Analyzing MicroStrategy's Bitcoin Strategy: Investment Approach and Market Potential

TechFlow Selected TechFlow Selected

Analyzing MicroStrategy's Bitcoin Strategy: Investment Approach and Market Potential

MicroStrategy's bold attempt might be just the prologue to Bitcoin's legend, yet it could mark a significant step into a new era of finance.

Author: 0xCousin, IOBC Capital

In the history of Wall Street, legendary stories are never in short supply. However, MicroStrategy's strategic transformation into a Bitcoin Treasury Company is destined to become a unique new legend.

A Bitcoin Strategy That Captured Global Attention

In 2020, the COVID-19 pandemic triggered a global liquidity crisis. Central banks adopted loose monetary policies to stimulate economies, leading to currency depreciation and heightened inflation risks.

During this period, Michael Saylor reevaluated Bitcoin’s value. He believed that with money supply growing at around 15% annually, there was an urgent need for a safe-haven asset uncorrelated to fiat cash flows. This insight led him to adopt a Bitcoin-centric strategy for MicroStrategy.

Compared to BlackRock's BTC ETF or other spot Bitcoin ETPs, MicroStrategy’s approach is far more aggressive. Instead of merely tracking price movements like ETFs/ETPs, it actively uses corporate idle capital, convertible bond issuances, and stock offerings to purchase Bitcoin—directly capturing upside potential while bearing full downside risk.

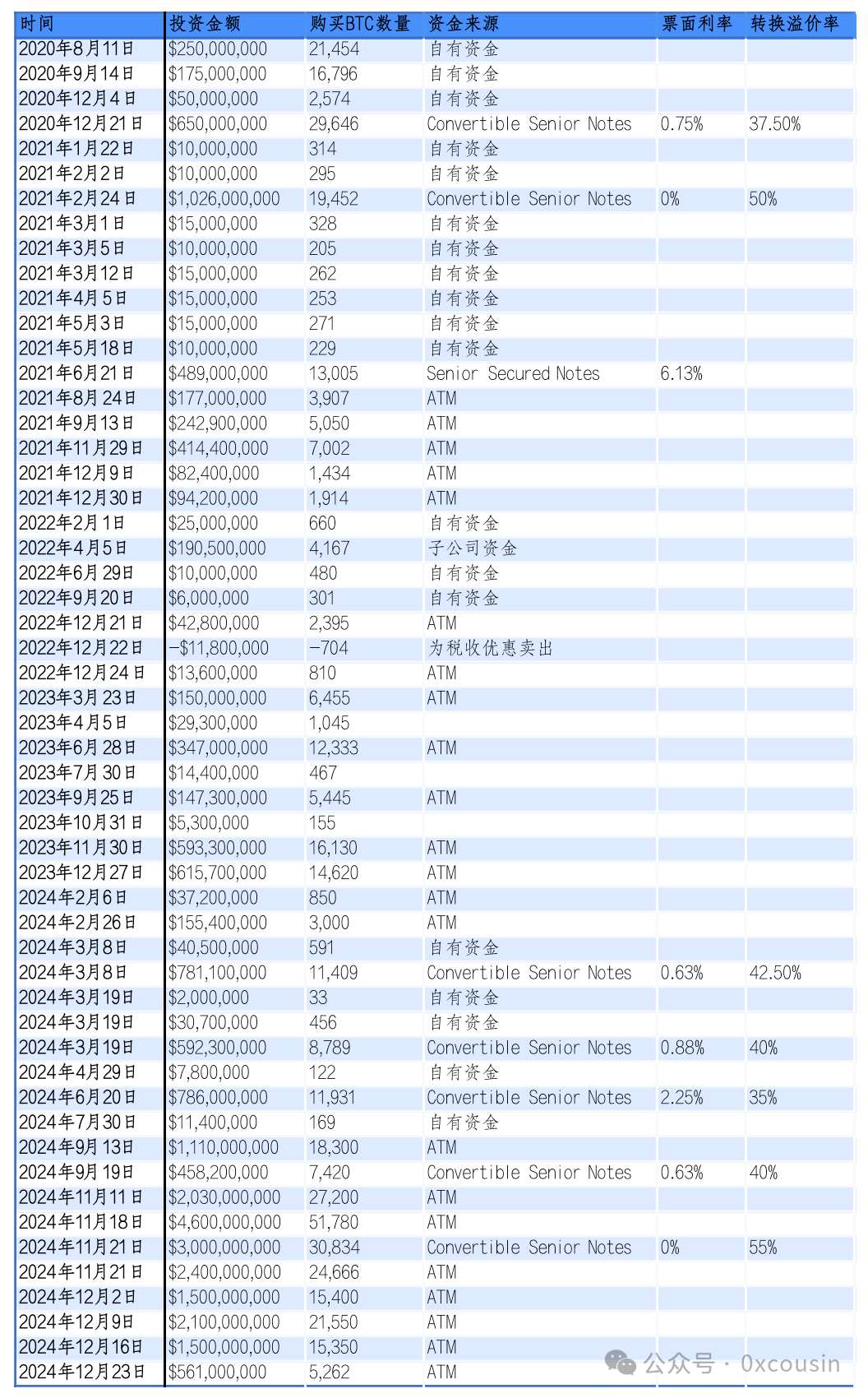

MicroStrategy’s Funding Sources and Bitcoin Acquisition Journey

MicroStrategy has primarily used four methods to raise funds for Bitcoin purchases:

1. Using Internal Capital

The first three investments were made using surplus cash on hand. In August 2020, MicroStrategy spent $250 million to acquire 21,400 BTC; in September, another $175 million bought 16,796 BTC; and in December, $50 million purchased 2,574 BTC.

2. Issuing Convertible Senior Notes

To scale up Bitcoin acquisitions, MicroStrategy began financing through convertible senior notes.

Convertible senior notes are financial instruments allowing investors to convert bonds into company shares under specific conditions. These bonds typically carry low or zero interest rates, with conversion prices set above the current market price. Investors accept such terms because they gain downside protection (principal and interest repayment at maturity) plus upside exposure if the stock rises. Most of MicroStrategy’s convertible notes have interest rates between 0% and 0.75%, indicating investor confidence in future MSTR stock appreciation and their preference for equity conversion over bond redemption.

3. Issuing Senior Secured Notes

In addition to convertible notes, MicroStrategy issued $489 million in senior secured notes due in 2028 with a 6.125% interest rate.

Senior secured notes are collateralized debt instruments, carrying lower risk than unsecured convertible bonds but offering only fixed income returns. MicroStrategy has since prepaid this tranche of secured debt.

4. At-the-Market Equity Offerings (ATM)

As MicroStrategy’s Bitcoin strategy gained traction and its stock price rose, the company increasingly turned to ATM equity offerings—a less risky funding method since it doesn’t create debt obligations or require scheduled repayments.

MicroStrategy entered public market sale agreements with agents including Jefferies, Cowen and Company LLC, and BTIG LLC. Under these agreements, it can periodically issue and sell Class A common stock via the open market—commonly known as an ATM program.

ATM offerings offer flexibility, enabling MicroStrategy to time share sales based on secondary market conditions. However, issuing new shares dilutes existing shareholders' equity. Despite complex market reactions and increased volatility in MSTR’s stock price, rising Bitcoin correlation and increasing BTC holdings per share have supported overall sentiment.

Below is a timeline of how MicroStrategy acquired Bitcoin through these four channels:

Visualization: IOBC Capital

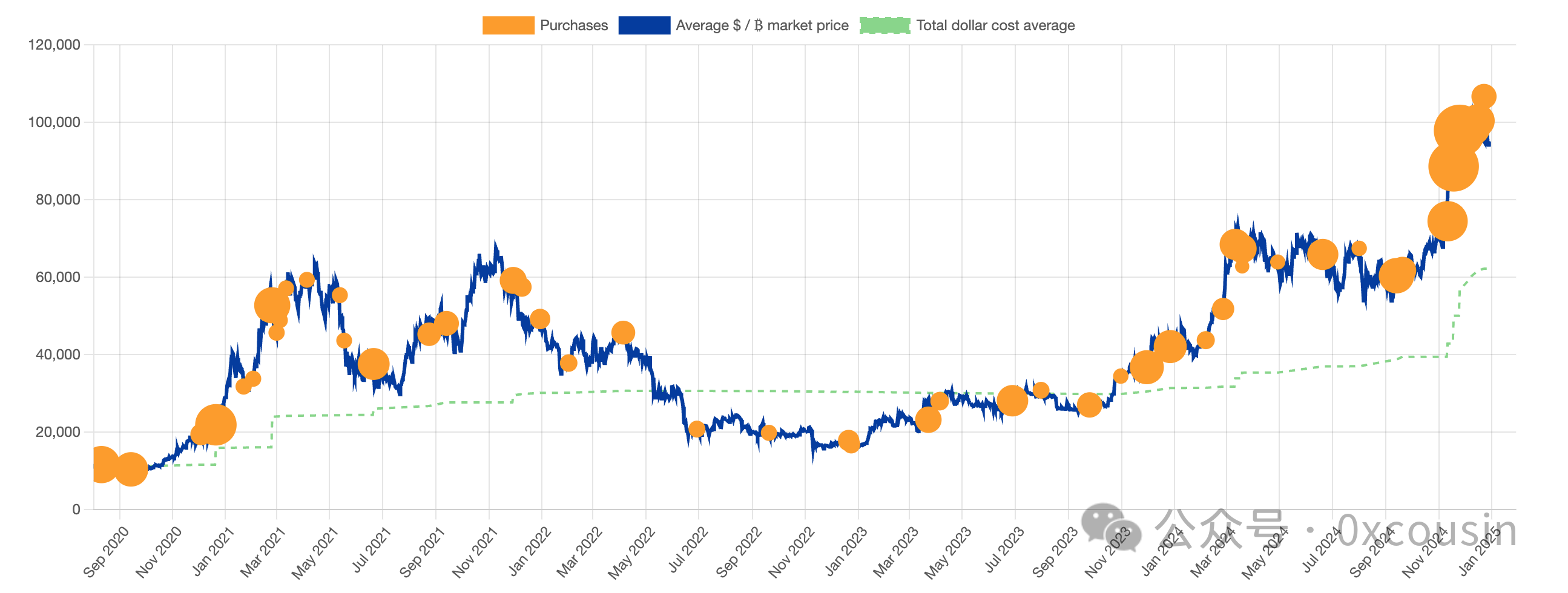

Mapping MicroStrategy’s actual Bitcoin purchases against BTC’s historical price chart:

Source: bitcointreasuries.net

As of December 30, 2024, MicroStrategy had invested approximately $27.7 billion to accumulate 444,262 BTC, at an average cost of $62,257 per BTC.

Key Questions About MicroStrategy’s “Intelligent Leverage” Bitcoin Strategy

There is significant debate around MicroStrategy’s so-called “intelligent leverage” model for acquiring Bitcoin.

Here are my thoughts on several key questions frequently discussed in the market:

1. Is MSTR’s Leverage Risk High?

Short answer: Not really.

According to disclosures from MicroStrategy’s Q3 2024 earnings call, total assets stood at approximately $8.344 billion. The reported carrying value of Bitcoin on the balance sheet was $6.85 billion (based on 252,220 BTC valued at $27,160 each). Total debt was about $4.57 billion, resulting in a debt-to-equity ratio of 1.21.

However, this accounting treatment uses historical cost rather than market value. If we use the actual market price of Bitcoin as of September 30, 2024—$63,560—the real market value of MSTR’s BTC holdings would be $16.03 billion. This reduces the debt-to-equity ratio to just 0.35.

Now consider data as of December 30, 2024.

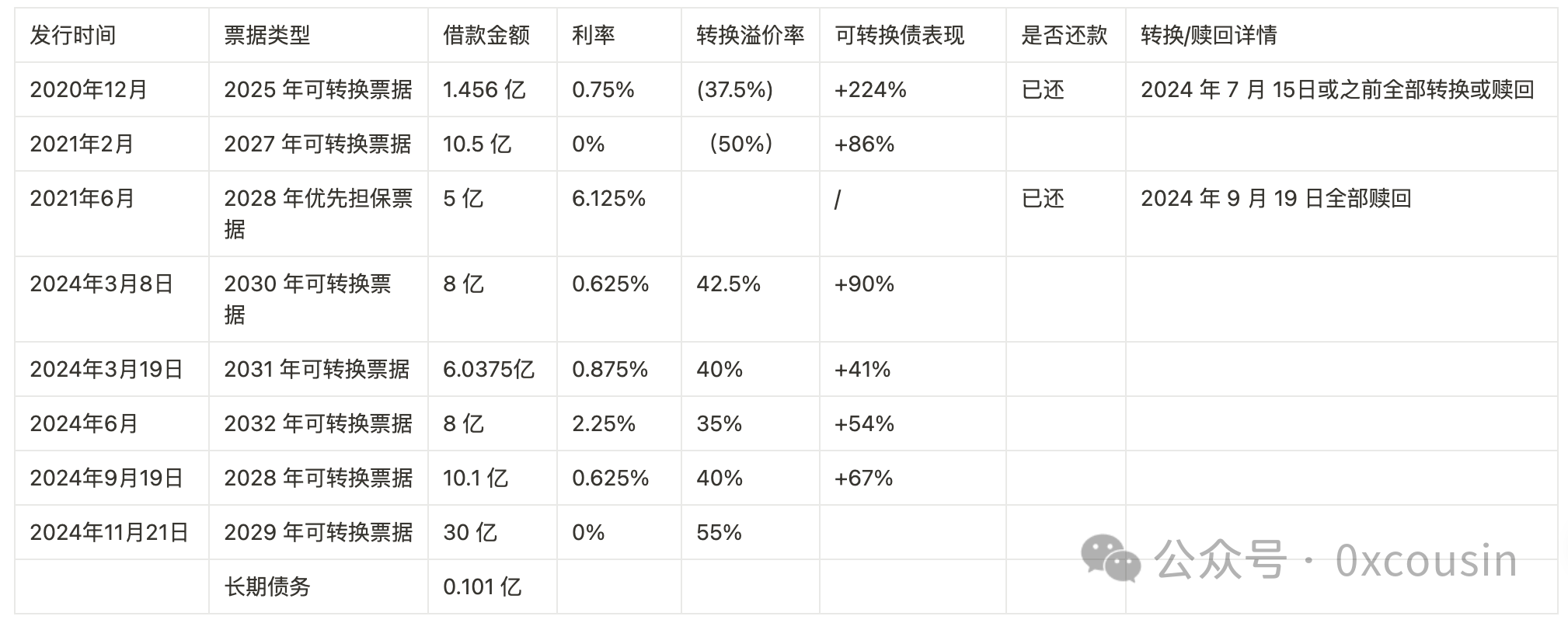

On that date, MicroStrategy’s total outstanding liabilities amounted to $7.27385 billion, broken down as follows:

Visualization: IOBC Capital

As of December 30, 2024, MicroStrategy held 444,262 BTC, worth $42.25 billion at current prices. Assuming non-Bitcoin assets remained unchanged at $1.49 billion, total assets would reach $43.74 billion. With liabilities at $7.27385 billion, the debt-to-equity ratio drops further to just 0.208.

Compare this to major U.S. public companies: Alphabet (0.05), Twitter (0.7), Meta (0.1), Goldman Sachs (2.5), JPMorgan Chase & Co. (1.5).

Given that MicroStrategy has effectively transformed from a software firm into a financial entity, its leverage level remains healthy.

2. Under What Conditions Could These Convertible Notes Become Unbearable?

Short answer: Only if Bitcoin permanently falls below ~$16,364—and even then, only if no further leveraged purchases occur.

If MicroStrategy stops issuing convertible notes and continues accumulating only via ATM programs or internal capital, its BTC holdings would need to fall below $16,364 per BTC for the total value of its 444,262 BTC to dip below its $7.27 billion in convertible debt. As BTC holdings grow, this breakeven price will continue to decline.

The real danger arises if MicroStrategy aggressively issues more convertible debt during high-price periods and then faces a bear market where BTC crashes below the break-even point. This could depress MSTR’s stock price, impairing both refinancing capacity and debt servicing ability—turning convertible notes into a true burden.

MicroStrategy’s convertible notes give bondholders two options:

- Early stage: If the bond price drops >2%, holders may exercise conversion rights, turning bonds into MSTR shares and selling them to recoup principal. Otherwise, they can simply sell the bonds on the secondary market.

- Late stage (near maturity): The 2% rule no longer applies. Holders can either redeem in cash or convert into MSTR stock.

Since these are low- or zero-coupon bonds, investors are clearly betting on stock appreciation via conversion premiums. If MSTR’s stock price is higher at maturity than at issuance, conversion becomes attractive. If the stock is lower, bondholders will likely opt for cash repayment.

If creditors demand repayment instead of converting, MicroStrategy still has multiple options:

- Issue additional shares to raise cash;

- Issue new debt to repay old debt (already done in September 2024);

- Sell part of its Bitcoin reserves.

Therefore, the likelihood of MicroStrategy facing insolvency or being unable to meet obligations remains very low under current conditions.

3. Why Are Investors Focusing on MSTR’s BTC Per Share Metric?

Short answer: Because BTC per share determines MSTR’s net asset value per share.

Both convertible bond issuance and ATM offerings dilute existing shareholders. Normally, dilution is seen as negative. But MicroStrategy’s management pitches a different narrative—one centered on the "BTC Yield KPI."

The core idea is this: As long as MSTR’s market cap exceeds the market value of its Bitcoin holdings (i.e., there is a premium), using diluted equity to buy more BTC increases BTC ownership per share. This growth in per-share BTC holdings translates directly into rising book value per share—making dilution worthwhile for long-term shareholders.

Currently, MicroStrategy holds 444,262 BTC, valued at ~$42.256 billion. With a market cap of $80.37 billion, its valuation trades at 1.902x the value of its BTC stash—implying a 90.2% premium.

With 244 million shares outstanding, each MSTR share represents approximately 0.0018 BTC.

This is the essence of “intelligent leverage”—leveraging the gap between enterprise market value and underlying Bitcoin asset value as a strategic advantage.

4. Why Has MicroStrategy Bought So Aggressively Recently?

Short answer: Likely because MSTR’s stock price is high.

In November and December 2024, MicroStrategy significantly accelerated its Bitcoin buying. It deployed $17.69 billion (63.8% of total investment) to purchase 192,042 BTC (43.2% of total holdings). Of this, only $3 billion came from convertible debt; the remaining $14.69 billion was raised via ATM equity offerings.

Looking at the broader timeline, MicroStrategy’s accumulation shows dollar-cost averaging characteristics over time—but quantitatively, it buys more aggressively during bull markets than bear markets.

This pattern is counterintuitive. My best guess? Bull market momentum drives higher MSTR stock valuations, making equity financing cheaper and more efficient.

In 2024, MSTR’s stock surged over 4x year-to-date—even after a 3x stock split in August—while Bitcoin itself rose only ~2.2x.

During the Q3 2024 earnings call, MicroStrategy’s CEO unveiled the ambitious “Plan 42B.”

Referencing Douglas Adams’ *The Hitchhiker’s Guide to the Galaxy*, where the supercomputer “Deep Thought” reveals “42” as the ultimate answer to life, the universe, and everything, MicroStrategy sees 42 as a symbolic number. Given that Bitcoin’s maximum supply is 21 million, the company plans to raise $21 billion via ATM equity and $21 billion via fixed-income instruments over the next three years to further increase its BTC reserves.

Assuming MicroStrategy raises $42 billion through share issuance at $330 per share, post-dilution shares outstanding would rise to 371.3 million. If it deploys all proceeds to buy BTC at an average price of $100,000, it could acquire an additional 420,000 BTC, bringing total holdings to 864,262 BTC. BTC per share would then increase to 0.00233—a 29.4% rise. At that point, MSTR’s market cap would be $122.53 billion, with BTC holdings valued at $86.4 billion—still maintaining a healthy valuation premium.

5. After MicroStrategy, What Drives Bitcoin’s Next Leg Up?

Short answer: Beyond corporate adoption inspired by MicroStrategy, the biggest catalyst could be national-level strategic reserves—though expectations for this in the current cycle should remain cautious.

Major sources of demand fueling this Bitcoin bull run include:

1. Long-Term Holders with Strong Conviction

For many BTC believers, Bitcoin’s long-term appreciation needs no justification—it’s as natural as monkeys climbing trees or rats burrowing holes. To them, Bitcoin is digital gold.

When BTC dropped below $16,000, mainstream miners like Antminer S17 series approached shutdown prices. Machines such as WhatsMiner M30S, Hippo H2, and Antminer T19 also entered unprofitable territory. At such levels, even without external catalysts, a rebound becomes structurally inevitable—like a basketball bouncing after hitting the ground following a free fall, with each bounce progressively weaker.

Source: Glassnode

As shown above, long-term holders began accumulating steadily starting in late 2022.

After more than a decade of development, Bitcoin’s network effect and consensus strength are robust. Market participants and long-term holders recognize miner capitulation zones as reliable support levels.

2. ETF Inflows Bringing Traditional Financial Capital

Since the approval of spot BTC ETFs, net inflows have reached 528,600 BTC. During this bull market, ETFs have injected nearly $36 billion in fresh buying pressure into Bitcoin—and around $2.6 billion into Ethereum.

Source: coinglass.com

Beyond direct capital inflows, the approval of BTC and ETH ETFs has catalyzed broader institutional interest, prompting more traditional finance players to explore and enter the crypto space.

3. MicroStrategy-Led Corporate Adoption and the “Double-Davis Effect”

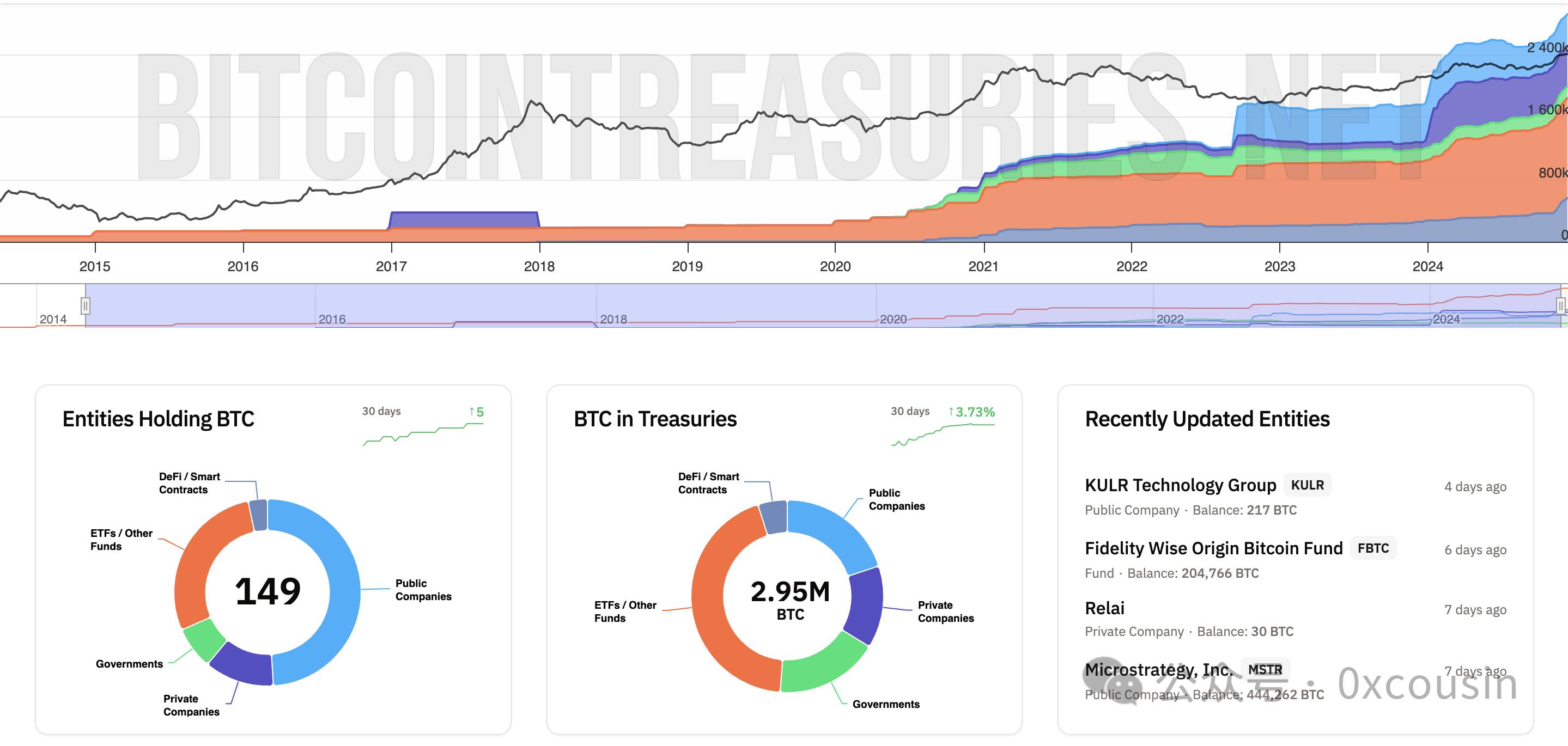

According to Bitcointreasuries data, as of December 30, 2024, 149 entities collectively hold over 2.95 million BTC—and this number is growing rapidly.

Source: bitcointreasuries.net

Among these holders: 73 are public companies, 18 private firms, 11 nations, 42 ETFs/funds, and 5 DeFi protocols.

While MicroStrategy pioneered the “Bitcoin Treasury Company” model, others have followed—Marathon Digital Holdings, Riot Platforms, Boyaa Interactive International Limited, among others. Still, MicroStrategy remains the most influential.

4. National Strategic Reserves

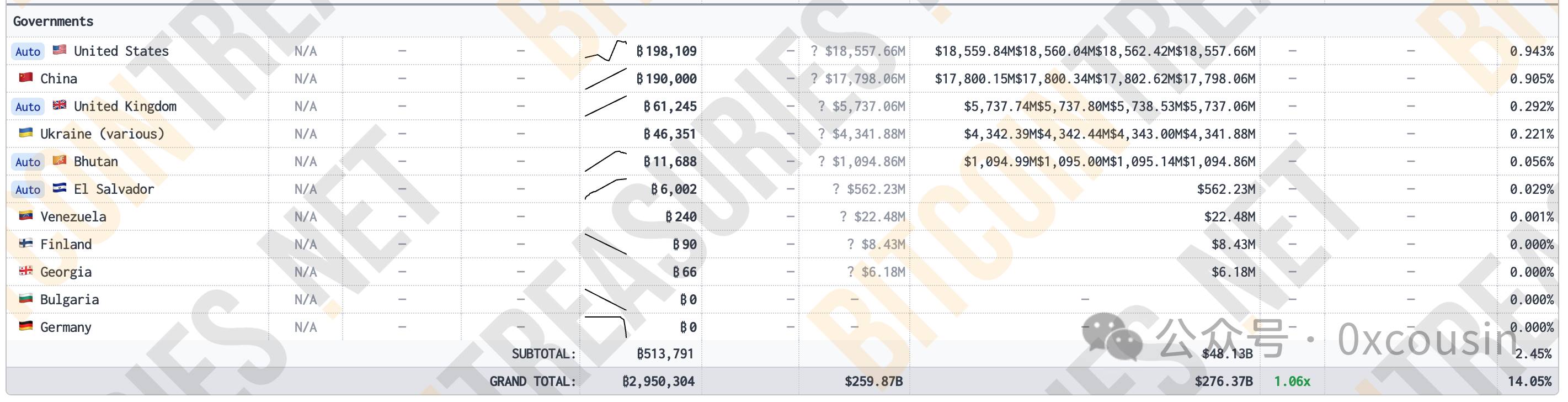

Some governments already hold Bitcoin, as illustrated below:

Source: bitcointreasuries.net

However, most government-held BTC comes from law enforcement seizures and has not been sold—yet these are not stable, intentional holders.

El Salvador stands out as the only country genuinely treating Bitcoin as a strategic reserve asset. Since 2021, it has consistently purchased 1 BTC per day and now holds 6,002 BTC, worth over $560 million.

Bhutan holds 11,688 BTC through mining activities, though it is not considered a committed holder and has recently reduced its position.

U.S. presidential candidate Donald Trump has stated that if elected, he would establish a U.S. Bitcoin strategic reserve.

If anything could succeed MicroStrategy as the next major driver for Bitcoin, it would be Trump enacting a federal BTC reserve policy—potentially triggering a wave of national-level Bitcoin adoption worldwide.

Conclusion

MicroStrategy’s Bitcoin strategy is more than just a corporate transformation experiment—it is a landmark innovation in financial history. Through sophisticated capital structuring, intelligent leverage, and deep conviction in Bitcoin’s value proposition, it has not only achieved remarkable market cap growth but also brought Bitcoin firmly into the view of traditional finance, effectively breaking down the wall between crypto assets and mainstream capital markets.

MicroStrategy’s bold move may be just the prelude to Bitcoin’s greater story—or merely a small step in its ascent. Yet either way, it could well mark a giant leap into a new era of finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News