Bear Market, Learn Bear Chain: A Guide to Understanding Bera's POL Mechanism and Bullish Case

TechFlow Selected TechFlow Selected

Bear Market, Learn Bear Chain: A Guide to Understanding Bera's POL Mechanism and Bullish Case

In-depth analysis of the technical details of Berachain's Proof of Liquidity (POL) mechanism.

Author: Francesco

Translation: TechFlow

After a year of unfulfilled promises for a new bull market, cryptocurrency has found a new spirit animal: Bera.

In the highly competitive environment of crypto, one project stands out more than others.

This article introduces Berachain, going beyond the hype to deeply analyze the technical details of its Protocol-Owned Liquidity (POL) mechanism, enabling a better understanding of its ecosystem.

What is Berachain?

Berachain is a novel Layer 1 (L1) blockchain.

Contrary to the prevailing belief that L1 development has peaked, Berachain and Monad aim to revitalize and redefine the potential of L1s.

This approach sharply contrasts with current trends, where most projects either focus on building Layer 2 (L2) solutions atop Ethereum or operate as standalone app chains and Layer 3 (L3) networks.

The decision to innovate at the L1 level is closely tied to Berachain’s most significant advancement—its novel POL consensus mechanism.

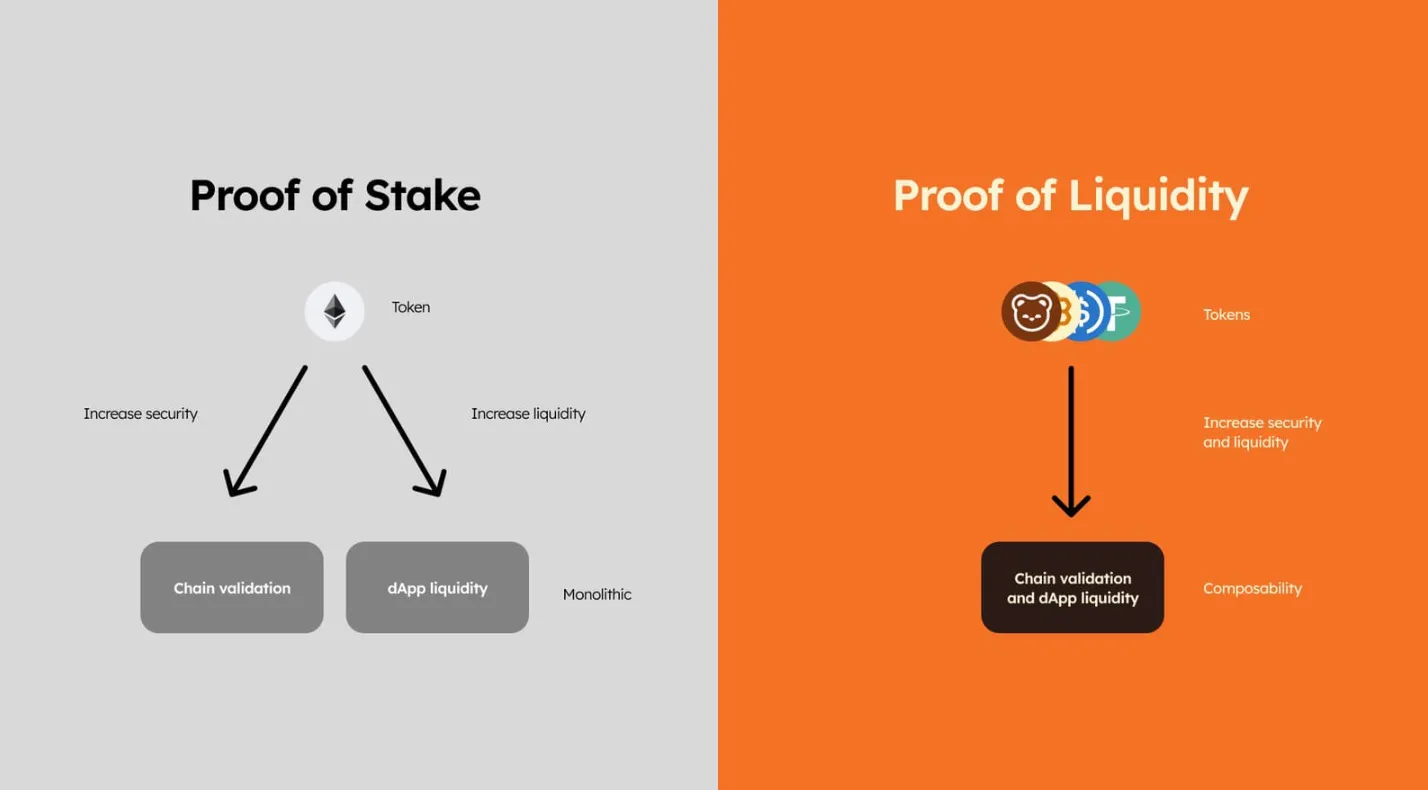

Distinguishing POL from PoL

Readers may recall the concept of Protocol-Owned Liquidity (PoL) from the Olympus DAO era, which might evoke mixed emotions.

However, the POL introduced by Berachain represents a unique and innovative concept that must be clearly differentiated:

POL = Proof of Liquidity

PoL = Protocol Owned Liquidity

The Evolution of Consensus

Since Bitcoin's inception, blockchain networks have grappled with the blockchain trilemma—the balance between security, speed, and decentralization.

Different consensus mechanisms have been developed to align incentives among participants in decentralized networks.

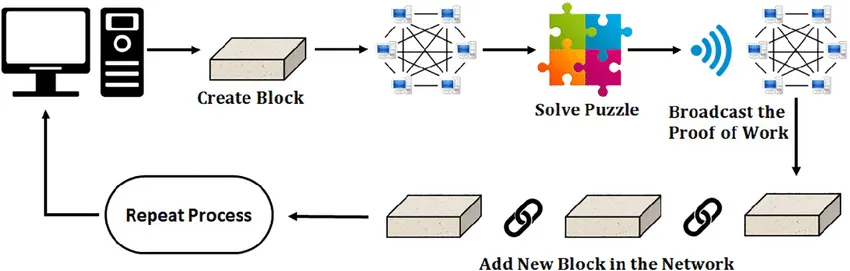

Initially, Bitcoin adopted Proof-of-Work (PoW), requiring miners to invest in hardware and pay electricity costs to solve cryptographic puzzles and mine new bitcoins.

PoW acts as a cryptographic proof where one party demonstrates to others that a specific amount of computational effort has been expended.

The PoW model was initially adopted by networks like Ethereum and became the most viable method for aligning incentives in decentralized systems.

However, as hardware costs and energy consumption associated with PoW increased, along with concerns about mining power centralization and long-term sustainability, the industry began shifting toward Proof-of-Stake (PoS) as the preferred consensus mechanism.

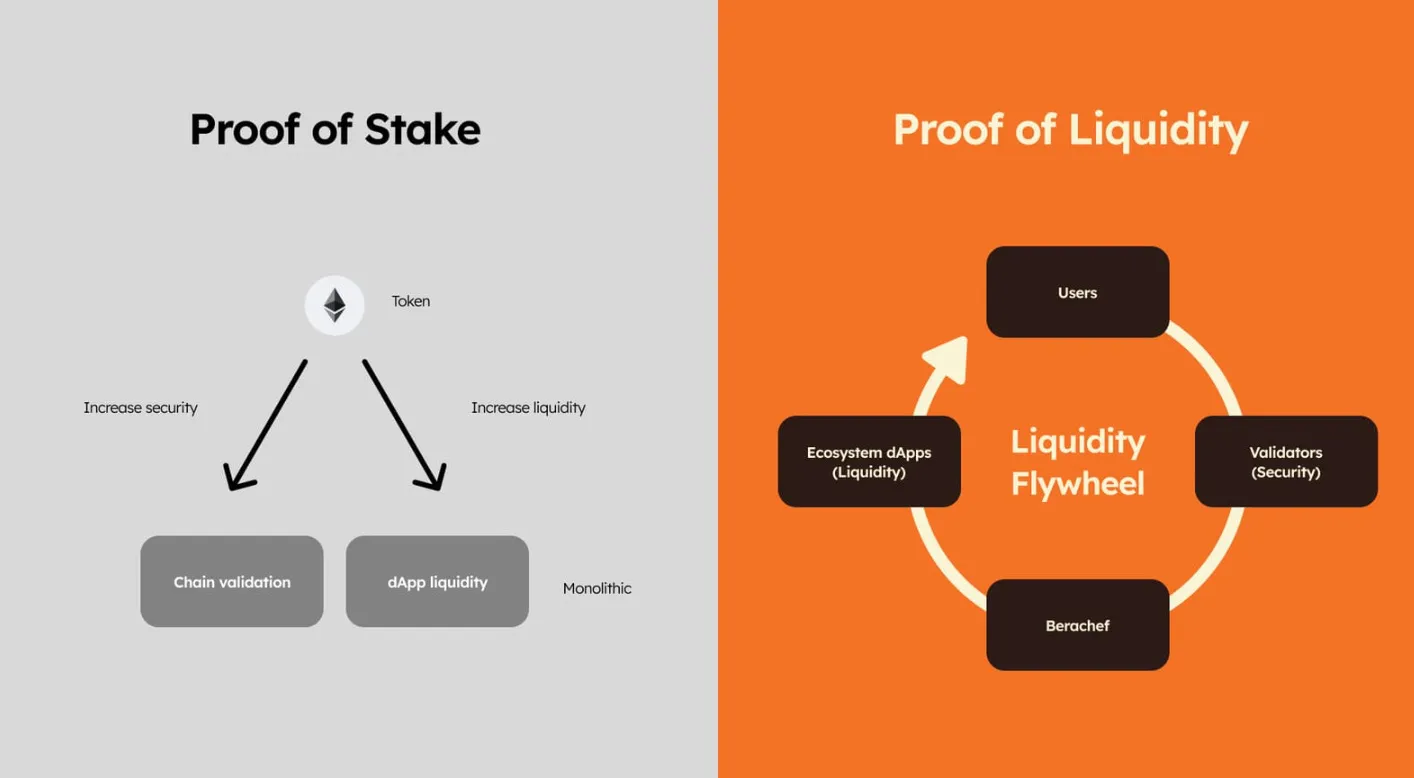

In PoW, validators must purchase physical hardware to mine Bitcoin. In contrast, PoS networks (like Ethereum) require validators to stake a certain amount of the network’s native token (e.g., 32 ETH in Ethereum) to participate in block production and transaction validation—giving them “skin in the game.”

Validator incentives are aligned with network health: malicious behavior results in part of their staked ETH being slashed.

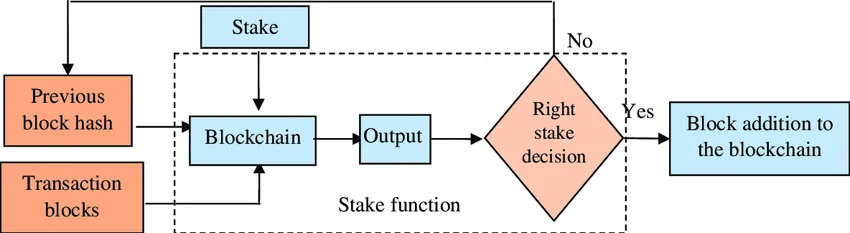

From PoS to POL

While the PoS model ensures validators have skin in the game, it fails to fully align their interests with cooperative efforts toward shared protocol goals.

At least at the consensus layer, there is a clear lack of alignment or deeper participation in the following areas:

-

Protocols ensuring network functionality

-

Validators ensuring protocols drive economic activity on the network

This lack of cooperation within consensus mechanisms also raises questions about the role of users.

This is where Berachain’s POL consensus comes into play.

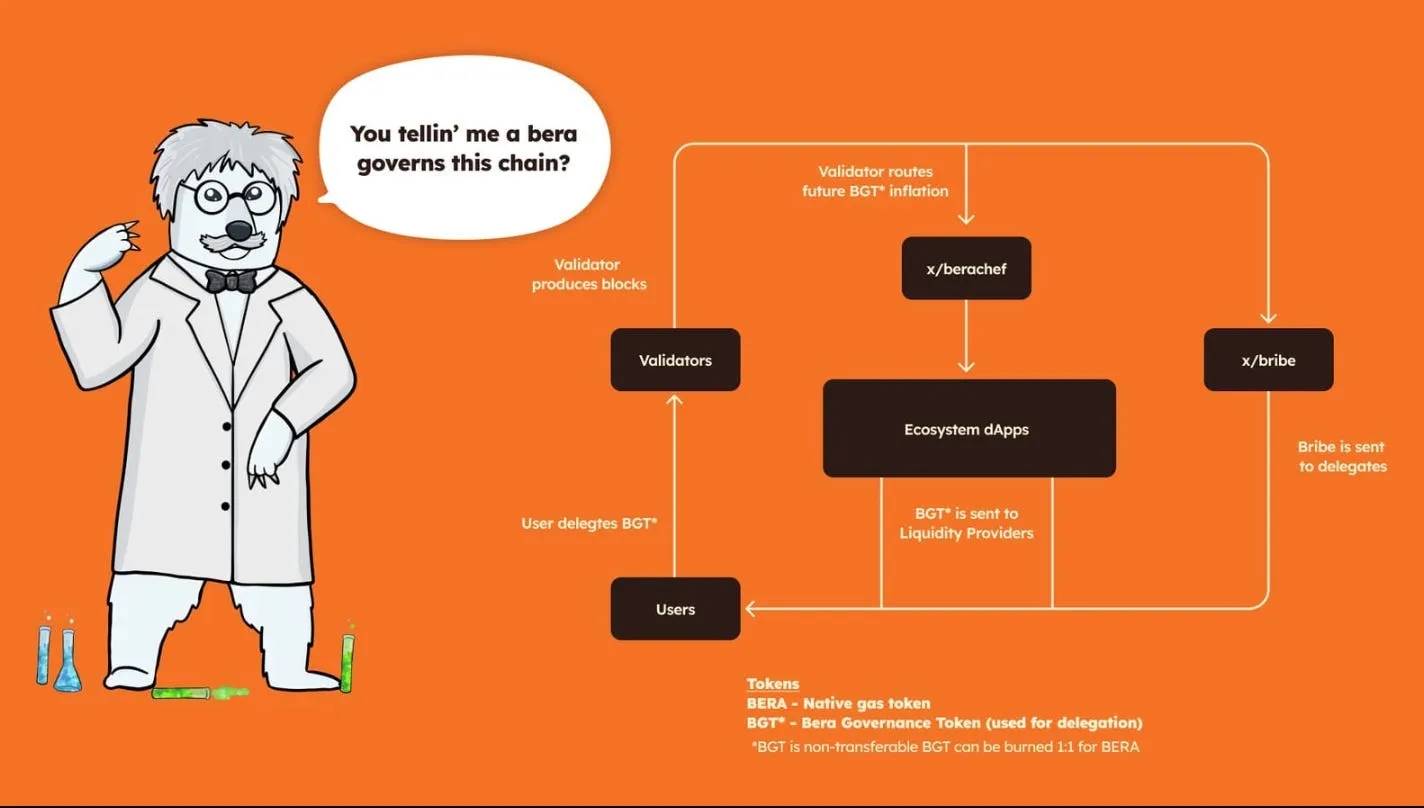

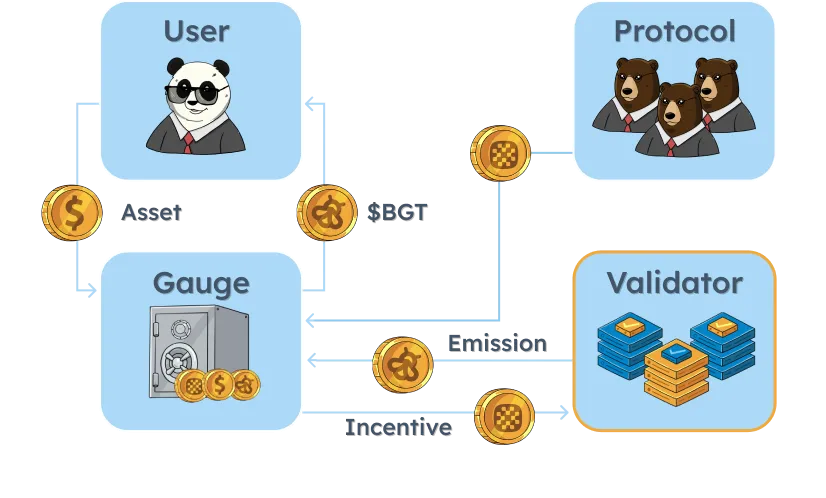

Building upon PoS, the POL consensus integrates an incentive system at the consensus layer designed to strategically align the interests of all network participants—validators, applications, and users.

In crypto, the use of incentives is well-proven; notable examples like Curve, Convex, and Redacted demonstrate the power of incentives in aligning interests and scaling products.

However, Berachain is pioneering the direct integration of bribe systems into the consensus model, ensuring collaboration among network participants is deeply embedded in the network infrastructure.

The Practical Impact of POL

Under this model, Berachain is building a network where liquidity and security scale proportionally with network growth, fostering community unity from day one.

The POL system incentivizes all participants, placing particular emphasis on active validator involvement, which is crucial to the network’s success.

To understand the incentive balance achieved through POL, we must examine Berachain’s token model:

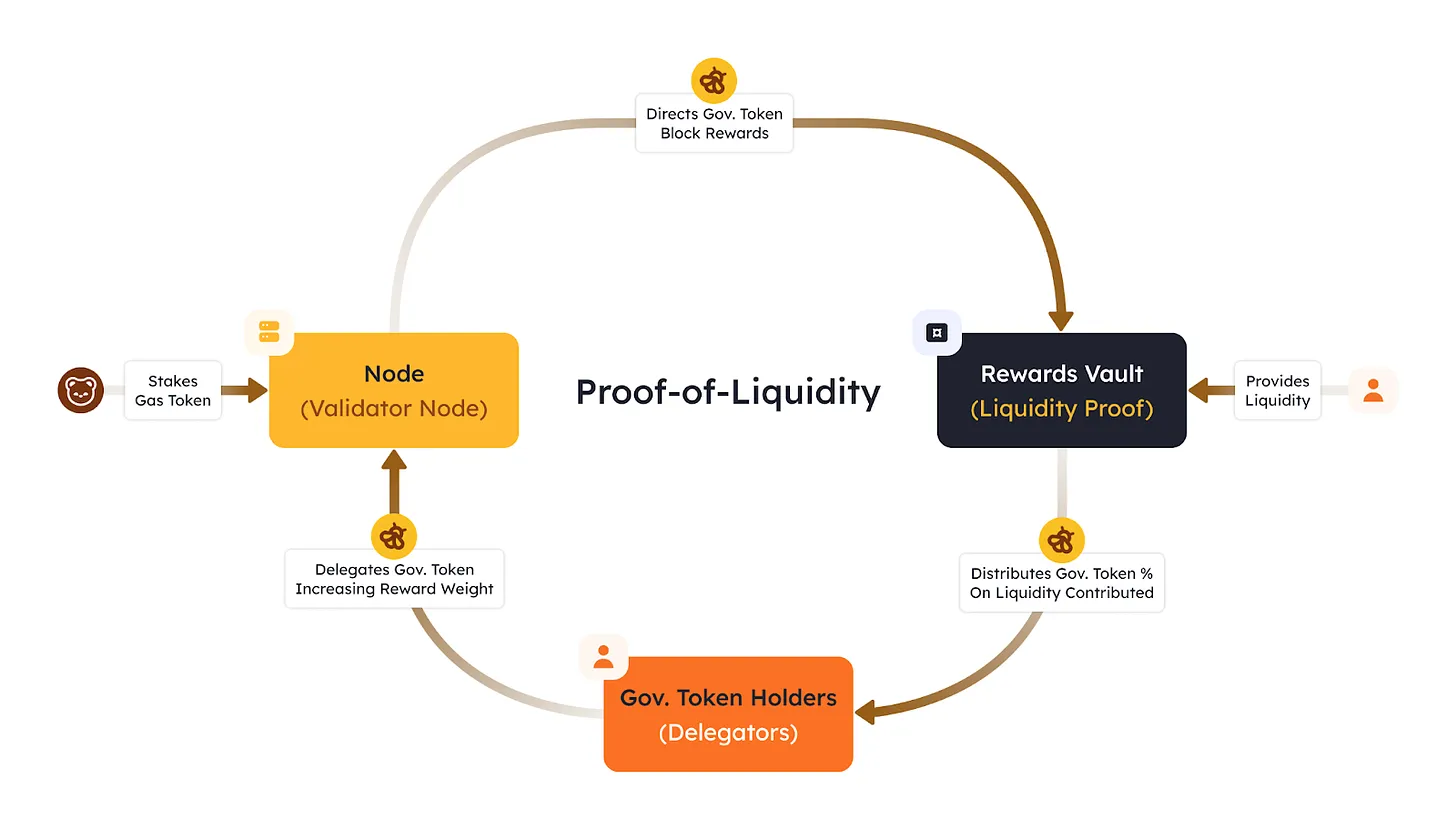

-

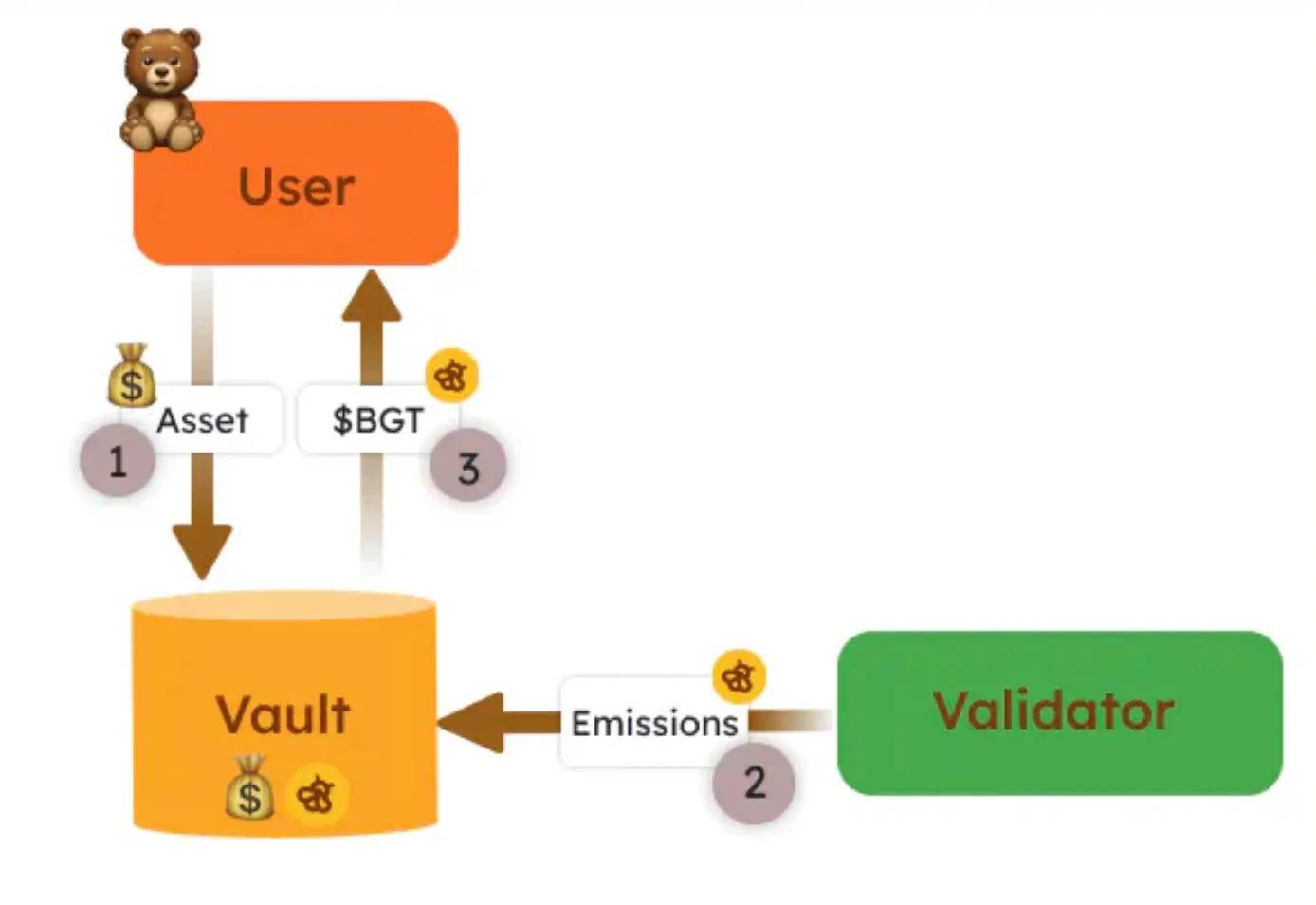

BGT: The Bera Governance Token (BGT) is central to the POL model. It is non-transferable and can only be earned through participation in POL. BGT is not merely a governance token for voting—it represents the most significant portion of POL rewards: users delegate BGT to validators; new BGT is minted as rewards only when validators propose valid blocks, which are then distributed by validators to applications based on received bribes. Users can only obtain BGT by providing liquidity to designated liquidity pools (LPs); once acquired, they may choose to use or burn it for BERA.

-

BERA: Berachain’s gas token, transferable, required to be staked by network participants to become active validators.

-

HONEY: Berachain’s native dollar-pegged overcollateralized stablecoin, minted by depositing approved collateral into vaults.

The Berachain Flywheel

Berachain’s “modular liquidity” transforms the ecosystem from a zero-sum game into a collaborative environment, generating a flywheel effect across the entire ecosystem:

-

Validators directly engage with users to maximize BGT delegated to them. The more BGT users delegate, the higher their rewards. Validators earn fees from these rewards.

-

Applications cooperate to attract larger BGT rewards to their liquidity pools, encouraging users to provide liquidity rather than compete.

-

Users have multiple options after depositing funds into liquidity pools, with choices evolving over time. Their rewards depend on their share of total assets staked in the pool and the amount of BGT allocated by validators to that gauge.

Ultimately, validators decide how BGT rewards are distributed across pools and protocols, and their strategies may vary.

Protocols can also attract more BGT rewards by incentivizing validators with native token rewards—i.e., bribes. Let’s consider a practical example:

-

Validators direct their BGT toward a protocol’s liquidity pool.

-

Suppose you are FrancescoProject and you have FRAcoin. You want to build strong liquidity for the FRAcoin/Bera pair.

-

To achieve this, you decide to bribe validators with X amount of FRAcoin, prompting them to allocate their BGT to the FRAcoin/Bera liquidity pool.

-

Users seeking BGT rewards will then add liquidity to that pool.

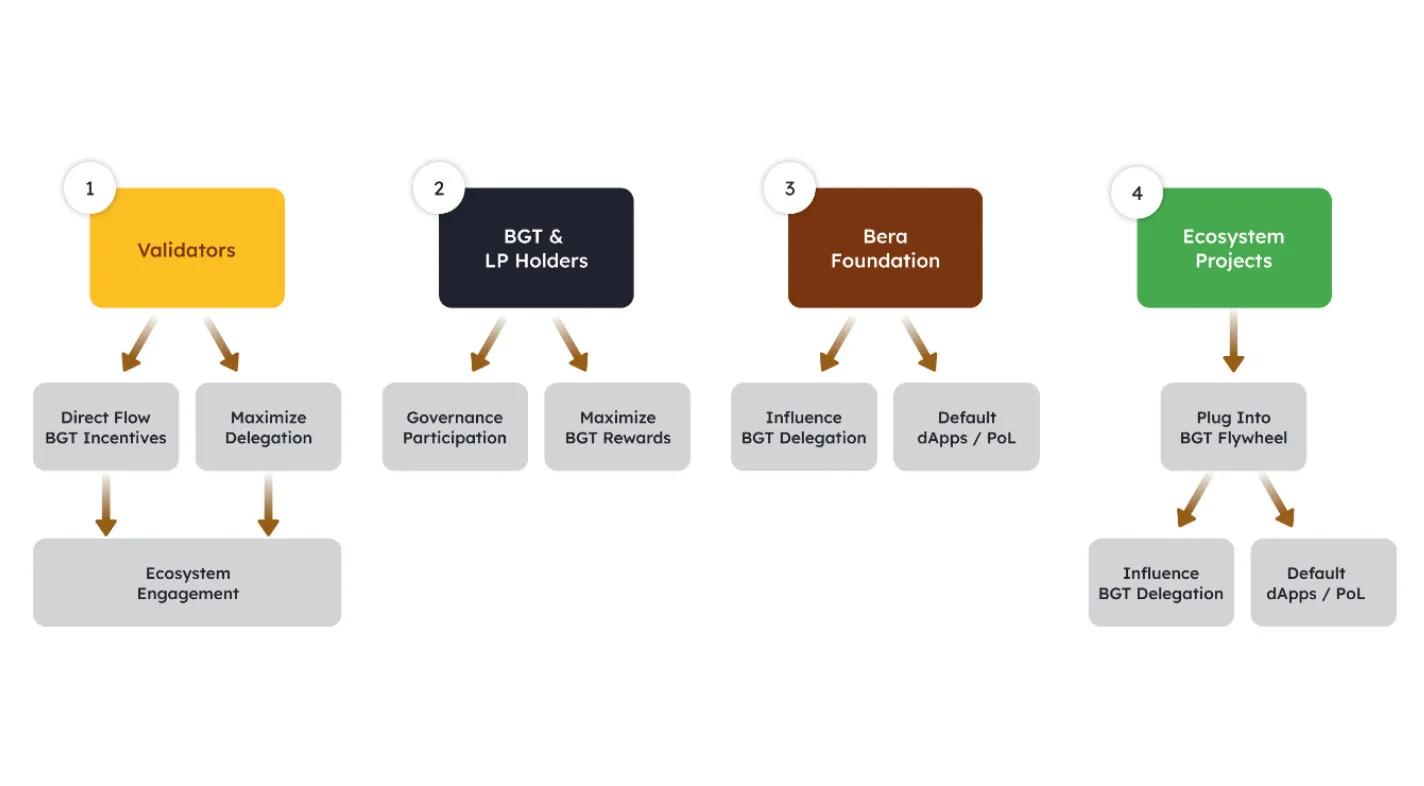

This model requires tight coordination among validators, applications, and users to incentivize all parties. Below is how each participant engages with the flywheel.

1. Validators: Validators distribute BGT rewards based on their reward weight, proportional to the amount of BGT delegated to them. Validator rewards also include bribes from ecosystem applications plus value captured from block production (e.g., BERA from gas, HONEY from transaction fees, etc.).

In addition to securing the network, validators must also:

-

Maximize BGT delegation to themselves

-

Directly incentivize BGT allocation

2. Users: Users vote with their wallets: they deposit liquidity into whitelisted pools and receive LP tokens. They can stake these tokens in specific gauges to earn BGT, which they then delegate to validators.

3. Ecosystem Projects: Anyone can leverage Berachain’s native emissions as a revenue source. Applications can send bribes to delegators, creating a positive feedback loop that incentivizes liquidity for specific gauges and allocates more rewards to those applications (e.g., users observe this and choose to deposit more liquidity into the gauge, earning BGT and increased relative rewards compared to other gauges).

Within this POL framework, the validator’s role becomes increasingly pivotal.

They can form direct partnerships with applications on Berachain, leveraging bribes to diversify income streams. For instance, validators might collaborate with protocols to enhance user incentives, thereby increasing LP participation.

Therefore, delegating BGT to validators requires careful consideration: due to their interconnectedness with applications and users, they play a critical role in the ecosystem.

While the PoS model ensures validators have skin in the game, POL extends this alignment, coordinating the interests of all network participants at the consensus layer.

Whereas protocols like Curve use incentives to direct emissions to a single pool, the Berachain ecosystem operates collectively to determine optimal value flow, enabling a more comprehensive ecosystem flywheel.

Addressing Challenges Faced by Traditional Liquidity Providers

The POL consensus addresses traditional challenges faced by Liquidity Providers (LPs) by offering multiple reward sources:

-

BGT allocations from validators

-

LP rewards

-

Additional rewards and incentives from bribes

Beyond earning these rewards, LPs also gain greater governance participation through BGT, further enhancing their role in the network.

POL also enables Protocol-Owned Liquidity (PoL) by allowing Berachain applications to utilize the chain’s native emissions as a revenue source instead of paying rent to LPs for liquidity.

This approach streamlines application deployment to bootstrap liquidity and deposits, attracting liquidity by aligning with validators and offering higher bribes.

In turn, this can foster the development of consumer-facing applications beyond decentralized finance (DeFi). These applications will rely less on short-term capital and can leverage the ecosystem’s liquidity to launch operations.

Berachain’s POL model assumes that as long as sufficient incentives exist to delegate BGT and participate in the network, liquidity will follow.

Broad Implications and Future Considerations

Great technology can only take you so far.

While technological innovation is crucial, Berachain distinguishes itself by focusing on positive feedback loops within its ecosystem to ensure sustained growth and collaboration.

In crypto, the scarcest resource is users.

As many compete for the same user base, POL consensus ensures Berachain users enjoy superior rewards and ecosystem engagement from day one. Many new L2s launch with predatory strategies, forcing users to lock liquidity for months without rewards or decision-making power.

Berachain rewrites this script, transforming users from mere liquidity providers into active and essential participants who can influence how liquidity and value flow within the ecosystem.

While previous incentive programs and closed-loop systems benefited only participants, POL is the first “scalable incentive system at the protocol level,” designed to ensure long-term network success and sustainability.

This aligns with the Fat Bera thesis—that “applications built with PoL at the forefront will capture most of the value within the Berachain ecosystem.”

Currently, the model heavily relies on the relationship between Berachain validators and BGT delegators. Will this relationship persist once the network launches?

Many also emphasize the critical role of validators in the ecosystem. Could they eventually become too powerful?

Validators’ dependence on block production could also become a single point of failure: what if demand for block creation declines?

Finally, decentralization remains a key concern.

While Berachain claims “Proof of Liquidity is for the people,” most validators and liquidity pools require whitelisting—does the system work as intended, or is it another way to concentrate power in the hands of a few?

Much of the model’s theoretical assumptions must be validated in practice.

The success of the POL model will depend on its real-world implementation and ongoing efforts to ensure decentralization and sustainability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News