The Evolution of Perpetual DEXs: From Niche Trading Venues to Drivers of On-Chain Adoption

TechFlow Selected TechFlow Selected

The Evolution of Perpetual DEXs: From Niche Trading Venues to Drivers of On-Chain Adoption

By providing a platform that builds an integrated experience similar to iOS, perpetual DEXs have the potential to usher in the next era of crypto adoption.

Author: GAURAV GANDHI

Translated by: TechFlow

Exchanges are foundational to capital markets, fulfilling their core purpose by facilitating asset trading among participants. The central goal of any exchange is to enable efficient (low transaction costs and low slippage), fast, and secure transactions between counterparties. Decentralized exchanges (DEXs) add a layer of trustlessness to this objective, aiming to eliminate reliance on intermediaries and centralized control. DEXs allow users to retain custody of their funds, encourage community participation, and promote open innovation. However, these benefits have historically come at the cost of higher latency and lower liquidity due to throughput and latency limitations of underlying blockchains.

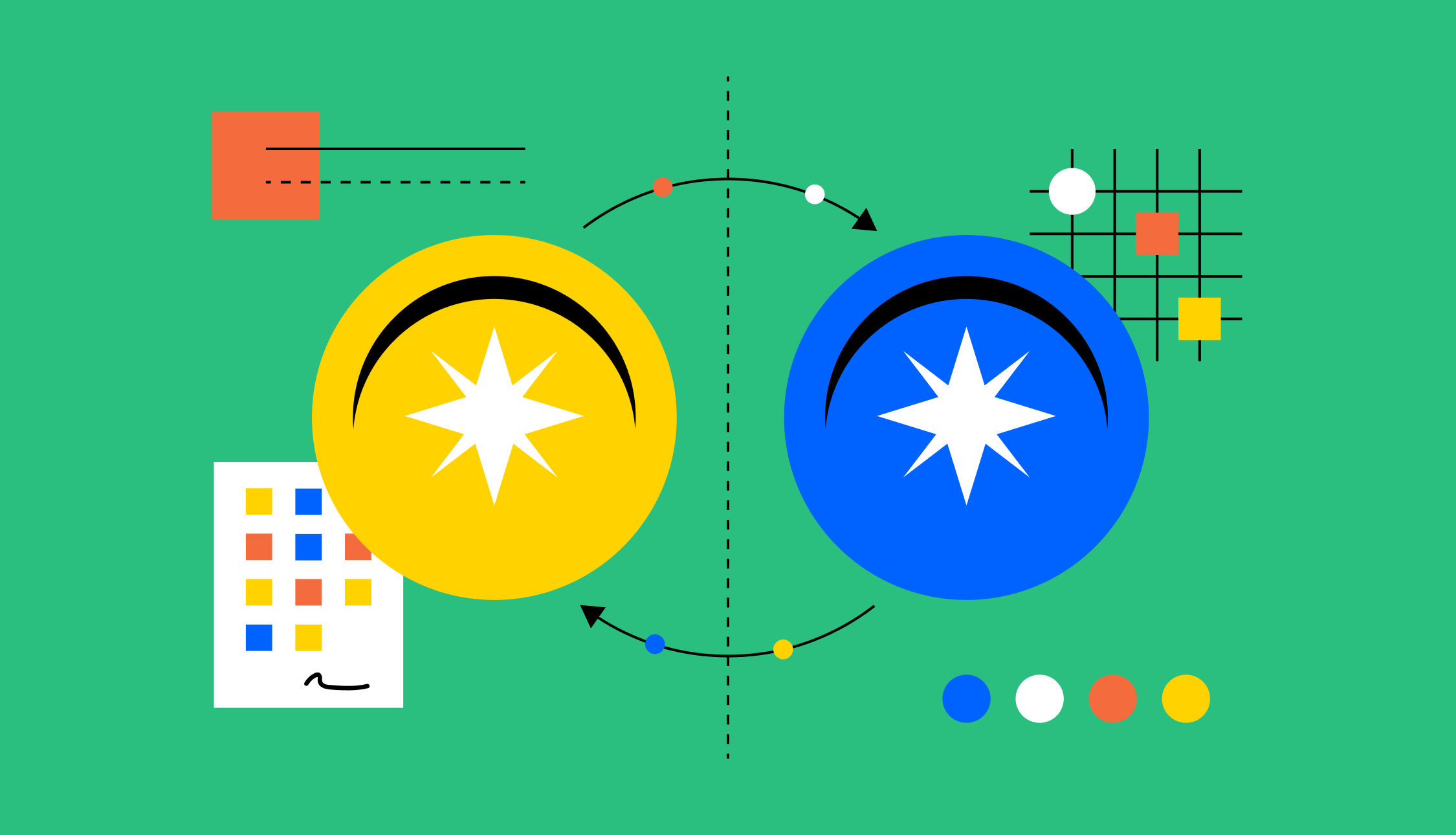

Source: Chainspect, selected block explorers

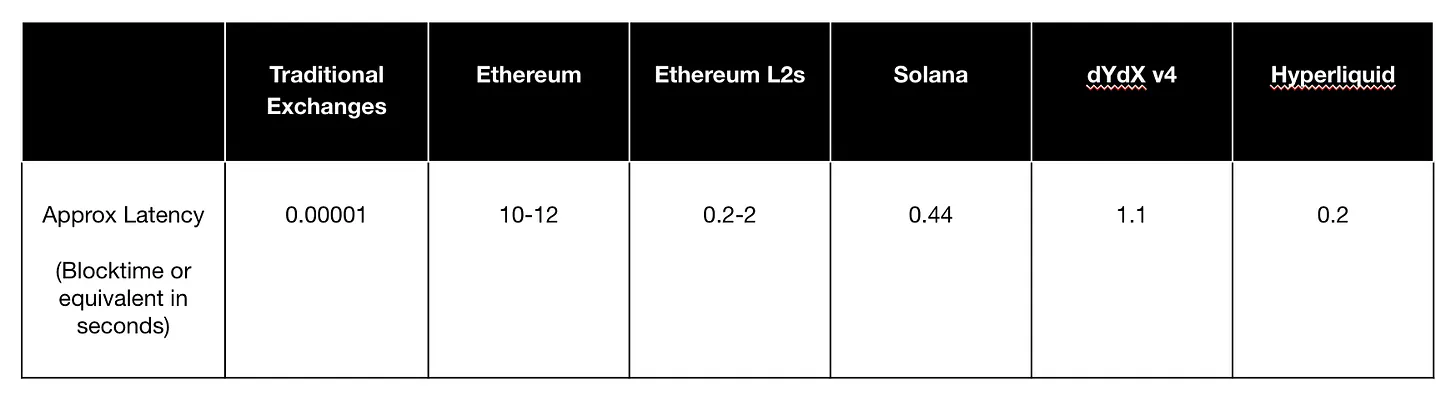

Spot DEXs now account for 15–20% of total spot trading volume, while perpetual contracts make up only about 5%. In the realm of perpetuals, centralized exchanges (CEXs) hold two major advantages—offering better user experience for retail investors and tighter spreads due to effective market maker control. The collapse of FTX further consolidated the industry, leaving only a few dominant CEXs in control. This concentration poses potential risks to the crypto ecosystem. Widespread adoption of decentralized exchanges could not only mitigate such risks but also support long-term sustainable growth across the entire ecosystem.

Source: The Block

In this article, we dive deep into the existing perpetual DEX landscape and review what the optimal design for decentralized perpetual exchanges might look like. The rise of Layer 2 solutions and the multi-chain environment provides a strong foundation for innovation in liquidity acquisition and user experience. Building upon previous research and learnings, we believe we are now entering a golden era for DEXs. Finally, we explore how perpetual DEXs may drive mainstream crypto adoption, extending beyond their core function of enabling efficient trading.

Perpetual contracts have found product-market fit (PMF) in the crypto ecosystem for speculation and hedging.

Perpetual contracts are futures contracts without an expiry date, allowing traders to hold positions indefinitely. These contracts resemble over-the-counter swaps that traditional financial institutions have offered for decades. However, through the introduction of funding rates, cryptocurrency has democratized this product—historically accessible only to qualified participants—making it available to everyday investors.

The perpetual market currently sees over $120 billion in monthly trading volume, creating efficient trading venues equipped with central limit order books, intuitive user interfaces, and fast, secure settlements via vertically integrated clearing systems. Moreover, projects like Ethena have built atop perpetual contracts, expanding their utility beyond mere speculation.

Perpetual contracts offer several advantages over traditional futures contracts:

-

Traders save on transaction fees and other costs associated with rolling over expiring futures contracts.

-

Investors avoid high roll costs caused by more expensive forward contracts.

-

The settlement/funding mechanism delivers continuous realized P&L, simplifying back-end processes for both contract holders and clearing systems.

-

Contracts provide smoother price discovery, avoiding price jumps when switching from one-month to the next-month contract.

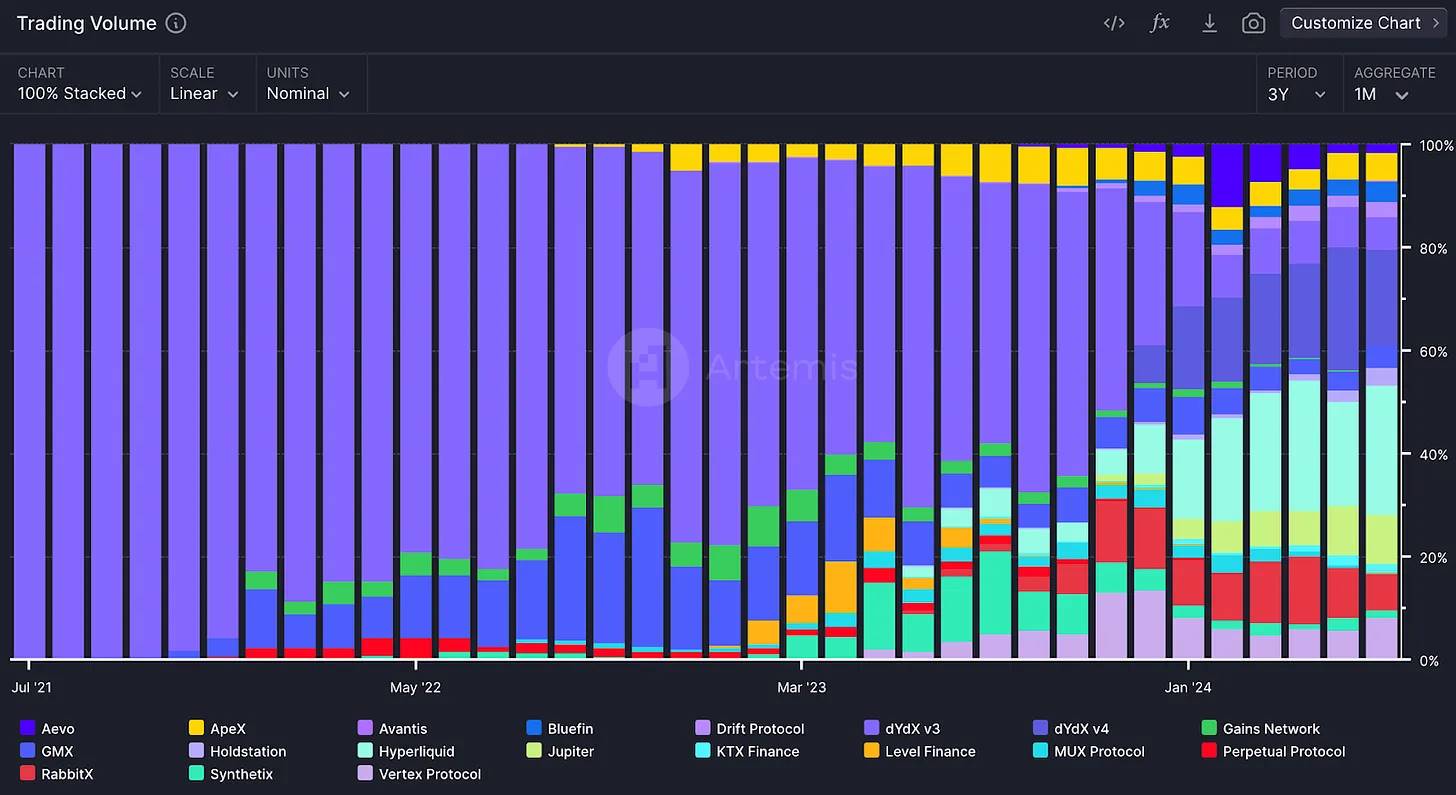

Source: Perpetual DEX Market Share – Artemis

Since BitMEX introduced the concept in 2016, the market has experienced a Cambrian explosion of perpetual DEXs, with over 100 implementations today. While dYdX initially dominated, we now have a vibrant ecosystem across multiple chains. Perpetual contracts have become a critical component of the crypto ecosystem—various leading-lagging studies show perpetual markets often initiate price discovery when spot markets are inactive. Perpetual trading volume on DEXs has grown from $1 billion in July 2021 to $120 billion in July 2024, representing a compound annual growth rate of approximately 393%.

However, for the market to mature further, the fundamental challenges of high latency and low liquidity must be addressed to create a cheap and efficient trading environment. High liquidity reduces slippage and enables a smoother trading experience. Low latency helps market makers quote tighter spreads, execute trades faster, enhance active quoting liquidity, and create a positive feedback loop.

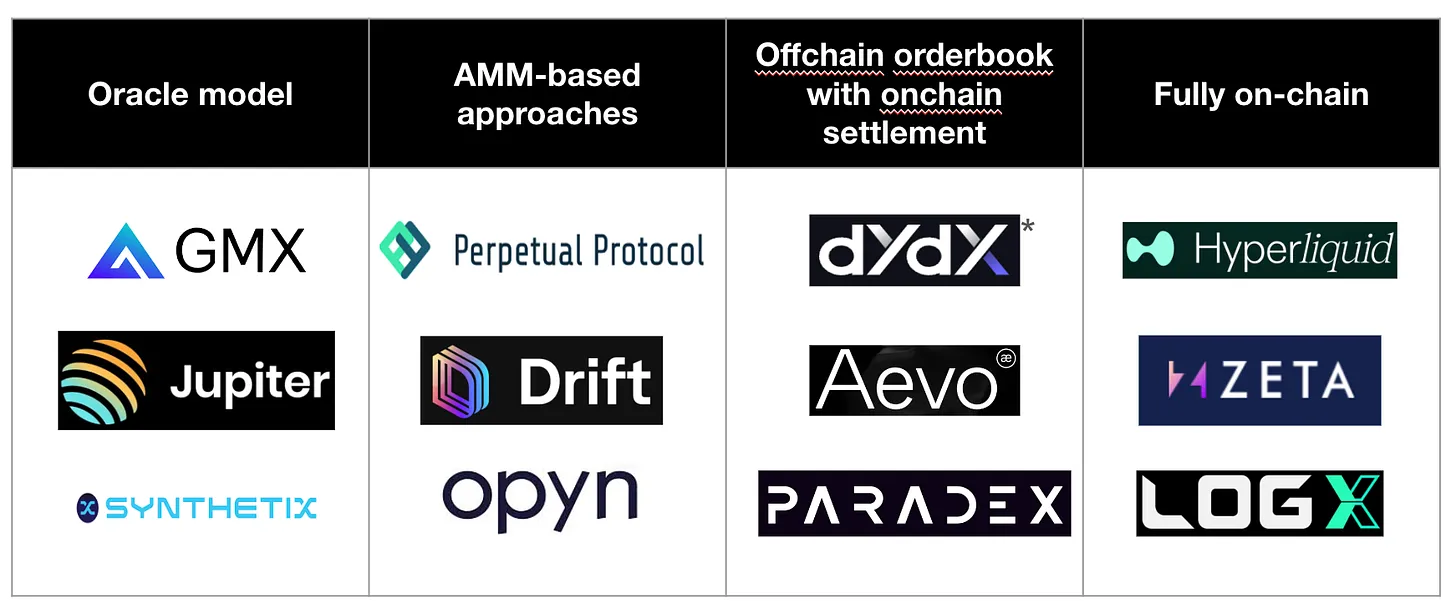

In the pursuit of the “holy grail” of decentralized exchanges (DEXs), various architectures have emerged—from oracle-based models to virtual automated market makers (vAMMs), to “off-chain order books with on-chain settlement.”

Oracle Model

The oracle model facilitates trading based on price data pulled from high-volume, leading exchanges. This approach eliminates the cost of bridging the gap between DEX prices and market prices, but introduces significant risk of oracle price manipulation. Platforms like GMX benefit from deep liquidity, offering zero price impact trades and fixed fees, demonstrating organic growth. By using protocols like Chainlink for price feeds, GMX ensures price accuracy and integrity, fostering a price-taker-friendly environment while providing sufficient incentives for price makers. However, a key challenge for these exchanges is that they act as price takers rather than facilitators of price discovery.

AMM-Based Approach

Virtual AMMs (vAMMs) facilitate perpetual contract trading without involving actual spot exchanges, inspired by Uniswap’s spot market AMM. Adopted by platforms such as Perpetual Protocol and Drift Protocol, this model allows for decentralized, composable liquidity bootstrapping for new tokens. Despite issues like high slippage and impermanent loss, vAMMs offer transparent on-chain price discovery. By adjusting virtual depth (K-value), these exchanges balance liquidity needs against the risks of excessive depth or high slippage, aiming for a sustainable model.

Off-Chain Order Books with On-Chain Settlement

To overcome the limitations of on-chain matching, some DEXs use off-chain order books with on-chain settlement. Trade matching occurs off-chain, while execution and asset custody remain on-chain. This approach preserves DeFi’s self-custody advantage while addressing performance and risk constraints such as miner extractable value (MEV). Notable examples include dYdX v3, Aevo, and Paradex, which leverage this hybrid model to deliver efficient trading while ensuring transparency and security via on-chain settlement.

Fully On-Chain Order Books

Fully on-chain order books represent the ideal way to maintain trade integrity, but face significant challenges due to blockchain latency and throughput limits. These issues create vulnerabilities such as front-running and market manipulation. However, chains like Solana and Monad are rapidly experimenting with infrastructure-level solutions to this problem. Projects such as Hyperliquid, dYdX v4, Zeta Markets, LogX, and Kuru Labs are pushing high-performance, fully on-chain systems, either leveraging existing chains or building their own app-chains.

Key trends in the current perpetual DEX space include community-driven cross-chain active liquidity and simplified user experiences via gasless trading, session keys, and social logins.

Historically, establishing liquidity on exchanges has been a cold-start problem. Exchanges acquire liquidity through a mix of incentives, rewards, and market forces. Market forces essentially refer to traders seeking arbitrage opportunities across different markets. However, as DEXs proliferate and compete for user attention, it becomes difficult for them to attract enough traders to reach critical mass. In the perpetual DEX space, another popular method involves incentivized liquidity pools. In this setup, liquidity providers (LPs) deposit assets into a pool used to facilitate trading on the DEX. Some perpetual DEXs offer high annual percentage yields (APYs) or airdrops to attract LPs. Recently, two main approaches have emerged to address this cold-start challenge more effectively—community-backed active liquidity vaults and cross-chain liquidity sourcing.

Hyperliquid launched the HLP Vault, which uses user funds to provide liquidity for the Hyperliquid exchange. The vault calculates fair prices using data from Hyperliquid and other exchanges and executes profitable liquidity strategies across various assets. Profits and losses (P&L) generated from these activities are distributed according to each participant's share in the vault. Beyond community-driven liquidity, Hyperliquid leverages HyperBFT to boost DEX performance through optimistic execution and responsiveness. Optimistic execution means transactions within a block can be executed before the block achieves finality at the consensus level. This means validators begin executing transactions in a proposed block in parallel with the consensus process. Optimistic responsiveness allows consensus to scale based on the number of validators able to reach agreement, adapting to network conditions. Currently, a major risk for Hyperliquid is the lack of open-source code and transparent infrastructure. Similar to Hyperliquid, an increasing number of projects are adopting application-specific chains to overcome inherent limitations of base-layer blockchains.

Source: Hyperliquid

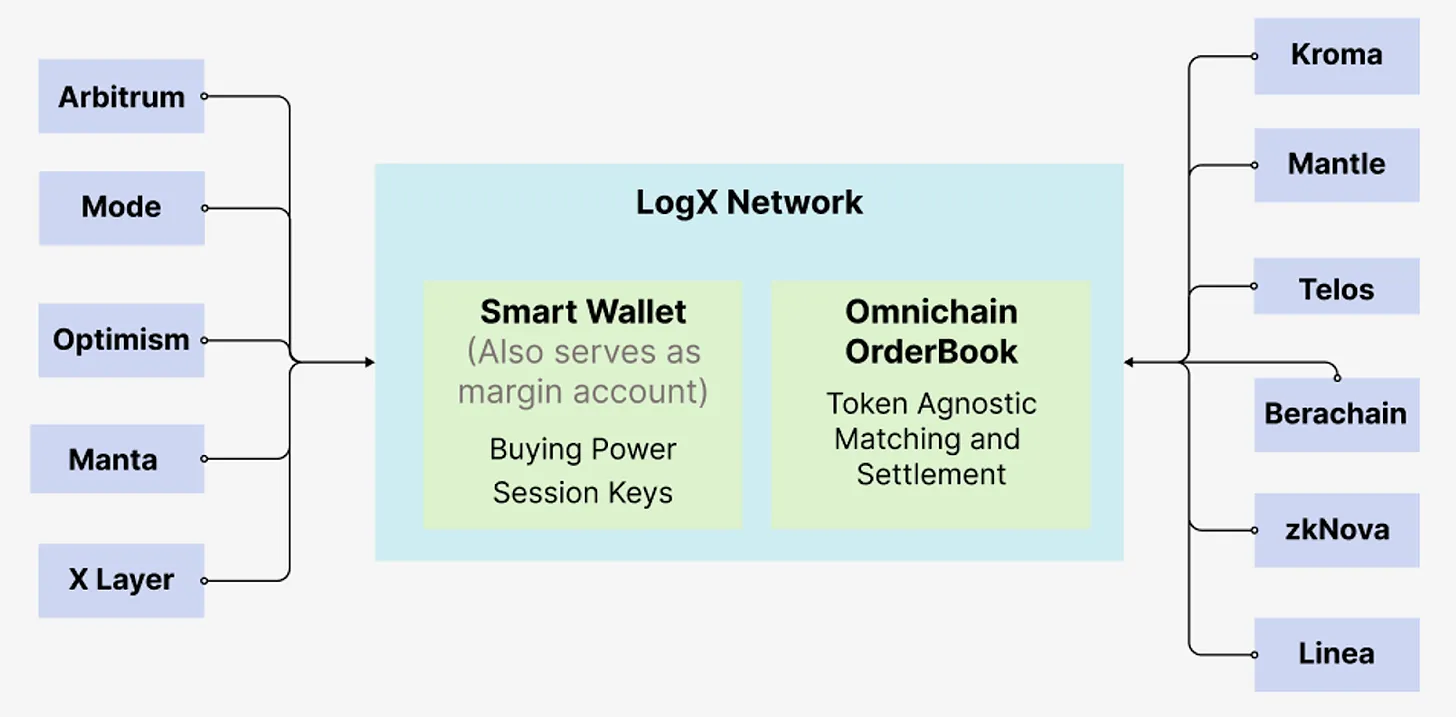

Another interesting approach is cross-chain liquidity sourcing, pioneered by projects like Orderly Network and LogX Network. These networks allow frontends to be created on any chain to trade perpetuals and tap into aggregated liquidity across all markets. By combining native on-chain liquidity, aggregated liquidity across other chains, and discrete asset, market-neutral (DAMN) AMM pools, LogX maintains liquidity even during periods of high market volatility. These pools use stable assets such as USDT, USDC, and wUSDM, enabling traders to engage in oracle-based perpetual trading. While designed for trading, this infrastructure also creates optionality for building various applications on top.

Source: LogX

As user interfaces become increasingly commoditized, DEXs are adding features like gasless trading, session keys, and social logins, leveraging wallet adapters to create seamless user experiences. Traditionally, centralized exchanges (CEXs) were deeply integrated into the ecosystem—acting not just as core exchanges but also as onboarding and bridging services—while DEXs typically remained siloed within their native ecosystems. These cross-chain DEXs are revolutionizing the user experience by enabling seamless trading across multiple blockchain networks, offering users broader access to trading pairs and tighter spreads, especially for certain long-tail tokens.

DEX aggregators like Vooi.io are also building intelligent routing systems that identify the most efficient execution path or best venue across various chains. This simplifies the trading process for users, who can manage complex trade routes within a single interface. These super-aggregators combine functionalities of multiple DEXs and bridges, delivering a smooth and user-friendly trading experience.

Telegram bots further simplify the trading experience by providing real-time trading alerts, trade execution, and portfolio management—all conveniently within Telegram chat interfaces. This integration enhances accessibility and user engagement, making it easier for traders to stay informed and act quickly on market opportunities. The listing of the BANANA token on Binance was a major win for the emerging Telegram bot ecosystem. However, Telegram bots carry significant risks, as users must share private keys with bots, exposing them to smart contract risks.

Perpetual decentralized exchanges (DEXs) continuously introduce new financial products or mechanisms to streamline trading of existing ones, meeting evolving trader demands.

Variance Perpetuals

These innovative financial instruments allow traders to speculate on an asset’s volatility. In the highly volatile crypto market, this product offers unique ways to hedge risk or capitalize on market swings. Opyn leverages existing markets to develop novel perpetual contracts that replicate complex strategies, hedge unique risks, and improve capital efficiency. Opyn’s perpetual offerings include Stable Perps (0-perps), Uniswap LP Perps (0.5-perps), Standard Perps (1-perps), and Squared Perps (2-perps, also known as Squeeth). Each serves a distinct purpose: Stable Perps provide a solid foundation for trading strategies, Uniswap LP Perps mirror yield without direct liquidity provision, Standard Perps offer simple long/short exposure, and Squared Perps amplify returns through quadratic exposure. These perps can be combined into more sophisticated strategies. For example, the Crab Strategy involves shorting 2-perps while going long on 1-perps in stable markets to earn funding. Another example is the Zen Bull strategy, which combines shorting 2-perps, going long on 1-perps, and shorting 0-perps to earn funding in calm markets while maintaining bullish exposure.

Source: Opyn

Pre-Launch Futures

Pre-launch perpetual contracts allow traders to speculate on the future price of digital assets before they are officially listed, serving as an on-chain version of IPO grey markets. These contracts enable investors to trade based on anticipated market value. Several perpetual DEXs—including Aevo, Helix, and Hyperliquid—utilize pre-launch futures to create unique market niches. The primary advantage of these contracts is their ability to attract and retain users by offering access to exclusive assets unavailable elsewhere.

Real-World Assets (RWAs)

Perpetual contracts may become the primary listing mechanism for real-world assets (RWAs). Listing a new asset as a perpetual is simpler than full tokenization—requiring only liquidity and a data source. Additionally, a spot market does not need to exist on-chain for a liquid perpetual market to thrive, since perpetuals can stand independently. In this scenario, once sufficient market interest and liquidity are established via perpetuals, they serve as a launchpad for eventual spot tokenization. Combining spot and perpetual contracts on RWAs opens new avenues for sentiment prediction, event-based trading, and cross-asset arbitrage strategies. Companies like Ostium Labs and Sphinx Protocol are emerging players in this space.

Exchange-Traded Products

Perpetuals can also be used to create exchange-traded products holding expiring futures contracts—such as ETFs holding WTI crude oil futures (e.g., USO) or ETNs holding VIX futures (e.g., VXX)—reducing fees and net asset value (NAV) decay. This eliminates the need to roll baskets into longer-dated contracts as expiration nears. Companies needing long-term economic exposure without physical delivery of commodities can reduce operational costs via perpetuals. Speculating or hedging restricted foreign currencies often involves non-deliverable 30-day or 90-day forwards, which are non-standard and traded OTC. These can be replaced with USD-denominated perpetual contracts.

Prediction Markets

Perpetual DEXs can revolutionize prediction markets by offering flexible, continuous trading mechanisms suited for irregular events like elections or unpredictable weather forecasts. Unlike traditional prediction markets reliant on real-world outcomes or oracles, perpetual futures allow markets to form based on ever-changing market data itself. This design enables sub-markets within long-term themes, giving users short-term trading opportunities and immediate gratification. Continuous settlement ensures regular market activity, enhancing liquidity and user engagement. Furthermore, community-governed perpetual markets using reputation and token incentives can encourage participation and align interests, laying a solid foundation for decentralized prediction markets. This approach democratizes market creation and offers scalable solutions for diverse forecasting scenarios.

By providing platforms that build iOS-like integrated experiences, perpetual DEXs have the potential to unlock the next era of crypto adoption.

As the crypto financial system evolves, the design of perpetual DEXs will continue to improve. The focus may shift from merely replicating centralized exchange (CEX) functionalities toward leveraging the unique advantages of decentralization—transparency, composability, and user empowerment. Building the optimal perpetual DEX design requires careful balancing of efficiency, speed, and security. Perpetual DEXs are also focusing on fostering community engagement through presales and developer involvement in ecosystems. This approach cultivates a sense of ownership and loyalty among users. Community-led initiatives, such as market-making via Hyperliquid bots, further democratize access to trading activities.

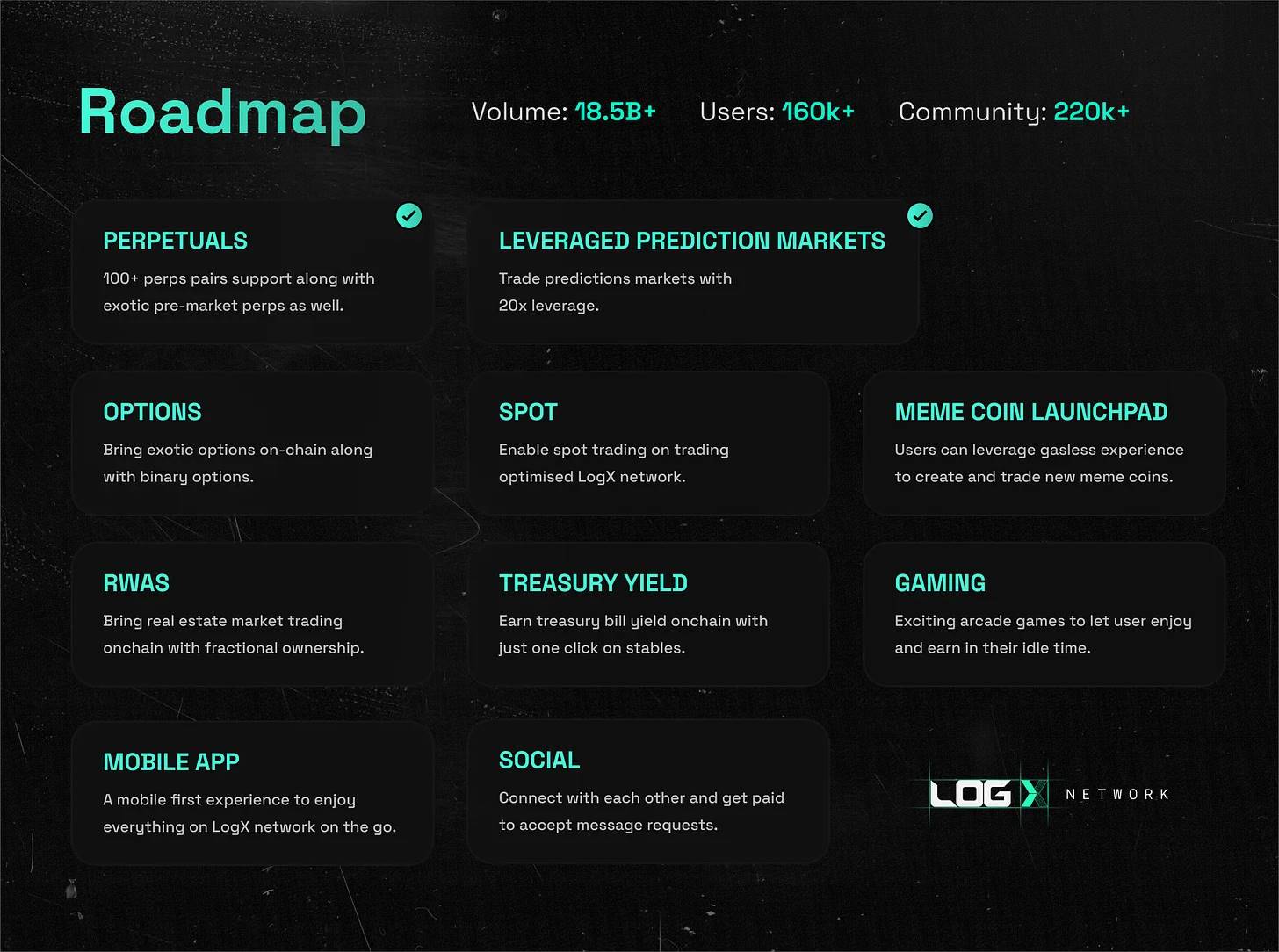

Creating iOS-like integrated and user-friendly experiences is crucial for mass crypto adoption, which in turn requires developing more intuitive interfaces and ensuring consistency across user journeys. These improvements can make crypto trading more appealing to non-native consumers, eventually guiding them toward other decentralized applications. Perpetual DEXs like Hyperliquid, LogX, and dYdX can also develop user-friendly, intuitive markets in domains beyond finance—such as elections and sports—opening new channels of engagement for the general public.

Source: LogX

Over the past decade, DeFi development has focused on DEXs and stablecoins. However, the next decade may see DeFi consumer applications intersecting with news, politics, sports, and other fields. These applications could become the most valuable and widely used, further driving crypto adoption. We look forward to collaborating with builders shaping the future of crypto.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News