How does DeFi drive the development of Ethereum?

TechFlow Selected TechFlow Selected

How does DeFi drive the development of Ethereum?

DeFi has not only pushed Ethereum to its limits but also accelerated the pace of innovation and experimentation.

Author: Coin Metrics team

Translation & Proofreading: Minmin & Ajian

Over the past few months, dozens of projects have launched and massive amounts of capital have poured in, pushing the DeFi sector to new heights.

The vast majority of DeFi applications are built on Ethereum, and the explosive growth of DeFi has significantly impacted the entire Ethereum network.

DeFi has not only pushed Ethereum to its limits but also accelerated the pace of innovation and experimentation.

In this article, we examine how four DeFi token projects have influenced Ethereum and driven its evolution.

The Rise of Decentralized Exchanges

The rise of DeFi has sparked a new wave of tokens, including some breakthroughs.

ETH's summer bull run coincided with yearn.finance launching its governance token, YFI.

However, this period also saw tragedies such as the YAM token skyrocketing before collapsing to zero. The chart below shows ETH’s price movements following the launch of four major DeFi token projects to date: YFI, YAM, SUSHI, and UNI.

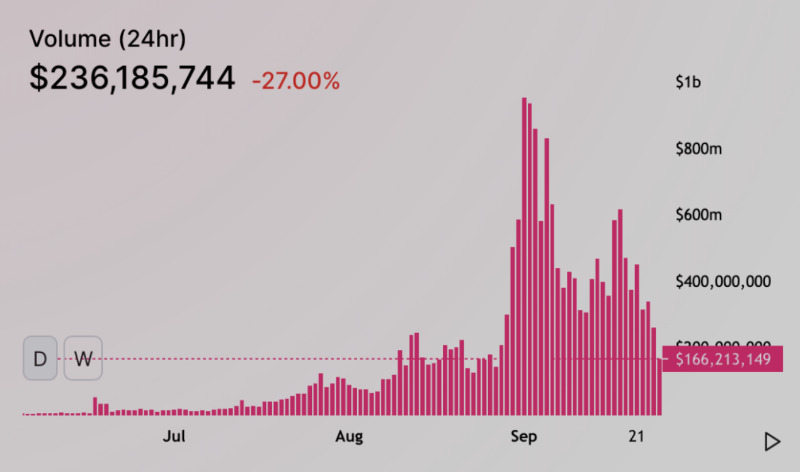

Uniswap, the largest decentralized exchange on Ethereum, has become an engine for DeFi token trading.

From early June to early September, Uniswap’s daily trading volume surged from $1 million to $1 billion.

Unlike centralized exchanges like Coinbase and Binance, all trades on Uniswap occur entirely on-chain.

This means every trade on Uniswap must be sent to and settled on the Ethereum blockchain. On-chain trading has rapidly become one of the largest use cases on Ethereum.

With the rise of Uniswap and other applications, the number of smart contract calls on Ethereum reached record highs this summer.

Tokens circulating within the ecosystem are increasingly governed by code, elevating automation efficiency and opportunities to new levels.

However, this also brings greater complexity, as DeFi smart contracts can interact with each other and automatically transfer tokens across multiple platforms.

Another indicator of the rise of decentralized exchanges is the growing supply of WETH (Wrapped ETH).

At its core, WETH is a method of wrapping ETH into an ERC-20 token.

DeFi tokens are built on a standard (ERC-20) that makes token trading easier.

However, the ERC-20 token standard was introduced after ether was issued, meaning ether itself does not comply with these standards.

To create WETH, users must first lock their ether in a smart contract to receive WETH tokens.

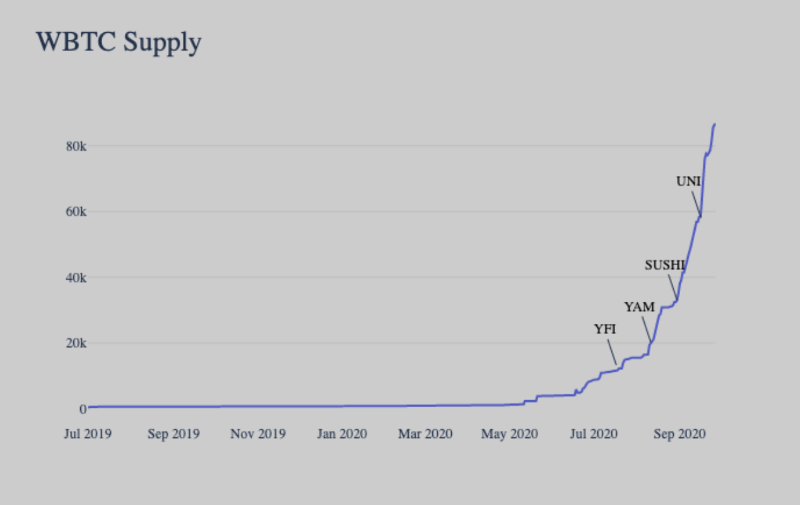

As DeFi grows, so too does the supply of WBTC (Wrapped BTC).

WBTC is similar to WETH, except that it locks bitcoin instead of ether.

WBTC can be used in DeFi applications such as Uniswap and Curve Finance.

As WBTC expands, hundreds of millions of dollars worth of bitcoin have moved into the Ethereum ecosystem—at least for now.

Whales Appear

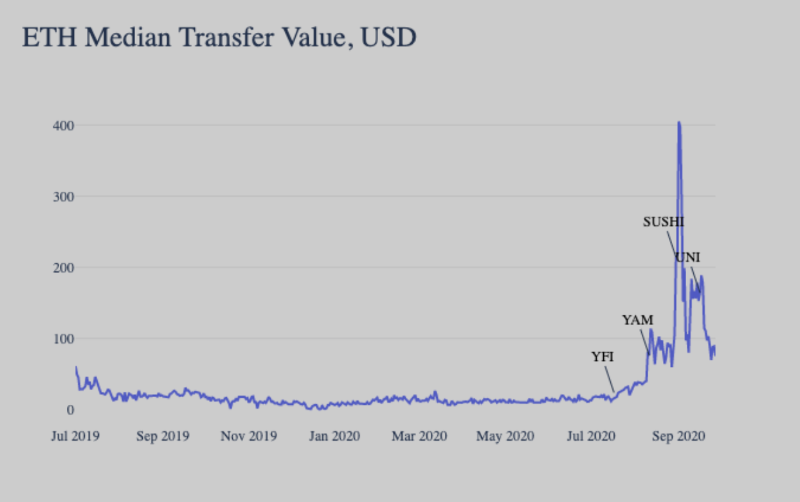

With high gas prices becoming the new normal, Ethereum transaction fees have undergone dramatic changes.

As the YFI, YAM, SUSHI, and UNI tokens launched, median Ethereum transaction fees spiked sharply.

Whenever a new token launches, people rush to acquire them and trade on exchanges like Uniswap.

Since Uniswap trades happen on-chain, each transaction requires a fee.

The higher the fee users pay (i.e., the higher the gas price), the more likely miners are to prioritize packaging that transaction, resulting in faster confirmation times. To complete transactions quickly, users engage in bidding wars over transaction fees.

When SUSHI launched, median Ethereum transaction fees hit a record high of $8.25 on September 2.

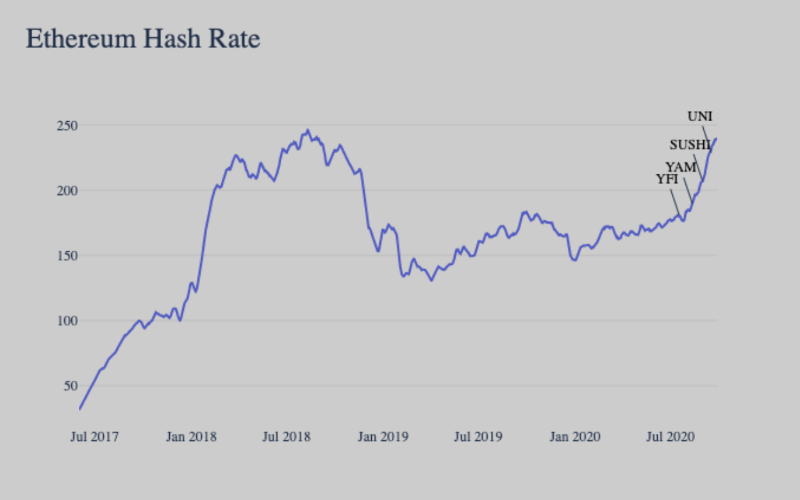

Blockchain transaction fees are a double-edged sword. These fees ultimately go to miners, so higher fees provide stronger incentives for more people to secure the Ethereum blockchain. Due to rising fees, Ethereum miner revenues hit record highs during the summer, driving Ethereum’s hash rate to new peaks as well. This is a positive sign for Ethereum, as network security is critical to the long-term health and success of blockchains.

However, high fees can also deter some users. Transaction fees are disproportionate to the value transferred—both a $100 and a $100,000 transaction may incur the same fee. Thus, high transaction fees favor whales and users making large transactions, making it difficult for small investors to profit.

Since the rise of DeFi, the median transaction value on Ethereum has increased to hundreds of dollars, indicating a shift toward larger participants on the Ethereum network.

Layer 2 Scaling Solutions

But Ethereum’s fee market will soon return to fairness. The rapid rise of DeFi is also sparking a new wave of innovation. Starting in the summer, the entire Ethereum ecosystem has been working hard to address scalability issues that lead to high transaction fees.

Last Friday marked a significant milestone in Ethereum’s pursuit of scalability: the launch of the Optimistic Ethereum testnet (Chinese translation). Optimistic Ethereum is a Layer 2 project aiming to enable near-instant Ethereum transactions at lower costs. Compatible with existing Ethereum infrastructure and smart contracts, it is easier to adopt compared to many other scaling solutions. Popular DeFi application Synthetix is incentivizing testnet users and plans to migrate to Optimistic Ethereum. Uniswap and Chainlink have also signed on as early adopters.

As new decentralized applications and tokens continue to emerge, DeFi will undoubtedly keep pushing Ethereum to its limits. However, Ethereum itself is evolving, and Layer 2 scalability will open new doors for the future of both DeFi and Ethereum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News