Market Volatility Fails to Deter Inflows: ETF Giants Quietly Accumulate Large Amounts of Bitcoin and Ethereum

TechFlow Selected TechFlow Selected

Market Volatility Fails to Deter Inflows: ETF Giants Quietly Accumulate Large Amounts of Bitcoin and Ethereum

These daily double-digit market adjustments have provided clients of the world's largest asset management firms with favorable entry points.

Author: Kairos Research

Compiled by: TechFlow

Crypto Twitter (CT) has a unique talent for endlessly debating trivial issues while overlooking the real forces reshaping markets. Despite volatility during this week's correction, inflows into Bitcoin (BTC) and Ethereum (ETH) ETFs continue unabated. To date, ETF issuers like BlackRock and Fidelity have accumulated substantial amounts of BTC and ETH—surpassing many native crypto peers—and have become among the largest holders of these two leading digital assets.

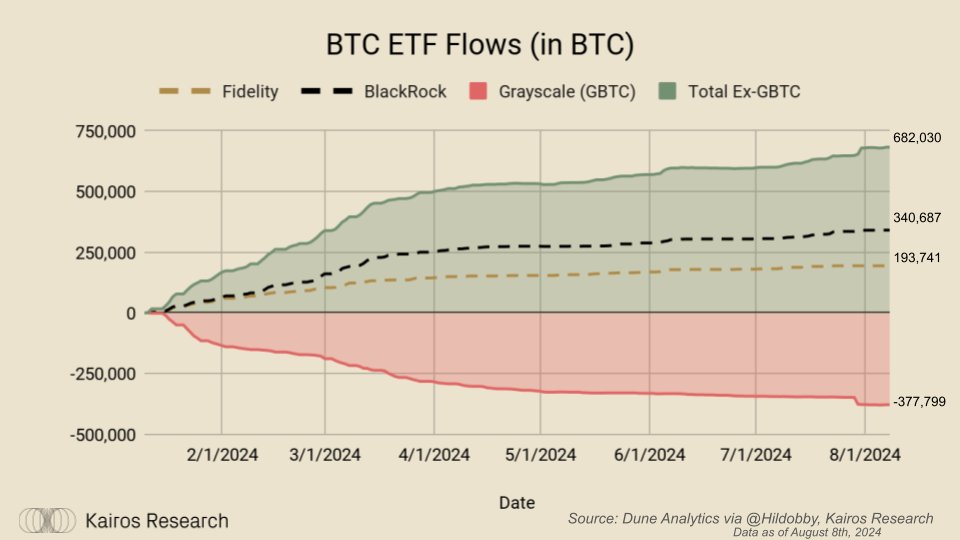

For Bitcoin (BTC):

After 141 trading days, net inflows into BTC ETFs now stand at approximately $18 billion. BlackRock currently holds 340,000 BTC, valued at around $19.5 billion, while Fidelity holds 193,000 BTC worth $11.2 billion.

Compared to native crypto peers and other entities:

Bitfinex holds 203,000 BTC

Kraken holds 186,000 BTC

Wrapped Bitcoin (wBTC) holds 151,000 BTC

Robinhood holds 140,000 BTC

OKX holds 121,000 BTC

Tether holds 75,000 BTC

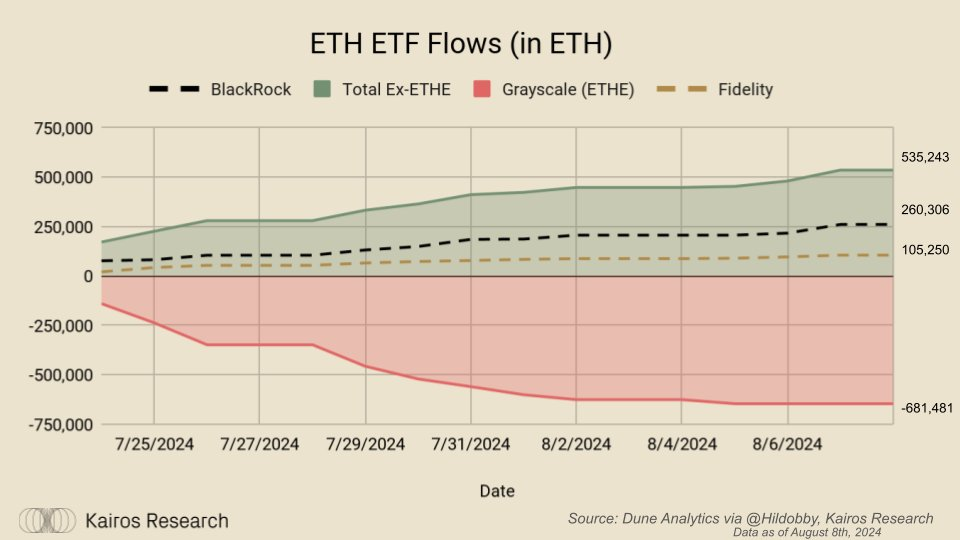

For Ethereum (ETH):

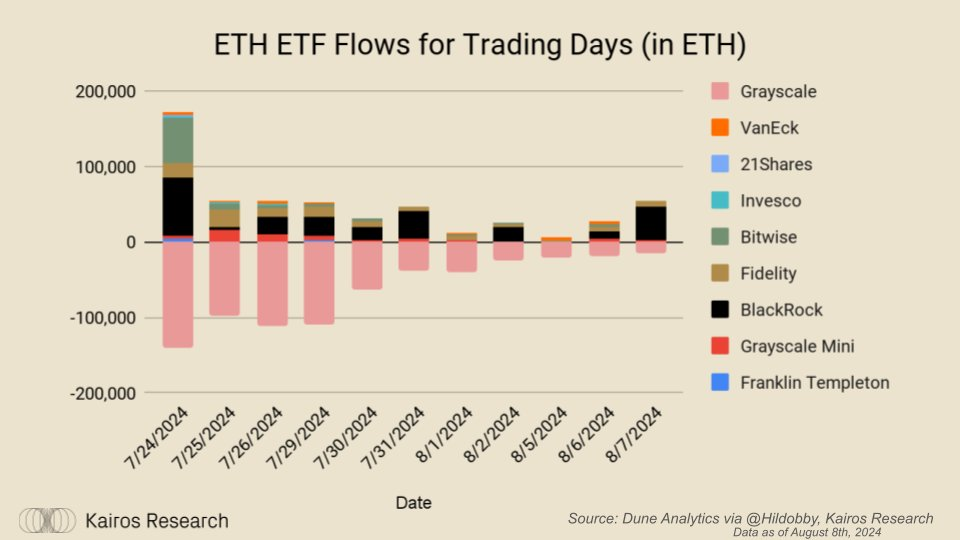

Within just 11 trading days, ETH ETFs have seen a net outflow of $132,000, primarily driven by outflows from Grayscale’s ETHE, which we attribute to higher management fees and profit-taking by investors who bought significantly below net asset value. Nevertheless, BlackRock’s ETHA has already accumulated 260,000 ETH, worth approximately $634 million, in this short period. Fidelity has also received significant inflows, totaling 105,000 ETH worth $256 million.

Compared to native crypto peers and other entities:

Linea holds 188,000 ETH

Gate.io holds 171,000 ETH

Polygon holds 160,000 ETH

zkSync holds 138,000 ETH

Bithumb holds 122,000 ETH

KuCoin holds 110,000 ETH

Scroll holds 102,000 ETH

Compound holds 71,000 ETH

A single day of strong capital flows into ETH ETFs is equivalent to launching a top-10 Layer 2 project. As on-chain demand drivers through DeFi primitives continue to fuel usage and underlying token demand, a feedback loop begins forming alongside ETF inflows.

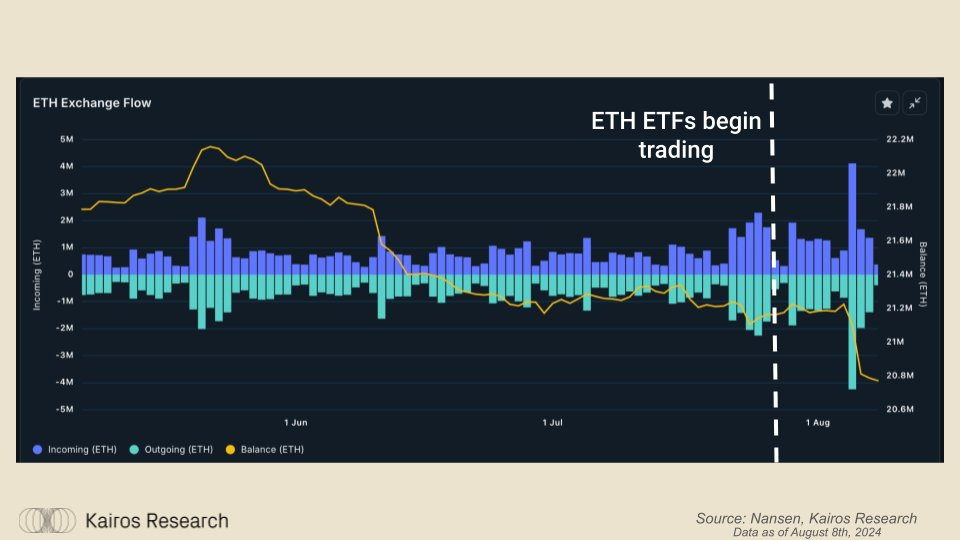

Meanwhile, exchange-based ETH balances continue to decline.

With the emergence of Bitcoin staking and Bitcoin Layer 2 solutions, Bitcoin DeFi is beginning to revive. We expect more on-chain demand drivers will emerge in this ecosystem as well, creating additional supply sinks for crypto’s largest asset.

Looking ahead, we anticipate that a SOL ETF would perform similarly to today’s ETH ETF. However, a much larger portion of Solana’s supply is staked—around 65%, compared to roughly 27% for Ethereum. Moreover, with key usage metrics for Solana continuing to rise, there is good reason to believe various on-chain supply sinks will keep emerging. Additionally, with the SEC withdrawing its request to classify Solana as a security in its ongoing Binance lawsuit, the path toward approval of a SOL ETF is becoming clearer. Notably, neither ETH nor BTC were named in the initial complaint.

Overall, fund flows into digital asset ETFs remain robust—not only in dollar terms but also structurally in terms of supply dynamics. While volatility is certainly difficult to endure, these double-digit daily market corrections provide favorable entry points for clients of the world’s largest asset managers to gain exposure to what may be the most exciting asset class of the century. Token supplies are finite, but demand drivers are multiplying.

Disclaimer:

The information provided by Kairos Research (including but not limited to research, analysis, data, or other content) is for informational purposes only and does not constitute investment advice, financial advice, trading advice, or any other form of advice. Kairos Research does not recommend buying, selling, or holding any cryptocurrency or other investment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News