Jump's Weekly Dump of Over $100 Million in ETH: Breaking Down the Numbers and Potential Selling Pressure

TechFlow Selected TechFlow Selected

Jump's Weekly Dump of Over $100 Million in ETH: Breaking Down the Numbers and Potential Selling Pressure

Jump Trading still holds between $100 million and several billion dollars worth of ETH.

Author: Nanzhi, Odaily Planet Daily

Today, the crypto market spiraled into panic-driven decline amid growing fears of a global economic recession. BTC plummeted from above 60,000 to below 50,000 within two days, while ETH dropped from above 3,000 to as low as around 2,100. Despite numerous macroeconomic headwinds, the primary catalyst behind today's sharp sell-off is widely believed to be massive dumping by prominent crypto firm Jump Trading.

Within just one week, Jump Trading rapidly offloaded over $100 million worth of ETH. Combined with prior news of an investigation by the U.S. Commodity Futures Trading Commission (CFTC), already jittery market participants are now speculating that its crypto-related operations may be shutting down.

How many tokens has Jump Trading sold, and what positions remain? Odaily breaks it down in this report.

Details of Jump’s Sell-Off

The first unusual activity linked to Jump Trading occurred on July 26, when an address transferred 7,000 ETH—worth approximately $22.6 million at the time—to Jump Trading, shortly after ETH had crashed from 3,500 to 3,100 USDT.

Two days later, Jump Trading began its first sale, depositing 4,737 ETH—valued at about $15.4 million—into Binance.

In the following days, Jump Trading conducted a series of fund consolidation activities, including unstaking ETH from Lido and multiple transfers of ETH from other wallets, before gradually moving these assets into exchanges.

Among Jump Trading’s ETH holdings, the largest portion consists of 120,000 wstETH tokens, which have been steadily redeemed since July 25.

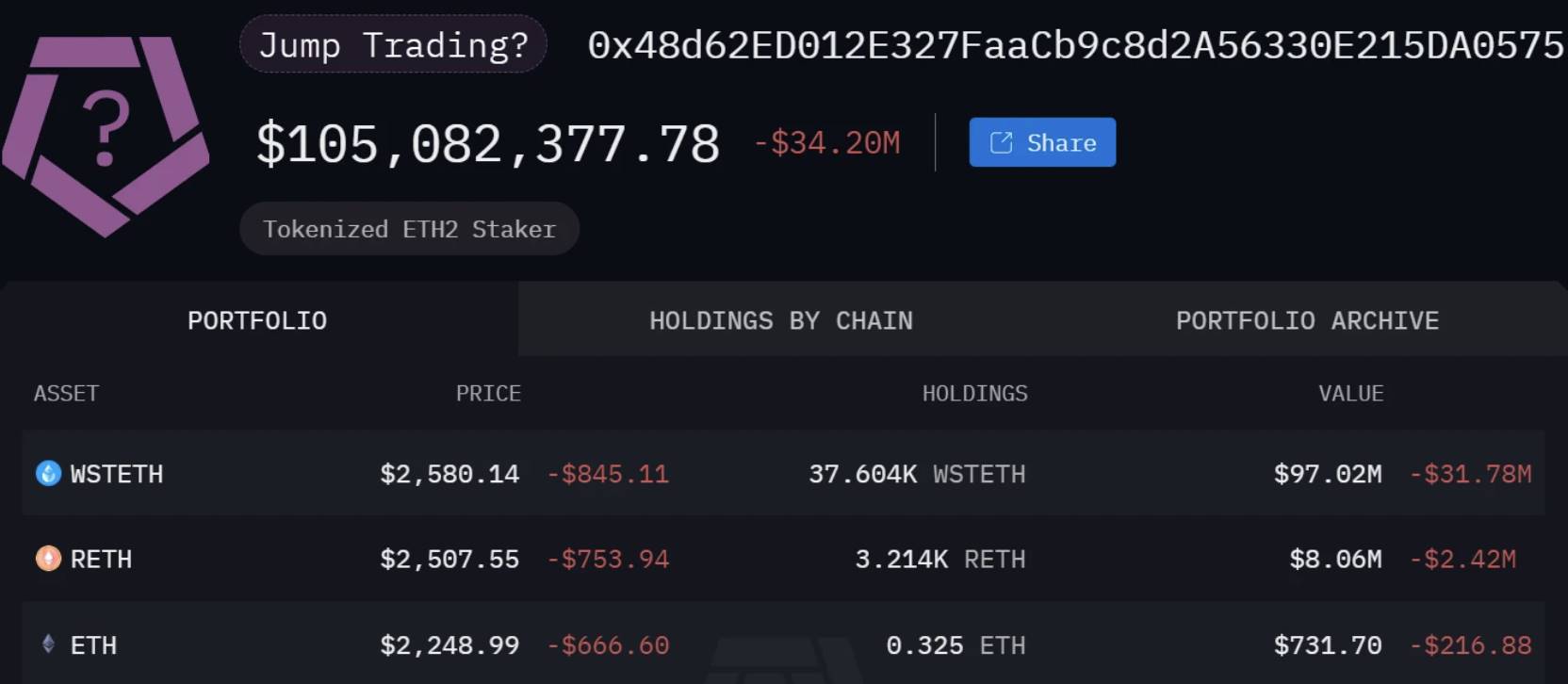

At the time of writing, Jump Trading still holds approximately 37,000 wstETH—worth $100 million—as well as $8 million in RETH, while the redeemed portion has already been transferred or sold.

(Odaily Note: The wstETH holding address is 0x48d62ED012E327FaaCb9c8d2A56330E215DA0575)

Remaining Holdings

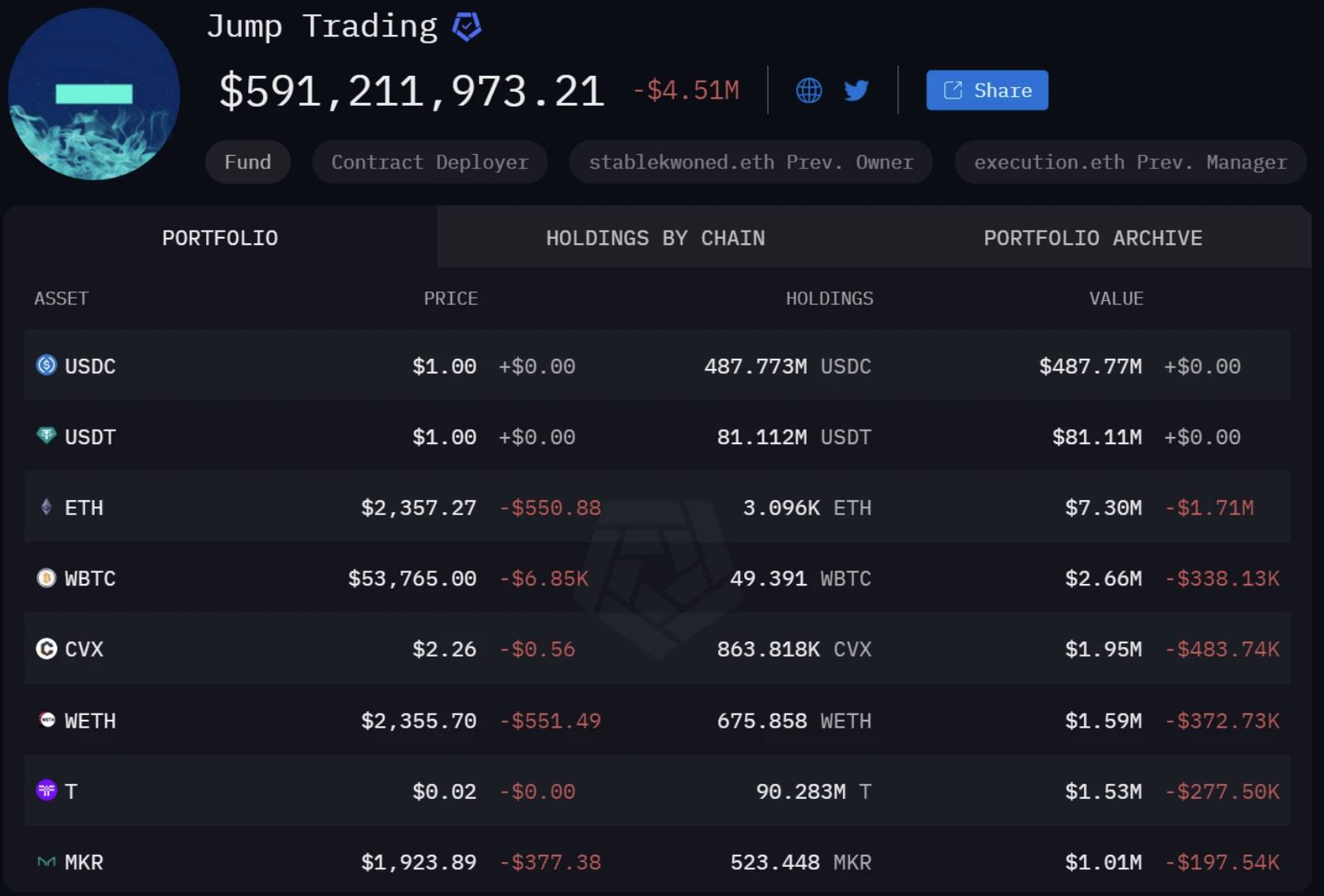

This morning, multiple on-chain analytics teams reported that 96% of the tokens in Jump Trading’s portfolio consist of stablecoins—though this analysis did not include the aforementioned address holding $100 million in wstETH.

Currently, Arkham-marked addresses associated with Jump Trading hold assets valued at $590 million, of which $569 million are stablecoins. Thus, the visible selling pressure amounts to the aforementioned $100 million in ETH.

However, as an industry leader, Jump Trading’s theoretical holdings should far exceed this $600 million figure. According to Odaily’s investigation, one of Jump Trading’s older addresses once held up to 1.64 million ETH at its peak—worth as much as $3.77 billion at $2,300 per ETH.

However, Jump Trading transferred these millions of ETH to Robinhood in May and June 2023. Whether they were sold or merely moved cannot currently be tracked, making it impossible to estimate potential future selling pressure—but it remains a point of concern.

(Odaily Note: Jump’s old address is 0x0716a17FBAeE714f1E6aB0f9d59edbC5f09815C0)

Is Jump Exiting the Crypto Space?

Why has Jump begun rapidly selling ETH? There is no official explanation yet, but market speculation points to the earlier CFTC investigation. On June 20, according to market reports, the U.S. Commodity Futures Trading Commission (CFTC) was investigating Jump Crypto, though it remained unclear whether any charges were being considered. Four days later, Kanav Kariya, President of Jump Crypto, announced his resignation on X.

(Odaily Note: Jump Crypto is the cryptocurrency division of Jump Trading, established in September 2021.)

During Jump’s ETH sell-off, Justin d'Anethan, Head of Asia-Pacific Business Development at crypto market maker Keyrock, commented: "There are rumors that they (Jump Trading) may be forced to exit the crypto business due to the CFTC investigation."

Following this morning’s price crash, Arthur Hayes, co-founder of BitMEX, posted on X that through traditional finance channels, he learned a certain “big player” had been taken down and was liquidating all crypto assets. He added that he couldn’t confirm the accuracy of the information and would not disclose the name. Based on various clues, the community suspects he was referring to Jump Crypto.

Projects Led by Jump

If Jump Trading is indeed forced to exit the crypto space for any reason, projects previously led by Jump Crypto could also face repercussions. Below is a list of projects where Jump Crypto led funding rounds in the past two years and have already issued tokens, including project name, token name, investment round, and current circulating market cap—with earlier rounds or larger holdings indicating stronger influence:

ZTX - ZTX - Seed Round - $18.5 million;

Port3 - PORT3 - Seed Round - $4.89 million;

Sui - SUI - Series B - $1.29 billion;

Injective - INJ - Post-listing financing - $1.4 billion;

Aptos - APT - Series A - $214 million;

AltLayer - ALT - Seed Round - $164 million;

Push Protocol - PUSH - Series A - $3.72 million;

Thetanuts Finance - NUTS - Seed Round - $5 million.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News