a16z raised $1.5 billion, saying it wants America to win

TechFlow Selected TechFlow Selected

a16z raised $1.5 billion, saying it wants America to win

Invest when others dare not, then wait for the cycle to turn and reap the trust.

By Curry, TechFlow

Last Friday, a16z announced it had raised $15 billion.

Note: raised—not invested. This is money from LPs being handed to them so they can invest in others.

How staggering is this number?

In 2025, all U.S. venture capital firms collectively raised $66.1 billion—the lowest in eight years. a16z alone took nearly 20% of that.

The industry is in winter. They’re stockpiling.

But why are LPs willing to hand over cash during such a downturn?

Possibly because a16z has a track record of making money in the cold.

They invested in Facebook in 2009, right after the financial crisis, when no one else dared. In 2013, they backed Coinbase, back when most thought Bitcoin was just a geek toy. In May 2022, when Bitcoin dropped 55% and Coinbase’s stock fell 80%, a16z raised a $4.5 billion crypto fund.

Back then, comment sections mocked them for catching the falling knife.

Last year, The Information reported that this fund's returns surged. The reason? Their investment in Solana, which rose from $8 to $180 at the time.

"Be fearful when others are greedy, be greedy when others are fearful"—often sounds like motivational fluff.

But if every time fear hits, you go all in—and keep getting it right—it stops being a quote and becomes:

Credit history.

Now, how will a16z spend this $15 billion?

$6.75 billion will go toward late-stage companies—doubling down on proven winners ready to scale. $1.7 billion for application-layer startups, another $1.7 billion for foundational tech, and $700 million into biotech.

Another $1.176 billion will be allocated to a theme called "American Dynamism."

Literally translated as "American Vitality," it sounds like a slogan invented by some high-end think tank. But looking at what they’ve already funded under this banner reveals its true meaning:

Make America able to build things again.

What things?

Weapons.

Companies in this portfolio include Anduril (autonomous weapons systems), Shield AI (military drones), Saronic (unmanned warships), and Castelion (hypersonic missiles). These firms share one thing: their biggest customer is the Pentagon.

a16z once shared a statistic: if the U.S. goes to war with China over Taiwan, American missile stockpiles would run out in eight days—and take three years to replenish.

To Americans, this isn’t alarmist rhetoric. It’s business.

The U.S. military-industrial complex is aging. Legacy contractors like Lockheed Martin are too slow and too expensive. The Pentagon needs new suppliers. a16z is betting on that gap—using VC capital to incubate a generation of “software-defined weapons” companies, then selling them to the Department of Defense.

$1.176 billion may not sound like much, but it’s a bet on a single thesis: America is rebuilding its manufacturing base—and starting with defense.

Betting on defense requires more than capital—it demands connections.

a16z has those in spades.

At the end of 2024, Marc Andreessen called himself an unpaid intern at DOGE (Department of Government Efficiency), helping recruit talent and reportedly spending half his time at Mar-a-Lago advising Trump.

DOGE was later disbanded in November last year, but a16z’s network remained intact. Their first employee, Scott Kupor, now heads the U.S. Office of Personnel Management.

This week, Trump said next year’s defense budget should rise to $1.5 trillion.

Many VCs invest in defense, but few can simultaneously fund companies and shape policy.

This might be one of a16z’s real moats—not just investing, but helping write the rules. Funding missile startups while also helping decide who gets government contracts.

Sure, it feels a bit like being both referee and player.

You could call it conflict of interest. Or you could call it resource integration. Either way, LPs don’t care—they only care about returns.

Many know a16z through crypto.

In this $15 billion raise, crypto wasn’t listed separately—it was folded into a $3 billion “other” category.

Is crypto abandoned?

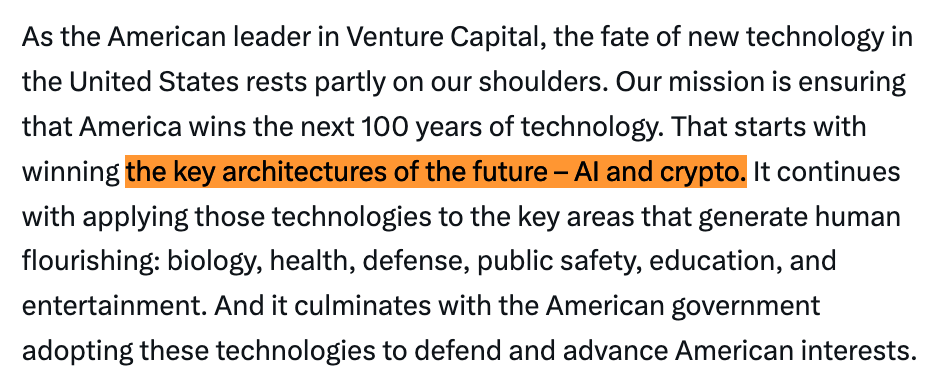

No. Ben Horowitz made it clear in a blog post: “AI and crypto are the key architectures of the future.”

It’s just that for a16z, crypto no longer needs its own dedicated fund.

Their first crypto fund in 2018 was $350 million. By 2022, it grew to $4.5 billion. Now? They invest directly from the main fund—alongside AI, defense, and energy.

What does this mean?

That crypto, in their eyes, has evolved from a “new frontier” into infrastructure.

Exchanges are infrastructure. Blockchains are infrastructure. DeFi protocols are infrastructure. Just like AWS, Nvidia, or missiles—they’re all foundational layers.

Once a crypto-focused VC, now a VC for foundational technologies.

The scope has expanded.

For the crypto industry, this is actually good news. Being lumped into “other” may seem like a downgrade, but it’s more like graduation. It means crypto no longer needs special explanation—LPs get it now, and Western regulators are beginning to accept it.

Of course, it also means crypto projects must now compete with AI and defense for funding from the same pool.

The competition just got tougher.

Meanwhile, Ben wrote something in his blog post that Redwood might find uncomfortable:

“As leaders of American venture capital, we bear part of the responsibility for shaping the fate of new technologies.”

Redwood has been around for 50 years. a16z has only existed for 16. Yet both now manage around $90 billion—tied for largest in the world.

Why?

VC, at its core, sells two things: vision and resources.

Vision is hard to prove—you claim to have foresight, but it takes ten years to verify. Resources, however, are accumulative.

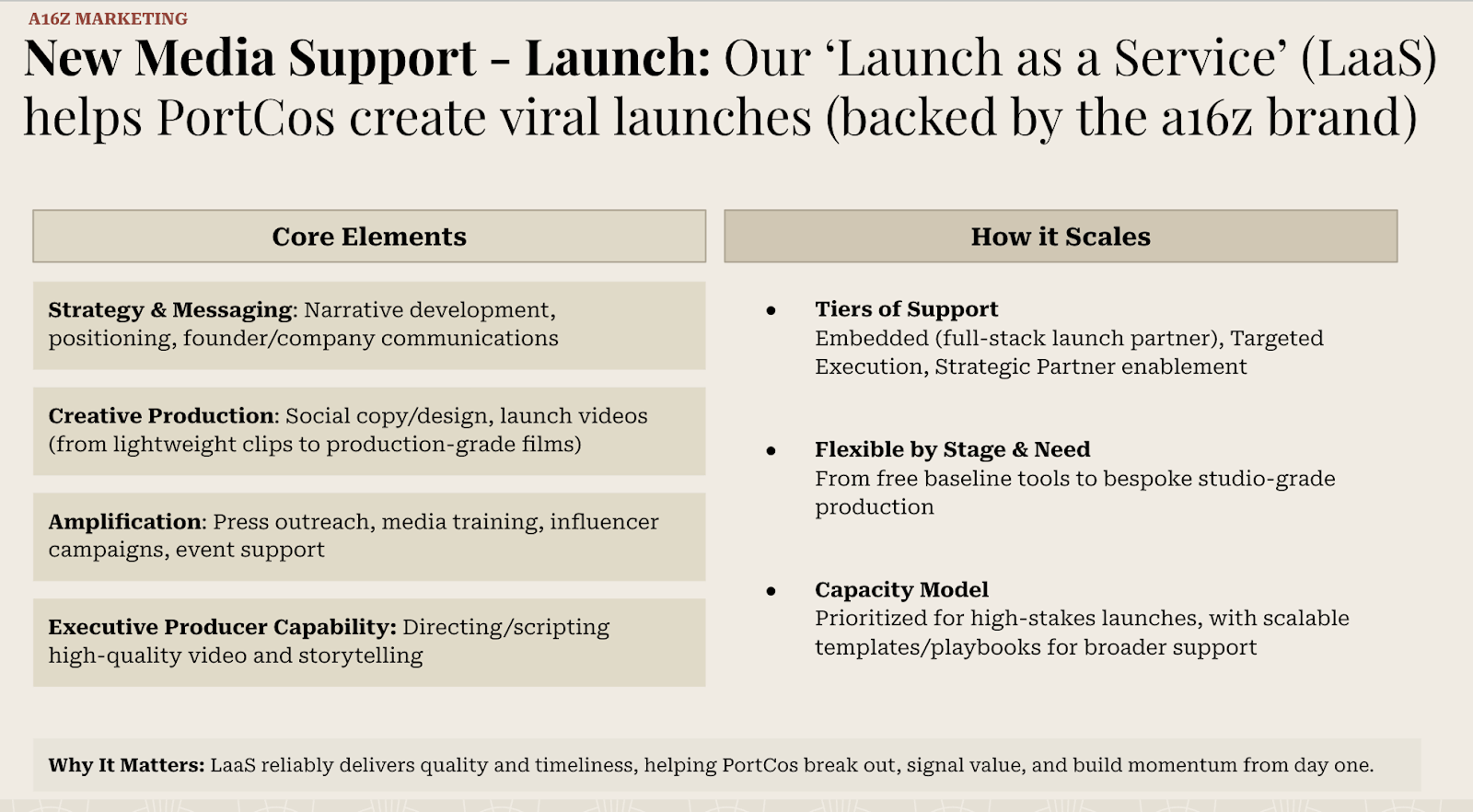

What a16z has done over the years is deepen their resource base.

They have the strongest content team in the industry—podcasts, blogs, newsletters—with output rivaling media companies. Founders are often indoctrinated into a16z’s worldview long before receiving funding.

They have deep ties in Washington—not just knowing politicians, but placing people directly into government roles.

And they benefit from scale itself. When managing $90 billion, you can write SpaceX a $1 billion check—something smaller funds simply cannot do.

It’s not just about picking winners. It’s about becoming irreplaceable.

Founders come to you not just because you have money, but because you can help secure government contracts. LPs come not just for returns, but because you offer policy influence others lack.

This playbook is nearly impossible for other VCs to replicate.

Still, there are risks.

a16z’s current strategy is partially tied to America’s national trajectory. If bets on AI dominance, defense expansion, and manufacturing revival turn out wrong, much of that $15 billion could be wasted.

a16z isn’t just betting on tech cycles—they’re betting on political cycles. And those are far harder to predict.

Yet LPs handing over $15 billion signals market confidence in their judgment.

Or rather, in an uncertain world, a16z offers a form of certainty:

We know how to turn capital into influence, and influence into returns. We invest when others hesitate. We place bets when others are confused. Then, when the tide turns, we harvest trust.

So view this $15 billion as a vote of confidence—from LPs to a16z.

Now, watch how a16z bets it back on America.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News