Breaking the 'zombie company' dilemma and following MicroStrategy's example, U.S.-listed healthcare company Semler Scientific launches Bitcoin strategic reserve

TechFlow Selected TechFlow Selected

Breaking the 'zombie company' dilemma and following MicroStrategy's example, U.S.-listed healthcare company Semler Scientific launches Bitcoin strategic reserve

Since announcing its Bitcoin asset reserve strategy on May 28, Semler Scientific has accumulated a total of 929 bitcoins.

Author: Weilin, PANews

MicroStrategy, currently the publicly traded company holding the largest amount of Bitcoin globally, has not only inspired Japanese-listed firm Metaplanet to follow suit in increasing its Bitcoin reserves, but has also become a case study for Semler Scientific, a U.S.-listed medical technology company.

On May 28 this year, the healthcare company—then valued at $200 million—announced its Bitcoin reserve strategy, purchasing 581 Bitcoins for $40 million. The following week, on June 6, Semler Scientific announced another purchase of 247 Bitcoins for $17 million. In the announcement, CEO Doug Murphy-Chutorian emphasized that this was just the beginning.

On August 6, Semler Scientific announced an additional purchase of 101 Bitcoins for $6 million. Since announcing its Bitcoin asset reserve strategy on May 28, 2024, the company has cumulatively acquired 929 Bitcoins at a total cost of $63 million. Recently, Eric Semler, Chairman of Semler Scientific, revealed the story behind this strategic shift toward increasing Bitcoin holdings.

Significant Stock Price Boost, Founder Enthusiastic About Investing in 'New Gold'

Semler Scientific is a U.S.-listed company that develops and manufactures innovative products and services supporting early detection and treatment of chronic diseases. Its founder, Dr. Herbert Semler, who served as an aviation surgeon during the Korean War and later specialized in cardiology at a hospital in Portland, co-founded Semler Scientific (SMLR) in 2007. The company's stock reached its peak on October 1, 2021, trading at $153.21, but afterward, compared to larger firms, it struggled with competitiveness and visibility.

However, since announcing its Bitcoin asset reserve strategy on May 28, 2024, Semler Scientific’s stock price has seen a significant boost. On May 24, SMLR traded at $23.32 on Nasdaq; by June 12, it had risen to $40.57—a 74% increase. As of August 7, amid a broader downturn in U.S. markets, the stock had pulled back to $27.52.

"He was very excited," said Eric Semler, son of founder Herbert Semler, describing his father’s reaction to the new investment strategy. Eric explained that his grandfather, Harry Semler, viewed gold as a great investment in his time, so Herbert was pleased to see the company investing in the "new gold."

Eric Semler has been a professional investor since 1998. He got acquainted with Bitcoin entrepreneurs early in the cryptocurrency space and began buying personally in 2016. He said his investment focus has always been on future trends, and he enjoys identifying stocks and companies—ranging from small-cap to large-cap—that align with those trends. However, Eric remained relatively passive in his involvement with Semler Scientific until April 2023, when corporate governance issues prompted him to take a more active role.

Breaking Free from the 'Zombie Company' Trap, Emulating—and Becoming—MicroStrategy

When U.S. software company MicroStrategy began investing in Bitcoin in August 2020, some thought then-CEO Michael Saylor was crazy. Despite Bitcoin’s plunge in 2022, which led to massive paper losses on MicroStrategy’s Bitcoin purchases, its stock still traded above pre-Bitcoin investment levels. Now, amid the current bull market, the company’s market capitalization approaches $30 billion—nearly 30 times its value in August 2020. On August 7, Tree News reported that Michael Saylor personally holds over $1 billion worth of Bitcoin.

Other companies have taken note of MicroStrategy’s success story, and now there are increasingly more followers.

PANews previously reported on Japanese-listed company Metaplanet’s Bitcoin investment strategy. Formerly operating in the economy hotel business, Metaplanet has announced several large-scale Bitcoin purchases since April this year. As of July 22, Metaplanet held a total of 245.992 Bitcoins. After pivoting to Bitcoin investments, market sentiment quickly improved, and after a prolonged slump, the company’s stock surged 360% between April and June.

On August 8, Metaplanet announced it had successfully secured a 1 billion yen loan (at an annual interest rate of 0.1%), with funds earmarked for further Bitcoin acquisitions.

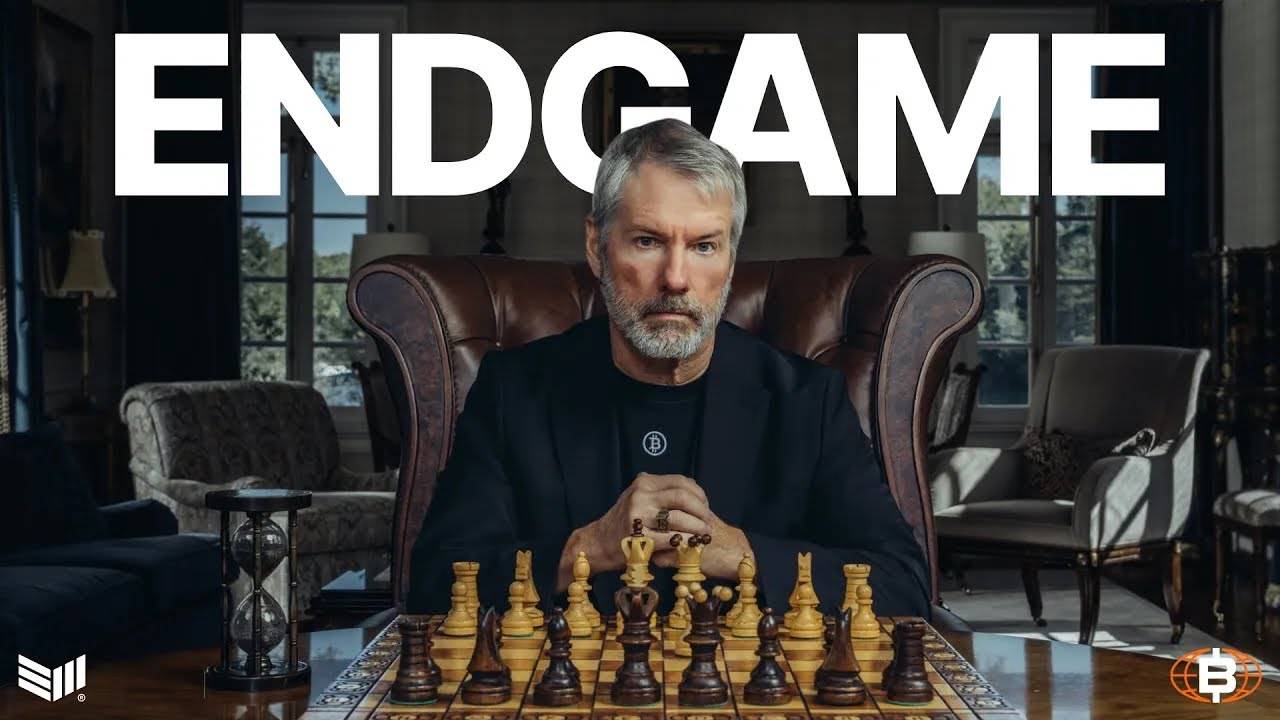

Michael Saylor, Chairman of MicroStrategy

Michael Saylor, Chairman of MicroStrategy

In early May this year, MicroStrategy Chairman Michael Saylor reiterated his views on Bitcoin in an episode of the On The Tape podcast, explaining why Bitcoin can help dead money and zombie companies escape their困境: "We were too ambitious, actually calling on a nation to do this. A more pragmatic and practical next step would be to have a thousand companies in the Russell 2000 index do this—all of them are dead money and zombie companies. Let them start doing this. Japan also has many such zombie companies. So the issue is, thousands of companies have stagnant treasuries because their capital assets sitting in the treasury carry negative real yields."

"I think the obvious beneficiaries listening to this podcast should be shareholders, managers, and directors of small and medium-sized companies, especially public companies that essentially cannot outperform the 'Magnificent Seven.' If you believe you can't surpass companies like Google, Meta, Microsoft, and Nvidia, and you have some cash on hand, then you should either use your cash to buy Bitcoin, issue shares to buy Bitcoin, or issue bonds—preferably convertible bonds that convert into equity—to buy Bitcoin, because this allows you to recapitalize through appreciating assets rather than lose capital or hold depreciating assets with negative real yields that erode shareholder value."

This time, Eric was clearly inspired by Michael Saylor’s thinking. Eric stated publicly, "Michael Saylor’s warning about small companies holding large amounts of cash—zombie companies ignored by the stock market—resonated deeply with all members of our board." As a result, they decided to study MicroStrategy’s success and recognized the value in adopting its strategy.

On Monday (August 5), crypto market conditions saw significant volatility. Eric Semler noted that when Bitcoin dropped to around $57,000, the value of the company’s Bitcoin holdings decreased by approximately $10 million. However, this did not shake the board’s conviction. "When you have such strong conviction about something, you must be willing to step up and buy even when things aren’t going well," he said. "I think the ultimate test of conviction is whether you’ll buy something that has fallen—something you once bought at a price 20% higher."

Drawing from Michael Saylor’s strategy, Semler Scientific has begun raising capital in the financial markets to purchase more Bitcoin. In early June, the company filed a mixed shelf offering registration statement with the SEC for a $150 million equity issuance. It is currently awaiting approval from the U.S. Securities and Exchange Commission to move forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News