Taproot Assets: The Next Growth Frontier in the Stablecoin Sector to Surpass Trillion-Dollar Market Cap

TechFlow Selected TechFlow Selected

Taproot Assets: The Next Growth Frontier in the Stablecoin Sector to Surpass Trillion-Dollar Market Cap

The introduction of the Taproot Assets protocol suggests broad potential for stablecoins to emerge in high-frequency, small-value payment scenarios.

Authors: van, Peter, Boris, Haozhe

The essence of blockchain lies in the extension of payment use cases. In terms of payments, stablecoins not only hold a significant position within the cryptocurrency market but are also playing an increasingly important role in global payments and cross-border settlements. Currently, centralized stablecoins still dominate over 90% of the market share. Among them, Tether's USDT holds absolute dominance in the stablecoin space. Despite stablecoins having issued more than $150 billion, according to the Federal Reserve’s 2024 M1 figure of $20 trillion (including all circulating cash, traveler’s checks, and demand deposits), stablecoin market capitalization represents just 0.75% of M1. The application of stablecoins in payments still has a long way to go. The introduction of the Taproot Assets protocol signals vast potential for stablecoins in high-frequency, small-value payment scenarios, and suggests that large-scale adoption of stablecoins as a standard payment method is becoming possible.

1. Stablecoins: The Next Trillion-Dollar Frontier

The rapid growth of the stablecoin market highlights its potential as a future trillion-dollar sector in finance. Currently, the stablecoin market cap exceeds $160 billion, with daily trading volumes surpassing $100 billion. Major countries are actively introducing stablecoin-related policies and regulations. Meanwhile, multiple institutions predict that stablecoins will unlock a new trillion-dollar market, with the primary growth driven by widespread adoption in global payments.

Stablecoins can be broadly categorized into centralized and decentralized types. Decentralized stablecoins can be further divided into algorithmic stablecoins, crypto-collateralized stablecoins, or hybrid models combining both. Centralized stablecoins currently dominate the market, led by two giants: USDT and USDC—issued by Tether and Circle, with $114.46 billion and $34.15 billion in USD-pegged stablecoins respectively. Notably, Tether achieved a gross profit of $4.5 billion in a single year with only 125 employees. Such lucrative prospects have naturally attracted many major institutions to enter the space:

-

BlackRock launched BUILD, a tokenized fund on Ethereum designed to offer stable value and yield generation, now one of the largest tokenized funds with a market cap of $384 million.

-

On July 24, according to Cailian Press, JD Blockchain Technology (Hong Kong) plans to issue a Hong Kong dollar-pegged cryptocurrency stablecoin in Hong Kong.

Centralized stablecoins have already achieved broad adoption within the crypto ecosystem; our daily transactions and settlements on DEXs or CEXs are typically conducted using centralized stablecoins. On the other hand, decentralized stablecoins are usually backed by crypto assets and primarily used in lending protocols.

Although stablecoins play a crucial role in cryptocurrency trading and DeFi, their integration with real-world commerce remains in early stages. In the long term, the most promising application for stablecoins lies in payments, particularly cross-border payments. Current cross-border payments involve multiple intermediaries—including issuing banks, payment gateways, and processors—resulting in high fees and long settlement times. Stablecoins are not merely a better alternative but represent an essential channel for economic participation. As stablecoin regulation gradually moves toward compliance, their importance in global payment systems will continue to grow. Moreover, the widespread adoption of stablecoins in payments could converge with DeFi to create "PayFi," enabling interoperability, programmability, and composability in payment systems—ushering in new financial paradigms and user experiences unattainable in traditional finance.

2. Taproot Assets + Lightning Network: Infrastructure for a Global Payment Network

Currently, stablecoins primarily circulate on the Ethereum and TRON blockchain networks, where transaction fees often exceed $1 and on-chain transfer times exceed one minute. In contrast, the Lightning Network offers faster, lower-cost, and highly scalable advantages.

2.1 What Is the Lightning Network?

The Lightning Network is the first relatively mature Layer 2 scaling solution for Bitcoin. After the release of the Lightning Network whitepaper, multiple teams began independently developing implementations, including Lightning Labs, Blockstream, and ACINQ. Taproot Assets is an asset issuance protocol developed by Lightning Labs.

How does it work? Two parties first establish a bidirectional state channel. Parties A and B create a 2-of-2 multisig address on-chain, allowing both to send or receive Bitcoin up to a certain limit from this address. Before any transfer, they exchange locking data and keep internal ledgers, enabling multiple off-chain payments. Only when the final settlement occurs do they broadcast the updated balances back to the blockchain. Only the latest version is valid, enforced through Hash Time-Locked Contracts (HTLC). Either party can close the channel at any time by broadcasting the latest state to the blockchain, without requiring trust or custodianship.

Thus, parties can conduct unlimited off-chain transactions while relying on the Bitcoin blockchain as an arbiter. Smart contracts only intervene if a dispute arises—such as insufficient balance—or upon final settlement. This resembles A and B signing numerous legal agreements without going to court each time; judicial intervention occurs only upon final confirmation or breach of contract.

2.2 The Lightning Network as Optimal Infrastructure for Global Stablecoin Payments

In effect, users can send unlimited transactions off-chain without congesting the Bitcoin network, while still benefiting from Bitcoin’s security. Theoretically, the Lightning Network has no upper limit on scalability.

To date, the Lightning Network has operated for nine years atop the most secure network in the crypto ecosystem—Bitcoin (with over 57,000+ nodes and PoW consensus)—maximizing its own security.

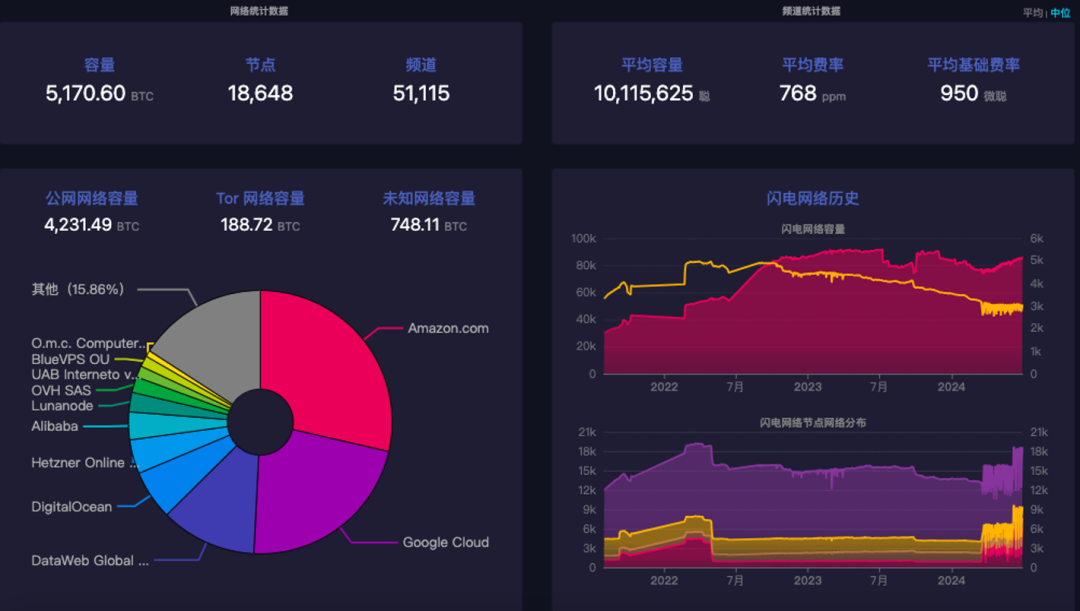

As of now, the Lightning Network holds over 5,000 BTC in capacity, supported by more than 18,000 global nodes and 50,000+ channels. By establishing bidirectional payment channels, it enables instant and low-cost transactions. It is increasingly being adopted by merchants and payment providers worldwide, emerging as the most widely accepted decentralized solution for global payments.

Bitcoin dominates half of the total crypto market cap. With the current cycle witnessing renewed enthusiasm for the Bitcoin ecosystem, the Lightning Network—the first Layer 2 scaling solution for Bitcoin—has realized Satoshi Nakamoto’s original vision of a peer-to-peer global payment system. The Lightning Network has become the most orthodox and consensus-driven segment of the Bitcoin community, representing the ideal infrastructure for global payments.

2.3 Taproot Assets Completes the Final Mile for the Lightning Network

The main limitation prior to Taproot Assets was that the Lightning Network only supported Bitcoin as a payment currency, severely restricting its use cases. Today, with Bitcoin widely regarded as digital gold, most people are unwilling to spend their BTC.

While earlier Bitcoin Layer 1 asset protocols existed—such as Atomicals and BRC20 based on Ordinals—they did not support direct integration with the Lightning Network. The launch of Taproot Assets perfectly addresses this gap. Developed by Lightning Labs, Taproot Assets is an asset issuance protocol built on the Bitcoin network. Like the Ordinals protocol, it allows anyone or any organization to issue their own tokens, including fiat-pegged stablecoins such as USD, AUD, CAD, and HKD equivalents.

The key advantage over other asset protocols is full compatibility with the Lightning Network, making stablecoin payments on Lightning feasible. This means a surge of new assets—especially stablecoins—issued on Bitcoin will soon flow into the Lightning Network, which in turn enhances the network’s global payment reach and influence.

Leveraging Bitcoin’s security and decentralization, Lightning Labs’ vision of “bitcoinizing the dollar and global financial assets” is becoming reality. The mainnet launch of the Taproot Assets protocol marks the official beginning of the trillion-dollar payment era for stablecoins.

3. Deep Dive: Taproot Assets Protocol (TA)

The operation of the TA protocol is deeply rooted in Bitcoin’s UTXO model and enabled by the Taproot upgrade (BIP 341). These two elements form the core foundation driving the protocol’s functionality.

3.1 UTXO vs Account Models: Differences, Pros, and Cons

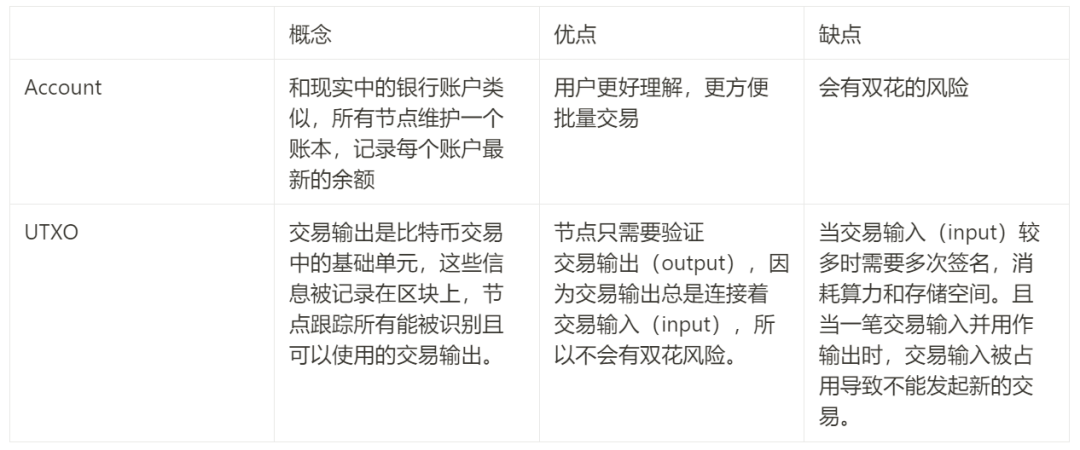

UTXO (Unspent Transaction Output) is a fundamental concept underpinning nearly all Bitcoin Layer 2 protocols, including Ordinals and Runes. In contrast, most other public chains like Ethereum and Solana adopt the Account model. Below is a comparison of the two:

The account model is intuitive—similar to Alipay—where every inflow or outflow updates the displayed balance in your account interface.

The UTXO model can be understood as person A’s wallet containing checks issued to A by B, C, and D, as well as checks A has issued to E, F, and G. A’s wallet balance equals (the face value of checks received from B, C, D) minus (checks sent to E, F, G). The Bitcoin network acts like a bank that honors these checks, calculating each address’s current balance based on the latest transaction records.

Due to its unique properties, the UTXO model inherently prevents double-spending, offering higher security compared to account-based models. Additionally, the TA protocol fully inherits Bitcoin’s layer-one security, eliminating risks of erroneous or missed transfers.

Moreover, TA employs a one-time seal mechanism: once a UTXO is spent, it cannot be reused, ensuring assets move securely with the UTXO. Under this mechanism, miners who mine the longest chain have final authority over UTXO resolution. Unlike BRC20, which relies on off-chain indexers to identify assets, TA enhances transaction security by preventing double-spending attacks and removing risks of errors or malicious behavior from centralized entities. These features make TA + Lightning Network a reliable infrastructure for payment applications.

3.2 Taproot Upgrade: Enabling More Complex Functionality

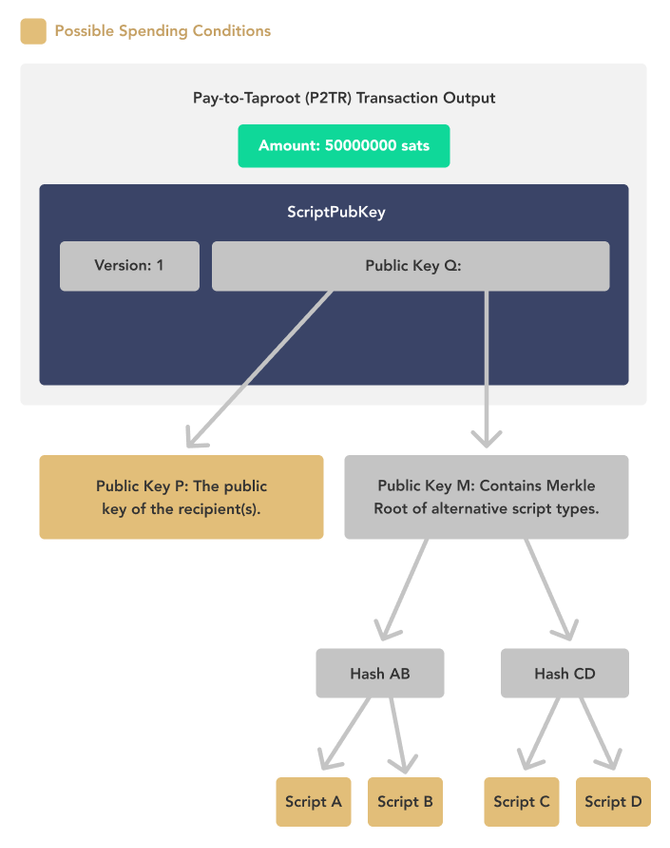

The 2021 Taproot upgrade introduced basic smart contract capabilities to Bitcoin, allowing P2TR wallet addresses to execute complex logic via BitScript, enabling new and sophisticated transaction types on-chain. An illustration of the Taproot upgrade is shown below:

Taproot Mechanism, River: https://river.com/learn/what-is-taproot/

The most critical improvement is support for multisignature (multisig) transactions. This enhances institutional transaction security. Multisig addresses have the same length as regular private wallet addresses, making them indistinguishable externally—thus improving privacy and security. This advancement lays a solid foundation for institutional and B2B transactions, promoting broader commercial adoption.

For users, the most visible change is the wallet address format: addresses starting with “bc1p…” indicate Taproot-upgraded wallets.

3.3 Technical Principles of TA

Initially, Bitcoin ecosystem excitement stemmed from the Ordinal and BRC20 protocols, both based on the account model where balances are tied to addresses. These protocols “inscribe” data onto individual satoshis (the smallest unit of Bitcoin) to represent assets, storing asset state data in JSON format within the SegWit portion of blocks (used for signatures/witness data). Every time an asset transaction occurs, the script recording the change is “inscribed” into a block and interpreted via off-chain indexers.

However, this approach requires every Ordinals or BRC20 transaction to be recorded on-chain, increasing block size and accumulating redundant data permanently stored on the Bitcoin chain—placing growing strain on full-node storage. In contrast, TA adopts a more efficient method: assets are tagged directly onto UTXOs, with only the root hash of the script tree stored on-chain, while the actual scripts reside off-chain.

Furthermore, TA assets can be deposited into Lightning Network payment channels and transferred via existing Lightning infrastructure, meaning TA assets are a new class of assets that can circulate across both the Bitcoin mainnet and the Lightning Network.

As the name suggests, Taproot Assets leverages the Bitcoin Taproot upgrade (BIP 341). Taproot allows spending a UTXO either via the original private key or through a script in a Merkle tree.

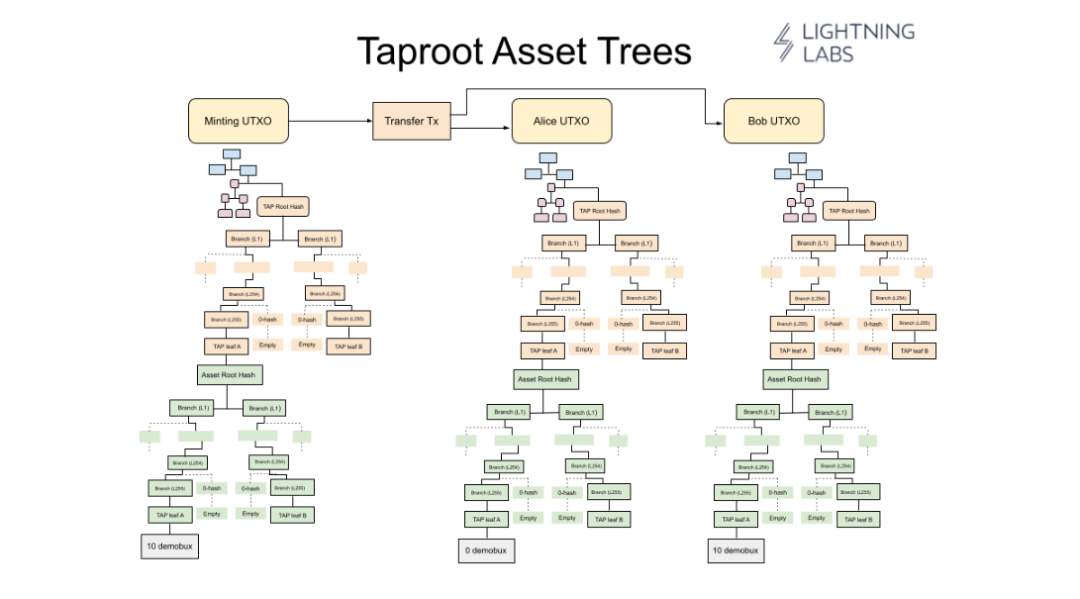

In short, Taproot Assets extends the Taproot upgrade by recording asset state transitions on Taproot’s Merkle tree. It leverages the UTXO’s “one-time seal” property to achieve consensus on asset state changes on the Bitcoin chain—eliminating the need for external off-chain indexers required by other protocols. Taproot Assets uses the structure shown below, employing a Merkle-Sum Sparse Merkle Tree (MS-SMT) to manage asset states and defining standards for asset state transitions.

Taproot Assets Trees, Lightning Labs: https://docs.lightning.engineering/the-lightning-network/taproot-assets/taproot-assets-protocol

Importantly, not all Merkle tree data is written to the Bitcoin chain—only the root hash is recorded. Thus, regardless of asset data size, on-chain transaction length remains constant. From this perspective, Taproot Assets is a non-bloated, “clean” protocol that does not pollute the Bitcoin chain.

3.4 Relationship Between TA Protocol and the Lightning Network

In Lightning Labs’ latest product update, Taproot Assets can now seamlessly enter the Bitcoin Layer 2 Lightning Network via TA Channels. Previously, the Lightning Network was solely a peer-to-peer Bitcoin payment network with no other crypto assets. The advent of Taproot Assets changes this: assets—especially stablecoins—can now be issued on the Bitcoin mainnet via the TA protocol and then transferred into the Lightning Network for circulation.

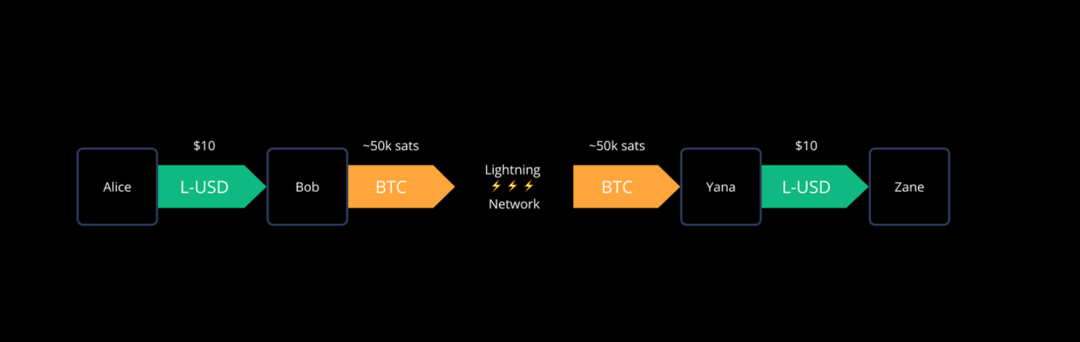

As illustrated below, a stablecoin asset L-USD is issued via Taproot Assets, and Alice sends $10 worth of L-USD to Zane over the Lightning Network.

An example of a Taproot Assets payment made to the wider Lightning Network, Lightning Labs: https://docs.lightning.engineering/the-lightning-network/taproot-assets/taproot-assets-on-lightning

The TA Channel operates similarly to a state channel, relying on HTLCs. Since Taproot Assets are embedded within a UTXO, the underlying mechanism remains unchanged—previously, only Bitcoin could flow through channels; now, TA assets can too. This breakthrough enables non-Bitcoin assets, especially stablecoins, to move seamlessly across the Lightning Network.

3.5 High User Costs and Custodial Challenges Remain

Although the TA protocol stores only the root hash of each transaction on-chain to preserve Bitcoin’s simplicity, the trade-off is that full asset data must be stored off-chain on each client. Like the RGB protocol, it requires Client-Side Validation (CSV) to verify asset authenticity. For users to use Taproot Assets as easily as BTC, they must possess both the private key (to the Virtual UTXO) and the relevant Merkle tree data related to the asset.

Additionally, the official implementation of the TA protocol (Tapd) heavily depends on LND wallet services and lacks an account management system. The Lightning Network’s unique architecture necessitates users to run their own nodes—a decentralized model that proves difficult for average users to adopt, explaining why the network hasn’t seen mass adoption yet.

Consequently, most wallet services on the Lightning Network today are custodial solutions, meaning newly issued TA assets are stored in custodial wallets. When large volumes of stablecoins begin circulating on TA, high-value assets will likely remain on the Bitcoin mainnet due to its superior security and consensus strength. Only smaller amounts or spare change will be deposited into the Lightning Network for payment purposes. Therefore, enabling truly decentralized ownership—where users maintain full control over their stablecoins—is critical for the secure storage and management of large-value assets.

4. Self-Custody Solutions: Completing the Final Piece of the Lightning Payment Puzzle

Several teams have already introduced decentralized solutions for TA assets on the Lightning Network. For example, LnFi proposes a cloud-hosted node solution that simplifies deployment of personal Lightning Network nodes, significantly lowering the entry barrier.

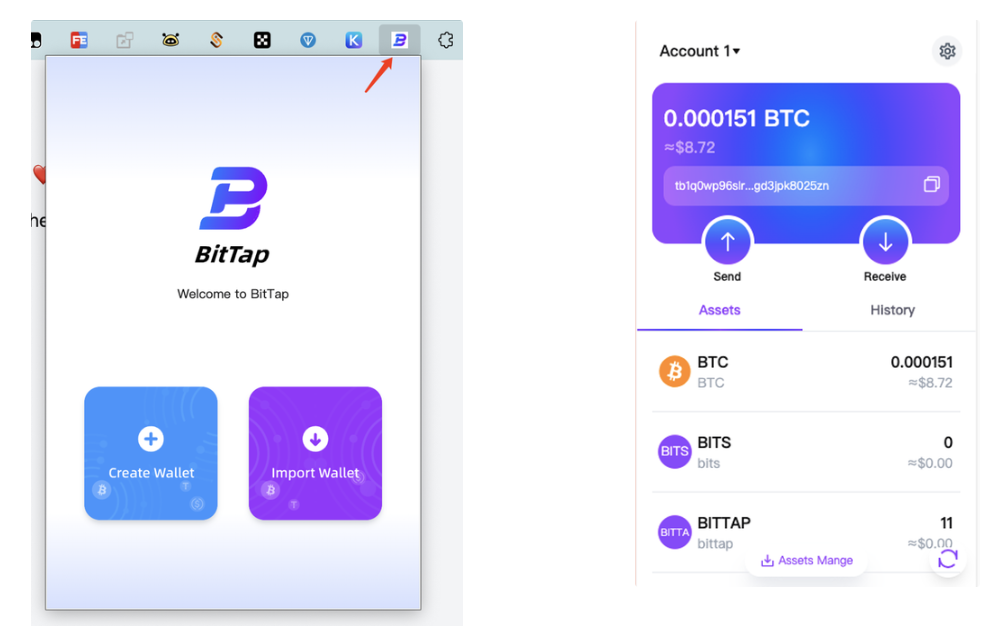

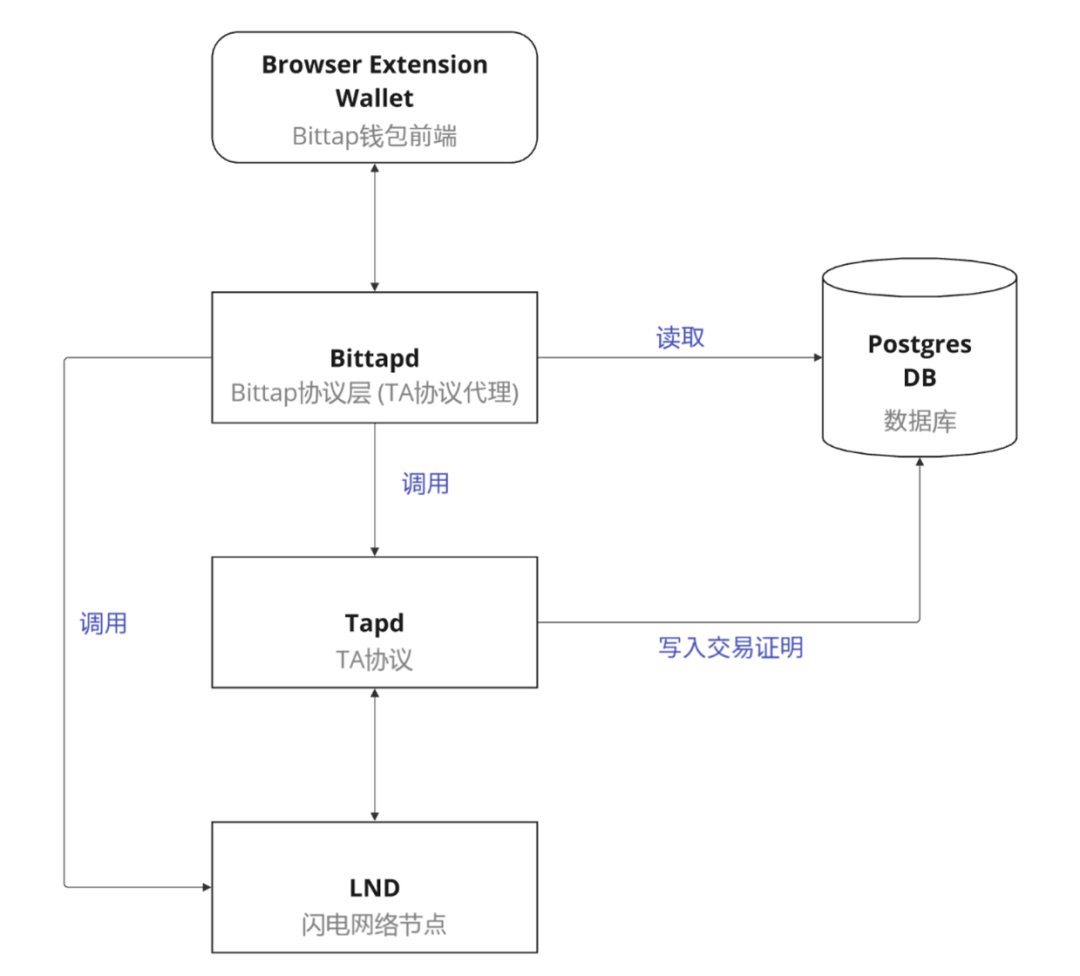

Another team, BitTap, focuses on building decentralized infrastructure for the TA protocol ecosystem and has developed a browser extension wallet for TA, granting users self-custody capabilities.

BitTap’s innovative wallet protocol (Bittapd) ensures users retain full control of their private keys. During transaction signing, Bittapd acts on behalf of the user to interact with Tapd, delivering a fully decentralized experience comparable to MetaMask—complete with robust security. When stablecoins are issued and circulated on TA, users can store and transfer their BTC-mainnet stablecoin assets via the BitTap wallet, freely choosing to move spare change to the Lightning Network. The technical architecture of BitTap is shown below:

BitTap wallet architecture, Bittap Docs: https://doc.bittap.org/developer-guides/overview

The Bittapd protocol essentially serves as a decentralized proxy for the TA protocol, transforming Tapd’s native custodial account system into a decentralized solution. It also handles network communication and request forwarding for plugin wallet users during transactions.

-

5. Conclusion

Stablecoins have gained widespread attention and adoption globally, evolving from narrow crypto trading tools into serious contenders for global payments. The Lightning Network, with its low fees and fast settlement, has emerged as ideal infrastructure for global transactions. The introduction of the Taproot Assets protocol further strengthens this foundation, making the issuance and circulation of stablecoins on Bitcoin a reality. This innovation mitigates Bitcoin’s volatility issue and dramatically improves its utility in everyday payments.

Moreover, addressing centralization issues in Lightning wallets, solutions like BitTap’s decentralized wallet provide users with safer, more autonomous asset management. These developments complete the final piece needed for Taproot Assets + Lightning Network to function as a global payment infrastructure.

Despite the dominance of traditional payment systems like Alipay, PayPal, and Stripe—backed by massive transaction volumes, user bases, government partnerships, regulatory compliance, and brand recognition—their custodial nature and reliance on complex internet and banking infrastructures result in inefficiencies and vulnerabilities to malicious actions or government sanctions. In cross-border payments, strict regulations and institutional constraints often impose geographic and amount limitations on accounts. These factors collectively undermine the security and flexibility of traditional payment methods.

The payment infrastructure formed by TA Protocol + Lightning Network matches traditional providers in speed and immediacy, while achieving trustless payments through elegant code design. Combined with self-custody solutions in the ecosystem, it ensures full user control over assets, enabling unrestricted, permissionless transfers of TA tokens anytime, anywhere—elevating payment freedom to unprecedented levels.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News