As WBTC faces a public opinion crisis, tBTC emerges into the spotlight

TechFlow Selected TechFlow Selected

As WBTC faces a public opinion crisis, tBTC emerges into the spotlight

Compared to Bitcoin, HBTC's price is closer to USDT.

Author: crv.mktcap.eth

Translation: Alex Liu, Foresight News

Could the bearish sentiment around WBTC be a bullish signal for tBTC?

Thinking you could safely touch grass this weekend? Unfortunately, new FUD has emerged!

Last week, BitGo announced it would transfer control of WBTC, sparking concerns over the project's health during the weekend. (In the announcement, BitGo stated this move is part of a strategic partnership with Justin Sun and the TRON ecosystem.)

BitGo Announcement

Why are people concerned about Justin Sun gaining greater strategic influence over WBTC?

Early DeFi participants may recall HBTC, the wrapped Bitcoin token previously launched by Justin Sun, which ultimately performed poorly—currently trading closer to USDT than BTC.

HBTC price on CoinMarketCap

Will this time be different?

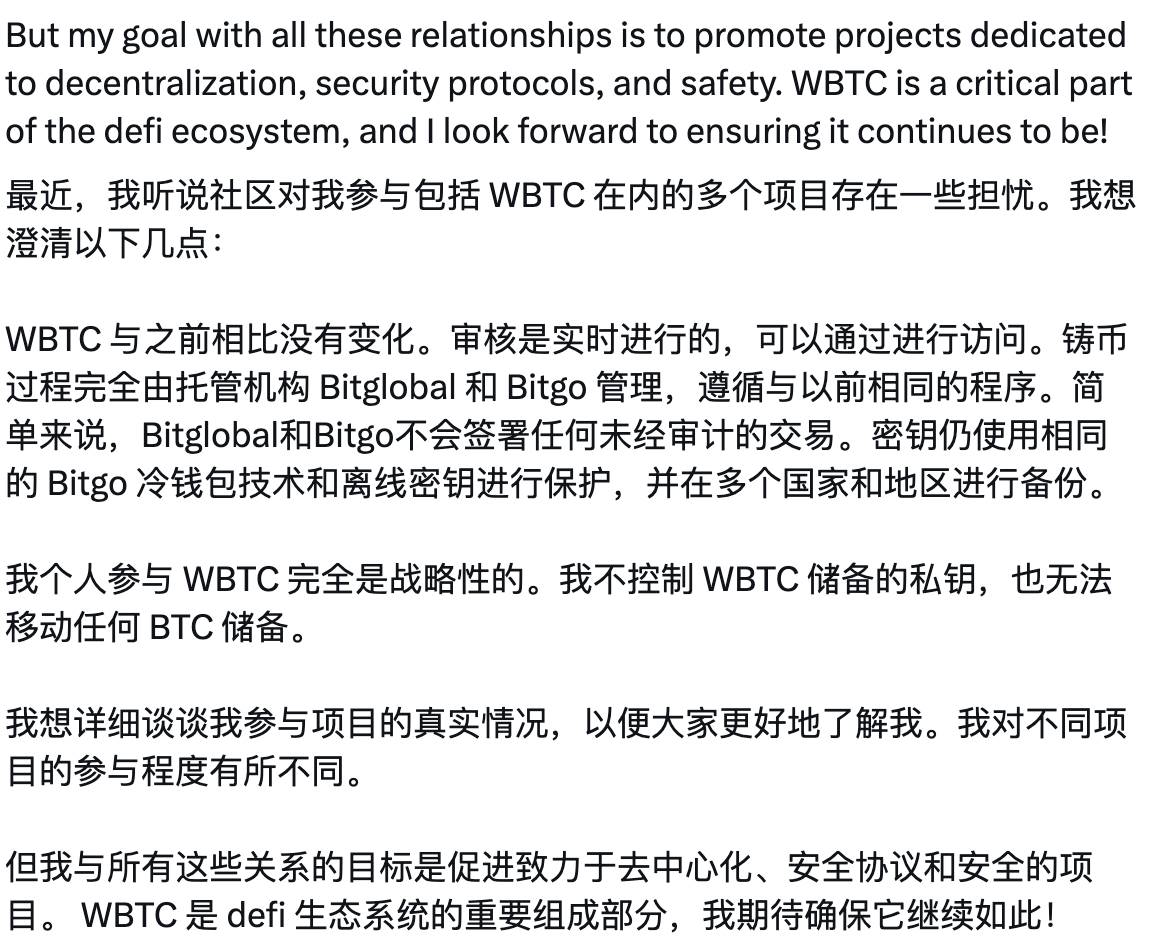

Justin Sun quickly clarified his exact role within the ecosystem:

Justin Sun's related statement

Nonetheless, DeFi users have initiated serious discussions about WBTC’s role in the ecosystem.

WBTC has long been criticized for its relative centralization. Its usual defense has been: "BitGo’s balance sheet is strong; if this were truly an issue, we’d gladly prove it to any qualified lawyer." In contrast, tBTC offers on-chain proof of reserves.

WBTC remains the largest wrapped BTC token, outpacing all competitors. In the previous cycle, other wrapped BTC tokens that had dual pools with WBTC on Curve Finance included renBTC from Ren Protocol and sBTC from Synthetix—but both are now defunct.

Are there any viable alternatives to WBTC? Currently, it's hard to say there's a perfect solution.

One appealing option is frxBTC, rumored to launch “soon.” But degens want “now,” not “soon.”

Frax founder says "frxBTC coming soon"

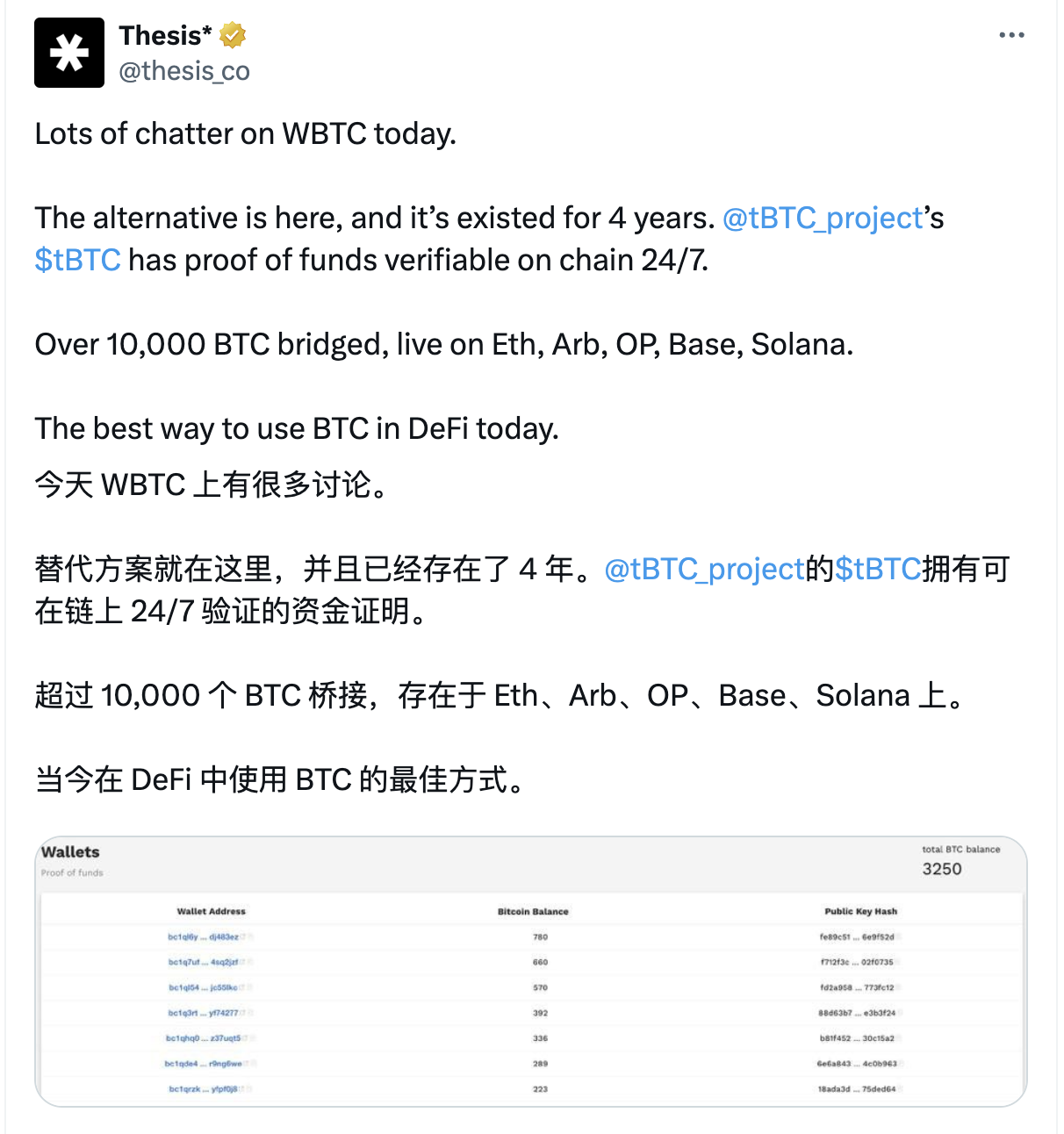

In reality, the most viable current alternative to WBTC is tBTC from The Threshold Network (Threshold Network). Beyond being more decentralized, tBTC has demonstrated long-term, large-scale reliability:

-

v1: 4 years

-

v2: 1.5 years

Following BitGo’s latest announcement, MakerDAO engaged in heated debate over shutting down all WBTC debt—which constitutes about 10% of DAI collateral. Phasing out WBTC would require a robust alternative. Unsurprisingly, tBTC entered the conversation.

tBTC already enjoys solid DeFi adoption. It sees significant usage on Curve Finance. Beyond active trading in major stable and volatile pools, tBTC can also be used to mint the crvUSD stablecoin.

Some traders have already begun switching—could the crvUSD whales be joining the WBTC/tBTC debate?

Whale user engaging with tBTC in DeFi

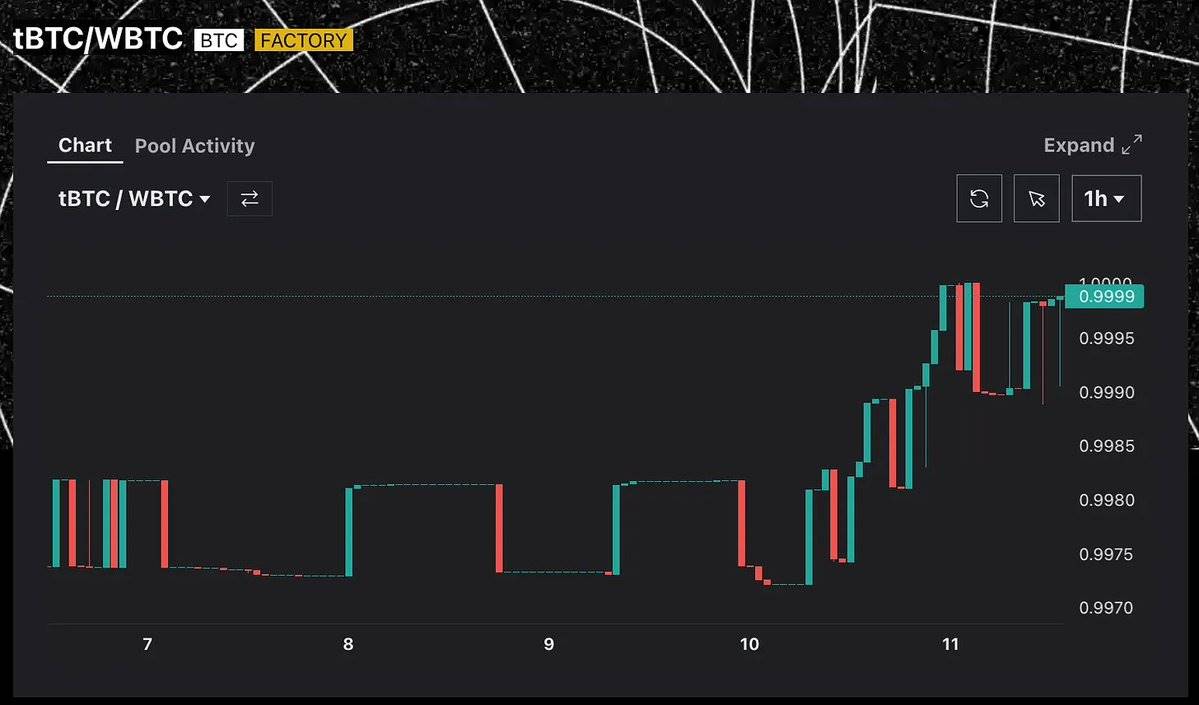

Could this storm lead to a $tBTC / $WBTC price flip?

After BitGo’s news spread, hourly charts showed some price movement.

However, we don’t expect such a shift to happen quickly.

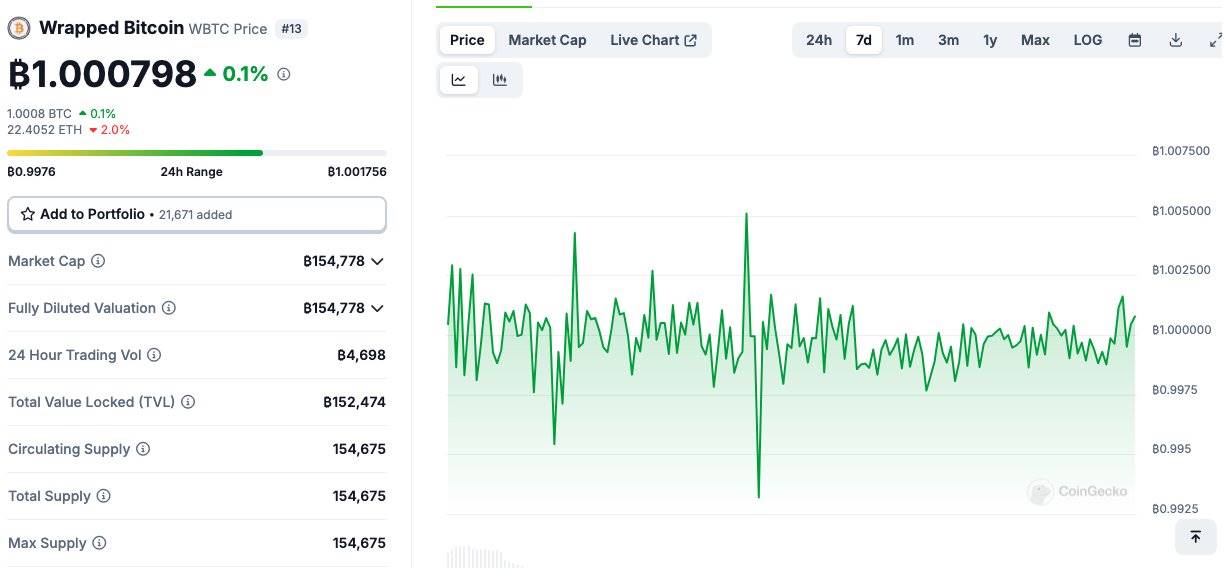

Over the past week, the market caps of both wrapped BTC tokens have remained quite stable. Even amid the debate, neither token has seen significant inflows or outflows.

Moreover, their market caps remain vastly apart:

-

WBTC: 155,000 BTC

-

tBTC: 3,000 BTC

WBTC indeed possesses a "crazy moat"! And its profit margin is extremely low—earning just $12 million in fees from $9 billion worth of BTC. Therefore, WBTC is unlikely to disappear anytime soon.

The liquidity and integrations accumulated by wrapped tokens over multiple cycles won’t be easily replaced—especially when the token continues functioning properly and maintains its peg.

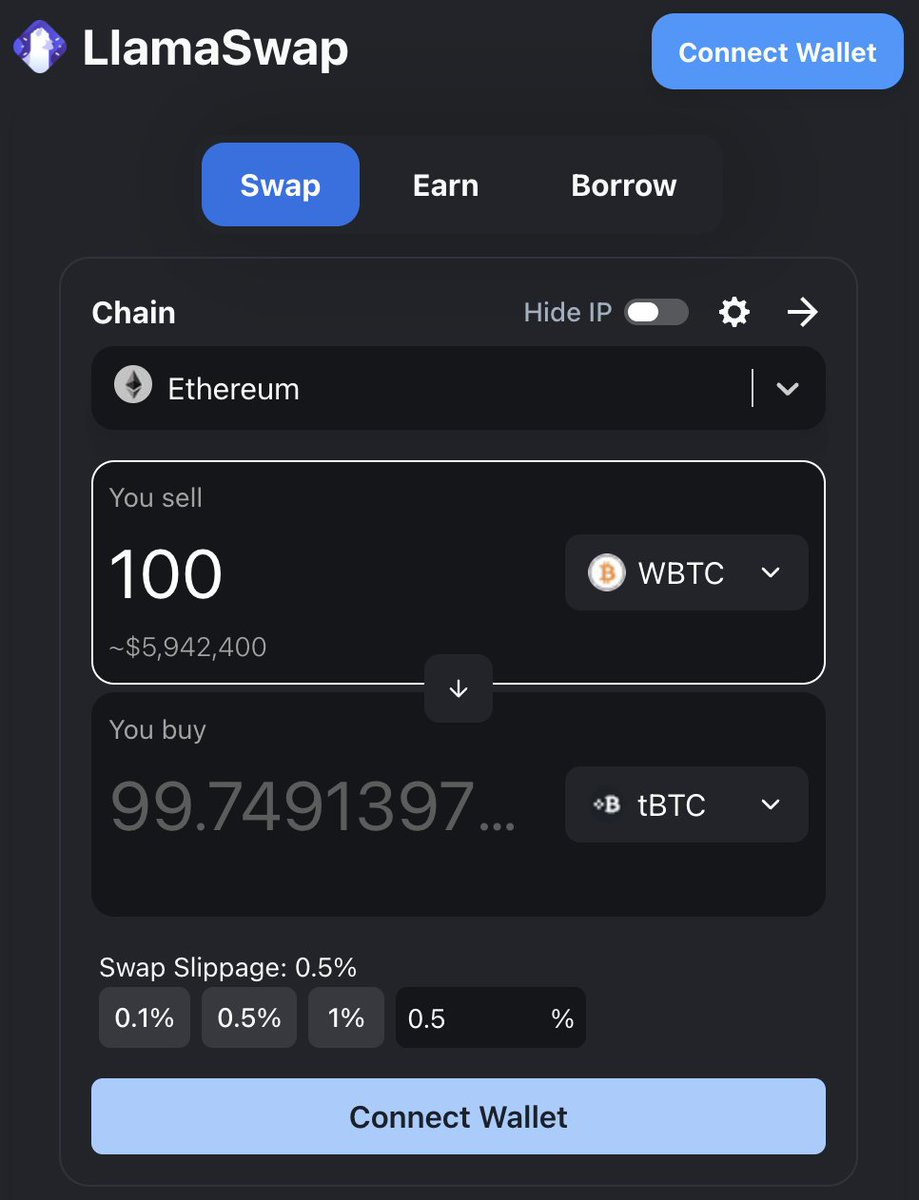

Nevertheless, if you support a more decentralized future, consider minting $tBTC when transitioning from BTC to ETH. You can swap wBTC for tBTC, then redeem it back into native BTC for secure custody—or continue using tBTC as DeFi collateral.

tBTC has solid on-chain liquidity

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News