Regulation and Trust: The Shadow Over WBTC

TechFlow Selected TechFlow Selected

Regulation and Trust: The Shadow Over WBTC

In the world of crypto and DeFi, custody is crucial.

Author: Chaos Labs

Translation: TechFlow

It has been a week since BitGo announced it would transfer WBTC governance to a new joint venture with BiT Global within 60 days. Since then, a lot has happened:

→ BitGo unveiled its initial WBTC custody proposal and issued clarifications after widespread industry concerns.

→ MakerDAO decided to halt new lending against WBTC.

→ Coinbase announced cbBTC, a competing WBTC alternative.

Let’s dive into what’s happening, why it matters, and the potential risks involved.

First, some background: WBTC is a critical bridge between Bitcoin and the DeFi ecosystem.

Since 2019, BitGo has served as the primary custodian and token issuer for WBTC.

Supply: 154.4K BTC

Value: $9.2 billion

WBTC is widely used as collateral across major DeFi protocols.

WBTC accounts for approximately 15% of total Aave capital

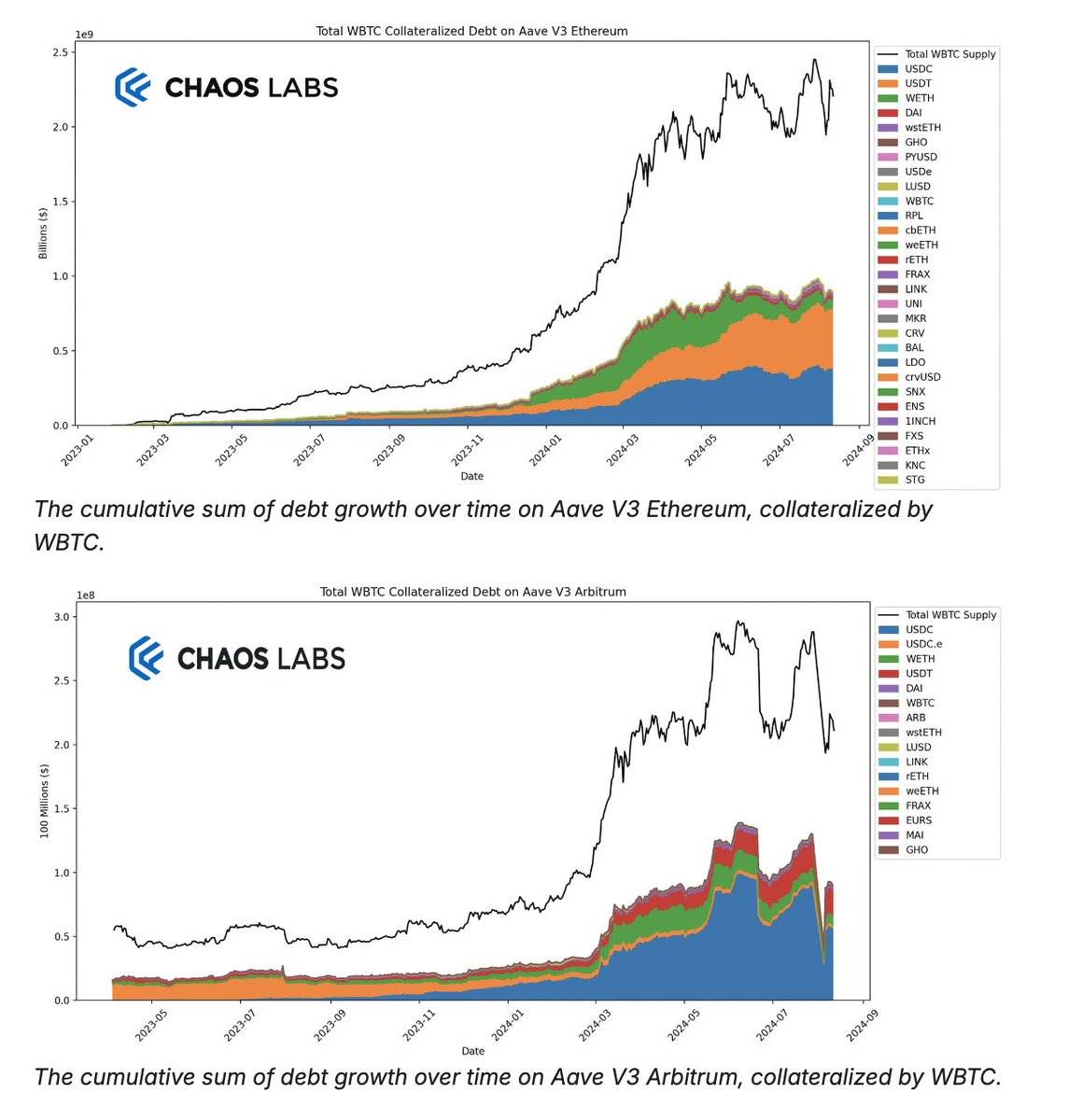

Aave V3 (Ethereum):

Supply: $2.2B, Borrowing: $900M – Aave V3 (Arbitrum):

Supply: $213M, Borrowing: $90M

→ Any changes to WBTC could significantly impact the stability of DeFi.

Catalyst: BitGo announced plans to transfer legal custody of WBTC to a joint venture with BiT Global, partnered with JustinSunTron and the TronDAO ecosystem.

This announcement immediately raised red flags across the crypto community. Why?

Let’s break down the original proposal and the concerns it sparked.

BitGo's Original Custody Proposal (August 9, 2024):

-

3 jurisdictions: United States, Hong Kong, Singapore

-

2 institutions: BitGo Inc. and BiT Global

-

2-of-3 cold storage multi-sig

-

BitGo Inc.: 1 key, BiT Global: 2 keys

BitGo moves WBTC to multi-jurisdictional custody to accelerate global expansion plans

What were the main concerns?

BiT Global, associated with the TronDAO ecosystem, would control two keys in the multi-sig setup. This introduced several risks.

Risk #1: Centralization

Allowing one entity (BiT Global) to hold two keys effectively centralizes control over WBTC.

This contradicts the decentralized principles underpinning DeFi.

Risk #2: Regulatory Uncertainty

Justin Sun’s standing in the crypto world and potential regulatory issues could put WBTC at risk.

If BiT Global faces regulatory action, the entire WBTC ecosystem could be jeopardized.

Risk #3: Trust Erosion

The crypto community’s trust in WBTC is crucial for its continued use in DeFi.

Association with controversial figures may erode this trust, potentially triggering a mass exodus from WBTC.

These concerns aren’t just theoretical. We’ve already seen real-world impacts:

Chaos Labs has proposed modest risk-reduction measures while we gather more information.

-

Additional recommendations will soon follow for partner protocols including Jupiter, GMX, Radiant, Venus, Seamless, Zerolend, and others.

Note: The second-order effects of delisting an asset with such wide distribution are non-trivial, so we’re taking a measured approach: measure twice, cut once.

MakerDAO voted to stop new lending against WBTC.

Over $30 million worth of WBTC was burned within a week.

Increased interest in competing products like tBTC and Coinbase’s new offering, cbBTC.

In response to strong community backlash, BitGo revised its proposal (August 14, 2024).

Let’s examine the details of the new model.

BitGo's Revised Custody Model (August 14, 2024):

-

Still 3 jurisdictions: United States, Hong Kong, Singapore

-

Now 3 institutions: (1) BitGo Inc., (2) BiT Global, (3) BitGo Singapore Ltd.

-

2-of-3 cold storage multi-sig

-

Each institution holds one key at separate locations.

Key Improvement: Introduction of BitGo Singapore Ltd. as a third keyholder.

This eliminates any single entity holding multiple keys, addressing immediate centralization concerns.

But does this solve all problems? Not entirely.

Several unresolved questions and potential risks remain.

Unresolved Issue #1: Role of BiT Global

Although they no longer hold two keys, BiT Global still plays a significant role in WBTC custody.

What assurances do we have about their operations and intentions?

Unresolved Issue #2: Regulatory Compliance

What is the regulatory compliance status of each entity—particularly BiT Global and BitGo Singapore?

Are they subject to rigorous oversight in their respective jurisdictions?

Unresolved Issue #3: Audits and Transparency

How will the community and DeFi projects audit this new setup?

What mechanisms ensure ongoing transparency of the custody arrangements?

Unresolved Issue #4: Contingency Procedures

In case of a security breach or regulatory action against one of the keyholders, what procedures exist to safeguard the wrapped BTC?

The WBTC situation highlights a key aspect of DeFi: the delicate balance between centralized custody and decentralized finance.

It reminds us that even in DeFi, we often rely on centralized entities as points of trust.

The BitGo proposal has broader implications for the DeFi ecosystem:

→ Could accelerate development of more decentralized BTC wrapping solutions.

→ May lead to stricter community scrutiny of custody arrangements for all wrapped assets.

→ Might prompt DeFi protocols to diversify their BTC-based collateral options.

Looking ahead, the crypto community will be closely watching:

-

How will BitGo implement and demonstrate the effectiveness of this new custody model?

-

Will confidence in WBTC fully recover, or will we see a shift toward alternative solutions?

-

How will major DeFi protocols adjust their risk models in response to this event?

In conclusion, while BitGo’s responsiveness to community feedback deserves recognition, the WBTC episode serves as a stark reminder: in crypto and DeFi, custody matters.

The security, transparency, and decentralization of asset custody can make or break an entire ecosystem.

As users, developers, and investors in the DeFi space, it is our responsibility to remain vigilant, ask tough questions, and hold projects accountable. The future of finance is being built on these foundations.

What are your thoughts on the WBTC situation? How do you think this will shape the future of BTC in DeFi?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News