MicroStrategy 2.0: Can Solv Become the On-Chain "Bitcoin Wealth" Company?

TechFlow Selected TechFlow Selected

MicroStrategy 2.0: Can Solv Become the On-Chain "Bitcoin Wealth" Company?

Who Will First Rush to the "Vast New Frontier" of On-Chain Asset Management?

By Chandler, Foresight News

When the Bitcoin price entered the six-figure range again, it was already in the hundred thousands.

Since its November 2022 low, Bitcoin has surged by 570%, pushing its market capitalization close to $2 trillion—surpassing government bond markets of countries like Spain and Brazil, and approaching the total market cap of the entire UK FTSE 100 Index (the top 100 companies by market value on the British stock exchange).

In this new wave of momentum, one company successfully seized the opportunity, transforming itself from crisis into a stunning comeback. That company is MicroStrategy.

As of January 6, MicroStrategy holds 446,400 bitcoins, representing 2.12% of Bitcoin’s total supply.

Due to its deep integration with Bitcoin, MicroStrategy's stock has become what many call a "Bitcoin proxy." In December 2022, when Bitcoin hit its lowest point, MicroStrategy’s share price dipped below $14.16. Two years later, it reached a high of $473, with a peak market capitalization nearing $100 billion—an increase of over 3,720%—making it a favorite among Wall Street hedge funds.

All of this奇迹 began with Michael Saylor’s strategic decision to adopt Bitcoin as corporate treasury reserves.

MicroStrategy’s “Davis Double Play”

It's important to note that MicroStrategy’s growth logic relies on a unique financial leverage mechanism operating across traditional and crypto markets, amplifying asset growth and shareholder returns through external capital.

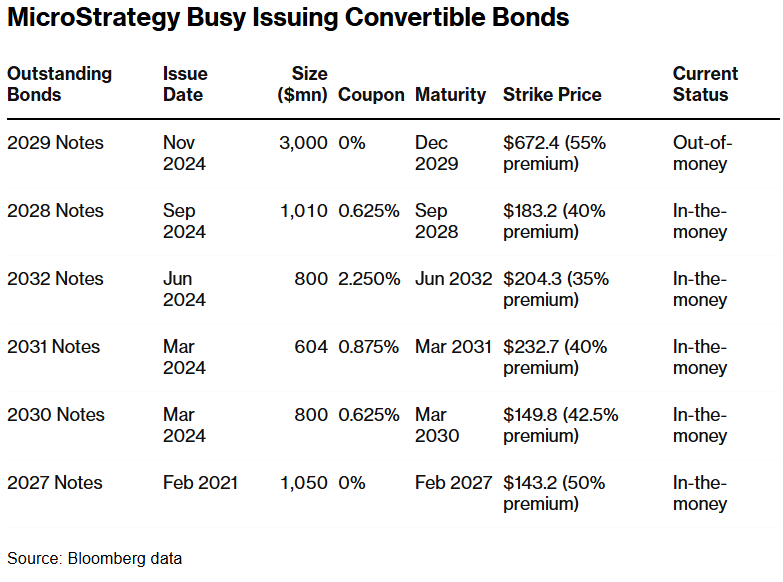

MicroStrategy’s multiple convertible bond financings

Under MicroStrategy’s model, increasing Bitcoin holdings continuously raise the company’s equity per share (net asset value per share). When Bitcoin rises in price, not only does the value of its reserves increase, but the capital raised via ATM offerings and convertible bonds also appreciates more rapidly.

This phenomenon is known as the “Davis Double Play”—a term describing how shareholder gains come from two sources: first, appreciation in Bitcoin’s price; second, the compounding effect of expanding asset scale through financing.

Michael Saylor once explicitly stated: “MicroStrategy = Bitcoin wealth operations + Bitcoin reserves,” where wealth operations include issuing securities, acquiring Bitcoin, adjusting leverage, and managing dividends.

Unfortunately, MicroStrategy’s Bitcoin reserve model still has limitations—it fails to fully unlock the dynamic income potential derived from holding Bitcoin.

It is precisely against this backdrop that Solv Protocol emerges, opening a new path for Bitcoin asset management by offering a more active solution than MicroStrategy’s simple “buy and hold” approach, positioning itself as a more imaginative on-chain version of MicroStrategy.

The Evolution of On-Chain Bitcoin Reserves: From Idle Assets to Dynamic Yield Generation

Imagine if this financial leverage model could be replicated natively within the crypto market—creating an on-chain protocol that mirrors MicroStrategy’s growth flywheel. What would we need?

We must first understand the core components of MicroStrategy’s growth engine: financial leverage, Bitcoin as a value anchor, and a cycle of capital appreciation and reinvestment.

To successfully translate this model into an “on-chain MicroStrategy,” the foundation lies in establishing a solid value anchor—such as Bitcoin or another digital asset—to serve as the base for corporate asset backing and capital appreciation. Next, we need a flexible capital-raising and incremental investment mechanism that drives market valuation growth through asset appreciation. Continuous capital inflow and reinvestment create a self-reinforcing “growth flywheel,” enhancing overall asset value and delivering returns to investors. Finally, leveraging DeFi’s innovation capacity can boost asset liquidity and yield generation, fueling market expansion and financialization.

Solv Protocol is a native yield platform powered by decentralized asset management infrastructure. It focuses on tokenizing and aggregating high-quality yields across the industry, acting as a unified liquidity gateway to reduce barriers and costs for users seeking premium investment opportunities. Users deposit BTC to receive SolvBTC—a token minted through Bitcoin staking. Holders of SolvBTC maintain exposure to BTC while earning additional native BTC yields generated through strategies such as market making, delta-neutral interest rate strategies, and cross-exchange arbitrage.

Compared to MicroStrategy’s growth flywheel, Solv offers a distinct path to capital appreciation and expansion through innovative staking mechanisms and a cross-chain yield aggregation platform.

Specifically, Solv’s “flexibility” in capital raising is evident in its staking and liquidity design. By converting Bitcoin into SolvBTC, Solv enables both capital appreciation and diversified yield generation. This dynamic “buy and stake” model is more flexible than MicroStrategy’s passive “buy and hold” strategy, offering Bitcoin more utility and value-addition pathways.

Through this mechanism, Solv effectively creates an “incremental capital” model: as Bitcoin staking and yield strategies continue, Solv expands its Bitcoin reserves while dynamically growing platform capital value and ecosystem appeal. Thus, in terms of Bitcoin reserve management, Solv shares fundamental similarities with MicroStrategy—both rely on Bitcoin’s reserve value to drive enterprise valuation growth. But Solv achieves this in a decentralized manner, enabling more diversified and highly liquid capital appreciation.

Moreover, according to recent announcements, Solv is launching a Bitcoin Reserve Offering (BRO) to build a protocol-owned Bitcoin reserve, using proceeds to purchase Bitcoin. The first BRO will be available to institutional buyers from traditional finance (TradFi), launching after the official release of the SOLV token. However, details about the initial BRO sale—including coupon rate, maturity date, and conversion premium—have not yet been disclosed.

In other words, Solv not only replicates MicroStrategy’s growth flywheel but enhances it with staking and yield aggregation mechanisms, transforming its Bitcoin reserves into continuously growing financial assets. This significantly incentivizes Bitcoin holders to participate in the platform’s reserve and staking activities, creating an even larger, self-reinforcing cycle of value creation and capital expansion.

On another front, similar to MicroStrategy, Solv’s market cap is expected to grow substantially as its Bitcoin holdings increase.

According to Defillama data, Solv Protocol has locked up over 33,000 BTC, with total platform TVL approaching $3.3 billion. If Solv reaches a Bitcoin holding size comparable to MicroStrategy—say, 400,000 BTC—its market capitalization could exceed tens of billions, potentially reaching nearly $100 billion at current prices.

Solv: Pioneering the Future of On-Chain Digital Asset Management as the On-Chain MicroStrategy

Solv represents a breakthrough innovation in on-chain Bitcoin reserve management. Through its Staking Abstraction Layer (SAL), SolvBTC, and SolvBTC.LST (liquid staking tokens), it allows retail and institutional investors to access diverse yield opportunities without sacrificing liquidity, seamlessly integrating Bitcoin into the DeFi ecosystem.

At the same time, compared to other homogenous projects in the BTCFi space, Solv demonstrates unique advantages, particularly in liquidity integration and innovative asset management.

A key differentiator is Solv’s introduction of more efficient yield-generation mechanisms within the Bitcoin ecosystem, enhanced by the Staking Abstraction Layer (SAL) and its cross-chain yield aggregation platform, which together optimize user experience and capital management. Under this framework, Solv has launched four SolvBTC LST variants: SolvBTC.BBN (Babylon), SolvBTC.ENA (Ethena), SolvBTC.Core, and SolvBTC.JUP (Jupiter Exchange on Solana).

On one hand, Solv employs its security system, Solv Guardian, to ensure the safety of staking transactions. Guardian features dynamic adaptability, capable of real-time rule optimization based on updates to blockchains and staking protocols. Collaborating closely with protocol developers, it establishes strict security standards and risk controls, ensuring operational reliability. Its unified security mechanism spans both EVM smart contracts and Bitcoin mainnet transactions, delivering consistent protection for users and developers alike. As a core component of SAL, Solv Guardian lays the foundation for standardized and diversified Bitcoin staking, expanding Bitcoin’s financial use cases while balancing flexibility and security—driving sustainable development of the staking ecosystem.

On the other hand, Solv proposes an industry-standard Bitcoin yield product model, providing standardized and diversified solutions for Bitcoin staking via SAL. SAL abstracts technical differences across various staking protocols through smart contracts, building a unified operational framework. This enables flexible design of LSTs based on lock-up duration, yield distribution models, and liquidity features, giving users diversified yield options and significantly improving capital efficiency and staking flexibility. With SAL, users can earn staking rewards while deploying LSTs in advanced strategies such as leveraged staking and arbitrage trading, further optimizing asset liquidity and returns.

Based on these innovations, Solv has built a broad ecosystem spanning 15 major public chains and over 50 DeFi protocols, creating a highly interconnected staking network. By consolidating multi-chain and multi-protocol resources, Solv delivers robust technical support and rich application scenarios for Bitcoin staking, greatly enhancing user experience and capital management efficiency.

To date, Solv Protocol has secured backing from leading investment firms including Binance Labs, Blockchain Capital, Laser Digital, and OKX Ventures. It has undergone comprehensive audits by top security firms such as Quantstamp, Certik, SlowMist, Salus, and Secbit. Recently, Solv announced a $11 million strategic funding round, bringing its total funding to $25 million, which will be used for developing its Staking Abstraction Layer and expanding its ecosystem.

In summary, through continuous Bitcoin accumulation and technological innovation, Solv Protocol is steadily shaping itself into a “MicroStrategy 2.0” for the crypto industry.

Recently, Binance announced that SolvProtocol (SOLV) will launch on its Megadrop platform. The maximum supply of SOLV is set at 9.66 billion tokens (increased via governance vote under the BTC Reserve Funding Initiative), with an initial supply of 8.4 billion. The Megadrop reward allocation amounts to 588 million tokens (7% of initial supply), and initial circulating supply stands at 1.4826 billion (17.65% of initial supply). The arrival of TGE (Token Generation Event) will provide Solv with greater capital support, accelerating its expansion in the crypto sector. The launch of the SOLV token not only strengthens funding for its Bitcoin reserve initiative but also establishes its foundational position in the BTCFi landscape, positioning it as a true on-chain MicroStrategy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News