At the Crossroads of the Crypto Market: Analyzing Three Bearish Signals and Three Bullish Signals

TechFlow Selected TechFlow Selected

At the Crossroads of the Crypto Market: Analyzing Three Bearish Signals and Three Bullish Signals

With continuous capital inflows, the long-term bearish outlook for the crypto market is difficult to sustain.

Author: CRYPTO, DISTILLED

Compiled by: TechFlow

Cryptocurrencies, like most risk assets, are currently facing severe macro headwinds, leading to increased market volatility and fear.

Despite these challenges, the strong value proposition of Bitcoin and blockchain continues to support a long-term bullish outlook.

In the short to medium term, some challenges are expected. Focus on security, remain open-minded, and cautiously seize opportunities.

Below are three bearish signals and three bullish signals for your reference.

Bearish Signal #1 - Gold Breakout

In 2019, when gold re-broke out, Bitcoin hit its peak.

This pattern repeated in March 2024.

Will the market cool down for 6–9 months before 2025?

Source: Intocryptoverse

(i) Why is a gold breakout bearish?

As a safe haven, gold tends to outperform other risk assets during risk-off markets.

Currently, macro uncertainty is high due to geopolitical conflicts, an uncertain U.S. election, and yen carry trades.

While Bitcoin may follow gold, high-risk altcoins might not.

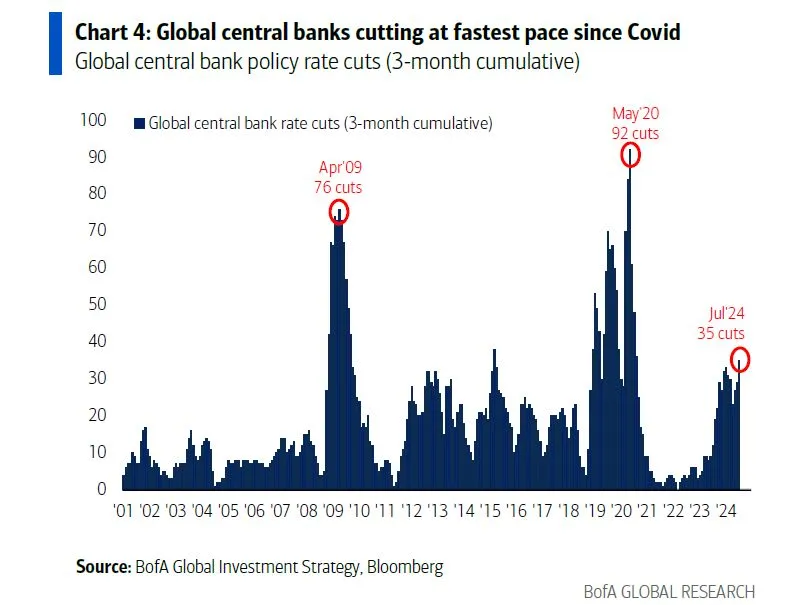

Bearish Signal #2 - Rate Cut Environment

Rate cuts may be bullish in the long run, but their immediate impact often negatively affects risk assets.

During the previous rate-cut cycle (2019), ALT/BTC pairs suffered heavily.

As oscillating indicators, if risk-off sentiment persists, these pairs could face further pain.

Source: Intocryptoverse

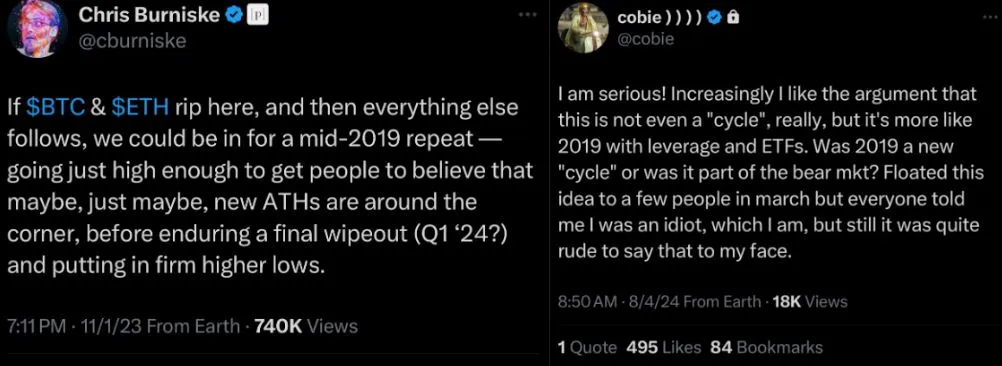

(i) Parallels with 2019 – Has the bull market not started yet?

Key thought leaders like Cobie and Chris Burniske also see parallels with 2019. Here are their core points:

-

Bitcoin dominance rose before liquidity returned

-

We have not yet entered a bull market (2023/2024 was an echo bubble)

-

March 2024 marked a mid-cycle high

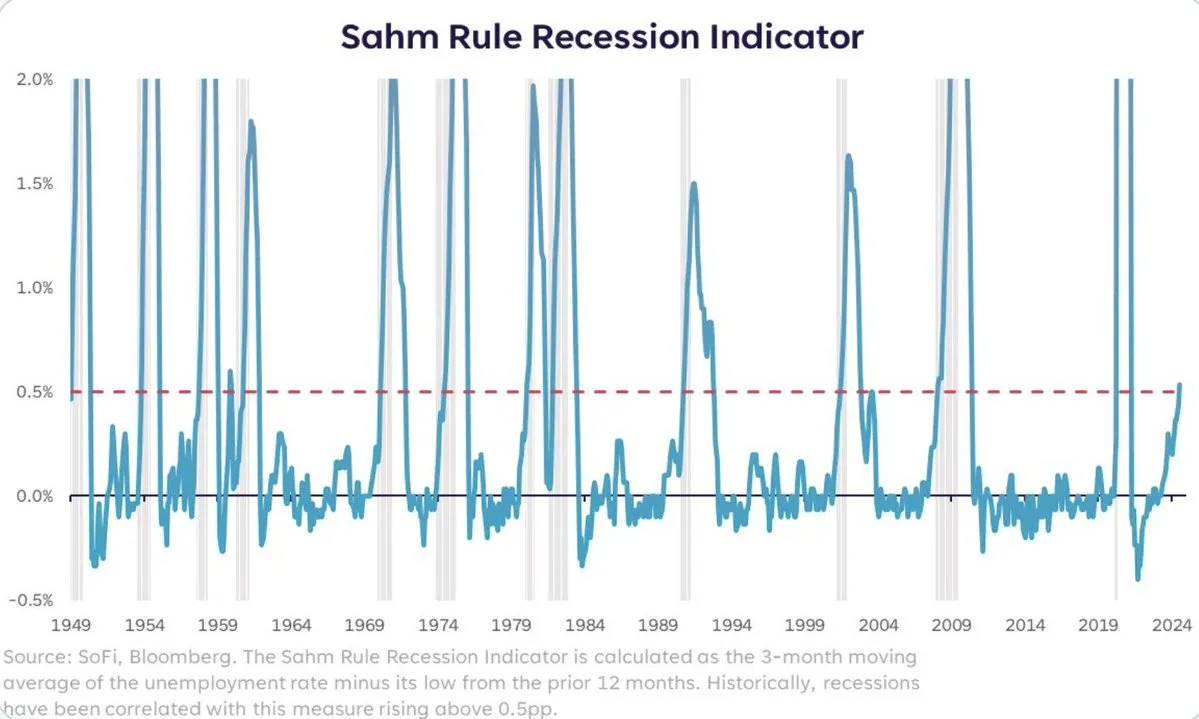

Bearish Signal #3 - Sahm Rule

The Sahm Rule predicts U.S. recessions (based on unemployment data).

(TechFlow note: The Sahm Rule is an economic indicator used to identify recessions by monitoring changes in the unemployment rate. Proposed by economist Claudia Sahm, it offers a simple and effective method for policymakers and analysts to detect downturn risks.)

Since 1950, every time this indicator exceeded 0.5, a recession followed.

Last week, it flashed again.

Source: saxena_puru

(i) Beyond the Sahm Rule:

Note that triggering the Sahm Rule isn’t the end of everything.

What matters is how global banks respond via monetary policy and liquidity provision.

The coming months will be critical in shaping the 2025 market trajectory.

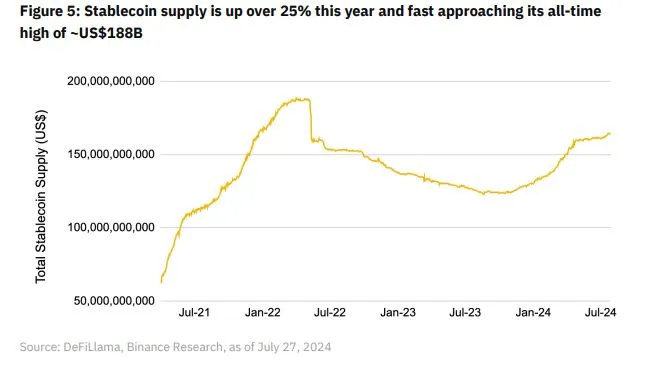

Bullish Signal #1 - Stablecoin Inflows

Despite plunging crypto prices, stablecoin supply is nearing all-time highs (ATH).

This year, stablecoin supply has grown over 25%.

With capital continuously flowing in, a long-term bearish outlook on crypto becomes difficult to sustain.

Source: Binance Research

(i) Why is rising stablecoin supply bullish?

An increase in stablecoin supply indicates more liquidity entering the crypto market.

Stablecoins represent investable capital in crypto assets.

Historically, supply growth often precedes price rallies in crypto.

(ii) Rate Cuts and the Rise of Stablecoins:

While rate cuts may hurt high-risk assets in the short term, they are bullish for stablecoins in the long run.

As traditional asset yields decline, on-chain yields become more attractive.

This could drive further expansion of stablecoins in the coming months.

Source: SplitCapital

Bullish Signal #2 - Pro-Crypto U.S. Regime

Positive regulatory adoption for crypto is growing.

A key sign is the increasing likelihood of a pro-crypto U.S. regime. Notable developments include:

-

Growing number of U.S. corporations holding Bitcoin

-

Pro-crypto factions in both Democratic and Republican parties

-

Bitcoin fair value accounting rules taking effect in 2025.

Although short-term obstacles may arise, the overall trend remains positive and strong.

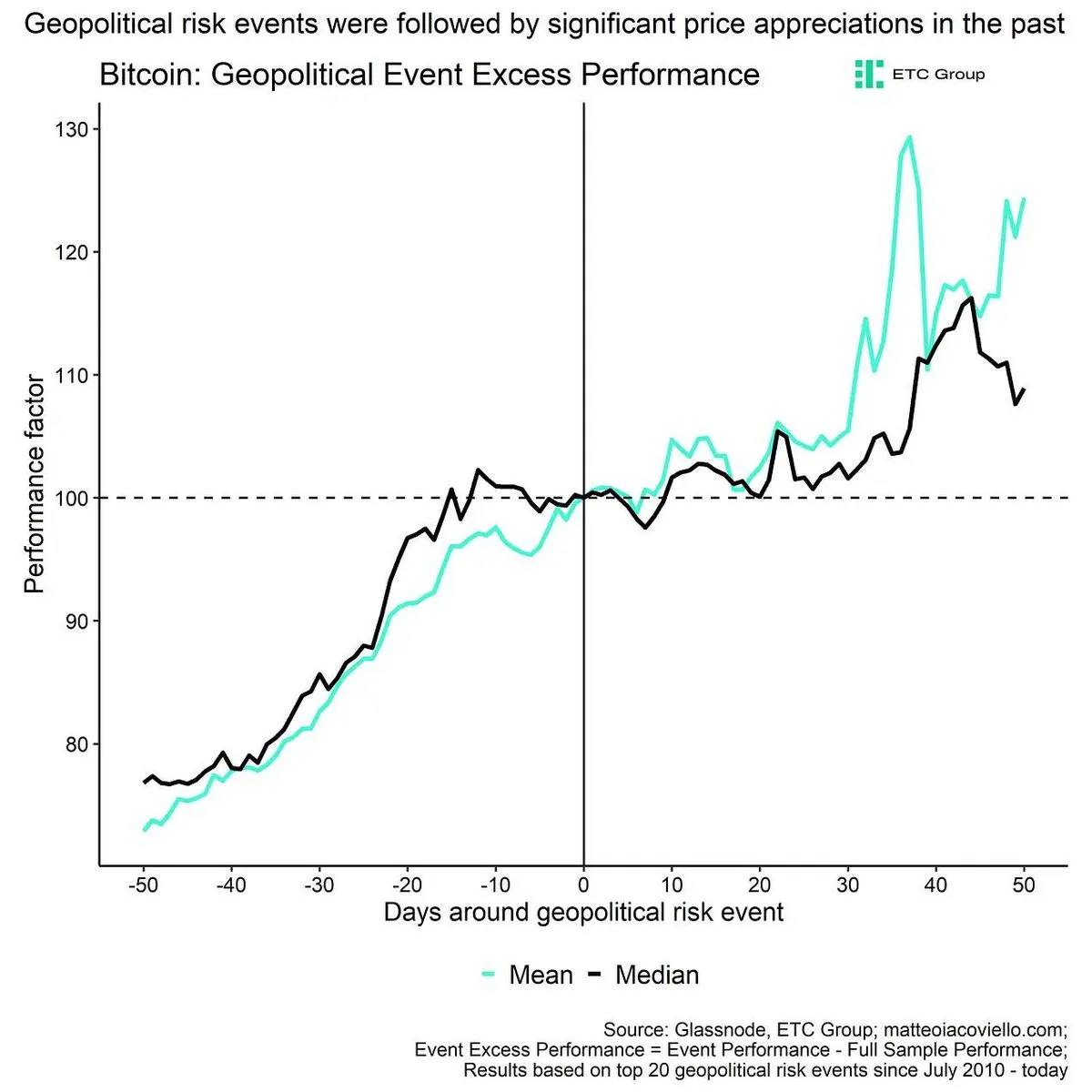

Bullish Signal #3 - Record Global Debt

Global debt reached a record high of $315 trillion earlier this year. With over 50 countries holding elections in 2024, governments may lean toward:

-

Tax cuts

-

Cash stimulus policies

(i) Why is rising debt bullish?

Bitcoin serves as a hedge against currency devaluation and geopolitical uncertainty.

“I believe if the world feels fear, Bitcoin will go up” — Larry Fink (CEO of BlackRock)

Source: Andre_Dragosch

(ii) Central Bank Liquidity and Stimulus:

In the medium to long term, altcoins may benefit from liquidity injections aimed at addressing debt issues.

Central banks may stimulate economic activity to mitigate recession.

Rate cuts have already begun, and fiscal policy may soon follow.

Source: Zerohedge

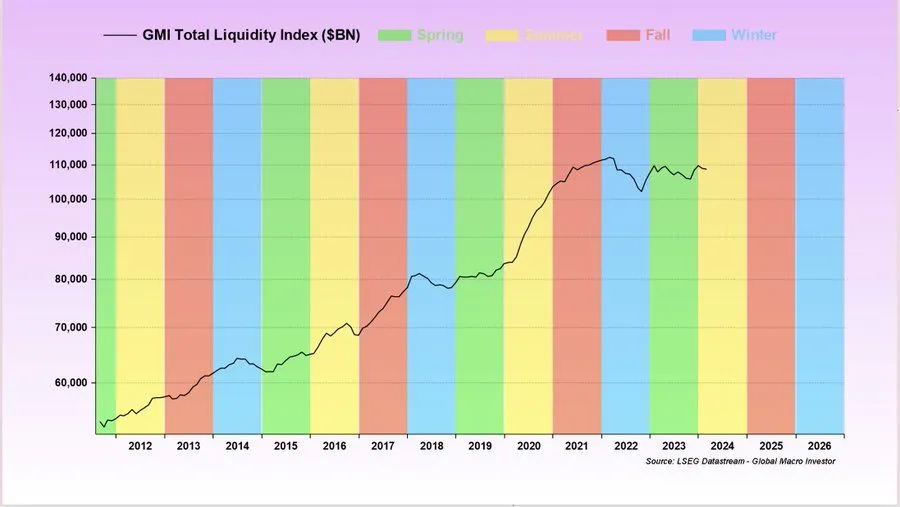

(iii) Macro Summer in the Four-Year Liquidity Cycle:

Finally, you can view the "debt situation" through the lens of the four-year liquidity cycle.

Since 2008, this cycle has been based on government refinancing of debt.

We are currently in a "macro summer," where returns are expected to gradually rise.

This phase typically leads into a "risk-on" macro autumn.

Source: Raoulgmi

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News