Should Ethereum abandon the 'ultrasound money' concept?

TechFlow Selected TechFlow Selected

Should Ethereum abandon the 'ultrasound money' concept?

It's crucial that Ethereum has stopped promoting the concept of "ultrasound money," but it's unclear whether this is good or bad.

Author: 0xBreadguy

Translation: Peisen, BlockBeats

Editor's note: Due to the Dencun upgrade reducing transaction fees on the Ethereum network, ETH burn levels have dropped to among the lowest since The Merge. CryptoQuant analysts say the Dencun upgrade has made Ethereum inflationary again, potentially undermining its characteristics as an "ultra-sound" money. 0xBreadguy discussed on social media whether the concept of "ultra-sound money" should be abandoned.

It’s crucial that Ethereum stops promoting the idea of being “ultra-sound money”—but I’m not sure whether this is good or bad.

Why? Because users are now being pushed to migrate off mainnet, and it’s unlikely we’ll ever see Layer 2s (L2s) return to the sustained ETH burn levels seen before Dencun (March 2024).

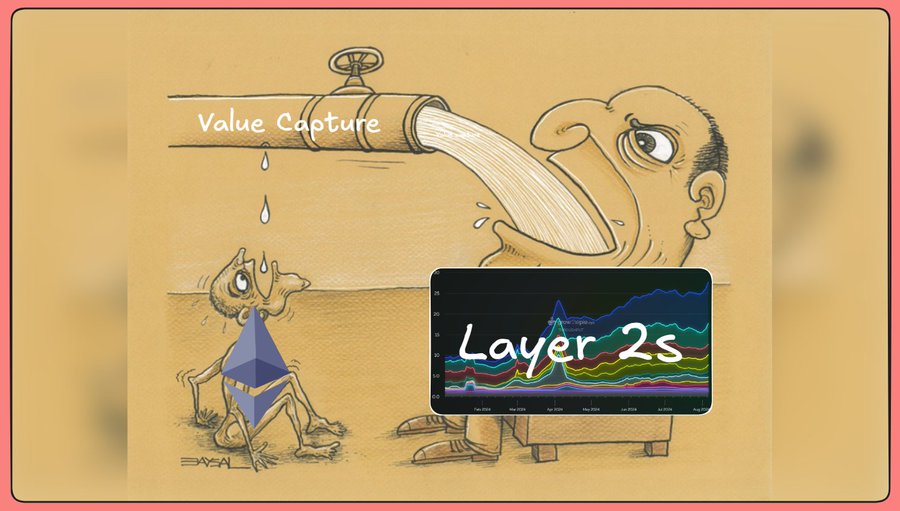

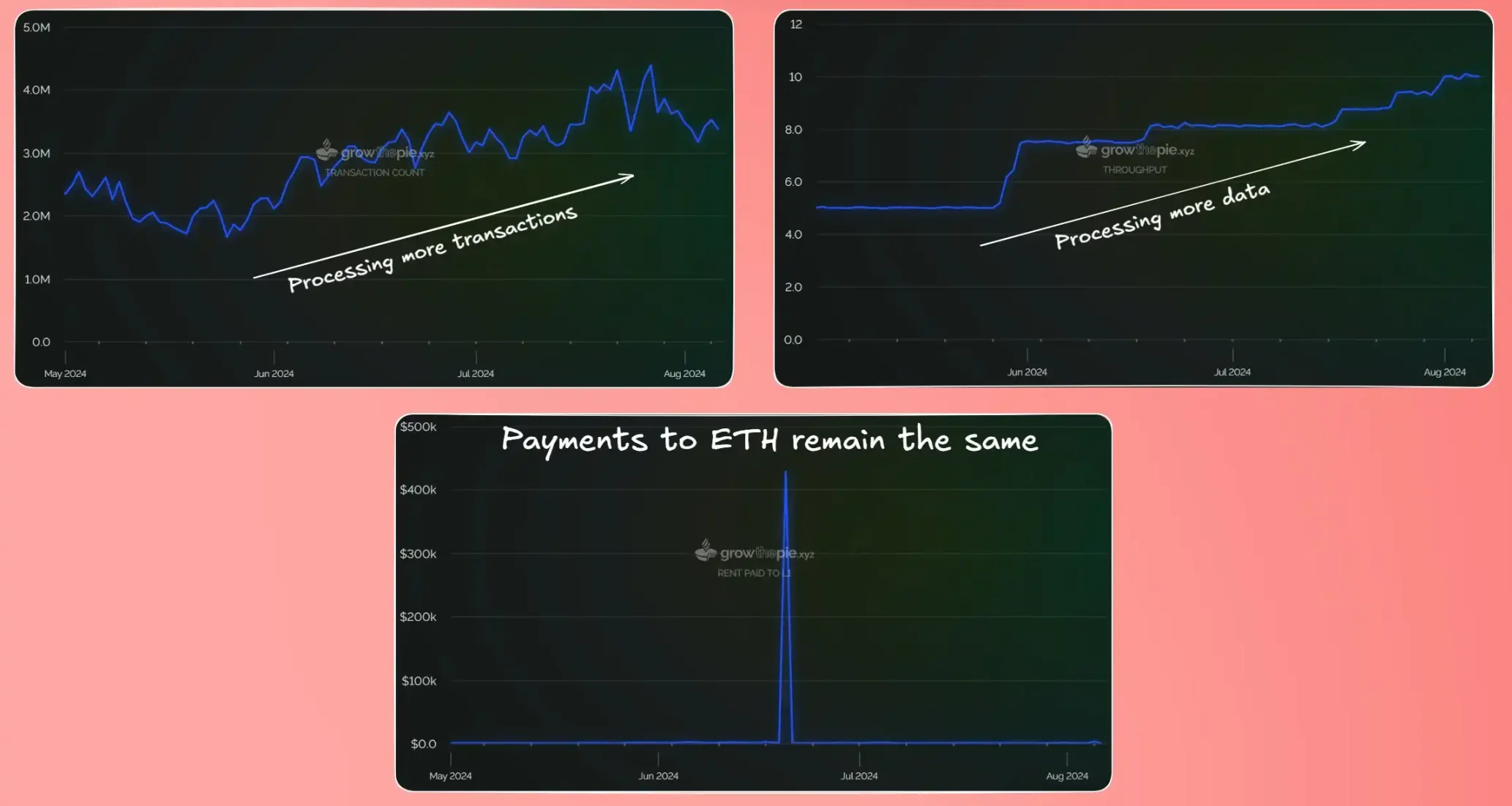

The current state of L2s:

-

Claim execution rewards

-

Own user relationships

-

Scale throughput while maintaining relatively fixed costs to Ethereum (even better with Alt-DA)

Image source: @growthepie_eth

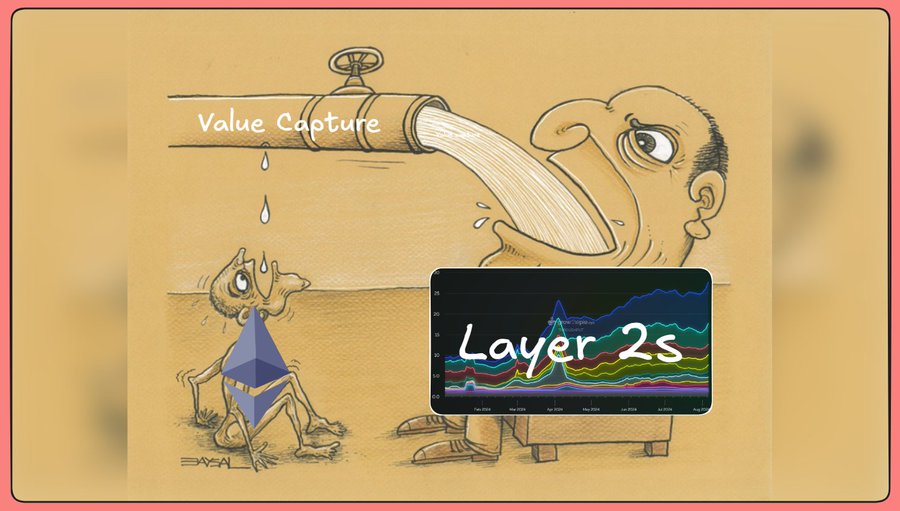

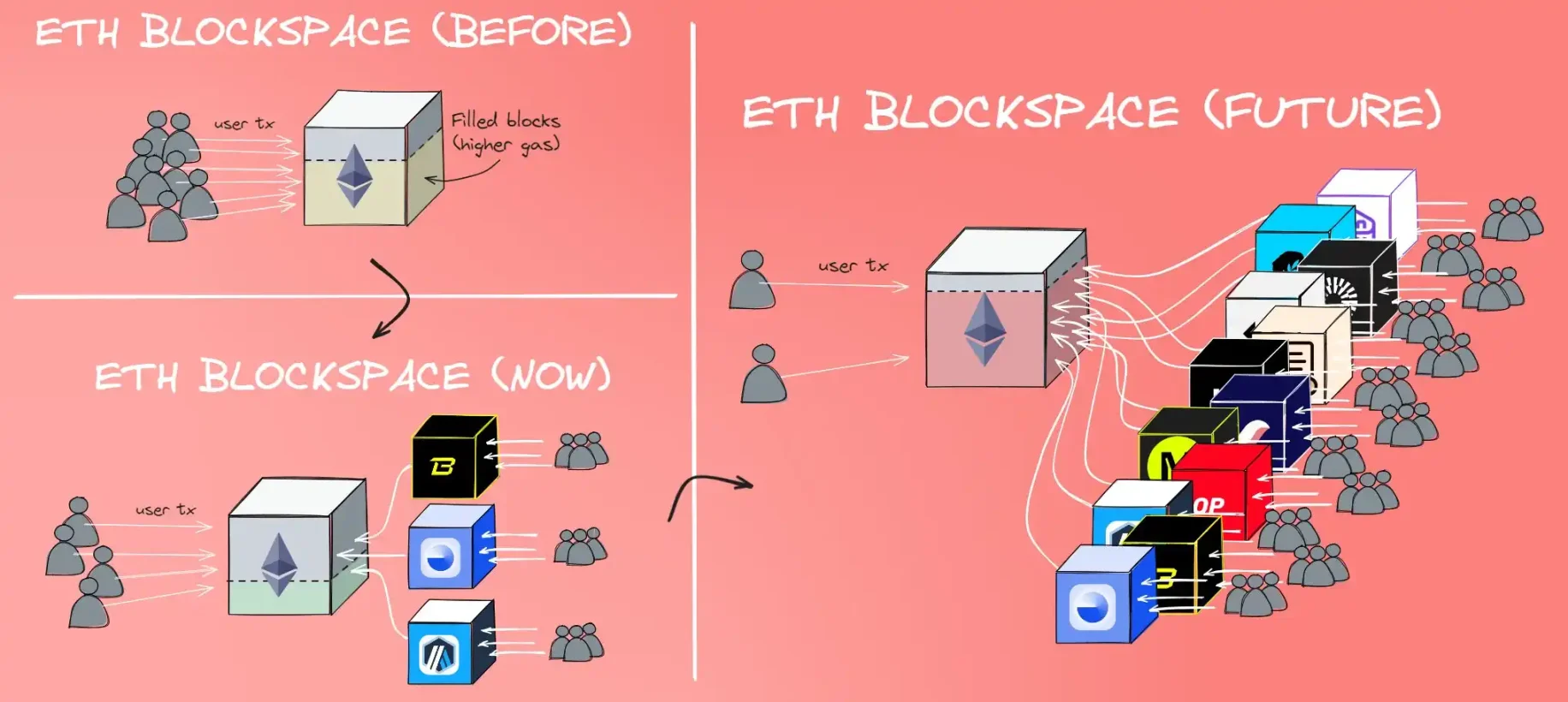

The Future We Imagined

There has always been a gap in the modular roadmap regarding user migration—when on-chain participants move to one or more preferred L2 solutions, activity on mainnet predictably declines.

The overall user flow trend looks roughly like this:

Image source: @growthepie_eth

Activity drops initially, as a small number of users disperse across several early L2 solutions, mainnet, and alternative L1s.

Then, these users are replaced by a wave of new L2 networks competing for the same block space we once used to mint monkey NFTs.

Demand for ETH block space—driven by cost-insensitive users (L2s)—brings the burn mechanism back into discussion. The ecosystem becomes ultra-sound again (ETH gradually deflationary), while scalable L2s attract mass adoption. Fantastic.

However, post-Dencun, things are different.

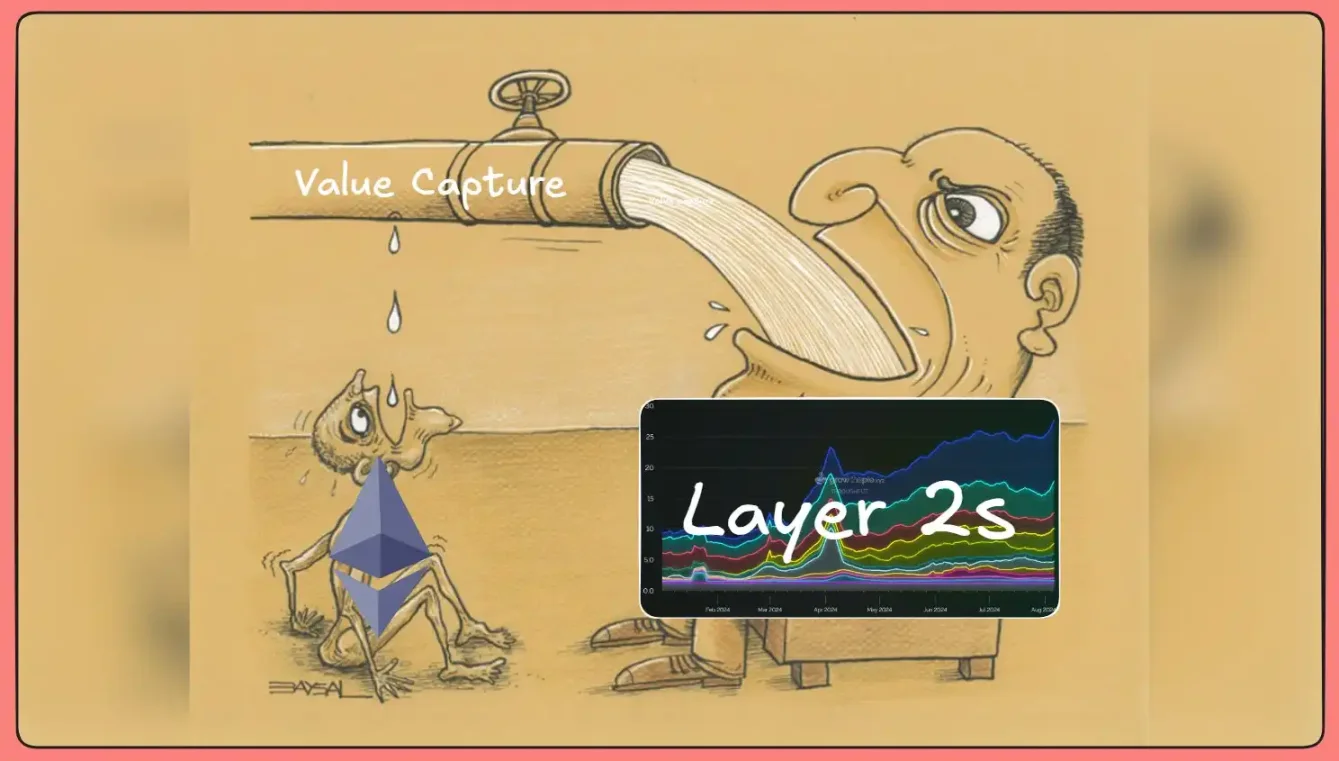

What We’re Seeing Now

Now that blobspace has been introduced, allowing L2s to process most transactions at a 10x discount, another trend is emerging:

Individual L2s are handling increasing transaction volume and throughput while keeping their costs to Ethereum relatively stable.

Here are Base’s metrics over the past 90 days:

-

Transaction volume up ~75%

-

Throughput up ~100%

-

Payments to Ethereum remain unchanged

Image source: @growthepie_eth

What happens when a single L2 ecosystem grows infinitely without adding extra ETH cost? These L2 ecosystems absorb users from other L2s without increasing ETH burn.

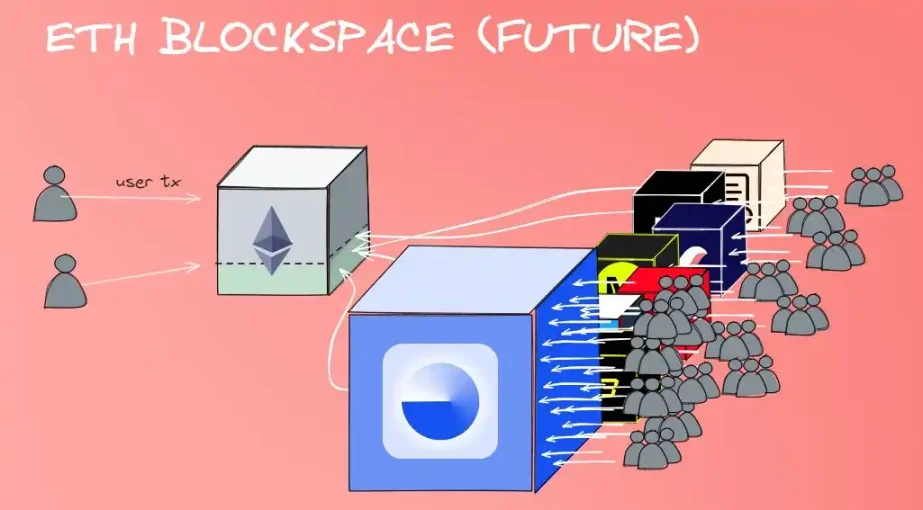

They act like black holes, pulling in users from across the Ethereum ecosystem. This means you likely end up with something like this:

Image source: @growthepie_eth

Power law effects begin to emerge, where dominant L2 solutions attract a disproportionate share of users, while Ethereum utilization remains low because the cost of publishing data to Ethereum stays relatively constant despite growth.

This is why I think it’s time to let go of the “ultra-sound money” concept: for the foreseeable future—especially on crypto timescales—it may no longer be a significant factor.

I’m also not sure this is bad. If you want ETH to serve primarily as a settlement and security layer rather than a user chain, inflation isn’t necessarily harmful—it can help improve liquidity and distribution across all these ecosystems.

Artificially making ETH scarce could hinder these properties (see: Bitcoin). Still, the concept was interesting, and that matters.

Other Thoughts

-

To clarify, these are comments about the “ultra-sound money” concept, not a bearish outlook on the asset itself—I remain optimistic about ETH.

-

I believe core developers should continue advancing the modular roadmap rather than fully shifting focus to scaling L1. They should attempt L1 scaling earlier and for longer before conceding to L2s, but at this point, user education and further economic benefits from L2s offer greater advantages.

-

Make optimizations (e.g., block timing) to reduce unnecessary complexity like pre-confirmations, but keep the overall direction unchanged.

-

The importance of ETFs for ETH cannot be overstated. They are structural game-changers, and in the coming years, all these discussions will become irrelevant compared to their impact.

-

Ironically, is L2s exploiting ETH in this way actually bullish? If I were a corporate entity wanting to monetize my user base, Coinbase has already laid out the perfect blueprint. So I’d still stay within the Ethereum ecosystem, perpetuating this concept—but from an extractive position. Not sure which side of this pendulum matters more.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News