DePIN Overview: Exploring the Current Landscape and Eight Emerging Projects

TechFlow Selected TechFlow Selected

DePIN Overview: Exploring the Current Landscape and Eight Emerging Projects

The market cap of DePIN has surpassed $20 billion, with an expected 20x growth potential in the future.

Author: Alvis, Mars Finance

We have already witnessed the waves of DeFi Summer, the NFT craze, and the metaverse frenzy. Could the next big wave shift toward DePIN?

Between 2020 and 2021, the market cap of DeFi surged nearly 100-fold, rising from $1.75 billion to $172.2 billion. If during the current bull market DeFi’s market cap grows tenfold and DePIN reaches 50% of DeFi's valuation, DePIN could surpass $500 billion in total market cap—representing at least a 20x growth potential. Messari estimates that by 2028, DePIN’s market cap could reach $3.5 trillion, implying a potential 120x increase.

Next, we will review eight popular new DePIN projects launched since 2024 that have either not yet issued tokens or recently secured funding, revealing emerging trends in this nascent sector.

Current State of DePIN

DePIN stands for Decentralized Physical Infrastructure Networks. It incentivizes users via tokens to share personal resources for building infrastructure networks—including storage space, communication bandwidth, cloud computing, and energy. In simple terms, DePIN uses a crowdsourced model to decentralize infrastructure services traditionally provided by centralized corporations across the globe.

Source: Messari

The DePIN ecosystem can be divided into six major categories: computing, wireless, energy, artificial intelligence, services, and sensors. Recently, several new narratives have emerged within these core areas, such as the rise of decentralized gaming infrastructure (DeGIN) within computing networks, AI data layers applied in bandwidth networks, robotics breakthroughs in mobile networks, and manufacturing demands on mobile connectivity.

Image source: Rootdata

This year has seen a significant recovery in venture capital investment in crypto projects. According to Rootdata, global investments reached $6.7 billion by August 2024. In recent months, the emergence of DePIN networks has shown product-market fit similar to the early stages of the "sharing economy." These projects span multiple domains of DePIN, each demonstrating unique use cases.

Notable investment highlights include io.net, a Solana-based distributed GPU project, which raised $20 million in its Series A round with a token valuation reaching $1 billion. Another standout is Aethir, a decentralized GPU compute node provider, which raised $65 million within the first hour of its node sale. These achievements mark DePIN rapidly maturing, attracting substantial investments and widespread attention.

DePIN Market Cap Overview, Source: Messari

According to Messari, the total market cap of DePIN projects has now exceeded $20 billion. Filecoin leads the pack with a market cap of $2.4 billion, securing the top spot. Render Network follows closely behind at $2.2 billion, ranking second. Opentensor comes third with a $2.1 billion market cap. Among the top eight DePIN protocols ranked by market cap, seven belong to DRN (Decentralized Resource Networks), collectively holding a market cap of $12.2 billion. Helium is the only Physical Resource Network (PRN) in the top eight, with an $870 million market cap, placing seventh. These figures highlight the rapid development and diverse investment opportunities within the DePIN space.

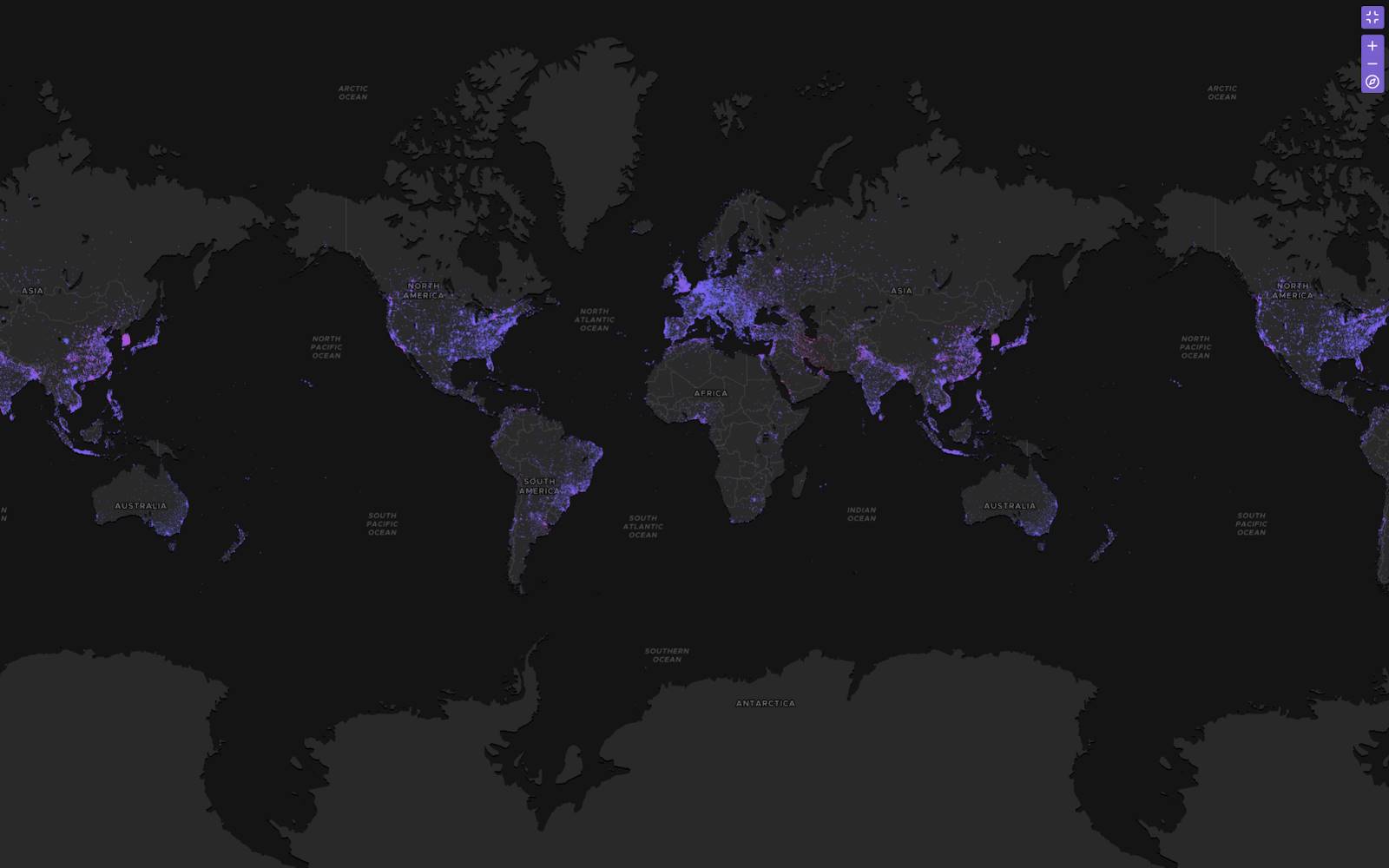

Global Node Distribution of DePIN, Image source: DePINScan

Currently, the total number of DePIN devices exceeds 18 million, with nodes spread across 195 countries and regions worldwide, primarily concentrated in North America, East Asia, Southeast Asia, Europe, and Africa.

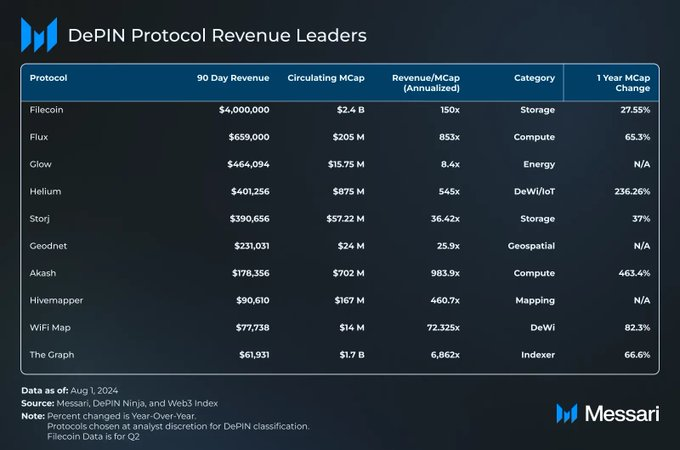

DePIN Revenue Overview, Source: Messari

Despite soaring valuations, revenue growth among DePIN projects has not kept pace. Only four of the largest DePIN protocols appear among the top eight by revenue. While valuations remain high—with FDV (Fully Diluted Valuation) to revenue ratios reaching up to 3000x—capital inflows remain strong, reflecting investor optimism for better product-market fit. The entire ecosystem now includes over 2,500 projects and more than 600,000 active nodes. This data reflects the tension between market recognition and actual revenue generation in DePIN, while also highlighting its future growth potential and challenges.

Today, Mars Finance will review eight major new projects launched since 2024, exploring how these cutting-edge technologies play pivotal roles in the DePIN ecosystem. Through this analysis, you may uncover hidden value propositions and seize promising investment opportunities.

The Eight Hot Projects

IoTeX

IoTeX is an Ethereum Virtual Machine (EVM)-compatible Layer 1 blockchain focused on enabling secure and reliable human-machine interaction, aiming to power the Internet of Trusted Things. By building a trusted IoT platform, IoTeX powers decentralized applications (like Cyclone and Mimo), smart devices (such as UCam and Pebble), services (like ioay and ioTube), and digital asset networks, delivering greater value and richer experiences to end users.

After raising a total of $35 million in funding rounds in 2018 and 2022, IoTeX secured another $50 million in April 2024. This round was led by top-tier investors including Borderless Capital, Amber Group, Foresight Ventures, FutureMoney Group, SNZ, Metrics Ventures, EV3, and Waterdrip Capital. The team stated that the funds will primarily support DePIN development and ecosystem adoption through long-term staking of IOTX, IoTeX’s native token. Additionally, the capital will be used alongside the IoTeX Foundation and the DePINsurf accelerator fund to further invest in IoTeX-based DePIN projects, driving innovation and real-world application deployment.

IoTeX has recently released its updated IoTeX 2.0 whitepaper, detailing modular composability, a unified trust layer, and a redesigned token economy. The plan aims to connect 100 million devices within the next three to five years, unlocking trillions of dollars in value. This strategy underscores IoTeX’s ambition in pushing technological boundaries and expanding market reach, showcasing a firm commitment to broad impact and sustainable long-term development.

The native IOTX token is currently trading at $0.03, down 9.10% over the past seven days, compared to a 3.60% decline in the broader cryptocurrency market. OKX Web3 Wallet has already integrated IoTeX—whether IOTX will be listed on OKX and its future price movements are worth watching!

io.net

io.net is a revolutionary decentralized computing network focused on developing, executing, and scaling machine learning (ML) applications on the Solana blockchain. By aggregating one million GPUs, it creates the world’s largest GPU cluster, offering unprecedented processing power for compute-intensive tasks. What sets io.net apart is its ability to pool underutilized GPU resources from independent data centers, crypto miners, and other crypto projects like Filecoin and Render. This integration forms a powerful computing platform within the DePIN framework, allowing engineers to access massive computational capacity in an accessible, customizable, cost-effective, and easy-to-deploy environment.

In fundraising, io.net successfully raised $10 million in seed funding last year and quickly followed up with a $30 million Series A round this year. Backed by a prestigious group of investors, the project enjoys robust financial support. Currently, io.net’s architecture is taking shape, featuring core components such as the IO Network and IO Engine, designed to enable efficient sharing of GPU resources in a decentralized manner, significantly improving resource utilization efficiency.

io.net executes a fixed schedule for $IO token buybacks and burns based on the $IO price at execution time. Funds for buybacks come from operational revenues of IOG (The Internet of GPUs), collecting a 0.25% order booking fee from both compute buyers and providers, plus a 2% transaction fee when $USDC is used to purchase compute. By repurchasing and burning tokens, scarcity increases, thereby enhancing token value. However, as a nascent project, io.net still faces challenges in technical execution and market demand alignment—investors and observers should closely monitor its progress.

Recently, Bithumb—the second-largest exchange in South Korea—listed IO, joining Binance and other major exchanges. IO currently has a market cap of $150 million, FDV of $1.28 billion, a maximum supply of 8 billion, and a circulation rate of 11.88%.

Aethir

Aethir is a decentralized real-time rendering network aiming to elevate metaverse content accessibility to new heights. By building scalable decentralized cloud infrastructure (DCI), Aethir enables game and AI companies to deliver their products directly to global users, breaking geographical and hardware limitations.

To date, Aethir’s GPU network and cloud services have generated over $36 million in annual revenue, converted weekly into ATH tokens, ensuring users can easily access computing power. This revenue level surpasses most DePIN projects and demonstrates Aethir’s strong market position. In the AI domain, Aethir’s collaboration with TensorOpera stands out. Using Aethir’s decentralized GPU infrastructure, TensorOpera successfully trained a 750-million-parameter AI model, showcasing its capabilities in high-performance computing.

To date, Aethir has raised a total of $11.53 million through an Initial DEX Offering (IDO) and other funding rounds. Public sales raised $2.53 million, while Pre-A funding totaled $9 million, accounting for 78% of the total. This funding round valued Aethir at $150 million.

ATH currently has a market cap of $260 million, FDV of $2.7 billion, and a circulation rate of 9.66%. Major trading venues include OKX, Bybit, HTX, Gate.io, KuCoin, and recently, the two largest exchanges in South Korea.

Bittensor

Bittensor is an open-source protocol designed to support blockchain-based machine learning networks. It facilitates collaborative training of machine learning models and rewards participants with TAO tokens based on the informational value they contribute to the collective. TAO tokens also grant users rights to extract information from the network and adjust their participation according to individual needs. Bittensor’s ultimate vision is to create a decentralized marketplace for artificial intelligence—a trustless, fully transparent environment where consumers and producers can interact seamlessly.

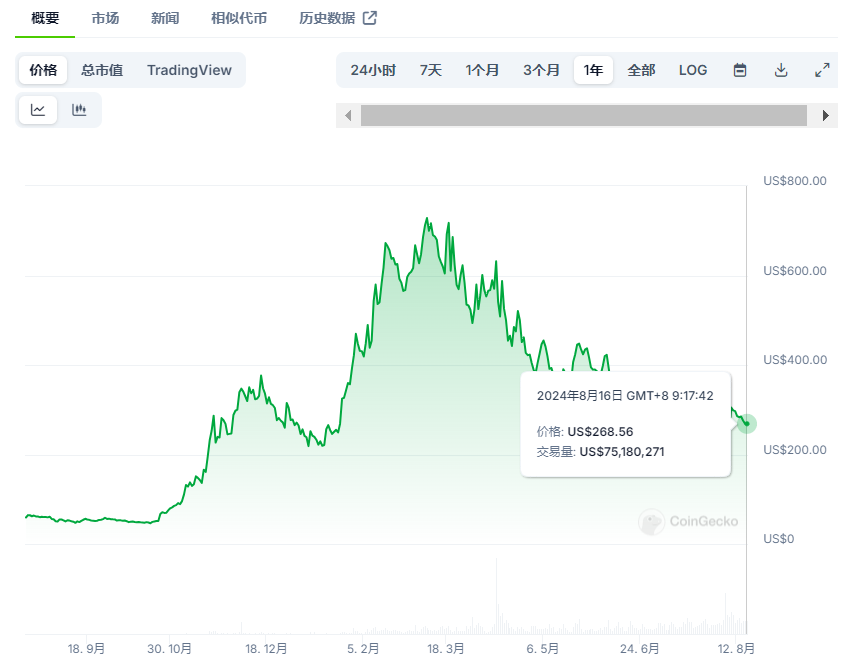

Since late last year, amid the AI boom, Bittensor has stood out—its TAO token price surged from around $80 in October last year, peaking above $730 in March this year, briefly pushing its market cap to about $4.7 billion. With its innovative narrative, Bittensor quickly rose to become a leader in the AI sector and briefly entered the top 30 in crypto market capitalization. The TAO token price has since retreated to $268.

Yet, Bittensor’s story is far from over—the ecosystem is just beginning. In 2024, Masa, the first AI project publicly sold on CoinList, announced it would launch an LLM-based AI data subnet on Bittensor, becoming the first tokenized data subnet in the Bittensor ecosystem. Masa’s launch marks the only notable new investment opportunity following TAO in the broader Bittensor ecosystem—an eagerly anticipated “new coin.”

DIMO Network

DIMO is a decentralized software and hardware IoT platform that allows users to create verified vehicle data streams to privately share with apps, enabling them to negotiate better services such as auto financing and insurance. Digital Infrastructure is building the DIMO network—a decentralized automotive data protocol—and DIMO Mobile, an app allowing drivers to collect and view their own car data while earning rewards in DIMO tokens.

Alex Felix, Managing Partner and Chief Investment Officer at CoinFund, will join Digital Infrastructure’s board. This latest funding round brings Digital Infrastructure’s total funding to $22 million.

$DIMO is an ERC-20 token on Polygon and Ethereum blockchains, with a total supply of 1,000,000,000.

700 million $DIMO will initially go to a community-controlled DAO treasury. Teams and individuals contributing to the network may receive $DIMO (and/or other accumulated cryptocurrencies) through bounties or grants. However, most users earn tokens via driver rewards.

The remaining 300 million $DIMO is allocated to the founding team (~224 million) and investment partners (~76 million). These allocations are subject to a minimum two-year lock-up starting from mainnet launch, with monthly unlocks until full vesting after three years.

The DIMO token is now listed on Coinbase, Gate, and several other exchanges. The current price is $0.12, with a circulation rate of 24%.

Helium Mobile

Helium Mobile is a decentralized hotspot network launched by Helium, allowing anyone to deploy hotspots and instantly add dynamic coverage to the Helium Mobile network. Users earn MOBILE rewards by expanding coverage and helping build the network.

According to the Helium website, a licensing program for its hotspot devices is being launched. Helium Mobile hotspots allow individuals or enterprises to set up “mini cell towers,” broadcasting cellular signals in exchange for token payments.

Multiple third-party manufacturers and suppliers already serve the Helium IoT network, but Helium Mobile is currently the only provider offering cellular signal equipment. Through its licensing program, Helium Mobile aims to earn licensing fees from externally manufactured hotspots while growing its cellular network.

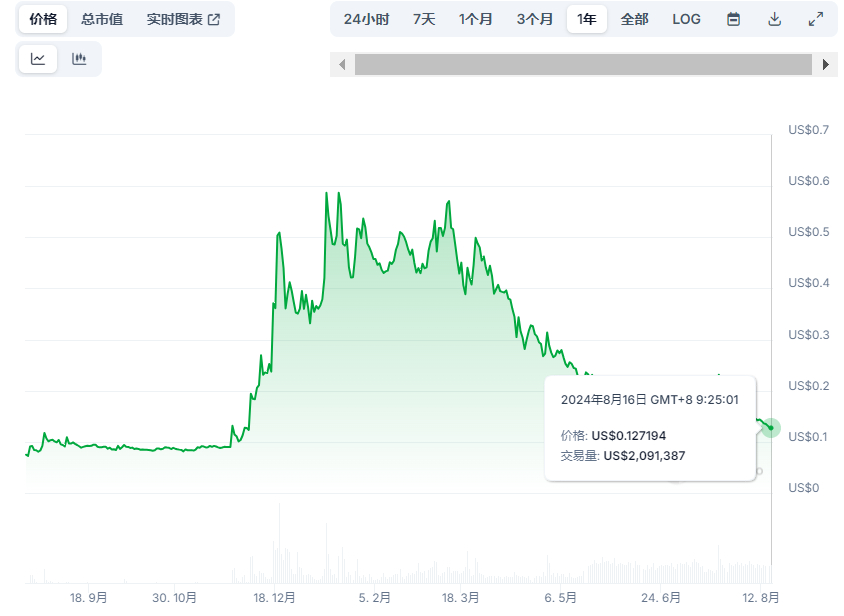

The Mobile token experienced explosive growth at the end of last year, surging over 50x at its peak. It currently trades at $0.001, with a circulation rate of 42%.

DAWN

Dawn, a Solana-based DePIN project, recently raised $18 million in funding led by Dragonfly, with participation from CMT Digital, Castle Island Ventures, Wintermute Ventures, 6th Man Ventures, and ParaFi. Solana also retweeted and promoted the announcement on X.

Neil Chatterjee, co-founder of Andrena, said this round was an extension of the Series A, structured as a Simple Agreement for Future Equity (SAFE) with token warrants. The round was “significantly oversubscribed”—initially targeting only $5 million—but ultimately raised additional funds in batches earlier this year to smoothly launch its token.

DAWN leverages the latest point-to-multipoint (PtMP) wireless technology, enabling nodes to efficiently communicate directly with multiple other nodes. This allows high-density bandwidth distribution among numerous users across the network, turning each node into a mini ISP. Through its protocol and hardware, users can buy and sell internet capacity in their local area, operate as internet service providers, and earn revenue via DAWN nodes.

Distribution of DAWN tokens: Hardware participants (network nodes) will receive 25% of the total token supply; third-party validators (software participants) will get 7%; the project treasury, team, and investors hold 20%. Unlock schedules are not yet disclosed.

The project remains in early stages—users can download a browser plugin to act as early validators and earn initial积分 rewards.

Peaq Network

Peaq is a Web3 network powering the Economy of Things (EoT) on Polkadot. It enables entrepreneurs and developers to build decentralized applications for vehicles, robots, and machines, while empowering users to manage and monetize goods and services provided by connected machines.

DePIN Layer 1 protocol Peaq completed a $20 million fundraising campaign via CoinList on May 17, drawing participation from over 14,500 community members and raising over $36 million—exceeding its token issuance target. This became the largest and highest-funded campaign on CoinList in over two years. The new capital will primarily ensure that Peaq-based DePIN becomes an industry leader, accelerate the growth of the peaqosystem, and promote various ecosystem and community initiatives.

Additionally, Peaq launched its native PEAQ token on CoinList from May 9 to May 16. However, users from the United States, Canada, China, South Korea, and certain other regions were ineligible to participate. Meanwhile, Peaq is actively preparing for mainnet launch, further advancing its ecosystem development.

Advantages of DePIN

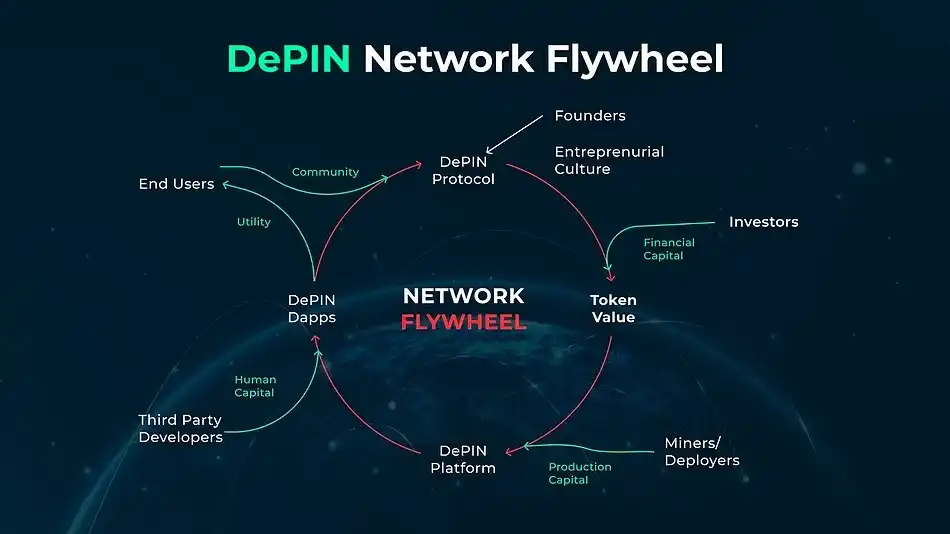

DePIN Network Growth Flywheel, Image source: Coingecko

Among the eight projects reviewed, some have already launched tokens while others remain in preparation. Compared to traditional centralized infrastructure providers, all these DePIN projects demonstrate clear advantages.

First, DePIN utilizes cryptographic incentives to offer a more efficient capital allocation model for launching and maintaining capital-intensive, high-cost traditional infrastructure. This mechanism not only optimizes capital usage but may also reduce costs to levels more accessible to consumers. By decentralizing operations, DePIN can flexibly mobilize resources, reducing reliance on conventional funding models and delivering more competitive services and products.

Second, DePIN networks distribute data and services across multiple nodes, creating a highly redundant system. This distributed structure ensures that even if one node fails, the rest of the network continues operating smoothly. Such redundancy greatly enhances system stability and reliability, minimizing downtime and service disruptions.

Third, DePIN’s community-centric approach empowers local communities to govern their own networks. This improves management efficiency and enables decisions about resource allocation and maintenance to be made at the grassroots level. Infrastructure is no longer viewed merely as a tool for economic profit, but rather as an asset serving long-term community interests. Local involvement strengthens ownership, accountability, and resource efficiency.

Overall, these characteristics highlight DePIN’s immense potential in driving infrastructure innovation. Through more efficient capital use, enhanced system reliability, and community-driven governance, DePIN not only improves operational efficiency of infrastructure but also creates deep societal impact—setting a new benchmark for future infrastructure development.

Conclusion

The rapid evolution of DePIN reminds us of the transformative shifts seen in the early days of the sharing economy—from bike-sharing and healthcare sharing to portable chargers. Rapid capital inflows aren’t always beneficial—especially in DePIN, where investment focuses more on technological maturity and real-world application expansion. Investors want to see how decentralized technologies translate into tangible benefits in the real world, differing from the initial market expansion patterns of the sharing economy. Moreover, DePIN faces regulatory risks similar to those encountered by the sharing economy, such as data protection, tax compliance, and labor rights—issues that could affect future capital investment.

The river flows eastward—no mountain can stop it.

Despite challenges and uncertainties, the momentum and potential of DePIN driven by decentralized technology remain unstoppable—it will continue moving forward!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News