Software stocks plunged 20%, but I’m heavily invested in Adobe and Salesforce.

TechFlow Selected TechFlow Selected

Software stocks plunged 20%, but I’m heavily invested in Adobe and Salesforce.

The reasons are: high switching costs, strong AI integration capabilities, and extremely low valuation.

Author: Ed Elson

Translated and edited by TechFlow

TechFlow Intro: Last week, the software industry lost $1 trillion in market capitalization—down 14% in a single week and roughly 20% year-to-date. Major names including Shopify, Atlassian, Salesforce, and Adobe all plunged sharply.

Why? Because Anthropic launched Claude Cowork and its domain-specific plugins, and OpenAI soon followed with similar tools. Investors panicked and sold off, concluding “AI has killed software.”

But Ed Elson argues this is irrational panic—and we’ve seen this movie before: Google fell 40% when ChatGPT emerged in 2022; Meta dropped 70% amid TikTok’s rise; and Nvidia declined 30% following DeepSeek’s breakout.

The result? Those companies subsequently rebounded—up 630%, 270%, and 55% respectively from their lows. On Thursday, Elson bought Adobe, Salesforce, ServiceNow, and Microsoft, citing high switching costs, strong AI integration capabilities, and deeply discounted valuations.

Full article below:

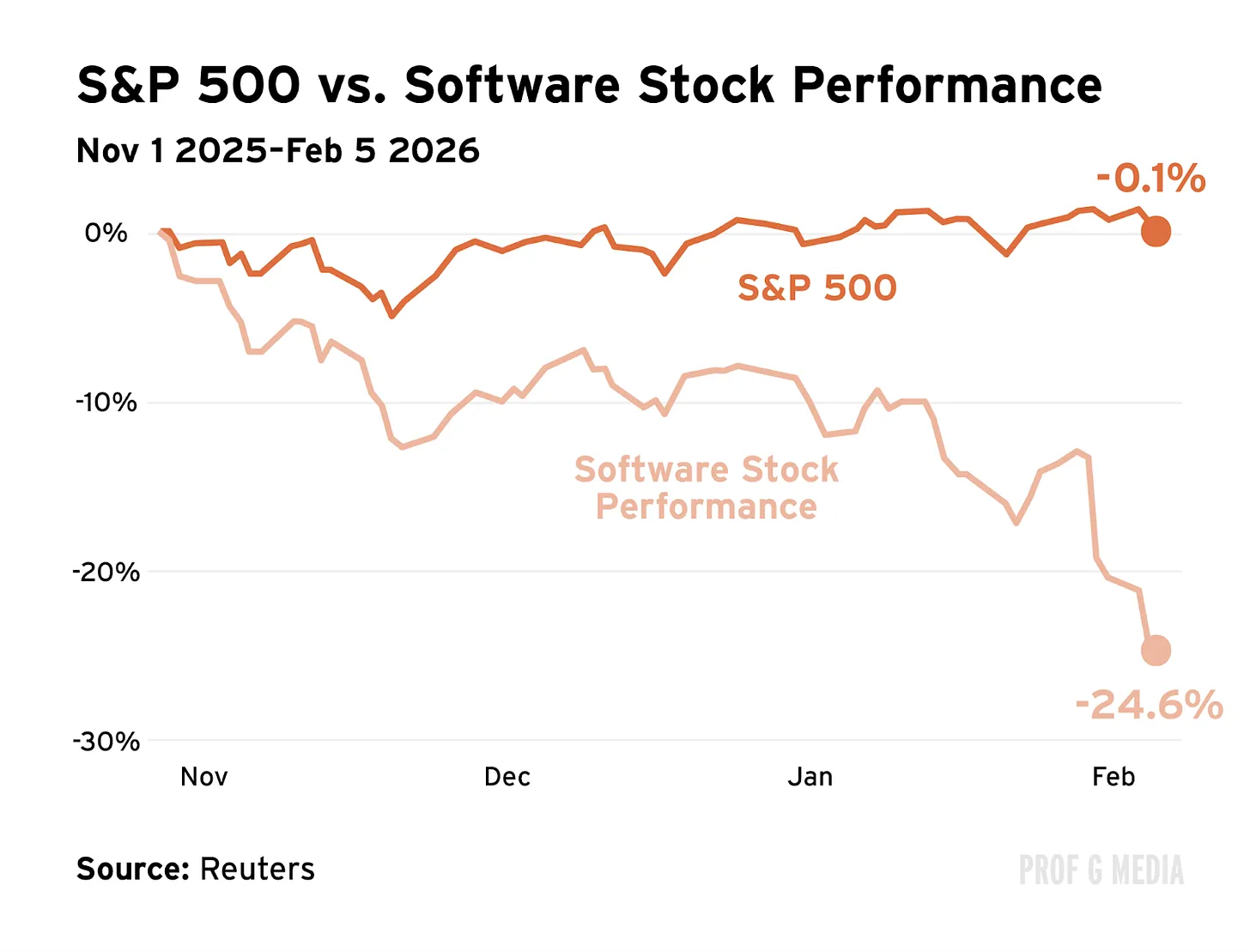

Last week, we witnessed what some called a massacre. $1 trillion in market value vanished. Selling activity hit historic highs. Companies shed 10%, 20%, even 30% of their value. If you were checking your retirement account, you might not have noticed: the S&P 500 index dipped only slightly. That’s because the massacre occurred in one very specific place—a sector that has dominated portfolios for decades and many considered invincible: software.

All the biggest names entered freefall: Shopify, Atlassian, Salesforce, Adobe—the list goes on. The software sector lost roughly 14% of its value in just one week. Year-to-date, that figure now stands at about 20%.

Why did this happen? Because of AI. A few weeks ago, Anthropic launched a new AI tool, Claude Cowork. Then (last week), it released domain-specific plugins—for legal work, sales, finance, marketing, and more. OpenAI quickly followed with similar offerings.

Investors immediately asked themselves an important question: Isn’t that exactly what every traditional software company does? Then came the follow-up: Has AI just killed software? Finally, their conclusion: Sell everything.

Deja Vu

We’ve seen this movie before. In 2022, an AI tool called ChatGPT swept across the internet. Investors asked themselves: Isn’t that exactly what Google does? Within months, Wall Street declared search dead. Google lost up to 40% of its value that year.

Prior to that, a social media app named TikTok arrived. Investors asked: Isn’t that exactly what Meta does? Once Meta reported declining users, $230 billion in market value evaporated—the largest 24-hour sell-off in stock market history. Meta continued to lose up to 70% of its value.

More recently, a Chinese AI model named DeepSeek gained traction. Investors asked themselves: *Isn’t that exactly what OpenAI does?* Since OpenAI isn’t publicly traded, the selling wasn’t visible there—but fear reverberated into public markets. Nvidia lost 30% of its value over the following months.

Since those market dislocations, Nvidia, Meta, and Google have each rebounded—up 55%, 270%, and 630% respectively from their lows. DeepSeek wasn’t the domestic AI killer investors feared. After TikTok, Meta learned and launched its own version—Reels—which now boasts 2 billion active users. After ChatGPT, Google doubled down on AI and ultimately launched Gemini, ChatGPT’s fastest-growing competitor. Google is now widely regarded as the undisputed heavyweight champion of AI.

The pattern here is simple. A transformative technology arrives. Investors indiscriminately conclude “it’s over.” Their judgment about the technology isn’t wrong—but they overestimate its impact. They panic-sell, assuming the game is zero-sum. Valuations collapse. Suddenly, America’s greatest companies trade at half-price. Meanwhile, those same companies continue deploying armies of talent and capital to sharpen focus and neutralize competition. Earnings grow larger, and valuations surge again. Years later, when we look back at the charts, we’ll wonder: What were we thinking? Meaning: all of us who sold.

Panic—and then this

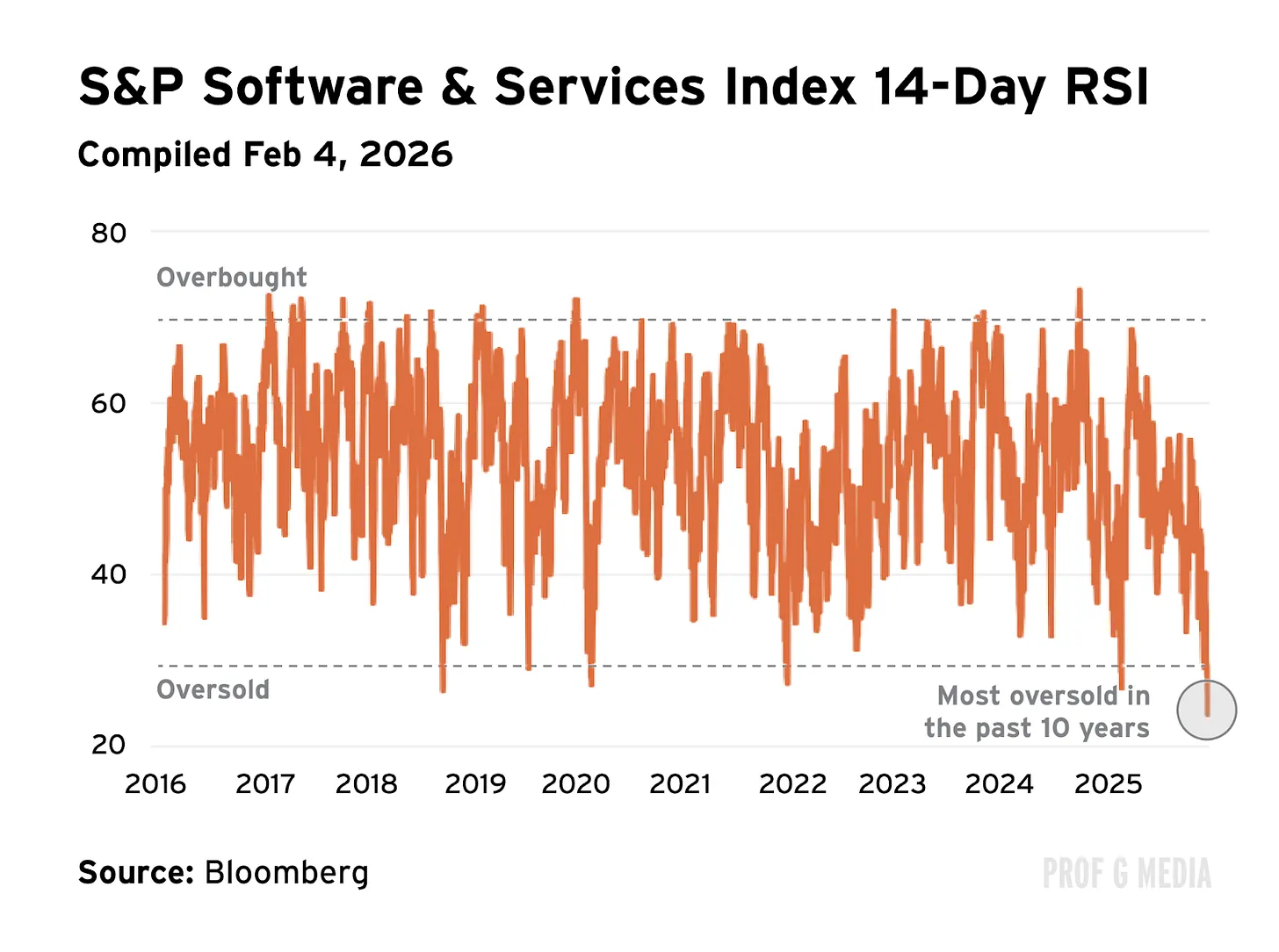

I believe what happened in the software sector last week is no different. This wasn’t a correction—it was a full-blown crisis. Let me paint a picture: The Relative Strength Index (RSI) is a formula that captures buying and selling pressure. An RSI score of 30 signals oversold conditions. Last week, the average RSI for software stocks hit 18. I usually dislike technical analysis—but in this case, it perfectly captures what we’re seeing: Armageddon.

On one hand, the concerns are reasonable. Will AI disrupt software? Yes. Will it pressure margins? Absolutely. Must SaaS companies rethink their distribution? Undoubtedly.

On the other hand, that’s not what the market told us last week. The market told us software is over—regardless of who you are or what you sell. That stance is far more suspect. While I was initially open to hearing the argument, I concluded it doesn’t stem from rationality—it stems from fear. In other words: it’s irrational.

Reality Check

First, nothing prevents software companies from integrating AI. The ChatGPT-versus-Google story is the perfect example. Just because OpenAI has a more exciting product doesn’t mean Google is dead. Google simply enhanced its existing products with AI features (Google Search is now America’s primary AI interface) and built its own AI chatbot. If SaaS companies were ignoring AI, short sellers might have a point—but they aren’t. Software companies are embracing AI across the board.

Second, investors underestimate how painful it is for enterprises to cancel SaaS contracts. Put more commercially: switching costs are extremely high. The average software sales cycle may take over six months to close—and requires approval from ten different decision-makers. This process is arduous, partly because contracts are long-term. We haven’t even mentioned the associated financial cost. For example, a typical Salesforce contract cannot be canceled for free—enterprises must pay 100% of the remaining contract value. In other words, switching your software provider is a massive undertaking. If you’re going to do it, you’d better have an extremely compelling reason why it’s worth it. Moreover, all other executives in your company must agree. Painful. Truly. Painful.

Finally, security is a huge issue in enterprise software. Signing a software agreement essentially means handing over all your private data to a third party—and hoping they won’t lose, misuse, or abuse it. In other words, it demands trust. This is the top priority for 80% of IT leaders. More importantly, trust can’t be coded overnight. It must be built over years—or even decades. It requires long-standing relationships and a substantial track record of success. These are assets traditional companies possess—and Anthropic does not. Trust and security represent a massive advantage that cannot be ignored.

It’s Time to Buy

By Thursday afternoon, I’d seen enough. Two voices echoed in my head: 1) Warren Buffett, telling me to be greedy when others are fearful; and 2) Mark Mahaney, urging me to find “DHQs” (dislocated high-quality companies). I decided it was time to buy—and gave myself two options.

Option 1: Buy the entire software basket. I looked at IGV, an ETF holding all major software names—it had been crushed. There may be a few losers inside, but the average multiple had fallen to a level where I felt I truly couldn’t go wrong. This was the safe choice.

Option 2: Pick individual stocks—identifying a select few software names I believed were high-quality companies. This was the riskier choice, as I risked making mistakes and picking losers. Still, I chose Option 2—because I felt bold.

DHQ (Dislocated High-Quality Companies)

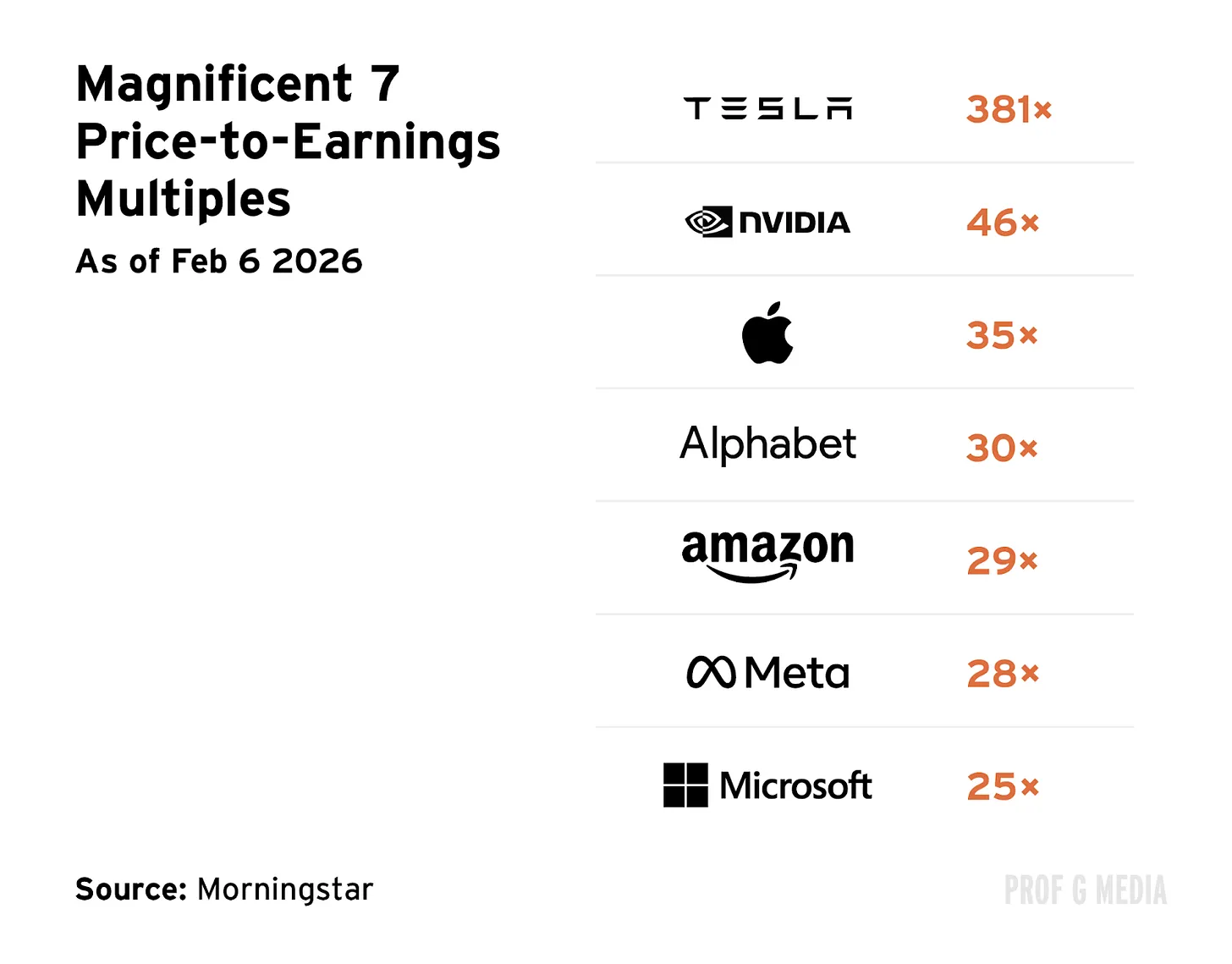

Thursday morning, I bought three stocks: Adobe, Salesforce, and ServiceNow. Later, I added a fourth: Microsoft. Note: I am not a financial advisor, and this is not financial advice—I’m simply telling you what I did. My rationale follows.

1. Adobe

Adobe currently trades at a P/E ratio of 16—less than half its five-year average. It’s also nearly half the S&P 500’s average P/E. It’s extremely cheap. The consensus view is that AI will render it irrelevant—but this overlooks two key facts.

1) Adobe is already aggressively integrating AI. In fact, its AI-powered features already generate over $5 billion in annual recurring revenue—more than half of Anthropic’s ARR.

2) Its moat is enormous. Over 98% of the Fortune 500 use Adobe, and like other software solutions, the product is deeply embedded across the entire creative workflow—making it extremely difficult to switch. It’s so ubiquitous that Adobe proficiency is listed as a job requirement for most digital creative roles. An additional tailwind: short-form video. Adobe Premiere Pro is the industry standard for video editing, and most media companies—including ours—are dramatically expanding short-form video budgets as this medium continues exploding.

2. Salesforce

Salesforce is another AI-powered company widely presumed dead.

Meanwhile, its AI agent products’ ARR quadrupled last quarter, and the company remains ranked #1 in industry trust for CRM. It’s fallen over 40% in the past year, its P/E now sits below the S&P average, and its price-to-cash-flow ratio is about half its five-year average.

Even if Claude has a more interesting product, I don’t believe that will overcome massive switching costs—certainly not within the timeframe Salesforce would need to build its own comparable offering.

3. ServiceNow

ServiceNow has taken a beating this year—down roughly 30% in 2026.

The consensus view is that growth is ending. Meanwhile, fundamentals tell the opposite story: subscription revenue grew 21% last quarter, and total revenue rose 20%. As for its AI capabilities, ServiceNow is more than capable.

In fact, the company expects to generate $1 billion in revenue from its AI products this year. It has also signed multi-year partnerships with both OpenAI and Anthropic—further evidence that the AI revolution isn’t a zero-sum game.

I believe OpenAI and Anthropic will grow significantly this year—and so will ServiceNow.

4. Microsoft

If you listened to yesterday’s podcast, you’ll notice I didn’t mention Microsoft. That’s because I hadn’t yet purchased it at recording time.

My initial view was that I didn’t need Microsoft, given my existing exposure (MSFT makes up 5% of the S&P 500). Yet upon reflection, I decided the valuation was simply too cheap to ignore.

At the time, Microsoft traded at just 25x P/E—the lowest among the Magnificent Seven. Given the reasons I highlighted above, that’s relatively absurd—and especially absurd for another key reason: Microsoft owns nearly one-third of OpenAI.

Even if Microsoft’s lunch gets eaten (which I doubt), the company holds contractual rights to compensation. Few companies are better positioned in AI than Microsoft—and today’s price fails to reflect that.

Efficient Market Hypothesis

In most cases, I believe in the Efficient Market Hypothesis—the idea that markets reflect all available information and are smarter than any individual. I deeply respect markets’ predictive power (especially after they correctly forecast 93% of Golden Globe winners). I don’t claim to be smarter than they are.

Yet I also believe that occasionally, extraordinary events occur—political upheavals, natural disasters, global pandemics, or indeed, the arrival of transformative technologies. In such cases, I believe markets can lose their minds. When that happens, the Efficient Market Hypothesis temporarily breaks down.

I’m risking error—and potential losses—here. But that’s what being an investor means. And if you don’t take risks once in a while… where’s the fun?

See you next week,

Ed

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News