MicroStrategy renamed to "Strategy", Q4 Bitcoin holdings nearly doubled, aiming to create Bitcoin "intelligent leverage"

TechFlow Selected TechFlow Selected

MicroStrategy renamed to "Strategy", Q4 Bitcoin holdings nearly doubled, aiming to create Bitcoin "intelligent leverage"

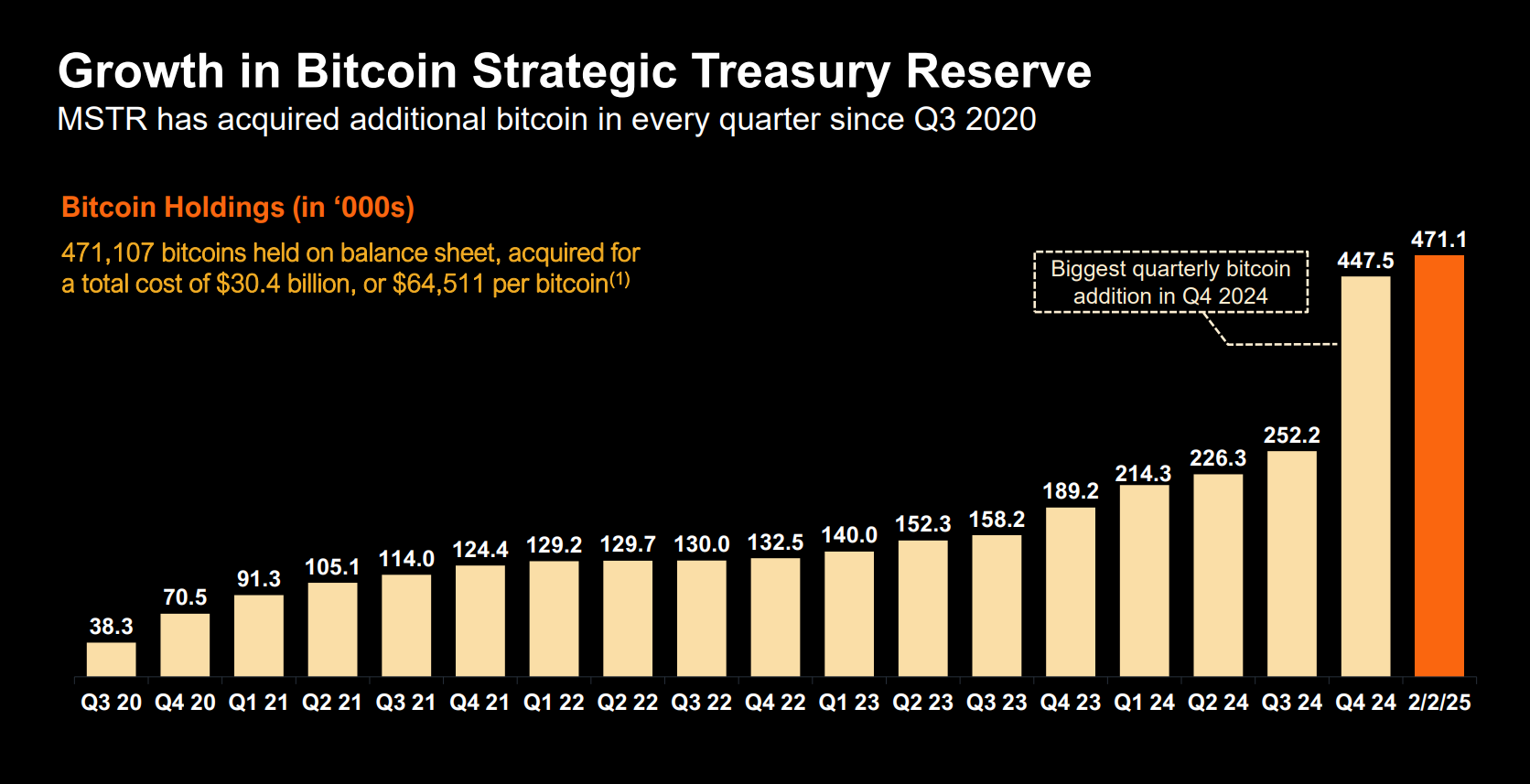

Q4 financial reports show that Strategy's Bitcoin holdings nearly doubled in just three months.

Author: Weilin, PANews

In the early hours of February 6, Beijing time, MicroStrategy held its 2024 fourth-quarter earnings call and announced a rebranding initiative, officially changing its name to "Strategy" and referring to itself as "the world's first and largest bitcoin treasury company."

The Q4 financial report shows a net loss of $670.8 million, with operating expenses (including impairment losses from bitcoin holdings) reaching $1.103 billion for the quarter, an increase of 693% year-on-year.

Strategy's bitcoin holdings nearly doubled within just three months. Additionally, Strategy has established KPIs—annual "BTC Gain" and "BTC $ Gain"—and set a target of $10 billion in annual "BTC $ Gain" for 2025. During the call, company founder and CEO Michael Saylor also revealed a new strategy to attract "a large number of investors."

Q4 Earnings: Bitcoin Holdings Nearly Doubled in Three Months

In the fourth quarter of 2024, Strategy reported a net loss of $670.8 million, or $3.03 per share, compared to a profit of $89.1 million, or $0.50 per share, in the same period last year. The loss was primarily driven by a $1.01 billion impairment charge on bitcoin holdings, significantly higher than the $39.2 million impairment recorded during the prior-year quarter.

Operating expenses for the quarter (including impairment losses on bitcoin holdings) reached $1.103 billion, up 693% year-over-year. As of December 31, 2024, the company’s cash and cash equivalents stood at $38.1 million, down from $46.8 million in the prior-year period.

While most investors focus on Strategy's bitcoin assets, the company also reported results from its traditional software business. Fourth-quarter software revenue totaled approximately $121 million, down 3% year-over-year. Full-year 2024 revenue was about $464 million, down 7% from the previous year.

According to the earnings report, the most striking development is that its already substantial bitcoin holdings nearly doubled in just three months. As of January 24, Strategy holds 471,107 bitcoins, valued at approximately $44 billion, with a total cost basis of $30.4 billion. The fourth quarter marked the largest quarterly increase in bitcoin holdings in the company’s history, with 218,887 bitcoins acquired for $20.5 billion. Throughout 2024, the company purchased 258,320 bitcoins at a total cost of $22.1 billion, averaging $85,447 per bitcoin.

Since August 2020, Strategy has added bitcoin to its balance sheet every quarter, issuing over 50 public announcements. This time, the company reported a 74.3% bitcoin yield for 2024, a metric used to evaluate the performance of its bitcoin investment strategy.

As described in the meeting materials, "BTC Yield is a key performance indicator (KPI) representing the percentage change over a period in the ratio of the number of bitcoins held by the company to its assumed diluted share count." Strategy has raised its annual BTC Yield target for the next three years from a range of 6%-8% to 15%. The company achieved a BTC Yield of 2.9% in Q4, compared to 5.1% in Q3.

Strategy also introduced another new KPI—annual "BTC Gain" and "BTC $ Gain"—and set a target of $10 billion in annual "BTC $ Gain" for 2025.

BTC Gain represents the number of bitcoins held by the company at the beginning of a period multiplied by the BTC Yield for that period. BTC $ Gain is the dollar value of BTC Gain, calculated by multiplying BTC Gain by the market price of bitcoin on Coinbase at 4:00 PM Eastern Time on the last day of the applicable period.

Bitcoin's "Smart Leverage"

To better reflect its bitcoin strategy, MicroStrategy announced it will now operate under the brand name Strategy. The announcement states that Strategy is the world’s first and largest bitcoin treasury company, the largest independent publicly traded business intelligence company, and a component of the Nasdaq-100 Index. The new logo features a stylized "B," symbolizing the company’s bitcoin strategy and its unique position as a bitcoin treasury company. The primary brand color has changed to orange, representing energy, intelligence, and bitcoin.

In its third-quarter earnings release from October last year, Strategy unveiled its "21/21 Plan," aiming to raise $42 billion in funding over the next three years—$21 billion through equity financing and another $21 billion through issuance of fixed-income securities.

Strategy significantly accelerated its capital raising and bitcoin purchasing pace in the fourth quarter of 2024, raising $15 billion through equity offerings and $3 billion through convertible bonds in less than two months.

"We’ve completed $20 billion of our $42 billion capital plan, well ahead of our original timeline, while leading the digital transformation of capital in financial markets," said CEO Phong Le in the announcement. "Looking ahead to the remainder of 2025, we are well positioned to further enhance shareholder value by leveraging strong support from institutional and retail investors in our strategic plan."

Beyond this, during the earnings call, company founder Michael Saylor highlighted a 45% volatility gap between bitcoin and traditional markets and revealed a new strategy to attract "a large number of investors."

"We've designed our business to maintain volatility," Saylor said, contrasting Strategy’s approach with traditional corporate treasury operations, which typically aim to minimize volatility.

A gap of roughly 45% exists between traditional assets (such as SPDR S&P 500 ETF and Invesco QQQ Trust, with volatility levels between 15–20) and bitcoin (with volatility levels between 50–60). Strategy targets even higher volatility for its common stock—aiming for a level of 80–90—while maintaining what Saylor calls "smart leverage" through a combination of equity offerings and convertible bonds.

"There are many investors who want this kind of volatility. They might not want MicroStrategy’s extreme leverage, nor perhaps the raw, unfiltered volatility of IBIT or BTC, but Strike (Strategy’s perpetual preferred shares STRK) attracts a new group with different return and volatility characteristics," Saylor said.

Saylor referred to the Strike preferred shares, which offer an 8% dividend yield and exposure to bitcoin. On January 27, according to official news, MicroStrategy announced its intention to issue 2,500,000 shares of MicroStrategy Series A Perpetual Preferred Stock, subject to market and other conditions. MicroStrategy intends to use the net proceeds from this offering for general corporate purposes, including purchasing bitcoin and working capital.

Subsequently, these shares were sold at $80 per share, 20% below market price, effectively increasing buyers’ yields to 10%.

For now, with the rebranding to Strategy and significant growth in its bitcoin holdings, the company is demonstrating its ambition to be one of the largest bitcoin treasury companies globally. Going forward, whether Strategy can continue generating returns from bitcoin investments while executing flexible strategic planning will be key to its success.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News