Behind the WBTC FUD, how can $1.2 trillion in Bitcoin liquidity be safely unlocked?

TechFlow Selected TechFlow Selected

Behind the WBTC FUD, how can $1.2 trillion in Bitcoin liquidity be safely unlocked?

Who Can Bring BTC into DeFi and Unlock Trillions in Liquidity?

By: Terry

Have you heard of WBTC?

Veterans who lived through DeFi Summer will surely be familiar with it. As one of the earliest stablecoins launched in 2018, WBTC played a leading role in bringing Bitcoin liquidity into the DeFi and Ethereum ecosystems in 2022.

However, WBTC has recently been caught in a wave of trust crisis——on August 9, BitGo announced a joint venture with Hong Kong-based firm BiT Global, planning to migrate WBTC's BTC management address to a multi-sig controlled by this new entity, whose actual controller is Justin Sun.

This move has triggered widespread market debate over the future security of WBTC’s control, although Justin Sun responded that there has been no change compared to before, with audits being conducted in real-time and full management still carried out by custodians Bit Global and BitGo under the same procedures as previously.

Nevertheless, within just six days following this news, Crypto.com and Galaxy alone redeemed over $27 million worth of Bitcoin, indicating lingering market skepticism. This article will examine WBTC’s operational mechanism and take a closer look at the current state of decentralized Bitcoin-backed stablecoins.

The Mechanism Behind the WBTC Controversy

We can first briefly review how WBTC maintains its peg, which reveals the core issue behind the current crisis.

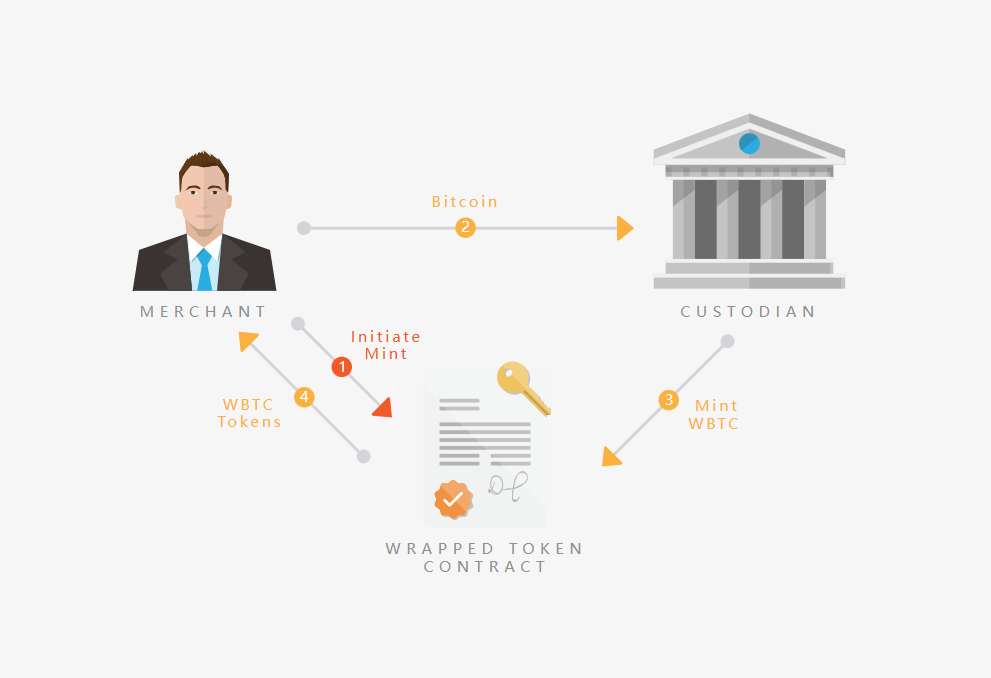

As an ERC20 token on Ethereum backed 1:1 by Bitcoin, WBTC operates via a consortium model, somewhat akin to traditional banking’s two-tier system, where “merchants” (authorized, multiple parties) act as intermediaries between the custodian (previously only BitGo) and end users.

The custodian receives and holds deposited Bitcoin, then mints an equivalent amount of WBTC tokens upon receipt, releasing them to designated Ethereum addresses; the burning process works in reverse.

Merchants serve a retail function, directly serving users by conducting required KYC/AML checks, verifying identities, and ultimately enabling users to acquire or redeem WBTC. In doing so, they act as a bridge, greatly facilitating WBTC’s circulation and trading in the market.

Source: WBTC Official Website

This means the custodian fundamentally determines WBTC’s credibility regarding minting, burning, and custody——a fully centralized point of failure. Users must fully trust that the custodian won’t falsify records or deviate from protocol when issuing or destroying WBTC.

For example, if the custodian receives 100 BTC but issues 120 WBTC, or re-pledges the 100 BTC held in custody, it would undermine the entire system’s balance and trust foundation.

Potential over-issuance could decouple WBTC’s value from its underlying Bitcoin collateral, triggering market chaos, investor panic, and potentially collapsing the entire stablecoin mechanism.

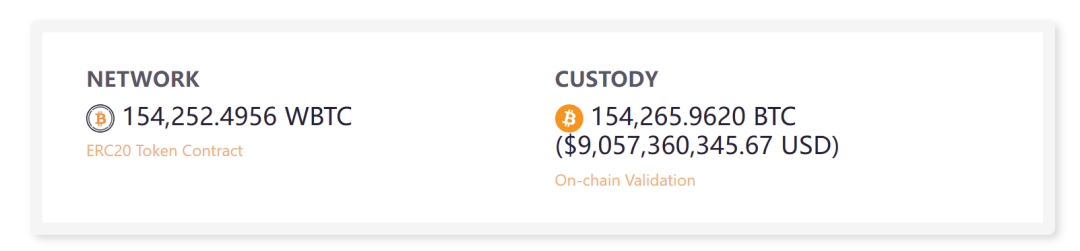

Until now, BitGo was the sole custodian for WBTC. As a well-established crypto custodian, BitGo had, to some extent, passed the test of time and market cycles, providing relatively stable support for WBTC’s growth. Data-wise, over 154,200 WBTC are currently in circulation, worth more than $9 billion, reflecting substantial market confidence in BitGo.

Source: WBTC Official Website

Ultimately, the concern stems from transferring WBTC’s reserve asset multi-sig authority from BitGo to a joint venture controlled by Justin Sun.

This highlights inherent centralization risks in WBTC’s design, prompting calls for decentralized alternatives to reduce reliance on centralized custodians. The goal is to leverage blockchain technology to minimize single points of failure and human manipulation, thereby enhancing the safety and reliability of Bitcoin-backed stablecoin systems.

The Rise and Fall of Decentralized BTC Projects

Since the previous bull cycle, various decentralized Bitcoin-backed stablecoin proposals have emerged as key innovation areas. Solutions like renBTC and sBTC surged in popularity, serving as major conduits for Bitcoin entering DeFi ecosystems and channeling large volumes of BTC capital into Ethereum, unlocking diversified yield opportunities for BTC holders.

Yet, through successive market cycles, most once-prominent projects have since collapsed.

First, renBTC, previously the most prominent decentralized alternative to WBTC, represented a decentralized approach to Bitcoin-backed tokens. Its issuance process was relatively decentralized: users deposited native BTC into the RenBridge gateway, and RenVM used smart contracts to mint corresponding renBTC on Ethereum.

The project also had close ties with Alameda Research (which effectively acquired the Ren team), a fact that initially boosted its profile. But fortune and risk went hand-in-hand; after the FTX collapse, Ren unsurprisingly suffered severe setbacks, including broken operations and massive fund outflows.

Despite subsequent recovery attempts, the latest public update remains the Ren Foundation announcement from September 2023. At this point, the project is practically brain-dead.

Next, sBTC launched by Synthetix was a synthetic Bitcoin asset generated through SNX staking, and once among the main decentralized BTC-pegged tokens. However, in early 2024, Synthetix completely phased out non-USD spot synthetics on Ethereum, including sETH and sBTC, preventing broader adoption across DeFi.

The most interesting live project today is Threshold Network’s tBTC. Yes, it shares lineage with the original tBTC from Keep Network——Threshold Network itself formed from the merger of Keep Network and NuCypher.

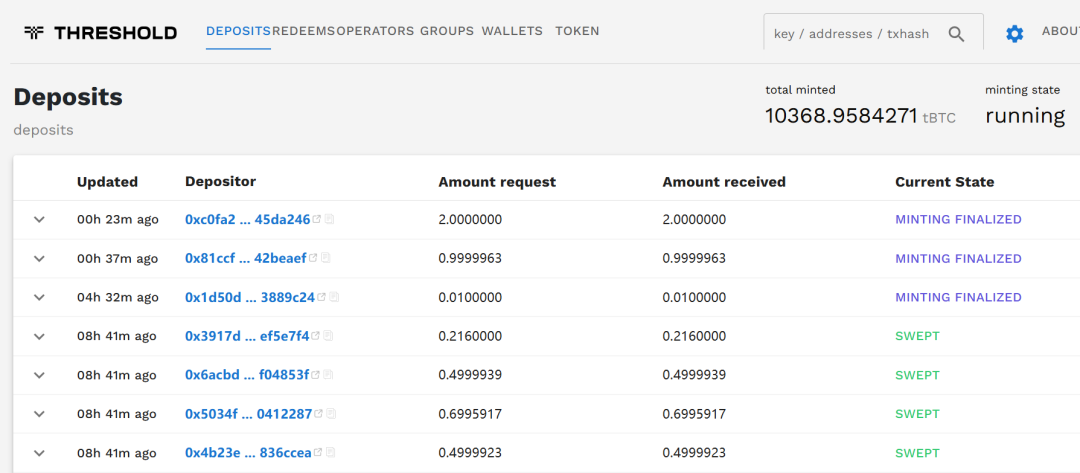

tBTC replaces centralized intermediaries with a randomly selected group of node operators on the network. These operators jointly secure user-deposited Bitcoin using Threshold cryptography, meaning user funds are controlled by majority consensus among operators.

At the time of writing, tBTC’s total supply exceeds 10,000 BTC, valued at nearly $600 million, up sharply from fewer than 1,500 BTC just six months ago——a remarkably rapid growth.

Source: Threshold Network

In summary, competition among these solutions revolves around asset security. This recent WBTC incident has exposed growing market demand for truly decentralized stablecoins. Going forward, whether tBTC or other similar projects, they must continue refining their decentralized designs while ensuring asset security to meet evolving market and user needs.

A New Solution for Bitcoin L2?

In fact, current WBTC and tBTC, along with past projects like renBTC and sBTC, share one common trait: they are all ERC20 tokens.

The reason is both simple and unavoidable: only by bridging into the Ethereum ecosystem and leveraging its rich DeFi landscape can Bitcoin’s liquidity be effectively unlocked. In a sense, Bitcoin’s $1.16 trillion market cap (as of CoinGecko data on August 15, 2024) makes it the largest “dormant capital pool” in crypto.

Hence, starting from DeFi Summer in 2020, WBTC and renBTC became primary vehicles for unlocking Bitcoin liquidity: users deposit BTC, receive wrapped Tokens, and bridge them into Ethereum’s ecosystem to participate in DeFi and other on-chain applications.

This Ethereum-dependent paradigm remained unchallenged until 2023, when the Ordinals boom ignited a resurgence in Bitcoin-native innovation, offering new possibilities through Bitcoin Layer 2s. These allow users to directly engage in smart contract applications such as staking, DeFi, social apps, and even complex financial derivatives on Bitcoin-based L2s, significantly expanding Bitcoin’s utility and value scope.

Take Stacks’ sBTC (same name as Synthetix’s version) as an example. As a decentralized 1:1 Bitcoin-backed asset, sBTC enables BTC deployment and movement between Bitcoin and the Stacks L2, and can be used directly as gas for transactions without requiring additional cryptocurrencies.

Theoretically, sBTC offers higher security than traditional wrapped tokens on Ethereum, as its security is partially guaranteed by Bitcoin’s hashing power——reversing transactions would require attacking Bitcoin itself.

In this light, sBTC on Bitcoin L2s like Stacks aims to replace the traditional “wrapped Token + Ethereum” model, introducing smart contracts into the Bitcoin ecosystem and bringing Bitcoin into DeFi in a decentralized manner.

Going forward, as Bitcoin L2s continue evolving and innovating, new approaches like sBTC may gradually erode the market share of wrapped tokens such as WBTC, further enhancing Bitcoin’s liquidity and use cases.

Conclusion

Looking back, the “wrapped Token + Ethereum” model since 2020 hasn’t scaled significantly, attracting only limited BTC inflows——a mere version 1.0 solution for unlocking Bitcoin liquidity.

To be fair, if we treat Bitcoin simply as a high-quality multi-billion-dollar asset pool, there may be no need to reinvent the wheel with Bitcoin L2s. The existing “wrapped Token + Ethereum” ecosystem and DeFi use cases might suffice. In fact, most current Bitcoin L2 logic isn't fundamentally different from earlier methods of wrapping BTC into ERC20 tokens like tBTC or renBTC for use in EVM ecosystems.

Yet, from the perspective of native security and maximizing Bitcoin’s own ecosystem value, the emergence of Bitcoin L2s holds significant importance: better protecting Bitcoin assets while keeping value accrual within Bitcoin’s own ecosystem rather than leaking entirely into Ethereum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News