VC Wallet Address Analysis: Which Tokens Do Top VCs Like Jump, a16z, and Wintermute Hold?

TechFlow Selected TechFlow Selected

VC Wallet Address Analysis: Which Tokens Do Top VCs Like Jump, a16z, and Wintermute Hold?

8 Largest Venture Capital Firms, Their Largest Holdings and Recent Investments.

Written by: Thor Hartvigsen

Translated by: TechFlow

Discovering profit opportunities from VC wallets — the top 20 crypto funds have over 1,200 wallets combined. I've been closely monitoring them throughout January and February. Below, I’ll cover the eight largest venture capital firms, their biggest holdings, and recent investments.

Disclaimer: We’ve seen that VCs aren’t always “smart money,” so please use this information cautiously. Also, due to numerous wallets across multiple chains, it's difficult to achieve complete accuracy in balance tracking. There may be unknown assets in wallets I can't monitor—please proceed with caution.

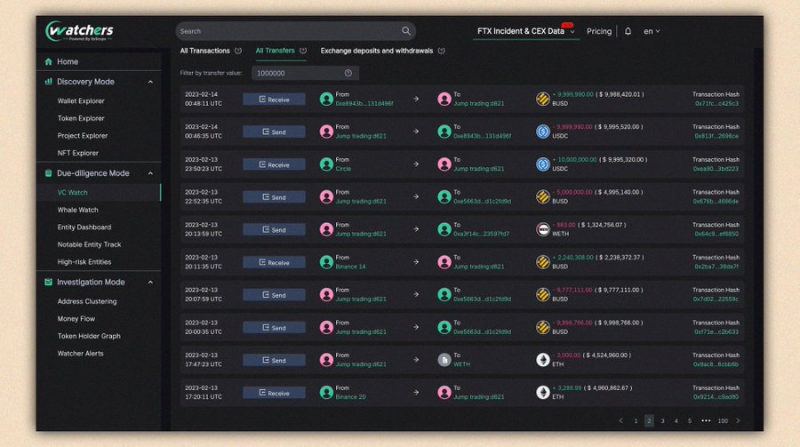

1. Jump Trading

Total value: $3.8 billion:

• $3.25 billion ETH

• $328 million $SHIB

• $81 million MATIC

• $50 million $USDC

• $50 million wBTC

• $20 million $LINK

• $14 million $COMP

Smaller positions ($1M–$10M): $HFT, $AVAX, $SNX, $CHZ, $MASK, $AAVE, $LDO.

In recent days, Jump redeemed over $50 million in BUSD on Paxos (possibly an arbitrage strategy). Note: These are only EVM-based wallets.

2. Blockchain Capital

Total value: $87.2 million:

• $21.7 million $MATIC

• $18.4 million $AAVE

• $15.7 million $UNI

• $11 million $ETH

• $5 million $RPL

• $3.6 million $LDO

• $3 million $1INCH

Smaller positions ($100K–$1M): $SUSHI, $NXM, $BAL, $GAMMA, $OHM, $PERP.

Interestingly, $MATIC is their largest public position—most of which was purchased in 2023.

Polygon is launching its zkEVM on March 27. Additionally, Blockchain Capital co-led zkSync’s $200 million Series C round alongside Dragonfly.

3. a16z

Total balance: $310 million:

• $257 million $UNI

• $15.5 million USDC/ETH LP

• $13.7 million $COMP

• Supplied $7.5 million BTC on Venus Protocol (borrowed $2.5 million ETH)

• Supplied $7.5 million USDC as collateral on Aave

• $3 million $MKR

• Supplied $1.8 million $wETH on Radiant.

a16z controls over 4% of $UNI’s total supply, giving them enough governance power to veto proposals (they recently did so regarding Uniswap deployment on BNB Chain via Wormhole). a16z has also invested in $LDO, $DYDX, $STG, $OP, among others.

4. Amber Group

Total balance: $245 million:

• $119 million $ETH

• $74 million $USDC/$USDT

• $21.5 million FET

• $8.3 million $DYDX

• $3.6 million wBTC

• $2.2 million $SWISE

• $1.8 million $CVX.

Smaller positions ($100K–$1M): $MATIC, $AAVE, $LINK, $GRT, $LDO, $SYN, $FTM.

Among all LSDs, Amber Group shows the strongest confidence in $SWISE. In the past three days, Amber Group purchased over $20 million in $FET (FetchAI). Additionally, Amber recently interacted with a wallet holding $17 million ETH, $8 million RNDR, and $5 million MATIC—which might also belong to them.

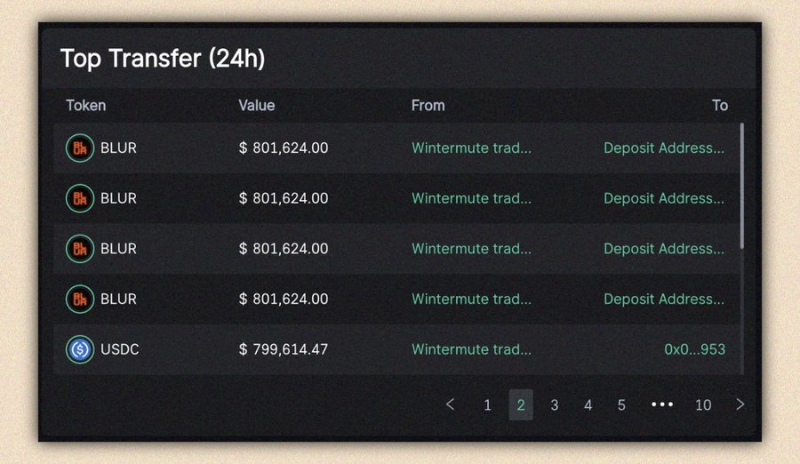

5. Wintermute

Total balance: $401 million:

• $301 million $wETH

• $47 million $OP

• $22.2 million LDO

• $17 million ETH

• $7.5 million $GALA (largest acquisition this month)

• $7.3 million FTM

• $6.6 million $DYDX

• $6 million $BLUR

• $5.7 million $HFT

• $5.1 million $MATIC.

Wintermute deposited over $5 million in $BLUR to several exchange deposit addresses around the airdrop (likely dumping).

In recent days, the fund appears to have been arbitraging/selling over $20 million in BUSD. Finally, Wintermute seems to have sold approximately $4 million worth of APE in February.

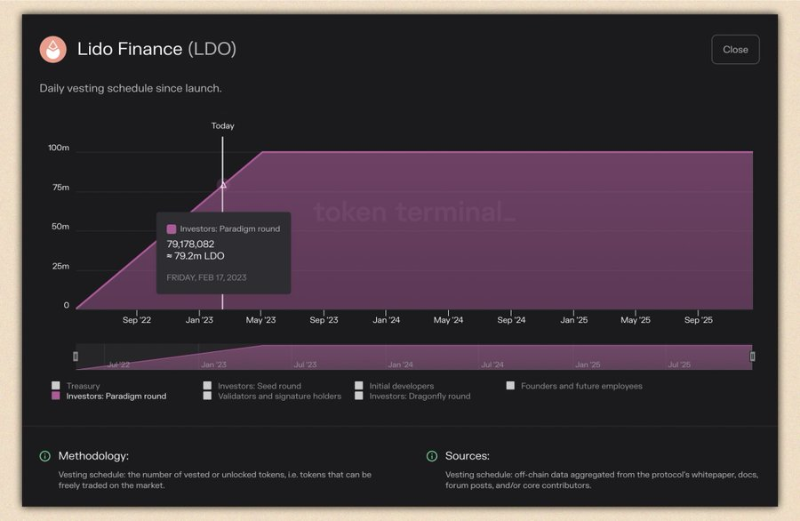

6. Paradigm

Total balance: $382 million:

• $195 million LDO

• $166.5 million ETH

• $20.47 million MKR

This may only represent a small portion of their larger holdings. Some of their investments include Optimism, Synthetix, DYDX, Osmosis, Uniswap, Starkware, etc.

Notably, Paradigm is one of the largest investors in Lido Finance. Of their 100 million LDO tokens, 79 million have already been unlocked (full unlock on May 1, 2023).

Paradigm has also committed over $2 million in MKR for MakerDAO governance.

7. Dragonfly Capital

Total balance: $90.4 million:

• $46 million $LDO

• $13.3 million $TON

• $10.6 million $MATIC

• $7 million $FXS

• $6.7 million $AAVE

• $2.5 million RBN

• $1.4 million $DYDX

Other notable investments include Near, Cosmos, Mina, zkSync, etc.

8. DeFiance Capital

Total balance: $85 million:

• $57 million $USDC/DAI/USDT

• $17 million LDO

• $3.1 million $AAVE

• $3 million $DODO

• $1.7 million $AXS

• $1.6 million ETH

• $1 million $MC

Merit Circle ($MC) is a gaming DAO building Web3 games. DeFiance also staked a large amount of USDC on Stargate.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News