Left hand pays the fine, right hand goes all in on BTC: U.S. healthcare company Semler plans to buy $500 million worth of Bitcoin

TechFlow Selected TechFlow Selected

Left hand pays the fine, right hand goes all in on BTC: U.S. healthcare company Semler plans to buy $500 million worth of Bitcoin

By signing a loan agreement with Coinbase, Semler used Bitcoin as collateral to obtain funds, avoiding market impact and tax burdens associated with direct selling.

Author: Alvis

Introduction: The Dual Narrative of Legal Settlement and Crypto Financing

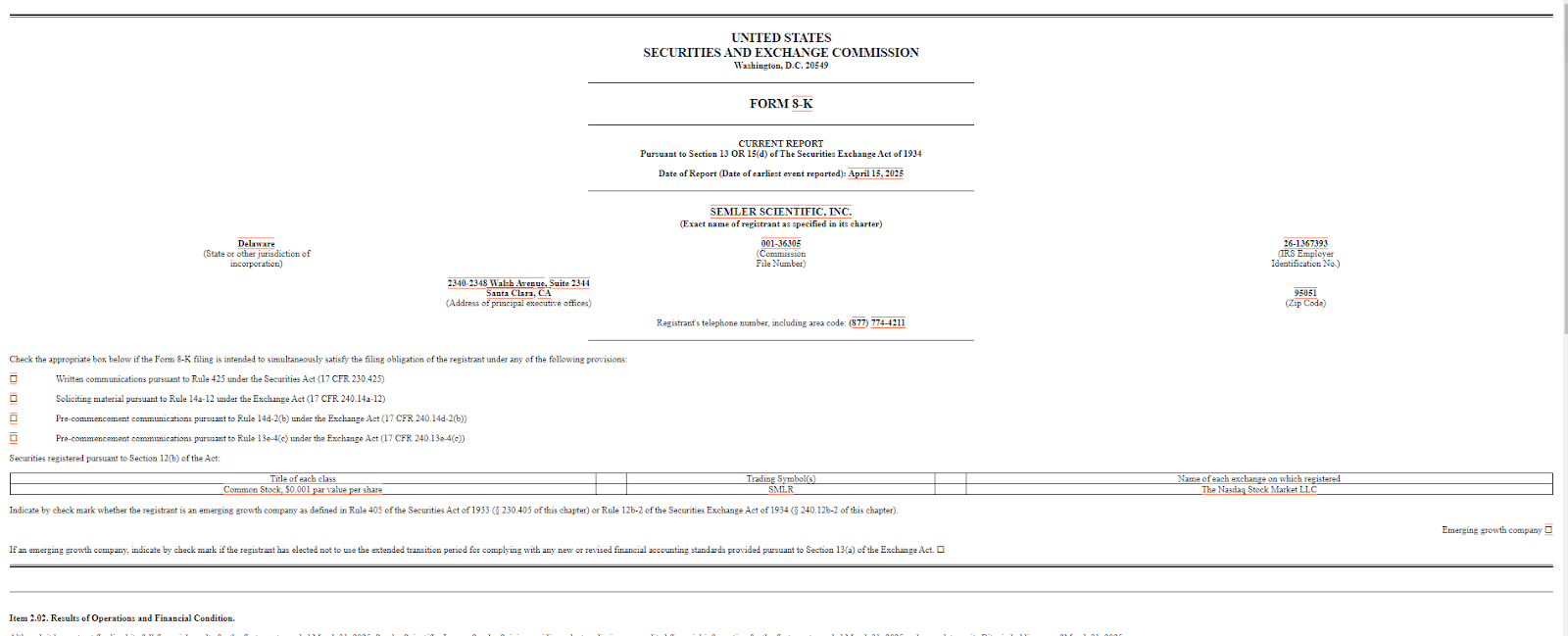

On April 16, 2025, Semler Scientific (NASDAQ: SMLR), a publicly traded company, filed an S-3 document with the SEC, sending shockwaves through capital markets.

This $500 million securities offering not only represents the company’s most ambitious Bitcoin accumulation plan in its history but also forms a dramatic counterpoint to the same-day disclosure of a $29.75 million settlement agreement with the U.S. Department of Justice—this medical technology firm is attempting to use cryptocurrency-based financial innovation to resolve a survival crisis under traditional regulatory scrutiny.

In what the crypto community has dubbed a "balance sheet reconstruction experiment on-chain," every move by Semler Scientific carries strategic significance: from pledging Bitcoin to secure funds for legal settlements, to using securities issuance to expand BTC reserves—its strategy reflects a qualitative leap in enterprise-grade applications of crypto financial tools.

Chapter One: Crisis and Redemption—The DOJ Investigation and the BTC Collateral Loan Breakthrough

1.1 The Lethal Threat of a Seven-Year Regulatory Standoff

As early as 2017, Semler Scientific received a subpoena from the Department of Justice over allegations that marketing tests for its product QuantaFlo violated the False Claims Act (FCA). After eight years of protracted legal wrangling centered on Medicare reimbursement eligibility, settlement negotiations finally began in February 2025.

According to an 8-K filing disclosed on April 16, Semler must pay $29.75 million—approximately 72.8% of its 2024 net profit—to reach a preliminary settlement.

For a medical device company with a market cap of just $330 million, this penalty could trigger a financial earthquake. Yet Semler chose an unprecedented path: transforming its Bitcoin holdings into on-chain credit assets.

1.2 Breaking the Impasse with Crypto Finance: Innovative Design of the Coinbase Loan Agreement

On the same day it disclosed the settlement, Semler announced a master loan agreement with Coinbase, allowing it to borrow cash against its 3,192 BTC holdings (worth approximately $267 million) as collateral. If the final settlement is approved, the company will finance the fine via this loan rather than selling BTC directly.

This maneuver achieves three breakthroughs:

-

Liquidity transformation: avoids price crashes caused by concentrated BTC selling

-

Tax optimization: collateralized borrowing does not trigger capital gains tax (unlike direct sales)

-

On-chain credit experiment: first public use by a listed company of BTC-backed loans to settle government penalties

"This marks the formal emergence of crypto assets as enterprise-grade liquidity management tools," commented an analyst at crypto investment bank GSR, noting that while annualized rates in the traditional corporate bond market have risen to 7.2%, BTC-backed loans typically offer preferential rates between 4% and 5%.

Chapter Two: The Deep Logic Behind a $500 Million Bet—The Evolution of BTC Reserve Strategy

2.1 From 'Zombie Company' to Crypto Pioneer

Looking back at Semler's Bitcoin strategy, its evolutionary trajectory is clear:

-

May 2024: Purchased 581 BTC for $40 million; stock surged 30% intraday

-

January 2025: Issued $75 million convertible bonds to increase holdings to 2,321 BTC

-

April 2025: BTC holdings reached 3,192 coins (valued at $266 million), making Semler the 12th-largest BTC holder among U.S.-listed companies

BitcoinTreasuries data shows Semler now ranks 12th among public companies holding Bitcoin, with 3,192 BTC worth over $260 million.

The proposed $500 million financing would enable Semler to scale its BTC reserves into the six-figure range (estimated at current prices), directly challenging the holdings of major players like Coinbase and Block.

2.2 Financial Restructuring: When BTC Becomes the Balance Sheet's Ballast

Semler's financial data reveals the core logic of its strategy:

(Source: Semler 2024 Annual Report, Yahoo Finance)

"Using ultra-low leverage to overweight BTC effectively treats cryptocurrencies as quasi-sovereign credit assets," noted a Morgan Stanley report, adding that Semler’s BTC holdings have already surpassed the cash flow generation capacity of its medical device business, creating a unique structure where 'assets are crypto-native, liabilities remain traditional.'

Chapter Three: The On-Chain Financial Experiment of the Coinbase Loan Agreement

3.1 Precision Calculations in Collateral Ratios and Risk Isolation

According to the loan framework disclosed by Coinbase, Semler must maintain a minimum collateralization ratio (Loan-to-Value) of 150%. Based on the current BTC value of $267 million, the maximum loan amount available is approximately $178 million—far exceeding the funds needed for the settlement.

This design enables:

-

Dynamic collateral management: automatic top-up mechanisms triggered by BTC price volatility

-

Flexible fund usage: borrowed capital can be used for operations or further BTC accumulation

-

Regulatory arbitrage: on-chain collateral is not subject to traditional banking Basel Accord constraints

3.2 The 'Metcalfe Effect' of On-Chain Credit Expansion

Semler’s case validates a crypto-economic hypothesis: the network effect of Bitcoin’s collateral value. As more enterprises integrate with institutional lending platforms like Coinbase, BTC’s on-chain credit multiplier grows exponentially—a mirror image of traditional finance’s deposit multiplication mechanism.

Chapter Four: Undercurrents Amid Regulatory Storms—How DOJ Investigations Are Reshaping Corporate Crypto Strategies

4.1 The Unintended Acceleration from DOJ Scrutiny

While the $29.75 million penalty presents short-term pressure, the investigation has objectively accelerated Semler’s shift toward on-chain finance:

-

Forced innovation in financing: traditional credit channels tightened due to litigation risk, pushing exploration of crypto-collateral solutions

-

Market expectation management: the settlement removes long-term uncertainty, turning BTC holdings into a “safe asset” label

-

Regulatory dialogue opportunity: negotiations with the DOJ provided valuable crypto compliance experience

4.2 The Cryptographic Reconfiguration of Stock Price Behavior

Notably, the 90-day correlation coefficient between Semler’s stock price (SMLR) and Bitcoin has reached 0.87, significantly higher than its 0.32 correlation with the Nasdaq Biotechnology Index. This redefinition of its identity as a “crypto stock” is upending traditional valuation models.

Chapter Five: Industry Butterfly Effects—Who Is Copying the 'Semler Model'?

5.1 Strategic Imitation Among Public Companies

-

MicroStrategy: A “crypto holding company” with 461,000 BTC, achieving an annualized financing cost of 4.5%

-

Metaplanet: Practitioner of Japan’s version of the “BTC capital strategy,” fully anchoring its market capitalization to Bitcoin

-

Rumble: Video platform leveraging BTC-backed loans to build a decentralized content ecosystem

5.2 National-Level Strategic Resonance

The Semler episode coincides with the U.S. government advancing the *Bitcoin Act 2025*, which aims to establish a one-million-BTC reserve using tariff revenues and gold revaluation. This dual-layer “corporate–national” crypto strategy is reshaping global capital flow paradigms.

Future Outlook—When Corporate Balance Sheets Navigate Bull and Bear Markets

Testing Strategic Sustainability

-

Bull Market Scenario: If BTC surpasses $100,000, a “collateralize-and-acquire” virtuous cycle could activate, potentially transforming Semler into the first “crypto holding company” in the healthcare tech sector

-

Bear Market Scenario: Prices falling below collateral thresholds may trigger a “death spiral,” forcing a return to core traditional operations

A Paradigm Shift in Regulatory Frameworks

The conclusion of the SEC’s review of Coinbase signals maturation of crypto compliance infrastructure. Future developments may include specialized accounting standards and disclosure rules for enterprise-level BTC-backed loans.

Restructuring of Industry Power Dynamics

"When a healthcare company’s market cap is determined by its Bitcoin holdings, R&D investment in new drugs becomes secondary." This ironic reality is compelling Wall Street to rewrite corporate valuation formulas.

Conclusion: The 'Trojan Horse' of Crypto Capitalism

Semler Scientific’s $500 million gamble is fundamentally a corporate-scale social experiment: when industrial giants inject crypto assets into their balance sheets, the impact extends beyond financial restructuring—it heralds a fundamental transformation of commercial civilization’s underlying logic.

The ultimate outcome of this experiment remains uncertain, but one thing is clear: the era of Bitcoin as a “strategic corporate reserve asset” has officially begun. And the Department of Justice’s $29.75 million settlement agreement has inadvertently become the key that unlocks this historic door.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News