Bitcoin Ecosystem by the Numbers: Sidechain TVL Reaches $2 Billion, Stacks Active Accounts Hit Record High

TechFlow Selected TechFlow Selected

Bitcoin Ecosystem by the Numbers: Sidechain TVL Reaches $2 Billion, Stacks Active Accounts Hit Record High

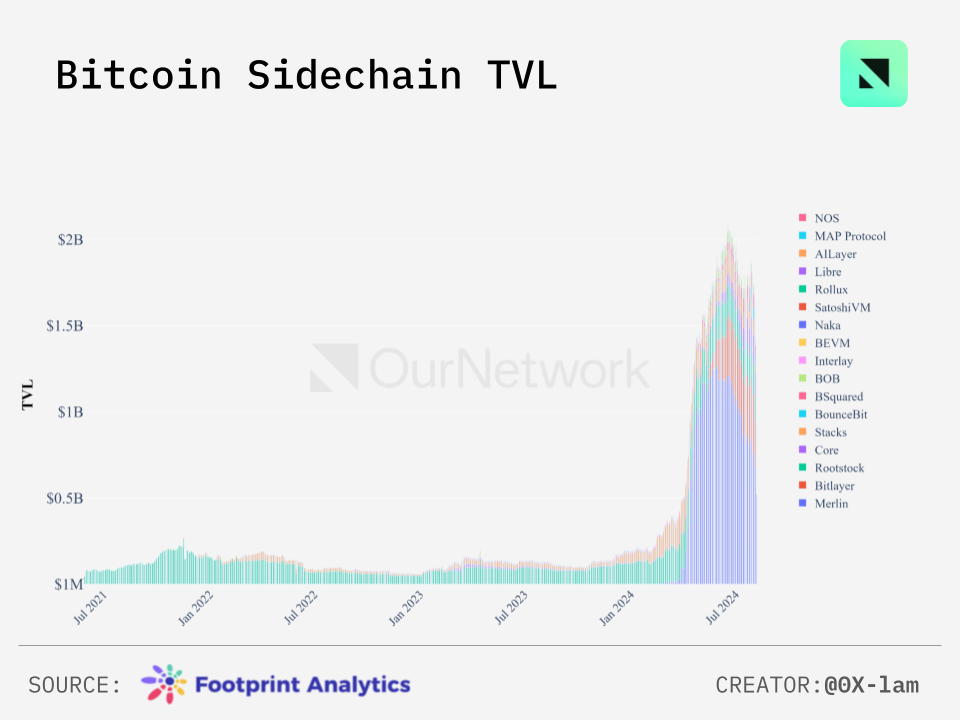

Bitcoin's Layer 2 total value locked briefly exceeded 2 billion USD in 2024 before slightly pulling back.

Author: OurNetwork

Compiled by: TechFlow

Building on Bitcoin

BOB, Bitcoin ETF, Stacks, Rootstock, Bitcoin Virtual Machine

In 2024, the total value locked (TVL) across Bitcoin sidechains reached a new high of $2 billion

-

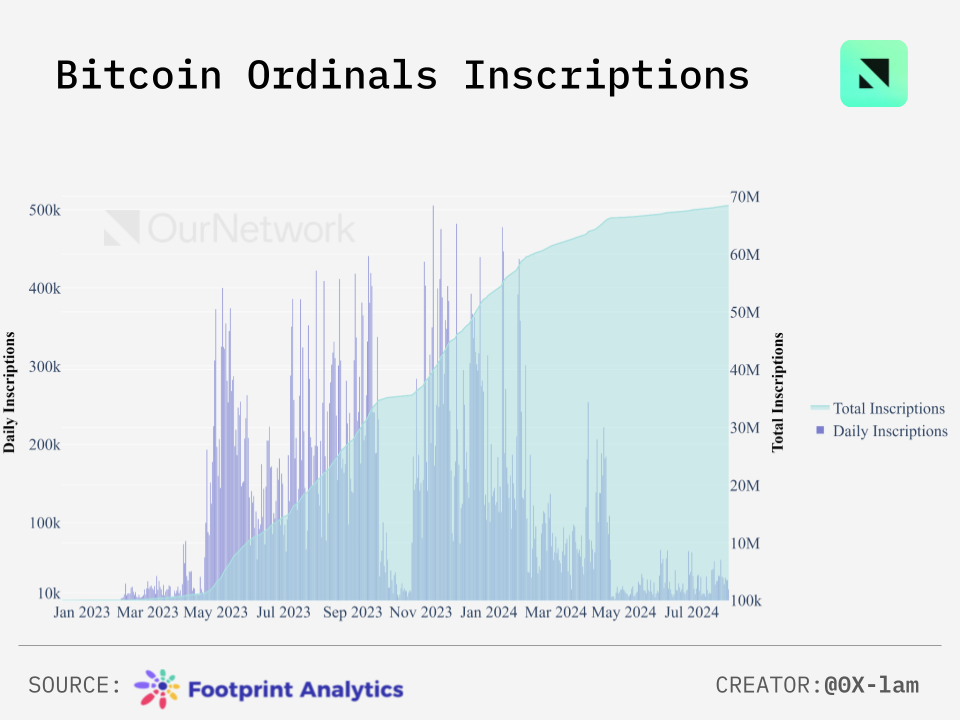

In 2023, the surge in Bitcoin inscriptions sparked excitement among crypto users. Inscriptions opened up new possibilities for Bitcoin, which was previously used mainly as digital gold. To date, the total number of Ordinals inscriptions has exceeded 68 million.

-

Bitcoin hit a new high of $73,000 in 2024, and the halving event renewed market attention on the world's most valuable cryptocurrency. This year also marked explosive growth for Bitcoin Layer 2 solutions—the TVL across Bitcoin L2s briefly surpassed $2 billion in 2024 before slightly pulling back.

-

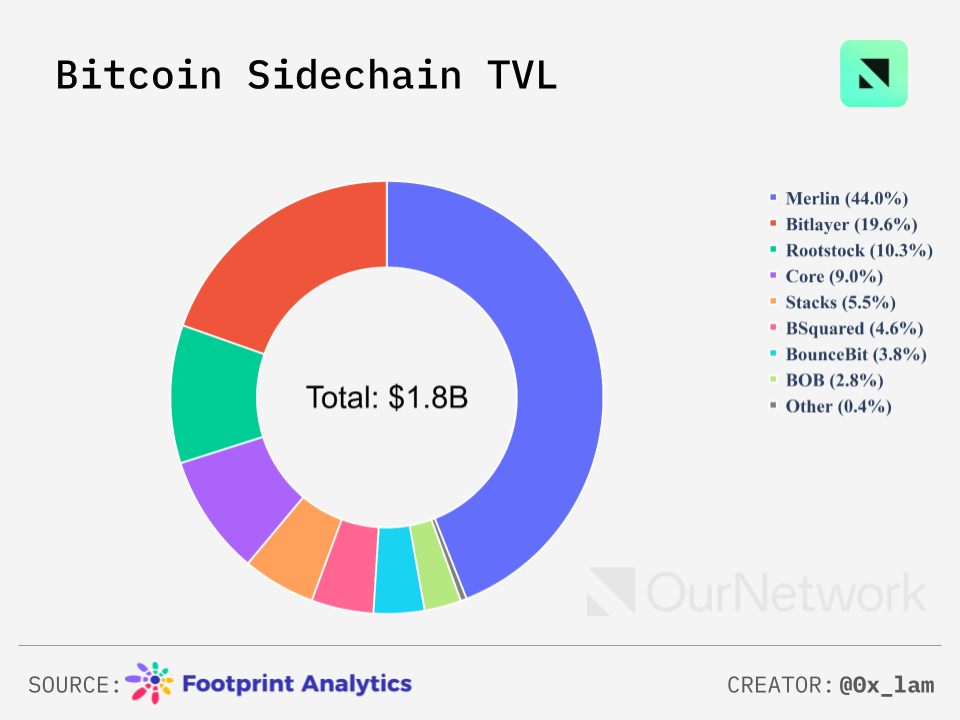

As of July 31, Merlin led the BTC Layer 2 ecosystem, holding 44% of the $1.76 billion TVL. Bitlayer followed with 19.6%, and Rootstock accounted for 10.31%. Together, these three chains held three-quarters of the total TVL.

BOB (Build on Bitcoin)

BOB surpasses 130,000 unique addresses, with 740,000 BTC bridged via gateways!

-

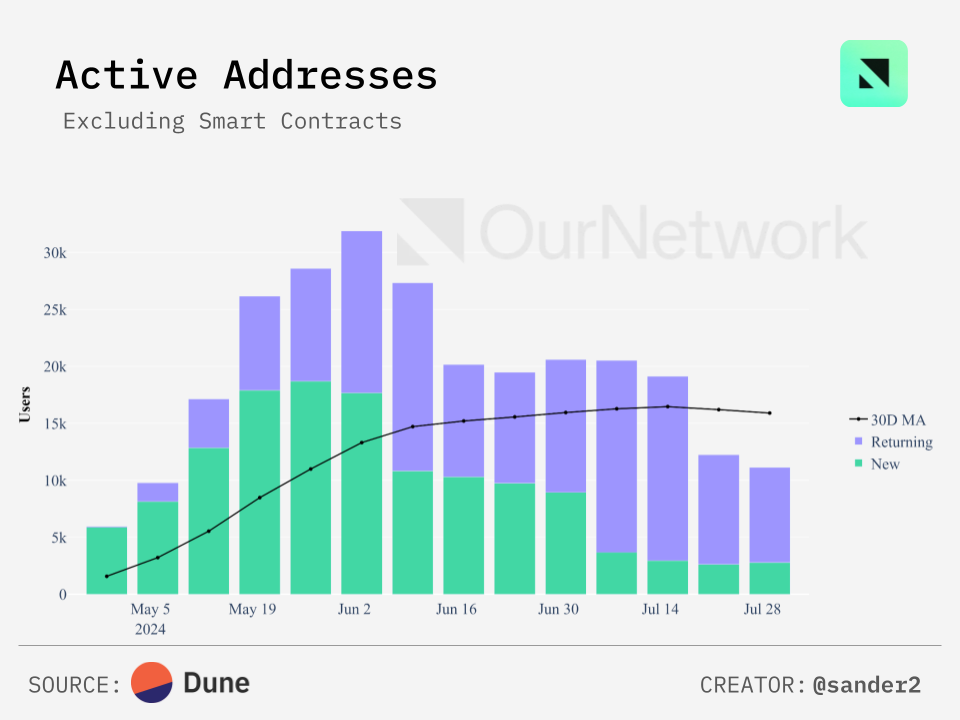

BOB is a hybrid Layer 2 backed by both Bitcoin and Ethereum, launched on May 1, 2024. Since launch, BOB has attracted significant user adoption, with over 133,000 unique addresses. The weekly active addresses chart shows a peak of over 30,000 users in early June. Although numbers have slightly declined, the 30-day moving average of active addresses remains around 16,000, indicating strong user retention.

Dune Analytics - @bob_collective & @sander2

-

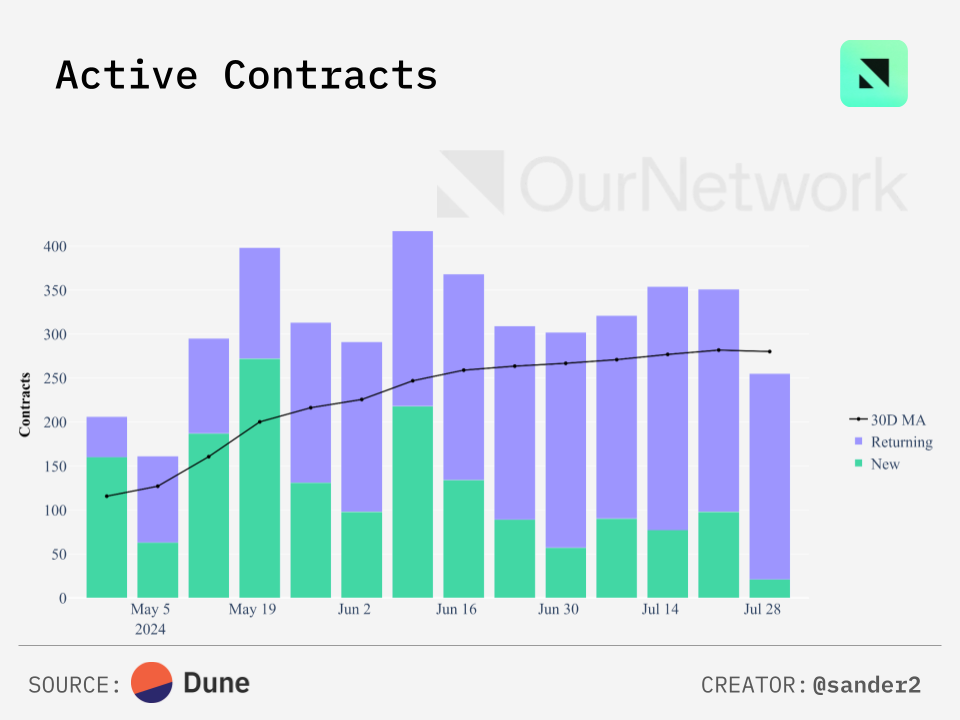

Developer engagement on BOB is rising, with nearly 300 active contract addresses per week. This sustained growth demonstrates the platform’s appeal to developers building and deploying smart contracts.

Dune Analytics - @bob_collective & @sander2

-

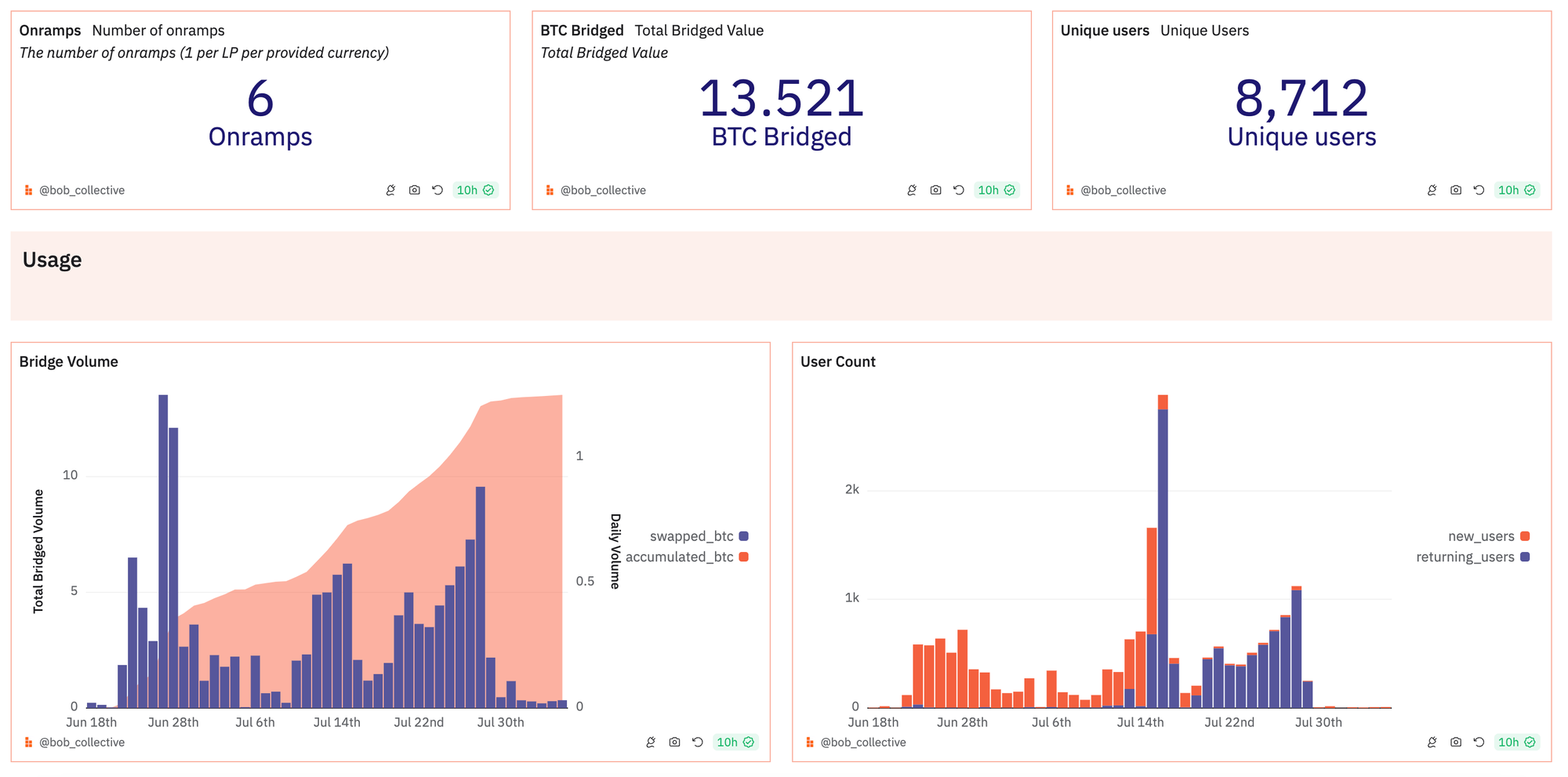

The BOB Gateway enables users to easily swap Bitcoin for wrapped Bitcoin to efficiently earn yield. To date, 8,712 users have used the gateway, completing swaps totaling 13.521 BTC (approximately $734,090.24).

Dune Analytics - @bob_collective & @sander2

-

Transaction-level Alpha: Over the past 30 days, the deposit contract on BOB consumed the most gas, totaling 6.4 ETH ($15,549). Here is an example transaction using the deposit contract.

Bitcoin ETFs

Bitcoin spot ETF issuers suffered nearly $10 billion in BTC holdings valuation losses

-

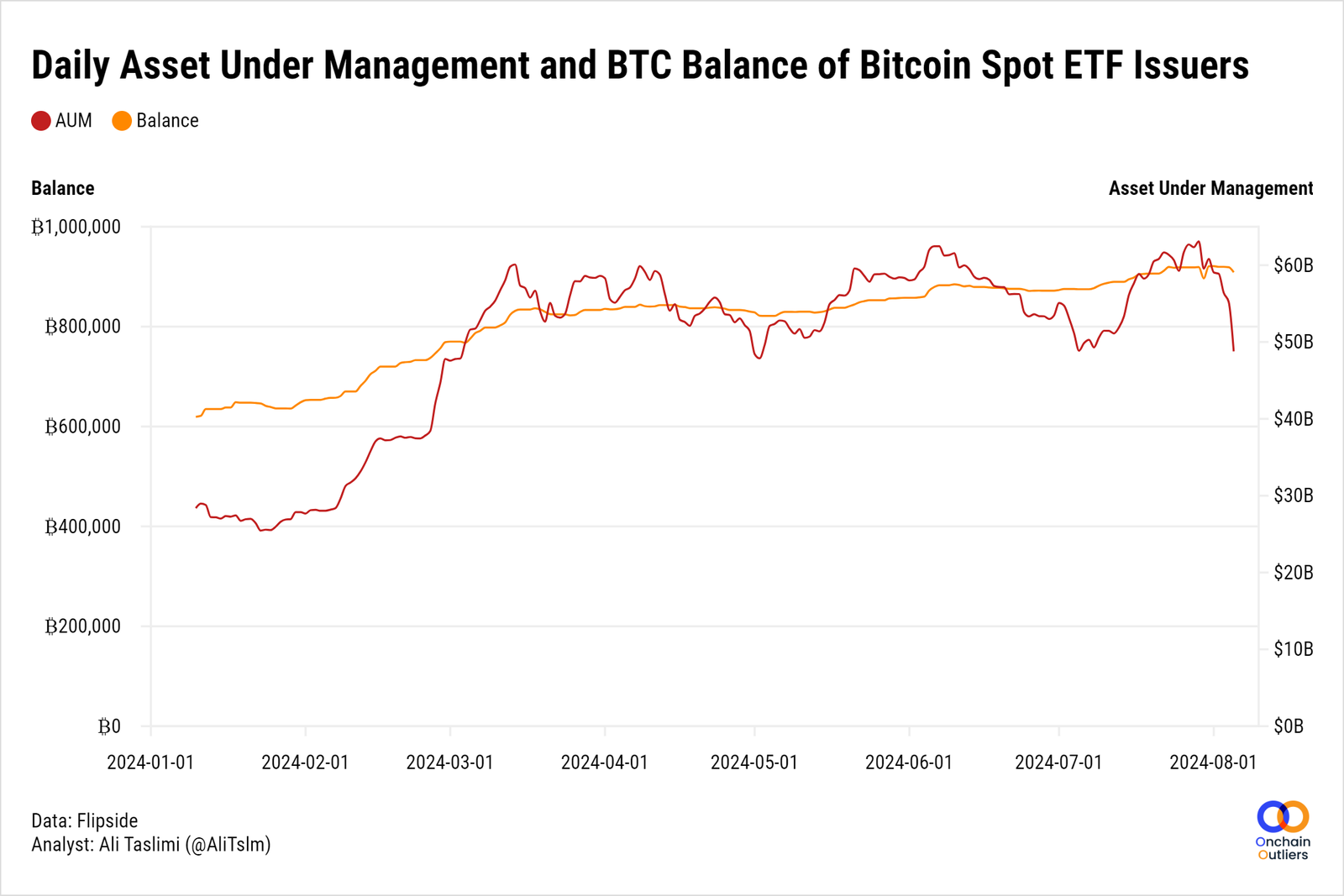

Over the past eight months, bitcoin spot ETF issuers have cumulatively held 4.5% of Bitcoin’s circulating supply. However, volatility in Bitcoin’s price has significantly impacted the dollar valuation of their holdings. Since early August 2024, during a crypto market crash, the value of their BTC holdings dropped by nearly $10 billion.

-

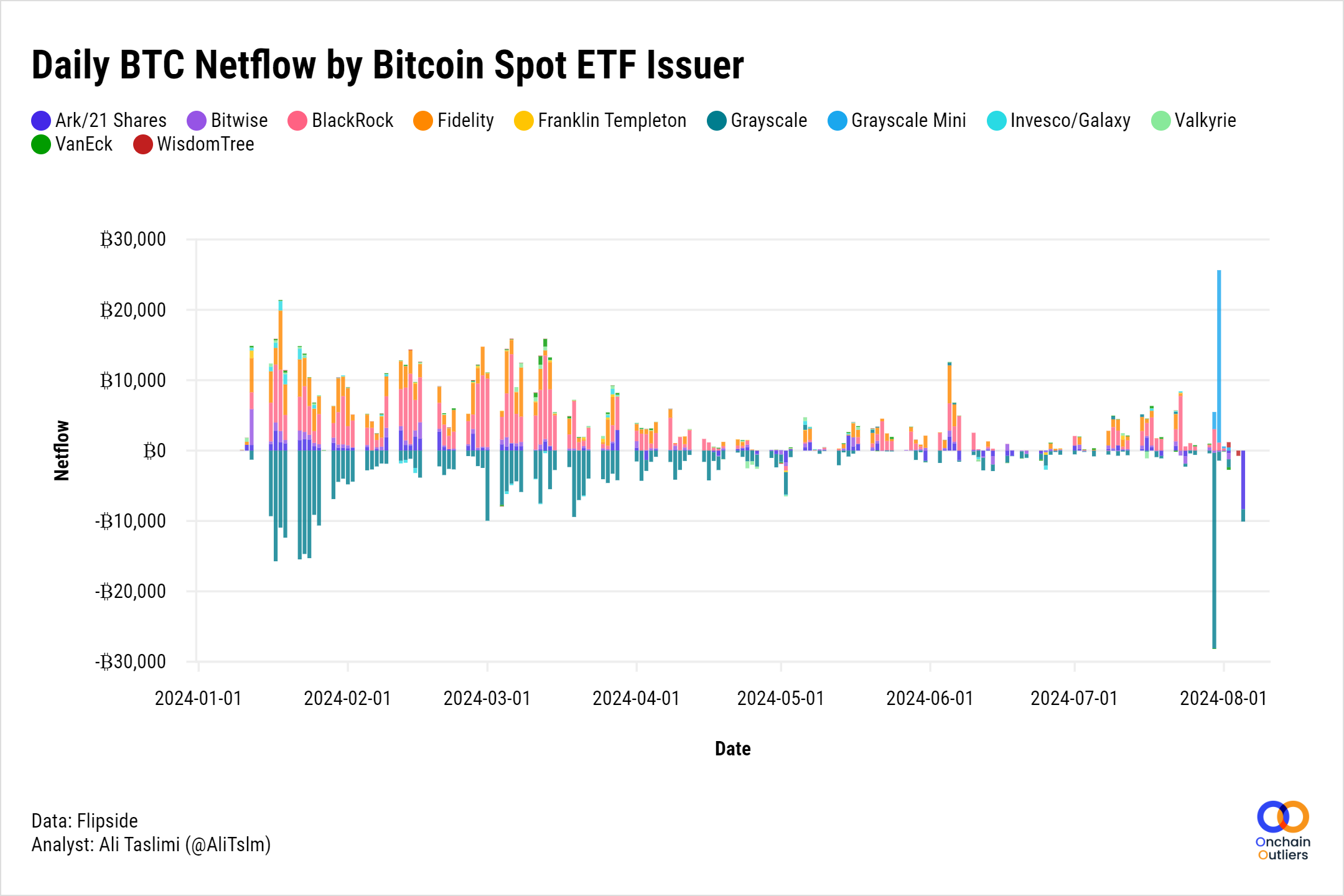

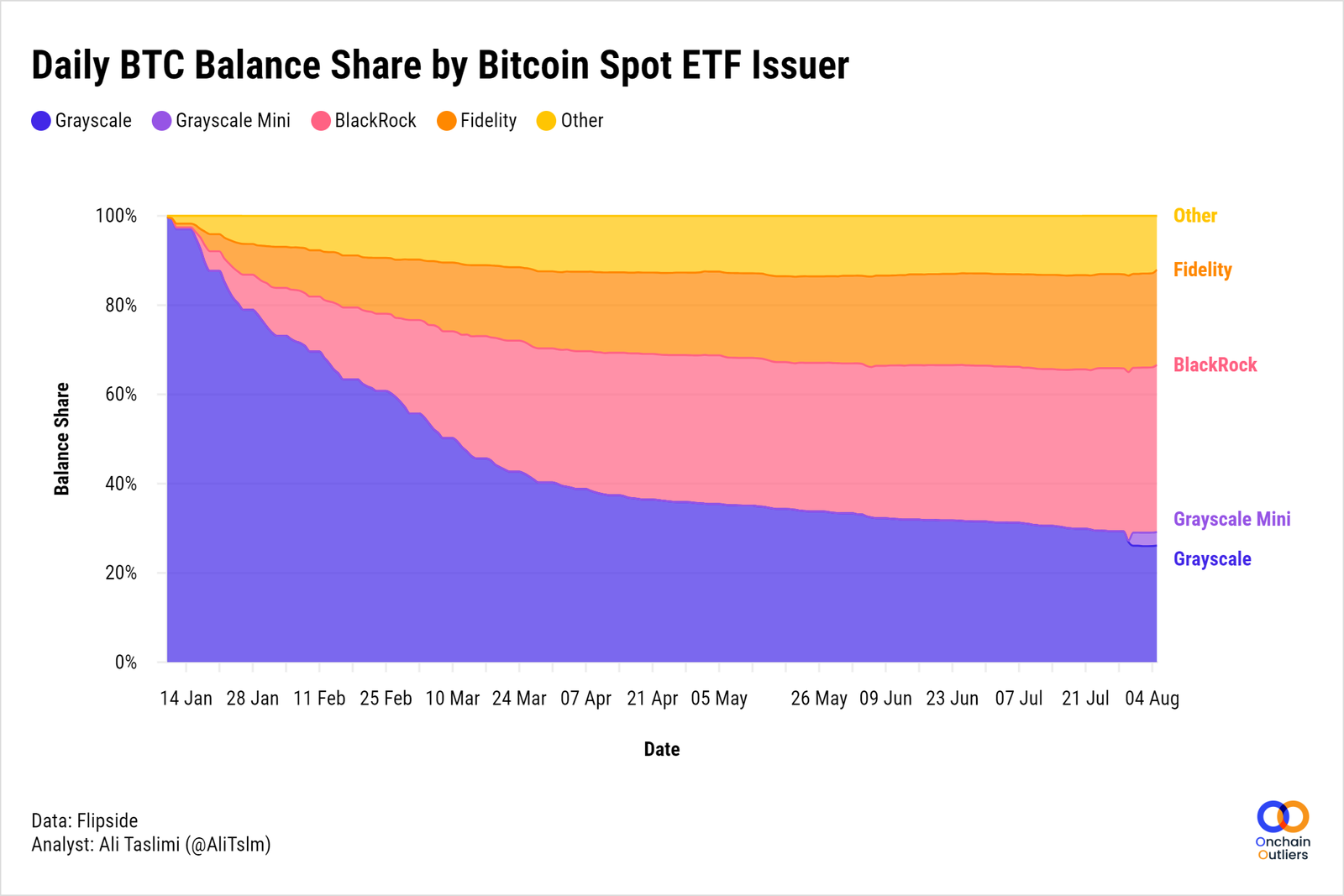

Since the approval of Bitcoin ETFs, Grayscale has been steadily reducing its holdings, while other issuers have been increasing their BTC positions. Additionally, at the end of July, Grayscale launched a low-cost Bitcoin spot ETF called Grayscale Mini and transferred most of its holdings into this new fund.

-

Grayscale was the dominant Bitcoin spot ETF issuer for several months. However, as Grayscale began selling its BTC holdings for profit-taking, other issuers increased their accumulation. This shift caused BlackRock to become the largest BTC holder among ETF issuers.

Stacks

Active accounts on Bitcoin L2 Stacks reach all-time highs

-

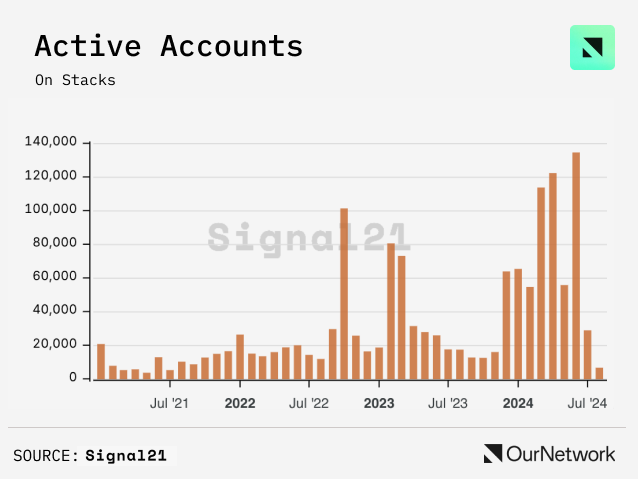

The Bitcoin summer injected momentum into the Bitcoin Layer 2 (L2) ecosystem. In June alone, Stacks—leading in developer activity among Bitcoin L2s—attracted over 134,000 active users. This surge in new users is attributed to several key developments: approval of the Grayscale Stacks Trust, optimistic news regarding Stacks and the SEC, and the integration of BitGo, the wBTC signer, into Stacks’ signer network. These advancements in compliance and institutional adoption have brought Stacks into the spotlight.

-

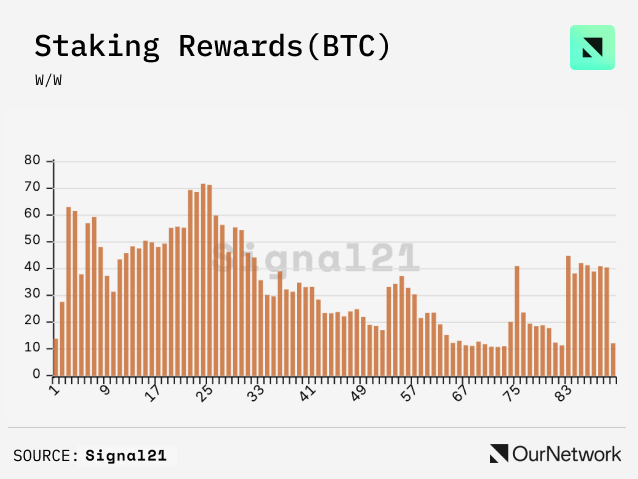

Stacks is the only Bitcoin L2 with native Bitcoin (BTC) rewards. In the most recent cycle (every two weeks), it distributed over 40 BTC (worth $2.2 million) to Stackers—a decentralized open network where users secure the network by staking STX. Anyone can stake their STX to earn BTC rewards.

-

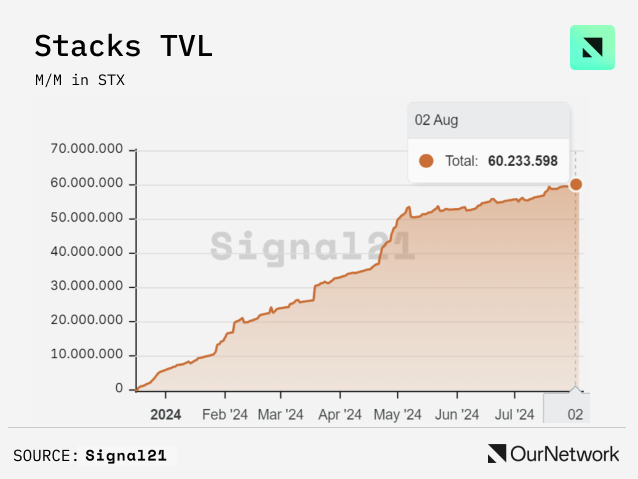

Increased user adoption in Stacks' Bitcoin DeFi ecosystem can be attributed to Stacking DAO reaching a milestone of 60 million STX in TVL. Stacking DAO is the leading liquid staking protocol on Stacks, allowing users to stake their STX, receive stSTX, and use it across DeFi protocols.

Rootstock

Gabriela Castillo Areco & Guilherme Wenceloski | Website | Dashboard

An $180 billion opportunity in Bitcoin’s untapped potential

-

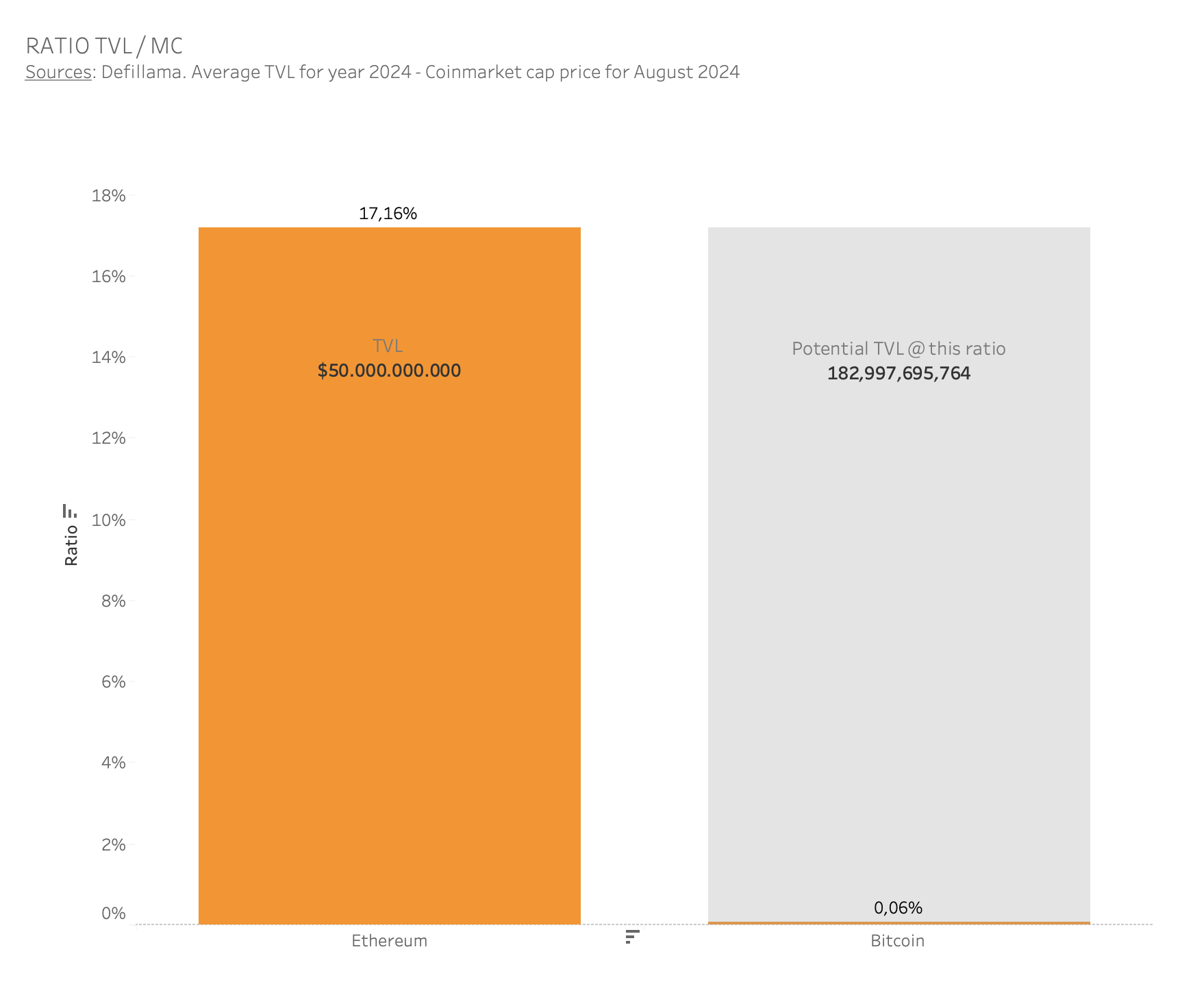

Michael Zhao’s report “The Bitcoin Renaissance” explains that Bitcoin’s usage potential can be seen through the ratio of Total Value Locked (TVL) to market cap. Currently, 17% of Ethereum’s value is used in decentralized applications (dApps), but Bitcoin uses only 0.06%. If Bitcoin were to reach Ethereum’s level, it would unlock $180 billion in value. This is a conservative estimate, as developers often test first on lower-cost blockchains. New BTC L2 technologies aim to expand Bitcoin’s utility beyond just store of value. Rootstock is a key player in this space, being one of the earliest Bitcoin sidechains, leveraging Bitcoin’s secured infrastructure and EVM compatibility to develop this market.

-

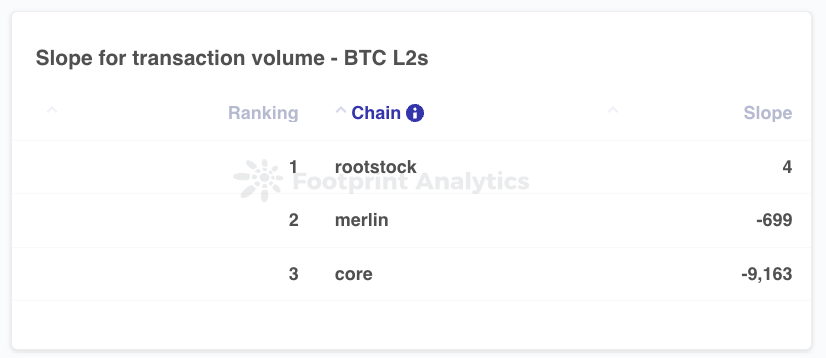

To capture the $180 billion opportunity, Bitcoin technology must expand its utility, driving the development of BTC L2 (Layer 2) solutions. The Spartan Report identifies Rootstock as one of the “Big Four BTC L2” networks. In the first half of 2024, Rootstock demonstrated strong growth, benefiting from the Bitcoin halving and partnerships with Uniswap, The Graph, Open Ocean, and Wormhole, enhancing its cross-chain interoperability. Other BTC L2s in the market are going through a maturation process that Rootstock has already completed. Rootstock maintains a positive transaction slope, demonstrating advanced development.

-

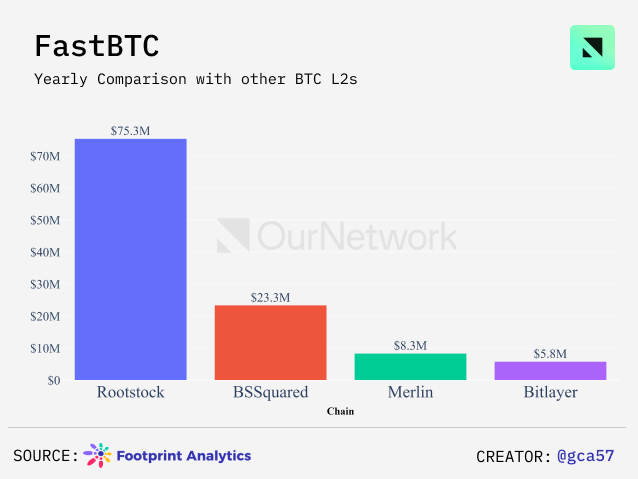

In 2024, Sovryn’s FastBTC held 1,300 BTC—existing protocols within the Rootstock ecosystem are key indicators of product-market fit. Sovryn demonstrated this potential through its FastBTC bridge, processing more volume than the combined total of all other non-native BTC L2 bridges, highlighting the massive demand and potential for such solutions.

-

Transaction-level Alpha: This is the first transaction on the Bitcoin mainnet using Bitvmx for dispute verification. The Bitcoin L2 space is expanding, and this technology is paving the way for building secure, efficient, and high-performance Bitcoin bridges. The existence of this transaction proves that verifying SNARK proofs on Bitcoin is possible without requiring a Bitcoin hard fork or OP_CAT.

Bitcoin Virtual Machine

BVM – Bitcoin’s pioneering Rollup-as-a-Service exceeds $8.2 million in TVL

-

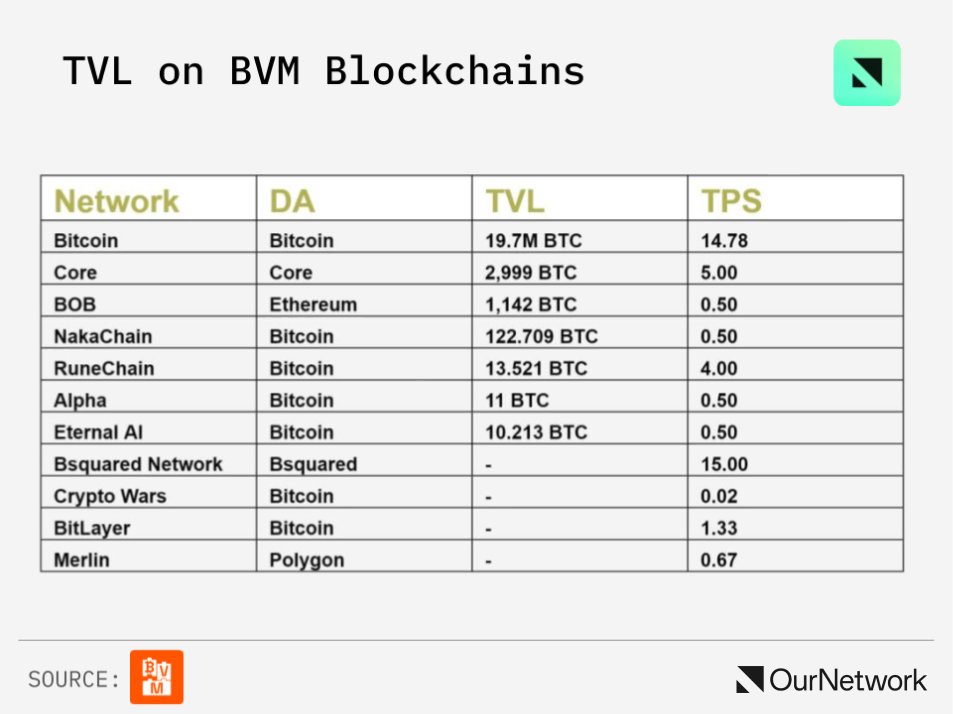

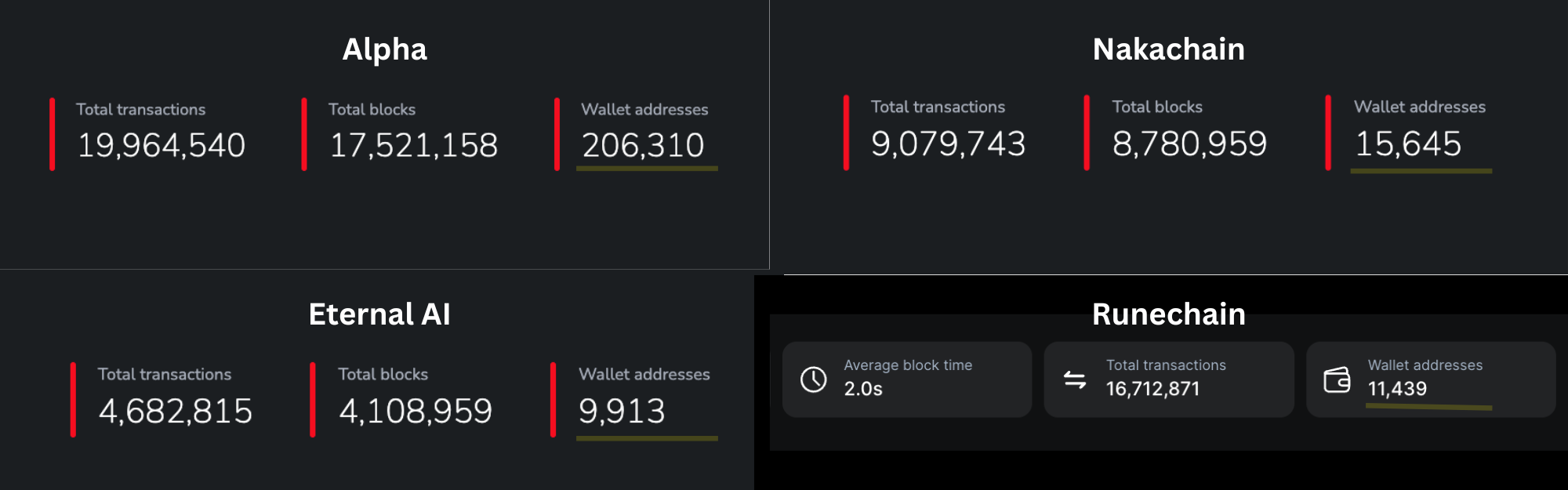

BVM is the leading Rollup-as-a-Service (RaaS) platform on Bitcoin, enabling anyone to easily deploy and run a Bitcoin L2/L3 for just $99 per month—no coding required. With BVM, you can customize your rollup on Bitcoin, choosing from various modules including data availability solutions like Avail DA, Celestia DA, and others. You can also select between ZK Rollups and OP Rollups, and different hardware configurations to build your own Bitcoin L2/L3. Rollups powered by BVM achieve high speed (<1 second block time) and low gas fees (~$0.001 per transaction), opening possibilities for consumer-grade applications on Bitcoin. The total value locked (TVL) across blockchains deployed on BVM has reached a new milestone of $8.2 million, with NakaChain, EAIChain, and RuneChain being major contributors to this growth.

-

BVM recently launched the Bitcoin RaaS Studio, a no-code tool enabling anyone to create a Bitcoin rollup in under two minutes. This visual programming editor is fully self-service, allowing users to easily design their rollup blockchain by dragging and dropping modules—similar to the Scratch user experience. Over 10 projects are already running their own rollups using BVM’s tech stack, collectively creating more than 243,000 wallets on the mainnet.

-

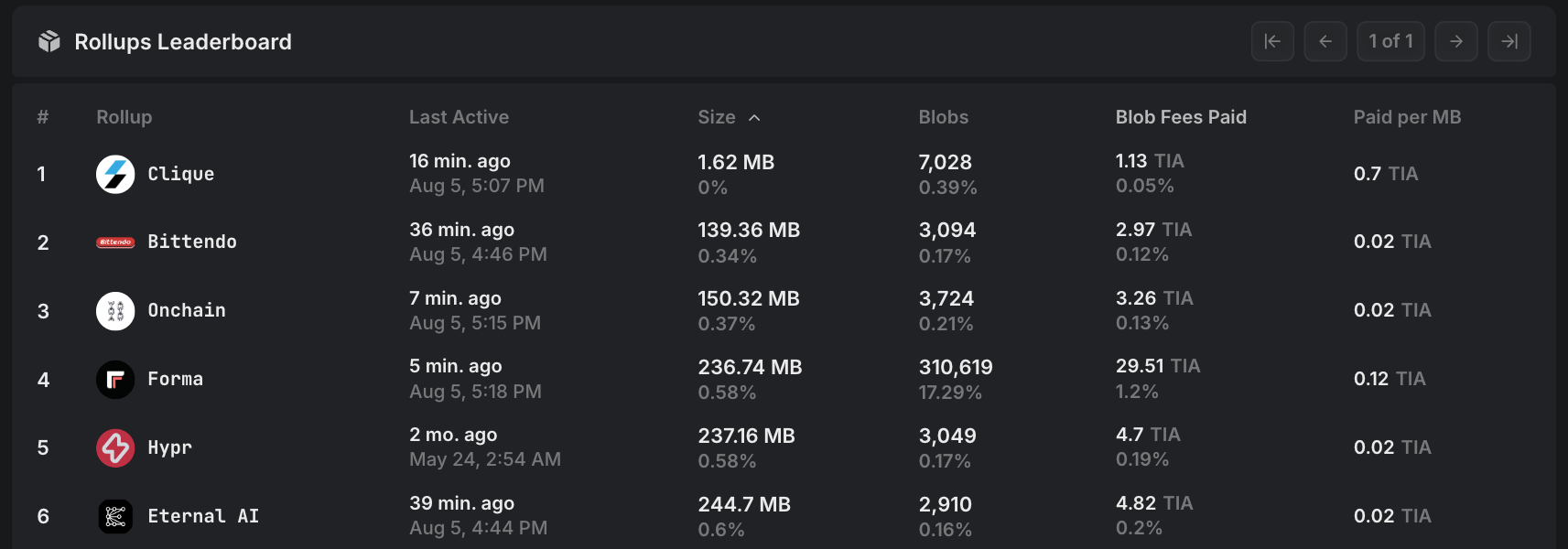

By integrating with data availability solutions such as Filecoin, Polygon, Avail, and Celestia to optimize costs, BVM is helping developers build more efficient and sustainable projects in DeFi, AI, and beyond. With BVM support, Eternal AI and Bittendo have optimized costs by leveraging Celestia for data availability, making them among the most cost-effective rollups, with storage costing just 0.02 TIA per MB.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News