Analyzing Aethir's tokenomics: How does it power its DePIN computing ecosystem?

TechFlow Selected TechFlow Selected

Analyzing Aethir's tokenomics: How does it power its DePIN computing ecosystem?

Aethir is one of the largest distributed GPU computing ecosystems in scale currently.

Author: Heise Mario

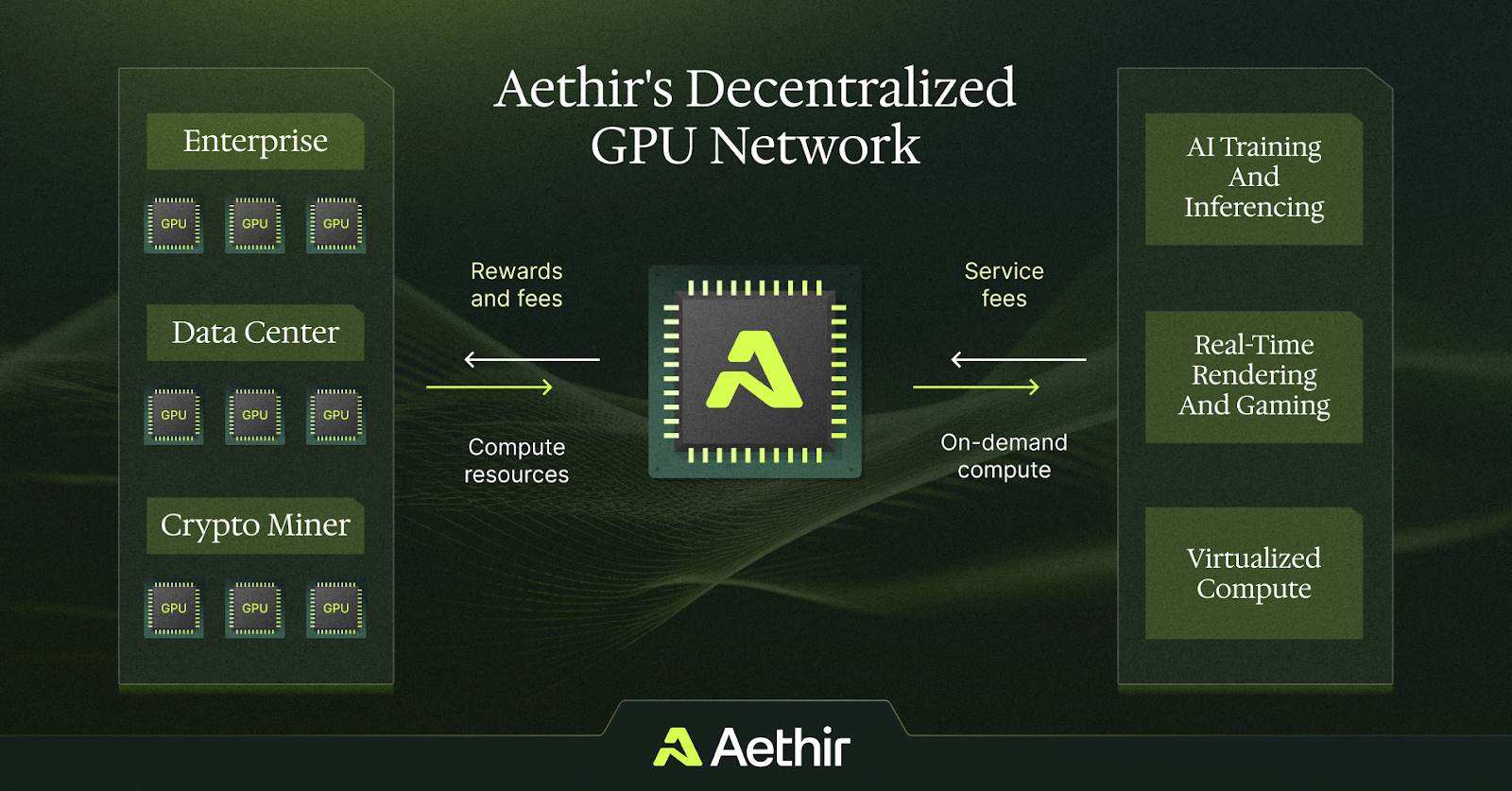

Aethir is a DePIN computing network built on GPU computing power, enabling users with idle computational resources to join the network as contributors and earn income. The network uses an on-chain system to allocate computing resources efficiently, ensuring low-latency, high-quality, and continuous matching between supply and demand.

In terms of scale, Aethir is currently one of the largest distributed GPU computing ecosystems. It already has over 4,000 NVIDIA H100 GPUs supporting its network, with 82% actively providing commercial services. An additional 2,000–3,000 H100 GPUs are expected to be added in the future. These computing resources are being connected to the network in a decentralized manner by enterprise users, Aethir partners, and individual users, delivering top-tier GPU resources globally. As a result, Aethir has become one of the few distributed computing networks capable of efficiently meeting the demands of even the most demanding AI clients.

Building on this foundation, Aethir is launching Model-as-a-Service (MaaS) for AI enterprises, deploying machine learning models at the enterprise level for end-user access. This enables AI users to seamlessly select and rapidly deploy open-source models. Aethir’s MaaS will help customers achieve efficient, intelligent data analysis and decision-making while lowering the barriers to model deployment.

As a Web3-oriented decentralized ecosystem, Aethir’s computing supply system is driven by an economic model centered on the ATH token. This economic framework not only ensures continued scaling of computing resources within the network but also plays a crucial role in optimizing resource allocation.

Aethir's Token-Centric Economic System

At the core of Aethir’s economy lies the ATH token, which serves not only as an incentive asset for various roles within the Aethir ecosystem but also as a utility token consumed for accessing computing resources and as a security deposit to ensure service efficiency and prevent malicious behavior. This structure balances stakeholder interests in both the short and long term, driving sustained network growth. Consequently, every participant in the Aethir ecosystem is tied to the ATH token, and as the ecosystem expands—particularly on the application and demand sides—the token exhibits deflationary characteristics.

Key use cases defined for the ATH token include:

-

Payment convenience—$ATH is used to pay for various services on the Aethir network, such as renting GPU resources for AI applications, cloud gaming, and other computational tasks.

-

Governance—$ATH holders can participate in the governance of the Aethir network by voting on proposals and decisions that shape the platform’s future.

-

Staking—Users can stake their $ATH tokens to support network security and operations, earning additional $ATH tokens as rewards.

-

Security and quality assurance—$ATH incentivizes network participants to maintain the security and quality of services provided.

We now break down the ecosystem further from the supply and demand perspectives.

1. Supply Side

Built on the Arbitrum blockchain, Aethir does not need to handle base-layer consensus or security, so its incentive model primarily focuses on GPU contributors—users who provide computational power to the network in exchange for ATH token rewards, including those using Aethir Edge computing devices.

Additionally, to ensure high-quality provisioning and allocation of these computing resources, Aethir introduces three key roles:

-

Container—the execution role responsible for running and rendering applications. It represents the actual site of virtual cloud computing and serves as a critical driver of network activity (earning income through effective work).

-

Indexer—the resource orchestrator that dynamically allocates computing power across the network based on real-time Container conditions (such as status, service deployment, resource needs, latency, and fees), ensuring optimal supply-demand matching and self-adjusting network performance.

-

Checker—the network monitor responsible for real-time oversight of Container services. It continuously reports metrics like processing capability, response time, and network latency back to the Indexer and earns token rewards for doing so.

Moreover, stakers who help secure the network also form part of the supply side, contributing to token distribution through participation incentives.

2. Demand Side

Internally, nearly all roles within the system have some demand for ATH tokens.

-

Core System Roles

Containers and Indexers are central to resource allocation and rendering within the Aethir network. To deter bad actors and ensure performance, individuals assuming these roles must typically stake a certain amount of ATH tokens, raising the economic cost of misconduct. Checkers supervise their activities and enable slashing when necessary.

-

Staking

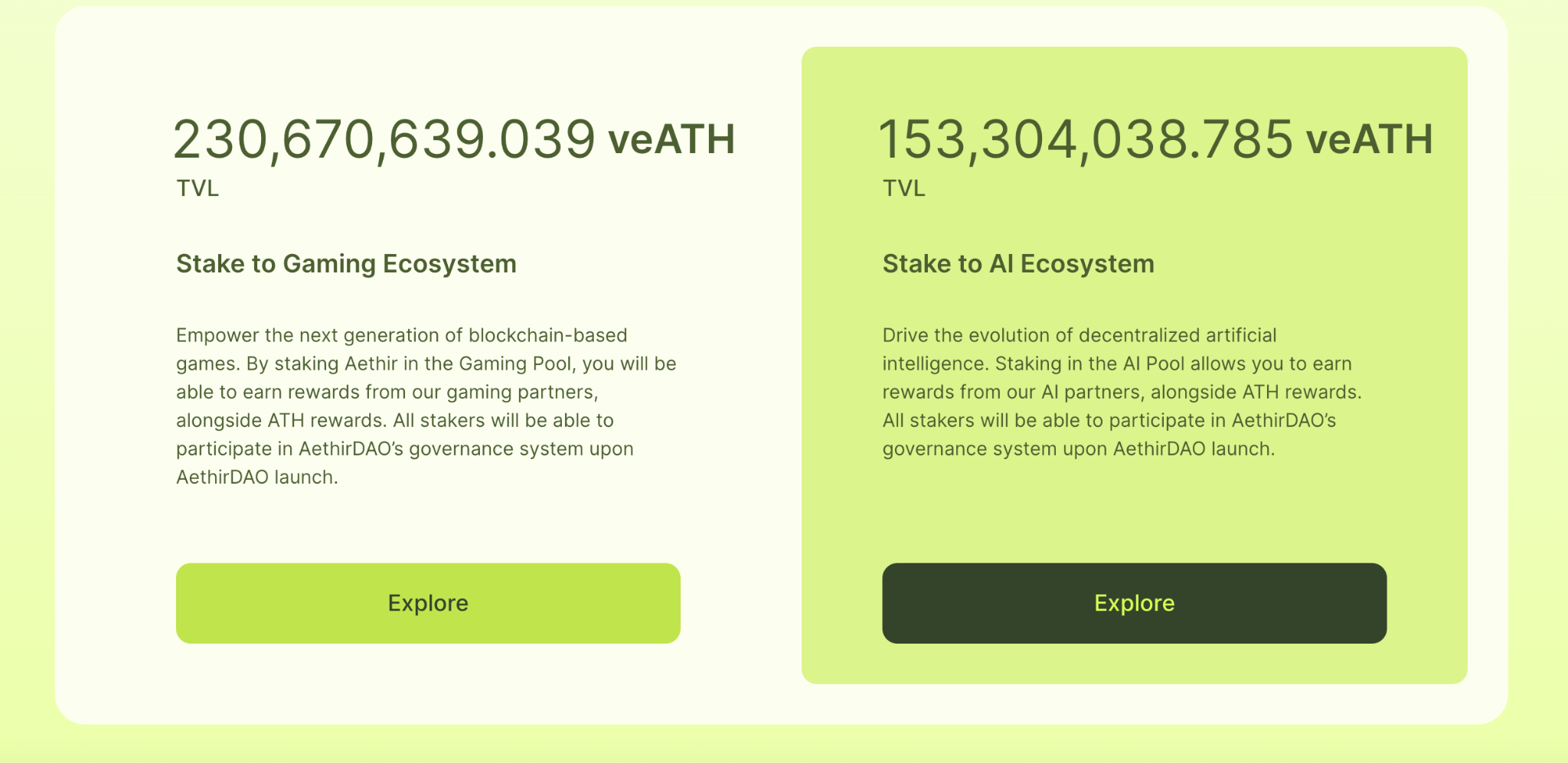

Stakers play a vital role in securing the network. Currently, Aethir offers two staking pools—one focused on game rendering and another on AI. Approximately 337 million ATH tokens are staked, representing about 9% of the current circulating supply (3.37 billion). Given that ATH has only been listed on exchanges for slightly over a month, staking enthusiasm is rising steadily, and the staking rate continues to climb.

Notably, Aethir recently launched a $50 million community rewards program. Of this, $20 million worth of ATH tokens will be allocated to Checker License (node operator) holders. The program has already been announced. Incentive link: https://massdrop.multisender.app/airdrop/rqng6ja15g

The remaining $30 million worth of ATH tokens will be distributed over 24 weeks to the ATH-AI staking pool (excluding the Gaming pool). This new injection of tokens will significantly boost rewards for users staking in the AI pool, further incentivizing participation and supporting the development of AI-driven applications on the Aethir network.

The newly rewarded ATH-AI pool offers returns up to 15 times the base reward. Long-term stakers enjoy even higher yields ranging from 400% to 600%, depending on the amount of ATH staked.

To qualify for these rewards, stakers must stake ATH at https://stake.aethir.com. Rewards are distributed every Thursday to those who began staking at least one week prior. Currently, the ATH-AI staking pool offers an APR exceeding 300%, with total staked ATH surpassing 700 million.

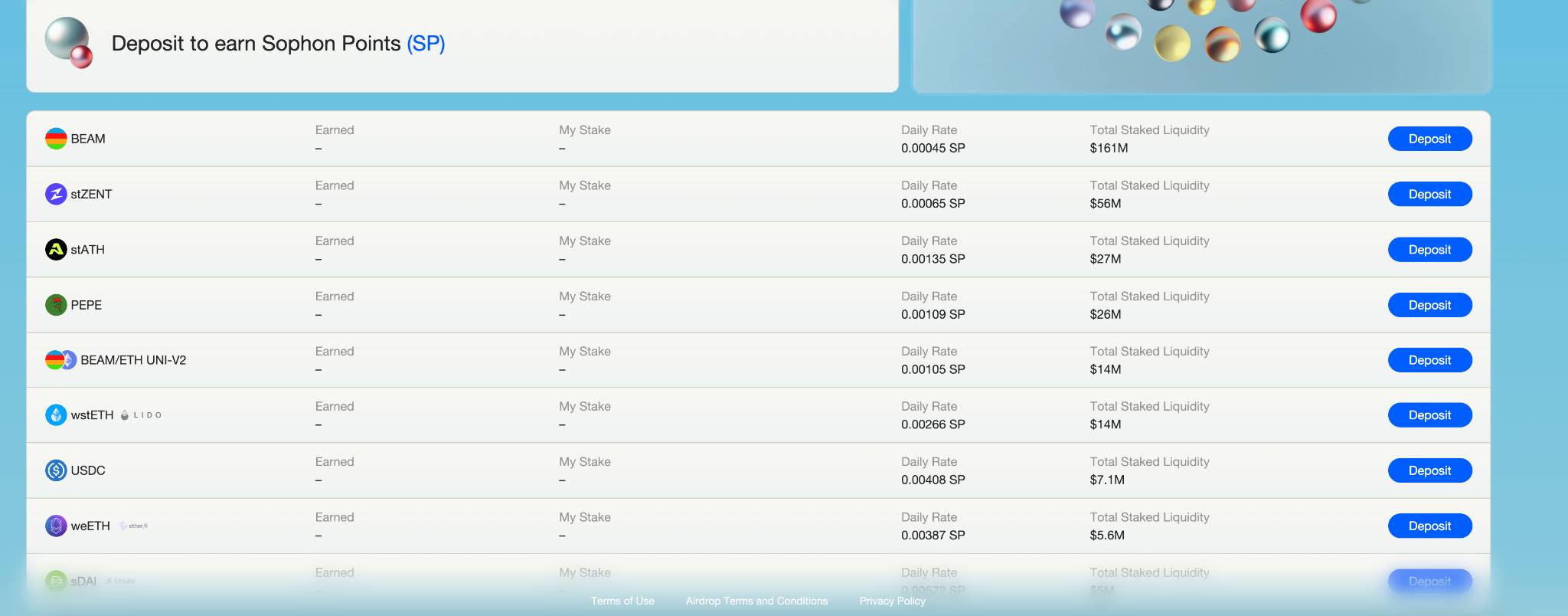

Beyond Aethir’s native staking platform (https://stake.aethir.com/dashboard), Aethir recently announced integration with Sophon’s ZK chain, launching liquid staking for ATH—called stATH. Users staking via Sophon’s platform receive both native Aethir staking rewards and additional stATH incentives.

Therefore, from the perspective of ATH stakers, participating in the staking pools offers multiple, highly attractive layers of return.

-

Computing Power Demanders

From the standpoint of Aethir’s core business, ATH is a fundamental utility token required to access computing power and rendering services. Any user needing computational capacity inherently requires ATH. Specifically, ATH serves as the standard medium of exchange within Aethir; all participants seeking processing power compensate providers in ATH. This is evident across three primary business areas: AI applications, cloud computing, and virtualized computing.

Indeed, Aethir offers several compelling advantages in delivering computing power.

As the largest H100 GPU compute cluster, Aethir is among the few GPU cloud ecosystems capable of supporting large-scale AI training. It meets the high-end demands of advanced AI applications and cloud computing. With the introduction of its MaaS framework, Aethir is poised for rapid market expansion.

In cloud gaming, Aethir leverages its multi-role architecture—Container, Indexer, Checker—and massive compute cluster to deliver extremely low costs, flexible scalability, and real-time, burst-capable, sustained computing power. This enables high-efficiency, low-latency GPU streaming and premium rendering services for global game developers and players, potentially bringing seamless AAA gaming experiences to low-end devices in developing regions.

Furthermore, Aethir supports both retail and wholesale models for computing resource delivery. Whether users have continuous, large-scale computing needs or temporary requirements—such as small rendering studios—they can find suitable support on the Aethir network, creating a solid foundation for broader adoption.

Across sectors like AI applications, cloud computing, virtualization, and cloud gaming, there exists significant unmet market demand for computing power. Aethir, with its unique advantages, is rapidly expanding its footprint in these areas, positioning itself to serve long-term demand. Currently, Aethir has established deep partnerships with several major cloud gaming companies, game developers, and leading international telecom providers. According to Aethir’s latest report, the platform generated $36 million in revenue last year, with a projected long-term total addressable market exceeding $30 billion.

Aethir’s inherent advantages lay the groundwork for broad market expansion, which will further strengthen demand for the ATH token and drive sustained value accumulation.

Beyond the above, community members and stakeholders interested in shaping the ecosystem tend to use ATH for governance participation, further accelerating market demand for the token.

From a supply-demand perspective, output-side activities in the Aethir network often correlate directly with market demand. For instance, when Containers, Indexers, or GPU contributors receive rewards, it indicates active usage by demand-side participants. Meanwhile, stakers, motivated by consistent rewards and potential ATH price appreciation, are likely to increase their staked amounts. Thus, ongoing ATH issuance may reflect overall value growth within the network.

The Value Growth Flywheel of the Aethir Ecosystem

The ATH-centric economic model is driving Aethir toward a positive feedback loop of value growth.

Currently, Aethir is experiencing rapid expansion in both market reach and business operations, attracting increasing numbers of GPU contributors, DePIN nodes, and participants fulfilling Container, Indexer, and Checker roles. Beyond the growing GPU cluster size, contributor roles are also scaling—for example, the number of Checkers has surpassed 74,000—driving improvements in cluster scale and service quality, which in turn attracts more demand-side users to the network.

From a tokenomics standpoint, the expansion of Aethir’s market size and demand base accelerates demand for ATH, reduces circulating supply, and pushes upward pressure on the token’s value, establishing a stronger fundamental value base.

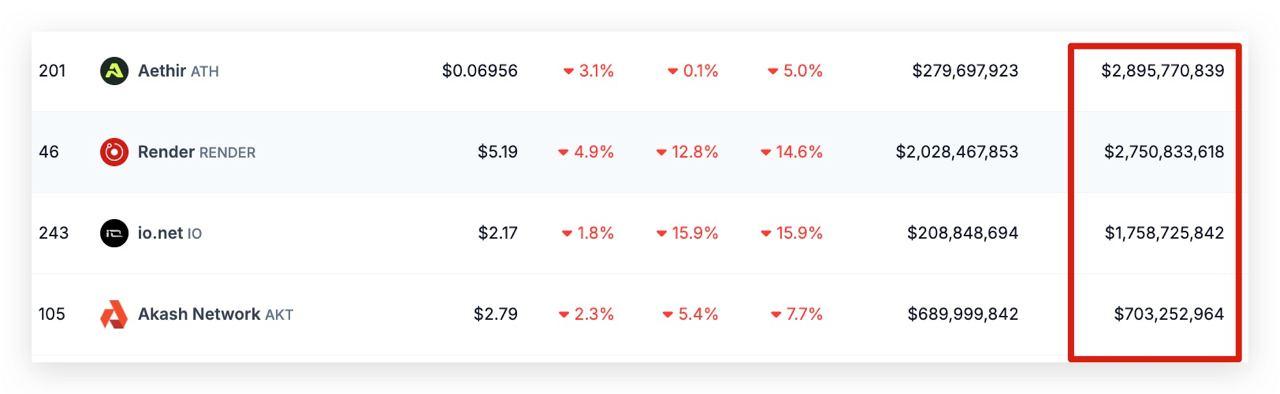

As the value of ATH rises, investors, users, and other stakeholders benefit from higher returns and increased earnings from the network, reinforcing confidence in Aethir’s long-term prospects. This attracts even more participants—including GPU contributors, service providers, and stakers—to join the ecosystem, further enhancing resource scale and service quality, and accelerating business collaboration and expansion. At present, Aethir has already become the highest-FDV project in the DePIN sector.

With the launch and exchange listing of the ATH token, this value flywheel is now spinning faster, allowing all participants to benefit from the success of Aethir’s GPU-based DePIN ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News