. To enable permissionless participation, Ondo collaborates with Flux Finance, a backend DeFi protocol, offering stablecoin-collateralized lending for regulated tokens like OUSG.

BlackRock BUIDL: Ethereum’s First Tokenized Fund

Concept

BlackRock BUIDL is an ETF (Exchange-Traded Fund) launched by global asset manager BlackRock in partnership with Securitize. Officially named the iShares U.S. Infrastructure ETF (ticker: BUIDL), BUIDL functions similarly to USDY—as a security where each $100 invested yields a $1 stable-value token, while generating investment returns.

Regulatory Compliance

Unlike many RWA projects, BUIDL features strong regulatory compliance. The fund operates through a special purpose vehicle (SPV) established by BlackRock in the British Virgin Islands (BVI)—a legally independent entity that isolates the fund’s assets and liabilities. BUIDL is registered under Regulation D of the U.S. Securities Act and is available exclusively to accredited investors.

Underlying Assets

BlackRock Financial manages the fund’s assets, investing in cash equivalents such as short-term U.S. Treasuries and overnight repurchase agreements to maintain each BUIDL token’s $1.00 peg. Securitize LLC handles the tokenization process, converting fund shares into on-chain tokens. Yield distribution is automated via smart contracts.

Market Response

Leveraging BlackRock’s reputation and strength, BUIDL has gained strong market recognition. Its TVL remains stable at $502.41 million, ranking fourth in the RWA TVL leaderboard.

Figure 15

Figure 16

While BUIDL lacks significant technological innovation compared to other projects, BlackRock’s longstanding credibility in the crypto space ensures its strong positioning within the RWA ecosystem.

Beyond integrating lending and securities with DeFi via Centrifuge, Ondo Finance, and BlackRock BUIDL, progress has also been made in real estate and DeFi integration—for instance, Propbase tokenizes real estate assets for circulation, while PARCL enables investment in neighborhoods or districts via tokens.

5. Summary

-

RWA represents real-world assets. The fundamental goal of this sector is to enable interoperability between real-world and on-chain assets, drawing more traditional capital into blockchain while gradually blurring the boundaries between DeFi and traditional finance.

-

The primary RWA sectors include both tangible and intangible assets, with current focus on securities, real estate, credit lending, and stablecoins.

-

Compared to other sectors, RWA faces stricter regulatory scrutiny and higher compliance requirements—giving established institutions a competitive advantage.

Although the RWA sector presents compelling narratives and promising prospects, uncertainties around compliance necessitate caution when investing in related projects, with continuous risk monitoring advised.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News